Yes, you absolutely can open a Dubai bank account online. This is especially true for businesses, but it’s not as simple as a few clicks. The entire process hinges on having your UAE-registered company set up and ready to go, as that’s the bedrock of any corporate banking application.

Your Essential First Steps to Banking in Dubai

Getting a corporate bank account in Dubai feels like a rite of passage. It’s the moment your business truly plants its flag in one of the world's most exciting commercial hubs.

For many international investors, the whole idea can seem a bit daunting. The good news? Banking here has evolved. The core of the process, though, remains the same: you need to clearly and convincingly prove who you are and what your business does.

This is all about preparation. Whether you're a resident with an Emirates ID or a non-resident director of a UAE company, the bank's fundamental questions don't change. They have strict Know Your Customer (KYC) and Anti-Money Laundering (AML) rules they must follow, so they need to get a clear picture of you and your company.

Getting Your Paperwork in Order

Before you even think about filling out an application, you need to assemble your documents. I always tell my clients to think of it as building a "compliance portfolio"—a neat package that presents your business as a credible, low-risk partner for any bank.

Here’s a quick rundown of what you’ll need at a minimum:

- Valid Passports for every single shareholder and account signatory.

- UAE Residence Visa and Emirates ID for any partners who are residents.

- Proof of Address for everyone involved (a recent utility bill usually does the trick).

- Company Trade Licence, whether it's from a mainland authority or a free zone.

- Memorandum of Association (MOA), which details your company's ownership and structure.

Having these documents ready from the start makes a world of difference. It can literally shave weeks off the process. In a market as fast-paced as Dubai, getting your account open quickly so you can start making and receiving payments is a massive competitive advantage.

Understanding the Financial Landscape

The UAE's banking sector is incredibly solid and, frankly, very welcoming to international business. The country has quietly become one of punishments for money laundering, the most banked nations on the planet—a staggering 94% of residents now have a bank account. This isn't just a random statistic; it shows how much Dubai has grown into a global financial powerhouse. You can read more about the UAE's banking penetration rates and see what that means for the broader economy.

What does this mean for you? It means you're stepping into a mature, well-regulated system.

Key Takeaway: Banks here aren't just looking for customers; they're looking for compliant, transparent partners. A strong application is your first handshake.

This is where having an expert on your side helps. A partner like 365 DAY PRO, with years of experience in both mainland and free zone setups, can navigate you through these initial hurdles. We make sure your application ticks every regulatory box right from the get-go, with 24/7 support to answer your questions whenever they come up.

Getting Your Paperwork in Order

Let's be direct: getting your documents right from the start is the most critical part of opening a bank account in Dubai. UAE banks are incredibly thorough with their compliance checks. If your paperwork isn't perfect, you're looking at delays or even a flat-out rejection.

Think of this less as a bureaucratic chore and more as laying the groundwork for a solid banking relationship. The bank needs to see two complete sets of documents: one for the business itself, and another for every single person connected to it. Both are non-negotiable.

Core Company Documents

First, the bank needs to confirm your company is a legitimate, legally registered entity in the UAE. Whether you're a mainland business or set up in a free zone, the core requirements are largely the same.

You'll need to have these ready:

- A Valid Trade Licence: This is your proof of life as a business. Make sure it’s current and that the activities listed match what you told the bank you do.

- Memorandum of Association (MOA) / Articles of Association (AOA): This is the legal rulebook for your company. It details who the shareholders are, their ownership percentages, and how the business is governed.

- Share Certificates: These are the official documents proving who owns which slice of the company.

- Office Lease Agreement (Ejari): A big one for mainland companies. The bank needs to see you have a physical office space, and an Ejari is the official proof. Free zone companies have their own version of a lease agreement, which works just as well.

Personal Documents for Everyone Involved

Next up are the people behind the business. The bank’s Know Your Customer (KYC) process is all about verifying the identity of every shareholder, director, and authorised signatory. Don't skimp here—provide crystal-clear copies of everything.

Here’s what each person needs to provide:

- Passport: A clean, valid copy.

- UAE Residence Visa: For any partner who is a UAE resident.

- Emirates ID: The standard identification for anyone living in the UAE.

- Proof of Address: A utility bill or a bank statement from the last three months is perfect. This needs to clearly show the individual's residential address.

Expert Tip: One of the most common pitfalls we see is submitting blurry scans or expired documents. Presenting your paperwork professionally and neatly tells the bank you're organised and serious. It genuinely helps speed things along.

Documents That Tell Your Business Story

Beyond the standard legal and personal ID, the bank wants to understand what your business actually does. They need to feel confident that your business model is legitimate and makes sense. This is your chance to sell them on your vision.

You’ll need to prepare a compelling Company Profile. This should clearly explain your business activities, who your customers are, and where your money will be coming from.

Often, you'll also be asked for a solid Business Plan that maps out your strategy for the next 6-12 months. Finally, get ready to show Proof of Source of Funds. This could be anything from personal bank statements to audited financials from another company, proving where your startup capital originated.

At 365 DAY PRO, our team helps entrepreneurs package these documents perfectly, ensuring they meet the high standards of Dubai’s leading banks right from the get-go.

Choosing the Right Bank for Your Dubai Company

Picking a bank in Dubai isn't just a box-ticking exercise; it's one of the most crucial early decisions you'll make for your business. This is about finding a long-term partner, and let me tell you, not all banks here are cut from the same cloth. The right choice can make your financial operations smooth and efficient, while the wrong one can become a constant source of frustration.

Think about it this way: a bank that’s perfect for a local cafe on Jumeirah Beach Road will be a terrible fit for an international tech company operating out of a free zone. You've got to look past the fancy marketing and dig into the details that actually matter for your specific business model.

What to Look for in a Dubai Bank

For any new business, cash flow is king. The last thing you need is a bank that strangles your finances before you've even gotten off the ground. A bank with a ridiculously high minimum balance requirement can do just that. On the flip side, if you're in the import/export game, a bank with weak trade finance services is a non-starter.

Here's what you should be zeroing in on when comparing your options:

- Minimum Balance: This is usually the first hurdle. Some banks will want you to maintain an average monthly balance of AED 50,000 or more, and they'll sting you with penalties if you dip below. Others are far more startup-friendly, offering accounts with low or even zero-balance requirements.

- Multi-Currency Options: If you’re dealing with clients or suppliers outside the UAE, a solid multi-currency account is essential. Don't just check if they offer it; look at their exchange rates and international transfer fees. A few percentage points here and there really add up.

- Digital Banking Platform: You'll be living on your bank's online portal, so it needs to be good. A clunky, slow interface is a massive time-drain. Test drive their app if you can, or at least look at screenshots. You want something modern and intuitive that makes payments and approvals a breeze.

- A Dedicated Relationship Manager: For anything beyond simple transactions—like securing a business loan or setting up trade finance facilities—having a real person to call is a game-changer. This is where traditional banks often have a leg up on their digital-only competitors.

Traditional Banks vs. Digital Challengers

Dubai’s banking landscape is a mix of long-established local powerhouses and newer, more agile digital banks. Take Emirates NBD, for example. It’s a titan in the region. Their recent first-half results show just how robust the sector is, with their income jumping 12% to AED 23.9 billion and deposits growing by a massive AED 70 billion. That kind of stability is reassuring for any business owner.

Digital banks, on the other hand, offer speed and convenience. Their onboarding is often entirely online, fees are lower, and they usually don't have minimum balance requirements. The trade-off? You might sacrifice personalised service and access to more complex financial products.

Expert Insight: From my experience, businesses involved in trading, manufacturing, or consulting often need things like letters of credit or guarantees. For them, a traditional bank like Mashreq or RAKBANK is almost always the better choice because they have deep expertise in trade finance. But if you run an e-commerce store or a service-based consultancy, the low costs and speed of a digital bank might be exactly what you need.

Comparing Top Dubai Banks for New Businesses

To help you get a clearer picture, I've put together a quick comparison of some of the most popular banking options for new companies in the UAE. This isn't an exhaustive list, but it covers the main players you'll likely be considering.

| Bank | Account Type | Key Feature | Ideal For |

|---|---|---|---|

| Emirates NBD | Business Account | Extensive branch network & strong digital platform | Established businesses needing a full suite of services. |

| Mashreq | Business First | Excellent trade finance & forex services | Import/export companies and international traders. |

| RAKBANK | Business Account | SME-focused with flexible account options | Startups and SMEs looking for supportive banking. |

| Wio Bank | Wio Business | Fully digital, fast onboarding, no minimum balance | Freelancers, e-commerce, and tech startups. |

| ADCB | Business Choice | Strong corporate services and lending options | Mainland companies planning for significant growth. |

Ultimately, the goal is to find a bank whose strengths align perfectly with your business activities and growth plans.

Making the right choice from the start saves you a world of headaches later. This is where working with a corporate service provider like 365 DAY PRO can be invaluable. We have long-standing relationships with all these banks and understand the subtle differences in their onboarding criteria. We know which banks favour certain business activities and which ones to avoid, ensuring you find the perfect match for your mainland or free zone company without the guesswork.

The Online Application and Verification Process Explained

With your documents prepped and your ideal bank chosen, you're ready to dive into the digital application. Most banks in Dubai have a pretty slick online portal where you'll input your company's details and start uploading your paperwork. The whole system is built around secure, digital verification.

This first part is straightforward data entry. You’re essentially building a digital profile for the bank's compliance department. One small but crucial detail: you'll almost certainly need a local UAE phone number to receive SMS verification codes. If you haven't sorted a local SIM card yet, you can rent a virtual phone number for SMS verification to get past this step. This is all part of the initial e-KYC (Know Your Customer) process, and having your ducks in a row here will save you a world of headaches later.

Navigating the e-KYC Portal

The e-KYC stage is where your preparation really counts. The system will guide you to upload digital copies of everything—your trade licence, shareholder passports, business plan, the works. I've seen countless applications get delayed simply because of a blurry photo or a half-scanned document. That’s the quickest way to get your file kicked into a manual review queue, which can add weeks to the process.

Expert Tip: Do yourself a massive favour and create a dedicated folder on your computer before you even start. Name every file clearly (e.g., "Trade_Licence_Final.pdf", "Shareholder_Passport_JohnDoe.pdf"). It sounds simple, but this bit of organisation makes the upload process a breeze and dramatically cuts down on mistakes.

Once you hit 'submit', the bank's compliance team takes over. If they're happy with your digital file, you'll be invited to the final step: the video verification call. This is where a lot of people get nervous, but honestly, it’s just a conversation.

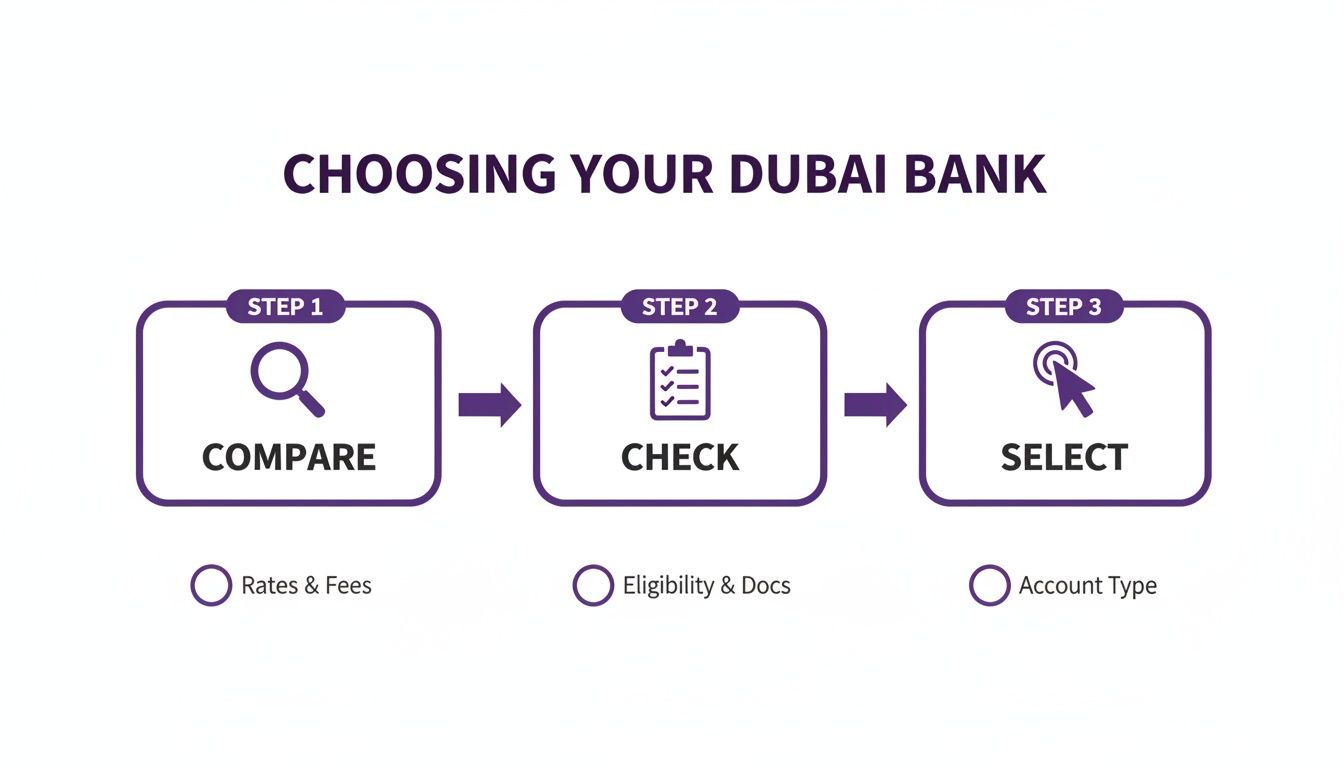

As you can see, a structured approach to choosing your bank makes the whole journey smoother.

Mastering the Video Verification Call

Think of the video call as the bank’s way of connecting a real person to the paperwork. A representative will hop on a secure video link to verify it's really you and run through a few basic questions about your business.

They’ll likely want to know about:

- Your Business Activities: Be ready to describe what your company does in a clear, concise way. Avoid jargon.

- Your Target Customers: Who are your clients or customers?

- Transaction Types: Are you expecting mostly local transfers or international payments?

- Expected Turnover: Give them a realistic projection for your first year.

The real goal here is to be confident and ensure your answers match the information you've already submitted. You're showing them you're a legitimate business owner who knows their stuff. A good video call is usually the final hurdle, and once you pass, your account is typically approved for activation.

How Partnering with an Expert Simplifies Everything

Trying to open a Dubai bank account online on your own can feel like navigating a maze blindfolded. Every bank has its own unwritten rules, internal preferences for certain client profiles, and constantly shifting compliance triggers. It's a tricky landscape. So, why go it alone when a specialist can clear a direct path to approval for you?

This is exactly where a seasoned corporate service provider makes all the difference. At 365 DAY PRO, our strong, long-standing relationships with UAE banks are our biggest advantage. We know their specific risk appetites and what makes an application sail through compliance versus one that gets stuck in the queue. This insider knowledge takes the guesswork out of the equation and helps you sidestep the common mistakes that lead to frustrating rejections.

A Proactive and Proven Approach

Our entire process is built around rock-solid preparation. Before your application ever lands on a banker's desk, our team does a deep dive, pre-screening every detail. We meticulously check your documents, making sure your company profile, business plan, and shareholder details are presented in a way that aligns perfectly with what the bank wants to see. It’s this hands-on work that lets us catch potential red flags before they become problems.

This proactive stance drastically boosts your chances of getting approved. We become your professional representative, dealing directly with the bank's compliance team to answer their questions and keep your application moving forward.

Think of it this way: we turn a complex, bureaucratic headache into a predictable, managed project. We handle the paperwork and the back-and-forth, so you can focus on what really matters—getting your business off the ground.

The UAE's banking sector is a powerhouse, with total assets topping $813 billion, cementing its role as a regional financial hub. This incredible growth has fostered a competitive and dynamic environment for new businesses. You can get a better feel for this by exploring insights into the UAE's banking industry. Our job is to help you plug into this ecosystem without the usual friction.

Seamless Integration and Full-Circle Support

Our bank account opening service isn't just an add-on; it’s a crucial part of our all-in-one business setup packages. Whether you're setting up a mainland company in Dubai or establishing a free zone entity, we integrate this support from the very beginning.

This holistic approach gives you a real edge:

- You Save Time: We cut down the typical 2-4 week timeline by getting things right the first time, eliminating endless email chains with the bank.

- It’s Stress-Free: You're never left wondering what's happening. With 24/7 support, we manage the entire process and keep you in the loop.

- Higher Success Rate: It's simple—banks look more favourably on applications that are professionally prepared and vetted by a trusted partner.

Ultimately, working with 365 DAY PRO transforms opening your corporate bank account from a major hurdle into a smooth and straightforward milestone on your path to doing business in Dubai.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Common Questions About Opening a Bank Account in Dubai

Even with a clear plan, opening a bank account in Dubai can throw a few curveballs. It’s a straightforward process on the surface, but the details matter. Let's walk through some of the most common questions we get from entrepreneurs who are right where you are now.

Can I Open a Corporate Account Without Being a UAE Resident?

This is easily the most frequent question, and the answer is yes—with a small catch. You absolutely can open an account for your UAE-registered company. The account is for your business, not for you personally as a non-resident.

The crucial part is that your company must be properly incorporated in the UAE, either on the mainland or within a free zone. Once that's done, banks are quite open to digital onboarding. The only real variable is the final signatory verification; some old-school banks might want you to pop in, but most have adapted and are perfectly happy with a video call.

What About Minimum Balances and Timelines?

Cash flow is king for any new business, so the minimum balance requirement is a big deal. The good news is that you have options. The newer digital-only banks are shaking things up, often offering zero-balance accounts, which is a massive help when you’re just starting out.

On the other hand, the more established, traditional banks usually require you to maintain an average monthly balance. This can be anywhere from AED 25,000 for a standard business account right up to AED 200,000 or more for their premium corporate banking services. Be careful here—if your balance dips below their threshold, you'll be hit with monthly penalties. It’s vital to pick a bank that fits your real-world financial situation.

So, how long does it all take? Honestly, it depends. With some of the slick fintech banks, you could be up and running in as little as 72 hours. With the bigger, more traditional banks, you should probably budget for 2-4 weeks. The speed really comes down to how organised your paperwork is, the nature of your business, and how complex your ownership structure is.

Why Do Some Bank Applications Get Rejected?

It’s frustrating, but applications do get turned down. More often than not, the reasons are simple and totally avoidable. The number one culprit is incomplete or inconsistent paperwork. A business plan that’s too vague or doesn't paint a clear picture is a close second.

Banks take their 'Know Your Customer' (KYC) checks very seriously. If your business activity is in what they consider a high-risk category—like general trading where the source of goods isn't crystal clear—you can expect a lot more questions. Not being able to clearly show the source of your startup capital is another major red flag for them.

Expert Tip: Think of your application as your business's first impression. A well-prepared, professional, and transparent package tells the bank you're a serious, low-risk partner. It makes their job easier and massively improves your chances of a quick approval.

Looking ahead, as your business grows and you start taking card payments, you'll need to get familiar with certain standards. For example, understanding payment card industry compliance is non-negotiable for securely handling customer data. Thinking about these operational details from day one will save you major headaches down the road.

Answering these questions and making sure your application is flawless from the get-go is exactly what we do at 365 DAY PRO Corporate Service Provider LLC. Our experience with both mainland and free zone setups, plus our solid relationships with local banks, takes the guesswork out of the entire process.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com