When people ask about the trading license cost in Dubai, the honest answer is, "it depends." You'll often see a range quoted, typically somewhere between AED 10,000 to AED 30,000 for the first year, but treating that as a fixed price is a mistake. It’s better to think of it as a baseline. The real cost gets dialled up or down based on the specifics of your business—what you sell, where you set up, and how many visas you need.

Decoding the Real Cost of a Dubai Trading License

Figuring out the exact cost of a Dubai trading license isn't like looking up a price tag in a shop. It’s more like building something custom. The final number is a mix of different government fees, necessary approvals from other departments, and professional service charges, all tailored to your business plan.

Every decision you make early on, from the legal structure of your company to its physical address, has a direct impact on the bottom line. Getting a clear-eyed view of these costs from the very beginning is the secret to a smooth, stress-free setup.

To give you a clearer picture, let's create a quick overview. This table summarises the typical cost ranges you can expect, helping you quickly see which bracket your business might fall into.

Estimated Dubai Trading License Costs at a Glance

| License Type and Jurisdiction | Typical Initial Cost Range (AED) | Key Influencing Factors |

|---|---|---|

| Mainland Trading License | AED 15,000 – AED 30,000+ | Office rental (Ejari), DED fees, external approvals, local service agent fees. |

| Free Zone Trading License | AED 10,000 – AED 25,000+ | Chosen free zone, package (e.g., flexi-desk vs. physical office), number of visas. |

| Offshore Company Setup | AED 8,000 – AED 20,000+ | Registered agent fees, jurisdiction (e.g., JAFZA, RAKEZ), complexity of structure. |

As you can see, the jurisdiction is one of the biggest factors. But no matter where you set up, a few core components will always be part of the final bill.

Core Cost Components to Anticipate

When you get the final invoice for your license, you’ll see it’s made up of several mandatory line items. The exact amounts will differ, but the categories are pretty much standard across the board.

Here’s what you can almost always expect to pay for:

- Government Fees: These are the non-negotiable charges that go directly to government bodies. For a mainland company, that's the Department of Economy and Tourism (DET); for a free zone setup, it's the authority of that specific zone.

- Third-Party Approvals: Depending on what you're trading, you might need a green light from other ministries or departments. Think of sectors like food, healthcare, or education—each comes with its own approval process and associated fee.

- Service Provider Charges: This is where an expert partner like 365 DAY PRO comes in. You're not just paying for paperwork; you're investing in getting it done right, fast, and without the expensive mistakes that can crop up if you go it alone.

This structure is why the trading license cost in Dubai varies so much. For most general trading or professional activities, that AED 10,000 to AED 30,000 yearly figure is a realistic ballpark. It covers essential steps like reserving your trade name (which can cost AED 100 to AED 620) and the initial registration, which itself can range from AED 5,000 to AED 15,000 or more depending on where and how you're setting up. You can explore more details on how these moving parts shape your startup budget.

A common mistake I see entrepreneurs make is getting fixated on just the main license fee. A smart budget plans for everything—from the first approval stamp to the final visa in your passport. That’s how you get a complete financial picture and avoid surprises.

Once you understand this cost breakdown, you stop asking "how much is it?" and start asking "what choices will shape my cost?" That simple shift in thinking is your first step toward a predictable and successful launch into the UAE's incredible business environment.

Mainland vs Free Zone Cost Differences Explained

Choosing between a Mainland and a Free Zone setup is easily the biggest decision you'll make, and it has a massive impact on your initial trading license cost in Dubai. This isn't just about picking a spot on a map; it's a fundamental choice that dictates who you can sell to, what your ownership looks like, and how much you'll spend year after year.

Think of it like this: a Mainland license is like building a custom home. You get total freedom—the ability to trade anywhere in the UAE and sell directly to local customers—but you’re on the hook for sourcing and paying for every single component. On the other hand, a Free Zone license is more like buying a high-end, all-inclusive property package. The big costs are bundled together for convenience, but your business activities are usually ring-fenced to the zone and international markets.

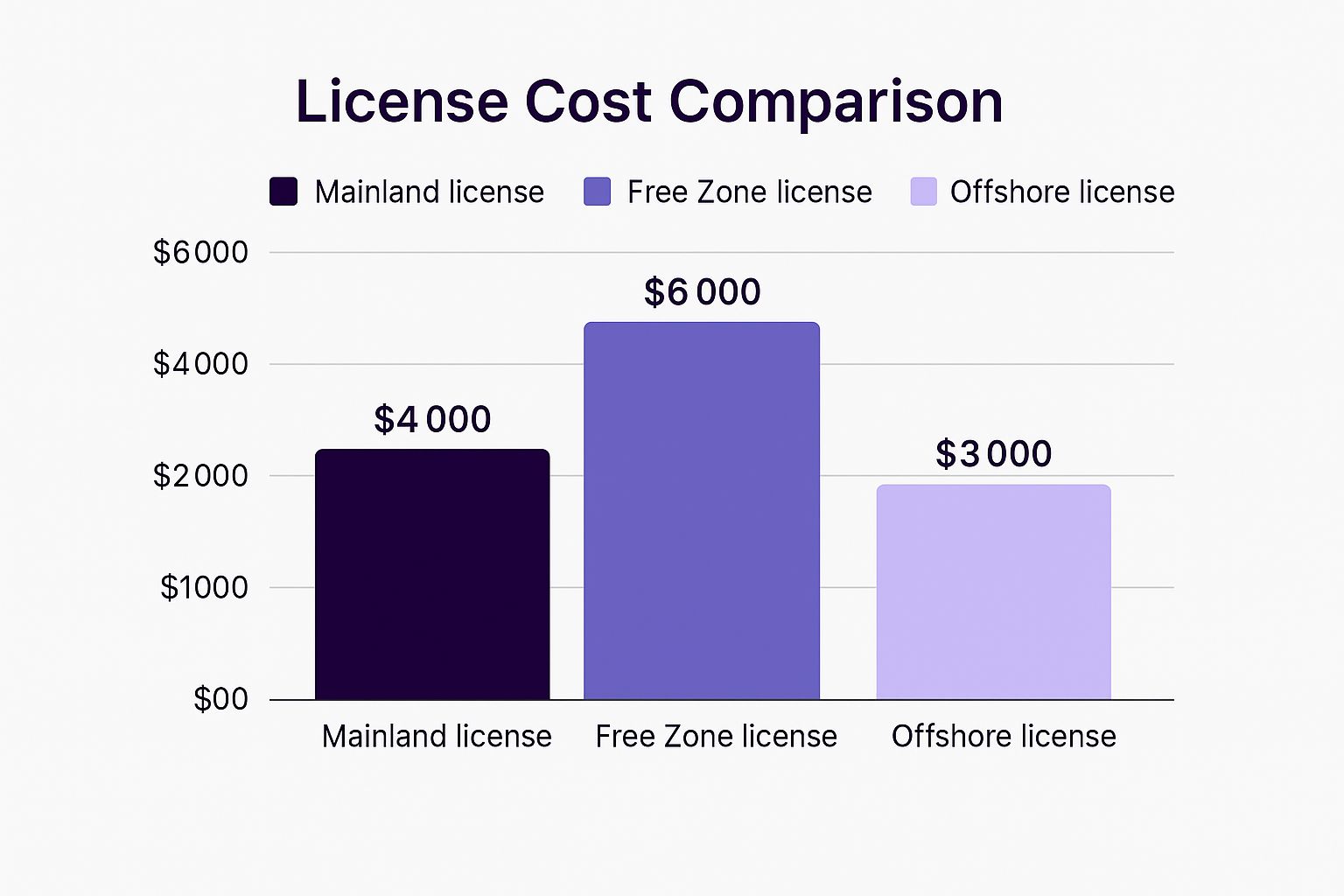

This visual gives you a quick snapshot of the typical starting costs across the different jurisdictions.

As you can see, Free Zones might look a bit pricier at first glance, but that figure often includes services you'd have to pay for separately on the Mainland.

The Financial Anatomy of a Dubai Mainland License

Setting up on the Dubai Mainland means you're dealing directly with the Department of Economy and Tourism (DET). This route is your golden ticket to the entire UAE market, which is absolutely essential if you're in retail, local distribution, or any business that serves the local population directly. The trade-off for this market access is a more itemised, à la carte cost structure.

You’ll be looking at a few key expenses specific to a Mainland setup:

- DET Fees: These are the standard government charges for issuing the license.

- Mandatory Office Space (Ejari): This is a big one. You must have a physical office lease registered with the Ejari system, and it’s a significant recurring annual cost.

- Local Service Agent (LSA) or UAE National Partner: While 100% foreign ownership is now standard for most business activities, some strategic sectors still need a local partner or agent, which comes with an annual fee.

When you add it all up, a typical Mainland trading license will land somewhere in the AED 15,000 to AED 30,000 range just for the first year. That’s before you even get into any special approvals your specific business might need. This approach gives you ultimate control, but you have to budget carefully for each individual line item.

The All-Inclusive Model of Free Zone Licenses

Dubai’s 40+ Free Zones are basically self-contained economic hubs, each with its own regulator and rules. They’re incredibly popular with international entrepreneurs for good reason—they offer major perks like 100% foreign ownership, zero tax on personal and corporate income, and the ability to send all your profits home.

The real difference, financially, is their pricing model. Most Free Zones sell "all-in-one" packages that bundle the essentials. A standard package will usually cover:

- The trading license fee itself.

- Company registration and trade name reservation.

- An allowance for one or more residency visas.

- Use of shared office facilities, like a flexi-desk.

By bundling these services, Free Zones offer a level of cost predictability that is a huge relief for new entrepreneurs. You know exactly what you’re paying for upfront, which dramatically reduces the risk of surprise fees popping up later.

This packaged approach is a major draw, but it’s crucial to remember that not all zones are created equal. A setup package in a premium zone like Dubai Multi Commodities Centre (DMCC) will come with a different price tag and list of perks than a more budget-friendly option like the International Free Zone Authority (IFZA). Generally, the trading license cost in Dubai for a Free Zone ranges from AED 10,000 to AED 25,000, with the final cost really boiling down to the zone’s reputation, location, and the package you choose.

To help you see exactly how the costs stack up, this table breaks it down side-by-side.

Mainland vs Free Zone Cost Component Comparison

This table provides a simple comparison of the typical fees you'll encounter when setting up a trading company on the Dubai mainland versus in a popular free zone.

| Cost Component | Dubai Mainland (Estimated AED) | Typical Free Zone (Estimated AED) |

|---|---|---|

| Trade Licence Fee | 10,000 – 15,000 | Often bundled in a package |

| Office Space/Ejari | 15,000+ (Annual Rent) | Included (Flexi-desk) or 10,000+ |

| Initial Approval | ~120 | Included in package |

| Trade Name Reservation | ~620 | Included in package |

| Visa Costs | 3,500 – 5,000 per visa (Separate) | Often 1-2 visas included in package |

| Establishment Card | ~2,000 (Separate) | ~2,000 (May be bundled) |

In the end, the "best" choice is all about your business model. If your plan is to sell directly to customers in Dubai and across the UAE, the Mainland is the only way to go, and its itemised costs are just part of the investment. But if your focus is on international trade, consulting, or e-commerce, a Free Zone package offers a predictable and efficient launchpad. As specialists in both setups, we can help you map out these costs to find the perfect fit for your ambitions.

Peeling Back the Layers: Government and Third-Party Fees

When you first see a price for a trading license, it's easy to think that's the final number. But in reality, that's just the tip of the iceberg. The total trading license cost in Dubai is actually a sum of many smaller, mandatory fees that can trip up even the most prepared entrepreneur. To build a realistic budget, you have to dig into every single line item, from government approvals to third-party services.

Think of it like buying a car. The sticker price looks great, but by the time you add registration, insurance, and other administrative charges, the final bill is always higher. It’s the same with setting up your business here. Knowing all the components upfront is the secret to avoiding last-minute financial surprises and frustrating delays.

Let's break these costs down so you can plan with confidence and see exactly where every dirham is going.

Core Government Fees: The Starting Line

Before you even get to the main license application, there are a few essential fees you'll have to pay. These are non-negotiable charges that go directly to government bodies like the Department of Economy and Tourism (DET) on the mainland or the relevant free zone authority. They are the foundation of your setup costs.

Here are the most common upfront government fees you can expect:

- Trade Name Reservation: This is your first official step. You need to secure a unique name for your company that follows the UAE's naming rules. This typically sets you back between AED 620 and AED 720.

- Initial Approval Certificate: This is the government's green light, confirming they have no objection to your business idea and the activities you've chosen. It's a must-have before you can proceed and usually costs around AED 115 to AED 125.

- Memorandum of Association (MOA) Attestation: If you're setting up an LLC or a similar structure, your MOA is a vital legal document. It lays out the ownership structure and rules of operation. Getting it officially attested comes with its own fee, which is a necessary legal expense.

These initial payments might seem small, but they are crucial gateways. You simply can't move forward in the licensing process without clearing them first.

This is exactly where a good corporate services provider proves its worth. Instead of you trying to figure out multiple government portals and payment deadlines, we handle all these foundational steps. We make sure everything is paid and filed correctly from the get-go.

Third-Party Approvals and External Fees

Beyond the standard government charges, many business activities need a special sign-off from other regulatory bodies. These "external approvals" are another layer of costs that depend entirely on what your company does. A business trading general goods will have a much simpler path than one dealing with food, medicine, or real estate.

For example, if your business involves:

- Foodstuffs: You’ll need the stamp of approval from the Dubai Municipality's Food Safety Department.

- Medical Products: Clearance from the Dubai Health Authority (DHA) is mandatory.

- Real Estate: The Real Estate Regulatory Agency (RERA) will have to be involved.

Each of these external agencies has its own fee schedule, inspection requirements, and paperwork, all of which add to your total trading license cost in Dubai. On top of that, every mainland license requires you to register your office tenancy contract through the Ejari system. This fee, which can be up to AED 5,000 depending on your lease, officially links your company to a physical address—a non-negotiable requirement for mainland operations.

As Specialists in Mainland Company Formation in Dubai & Abu Dhabi and Specialists in Freezone Company Formation across the UAE, we identify every single external approval you'll need right from day one. Our expertise means you get a complete, accurate budget with no hidden costs from third-party authorities. This lets you focus on what really matters: launching your business with total financial clarity.

Uncovering Hidden Costs Beyond the Initial License Fee

Getting your trading license in hand is a fantastic milestone, but it's really just the starting gun for your business journey, not the finish line. That initial trading license cost in Dubai is only the first piece of the financial puzzle. So many entrepreneurs get tunnel vision on the setup fees and completely miss the recurring expenses that really define the long-term cost of doing business here.

You have to think beyond year one. It's a common and costly mistake to see the license fee as a one-time purchase. A better way to look at it is the beginning of a long-term relationship with your business—one where annual renewals and compliance are just as critical as that first payment.

This kind of forward-thinking is what separates businesses that thrive from those that struggle. When you understand the full picture of your costs from day one, you can build a solid financial plan that actually supports growth, instead of getting blindsided by expenses that were entirely predictable.

Annual Recurring Costs You Cannot Ignore

Once you're officially up and running, a new set of yearly costs kicks in. These aren't optional extras; they're mandatory to keep your business legal and operational. You absolutely have to budget for them to stay in good standing with the authorities.

The biggest recurring items on your checklist will be:

- Trade License Renewal: This is the big one. Your license has to be renewed every single year, and the fee is usually pretty close to the initial government fee, just without some of the one-time setup charges.

- Office Rent: For a mainland company, your Ejari (the registered tenancy contract) is a major annual expense. Even in a free zone, if you have a physical office or a flexi-desk package, that payment will come around every year.

- Establishment Card Renewal: Think of this as your company's link to the immigration and labour departments. It’s essential for handling visas and needs to be renewed annually, typically setting you back around AED 2,000.

- Visa Renewals: Every residency visa for you and your employees has a shelf life. While they're often valid for two years, this is a significant recurring cost that you need to plan for in your cash flow.

The true cost of ownership for a Dubai trading license isn't what you pay in year one; it's the cumulative total over three to five years. Smart entrepreneurs budget for renewals with the same seriousness they apply to their initial setup costs.

Essential Compliance and Regulatory Costs

On top of the standard renewals, there's another layer of costs that has become a big deal in the UAE's business world. These expenses are all about financial reporting and taxation, and ignoring them can lead to some hefty penalties. They aren't just admin tasks; they're vital for ensuring your business operates by the book.

Looking at the bigger picture, keeping a trade license active involves ongoing expenses that go way beyond the initial fee. You can expect trade license renewal fees to be anywhere from AED 10,000 to AED 25,000 each year, whether you're on the mainland or in a free zone. Then there are visa-related costs, with UAE residence visas running between AED 3,500 and AED 5,000 per person every two years, which includes the medical tests and Emirates ID. Plus, compliance costs are on the rise, with new rules requiring audited financials and VAT registration for any company with a turnover above AED 375,000. You can find more detail about the cost of running a business in the UAE on propartnergroup.com.

Here are the key compliance costs you need to have on your radar:

- Mandatory Financial Audits: Many authorities, especially in the free zones, now insist on seeing audited financial statements every year. This means you’ll need to hire a licensed audit firm, adding another professional service fee to your budget.

- VAT Registration and Filing: If your annual revenue crosses the AED 375,000 threshold, you are legally required to register for Value Added Tax (VAT). This comes with regular filing duties, and you’ll likely need an accountant to handle it correctly.

- UAE Corporate Tax: The introduction of Corporate Tax has added a whole new dimension to financial management. You’ll need to register, keep meticulous accounting records, and file tax returns—all of which might require bringing in an expert.

At 365 DAY PRO, our Cost-Effective Business Setup Solutions are built specifically with this long-term perspective. We make sure you have total clarity on both the initial and ongoing costs, so you get a complete and honest financial picture right from the start. Our 24/7 Support Service is always on standby to help you navigate renewals and compliance, making sure your success is built to last.

The E-Trader Licence: A Low-Cost Alternative

For the wave of entrepreneurs selling through Instagram or running a passion project from their living room, the standard trading licence cost in Dubai can feel like a steep hill to climb. A full commercial licence, which often demands a physical office and comes with higher fees, just doesn't make sense for a solo digital operator.

This is exactly why the Dubai government stepped in with a brilliant solution: the E-Trader licence. It’s a streamlined, affordable permit designed specifically to empower home-based businesses and social media sellers. Think of it as a legal launchpad that lets you join Dubai's booming market without the heavy overheads.

This initiative is a direct nod to the new age of e-commerce, creating a legitimate and budget-friendly path for a growing number of digital entrepreneurs.

Who It's For and What You Can't Do

The E-Trader licence is tailored for individuals, not big corporations. It’s the perfect fit for freelancers, stay-at-home parents, or anyone turning a hobby into a side hustle from home. But it's crucial to know the rules of the game.

Currently, eligibility is limited to UAE and GCC nationals residing in Dubai. This licence gives you the green light to sell your products and services online, whether that's through your own website or on social media channels.

At its heart, the E-Trader licence is about supporting micro-businesses. It brings online sales activities out of the grey area and into a clear, legal framework, giving small-time sellers a proper start.

This affordability, however, comes with a few trade-offs to keep it focused on its intended audience. With an E-Trader licence, you are not permitted to:

- Lease a physical office space or open a brick-and-mortar shop.

- Sponsor visas for employees.

- Import goods yourself; you'll need to partner with a third-party logistics provider.

As you weigh local options like this, it’s also smart to look into general e-commerce licensing considerations to get the full picture.

A Clear Cost Comparison

The biggest draw of the E-Trader licence is its price tag. The government has deliberately made this accessible for anyone wanting to start a small online business from home. The base cost for the licence itself is just AED 1,200—a tiny fraction of what a standard commercial licence would set you back.

Of course, there are a couple of other mandatory fees to keep in mind. You'll need to join the Dubai Chamber of Commerce, which is an annual fee of around AED 350. If you have a unique business name in mind, a trade name reservation fee of AED 100 to AED 200 will also apply.

This simple, transparent structure makes it one of the most cost-effective ways for a solo entrepreneur to get up and running legally in Dubai.

Partner With Experts for a Smarter Business Setup

Trying to navigate Dubai's business setup landscape on your own can feel like putting together a complex puzzle without the instruction manual. It’s a journey filled with potential wrong turns, from picking a jurisdiction that doesn't quite fit your vision to miscategorising your business activities. These missteps often lead to surprise costs and frustrating delays.

This is where having an expert in your corner shifts from being a simple service to becoming your most valuable strategic asset.

Going it alone often means the final trading license cost in Dubai is much higher than you first budgeted for. A seasoned partner, on the other hand, transforms a confusing and potentially expensive process into a clear, predictable, and efficient one. Our job isn't just about filing paperwork; it's about being your dedicated guide, making sure every decision is the right one for your success.

Your Strategic Advantage in Dubai

We specialise in crafting the right solutions for entrepreneurs. Whether you're aiming for the local market with a Mainland company or looking to seize global opportunities from a Free Zone, we have the know-how to build the perfect foundation for your business.

Our team makes sure you're set up to take full advantage of all the UAE Tax Benefits for International Entrepreneurs—a huge plus for international entrepreneurs. We offer a true partnership that saves you time, money, and a whole lot of stress, letting you focus on what you do best: running your business.

Think of our service not as another expense, but as your first and best investment. By helping you sidestep costly errors and getting your setup right from day one, we deliver a return that benefits your business for years to come.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we have a deep, practical understanding of the local regulatory environment. We are Specialists in Mainland Company Formation in Dubai & Abu Dhabi and Specialists in Freezone Company Formation across the UAE. Our entire approach is built on providing Cost-Effective Business Setup Solutions that are a perfect fit for what you need.

Plus, our commitment doesn’t stop when your license is in your hands. With our 24/7 Support Service, we're always here when you need us, offering ongoing help to ensure your business continues to grow and succeed long after launch.

Ready to get your Dubai business setup right the first time?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When you're looking to set up a business in Dubai, it's natural for questions about costs to be front and centre. We get asked about the financial side of things all the time, so we've put together some straight answers to the most common queries we hear about the trading license cost in Dubai.

What Is the Cheapest Trading License in Dubai?

This really depends on who you are and what you need. For UAE or GCC nationals living in Dubai and running a business from home or through social media, the E-Trader Licence is unbeatable. The base fee is just AED 1,200, plus a mandatory Dubai Chamber membership, making it the most affordable official license out there.

If you're an international entrepreneur, your best bet for a low-cost start is usually in one of the Free Zones. Some of the more budget-friendly zones have packages that start in the AED 10,000 to AED 12,000 range. These often bundle your license, registration, and sometimes even a visa, which is fantastic value when you're just getting started.

Can I Get a Dubai Trading License Without an Office?

Yes, you absolutely can—but where you set up your company is the deciding factor. If you're going for a Mainland license, there's no way around it: you need a physical office space with a registered Ejari (tenancy contract). It's a non-negotiable part of the Mainland setup process.

On the other hand, the Free Zones are built for flexibility. Most of them offer clever solutions for entrepreneurs who don't need a traditional office. These usually come in two flavours:

- Flexi-desk packages: You get access to a shared workspace when you need it.

- Virtual office packages: This gives you a legitimate business address without the expense of renting a physical space.

These options are a huge help in keeping the initial trading license cost in Dubai down, especially for consultants, international traders, or anyone who can operate remotely.

How Much Is the Annual Renewal Fee for a Trading License?

This is a critical number to factor into your annual budget. A good rule of thumb is that your renewal fee will be quite close to the initial government fees you paid, minus any one-off charges like the MOA attestation.

For a Mainland license, you're typically looking at renewal costs between AED 10,000 and AED 25,000, and don't forget you'll also have the annual cost of your office lease on top of that. In a Free Zone, the renewal is usually bundled into an annual package, which can run anywhere from AED 10,000 to AED 20,000+, depending on the zone and your specific package.

So many entrepreneurs focus entirely on the upfront setup cost and get caught off guard by the renewal fee a year later. Thinking about this recurring expense from the very beginning is key to keeping your business legally sound and stable for the long haul.

What Happens if I Don’t Renew My Trade License on Time?

Letting your trade license expire is a mistake you don't want to make. The consequences can be severe and costly. First, the authorities will hit you with fines for the late renewal, and these can add up fast.

Worse than the fines, an expired license can lead to your company's bank account being frozen. It also invalidates all visas sponsored by your company, which means your business operations grind to a halt. It’s a situation that can quickly spiral, so staying on top of your renewal date is essential.

At 365 DAY PRO Corporate Service Provider LLC, we take the guesswork out of this process and turn it into a clear, cost-effective plan. Our specialists build smart solutions for both Mainland and Free Zone setups, helping you sidestep expensive mistakes and make the most of the UAE's tax advantages. Partner with us for a better way to set up your business. Learn more and get a free consultation.