Starting a business in Dubai might seem like a maze of regulations, but one structure stands out for making the journey both secure and straightforward: the Limited Liability Company (LLC). It cleverly builds a legal wall between you and your business, which means your personal assets—your home, your car, your savings—are shielded from any business debts. This single, powerful feature is why it's the go-to choice for countless entrepreneurs setting up shop in the UAE.

What Exactly Is a Limited Liability Company in Dubai?

Picture a limited liability company in Dubai as a financial bodyguard for your personal life. It formally establishes your business as its own legal person, totally separate from its owners (who are called shareholders). This separation is the heart of what "limited liability" really means.

So, if the business runs into financial trouble or faces a lawsuit, any claims are made against the company's assets, not yours. It’s a powerful blend of flexibility and security, perfect for everything from a small startup to a major multinational branch. You get the operational agility of a partnership but with the kind of asset protection you’d normally associate with a much larger corporation.

Core Components of a Dubai LLC

Getting to grips with the basic building blocks of an LLC makes it obvious why it’s such a popular setup. The structure is designed to help you grow without putting your personal finances on the line, which is a huge deal for international entrepreneurs.

Here are the key things to know:

- Separate Legal Identity: Your business can legally own property, sign contracts, and even go to court (or be taken to court) under its own name.

- Shareholder Liability: As a shareholder, the most you can ever lose is the amount you’ve invested into the company. Your personal wealth stays off-limits.

- Ownership Flexibility: Thanks to recent legal changes, most business activities on the Dubai Mainland now allow for 100% foreign ownership—a massive draw for global investors.

- Operational Scope: You've got options. Set up on the Mainland to trade directly within the entire UAE market, or choose one of Dubai's 40+ Free Zones to focus on international trade and enjoy specific benefits.

The appeal of the LLC has shot up recently, largely thanks to forward-thinking government policies. The UAE is seeing a huge spike in new business registrations, with LLCs leading the charge after major updates to the Commercial Companies Law. This isn't just boosting the economy; it’s creating a tidal wave of new jobs. You can discover more about the UAE's booming business landscape and see how LLCs are at the centre of this growth.

A Dubai LLC is more than just a legal structure; it’s a strategic tool. It gives you the confidence to operate and innovate, knowing your personal wealth is safely fenced off from business risks. That peace of mind lets you focus on what truly matters: growing your business in one of the world's most exciting economies.

The Strategic Advantages of a Dubai LLC

Opting for a limited liability company in Dubai is more than just getting a business licence. It’s about arming your venture with a powerful toolkit for real, sustainable growth. The entire structure is designed to meet the practical needs of everyone from local startups to global investors, giving you a solid launchpad to operate and scale.

The most talked-about benefit, and for good reason, is asset protection. We mentioned it before, but it's worth repeating: keeping your personal finances separate from your business debts is a game-changer. It provides the peace of mind you need to take calculated risks, innovate, and chase growth without putting your personal wealth on the line.

Gaining Credibility and Market Access

From day one, a registered LLC tells the world you’re serious. It projects an image of stability and professionalism that banks, suppliers, and customers notice. This credibility makes everything easier, from opening a corporate bank account to securing business loans or getting better payment terms from partners.

If you set up on the mainland, an LLC gives you a golden ticket to the entire UAE market. This is a massive competitive edge. It means you can:

- Trade Directly: Forget needing a local agent. You can sell your goods and services to any customer across all seven emirates.

- Bid on Government Contracts: This opens the door to competing for large-scale, often lucrative, public sector projects.

- Establish a Physical Presence: Want to open a shop in a prime location or an office downtown? You can. An LLC lets you set up anywhere in Dubai's commercial zones, putting you right in front of your customers.

This freedom to operate anywhere within the local economy is what gives you maximum flexibility and unlocks a far broader range of opportunities than more restrictive setups.

Financial and Immigration Perks

Let's be honest, the financial incentives are a huge draw. The UAE’s tax system is famously attractive. There is completely tax-free personal income, and the corporate tax is a competitive 9%—but only on profits over AED 375,000 a year. For many startups and small businesses, this effectively means they pay 0% corporate tax as they get off the ground.

This tax-friendly setup isn't just about saving money; it's about fuelling your growth. You get to reinvest more of your earnings back into the business to hire talent, improve your product, or expand your operations.

On top of that, forming a limited liability company in Dubai is a clear and reliable route to UAE residency. As the owner, you're eligible for an investor visa, and you can sponsor your family, too. This benefit also extends to your employees, making it much easier to attract top international talent by offering them a secure and appealing life in Dubai. Each of these advantages works together, making the LLC the go-to choice for building a lasting business in the region.

Choosing Your Path: Mainland vs. Free Zone LLCs

When you decide to set up a limited liability company in Dubai, your very first, and arguably most important, decision is where to establish it. This isn't just about a physical address; it’s a strategic choice between two very different paths: the Dubai Mainland or one of the many specialised Free Zones.

Think of it this way. A Mainland LLC is like opening a high-street shop with the freedom to sell to anyone and everyone walking past, right across the country. A Free Zone LLC, on the other hand, is like setting up a specialist workshop in a dedicated industrial park, perfectly equipped for manufacturing and shipping goods globally, but with specific rules about selling locally. Your choice fundamentally shapes who you can do business with and how you operate.

The All-Access Pass: A Dubai Mainland LLC

A Mainland LLC is your ticket to the entire UAE economy. It's the go-to structure for any business that wants to trade, offer services, or sell directly to the local market, whether that's in Dubai or any of the other emirates. This unrestricted access is its greatest strength.

Here’s what that really means for you:

- Unrestricted Trading: You can work directly with any client or company, anywhere in the UAE. There's no need to go through a local agent or distributor, which simplifies your operations and protects your margins.

- Government Contracts: Mainland companies are the only ones eligible to bid on lucrative government projects and tenders—a massive and often stable source of revenue.

- Prime Locations: You have the freedom to rent an office or retail space anywhere you like, from the bustling financial district to a high-footfall shopping mall. You can be right where your customers are.

For years, the biggest hurdle for foreign entrepreneurs was the requirement to have a local Emirati partner. But that's changed. Recent legal reforms now permit 100% foreign ownership for thousands of business activities on the mainland. This has been a complete game-changer, making a Mainland setup more appealing than ever.

The Global Gateway: A Free Zone LLC

Dubai is home to more than 40 specialised Free Zones, each a self-contained economic ecosystem with its own regulator and rules. A Free Zone limited liability company in Dubai is tailor-made for businesses focused on international trade, import/export, or providing services to a global client base.

While you're geographically based within a specific zone, the benefits are designed for worldwide reach:

- Full Repatriation of Profits: You can send 100% of your profits and capital back to your home country, no questions asked.

- Customs Duty Exemption: If you're in the trading business, this is huge. Goods brought into a Free Zone for re-export are generally exempt from customs duties.

- Streamlined Setup: Free Zones are famous for their efficiency. The authorities act as a one-stop-shop, making the process of getting licensed and operational remarkably fast and smooth.

Free Zones are powerful magnets for foreign investment, offering top-tier infrastructure and creating clusters of industry-specific talent. The proof is in the numbers. For example, the Dubai International Financial Centre (DIFC) saw incredible growth, registering over a thousand new companies in just the first half of one recent year. This boom demonstrates just how attractive these 100% foreign-owned, tax-efficient structures are to global investors. You can see the latest Dubai business statistics to get a sense of this rapid expansion.

The core difference is simple: Mainland LLCs operate within the UAE economy. Free Zone LLCs operate from the UAE to serve the rest of the world. Your business model will tell you exactly which path to take.

Mainland LLC vs Free Zone LLC: Key Differences

To make the choice clearer, it helps to see the main distinctions side-by-side. This table breaks down the most critical factors you'll need to weigh up.

| Feature | Mainland LLC | Free Zone LLC |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE local market. | Primarily for international business; trading within the UAE requires a local agent or distributor. |

| Office Location | Can lease physical office space anywhere in Dubai. | Must operate from a physical or flexi-desk office within the specific Free Zone. |

| Ownership | 100% foreign ownership is available for most business activities. | 100% foreign ownership is standard for all business activities. |

| Visa Eligibility | Typically linked to the size of the physical office space leased. | The number of visas is often determined by the office package chosen (e.g., flexi-desk vs. physical office). |

| Government Approvals | Primarily involves approvals from the Department of Economy and Tourism (DET). | Approvals are managed by the respective Free Zone authority. |

Ultimately, there's no single "best" option—only the best option for your business. By understanding these fundamental differences, you can make an informed decision that sets your company up for success from day one.

Your Step-by-Step Guide to LLC Formation

Setting up a limited liability company in Dubai can feel like a maze at first, but it's actually a well-trodden path with clear signposts. Think of it like assembling a piece of high-end furniture; if you follow the instructions step-by-step, you end up with a solid, functional result. This roadmap will break down the entire journey into clear, manageable actions.

It all starts with one simple question: What will your business actually do? This isn't just about your vision; the business activities you choose will directly dictate the kind of trade licence you need, which is the very foundation of your company.

The Initial Steps: Laying the Groundwork

Before you even start looking at office spaces or thinking about visas, there are a few essential preliminary tasks. These first moves are all about defining your company's identity and getting the green light from the authorities to move forward. Getting this part right is absolutely critical for a smooth ride later on.

This is where a good corporate service provider really earns their keep. They'll help you make sure your initial choices tick all the regulatory boxes, steering you clear of common mistakes that can cause serious delays.

Here’s what that initial phase looks like:

- Define Your Business Activities: You’ll need to pick your specific activities from an approved list, whether that’s from the Department of Economy and Tourism (DET) for mainland companies or the relevant Free Zone authority. This decision shapes everything, determining if you need a commercial, professional, or industrial licence.

- Choose and Reserve a Trade Name: Your company name has to be unique and follow UAE naming rules. That means no religious references or using names of other organisations, for example. Once you have a name, you need to officially reserve it.

- Secure Initial Approval: Think of this as a provisional 'no objection' from the authorities. It’s a key milestone that confirms they're okay with your proposed business and gives you the go-ahead to tackle the more serious legal steps.

From Paperwork to Premises

Once you have that Initial Approval in hand, things start to get real. You’ll move from the conceptual stage to the concrete, finalising your company's legal structure and sorting out its physical address in Dubai. Every single document from here on plays a vital role in bringing your limited liability company in Dubai to life.

The Memorandum of Association (MOA) is your LLC’s constitution. It lays out everything from the company's purpose and shareholding structure to the specific roles and responsibilities of each partner. It’s a legally binding document that will govern how your business operates.

Your next step is to get this critical document drafted and notarised, which means all shareholders must sign it in front of a public notary. This is the moment your partnership and its terms become legally official.

After that, you need a physical address. For a mainland LLC, this means leasing an office and registering the tenancy contract with Ejari, the government’s online registration system. This registered contract is non-negotiable; it's the mandatory proof of your physical address needed for the final licence application.

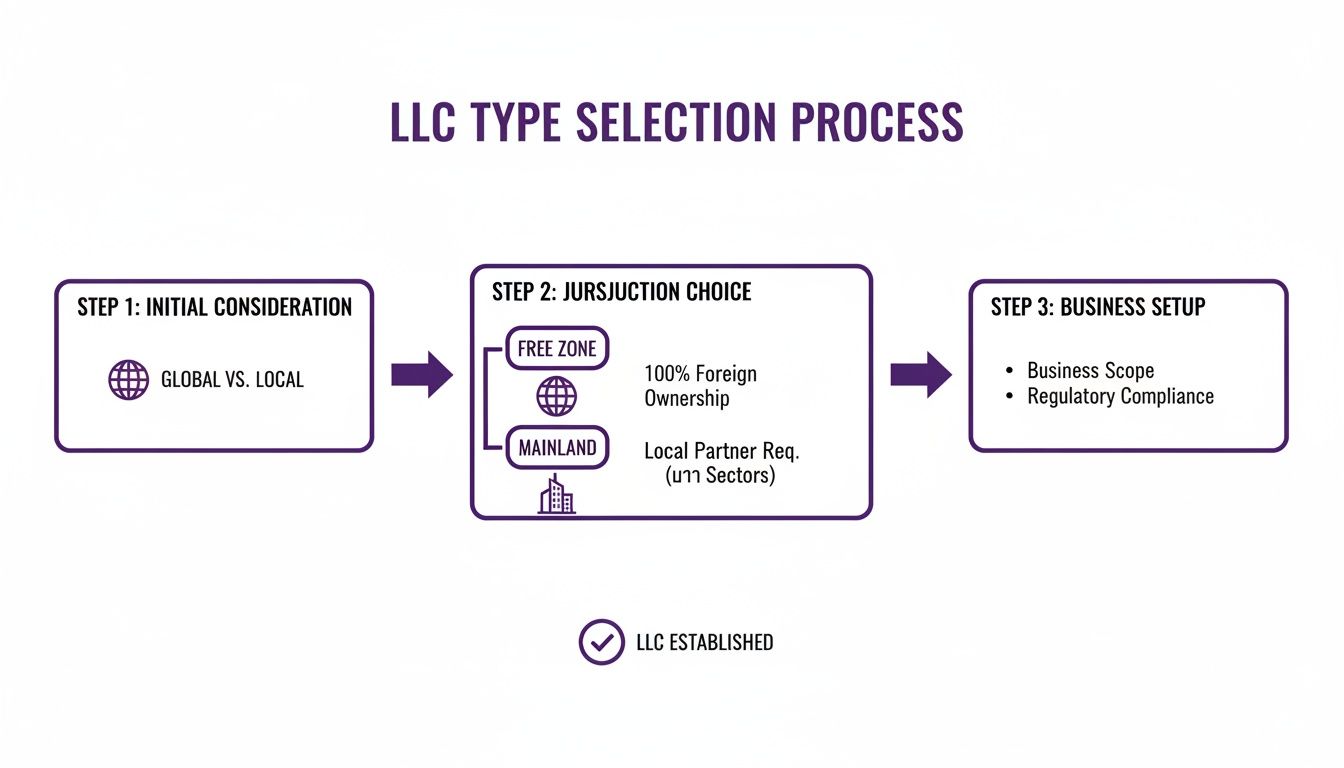

To give you a clearer picture, this flowchart maps out the key decision points you'll encounter.

As you can see, the path diverges depending on whether you opt for a Mainland or Free Zone setup, highlighting the different steps each jurisdiction requires.

Finalising Your LLC and Getting Your Licence

The home stretch involves gathering all your paperwork and submitting it for final review. This package will include your Initial Approval certificate, the notarised MOA, your Ejari-registered tenancy contract, and copies of all the shareholders' passports.

Once everything is submitted and verified, the relevant authority—either the DET for a mainland setup or the specific Free Zone authority—will issue your official trade licence. This is the document that legally permits you to start doing business in Dubai.

Working with a specialist like 365 DAY PRO Corporate Service Provider turns this entire process on its head. With our 24/7 support and deep expertise in both Mainland and Free Zone formations, we handle every last detail. It's a seamless and cost-effective way to get set up, leaving you free to focus on what really matters: your business.

What’s the Real Cost of a Dubai LLC?

Let's talk numbers. Getting a handle on the costs to set up your limited liability company in Dubai is one of the most critical first steps you'll take. A clear budget from day one isn't just about good planning; it's about avoiding nasty surprises down the road and starting your business on a secure financial footing. The total cost isn't a single figure—it's a mix of one-time setup fees and the annual costs you'll need to keep the lights on.

Think of the initial investment as the price of entry. These are the mandatory government and administrative fees required to get your company legally on the books. While the final amount will vary, having a realistic budget for these non-negotiable costs is key.

Breaking Down the One-Time Setup Fees

Your biggest upfront expenses will be the government fees tied to the registration process. There's no getting around these, and they form the core of your initial budget.

Here’s a practical look at what you’ll be paying for:

- Trade Name Registration: This fee reserves your unique business name, making sure it’s yours and yours alone.

- Initial Approval: This is the fee for the official nod from the authorities, giving you the go-ahead to proceed with the full formation.

- MOA Notarisation: Your Memorandum of Association (the legal backbone of your company) needs to be officially notarised, and that comes with a fee for the stamping and verification.

- Trade Licence Issuance: This is the big one. It’s the final fee you pay to the Department of Economy and Tourism (DET) or your chosen Free Zone authority to actually get your licence to operate.

All in, you should expect these one-time fees to land somewhere between AED 15,000 to AED 25,000+. The final figure really depends on your business activity and, crucially, whether you set up on the Mainland or in a Free Zone.

Factoring in Recurring and Visa Costs

Once you're up and running, your attention needs to shift to the ongoing costs. These annual expenses, along with visa-related costs, are just as important for your long-term financial health.

The most significant recurring cost is almost always your office lease. If you’re a mainland company, a physical office is mandatory, and your tenancy contract (Ejari) must be renewed every year. This isn't just a box-ticking exercise; the size of your office directly influences how many employee visas you can apply for. Simply put, a bigger office space usually means a bigger visa quota.

Don't forget to budget for visa processing. You'll have costs for your own investor visa, plus any residency visas for your team. This covers everything from medical tests and Emirates ID applications to the final visa stamping in their passports.

It's no secret that Dubai is booming. Just look at the latest figures from the Dubai Chamber of Commerce, which reported a huge jump in new member companies—tens of thousands joined in just the first half of a recent year. This incredible growth is a direct result of policies that make it attractive for entrepreneurs to set up a limited liability company in Dubai, giving them a foothold in the market and access to multiple visas. You can discover more about Dubai's membership growth to see just how active the business scene is.

By mapping out both the upfront setup fees and the ongoing financial commitments, you can build a solid, realistic budget that will truly support your company's growth from the very beginning.

Staying Compliant After Your Business Is Registered

Getting your trade licence in hand is a fantastic milestone, but it's really just the starting pistol for your journey with a limited liability company in Dubai. The real work of keeping your company in good legal standing is an ongoing process, and it requires your attention. Think of it less as a box-ticking exercise and more as a way to ensure your business can run smoothly without any unwelcome surprises.

The first and most critical tasks on your annual calendar are the renewals. Both your trade licence and your office lease (Ejari) have to be renewed every single year. Let this slip, and you're not just looking at fines; your company's operations could be frozen. That means no new employee visas, no invoicing clients—everything grinds to a halt.

Navigating the UAE Corporate Tax Framework

A huge piece of the compliance puzzle is getting to grips with the UAE's Corporate Tax system. While the headline rate is a very competitive 9%, the most important detail to remember is that this tax only kicks in on annual profits above AED 375,000.

What does that mean for you? Well, if you're a new startup, it's likely your profits will fall below that threshold in the early days. For those businesses, the effective corporate tax rate is 0%. This isn't an accident; it's a deliberate part of the system designed to give startups and SMEs the breathing room they need to get established and grow.

Core Compliance Responsibilities

Beyond the yearly renewals and tax, there are a few other duties you need to stay on top of to keep your LLC compliant and out of trouble. These rules are all about maintaining transparency and protecting the integrity of the UAE's business environment.

Here are the key responsibilities you'll be managing:

- Proper Accounting and Bookkeeping: Every company is legally required to keep accurate and up-to-date financial records. These books are the foundation for your tax filings and give you a clear, honest look at the financial health of your business.

- Ultimate Beneficial Owner (UBO) Regulations: You must keep a register of who ultimately owns and controls your company and share this information with the authorities. It’s a key part of the UAE's commitment to preventing money laundering and promoting corporate transparency.

- Economic Substance Regulations (ESR): This applies if your business operates in specific sectors like banking, insurance, or fund management. You'll need to prove you have a real economic presence in the UAE by filing an annual ESR report.

Juggling these tasks isn't just about avoiding penalties. It’s about building a solid, respectable foundation for your company's growth. Proactive compliance is what separates a well-run business from one that's always fighting fires.

To hit the ground running, it’s a smart move to set up clear internal processes from the very beginning. This ensures your new LLC operates efficiently and keeps compliance on track. You can find some great templates and guides in resources like these Standard Operating Procedures for MENA to help you structure your operations. Staying organised with these duties frees you up to focus on what really matters: growing your business.

Why Partnering with a Setup Specialist is a Smart Move

You can absolutely tackle the process of setting up a limited liability company in Dubai on your own. But the real question is, should you? Bringing a corporate service provider on board isn't just an added expense; think of it as a strategic investment in getting things done right, done fast, and without the headaches.

These specialists are your on-the-ground guides and project managers. They save you an incredible amount of time by dealing with the mountain of paperwork and liaising with government offices. They know the system inside and out, which helps you sidestep the common, costly mistakes that trip up so many new entrepreneurs. Their expertise turns what feels like a maze into a clear, step-by-step path.

The Efficiency Advantage

A good setup partner has established relationships with the authorities, which helps push your application along smoothly. They'll give you total clarity on what's needed for your specific business activity, from the exact document formats to the subtle requirements of different government departments. That kind of insider knowledge is a massive advantage.

They manage the entire journey, ensuring you launch without a hitch. This typically covers:

- Licence Secured: They handle every submission to the DED or the relevant Free Zone authority.

- Visas Processed: They manage the applications for you, your family, and any staff you're bringing on.

- Ongoing PRO Support: You'll have continuous help for any government-related tasks that pop up later.

- Bank Account Opening: They guide you through opening a corporate bank account, a step that can be surprisingly difficult for new companies.

While you're considering a setup partner, it's also worth looking into modern tools that can give you an edge. For instance, many entrepreneurs are now using specialized legal resources for business owners that employ AI to simplify various legal tasks, which works well alongside the hands-on expertise of a setup firm.

Keeping Your Focus Where It Belongs

Ultimately, the biggest win here is focus. When a specialist is handling the bureaucracy, you're free to do what you do best: build your business. Your time and energy can go into your strategy, finding clients, and getting your operations ready, instead of being drained by administrative hurdles.

Partnering with a setup expert lets you sidestep the complexity and get straight to business from day one. Let them handle the red tape so you can focus on growth.

With tailored, cost-effective packages and 24/7 support, you get a clear and direct route to launching. It takes a potentially overwhelming experience and turns it into a managed project, making sure you start your new venture on the strongest possible foundation.

Ready for a hassle-free start in Dubai? At 365 DAY PRO Corporate Service Provider LLC, our specialists are here to help you navigate every step of your company formation.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com