Opening a non-resident bank account in Dubai is absolutely possible, and for many international entrepreneurs and investors, it’s a brilliant strategic move. It plugs you directly into one of the world's most stable, pro-business financial hubs, making it easier to manage global transactions, protect your wealth, and take advantage of a very favourable tax system. The secret isn't whether you can do it, but how you do it—the process is direct, but it demands perfect documentation and a solid understanding of local compliance rules.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why Dubai Is the Premier Hub for Non-Resident Banking

Dubai has cemented its reputation as a global financial powerhouse, drawing in capital and talent from all over the world. For non-residents, the attraction is about much more than just the impressive skyline and luxury lifestyle. The city offers a banking environment that's secure, sophisticated, and perfectly positioned for international business and wealth management. This unique mix makes a Dubai bank account a powerful tool for any global entrepreneur.

The UAE's economic stability is the bedrock of its banking sector. With strong government policies and an increasingly diverse economy, the financial system is a true safe haven for assets. A huge advantage here, especially compared to other jurisdictions, is that the UAE Dirham (AED) is pegged to the US Dollar. This completely removes currency fluctuation risk if you're dealing mainly in USD, offering a level of predictability that’s been solid for decades—a massive plus for international trade and investment.

Strategic Advantages for Global Entrepreneurs

Choosing to open a non-resident bank account in Dubai gives you a real competitive edge. It's not just a place to park your money; it’s your entry ticket into a forward-thinking financial ecosystem designed for growth.

Here’s what you really gain:

- Enjoy UAE Tax Benefits: This is the big one. The UAE has no personal income tax, no capital gains tax, and no withholding tax. This incredibly friendly tax environment means international entrepreneurs keep more of their profits to reinvest back into their businesses.

- Access to a Tech-Forward Banking System: Dubai's banks are on another level when it comes to digital platforms. You can manage your accounts, fire off international transfers, and keep an eye on everything from anywhere in the world, all through highly secure and user-friendly online and mobile banking.

- Political and Economic Stability: In a world filled with uncertainty, the UAE is a beacon of stability. Its pro-business government and clear long-term economic vision create a predictable and reliable environment for your money.

The real value of a Dubai bank account is its power to centralise your international business finances. Think of it as a secure hub for getting paid by clients worldwide and paying suppliers in different regions, all while sitting in a tax-efficient structure.

Navigating the Process with an Expert Guide

While the benefits are crystal clear, the actual process of opening an account can have its tricky moments. Banks here have very strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations they must follow. Getting your documentation right—from properly attested corporate papers to a well-written business plan—is absolutely critical to getting approved.

This is where having an expert in your corner makes all the difference. A partner like 365 DAY PRO, which specialises in Mainland and Freezone Company Formation, can turn a potentially confusing procedure into a straightforward, manageable journey. We build cost-effective business setup solutions that fit your exact needs, making sure every document is perfect and every box is ticked. With our 24/7 support, you get a dedicated specialist who guides you from start to finish, letting you focus on what you do best—running your business.

So, you're ready to open a bank account in Dubai. Your first major crossroad is deciding whether you need a personal account or a corporate one. This isn't just a simple checkbox on a form; it's a foundational choice that dictates how you can legally manage your money in the UAE.

Getting this wrong can cause some serious headaches down the line. The UAE’s banking system draws a very clear, sharp line between your personal money and your business's capital. Let's break down which one is right for you.

Personal Accounts for Your Private Wealth

Think of a personal account as your home base for managing individual finances in Dubai. It’s perfect for non-residents who are investing in property, looking for a safe place to grow their savings, or simply need a local account for their visits.

A personal account is the ideal fit if you're:

- Investing in Real Estate: You'll need a straightforward way to collect rent from your Dubai property and cover any associated costs like maintenance or service charges.

- Building a Savings Nest Egg: Many non-residents open accounts here to benefit from a stable, tax-neutral environment, protecting their funds from volatility or high taxes back home.

- A Frequent Visitor: If you spend a lot of time in Dubai, having a local debit card is a game-changer. It makes life easier and helps you sidestep those frustrating international transaction fees.

But here’s the crucial limitation: you absolutely cannot run a business through your personal account. Banks are incredibly strict about this. If their compliance team sees a pattern of commercial-looking payments flowing into your personal account, they won't hesitate to raise a red flag.

Corporate Accounts: A Must-Have for Business

If you've registered a company in the UAE—whether it’s on the mainland or in a free zone—a corporate bank account isn't just an option; it's a mandatory requirement. This account creates the legal firewall between your business's finances and your personal assets, which is essential for liability protection and clean bookkeeping.

The advantages are significant:

- Builds Business Credibility: Having a proper corporate account instantly signals to clients and suppliers that you're a legitimate, serious operation.

- Handles Business Transactions: These accounts are built to manage everything from paying employee salaries and handling supplier invoices to processing international payments from customers.

- Keeps You Compliant: It creates a crystal-clear financial record for your business. This is non-negotiable for audits, renewing your trade licence, and preparing accurate financial statements.

Before we dive deeper, let's look at a quick side-by-side comparison to make the differences crystal clear.

Personal vs Corporate Non Resident Accounts A Quick Comparison

| Feature | Personal Account | Corporate Account |

|---|---|---|

| Primary Use | Savings, investments, property income, personal expenses | Business operations, trade, payroll, client payments |

| Account Holder | Individual person | Registered legal entity (company) |

| Transaction Type | Personal transfers, lifestyle spending, rent | Commercial transactions, invoicing, salaries |

| Key Requirement | Passport, visa/entry stamp, proof of address | Trade licence, company documents, owner/shareholder IDs |

| Compliance Focus | Source of personal wealth, individual transactions | Source of funds, business activity, beneficial ownership |

This table neatly summarises the core distinctions. Choosing the right one from the start saves you from compliance issues and ensures your financial activities align with UAE regulations.

My takeaway is simple: If you have a registered UAE company, you must open a corporate bank account. Trying to use a personal account for business is the fastest way to get it frozen or shut down.

This strict separation is one reason the UAE's banking sector is trusted globally. The numbers back it up. Recent data from the Central Bank of the UAE showed non-resident deposits climbing from AED 230 billion to around AED 257 billion in just a couple of months—that’s an 11% jump. This kind of growth only happens in a well-regulated, secure environment. You can dig into more data on the UAE's banking growth to see just why compliance is taken so seriously here.

Getting Your Paperwork and Compliance in Order

Let's be blunt: getting your documents right is the most important part of opening a non-resident bank account in Dubai. It's where most applications fall apart. UAE banks are serious about international compliance standards like Know Your Customer (KYC) and Anti-Money Laundering (AML). This isn't just red tape; it's how they protect the integrity of the financial system.

For you, this means every single document has to be perfect. A missing page, a blurry copy, or an incorrectly attested certificate is often all it takes for an application to be delayed or, worse, flat-out rejected. Knowing why the banks ask for each document helps you build a solid, approval-ready file from the get-go.

The Essentials for a Personal Account

When it comes to a personal account, the bank has two main goals: to confirm who you are and to understand where your money comes from. They need to be completely satisfied that your funds are legitimate.

Here's what you'll almost certainly need to provide:

- Passport Copy: A clear, valid copy. This is non-negotiable.

- UAE Entry Stamp or Visa Page: This proves you've entered the country legally, a key requirement even for non-resident accounts.

- Proof of Address: A recent utility bill (typically under three months old) from back home usually does the trick. Make sure the address on it is an exact match with your other documents.

- Bank Reference Letter: A simple letter from your current bank stating that you're a customer in good standing. It's a quick way to add credibility.

- Your CV: A brief rundown of your professional background helps the bank understand your profile and line of work.

- Source of Wealth Declaration: You'll need to clearly explain the origin of your funds—whether it’s salary, business income, investments, or an inheritance.

Here's a tip from experience: Double-check that all your details are consistent across every single document. If the address on your utility bill is different from the one on your bank statement, a compliance officer will spot it immediately. That small inconsistency can cause a major headache.

The Deeper Dive: Corporate Account Documentation

Opening a corporate account is a whole different ball game. The bank's scrutiny is much higher because they aren't just vetting you; they're vetting your entire business. They need a crystal-clear picture of your business model, its legitimacy, and who really owns and benefits from it.

The document list is longer and demands meticulous attention to detail:

- Company Trade Licence: This is the core document proving your company is legally registered in the UAE.

- Certificate of Incorporation/Registration: Confirms the legal formation of your company.

- Memorandum and Articles of Association (MOA/AOA): These are the rulebooks for your company, outlining its purpose, share structure, and how it's run.

- Share Certificates: Shows exactly who owns the company.

- Passport and Visa Copies for All Shareholders: Every significant owner must provide their identification.

- Board Resolution: A formal, signed document from your company's board that authorizes the opening of the bank account and names the people who can sign on its behalf.

- A Comprehensive Business Plan: This is absolutely critical. It needs to explain what your company does, who your customers are, your projected revenue, and your main suppliers. A vague or generic business plan is a one-way ticket to rejection.

The Importance of Attestation

Many of your corporate documents, especially if they were issued outside the UAE, will need to be "attested." This is a formal verification process involving the UAE Embassy in the document's country of origin and then the Ministry of Foreign Affairs (MOFA) here in the UAE. It’s how they confirm a document is authentic. If you skip this, your application goes nowhere.

For a bit of perspective on how different financial hubs handle this, a guide to understanding non-resident business bank account requirements in the UK can be an interesting read. While the specifics change, the fundamental principles of compliance and solid paperwork are the same everywhere.

This is exactly where having an expert like 365 DAY PRO on your side makes a real difference. We don't just hand you a checklist. We walk you through preparing each document to meet the bank's exact standards. We know what compliance officers look for and how to present your company in the best possible light, removing the guesswork and dramatically improving your odds of getting that account open quickly and smoothly.

The Account Opening Process From Start to Finish

Knowing what to expect when opening a non-resident bank account in Dubai is half the battle. Let's be clear from the outset: this is a thorough, compliance-focused process. It’s best to think in weeks, not days. From the moment you start gathering documents to the day your account is live, you'll move through several distinct stages.

To make this real, let’s consider a common scenario. Picture a European tech founder who has just set up their new company in a Dubai free zone. They urgently need a corporate account to start sending invoices and paying for operating costs. Their first real task is picking the right bank—a choice that often hinges on the bank’s familiarity with international clients and the quality of its digital banking platform.

Getting Started: The Remote Preparation Phase

A surprising amount of the initial legwork can be handled before you even book a flight to Dubai. This first phase is all about documentation and getting a preliminary green light from the bank. This is where you, or a consultant helping you, will meticulously compile every single piece of required paperwork, making sure it’s exactly what the bank needs.

For our tech founder, this means getting their company’s trade licence, Memorandum of Association, a solid business plan, and personal documents for all shareholders in order.

Why is this pre-vetting so critical? Because a complete and perfectly organised application file drastically cuts down on the back-and-forth emails and calls from the bank, which are the number one cause of delays. While you'll almost always need to visit in person to sign the final papers, getting everything pre-approved makes that trip short and sweet—just a quick stop for signatures and identity verification.

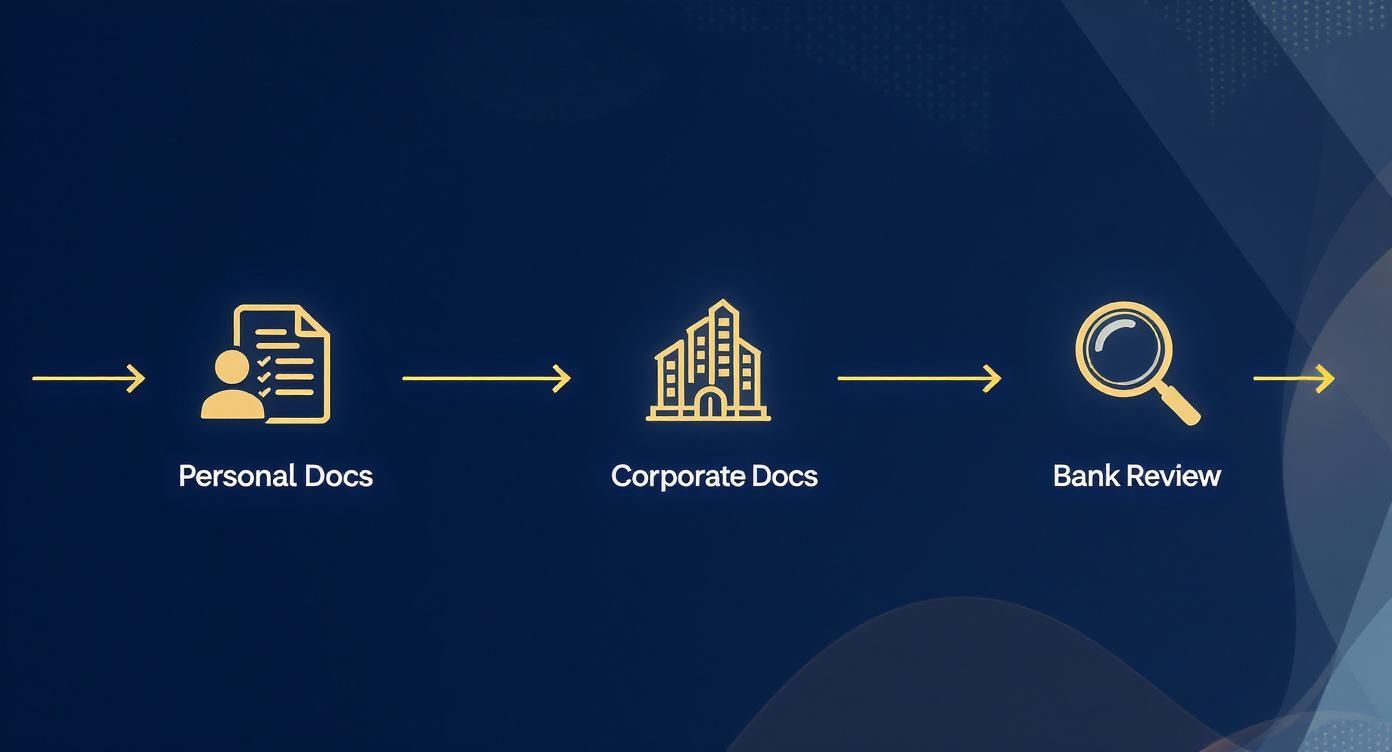

This workflow gives you a visual idea of how the documents flow from your side to the bank's review team.

As you can see, it's a linear process. The bank's compliance team won't even start their review until they have a complete set of personal and corporate documents.

This methodical approach is a hallmark of the UAE's banking system, which is both highly organised and secure. It's worth noting that financial inclusion here is incredibly high, with surveys indicating that around 94% of residents have personal bank accounts. This points to a mature, tech-forward financial environment, which ultimately benefits non-resident clients as well. You can read more about the UAE's high financial inclusion rates to understand the broader context.

The In-Person Meeting and Final Hurdles

Once the bank has given your initial application the thumbs-up, the next step is usually a compliance meeting. This might be a video call, but more often than not, it happens during your in-person visit. This is no mere formality. It’s the bank’s chance to put a face to the name, get a feel for your business, and ask pointed questions about where your money comes from and how you plan to use the account.

For our tech founder, the bank manager might ask things like:

- Where are your main clients based?

- What’s your projected monthly turnover for the first 12 months?

- Walk me through the typical payment flow for one of your projects.

Pro Tip: Clarity and confidence are your best friends in this meeting. Be ready to talk about your business in detail. Vague answers about your operations or revenue sources are a huge red flag for any compliance officer.

After a successful meeting and signing the paperwork, your application goes into the bank's internal system for final risk assessment and compliance approval. This part happens behind the scenes and can take anywhere from one to three weeks. It’s here that the bank does its final due diligence.

Once you get the final approval, you’ll receive your account number and IBAN. The debit card, chequebook, and online banking login details usually arrive a few days later. A realistic timeframe, from your first enquiry to having a fully working account, is anywhere between two and six weeks—and that’s assuming your paperwork is flawless from day one. This careful, multi-step journey is what protects the integrity of Dubai's financial system while offering a secure banking hub for global businesses.

Finding the Right Bank in Dubai for Your Needs

Picking a bank in Dubai isn’t like choosing one back home. It's a strategic move that can make or break your financial experience here, especially as a non-resident. You can't just walk into the first shiny branch you see; not all banks are keen on non-resident clients, and their rules, fees, and service levels are all over the map.

The right banking partner should fit your specific situation. Are you a high-net-worth individual managing a diverse portfolio? A global trader using Jebel Ali as a hub? Your profile dictates your best options. Make the wrong call, and you're in for a frustrating loop of rejected applications and wasted time. The real trick is to look past the glossy ads and zero in on what truly matters for someone opening a non-resident bank account in Dubai.

What to Look for When Choosing a Bank

For a non-resident, the list of priorities is quite different from a local's. Your decision should really hinge on a few key factors that will directly impact how you manage your money from abroad.

Here's what you need to scrutinise:

- Minimum Balance Requirements: This is probably the single biggest hurdle. Banks almost always demand a significantly higher minimum monthly balance for non-resident accounts compared to what residents need to maintain.

- The Real Cost of Banking: Dig into the fee schedule. Pay close attention to monthly account fees, charges for international transfers (both sending and receiving), and the penalties for dipping below that minimum balance. These can add up fast.

- Digital Banking That Actually Works: You'll be managing your account remotely, so a top-notch online portal and mobile app aren't just a nice-to-have—they're essential. It needs to be secure, intuitive, and reliable.

- Multi-Currency Capabilities: If your business or personal finances cross borders, an account that can hold and transact in currencies like USD, EUR, and GBP is a game-changer. It can save you a small fortune in conversion fees over time.

A Quick Look at Dubai's Top Banks

Dubai's banking scene is a mix of massive local powerhouses and well-known international names. Each has its own personality and appetite for different types of non-resident clients.

- Emirates NBD: As one of the biggest players in the entire region, ENBD has a huge range of services and a very solid digital platform. They're generally open to non-resident corporate accounts, but they tend to favour established, well-documented businesses.

- Mashreq Bank: Often seen as an innovator and a more expat-friendly option, Mashreq is a popular choice. This openness, however, comes with some of the strictest due diligence. You'll see a clear difference in their requirements; a non-resident savings account might need you to keep over AED 30,000 to stay fee-free, while a resident might only need AED 3,000. Want to dig deeper? You can learn more about the best banks in the UAE and their requirements.

- Abu Dhabi Islamic Bank (ADIB): If Shariah-compliant banking is what you need, ADIB is a leading choice. They provide a full suite of Islamic finance products and are a very strong option, particularly for clients from the GCC and other Islamic nations.

The secret isn't just about picking a famous bank name. It's about presenting your profile in a way that fits that specific bank's risk appetite and ideal customer. A bank that's perfect for a real estate investor could be a terrible match for a new tech startup.

How a Corporate Service Provider Makes It Happen

This is where having an expert in your corner becomes priceless. At 365 DAY PRO, we live and breathe Freezone and Mainland Company Formation. Over the years, we've built solid relationships with a wide range of banks across the UAE. We have a real-time pulse on which banks are welcoming non-resident applications right now and, more importantly, we understand the unwritten rules their compliance teams follow.

When you work with us, you're tapping into that deep-seated expertise. We don't just point you to a bank; we help you build an application package that ticks all their boxes. Our Cost-Effective Business Setup Solutions are designed to ensure your company's structure and paperwork align perfectly with banking expectations from the get-go.

A bank's offerings extend beyond just a current account, so it’s wise to consider their broader lending and finance services for future needs. With our 24/7 support service, we'll guide you through the entire selection process, helping you lock in a banking partner that not only meets your immediate needs but also supports your long-term growth so you can fully enjoy UAE tax benefits.

Let 365 DAY PRO Handle the Heavy Lifting for You

Trying to open a non resident bank account in Dubai on your own can feel like navigating a maze. It’s not just about ticking boxes on a form; it’s about understanding the nuances of the local banking system. This is precisely where having an expert on the ground makes all the difference.

At 365 DAY PRO, we specialise in making this process straightforward. We've been through it countless times and know exactly what the banks are looking for.

Your Local Banking Partner

We live and breathe Mainland and Freezone Company Formation. This means we can help you build your business structure in a way that aligns perfectly with banking requirements right from the start, avoiding common pitfalls that cause delays.

Our team doesn't just hand you a list of documents. We get hands-on with the preparation and use our long-standing relationships with UAE banks to help your application move smoothly through the system. We've built our reputation on providing practical, cost-effective solutions for international entrepreneurs.

Think of us as your local partner. We'll handle the complex paperwork and compliance hurdles so you can focus on what you came here to do: grow your business. And with our 24/7 support service, you always have someone to call.

Working with us means you can get right to enjoying the UAE tax benefits without getting bogged down by administrative headaches. We're here to help you lay a solid financial foundation for your success in Dubai.

Ready to get started?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Got Questions? We've Got Answers

You're bound to have some questions when navigating the ins and outs of opening a Dubai non-resident bank account. Let's get straight to the answers for the most common things people ask us.

Can I Really Open a Dubai Bank Account Remotely?

The short answer is, almost certainly not. While we at 365 DAY PRO can handle the entire groundwork for you from anywhere in the world—getting your documents in order, pre-approvals, and all the back-and-forth with the bank—you will need to be physically present in Dubai for the final step.

This isn't just a formality; it's a non-negotiable compliance requirement. Banks need to see you in person to verify your identity and get your signature on the final paperwork. For a corporate account, this applies to everyone who will be a signatory. The good news? Our process makes this trip quick and painless. You’ll land in Dubai with everything already lined up, turning a potentially tedious process into a simple signing session.

What’s the Minimum Balance I Need to Keep in the Account?

This is a big one, and the answer varies wildly from bank to bank. It’s a critical piece of the puzzle when you're deciding where to bank.

For a personal non-resident account, you’re typically looking at a minimum balance anywhere from AED 30,000 to over AED 100,000. Corporate accounts often demand even more. Be warned: if your balance dips below this required minimum, the bank will hit you with monthly penalty fees, and those can stack up fast. We make sure to match our clients with banks whose requirements make sense for their financial situation, so they aren't bleeding money on avoidable fees.

The minimum balance isn't just an arbitrary number. Think of it as the bank's way of managing risk with international clients. Higher balances often unlock premium services and a dedicated relationship manager, which can be a game-changer for entrepreneurs operating globally.

How Long Will This Whole Process Take?

Realistically, you should expect the entire process to take somewhere between two and six weeks. This clock starts once you've submitted a complete and correct application and ends when your account is live and ready to use.

What can slow things down? The biggest culprit, by far, is incomplete or incorrect paperwork. A single missing document or a delayed response to a compliance question can easily set you back weeks. This is precisely where having an expert on your side makes all the difference. We ensure your application is perfect from the get-go, which is the best way to keep the process moving and get your account up and running without any frustrating delays.

Making your way through Dubai's banking world requires a steady hand. At 365 DAY PRO Corporate Service Provider LLC, our expertise is in mainland and free zone company formation, and we turn what can be a complicated ordeal into a straightforward one. We deliver practical, cost-effective solutions with 24/7 support. Let our team show you the clearest path to establishing your financial footprint in Dubai.

For a hassle-free journey, contact us for a free consultation.