So, what exactly is an offshore company in Dubai?

Think of it less as a traditional business with a physical office and more like a specialised financial vehicle. It's a legal entity you register in one of the UAE's dedicated offshore jurisdictions, like JAFZA or RAK ICC, but it's built exclusively for international business.

This structure is a powerful tool for global operations—it lets you manage assets and investments from a secure, reputable base in the UAE, but it's not designed for trading directly within the country.

Demystifying the Dubai Offshore Company

Let's break that down. A Dubai offshore company is fundamentally different from the mainland and free zone companies you might be familiar with. Those are set up to do business in the UAE. An offshore company, on the other hand, is built to face outwards, toward the rest of the world.

Its whole identity is its international focus. You'd use it to hold assets, facilitate trade between other countries, manage global investments, and protect your wealth. A key feature is that it legally separates your personal finances from the company's liabilities, giving you a solid layer of protection. If you're new to this, it helps to understand concepts like piercing the corporate veil, which shows just how strong this separation can be.

Core Purpose and Functionality

At its heart, an offshore company is a non-resident entity. This is a crucial point. Even though it's registered in the UAE, all its business has to happen outside the country. For example, you could use it to invoice clients in Europe, own a property portfolio in London, or hold shares in a tech company in Silicon Valley—all managed from your UAE-based corporate structure.

Here’s what people typically use them for:

- Asset Holding: A secure way to own properties, stocks, intellectual property, or other high-value assets under a corporate name.

- International Trading: Perfect for managing import/export operations or conducting business with clients and partners anywhere in the world.

- Tax Optimisation: These companies exist in a 0% corporate tax environment on international profits, making them incredibly efficient.

- Confidentiality: Unlike many jurisdictions, the details of shareholders and directors are not on a public register, which offers a significant degree of privacy.

An offshore company acts as a legal firewall. It gives international entrepreneurs a powerful tool for asset protection and wealth management, all within a globally respected jurisdiction.

The numbers speak for themselves. Dubai's offshore sector is a huge part of its appeal for international business. JAFZA, one of the world's most successful free zones, had over 10,000 active companies in 2023, many of which are offshore structures. When you see that the UAE's non-oil foreign trade hit a record AED 3.5 trillion in 2023, you get a sense of the sheer scale of international business flowing through entities based here.

Choosing Your Jurisdiction: JAFZA vs. RAK ICC

So, you’re ready to set up an offshore company in the UAE. The very first, and most important, decision you'll make is picking the right jurisdiction. This isn't just about choosing a name on a map; it's a strategic move that needs to align with your business goals from day one.

In the UAE, this choice almost always boils down to two heavyweights: the Jebel Ali Free Zone Authority (JAFZA) and the Ras Al Khaimah International Corporate Centre (RAK ICC).

Think of it like choosing a car. JAFZA is the high-end luxury sedan—it makes a powerful statement and offers premium features. RAK ICC, on the other hand, is the modern, efficient SUV—versatile, practical, and built for performance without the hefty price tag. Which one you pick depends entirely on where you’re headed.

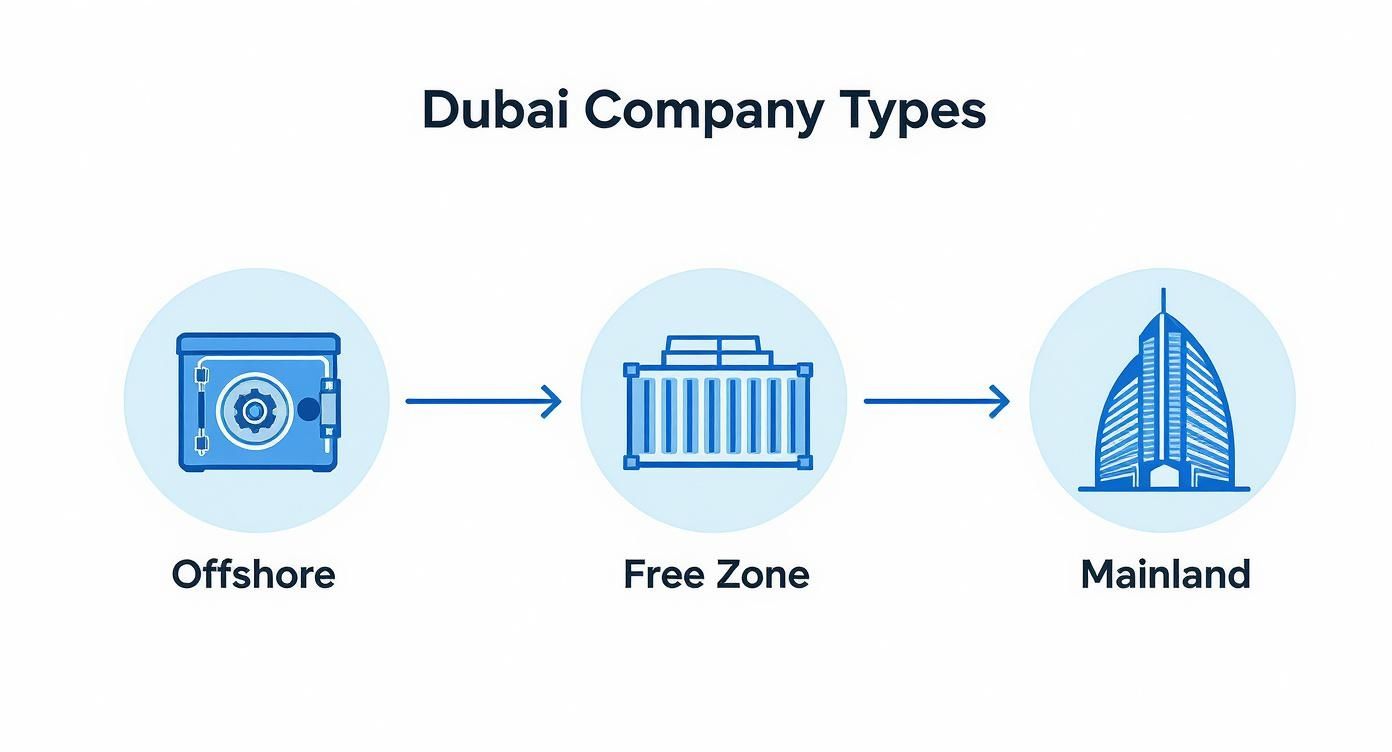

This infographic helps put the offshore model into context against the other two company types you'll find in the UAE.

As you can see, an offshore company isn’t a local trading business like a mainland or free zone entity. It’s a completely different tool, designed as a secure international vehicle for holding assets and conducting global business.

JAFZA: The Gold Standard for Global Prestige

Let's be clear: JAFZA is arguably the most prestigious offshore jurisdiction in the entire Middle East. Established way back in 1985, its name carries serious weight in international finance and trade. When you register a company with JAFZA, you're buying instant credibility.

This reputation makes JAFZA the go-to choice for specific, high-stakes activities:

- International Trading: Its direct link to the Jebel Ali Port, one of the world’s busiest, is a massive plus for any business involved in global logistics.

- Holding Companies: Large corporations almost always turn to JAFZA to hold shares in their subsidiaries or manage huge asset portfolios. The brand name alone inspires confidence.

- Dubai Property Ownership: A JAFZA offshore company is one of the only approved ways for foreign investors to own freehold property in designated areas of Dubai.

But, as you’d expect, this level of prestige comes at a price. Both the initial setup fees and the annual renewal costs for JAFZA are significantly higher than for RAK ICC.

RAK ICC: Modern Flexibility and Cost-Effectiveness

If JAFZA is the established veteran, then RAK ICC is the modern, agile contender. Formed by merging two previous authorities in Ras Al Khaimah, RAK ICC has quickly earned a reputation for its flexible rules, streamlined processes, and fantastic value.

RAK ICC is an outstanding option for entrepreneurs and investors who need robust asset protection and operational efficiency without the premium JAFZA price tag.

Its main strengths really shine through in these areas:

- Asset Protection: The legal framework here is exceptionally well-designed for creating structures that safeguard family wealth and investments from external threats.

- Broader Investment Activities: It’s a very flexible platform for managing a diverse portfolio of global investments—from stocks and bonds to intellectual property.

- Cost Efficiency: The setup and annual maintenance costs are much lower, making it a far more accessible choice for start-ups, family offices, and individual investors.

The choice between JAFZA and RAK ICC really comes down to budget versus brand. JAFZA offers unmatched prestige for a premium, while RAK ICC delivers a flexible, modern, and highly cost-effective framework.

To make the right call, you have to be honest about what matters most. If your business relies on a high-profile image to close deals with multinational corporations or financial institutions, the extra cost of JAFZA is an investment that pays for itself.

On the other hand, if your main goals are efficient asset management, investment holding, or general international business with a sharp eye on the bottom line, RAK ICC provides an equally robust and fully compliant solution.

Ultimately, both jurisdictions give you the core benefits that make a UAE offshore company so powerful: 100% foreign ownership, iron-clad confidentiality, and a tax-efficient environment.

The Strategic Benefits of a UAE Offshore Company

So, you’ve got the basics of what a UAE offshore company is and where you can set one up. Now, let’s get into the why. What makes this structure so attractive to international entrepreneurs and investors? It's not just a list of features; these are powerful strategic tools for protecting your wealth, boosting financial efficiency, and managing a global business.

At its heart, the appeal is simple: you create a legal entity that plays on the global stage but is anchored in the UAE's remarkably stable and well-respected economic environment. This unique setup opens up a range of advantages that are tough to find anywhere else.

Complete Asset Protection and Risk Mitigation

First and foremost, one of the biggest draws is rock-solid asset protection. Think of your offshore company as a legal fortress. It builds a strong wall between your personal assets and the liabilities of your business. If the business ever runs into legal trouble or hits a rough patch financially, the assets held safely inside that company are protected.

This is a game-changer for a few key groups:

- High-Net-Worth Individuals looking to shield family wealth from unpredictable commercial or personal risks.

- Entrepreneurs in fast-moving or litigious industries where disputes can pop up unexpectedly.

- Property Investors who want to hold their real estate portfolio under a corporate structure, keeping it separate from their other ventures.

By moving assets like property, stocks, or intellectual property into the offshore company, you legally hand over ownership to the business. In today's interconnected world, that separation is absolutely crucial for long-term wealth preservation and smart risk management.

Significant Tax Advantages

Let's be clear: the UAE’s tax environment is a huge reason people choose to set up an offshore company here. These entities were built from the ground up to be incredibly tax-efficient for international business.

The key takeaway is simple: international profits generated by a UAE offshore company are not subject to corporate tax. This means 100% of the profits you earn from global activities stay in the company, giving you a massive financial leg up.

On top of that, the UAE has no personal income tax, no capital gains tax, and no withholding taxes when your offshore company distributes profits to its shareholders. This tax-neutral environment is the foundation of its appeal, letting you maximise capital growth and reinvestment. Before making the leap, it's wise to evaluate if your business is truly prepared, as detailed in a comprehensive guide to global expansion through offshoring. This framework lets you enjoy UAE Tax Benefits for International Entrepreneurs, creating the perfect launchpad for your global financial strategy. You can learn more about how 365 Day PRO helps international entrepreneurs with cost-effective business setup solutions.

Enhanced Privacy and Financial Confidentiality

In many countries, company ownership information is public knowledge, available to pretty much anyone who looks for it. A UAE offshore company is different, offering a much higher level of privacy. The names and personal details of the shareholders and directors are not listed on any public register.

This isn't about hiding things; it's about legitimate financial privacy. It protects you from unwanted attention and keeps your financial details private—a major concern for many international investors and family offices. This discretion, backed by the UAE's strong legal system, gives you confidence that your business affairs will stay confidential.

That privacy extends to banking, too. The UAE is home to a world-class banking sector known for its security and professionalism. An offshore company gets you full access, letting you open multi-currency corporate bank accounts to handle international payments with ease. The mix of a stable government and a sophisticated financial system gives you the peace of mind that your capital is in a safe place.

Your Step-by-Step Formation and Cost Guide

So, you're ready to move from concept to reality. The good news is that setting up an offshore company in Dubai isn't some mystical, complex puzzle. It’s actually a pretty straightforward, structured process when you know the steps.

It all starts with getting your documents in order. Think of this as laying the foundation – get it right, and the rest of the build goes smoothly. From there, you'll work with a registered agent who will be your direct line to the offshore authority, making sure everything is filed correctly and on time.

Let's walk through exactly what you'll need.

The Essential Documentation Checklist

First things first, you’ll need to pull together a file of key documents. Both JAFZA and RAK ICC have strict 'Know Your Customer' (KYC) protocols, so these items are non-negotiable. They need to verify who you are.

Here’s what your standard pack should contain:

- Passport Copies: Good quality, colour copies for every shareholder and director involved.

- Proof of Residential Address: A recent utility bill or bank statement usually does the trick. It just needs to be dated within the last three months and clearly show your name and current address.

- A Brief Business Plan: Don't overthink this. It’s not a 50-page thesis. Just a simple, concise summary of what the company will do—be it holding assets, managing investments, or facilitating international trade.

- Curriculum Vitae (CV): A quick professional overview for each shareholder, outlining their background.

Getting this paperwork sorted upfront saves a massive amount of back-and-forth later on.

Understanding the Formation Process

With your documents ready, the actual setup can kick off. While JAFZA and RAK ICC have their own minor quirks, the core process is remarkably similar. This is where having an experienced hand to guide you really pays off. A seasoned corporate service provider, particularly one who also acts as Specialists in Mainland Company Formation in Dubai & Abu Dhabi and Specialists in Freezone Company Formation across the UAE, has a holistic view of the landscape. They know the ins and outs of the entire system.

You can learn more about how 365 DAY PRO offers expert guidance on UAE company setups.

Your registered agent isn't just a box to tick on a form; they are your local partner on the ground. They handle the submission, deal with the authorities for you, and ensure your company stays compliant long after it's formed.

Typically, you can expect to have your Certificate of Incorporation in hand anywhere from a few working days to a couple of weeks after a complete application is submitted. This efficiency is one of the UAE's biggest draws for offshore setups.

A Transparent Breakdown of Costs

When it comes to budgeting, there are no real smoke and mirrors. The costs are typically broken down into three clear categories, so you can plan your finances without any nasty surprises.

- One-Time Setup Fee: This is your initial investment. It covers the government registration fees, administrative costs, and the issuance of all your official incorporation documents. You pay this once, right at the start.

- Annual Renewal Fees: To keep the lights on, legally speaking, there's an annual fee. This payment to both the jurisdiction and your registered agent ensures your company remains active and in good standing.

- Additional Service Fees: Think of these as optional extras based on what you need. You might want help opening a corporate bank account, require a nominee director for privacy, or need documents attested for use abroad. These are add-on costs, not standard requirements.

Knowing these three components from the outset allows you to budget accurately and move forward with confidence.

Navigating Corporate Banking and Compliance

Registering your offshore company in Dubai is just the first step. The real key that unlocks its power is securing a corporate bank account. This isn't just a box to tick; it's the engine that lets you manage international payments, hold different currencies, and actually run your business from the UAE. But getting one isn't always straightforward.

The UAE's banking system is known for being incredibly stable and secure, and it intends to keep it that way. To protect this reputation, banks perform very thorough checks on all new clients, especially non-resident structures like offshore companies. They need to know exactly who you are, what your business does, and the source of your funds.

Simply put, a successful application comes down to presenting a crystal-clear, professional business profile that answers all their questions before they even ask them.

Preparing for Banking Due Diligence

Think of opening your corporate account like pitching an investment. The bank is your potential partner, and they need to be sold on the legitimacy and stability of your business. A vague or messy application is the quickest way to get a "no."

To make a strong impression, you need to show the bank a clear, lawful purpose for your company. This means having a solid business plan, knowing who your customers are, and being ready to explain how money will move through the account. Generic descriptions like “international trade” or “business consultancy” won’t cut it – they’ll just raise more questions.

Key Insight: UAE banks are on the front lines of enforcing global Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) rules. Your application isn't just paperwork; it's a core part of their duty to protect the integrity of the financial system.

Your job is to paint a complete picture of a legitimate business, building trust with the bank’s compliance officers from the very start.

Opening a bank account for an offshore company requires a comprehensive set of documents. Banks need to verify the company's legal status, identify its owners, and understand its business activities to meet their compliance obligations. Below is a checklist of the typical documentation you'll need to prepare.

Required Documents for a Corporate Bank Account

| Document Type | Description and Key Considerations |

|---|---|

| Certificate of Incorporation | The official document proving your company is legally registered. |

| Memorandum & Articles of Association | The company's 'rulebook'. The bank will review this to understand the company's purpose and structure. |

| Shareholder & Director Register | A complete list of all owners and directors. This must be up-to-date. |

| Passport & Visa Copies | For all shareholders and signatories. A UAE residence visa is not required but can strengthen the application. |

| Proof of Address | A recent utility bill or bank statement (less than 3 months old) for each shareholder and signatory. |

| Business Plan | A clear, concise document explaining your business model, target market, and projected cash flow. |

| Owner's Profile/CV | A brief professional background of the key shareholders to demonstrate experience in the relevant industry. |

| Source of Funds Declaration | A statement explaining where the initial capital for the business is coming from. |

Having these documents organised and ready will significantly speed up the account opening process and show the bank that you're a serious and professional client.

Staying Compliant with UAE Regulations

Beyond the bank, your offshore company must follow a few key national rules. These regulations are designed to prove your company has a genuine economic reason for existing and isn't just a "paper" company. The two big ones to know are the Economic Substance Regulations (ESR) and Anti-Money Laundering (AML) rules.

Ignoring these can lead to heavy fines and can even put your company's good standing at risk. Here's what you need to focus on:

- Economic Substance Regulations (ESR): If your company is involved in certain activities (like being a holding company or managing intellectual property), you have to prove it has real "substance" in the UAE. This usually means showing that key decisions and management activities happen here.

- Anti-Money Laundering (AML): You are legally required to keep an accurate, updated register of the company's Ultimate Beneficial Owners (UBOs). This information must be filed with the authorities to ensure total transparency over who really owns and controls the company.

- Proper Record-Keeping: You must maintain financial records that accurately show your company's transactions and financial health. While a formal audit isn't always mandatory for offshore entities, having these books in order is a non-negotiable legal requirement.

These compliance tasks are fundamental to running a legal and credible offshore company in Dubai. They're what helps the UAE maintain its status as a trusted global business hub, which ultimately benefits every company registered here.

Practical Applications for Your Dubai Offshore Company

Right, so you've got this legal entity, this offshore company. What now? A company on paper is one thing, but making it work for you is where the real value lies. Let's move past the theory and get into the practical, real-world ways you can use a Dubai offshore company to supercharge your international business and protect your assets.

Think of it less as a document and more as a powerful tool in your financial toolkit.

A Hub for International Trade

One of the most popular reasons people set up a Dubai offshore company is for global trade. It’s a classic, and for good reason.

Picture this: you’re a consultant living in Asia, with clients in Europe and suppliers in Africa. Juggling invoices, currencies, and different tax rules can become a massive headache, fast. A Dubai offshore company cleans all of that up. You can invoice your European clients and pay your African suppliers all from one central, stable corporate bank account in the UAE.

Suddenly, your cash flow is simplified. All your profits accumulate in one place, and since you’re in a 0% corporate tax environment, you keep more of your hard-earned money to pour back into growing the business.

A Safe for Your Global Assets

Another brilliant use is turning your offshore company into a holding company. Imagine it as a secure corporate safe where you can place all your valuable assets from around the world under a single, protective legal entity.

This is perfect for things like:

- Holding Property: If you own real estate in different countries, holding it through your offshore company shields it from your personal liabilities.

- Managing Investments: Instead of having share portfolios scattered everywhere, you can consolidate them under one roof, making it much easier to manage dividends and track performance.

- Protecting Intellectual Property: Your company can own trademarks, patents, or copyrights. It can then license the rights to use them globally, creating a neat, centralised, and protected income stream.

It’s not just about tidying things up; this structure adds a serious layer of protection.

Bulletproof Asset Protection and Legacy Planning

This brings us to what is arguably the most critical role of an offshore company: pure, unadulterated asset protection. When you transfer ownership of valuable assets—be it property, investments, or even cash savings—to your company, you legally create distance between you and them. It’s a legal firewall.

If you ever face unexpected legal troubles, whether personal or professional, the assets held by the company are generally beyond the reach of creditors or lawsuits aimed at you personally. It’s a foundational strategy for anyone serious about preserving their wealth for the long haul.

Setting these structures up correctly is key to making them effective and compliant. Working with someone who understands the ins and outs can be a game-changer. If you need help structuring your offshore company for one of these specific goals, find a team that offers Cost-Effective Business Setup Solutions tailored to your needs. You can see how we at 365 DAY PRO help structure your offshore company to get the most out of it.

Let 365 Day PRO Handle the Details for You

Setting up an offshore company in Dubai isn't just about filling out forms. It's a maze of choices, from picking the right jurisdiction to getting your documents pitch-perfect and satisfying some of the world's strictest banking compliance rules. Every single step requires a sharp eye and deep local know-how.

This is exactly where we come in. Working with a specialist like 365 Day PRO takes the guesswork out of the equation. We’ve been down this road countless times, and our team has a real-world, practical understanding of the UAE's regulations. We are the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, handling the nitty-gritty so you can stay focused on the bigger picture: your global business strategy.

Why Bring in an Expert?

Going it alone might seem like a way to save money, but it often leads to frustrating delays and expensive mistakes. A real partner does more than just push paper; we give you strategic advice that fits your specific situation.

Here’s what our experience means for you:

- No Cookie-Cutter Solutions: We listen first. Your goals—whether it’s protecting assets, managing international trade, or setting up a holding structure—drive our recommendations. We deliver Cost-Effective Business Setup Solutions tailored to your needs.

- The Full Picture: Our expertise isn't limited to offshore. We are also Specialists in Mainland Company Formation in Dubai & Abu Dhabi and Specialists in Freezone Company Formation across the UAE, giving us a complete perspective on the best corporate structure for you.

- Smooth Sailing: We know who to talk to and how to get things done. We manage all the back-and-forth with government authorities, making the approval process as seamless as possible.

The single best investment you can make in your new offshore company is choosing the right partner. It's the difference between a shaky start and a solid foundation built to last.

And our job doesn’t end when your company is officially registered. We’re in this for the long haul, ready to help you navigate the ever-changing compliance and banking landscape. It’s why we offer a 24/7 Support Service – Always here when you need us. You’ll always have an expert in your corner. Find out more about our dedicated client support system.

Let us take care of the complexities. Think of 365 Day PRO as your trusted advisor, completely focused on making your venture a success.

Ready to get your offshore company set up the right way? Contact 365 DAY PRO Corporate Service Provider LLC for a free chat to see how our team can make it happen.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation: https://365dayproservices.com