So, you're thinking about starting a business in Dubai. The first piece of the puzzle you'll need to get your head around is the Dubai trade licence. What is it? In simple terms, it's the official government seal of approval that gives you the legal right to operate.

Think of it as your company's passport. Without it, you can't legally conduct any commercial activities in the emirate. It's the absolute cornerstone of your business setup, proving to the authorities and the market that you're a legitimate, registered entity.

What a Dubai Trade Licence Really Means for Your Business

Getting that trade licence is about so much more than just ticking a legal box. It’s the key that unlocks your ability to actually do business here. Without this vital document, you'll find that basic operations are simply out of reach.

This licence is your entry ticket to one of the most dynamic economies on the planet. It’s what you'll need to open a corporate bank account, sign a lease for an office, and, crucially, sponsor visas for yourself and your team. It also instantly builds trust with potential clients, partners, and suppliers, showing them you’re a serious player recognised by the UAE government.

Your First Major Decision: Mainland or Free Zone?

Before you even start filling out forms, you face a foundational choice that will steer the entire future of your company: will you set up on the Mainland or in a Free Zone? This isn't just a minor detail; it directly impacts the type of licence you get and defines where and how you can operate.

- Mainland Licence: This is your go-to if you want to trade directly within the broader UAE market. It gives you the freedom to work with local customers and even bid on government contracts, making it perfect for businesses that need a physical presence across the emirate.

- Free Zone Licence: A fantastic option for international entrepreneurs. Free Zones offer major perks like 100% foreign ownership and significant tax benefits. The trade-off? Your business activities are generally restricted to within that specific Free Zone or to international clients.

A business's legal structure influences everything from day-to-day operations to taxes and personal liability. Choosing the right one provides the correct balance of legal protections and benefits for your specific goals.

Getting this distinction right from the start is your first real step. The choice between a Mainland and a Free Zone setup doesn't just decide your licence type—it lays the very foundation your Dubai business will be built on. We'll dive much deeper into this soon.

Choosing Your Path: Mainland vs Free Zone Licence

Making the right call between a Mainland and a Free Zone licence is one of the first, and most important, decisions you'll make when setting up in Dubai. This isn't just about red tape; it's a strategic move that dictates who you can do business with, how your company is owned, and where you can operate. Each path has its own set of advantages, designed for very different kinds of businesses.

Here’s a simple way to think about it: A Mainland licence is like opening a shop on a bustling high street. You have direct access to every customer walking by, anywhere in the country. A Free Zone licence is more like setting up in an exclusive, high-tech business park – it's perfect for international trade and specific industries, but comes with rules about selling directly to the local market outside the park.

Understanding the Mainland Advantage

A Mainland trade licence, issued by Dubai's Department of Economy and Tourism (DET), is the classic choice for anyone looking to trade directly within the UAE market. This licence gives you the freedom to set up shop and conduct business anywhere across the Emirates, with no restrictions.

If your plan is to open a café, a retail store, or offer services directly to people living in Dubai, the Mainland licence is non-negotiable. It's also the only way you can bid on lucrative government contracts, a massive part of Dubai's economy. While this route used to mean needing a local sponsor, recent changes have made 100% foreign ownership possible for a huge list of business activities, making it a far more appealing option for international entrepreneurs.

Exploring the Freedom of Free Zones

On the flip side, you have the Free Zones. These are special economic areas designed to attract foreign investment with a very compelling package of benefits. Dubai has over 40 of them, and many are tailored to specific industries, like tech, media, finance, or logistics.

The big draw? A Free Zone licence guarantees 100% foreign ownership, 0% personal and corporate income tax, and the ability to send all your profits and capital back home. This setup is a perfect fit for businesses that are focused on international trade, consulting for overseas clients, or running an e-commerce store that ships globally. The main trade-off is that you generally can't sell your goods or services directly into the UAE mainland market.

Choosing the right jurisdiction is fundamental to your success. A Mainland licence provides market depth, while a Free Zone licence offers global connectivity and tax efficiency. Aligning this choice with your long-term business goals from day one is paramount.

The sheer number of businesses flocking to Dubai speaks volumes. By the end of the first quarter of 2025, Dubai was home to 59% of all business licences issued across the UAE, with nearly 990,000 licences active in the emirate alone. You can read more about these economic trends on CairoScene.com. This market dominance really drives home why making an informed licence choice from the get-go is so critical.

To put it all into perspective, let's break down the key differences side-by-side.

Mainland vs Free Zone Licence Key Differences

Choosing between these two popular options can feel daunting, but it really boils down to your specific business model. This table cuts through the noise and compares the most crucial factors you need to consider.

| Feature | Mainland Licence | Free Zone Licence |

|---|---|---|

| Business Scope | Unrestricted trade across the UAE | Operations restricted to the Free Zone and internationally |

| Ownership | 100% foreign ownership for many activities | 100% foreign ownership guaranteed |

| Office Space | Mandatory physical office space (Ejari) | Flexible options, including virtual offices |

| Visas | Generally unlimited, based on office size | Number of visas often tied to office package |

| Regulatory Body | Department of Economy and Tourism (DET) | Specific Free Zone Authority (e.g., DMCC, DAFZ) |

| Government Tenders | Eligible to bid on government projects | Not eligible for direct bidding |

Ultimately, the best choice depends entirely on your vision. If your target customers are in the UAE, the Mainland is your playground. If your sights are set on the global stage, a Free Zone offers the ideal launchpad.

Finding the Right Licence for Your Business Activity

So, you’ve picked your battleground: Mainland or Free Zone. The next move is just as crucial—pinning down the exact trade licence in Dubai that matches what your business actually does. This isn't just paperwork; it’s the legal backbone of your entire operation.

Think of it this way: you wouldn't open a restaurant with a plumber's permit. The same logic applies here. Your day-to-day activities, whether you're selling handmade jewellery or developing sophisticated software, dictate the licence you need. The Dubai Department of Economy and Tourism (DET) has a system for this, and getting it right from the start is non-negotiable.

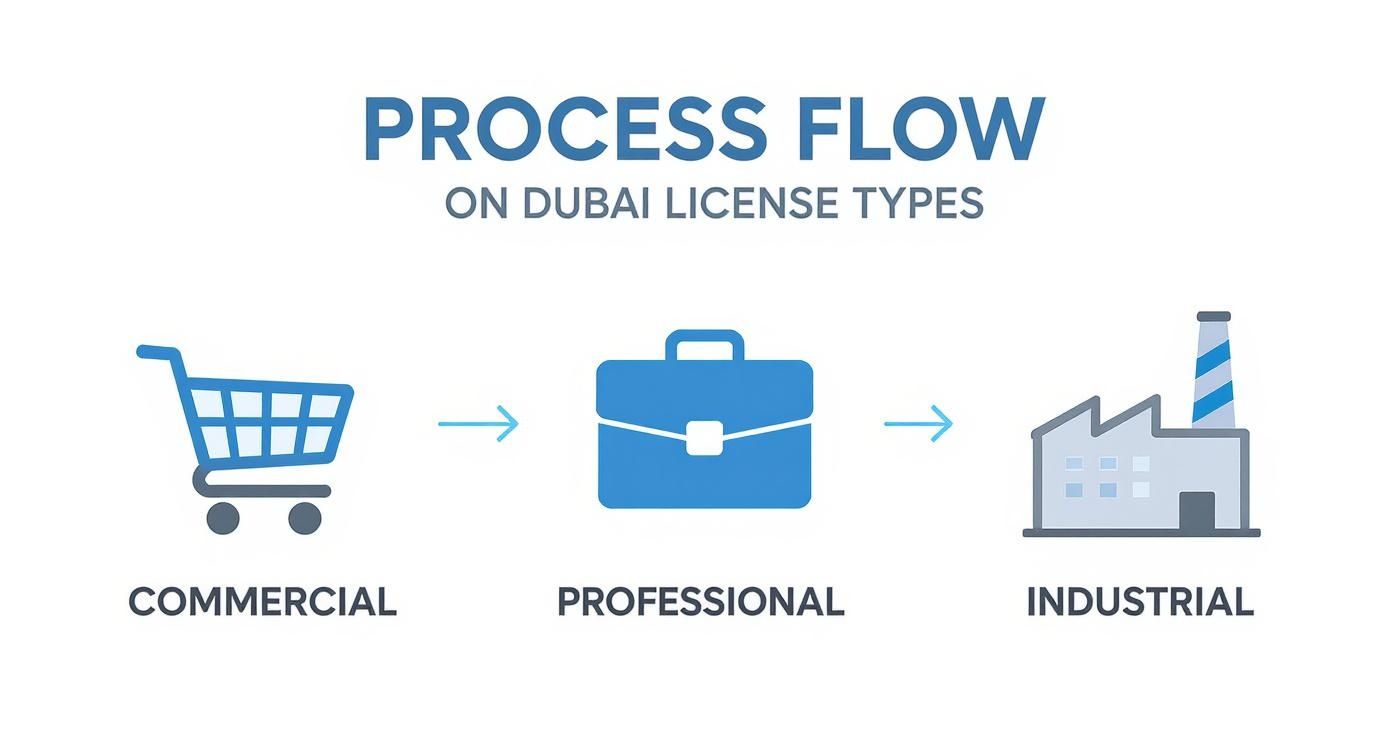

The Three Core Licence Categories

In Dubai, business activities are generally funnelled into three main buckets. Each one is designed for a different kind of operation, so figuring out which one fits your business is the key to getting set up smoothly and legally.

- Commercial Licence: This is your go-to if you're in the business of buying and selling things. It's a broad category that covers everything from a bustling e-commerce store and a real estate agency to a logistics company moving goods across the city. If physical products are changing hands, you're almost certainly looking at a Commercial Licence.

- Professional Licence: Are you selling your skills, knowledge, or expertise? Then you’ll need a Professional Licence. This is for the consultants, the marketing gurus, the graphic designers, the artisans, and the IT wizards. It’s a licence that recognises your talent as the core of your business.

- Industrial Licence: If you’re making something, this one’s for you. An Industrial Licence is required for any business that involves manufacturing, processing, assembling, or packaging. From small workshops creating bespoke furniture to large factories producing consumer goods, this licence covers the creation process from raw materials to finished products.

Picking the right business activity is more than just checking a box. It legally defines what you can and can't do. A good consultant can guide you through the thousands of approved activities to find the perfect fit for what you do now—and what you plan to do in the future.

This whole system creates a really transparent business environment. In fact, the DET keeps public records of all business licences, so you can see exactly who is doing what. This openness is a huge advantage for anyone wanting to understand the market. You can explore some of that data for yourself and get more insights on Dubai's business activity trends via dsc.gov.ae.

Real-World Licence Examples

Let's ground this in a few practical scenarios to see how it works:

- Someone launching an online store selling fashion accessories would need a Commercial Licence. This covers all the importing, selling, and shipping involved.

- A group of talented developers starting a tech consultancy firm would apply for a Professional Licence, as they are offering specialised, expert services.

- An entrepreneur opening a facility to produce organic snacks would have to get an Industrial Licence to legally manufacture their food products.

Matching your business to the right trade licence in Dubai is a foundational step. By figuring out if you're a commercial, professional, or industrial venture, you're building a solid legal base for everything that comes next.

The Step-by-Step Path to Getting Your Dubai Trade Licence

Getting a trade licence in Dubai is a well-defined process. While it might look daunting at first glance, it’s really just a series of logical steps. Think of it less as a mountain to climb and more as a clear checklist. Each step is there for a reason, helping you build a legitimate, compliant business from the ground up.

The real work starts before you even think about paperwork. It all begins with the fundamentals: what will your business actually do? You need to nail down your specific business activities and pick a trading name that not only captures your brand but also follows the UAE’s naming rules. These early decisions are critical because they shape the entire rest of your application.

Step 1: Laying the Groundwork with Initial Approvals

With your business activity and trade name sorted, it's time to get the ball rolling with the authorities. For a Mainland company, this means getting an initial nod from the Department of Economy and Tourism (DET). If you're going the Free Zone route, you'll deal with that zone's specific governing body. This stage is essentially a green light from the government, confirming they have no objections to your business idea.

Next, you’ll focus on the core legal documents that define your company.

- Memorandum of Association (MOA): This is your company's rulebook. It lays out your business goals, who owns what (the shareholding structure), and the duties of each partner. It needs to be properly drafted and officially notarised.

- Shareholder and Director Documents: You'll need to gather clear copies of passports, visa details, and other forms of ID for every shareholder and manager involved.

This infographic breaks down the main licence types your business will fit into.

As you can see, your chosen activity directly determines whether you need a Commercial, Professional, or Industrial licence, which becomes the foundation of your application.

Step 2: Finding a Home for Your Business

Every Mainland business in Dubai must have a physical office. This isn’t just a PO Box—it has to be a real, physical space with a tenancy contract registered through Ejari, the government's online portal. You can't finalise your trade licence in Dubai without securing a lease and getting that all-important Ejari certificate.

Free Zones tend to be more flexible here. They often have options like virtual offices or co-working desks, which can be a great, budget-friendly choice for new businesses or solo entrepreneurs. But no matter which path you take, you absolutely need proof of a registered business address.

The application process can feel like putting together a complex puzzle. One missing piece—a document that isn't quite right, a missed approval—can bring everything to a grinding halt. An expert partner is like having the picture on the box, making sure every piece fits perfectly on the first try.

Step 3: The Final Stretch – Submission and Payment

Once you’ve gathered all your documents—the initial approval, your notarised MOA, passport copies, and the Ejari certificate—you’re on the home straight. You'll submit the complete package to the relevant authority and pay the required fees. After a final review, they’ll issue a payment voucher.

As soon as that final payment is made, you'll receive your official trade licence. This is the document that legally allows you to open for business in Dubai. It’s a huge milestone, but it’s also the start of your ongoing responsibilities, like annual renewals and staying in good standing. This is where working with the best corporate service provider can make all the difference, ensuring the entire journey is smooth and mistake-free so you can get back to what you do best: running your business.

A Realistic Breakdown of Dubai Trade Licence Costs

Let's talk numbers. Getting your business off the ground in Dubai means understanding the full financial picture, not just the headline price of the licence itself. Budgeting for your trade licence in Dubai is really about planning for two distinct categories: the initial, one-time setup fees and the recurring costs you'll face every year.

Thinking about these expenses from day one is crucial. It helps you build a solid financial plan and, more importantly, avoids those nasty surprises that can derail a new venture before it even starts.

One-Time Setup Fees

Your first major investment goes towards a handful of essential government and administrative services. These are the non-negotiable costs required to get your company legally registered and ready for business.

Think of these as the foundational building blocks of your company setup:

- Trade Name Reservation: This is where you officially claim your business name, making sure it’s unique to you.

- Initial Approval Certificate: Consider this the preliminary green light from the authorities, giving you permission to move forward with your business idea.

- Memorandum of Association (MOA) Attestation: This step involves getting your company’s key legal document notarised, making it official.

- Licence Issuance Fee: The final payment to the government that gets that all-important trade licence into your hands.

These are the hurdles you have to clear just to get to the starting line. But the financial journey doesn't end once you have the licence.

Ongoing Operational Costs

Once you're up and running, you'll need to account for the annual expenses that keep your business compliant and legally active. These costs become a regular fixture in your yearly budget.

The big one is the annual licence renewal. This fee is due every year to keep your trade licence valid and avoid any fines. You'll also need to budget for visa processing for yourself and your team, plus the renewal of your company's establishment card.

Your choice of jurisdiction—Mainland or Free Zone—will have the single biggest impact on your total costs. A Mainland setup often requires a physical office lease (Ejari), while many Free Zones offer more affordable virtual office packages.

Factoring in your office space, whether it's a physical address or a flexible package, is another key piece of the puzzle. When you add it all up, these elements give you the true cost of doing business in Dubai. Working with a company formation specialist can be a game-changer here. We provide cost-effective business setup solutions with no hidden fees, giving you a clear financial roadmap from the very beginning.

How We Make Your Dubai Business Setup Seamless

This is where the right guidance turns a daunting process into a straightforward one. We don't just list services; we actively solve the real challenges that come with getting a trade licence in Dubai. Think of us as your navigators, charting the entire course for you so you're set up for success from the very beginning.

Whether you've got your sights set on a Mainland company or a Free Zone enterprise, we take care of it all. As specialists in both Mainland and Freezone company formation across the UAE, we manage the complexities. This frees you up to concentrate on what truly matters—growing your business.

Your Dedicated Partner for UAE Success

We are recognised as a leading corporate service provider in Dubai, Abu Dhabi, and Sharjah. This hands-on experience means we can deliver practical, cost-effective solutions that are genuinely right for your business.

Our commitment to you includes:

- 24/7 Support Service: Questions don't stick to business hours, and neither do we. We're always here when you need us.

- UAE Tax Benefits: We guide international entrepreneurs so you can enjoy the UAE's highly attractive tax environment.

A smooth setup also involves getting your digital infrastructure right from day one. For many businesses, this includes understanding how to manage their digital footprint. You can learn more about secure and unrestricted online operations in the UAE.

Our mission is simple: to transform a complicated bureaucratic process into a streamlined milestone for your business. We handle every detail, ensuring your launch in Dubai is efficient, compliant, and stress-free.

Ready to get started? Let's talk.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Got Questions? Let's Talk Dubai Trade Licences

Diving into the Dubai business world for the first time? It's completely normal to have a few questions pop up along the way. Getting these sorted out is the best way to move forward with confidence.

Here are the answers to some of the most common things entrepreneurs ask us about getting a trade licence in Dubai.

Do I Absolutely Need an Office to Get a Dubai Trade Licence?

Not always, but it really boils down to where you decide to set up.

Many Free Zones are built for modern businesses, offering virtual office packages and flexi-desk options. These are perfect for consultants, freelancers, or international companies that don't need a full-time physical space right away. It's a smart, cost-effective way to get your foot in the door.

For a Mainland licence, however, a physical office is pretty much non-negotiable. You'll need a proper tenancy contract registered on the official Ejari portal to get your licence approved.

So, How Long Will It Take to Get My Licence?

The timeline can really vary. If you're going for a straightforward Free Zone setup, you could be holding your licence in just a few days. They're known for being incredibly efficient.

On the other hand, Mainland companies or businesses that need special approvals from other government bodies can take a bit longer—think several weeks. The biggest factors are how organised your paperwork is, the specific authority's processing speed, and the complexity of your business activity.

A lot of people get tripped up on this: 'trade licence' isn't different from a 'commercial licence'. Think of 'trade licence' as the main category for all business permits in Dubai. A 'commercial licence' is just one specific type that falls under it.

What’s the Real Difference Between a "Trade Licence" and a "Commercial Licence"?

This is easily the most common point of confusion, so let's clear it up.

A "trade licence" is the general, catch-all term for any permit that lets you legally run a business in Dubai. Every single business, no matter what it does, operates under some form of trade licence.

A "commercial licence" is a specific type of trade licence. You get one of these if your business is all about trading—buying, selling, importing, or exporting goods and products.

Getting the right answers and navigating the entire setup is exactly what we do best. As specialists in Mainland and Freezone company formation, we offer tailored solutions and 24/7 support to make sure your launch is smooth. Let us handle the red tape so you can focus on the real prize: growing your business in the UAE.

📞 Call Us Now: +971-52 923 1246 or WhatsApp Us Today for a Free Consultation.