So, you're thinking about setting up a business in Dubai. The first question on everyone's mind is always the same: what's it really going to cost? There’s no simple, one-size-fits-all answer. The final price tag is a blend of your specific choices—what kind of license you need, what your business will actually do, and whether you set up on the Mainland or in a Free Zone.

As a ballpark figure, you can expect a mainland trade license to set you back anywhere from AED 15,000 to over AED 50,000 for the first year of operation.

A Quick Guide To Dubai Trade License Costs

Launching a business in Dubai is exciting, but it demands a solid financial plan from day one. The trade license cost in Dubai isn't some fixed fee you just pay off a list. It's a dynamic figure that shifts based on your unique business goals. I like to think of it like building a custom car: the final price depends on the engine you choose (your business activity), the body style (Mainland or Free Zone), and all the extras (like visas and office space).

Getting a handle on these moving parts right from the start is the key to a stress-free launch. As specialists in Mainland and Freezone company formation, we can help you find the most efficient and cost-effective path for your specific needs. This overview will give you the high-level summary before we dive into the nitty-gritty of each cost.

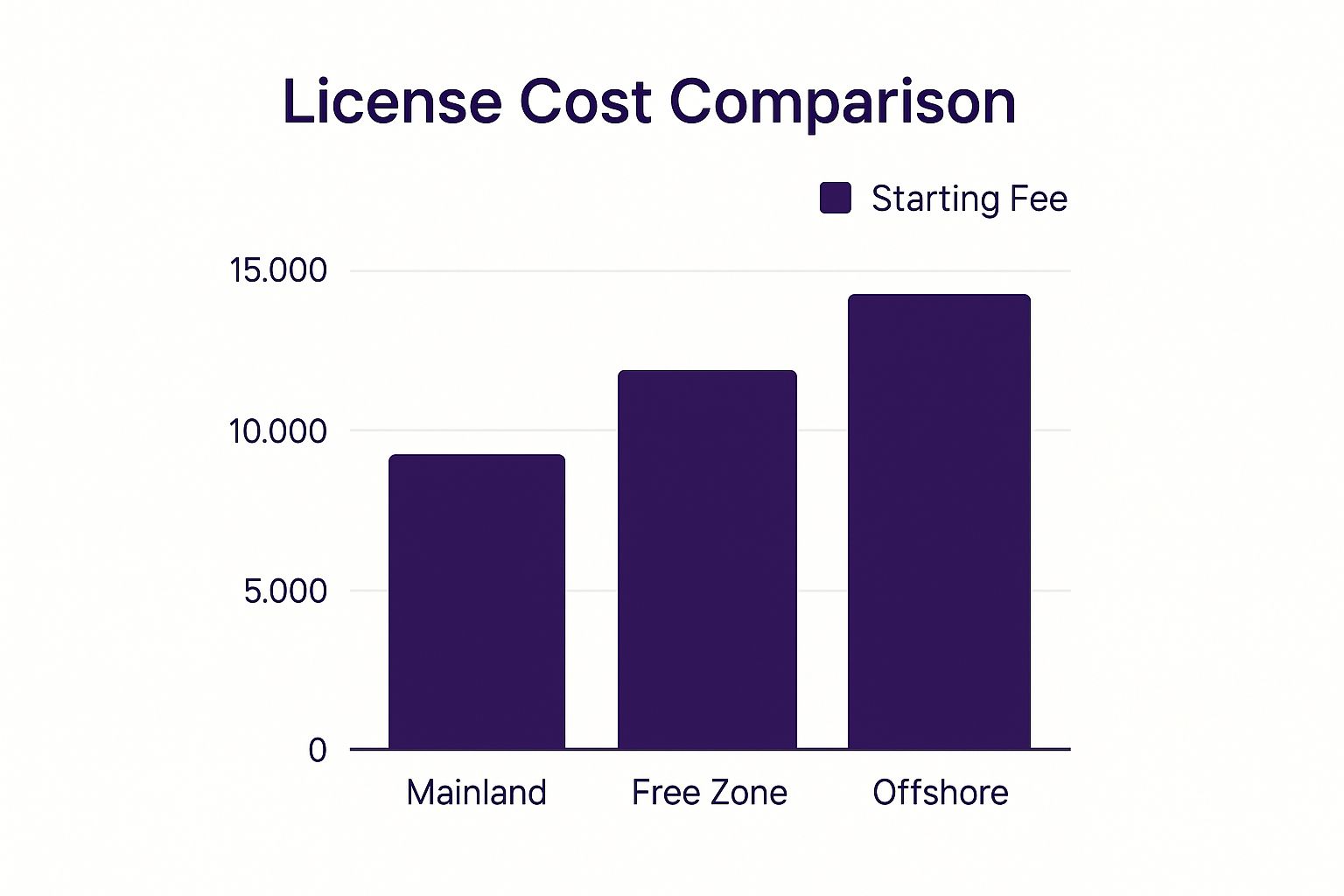

Comparing Initial License Fees at a Glance

To give you a clearer idea of what to expect, it's helpful to see how the starting costs stack up across different jurisdictions. The chart below gives a visual snapshot of the typical entry-level fees for the three main license categories.

This comparison really drives home the point that while the costs are competitive across the board, your choice of jurisdiction lays the financial groundwork for your entire business setup.

The Variables That Shape Your Final Cost

That initial fee is just the starting line. A handful of other critical factors will ultimately determine the final amount you'll pay. Getting these right is crucial for accurate budgeting and avoiding any nasty surprises down the road.

Things like your company’s legal structure and the number of employee visas you need will have a major impact. For instance, a General Trading License can range from AED 12,500 to AED 35,000. A more standard license package with two visa slots might come in around AED 20,500, while a premium license with three visas could push that figure closer to AED 32,500. You can learn more about how visa quotas and license types affect costs on globoprime.ae.

The Bottom Line: Your total investment is a direct reflection of your choices. Every decision, from the type of license you select to the number of visas you apply for, builds up the final trade license cost.

To help you get a quick overview, here's a table summarising the estimated starting costs for some common license types.

Estimated First-Year Trade License Costs in Dubai

This table provides a summary of approximate starting costs for common trade licenses in Dubai, giving new entrepreneurs a quick reference point.

| License Type | Jurisdiction | Estimated Starting Cost (AED) |

|---|---|---|

| Professional License | Mainland | AED 17,000 |

| E-commerce License | Free Zone | AED 15,000 |

| General Trading License | Mainland | AED 25,000 |

| Commercial License | Mainland | AED 20,000 |

Keep in mind, these are starting estimates. The actual costs will vary based on the specific details of your business setup, including approvals, office space, and visa allocations.

Breaking Down Your Dubai Mainland Licence Fees

Setting up on the Dubai Mainland is a big move. It gives you direct access to the entire UAE market, which is a massive advantage for any ambitious business. But when you get that first invoice, figuring out what you’re actually paying for can be a little confusing. To get a real handle on your trade licence cost in Dubai, you need to know what each of those line items means.

Think of it like getting a detailed quote for building a house. Every fee covers a specific, mandatory part of the construction process, handled by government departments to make sure your business is legal and compliant from the get-go. Let's walk through those core government fees together.

Core Government Fees Explained

The first chunk of your setup cost goes straight to the Dubai government for all the necessary processing and approvals. These are fixed, non-negotiable fees, but getting them right the first time is where a good setup partner earns their keep, preventing any frustrating delays.

- Initial Approval Fee: This is your first official thumbs-up. The Department of Economy and Tourism (DET) takes a look at your business plan and activities to give you the preliminary green light.

- Trade Name Reservation: Your business name is your identity, and this fee locks it in. It reserves your chosen name so no one else can grab it while you’re sorting out the rest of your paperwork.

- Memorandum of Association (MOA) Attestation: The MOA is the rulebook for your company. This fee is for getting this vital legal document officially notarised, which makes it a legally binding contract between all the shareholders.

These initial charges are the foundation of your mainland application. They’re predictable costs, and any reputable corporate service provider should be able to lay them out for you clearly from the very beginning.

As specialists in Mainland Company Formation in Dubai & Abu Dhabi, it's our job to make this process seamless. An expert makes sure every fee is paid correctly and on schedule, saving you from expensive mistakes or delays that can quickly bloat your startup budget.

Variable Costs and Other Charges

Once you get past the initial government processing fees, your final bill will have other charges that can change depending on the specifics of your company. These costs are just as important and make up a significant part of the total trade licence cost in Dubai.

One of the most significant variable costs is the Market Fee. The government calculates this as a small percentage (usually around 2.5%) of your office's annual rent, and it's paid directly to the DET. It essentially links your physical office space to your official licence.

You'll also find a fee for the Dubai Chamber of Commerce. For most mainland companies, membership is mandatory. It shows you're a committed member of the local business community, and the fee itself varies based on your company's legal type and primary activity. Our team is on hand 24/7 to help demystify these variable costs and put together a package that works for your specific budget.

Breaking Down Free Zone Trade Licence Packages

Dubai's Free Zones are a huge draw for international entrepreneurs, and for good reason. They offer incredible benefits like 100% foreign ownership and major UAE tax advantages. But when it comes to pricing, they operate a little differently than a mainland business setup.

Instead of paying for a list of separate government fees, Free Zones bundle everything into neat, all-in-one packages. This is a big part of their appeal. Think of it like a business subscription—you pick a plan that matches your needs, and it comes with all the essentials to get your company off the ground. A basic package usually covers your registration, the licence itself, and a "flexi-desk" to meet the physical address requirement.

This bundled model is a game-changer when you're working out the total trade licence cost in Dubai for a Free Zone company. For anyone looking for a straightforward and budget-friendly launchpad, these packages offer fantastic value.

How Your Choices Shape the Final Price

The cost of your Free Zone package isn't a one-size-fits-all number. It’s directly linked to three key decisions you'll make. These choices are what scale the price up or down, helping you find a sweet spot between your budget and what your business actually needs.

-

Your Business Activity: First and foremost, what will your company do? A simple consultancy or e-commerce licence will almost always be cheaper than a general trading or industrial licence, which comes with more regulatory checks.

-

Your Office Space: The type of facility you choose has a big impact on the price. A basic flexi-desk package is the most affordable route. If you need a dedicated private office, the package cost will naturally go up.

-

Your Visa Needs: The number of residence visas your package includes is another major cost factor. A zero-visa or single-visa package will be the most economical starting point. The price climbs with every extra visa slot you add.

Our specialists in Freezone Company Formation across the UAE are experts at unpacking these packages. We can help you compare options from top zones like DMCC, JAFZA, and Dubai Silicon Oasis to find the perfect fit—balancing cost with the strategic edge your business deserves.

A Look at Real-World Costs

When you start digging into the numbers, you'll see that costs in these special economic zones look quite different from mainland Dubai. For example, in a major hub like the Jebel Ali Free Zone Authority (JAFZA), a general trading licence can run up to AED 30,000 each year.

On the other hand, more specialised trading or industrial licences focused on a limited range of products often land somewhere between AED 5,500 and AED 9,000 annually. These figures typically bundle the annual licence fees, one-time registration fees of around AED 10,000, and the mandatory office space costs, which can vary widely. You can discover more insights in this comprehensive UAE Free Zones guide.

Looking Beyond the Licence Fee: What Else Do You Need to Budget For?

Figuring out the total trade licence cost in Dubai can feel like trying to solve a puzzle with moving pieces. The number you see for the licence itself? That's just the start. Many first-time entrepreneurs get laser-focused on that initial fee, only to be caught off guard by the other costs needed to get their business up and running.

They aren't "hidden" costs, exactly. They're just easy to miss when you're caught up in the excitement of the launch.

A great way to think about it is like buying a high-performance engine for a car. It's the most critical component, no doubt, but you can't go anywhere without the chassis, wheels, and a steering wheel. It's the same with your business; the licence gets you started, but several other elements are essential before you can open your doors. Factoring these in from the get-go is the secret to a stress-free start.

Factoring in Visa and Establishment Card Costs

Once your trade licence is in hand, the next big-ticket item is getting the right legal paperwork for you and your staff. It all starts with the Establishment Card. Think of this as your company's master key for immigration, allowing you to sponsor employees. This card will set you back around AED 2,000.

With the Establishment Card secured, you can start applying for residence visas. Each visa isn't a single flat fee but a collection of payments for different steps in the process:

- Entry Permit: This is the first step, giving an individual permission to enter the UAE for work.

- Medical Fitness Test: A mandatory health checkup that every residence visa applicant must pass.

- Emirates ID Application: The fee for the compulsory national ID card.

- Visa Stamping: The final stage where the residence visa is officially stamped into the passport.

All in, the cost for an investor or employee visa typically falls somewhere between AED 3,500 and AED 7,500 per person. The final amount can vary depending on things like how quickly you need it processed and whether the person is applying from inside or outside the UAE.

Planning for a successful launch means seeing the complete financial picture. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we provide transparent, cost-effective business setup solutions that account for every single expense, ensuring there are no surprises.

Don't Forget Office and Admin Expenses

For most mainland businesses in Dubai, having a physical address is non-negotiable. This means more than just signing a lease; you have to register that rental agreement through Ejari, Dubai's official online portal. While the registration fee is small, it’s a mandatory step that validates your office lease—which is, of course, a major operational cost on its own.

Beyond the office, other administrative costs can creep in and add up.

- Corporate Bank Account Setup: Many banks will open your account for free, but some might ask you to maintain a minimum balance or charge a setup fee, particularly for more complex company structures.

- Legal Translation and Attestation: If your key business documents aren't in Arabic, you'll need them legally translated. On top of that, documents issued outside the UAE must be attested—first by the UAE Embassy in their country of origin and then by the Ministry of Foreign Affairs here in the UAE. Each stamp adds to the final bill.

Getting a handle on these extra expenses will help you build a much more accurate budget. For a free consultation to map out a complete financial plan for your Dubai business, feel free to WhatsApp Us Today for a Free Consultation or give us a call at +971-52 923 1246.

How Dubai Made Setting Up a Business More Affordable

Dubai's government hasn't just sat back and watched; they've been actively tearing down the financial barriers that can stop entrepreneurs in their tracks. Think of it less as a rigid, unchanging system and more as a landscape they're constantly reshaping to be more welcoming and less expensive. This commitment directly translates into a lower trade license cost in Dubai, with practical changes you can actually feel in your wallet.

One of the biggest shifts has been the move to digital. By taking most government services online, they've slashed the time and extra costs that used to come with stacks of paperwork and running around the city. Your application gets processed faster, you spend less on administrative headaches, and you can put that money right back into what really matters: growing your business.

Cheaper Licence Options are Now on the Table

Perhaps the most significant change has been the introduction of new licence types built for how we work today. The government realised that not everyone needs a sprawling office, especially with so much business happening online. This thinking has led to some genuinely clever solutions that drastically cut your initial setup costs.

Take the eTrader licence, for example. It’s been a total game-changer for entrepreneurs running businesses from home or selling through social media. The old way of thinking tied every business to a commercial address, but reforms like the eTrader licence from Dubai Economy have flipped that script. It allows UAE and GCC nationals to legally operate online from their residence, completely wiping out the hefty expense of a commercial lease. You can see how this initiative works on the Dubai Trade portal.

What this all shows is Dubai's genuine commitment to building a dynamic, pro-business environment. The focus is clear: provide flexible, affordable ways for entrepreneurs from around the world to set up shop and tap into the UAE's tax advantages and incredible growth potential.

By going digital and offering these flexible licences, Dubai has made launching a business here more achievable than ever before. If you want expert help finding the smartest, most affordable path for your own venture, just WhatsApp Us Today for a Free Consultation or give us a call at +971-52 923 1246.

Smart Strategies To Reduce Your Setup Costs

While you can't negotiate government fees, there are absolutely ways to be clever about managing your total trade license cost in Dubai. Starting lean isn't about cutting corners on quality; it's about making savvy decisions right from the get-go.

One of the biggest levers you can pull is your choice of business activity and legal structure. For instance, a professional license typically comes with lower startup fees compared to a general trading license. The legal form you choose—like a Sole Establishment versus an LLC—also plays a direct role in your final bill.

Choose Your Jurisdiction Wisely

The decision between a Free Zone and the Mainland is a major fork in the road, financially speaking. A Free Zone package bundled with a flexi-desk is often the most wallet-friendly route, especially since it lets you sidestep the hefty expense of leasing a physical office. This setup is perfect for consultants, freelancers, and global entrepreneurs who don't need a physical presence in the local market.

On the other hand, if you need to trade directly within the UAE, a Mainland license is non-negotiable. But even here, there are ways to keep costs down. Working with a specialist in Mainland company formation can uncover cost-effective solutions you might not find on your own.

The single best cost-saving strategy? Partnering with an experienced corporate service provider. We help you dodge expensive mistakes, cut through the red tape, and find the most efficient path to getting your license. It’s about getting the most value from your investment, backed by our 24/7 support.

Minimise Ancillary Expenses

The main license fee is just one piece of the puzzle. Administrative costs for things like paperwork and attestation can quickly add up. To keep these extra expenses in check, look into options like affordable document preparation services, which can noticeably reduce your overall setup spend.

Making these smart choices early on means you can take full advantage of the UAE's tax benefits for international entrepreneurs without breaking the bank.

For a detailed breakdown of your options, Call Us Now: +971-52 923 1246 or WhatsApp Us Today for a Free Consultation.

Frequently Asked Questions

When you're looking to set up a business in Dubai, a lot of questions come up. It's completely normal. Getting clear answers is the key to creating a realistic budget and a roadmap that actually works. Here, we'll answer some of the most common things entrepreneurs ask us about the trade license cost in Dubai and what the process really looks like.

Can I Get a Dubai Trade License Without an Office Space?

Yes, you absolutely can. This is actually a very popular strategy for keeping those initial startup costs down.

Many Free Zones are experts at this, offering what’s called a flexi-desk package. Think of it as a shared workspace solution that gives you a legitimate physical address without the heavy price tag of a dedicated office lease. It ticks the legal box while keeping you lean.

On top of that, some mainland licenses are designed for home-based businesses, like the DED's eTrader license for UAE and GCC nationals. This option removes the need for a commercial office entirely.

The best way to know for sure is to talk to a professional. A corporate service provider can quickly tell you which licenses fit your business model and allow for remote or home-based work. Our team can guide you to the most cost-effective choice for your specific needs.

What Is the Cheapest Trade License in Dubai?

This is the golden question! Generally speaking, the most budget-friendly options are usually freelance permits or certain e-commerce licenses within specific Free Zones. They're built for solopreneurs and often come in neat packages that bundle all the essentials.

But here's the honest answer: the "cheapest" license is the one that's right for your business. It all comes down to your planned activities and whether or not you need visas. A zero-visa package will always have the lowest upfront cost, but that might not work for your long-term plans. Our cost-effective business setup solutions are tailored to your needs to help you weigh the pros and cons and find the best value, not just the lowest price.

How Long Does It Take to Get a Trade License in Dubai?

The timeline can really vary. If you're going for a straightforward Free Zone setup and have all your paperwork ready to go, you could have your license in hand in just a few working days. It can be surprisingly fast.

A Dubai Mainland license, however, usually takes a bit longer, often somewhere between one and three weeks. This is because your business activity might need a sign-off from other government departments, adding extra steps to the process.

The quickest way to get through it all is to work with an experienced business setup consultant. They know the system inside and out and can manage the entire application smoothly, avoiding common pitfalls that cause delays. Our 24/7 support service means we’re always here when you need us, ensuring you're never left wondering what's happening next.

Ready to turn your business idea into a reality? We are the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah. As specialists in Mainland and Freezone company formation, we provide cost-effective solutions designed for you, helping you enjoy all the UAE tax benefits for international entrepreneurs.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation