Setting up a Limited Liability Company (LLC) in Dubai is a smart play if you're serious about tapping into the UAE's bustling local market. It’s the structure that gives you the best of both worlds: the safety net of limited liability, which shields your personal assets, and now, the game-changing advantage of 100% foreign ownership for most business activities. Frankly, it's become the go-to choice for savvy international investors.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Your Blueprint for a Dubai Mainland LLC

When you decide to launch a business in Dubai, you’re met with a landscape of incredible opportunities. But your very first make-or-break decision is choosing the right legal structure. For anyone looking to operate on the Dubai mainland, the LLC consistently comes out on top as the most popular and flexible option. It's built for entrepreneurs who want to trade directly with customers here, bid on government tenders, and plant a real flag anywhere in the UAE.

This is where the mainland model really pulls away from its free zone counterpart. Free zone companies are fantastic, but they are generally restricted to doing business within their specific zone or internationally. A mainland LLC, on the other hand, gives you the freedom to engage with the entire domestic economy. That’s a massive advantage if you're in retail, trading, hospitality, or any service industry where getting in front of local clients is crucial for growth. You can open an office or shop in the heart of Downtown Dubai or any other prime commercial area, giving you a serious edge.

The Strategic Value of a Mainland LLC

The appeal of a mainland setup has exploded thanks to recent legal changes. The landmark move to allow 100% foreign ownership for thousands of business activities tore down one of the biggest historical hurdles for foreign investors. It means you can now hold complete control of your company and its profits without needing to bring on a local Emirati partner, a requirement that used to be a major sticking point for many.

This shift makes the Dubai mainland LLC an incredibly powerful tool for everyone, from nimble startups to established global corporations. You get the asset protection of a separate legal entity combined with the operational freedom of a truly local business.

Here's what that looks like in practice:

- Unrestricted Market Access: You can trade directly with any person or company across all seven emirates. No barriers.

- Full Ownership Control: For most commercial and professional activities, you own 100% of your business. It's all yours.

- Government Contract Eligibility: This structure puts you in the running for lucrative public sector projects.

- Flexible Visa Options: You can secure residency visas for yourself, your family, and your team. The number of employee visas is tied to your office space, so it can scale with you.

- Enhanced Credibility: A mainland licence signals stability and a real commitment to the UAE market, which builds a lot of trust with clients, banks, and partners.

The real power of a mainland LLC is its versatility. It's more than just a licence; it's your key to unlocking the entire UAE economy, from selling to retail customers in Dubai Mall to landing large-scale government contracts in Abu Dhabi.

Turning Complexity into a Seamless Process

While the benefits are crystal clear, an LLC company formation in Dubai does involve navigating a maze of government departments, legal paperwork, and specific compliance hurdles. From reserving the perfect trade name and drafting a proper Memorandum of Association to securing a physical office lease and getting that final trade licence in hand, every step has to be done just right.

This is where having an expert in your corner becomes invaluable. As a leading corporate service provider in Dubai, Abu Dhabi, and Sharjah, we specialise in making this intricate process straightforward and cost-effective. Our team is here with 24/7 support, acting as your trusted partner from start to finish. We customise our business setup solutions to fit your exact goals, helping you take full advantage of the significant UAE tax benefits and get your company up and running with zero fuss.

Getting to Grips with Dubai’s Legal and Ownership Rules

Figuring out the legal side of setting up an LLC in Dubai used to be a real headache. But things have changed—a lot. The UAE government has been busy overhauling its commercial laws, making the whole process much more straightforward and welcoming for entrepreneurs from around the world.

The biggest shift? They’ve largely done away with the old mandatory local partnership rules. This single change has thrown the doors wide open for international investment.

Not long ago, the biggest hurdle for any foreigner wanting to set up on the mainland was the rule requiring a UAE national to hold 51% of the company's shares. This created a lot of uncertainty and, frankly, made things more complicated than they needed to be. Today, that old system is gone, making Dubai's mainland an even more powerful magnet for global business.

This isn't just some minor policy update. It's a calculated move to bring the UAE's business environment in line with global standards. The message is loud and clear: Dubai is open for business, and you can be in the driver's seat of your own company.

The New Reality: 100% Foreign Ownership

The game-changer for mainland LLCs is the new standard of 100% foreign ownership. This isn’t a perk reserved for a handful of obscure industries; it applies to thousands of different business activities. Whether you're launching an e-commerce brand, a consulting firm, a manufacturing plant, or a trading company, chances are you can now own it 100% yourself. No local sponsor needed.

What does this actually mean for you day-to-day?

- Total Control: You call the shots. Every decision, from operational tactics to your long-term vision, is yours to make.

- Keep Your Profits: Every dirham your company earns belongs to you and any foreign partners you might have.

- Simpler Setup: Your company’s legal structure is clean and direct. This is a huge plus when you're talking to banks or looking for future investment.

Now, it’s not a blanket rule for every single industry. A few "strategic" sectors, usually tied to national security or key public services, still have specific ownership requirements. This is precisely why the very first thing you need to do is get crystal clear on your business activities.

How Your Business Activities Shape Your Company

Choosing your business activities isn’t just about filling out a form; it’s the blueprint for your entire company. The Department of Economy and Tourism (DET) has a massive list of approved activities, and your selections will directly decide your ownership eligibility.

They also determine the type of licence you get—commercial, professional, or industrial—and whether you'll need to chase down any extra approvals from other government bodies.

For instance, a software development company or a digital marketing agency will almost certainly qualify for full foreign ownership. A business in a more heavily regulated field, however, might face a different set of rules. This one decision has a ripple effect on everything, from your startup costs to how easily you can scale down the road.

Think of your business activities as the foundation of your company. It dictates your ownership rights, operational freedom, and future flexibility. Nail this step first, and you'll save yourself a world of headaches and money later on.

The UAE's legal system is constantly being refined to be more investor-friendly. As you dive deeper, it's worth understanding how LLCs can protect assets from lawsuits, which is one of the core benefits of this structure.

Recent updates, like the Federal Commercial Companies Law No. 32 of 2021, were what officially scrapped the old 51% local partner rule and brought in the activity-based system we have now. Looking ahead, we expect even more flexibility, like the introduction of different share classes that allow for varied voting and dividend rights. This is a huge deal for attracting venture capital and setting up sophisticated investor agreements, putting Dubai on par with major international business hubs. These ongoing improvements are exactly why working with a specialised corporate services provider can give you the confidence to navigate the system effectively.

The LLC Formation Process From Start to Finish

Setting up an LLC in Dubai isn't just a single event; it's a structured journey with clear milestones. And while the rewards are significant, you need to navigate several government departments correctly. It all starts with the foundational decisions that give your company its identity and ends with that all-important trade licence that officially brings your business to life.

The very first thing on your checklist is choosing a trade name and defining your business activities. It sounds simple, but your trade name has to be unique and follow UAE naming rules—no restricted terms allowed. At the same time, you'll need to pick your business activities from a huge list approved by the Department of Economy and Tourism (DET). This choice is critical as it directly impacts your licence type and even your ownership options.

Once those core details are sorted, the next hurdle is getting Initial Approval. Think of this as a "no objection certificate" from the DET, giving you the green light to move forward with your proposed business and its shareholders. You absolutely cannot proceed with any legal documents or lease agreements until this is in your hands.

Securing Your Legal Foundation

With the Initial Approval secured, it’s time to get into the legal heart of your company: the Memorandum of Association (MOA). This document is far more than a formality. It’s a legally binding contract that spells out the company’s structure, how shares are distributed, who’s in charge, and how profits are shared.

Drafting the MOA demands real precision. It needs to be written perfectly in both Arabic and English before being signed by all shareholders in front of a public notary. For foreign investors, this is the document that locks in their rights and responsibilities, making it a cornerstone of the whole setup. Getting an expert to help here is a smart move to ensure every clause protects you and lines up with UAE Commercial Companies Law.

The MOA is effectively the constitution for your LLC. It governs the relationship between shareholders and the company itself. Getting it right from day one is the best way to prevent future disputes and keep things running smoothly.

The Physical Presence Requirement

Here’s a key difference between mainland and free zone setups: a mainland LLC must have a physical office space. This isn't optional; it's a non-negotiable requirement for getting your trade licence. Your tenancy contract needs to be registered through the Real Estate Regulatory Agency's (RERA) Ejari system.

Registering for Ejari generates a unique certificate that proves your lease is official and legally valid. The DET will not issue your final licence without it. There's also a strategic element here—the size of your office directly affects how many employee visas you can apply for, so you need to think about your future growth plans when choosing a space.

From Final Submission to Full Operation

Once your MOA is notarised and your Ejari is registered, you’re on the home stretch. You'll compile all your documents—shareholder passports, visa copies, the initial approval certificate, and more—for final submission to the DET. The authorities will do one last review to make sure everything is in order.

After a successful review, you'll receive a final payment voucher. Pay that, and your trade licence is officially issued. But you're not quite done. The company then needs to be registered with the Ministry of Human Resources and Emiratisation (MOHRE) and the General Directorate of Residency and Foreigners Affairs (GDRFA). These steps are what get you your Establishment Card, which finally allows you to start processing visas for yourself and your staff.

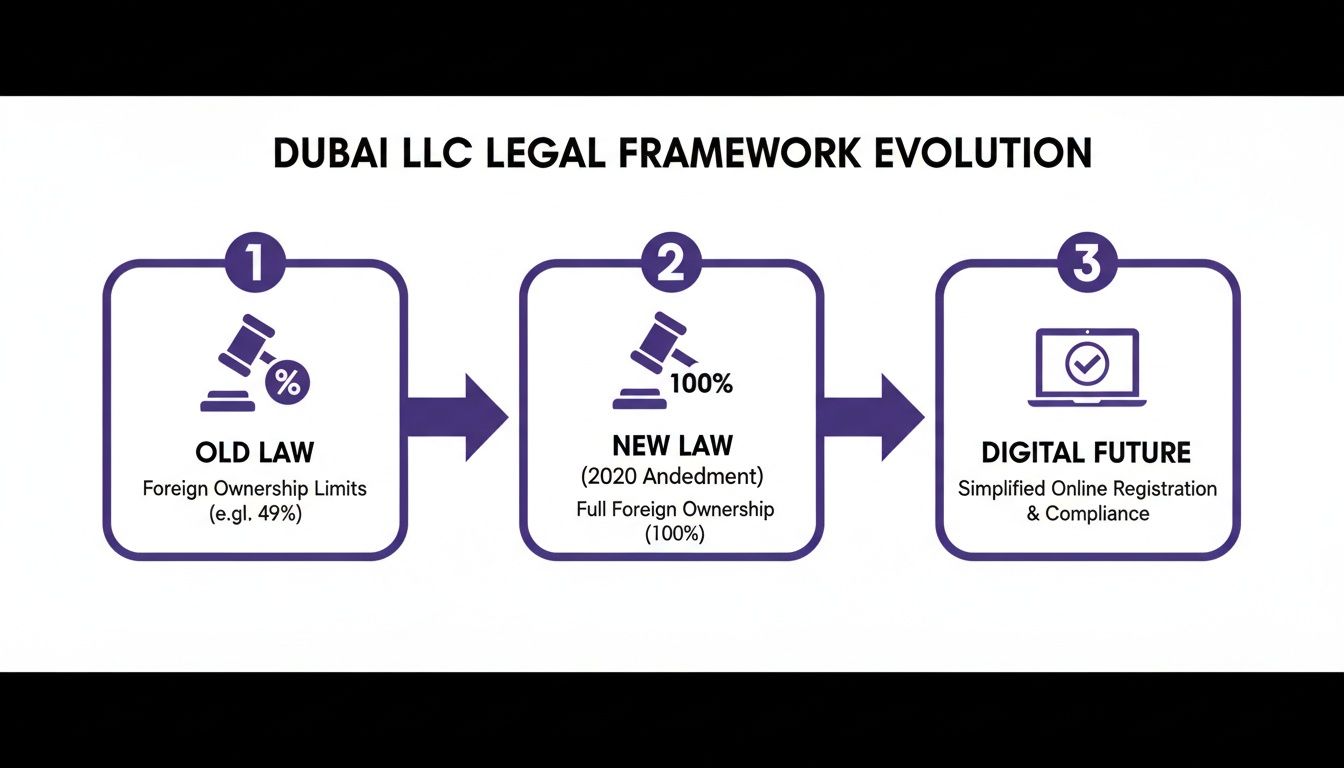

The infographic below shows how the legal framework has evolved to create this modern, investor-friendly process.

This flow really highlights the shift from the older, more restrictive laws to today's 100% foreign ownership model and the government's move towards digital platforms for quicker turnarounds.

The entire process, while detailed, is now impressively efficient. In fact, between 2023 and 2025, Dubai saw over 350,000 new business registrations, with LLCs being a popular choice for their flexibility. Thanks to digital initiatives, the DET has managed to slash registration times to as little as 4–5 working days for many standard setups. This streamlined approach, combined with dropping the 51% local partner rule for most activities, has made the LLC the top choice for international entrepreneurs looking to break into the UAE market. Learn more about Dubai's booming business environment.

Juggling all these steps requires serious attention to detail. Working with a specialist in mainland company formation ensures every document is perfect, every submission is on time, and you can focus on what you do best—planning your business launch. With 24/7 support, we can take care of all these complexities for you.

Let's get straight to the point: what does it really cost to set up a mainland LLC in Dubai? It’s the first question every entrepreneur asks, and getting a clear, no-nonsense answer is essential for planning your launch. Moving past vague online estimates and understanding the actual numbers is the first step to allocating your funds wisely and avoiding any nasty surprises.

The total investment isn't just one single fee. It's a mix of one-time government charges, annual recurring costs like your trade licence, and any professional fees if you decide to work with a setup specialist (which I highly recommend).

Core Government and Licensing Fees

The foundation of your setup budget is built on government-mandated fees. These are fixed costs, and while the final amount will depend on your specific business activity, they are non-negotiable.

Think of it like this, you'll always have a few key line items on the bill:

- Trade Name Reservation: Securing your company's identity.

- Initial Approval Certificate: This is the Dubai Economy and Tourism (DET) giving your business concept the green light.

- Trade Licence Issuance: The big one. This is the main fee for your commercial or professional licence and usually the largest single government cost.

- Market Fees: A government charge calculated as a small percentage of your office's annual rent.

- Notarisation Fees: For legally attesting your Memorandum of Association (MOA).

So, what’s the damage? The good news is that setting up on the mainland has become much more straightforward. You can expect the baseline government and licence fees to start from around AED 18,500. For a standard commercial licence, once you add in all the DET fees, name reservation, and approvals, you’re looking at a realistic range of AED 25,000–27,000. This makes the mainland an incredibly competitive option if you need direct access to the UAE market. Discover more insights about Dubai LLC setup costs.

The Myth of Paid-Up Share Capital

Here’s a common point of confusion that trips up a lot of new investors: share capital. Yes, your company's MOA must state a minimum share capital, often around AED 100,000.

But here’s the crucial detail: you don't actually have to deposit this money into a bank account. It's largely a figure on paper. This is a game-changer because it removes a massive financial hurdle for startups and small businesses.

Mainland Value vs Premium Free Zone Costs

Putting the mainland cost into perspective is key. How does it stack up against a high-end free zone? While both now offer 100% foreign ownership, their costs and target markets are worlds apart.

To give you a clearer picture, let's compare the estimated first-year costs for a mainland LLC against a couple of premium free zone options. This helps highlight where your money goes and what kind of investment is needed for each jurisdiction.

Mainland LLC vs Premium Free Zone Cost Comparison (Year 1 Estimate)

| Cost Component | Dubai Mainland LLC (Estimate) | Premium Financial Free Zone (e.g. DIFC) | Specialised E-commerce Free Zone (e.g. CommerCity) |

|---|---|---|---|

| Initial Licence & Registration | AED 25,000 – 27,000 | AED 55,000 – 95,000 | AED 25,000 – 45,000 |

| Mandatory Office Lease (Annual) | Varies (Flexi-desk option available) | AED 100,000 – 300,000+ | AED 20,000 – 55,000 |

| Visas & Establishment Card | AED 5,000 – 8,000 | AED 15,000 – 25,000 | AED 3,250 – 3,250 |

| Professional Service Fees | AED 5,000 – 15,000 | AED 7,000 – 15,000 | AED – |

| Total Estimated Year 1 Cost | AED 35,000 – 50,000+ | AED 177,000 – 435,000+ | AED 48,250 – 103,250 |

As you can see, a premium financial hub like the DIFC caters to a very different budget and business type. The mainland offers a much more accessible entry point, especially for businesses targeting local trade, retail, or government contracts—particularly since the 51% Emirati partner rule was abolished for most activities.

How Bundled Services Create Real Savings

Trying to navigate the setup process yourself might look cheaper on paper, but the hidden costs can bite you. Think about the fees for document translation, legal attestations, and the time wasted making multiple trips to different government departments. It all adds up, fast.

This is where partnering with a specialist really pays off. As an experienced corporate service provider, we create cost-effective, bundled packages that cover everything you need. For instance, our targeted PRO and licence packages can start from as low as AED 6,010. By handling all the administrative legwork, we cut down the total cost of your LLC company formation in Dubai and provide you with 24/7 support. You get to launch with complete financial clarity, avoiding the costly rookie mistakes.

Life After Licensing: Your Post-Formation Checklist

Getting that freshly printed trade licence in your hands is a fantastic feeling. It’s a huge milestone. But in reality, it’s the starting line, not the finish. The real work of an LLC company formation in Dubai begins now, turning that legal document into a living, breathing business that can hire staff, sign contracts, and generate revenue.

Too many entrepreneurs get tunnel vision on just securing the licence and forget about the crucial next steps. This post-formation checklist is where the momentum builds, ensuring you start operating legally and efficiently right out of the gate. Let’s break down what you need to tackle next.

Activating Your Corporate Bank Account

This one surprises a lot of people. Opening a corporate bank account in the UAE isn't just a simple trip to the bank; it can be a real hurdle. Banks here have very strict due diligence and know-your-customer (KYC) checks. You can't just show up with your new licence and expect an account to be opened that day.

To have any chance of a smooth process, you need a perfectly organised file. Typically, you’ll be asked for:

- Your trade licence and Memorandum of Association (MOA).

- Passport and visa copies for every shareholder.

- The company’s Establishment Card.

- Proof of a physical office (your Ejari certificate is key).

- A solid business plan showing what you do and your financial projections.

Banks need to see a legitimate, well-thought-out business. This is where having a professional by your side helps immensely. We know exactly what each bank is looking for and can help package your application to avoid unnecessary delays.

Navigating the Visa and Immigration Process

With your licence sorted, the next move is to get your company registered with the immigration and labour authorities. The first step is applying for an Establishment Card from the General Directorate of Residency and Foreigners Affairs (GDRFA).

This card is the master key to your company's visa sponsorship capabilities. Without it, you can’t hire a single employee or even process your own investor visa. Once the Establishment Card is issued, you can finally start the residency visa process—for yourself as an investor, for your partners, and for your team. It’s a multi-stage affair involving an entry permit, a medical fitness test, and an Emirates ID application before the visa is finally stamped into your passport.

Think of the Establishment Card as your company's own passport. It’s the official document that lets your business interact with the UAE's immigration system, making it an absolute priority right after you get your licence.

Understanding Tax Registration and Compliance

The UAE's tax environment is a major draw, but "low tax" doesn't mean "no admin." Staying compliant is non-negotiable. Your new LLC needs to be registered for both Value Added Tax (VAT) and Corporate Tax.

For VAT, you are legally required to register with the Federal Tax Authority (FTA) if your annual turnover is expected to hit the AED 375,000 threshold. If your turnover is above AED 187,500, you can also choose to register voluntarily, which can be beneficial for some business models.

When it comes to Corporate Tax, things are simpler: every licensed business must register, no matter its income. The great news is the rate. Your first AED 375,000 in profit is taxed at 0%. Anything above that is taxed at a very competitive 9%. The key is to register on time to avoid any penalties down the line.

The Importance of Ongoing PRO Support

Your relationship with government departments doesn't stop once the company is formed. Trade licences need annual renewal, employee visas expire, and rules can change. This is where ongoing Public Relations Officer (PRO) support is worth its weight in gold. A crucial step after licensing involves establishing your physical presence, and understanding available corporate real estate services in Dubai is a key part of that operational puzzle.

A good PRO service takes all of this recurring admin off your plate. From licence and visa renewals to handling official amendments if you add a partner or change your business activities, they keep your company compliant. This frees you from the risk of fines or disruptions, letting you focus on what you do best: growing your business. That’s precisely why our 24/7 support service exists—to manage the complexities for you, whenever you need it.

Why You Should Work with a Business Setup Specialist

Trying to form an LLC in Dubai on your own can feel a bit like navigating a maze blindfolded. You know where you want to end up, but every turn presents a new challenge—from choosing the right business activities to finalising your Memorandum of Association. While you can technically do it all yourself, the process is notoriously complex and full of bureaucratic hurdles that can trip up even the most prepared entrepreneur.

This is where bringing in a business setup specialist makes all the difference. Think of them less as someone just handling paperwork and more as a guide who knows every shortcut, potential pitfall, and unwritten rule of the UAE’s business environment. Instead of losing weeks trying to decipher the requirements of various government departments, you get a dedicated team to manage all the back-and-forth for you.

Ultimately, this saves you a massive amount of time. More importantly, it helps you sidestep costly mistakes that could delay your launch or cause compliance headaches down the road.

Experts in Mainland and Free Zone Setups

One of the biggest perks of working with seasoned pros is their in-depth knowledge of different jurisdictions. They can give you an honest, unbiased assessment of whether your business is a better fit for a mainland company in Dubai or if you’d be better served by a specialised free zone. They'll look at your actual goals—are you targeting the local market or focusing on international trade?—and point you to the structure that truly fits.

This kind of guidance ensures you don’t just get any licence; you get the right one. A good specialist will help you:

- Fine-Tune Your Activity List: They’ll make sure you have the perfect mix of activities to cover what you do now and what you plan to do in the future.

- Clarify Ownership Rules: They can confirm if your business qualifies for 100% foreign ownership and handle all the legal structuring to make it happen.

- Handle Government Approvals: They know exactly how to get the necessary permissions from entities like the DET and the Ministry of Labour without unnecessary delays.

The real value isn’t just about getting it done faster. It’s the confidence you get from knowing every step you take is compliant, strategic, and sets you up for long-term success here in the UAE.

Cost-Effective Packages and Ongoing Support

There’s a common myth that hiring a specialist is just an added expense. The truth is, it's an investment that often saves you money. Reputable corporate service providers offer all-inclusive packages that can be more affordable than paying for government fees, legal translations, and document attestations one by one. By preventing mistakes and avoiding hidden charges, you can actually lower your total setup costs.

And let's be realistic, the journey doesn't stop once you have your trade licence in hand. You still have to tackle visa processing, opening a corporate bank account, and handling annual renewals. This is why having ongoing support is so important.

Knowing you have a team on call with 24/7 support service gives you a reliable partner to turn to for anything that comes up. Whether it's a quick question about a visa amendment or a new compliance rule you need to understand, you've got experts ready to help. It frees you up to focus on what actually matters: building your business and making money, while someone else manages the administrative headaches. This partnership allows you to take full advantage of the UAE's incredible business environment without getting bogged down by red tape.

Got Questions About Setting Up Your Dubai LLC?

Setting up a business in Dubai is an exciting prospect, but it's natural to have questions bubble up along the way. Even the most straightforward process has its nuances. Getting clear, practical answers is key to moving forward with confidence.

Let's dive into some of the most common questions we hear from entrepreneurs just like you. These are based on our day-to-day experience helping businesses get off the ground in Dubai, Abu Dhabi, and Sharjah.

Can I Really Own 100% of My Mainland LLC as a Foreigner?

Yes, you absolutely can. For most business activities, foreigners can now have 100% ownership of a mainland LLC in Dubai. This was a game-changing reform to the UAE's Commercial Companies Law, doing away with the old rule that required a 51% Emirati shareholder for the majority of businesses.

But—and this is a big "but"—it's not a universal green light for every single industry. A handful of strategic sectors still have specific ownership rules. The only way to be certain is to check the regulations for your specific business activity with the Department of Economy and Tourism (DET). Better yet, let a setup specialist confirm it for you to ensure there are no surprises down the road.

Do I Actually Need a Physical Office for a Mainland Company?

For a mainland LLC in Dubai, a physical office address isn't just a nice-to-have; it's a must. You cannot get your licence without it. The kind of space you'll need really depends on what your business does and how many employee visas you're planning for.

If you're running a small professional service with just a couple of people, a 'flexi-desk' in a shared business centre might do the trick. On the other hand, if you're in trading or any commercial activity, you'll almost certainly need a proper, dedicated office or even a warehouse. No matter what you choose, your tenancy contract has to be registered with the Ejari system. We can help you find a smart, cost-effective space that ticks all the legal boxes.

How Long Does It Realistically Take to Set Up an LLC?

Thanks to a major push from the government to digitise everything, the whole process is much faster than it used to be. The first couple of steps, like reserving your trade name and getting the initial approval certificate, can often be sorted out in just one business day.

From start to finish—meaning from the day you submit your application to the moment you have the final trade licence in your hands—you're typically looking at about one to two weeks. This timeline assumes all your paperwork is in perfect order from the get-go. Delays can happen, of course, usually because of external approvals needed for certain activities or a snag in finalising your office lease. This is where having an experienced hand guiding you can really save you time and headaches.

What's the Real Difference Between a Mainland and a Free Zone Company?

It all boils down to where you can do business and who you can do it with. Think of it this way: a mainland LLC, registered with the Department of Economy and Tourism (DET), has the freedom of the entire UAE market. You can trade directly with any customer or business, anywhere in the country, and even bid on lucrative government contracts.

A free zone company is a different beast. It’s registered in a specific geographical area (like DMCC or JAFZA) and is built for doing business inside that zone or internationally. While both setups now offer 100% foreign ownership, only a mainland LLC gives you unrestricted access to the local UAE economy. If you're opening a retail shop, a restaurant, or any business serving the local market directly, mainland is the only way to go.

Navigating these questions is simpler with an expert partner. 365 DAY PRO Corporate Service Provider LLC specialises in cost-effective business setup solutions tailored to your needs. With 24/7 support and deep expertise in mainland company formation, we ensure a smooth and compliant launch. Contact us today for a free consultation.