Setting up a mainland company in Dubai means you're registering your business directly with the Department of Economic Development (DED). This is the path you take when you want to trade freely anywhere in the UAE and internationally, without restrictions.

It’s the ideal structure for entrepreneurs aiming for full market access, the freedom to bid on government projects, and total operational flexibility. And the best part? Thanks to recent legal changes, international entrepreneurs can now get 100% foreign ownership for most business activities.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why a Dubai Mainland Company Is Your Gateway to the UAE

Deciding to set up on the Dubai mainland isn't just a legal step; it’s a strategic move that places your business right in the middle of the UAE's bustling economy. Unlike a free zone company, which often limits your operations to a specific geographic area, a mainland business has no such boundaries. This freedom is precisely why so many ambitious founders choose this route.

With a mainland license, you can open an office, a retail shop, or a warehouse anywhere you want—be it in Dubai, Abu Dhabi, Sharjah, or any other emirate. Even more critically, it makes you eligible to bid on lucrative government contracts, a massive and often untapped sector of the UAE's economy.

Unlocking Unrestricted Market Access

The number one benefit of a mainland license is direct, unfettered access to the local market. You can deal directly with consumers (B2C) and other businesses (B2B) without needing an intermediary or agent. Imagine a retail brand opening its flagship store in a prime mall, or a consulting firm setting up its office in the financial district to be right next to its clients.

This level of access gives you:

- Complete Geographical Freedom: You have the liberty to set up multiple branches across the entire UAE.

- Direct Customer Engagement: Sell your products and services directly to the local population without restrictions.

- Government Tenders: Qualify to participate in and win valuable public sector projects.

A mainland company signals a serious, long-term commitment to the UAE market. This builds incredible trust with local partners, banks, and government entities, giving your business a solid foundation for growth and credibility right from the start.

Capitalising on Favourable Business Policies

Recent changes to the UAE's Commercial Companies Law have completely transformed the landscape for international investors. The long-standing rule requiring a local Emirati sponsor to hold 51% of the shares has been abolished for most business activities. This means you can now maintain full control and ownership of your company.

When you combine 100% ownership with the UAE's attractive tax policies, you have a powerful incentive for setting up shop here. It's a clear signal that the UAE is serious about attracting global talent and capital.

Beyond just the company setup, it’s worth exploring the broader advantages of real estate investment in Dubai to understand the emirate's overall economic pull. It's all part of a bigger picture of investor-friendly policies.

Working with a specialist corporate service provider can make navigating this process straightforward. With 24/7 support, you have experts ensuring every detail, from DED approvals to visa processing, is handled correctly and efficiently. It turns what could be a complex journey into a clear, manageable path to launching your business.

Picking the Right Business Structure and License

Let's get straight to it: the legal structure you choose for your company is the bedrock of your entire Dubai operation. Getting this right from day one saves a world of headaches down the line. Paired with the correct license from the Department of Economic Development (DED), it ensures you're operating completely above board.

For anyone coming from outside the UAE, this decision really boils down to a few key choices. But don't mistake this for a simple box-ticking exercise. What you decide here will directly influence your personal liability, what you're allowed to do, and how easily you can grow. It’s a strategic move that sets the entire course for your mainland company.

LLC vs. Sole Establishment: What's the Real Difference?

For most foreign investors, the big decision is between a Limited Liability Company (LLC) and a Sole Establishment. Both get you onto the mainland, but they have massively different implications for your personal risk and ownership.

A Sole Establishment is exactly what it sounds like—owned by one person. It's a common path for professionals offering services, like freelance consultants or graphic designers. The critical thing to know here is that there's no legal separation between you and the business. You are personally on the hook for all company debts.

This is why the Limited Liability Company (LLC) is, by far, the most popular and recommended structure. An LLC is its own legal entity, which means your personal assets are shielded from any business liabilities. Thanks to recent changes in UAE law allowing 100% foreign ownership for the vast majority of activities, the LLC now gives you both total control and total peace of mind.

Frankly, choosing an LLC is almost always the smarter long-term play. It not only protects your personal wealth but also gives you a more professional and credible standing with banks, clients, and partners here in the UAE.

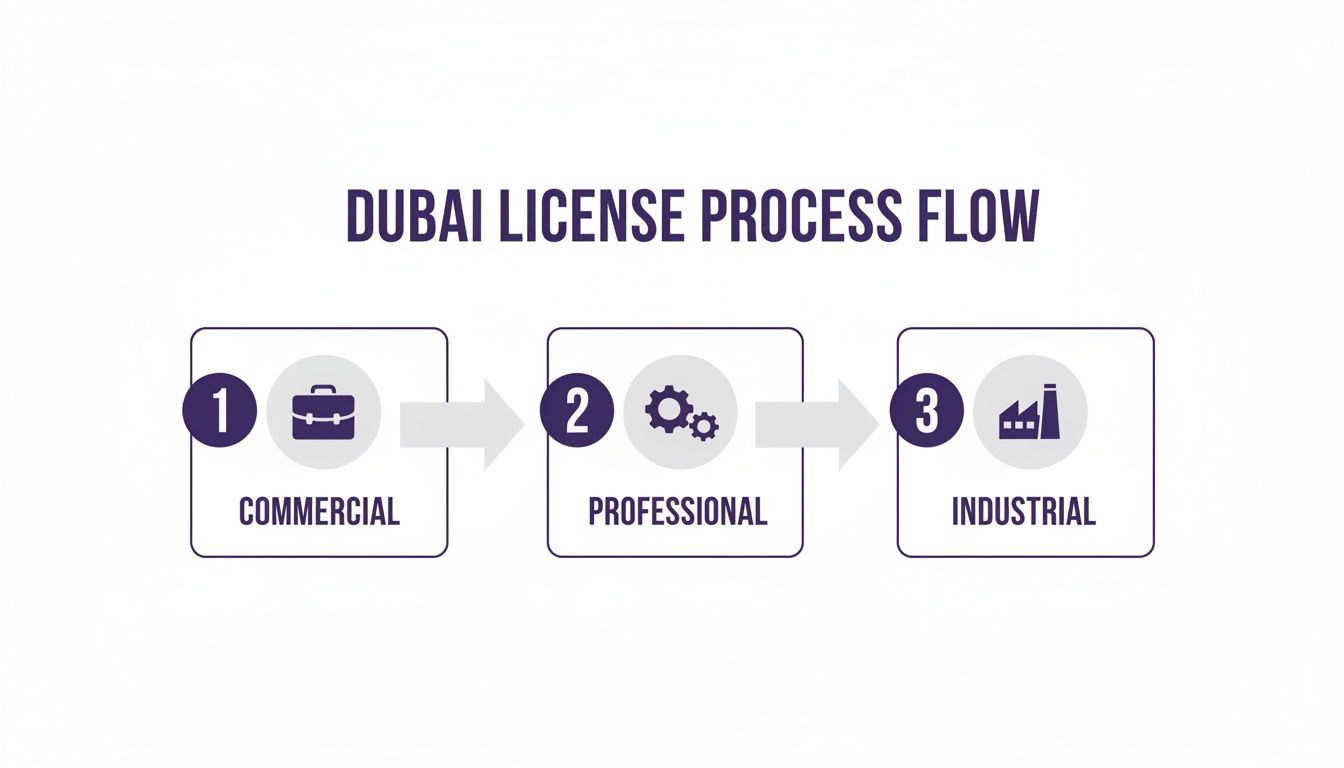

Matching Your Business Activities to the Right License

Once you've settled on a legal structure, the next step is getting the right trade license. This isn't about picking a category that sounds close enough; it has to be a precise match for what your business actually does every day. The DED generally groups these into three main buckets.

-

Commercial License: This is your go-to for any business that buys, sells, or trades physical goods. Think e-commerce stores, general traders importing electronics, or a retail shop. If your business is about products, you need a commercial license.

-

Professional License: This one is for service-based businesses and skilled professionals. We're talking about marketing agencies, IT consultants, business advisors, and legal firms. It’s the license that authorises you to sell your expertise.

-

Industrial License: As you'd guess, this is for any business involved in making things—manufacturing, production, assembly, or industrial processing. A company that builds furniture, packages food, or fabricates metal parts falls squarely into this category.

Getting this wrong is a costly mistake. I’ve seen marketing consultants apply for a commercial license by mistake, only to get rejected and have to start the whole process over again. It’s a waste of time and money. This is exactly where having an expert on your side makes all the difference. Someone who sets up mainland companies for a living can look at your business model and point you to the correct license instantly.

To make these distinctions clearer, here’s a simple breakdown of how different businesses fit into each license category.

Comparing Mainland License Types

The table below breaks down the three primary license types, who they're for, and what you need to keep in mind.

| License Type | Ideal For | Typical Ownership | Key Consideration |

|---|---|---|---|

| Commercial | Businesses trading, importing, or selling physical goods like electronics, apparel, or general merchandise. | A Limited Liability Company (LLC) is the standard choice for liability protection. | The license must list every specific type of product you plan to trade. |

| Professional | Service providers like consultants, designers, accountants, and marketing specialists. | Can be a Sole Establishment or an LLC, depending on your preference for liability protection. | Allows for 100% foreign ownership but requires a Local Service Agent (LSA). |

| Industrial | Companies involved in the manufacturing, processing, or assembly of products. | Almost always an LLC to manage the higher operational risks and capital involved. | Requires additional approvals from bodies like the Ministry of Industry and Dubai Municipality. |

Choosing the right license is about more than just compliance; it's about setting your business up for success without unnecessary hurdles.

Navigating DED Approval and Company Registration

Getting your business legally recognized by Dubai's Department of Economic Development (DED) is the single most important part of setting up on the mainland. This is where the rubber meets the road—transforming your business plan into a real, licensed company. It’s a sequence of precise steps, and believe me, getting them right the first time will save you a world of headaches and unexpected costs.

This isn't just a paper-pushing exercise; it's about executing a legal strategy. Every detail, from picking a trade name that won't get flagged to drafting a rock-solid Memorandum of Association (MOA), lays the foundation for your entire operation in the UAE.

Getting Your Trade Name and Initial Approval

First things first: you need to reserve your company's trade name. It sounds simple, but the DED has strict rules. Your name has to be completely unique, and you can't use any language that's considered offensive or has religious connotations. A classic rookie mistake is picking a name that's just a little too close to an existing brand—that’s an instant rejection.

Once the name is approved, you'll work towards the Initial Approval Certificate (IAC). This is a critical document. It’s the DED’s official nod, confirming they have no objection to your business activity. This preliminary green light is what allows you to move on to the next stages, like drafting your legal documents and signing an office lease.

Think of the Initial Approval as the DED giving you a provisional "yes." It doesn't mean your license is in the bag, but it confirms your business idea is viable and you're cleared to proceed. Getting this sorted is a major milestone.

Drafting the Memorandum and Securing Your Office

With the Initial Approval in hand, it's time to draft your Memorandum of Association (MOA) and get it notarised. For an LLC, this is the backbone of your company. It outlines everything from the corporate structure and shareholder responsibilities to how profits will be split.

Your MOA has to be perfectly aligned with UAE Commercial Companies Law. Any grey areas or mistakes will get it kicked back by the notary public, sending you back to the drawing board. This is one area where professional help is non-negotiable; you need this document to be legally airtight.

At the same time, you need to lock down a physical office. A Dubai mainland company must have a registered physical address, which is validated by an Ejari. The Ejari is the government's mandatory registration of your tenancy contract. Without a valid Ejari, you simply cannot get your final trade license.

- Memorandum of Association (MOA): This document defines the legal framework of your company and shareholder agreements. It must be prepared in both Arabic and English.

- Ejari (Tenancy Contract): This officially registers your office lease with the government, proving you have a legitimate physical presence for your mainland company setup in Dubai.

The core process is the same whether you're going for a Commercial, Professional, or Industrial license, though you might need a few extra external approvals depending on your specific business activity.

As you can see, while the license types cater to different activities, the fundamental DED registration journey is consistent across the board.

How Recent Legal Reforms Have Changed the Game

Thanks to major legal reforms, the whole process is much more direct than it used to be. The updated Dubai Company Law was a game-changer, especially the move to allow 100% foreign ownership without needing a local sponsor. For decades, foreign investors had to give a 51% share to a local partner, a structure that's now a thing of the past for most activities. You can read more about how this has opened up the market for international entrepreneurs.

This change doesn't just give you full control; it also makes drafting the MOA and the entire registration process far simpler, since you're often the sole shareholder.

Trying to manage the DED's online portal, ensuring documents are correctly formatted (and in Arabic), and hitting submission deadlines can be a real challenge. One tiny error can derail your application and set you back weeks. This is exactly why bringing in a corporate service provider is such a smart move. With years of experience handling DED protocols, specialists like 365 DAY PRO take care of everything, making sure every form is perfect and every submission is on time, clearing the path for a smooth, fast license approval.

A Realistic Look at Costs, Visas, and Staying Compliant

Let's talk numbers. A successful launch in Dubai hinges on having a realistic budget from day one. While the advertised costs for a mainland company setup can look appealing, the full financial picture is what really matters. You need to plan for more than just the trade license; we're talking about mapping out every government charge, processing fee, and ongoing cost for your first year.

Think of it as a financial roadmap. Getting this right from the start prevents the kind of cash flow surprises that can cripple a new business before it even gets a chance to get going.

Breaking Down the Setup Costs

The final bill for your mainland license isn't a single line item. It's a combination of several mandatory fees, and the total can shift depending on your specific business activity and legal structure. For example, setting up a consulting firm with a professional license is a different financial ballgame than launching an industrial company that needs multiple external approvals.

Here’s a practical look at the typical costs you'll encounter:

- Trade License Fee: The primary fee paid to the Department of Economic Development (DED).

- Initial Approval & Trade Name Reservation: Fixed fees you pay right at the beginning.

- Memorandum of Association (MOA) Notarisation: The cost to legally attest your company’s foundational document.

- Ejari (Tenancy Contract Registration): A required fee to register your office lease with the authorities.

- Market Fees: This is calculated as a percentage of your annual office rent and paid to the DED.

- External Approvals: If your business is in a field like healthcare or construction, you'll need a sign-off from other government bodies, each with its own fee.

For a standard LLC holding a professional or commercial license, you should realistically budget between AED 15,000 to AED 25,000. This range covers most of the government-side fees, but keep in mind, your office rent and other variables are on top of this.

Budgeting for Visas and Bringing Your Team Onboard

Once your company has its license, the next big-ticket item is residency visas for yourself and any employees. Each visa application is a multi-step journey with its own set of government fees. If you don't account for these costs properly, you can put a serious strain on your operational budget, especially if you're planning to hire a team right away.

The visa process generally involves these key costs:

- Immigration Establishment Card: A one-time fee to get your company registered with the immigration department.

- Entry Permit (Pink Visa): This is the initial permit that allows an employee to enter the UAE to start their employment.

- Medical Fitness Test: A mandatory health screening for all new residents.

- Emirates ID Application: The fee for the national identity card, which is valid for the visa's duration.

- Visa Stamping: The final step, where the residency visa is physically placed in the passport.

A good rule of thumb is to budget approximately AED 5,000 to AED 7,000 for each investor or employee visa to cover all the government fees from start to finish.

Staying on Track: Ongoing Compliance and Post-Setup Duties

Your financial planning doesn't stop once the license is hanging on the wall and the visas are stamped. To operate legally and avoid headaches, you have to manage your ongoing compliance. The biggest recurring cost is your annual trade license renewal, which is typically around the same price as the initial setup.

On top of that, you’ll need to maintain a corporate bank account and keep up with regulatory changes. Dubai has seen incredible growth in Foreign Direct Investment (FDI), particularly in the tech sector, which shows how much confidence international investors have in the UAE. This is largely thanks to a clear regulatory environment, which now includes a corporate tax framework. The current structure sets a 9% tax on profits that exceed AED 375,000, giving businesses clear parameters for financial planning while keeping the UAE competitive. You can get more insight into business trends and their impact on future setups.

Beyond the setup, thinking about long-term financial health means preparing for ongoing responsibilities like understanding tax season for small business owners. Being ready for these recurring obligations is just as critical as funding the initial launch. Working with a good corporate service provider can ensure you never miss a deadline, helping you avoid fines and maintain a solid reputation with the authorities.

How Professional Services Make Your Company Setup a Success

Trying to navigate a mainland company setup in Dubai on your own can feel like piecing together a complex puzzle without the picture on the box. While you technically can do it yourself, the chances of making small, expensive mistakes are incredibly high. This is exactly why smart founders and international businesses bring in professional corporate service providers.

Engaging a specialist firm isn't just about offloading paperwork. It’s a strategic move to ensure your launch is smooth and, most importantly, correct from the start. Think of a provider like 365 DAY PRO as your operational team on the ground here in the UAE. They become your guide and representative, transforming what could be a confusing bureaucratic maze into a clear, efficient process.

Your Direct Line to Government Authorities

One of the biggest hurdles for any new business is dealing with government departments. This is where a professional service’s real value shines through. They have deep, established relationships with key authorities like the Department of Economic Development (DED), Tasheel (Ministry of Labour), and Amer (Immigration).

This isn't just about knowing who to call. It's about understanding the unwritten rules, anticipating roadblocks before they happen, and making sure every single document is perfect on the first submission. Their expertise helps you dodge common setbacks that can easily delay your trade license by weeks or even months.

For example, a minor error in your Memorandum of Association (MOA) or choosing a business activity that’s slightly miscategorised can get your application instantly rejected by the DED. A professional consultant spots these issues long before they become problems, ensuring your application sails through every approval stage.

The Real Value of a Dedicated PRO

Getting your license is just the beginning. The ongoing management of visas, corporate documents, and annual renewals is a constant administrative drain. This is where having a Public Relations Officer (PRO) on your side becomes absolutely essential.

A dedicated PRO team handles every interaction with the government for you, including:

- Visa Processing: Managing new applications, renewals, and cancellations for both investors and employees.

- Document Attestation and Clearing: Ensuring all your legal and corporate documents are properly attested and cleared by the right authorities.

- Labour and Immigration Filings: Taking care of everything from labour card applications to Emirates ID registrations.

- Annual License Renewal: Proactively managing the renewal process so your company stays compliant and you never face a fine.

When you bring in a corporate service provider, your entire focus shifts. Instead of drowning in administrative tasks, you can dedicate 100% of your energy to what actually matters—building your client base, perfecting your product, and growing your business from day one.

Turning Complex Scenarios into Simple Solutions

Professional consultants also prove their worth when your business needs aren't straightforward. Take entrepreneurs who are already operating in a UAE free zone. In the past, expanding to the mainland meant a complete and costly corporate restructuring.

Thankfully, recent regulatory changes have opened up new, smarter pathways. The Free Zone Mainland Operating Permit (FZMOP), for instance, now acts as a bridge, allowing certain free zone companies to do business on the mainland without setting up an entirely new entity. Knowing if you qualify and how to navigate such specific permits requires expert knowledge of the latest rules. A specialist can advise if this is a viable option for you, potentially saving you a significant amount of capital. You can learn more about how this permit is reshaping business integration in Dubai.

Ultimately, the right partner gives you more than just a service; they give you peace of mind. With 24/7 support, you have a team of experts ready to answer your questions and handle any challenge that comes up. Their cost-effective solutions are designed to deliver a seamless experience, making sure your mainland company setup in Dubai is not just successful, but a strategic advantage for your long-term growth.

Your Dubai Mainland Setup Questions Answered

Starting a mainland company in Dubai is a big move, and naturally, it comes with a lot of questions. We get calls every day from entrepreneurs trying to wrap their heads around the process. Here are some of the most common questions we hear, with straightforward answers based on our hands-on experience.

Can I Really Own 100% of My Mainland Company?

Yes, you absolutely can. This is a game-changer and probably the single biggest question we get. A few years ago, the UAE government overhauled the rules, and for most business activities—we're talking over 1,000 of them—foreign entrepreneurs can now have 100% ownership of their mainland business.

This means the old requirement of having an Emirati sponsor hold a 51% stake is gone for the vast majority of companies. You get full control of your business, your finances, and your future. It's a massive step forward and makes setting up on the mainland more appealing than ever.

What’s the Real Difference Between a Mainland and Free Zone Company?

The biggest difference boils down to one simple thing: where you can do business.

-

A Mainland Company is registered directly with the Department of Economic Development (DED). This is your ticket to operate anywhere in the UAE. You can open a shop in a mall, rent an office in any commercial tower, trade directly with any customer on the mainland, and, crucially, bid on lucrative government contracts.

-

A Free Zone Company, on the other hand, is licensed within a designated economic zone. They're fantastic for international trade and certain niche industries. However, your operations are largely confined to that zone or overseas. If you want to sell products or services directly in the Dubai market, you'll typically need to go through a local distributor.

For anyone serious about tapping into the local UAE market, working with government bodies, or opening a physical retail space, a mainland license isn't just an option—it's a necessity. It shows you’re truly invested in the local economy.

Is a Physical Office Mandatory for a Mainland Company?

Yes, a physical office address is non-negotiable for a mainland company in Dubai. The government needs to see proof of a registered tenancy contract, which is called an Ejari.

But this doesn't mean you have to break the bank on a huge office right away. You can start with a small, dedicated office or even a flexi-desk in an approved business center. The key is that it has to be a real, verifiable commercial space linked to your trade license. Remember, the size and type of your office will also directly influence how many employee visas you're eligible to apply for.

What Are the Actual Costs I Should Budget For?

Talking about costs is crucial because the trade license fee is only one piece of the puzzle. To get a realistic picture, you need to account for several different payments.

Here’s a look at what you’re actually paying for:

- Initial Government Fees: This covers things like reserving your trade name and getting initial approval from the DED.

- Trade License Fee: This is the main fee, and its cost is tied directly to the business activities you choose.

- Notarisation and Legal Fees: You'll need to have your Memorandum of Association (MOA) officially attested.

- Office Rent and Ejari: This includes your first year's rent and the fee for registering the tenancy contract.

- Immigration Card: This is a one-time fee to register your company with the immigration authorities so you can start processing visas.

As a ballpark figure, you should probably budget somewhere between AED 15,000 and AED 25,000 for the initial government and setup fees. Keep in mind, this estimate doesn't include your office rent.

How Long Does the Whole Setup Process Take?

If you have all your documents perfectly in order, the timeline for a mainland company setup in Dubai can be surprisingly fast. From start to finish—that's from the initial name reservation to getting the trade license in your hand—you're typically looking at about one to three weeks.

The catch? That timeline depends entirely on everything being perfect. A small mistake on your MOA, a rejected trade name, or a document that isn’t properly attested can bring the whole process to a screeching halt and cause major delays. This is where working with a specialist really pays off. They know the system inside out and can spot potential problems before they happen, keeping your setup on the fast track so you can focus on what matters: launching your business.

We've compiled some of the most frequent queries into a simple table to give you quick, clear answers.

Your Dubai Mainland Setup Questions Answered

| Question | Answer |

|---|---|

| Do I still need a local sponsor? | For most business activities (over 1,000), no. You can have 100% foreign ownership. However, some strategic sectors may still require a local partner. |

| Can I operate anywhere in the UAE? | Yes. A mainland license gives you the freedom to trade directly across all seven emirates and bid on government contracts. |

| What is an Ejari? | An Ejari is the mandatory government registration of your office tenancy contract. You cannot get a mainland license without it. |

| What is the minimum office space required? | There isn't a single minimum size. It depends on your business activity. The key is that your space must be a physical, DED-approved commercial location. |

| Can I get visas for my employees? | Absolutely. The number of visas you are allocated is directly linked to the size of your registered office space. |

| Is the process complicated? | It can be if you're unfamiliar with the DED's procedures and documentation requirements. A small error can cause significant delays. |

Navigating these steps is much simpler with an expert by your side to handle the details and ensure a smooth process.

Ready to make your move? At 365 DAY PRO Corporate Service Provider LLC, we specialize in mainland company formation in both Dubai and Abu Dhabi. We provide affordable, straightforward business setup solutions with 24/7 support to get you up and running without any hassle.

📞 Call Us Now: +971-52 923 1246 or Get Your Free Consultation Today.