Absolutely. You can open a non-resident bank account in the UAE, giving you a financial foothold in one of the world's most stable economies without needing a residency visa. It's a fantastic option for international entrepreneurs and investors looking to tap into the UAE's strategic location and business-friendly environment. The secret, however, lies in putting together a rock-solid application, and that’s where having an expert guide you through the bank's strict compliance hurdles makes all the difference.

Your Financial Gateway: The UAE Non-Resident Bank Account

The UAE has cemented its reputation as a top-tier global hub for business and finance. Its allure is undeniable, pulling in international investors, entrepreneurs, and high-net-worth individuals who want a secure, strategic base for their operations and assets. Central to this appeal is the ability to open a non-resident bank account in the UAE—a powerful tool for anyone managing finances across borders.

So, what exactly is a non-resident account? Think of it as your financial access point to the UAE, without the requirement of living here. While a resident account is tied to having a UAE residency visa, a non-resident account is specifically tailored for individuals and companies whose base of operations is outside the country. This is a critical distinction, as it unlocks the advantages of the UAE banking system while you maintain your global mobility.

Who Is a Good Fit for a Non-Resident Account?

The eligibility for a non-resident account is actually quite broad, designed to accommodate a wide variety of global players. The most common applicants are international entrepreneurs who have set up a company in one of the UAE's many free zones or have an offshore entity. Since these business structures are built for global trade and investment, a local bank account isn't just a convenience; it's an operational must-have.

Individual investors looking to diversify their portfolios or safeguard their assets in a politically and economically stable jurisdiction are also prime candidates. Be prepared, though—banks conduct rigorous due diligence to verify your professional background and the source of your wealth. A clean, well-documented professional profile is your ticket to a successful application.

One of the biggest myths is that non-resident accounts face less scrutiny. The opposite is true. UAE banks apply the same tough international compliance standards (like KYC and AML) to every client, resident or not, to protect the integrity of the financial system.

Personal vs. Corporate: What’s the Difference?

Getting the distinction between personal and corporate non-resident accounts right is the first step in choosing the correct setup.

-

Personal Non-Resident Accounts: These are designed for individuals managing their personal wealth. You might use one to hold savings in a stable currency like the UAE Dirham, receive international payments, or manage funds related to a property investment. They're also popular among frequent business travellers.

-

Corporate Non-Resident Accounts: If you have a business entity—whether it's a Free Zone Establishment (FZE) or an offshore company—this is what you need. A corporate account is essential for day-to-day business: paying suppliers, invoicing clients, and managing company cash flow. Opening one is a non-negotiable step in your company formation process.

Navigating this rewarding landscape requires a steady hand. As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we specialise in company formation and provide dedicated support for opening your non-resident bank account in the UAE. With our 24/7 support service, we are always here when you need us, ensuring your entry into the UAE market is both smooth and successful.

Key Documents for Your UAE Bank Application

Getting your documents in order is the most crucial part of opening a non-resident bank account in UAE. It’s not just about ticking boxes; it’s about presenting yourself or your business professionally. UAE banks adhere to strict international compliance standards, so a complete and well-organised application file makes all the difference, speeding things up and showing the bank you're a credible client.

Think of each document as a piece of a puzzle. The bank needs every single piece to build a clear picture of who you are and, for a corporate account, what your business does. One missing item can stall the entire process or even lead to a rejection. This is where attention to detail really pays off.

Essential Personal Documents

Every non-resident application, whether personal or for a company, starts with a core set of personal documents. These are the absolute basics the bank needs to identify you.

- Passport Copy: A clear, colour copy is non-negotiable. It’s your primary form of identification.

- UAE Entry Stamp or Visa Page: This simply proves you have entered the country legally.

- Proof of Address: You'll need a recent utility bill or a bank statement from your home country (usually less than three months old) to confirm where you live.

- Curriculum Vitae (CV): This isn't just about your job history. It gives the bank a sense of your professional background and adds to your credibility.

- Source of Wealth Declaration: Banks need to know where your money comes from. Be prepared to explain and document the origins of your funds, whether it's from a salary, business profits, investments, or inheritance.

On top of this, you’ll almost always be asked for a reference letter from your current bank and your last six months of personal bank statements. These show you have a solid financial history and are in good standing.

Critical Corporate Documents

If you're opening an account for a UAE-based company (whether free zone, mainland, or offshore), the paperwork gets a lot more detailed. You'll need to provide all the personal documents for the shareholders, plus a full set of corporate files to prove your business is legitimate.

Think of your corporate account application as building a business case. The stronger your evidence—clear ownership, a solid business plan, and transparent financials—the faster you’ll get a positive decision from the bank.

Here’s what the bank will need to see for the company itself:

- Certificate of Incorporation and/or Trade Licence: The official document proving your company is legally registered.

- Memorandum and Articles of Association (MOA/AOA): This details your company's purpose, structure, and internal rules.

- Share Certificates and Company Register: These documents confirm who owns the company and how it's structured.

- Board Resolution: A formal, signed document from the company's directors authorising you to open and manage the bank account.

- Proof of Business Address: This is typically your office lease agreement here in the UAE.

A core part of this entire process is what's known as 'Know Your Customer' (KYC). Banks are legally required to verify the identity of their clients to prevent financial crime. To get a better feel for this, understanding KYC in banking and crypto provides a good overview. These checks, along with Anti-Money Laundering (AML) screenings, are not there to make your life difficult—they’re in place to protect the entire financial system.

To help you visualise the requirements, here is a simple breakdown of what's needed for both account types.

Document Checklist Personal vs Corporate Non Resident Accounts

| Document Type | Required for Personal Account | Required for Corporate Account |

|---|---|---|

| Passport Copy | ✔️ | ✔️ (For all shareholders/signatories) |

| UAE Entry Stamp/Visa Page | ✔️ | ✔️ (For all shareholders/signatories) |

| Proof of Address (Home Country) | ✔️ | ✔️ (For all shareholders/signatories) |

| Curriculum Vitae (CV) | ✔️ | ✔️ (For all shareholders/signatories) |

| 6 Months Personal Bank Statements | ✔️ | ✔️ (For all shareholders/signatories) |

| Bank Reference Letter | ✔️ | ✔️ (For all shareholders/signatories) |

| Trade Licence/Certificate of Incorporation | ❌ | ✔️ |

| Memorandum & Articles of Association | ❌ | ✔️ |

| Share Certificates & Register | ❌ | ✔️ |

| Board Resolution to Open Account | ❌ | ✔️ |

| Proof of Business Address (UAE) | ❌ | ✔️ |

This checklist shows why corporate accounts require a more comprehensive file. Partnering with a specialist takes the guesswork out of this. We know exactly what each bank is looking for and make sure your file is prepared perfectly, helping you avoid common delays and get your account opened successfully.

Choosing the Right Bank for Your Needs

Picking the right banking partner is one of the most critical decisions you'll make when setting up your business in the UAE. The financial landscape here is a mix of massive international players, powerful local banks, and specialised Sharia-compliant institutions. Who you choose to bank with will genuinely affect your daily operations, how much you pay in fees, and your overall peace of mind.

Let's be clear: not every bank rolls out the red carpet for non-resident clients. While some are keen on international business, others have much tighter internal policies that can make getting an account approved a real challenge. Your company structure also plays a huge role. For instance, a bank that happily opens an account for a Dubai mainland LLC might get very cautious when they see an application from a Ras Al Khaimah offshore company. Knowing these unwritten rules is the key to a smooth process.

Local Giants vs International Players

Your first big decision is whether to go with a home-grown UAE bank or a branch of a big international name. Each has its own set of pros and cons that you need to weigh against what your business actually needs.

-

Local UAE Banks (e.g., Emirates NBD, FAB): These are the powerhouses of the region, with the most extensive branch and ATM networks you can find. They understand the local market inside and out, which can be a massive advantage for mainland companies. On the flip side, their online banking platforms or international transfer systems can sometimes feel a bit clunky compared to their global competitors.

-

International Banks (e.g., HSBC, Standard Chartered): If your business deals heavily with Europe, Asia, or North America, an international bank is probably a smarter bet. Their global networks make cross-border payments feel seamless and can often be cheaper. The trade-off? They usually demand higher minimum balances and can be pickier about which non-resident applications they approve.

-

Islamic Banks (e.g., Dubai Islamic Bank, Abu Dhabi Islamic Bank): These banks operate on Sharia principles, offering financial products that are fundamentally different from conventional banking. Instead of loans, for example, you'll find things like Murabaha (cost-plus financing). They are a fantastic option if you're looking for ethical, interest-free banking solutions.

Key Factors to Compare

Once you've decided on the type of bank, it's time to get into the nitty-gritty. A mismatch here can lead to frustratingly high fees and operational headaches down the road.

The "best" bank for one company is rarely the best for another. You need to focus on the practical details. What’s the monthly penalty if your balance drops? How easy is it to authorise an international payment on their mobile app? These are the questions that truly matter in the long run.

When you're comparing your options, here’s a simple checklist to work through:

- Minimum Balance Requirements: This is often the biggest deal-breaker. For corporate accounts, this can be anything from AED 50,000 to over AED 250,000. If you fail to maintain it, expect a monthly penalty, usually around AED 250 or more.

- Account Fees: Don't just look at the minimum balance penalty. Dig into the fees for everything else: international transfers, issuing a chequebook, and even just monthly account maintenance. These small charges add up surprisingly fast.

- Multi-Currency Options: Do you bill clients or pay suppliers in USD, EUR, or GBP? If so, a multi-currency account isn't a luxury; it's a necessity. It lets you hold foreign currencies directly, so you aren't forced to convert everything to AED at potentially bad exchange rates.

- Digital Banking Platform: In this day and age, a clunky online portal is simply not an option. Check out their platform. Is it secure and user-friendly? Can it handle bulk payments, manage different user permissions, and connect with your accounting software?

Offshore Accounts and Asset Protection

People often use the term 'offshore account' when they mean a non-resident account, but there is a subtle difference. While any bank account for a UAE offshore company (like one from JAFZA or RAK ICC) is technically an offshore account, the term also points to a specific strategy for protecting assets. These accounts, typically held by a holding company, are structured to legally shield your personal or corporate wealth from liabilities.

As specialists in mainland company formation in Dubai & Abu Dhabi and freezone company formation across the UAE, we have built a deep understanding of what different banks are looking for. We don’t just hand you a list of banks; we make personal introductions to the right relationship managers at institutions that are a good match for your specific business. This ensures your application has the best possible chance of success from day one.

Getting Your Account Open: The Real Work Begins

Alright, you've gathered your documents and picked a bank. Now comes the part where the rubber meets the road: actually opening your non-resident bank account in the UAE. It's not a single event but a journey with several stages, and knowing what to expect can save you a lot of time and frustration.

This is where having a corporate service provider in your corner really pays off. Instead of just walking into a bank branch cold, we build and pre-check your entire application file. We make sure every document is exactly what the bank needs and that your profile is presented in the best possible way, answering the compliance team's questions before they even ask them.

Remote Work vs. The In-Person Visit

One of the biggest questions we get is: "Can I do all of this from my home country?" While a lot of the initial legwork can be handled remotely, the final, crucial step almost always requires you to be here in person. UAE banking regulations, like those in most major financial hubs, are strict on this point to combat money laundering (AML).

Think of the in-person visit as the final handshake. It's the bank's way of putting a face to the name, verifying your identity beyond a doubt, and officially welcoming you as a client under their compliance rules. It's a step that simply can't be skipped.

So yes, you'll need to plan for at least one trip to the UAE. The goal, however, is to make that trip a quick and efficient one. A partner like us does all the heavy lifting beforehand. We submit your file, handle the back-and-forth with the bank's compliance department, and secure a pre-approval. Your visit then becomes a simple, pre-arranged appointment to sign the paperwork, not a series of endless, uncertain meetings.

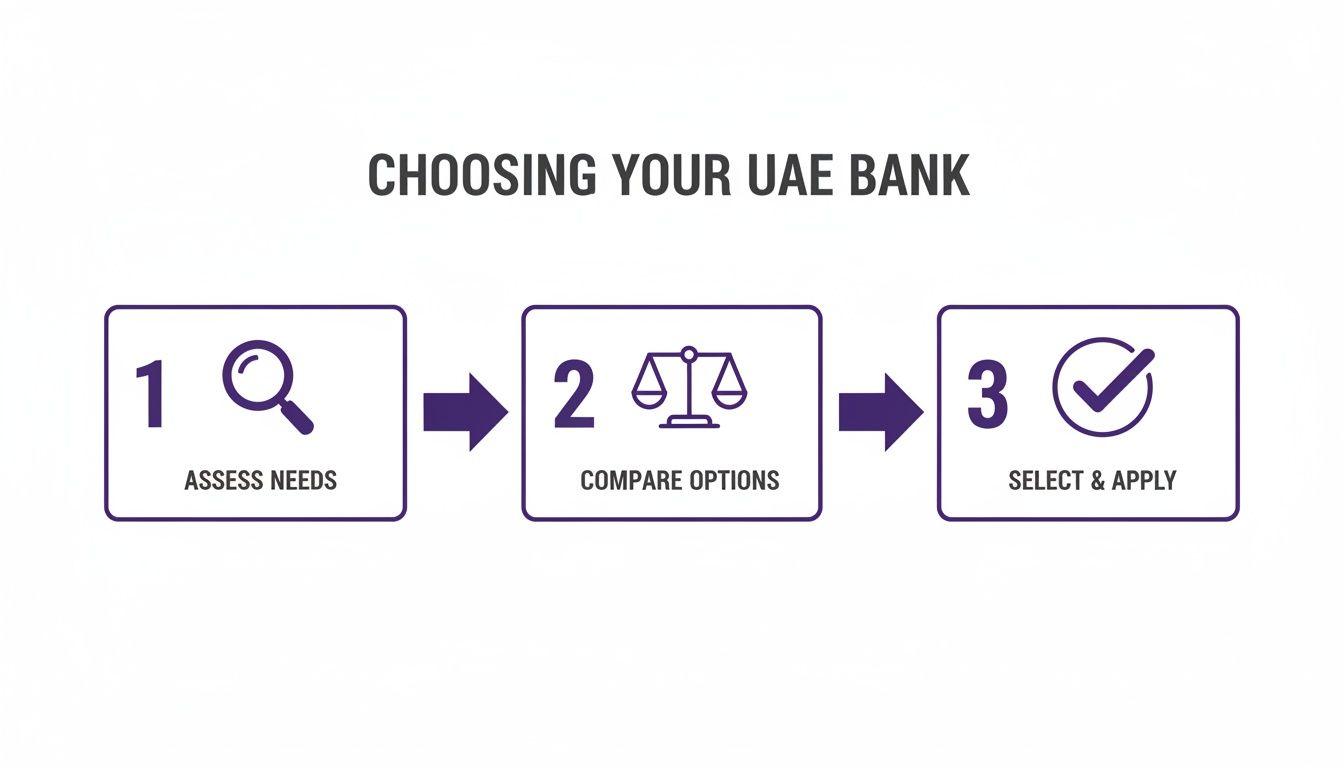

Before you even start the application, choosing the right bank is key. This simple flow shows how to approach it.

Starting with a clear strategy—knowing your needs, weighing your options, and then applying—is the foundation for getting this done right.

The Application Journey: Step-by-Step

Once we submit your application, it goes into the bank's internal review process. This can feel like a bit of a black box from the outside, but there’s a consistent path it follows.

- Initial Submission: Your complete, vetted file is given to a dedicated relationship manager at the bank.

- Compliance Review: This is the most intensive stage. The bank's compliance team will dig into everything – they’ll verify your documents, scrutinise your business plan, and analyse your source of funds.

- Due Diligence Call: Don't be surprised if the bank asks for a quick video or phone call. It's a chance for them to ask a few more questions about your business or background. Being prepared for this is vital.

- Final Approval & Activation: Once compliance signs off, you're in. The bank will issue your account number and IBAN, and you’ll get your online banking login details. Your account is officially open for business.

Our process turns this complex journey into a managed project. We act as your single point of contact, professionally handling all the communication with the bank and giving you clear, regular updates. Our experience not only increases the odds of a fast approval but also brings much-needed clarity to the entire process.

Why Global Investors are Flocking to UAE Banks

The UAE isn't just building a reputation as a top financial hub; it's living up to it, and the numbers prove it. For savvy global investors and entrepreneurs, opening a non-resident bank account in the UAE has become a go-to strategy for protecting and growing their wealth. It’s a move driven by a potent mix of rock-solid economic stability, smart regulations, and a tax-friendly environment that just makes sense for international business.

This flood of global capital is more than just a trend—it's a massive vote of confidence. When high-net-worth individuals and fast-moving tech startups choose the UAE, they’re betting on a financial ecosystem that’s secure, competitive, and flush with liquidity. This in turn strengthens the entire banking sector, creating a well-capitalised and sophisticated environment that benefits everyone.

The Numbers Don't Lie

A quick look at the data reveals a compelling story of trust and sustained growth from the international community. One of the clearest indicators is the steady climb in non-resident deposits over the last decade, proving the country's powerful draw for foreign capital. This isn't just luck; it's the direct result of deliberate, pro-business policies designed to encourage investment and keep it safe.

Recent figures highlight this consistent expansion. Between 2015 and 2024, deposits from non-residents in UAE banks grew steadily from AED 0.17 trillion to AED 0.24 trillion. While the local economy was also booming, this consistent growth shows just how vital non-resident accounts are for everything from international trade and managing offshore companies to simply protecting personal assets.

The constant flow of non-resident money into the UAE banking system is a huge stabilising force. It proves a deep-seated trust in the country's economic management and long-term vision, cementing its status as a reliable hub for global finance.

More Than Just an Account—It's a Launchpad

Opening a non-resident account is often just the first piece of a much bigger financial puzzle. For many, it’s the bedrock for launching broader investment activities, both within the region and across the globe. The UAE's famously business-friendly rules, especially in the free zones of Dubai and Abu Dhabi, make it the perfect launchpad for entrepreneurs ready to scale.

Once your account is up and running, the real work begins: making your capital work for you. The desire for financial growth is what pulls so many investors to the UAE in the first place. After you're set up, it's crucial to understand how to start investing effectively to truly capitalise on the opportunities. This is where the UAE's financial ecosystem truly shines.

We are on the front lines of these trends every day. We help a wide array of clients, from Golden Visa investors securing their family’s future to ambitious tech startups setting up shop in a Dubai free zone. Our job is to make the entry process smooth by taking care of the tricky parts of both company formation and bank account introductions. With our cost-effective business setup solutions and 24/7 support, we make sure you’re perfectly placed to enjoy UAE tax benefits for international entrepreneurs.

How 365 Day PRO Makes Your Application Easy

Trying to open a non-resident bank account in the UAE on your own can feel like navigating a maze blindfolded. That’s where we come in. Our job is to light the path, turning a confusing process into a series of clear, simple steps. We’ve designed our entire service around solving the exact problems that international entrepreneurs and investors run into.

Everything starts with a free, no-pressure chat. In this first call, we listen carefully to understand what your business really needs and figure out your eligibility. This isn't just a sales pitch; it's a vital first step where we map out a banking strategy that’s built just for you.

Getting Your Profile Ready for the Bank

UAE banks are thorough, to say the least. A professional and perfectly compliant application isn't just a suggestion—it's essential. We work with you to build a strong profile that ticks all their boxes. This goes beyond just collecting paperwork; we help you present your business plan, your professional history, and your source of funds in a way that builds trust and gets you past the compliance checks.

A successful application is a story well told. It needs to clearly explain who you are, what your business does, and why you are a credible, low-risk client. We help you tell that story.

Thanks to our long-standing relationships with major banks in Dubai, Abu Dhabi, and Sharjah, we can introduce you to the right people at the right institutions. We’ll find the best fit for your company, whether it's a mainland LLC or a free zone setup. You won't just get a generic list; you'll get a direct connection.

Full Support, Every Step of the Way

Our help doesn't stop there. We prepare and double-check every single document to make sure nothing is overlooked. We stay by your side through the entire compliance process, handling communications with the bank so you don't have to. We also make sure your company formation and bank account application move forward together, creating a seamless and efficient start for your business.

This kind of hands-on guidance is crucial, especially now. The UAE banking sector is booming, with non-resident deposits jumping by 5.1% in just one month to hit AED 249.1 billion in early 2025. This shows incredible global trust. Corporate non-resident deposits alone are consistently above AED 31 billion, proving that businesses worldwide see the UAE as a stable place to bank. For a deeper dive into these numbers, you can check out the Central Bank’s detailed statistical bulletin.

With affordable business setup packages and 24/7 support, we're more than just consultants; we're your partners. We’re always available when you need us, completely focused on one thing: getting your account open.

Ready to start?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Common Questions About Non-Resident Banking in the UAE

When it comes to setting up a non-resident bank account in the UAE, it's natural to have a few questions. We get asked these all the time by international entrepreneurs and investors just like you. Here are some clear, straightforward answers to help you navigate the process with confidence.

Can I Open a UAE Bank Account Remotely, Without Visiting?

This is probably the most common question we hear, and the short answer is usually no. While we can handle almost all the groundwork for you from a distance, UAE banks almost universally require one in-person visit. This isn't just a bank rule; it's a critical compliance step to meet global anti-money laundering standards.

So, what’s our role? We make that single visit as quick and productive as possible. We handle all the pre-approvals, gather the documentation, and get everything lined up so that when you arrive, you’re just walking in for a scheduled appointment to sign the final papers and verify your identity. No wasted time, no guesswork.

What’s the Minimum Balance I Need to Keep in the Account?

There's no single answer here, as the minimum balance depends heavily on the bank and the type of account you're opening. For personal accounts, you might find options ranging from zero balance all the way up to AED 100,000.

Corporate accounts are a different story and almost always require a higher commitment, typically starting around AED 50,000. Sometimes, a bank might waive this if your business shows significant turnover or you have other investments with them. It's really important to get this right, because falling below the minimum can trigger hefty monthly fees. We'll work with you to find a bank whose requirements make sense for your specific business plan.

It's worth noting that the UAE's banking sector is drawing in more global capital than ever. In early 2025, non-resident deposits jumped by an impressive 5.1%, hitting AED 249.1 billion by February. This flood of international investment speaks volumes about the country's stability and the opportunities waiting for new account holders. To see more on this growth, read the full report on the UAE's banking surge on Khaleej Times.

My Application Was Rejected. What Went Wrong?

A rejection can be frustrating, but it almost always comes down to a few common culprits. The most frequent reasons we see are missing paperwork, a business activity the bank considers high-risk, or an inability to clearly show the source of your funds.

UAE banks are incredibly thorough with their compliance checks. Even something as small as a mismatch between your professional background on your CV and the activities in your business plan can raise a red flag. This is where our experience really counts. We run a detailed pre-check on your entire profile to spot these potential roadblocks before the application goes to the bank. This massively boosts your chances of getting approved on the first try.

Partner with the experts who make setting up a business in the UAE straightforward. As specialists in mainland and free zone company formation, we provide cost-effective business setup solutions tailored to your needs, all backed by our 24/7 support service. Let us handle the complexities of opening your non-resident bank account so you can focus on the business opportunities.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com