Navigating the UAE's banking system for the first time can feel a bit daunting, but it all boils down to having the right documents in order. Think of it like a checklist: for residents, your passport, visa, and Emirates ID are the golden tickets. If you're a non-resident, the bank will want to see proof of your address back home and a few bank statements to get a sense of your financial history.

From there, it's about choosing the right bank, pulling together the specific paperwork for either a personal or corporate account, and submitting it all for the bank's compliance team to review.

Your Essential First Steps to UAE Banking

Whether you're an expat starting a new life or an entrepreneur launching a Mainland Company Formation in Dubai, getting your banking sorted is a top priority. The entire financial system here is robust and well-regulated, which is great for security but means you need to get the process right from the start.

The first big decision is whether you need a personal account for your salary and day-to-day spending, or a corporate account to handle business transactions. Each has its own distinct path, with different documents and compliance hurdles to clear.

Core Requirements for Applicants

No matter which bank or account type you choose, they'll all need to verify who you are and your legal status in the country. For UAE residents, the Emirates ID is the key that unlocks almost everything, making the application process much simpler.

Non-residents have a higher bar to clear. You'll need to provide more extensive documentation to prove your identity, address, and financial credibility. It's not just about submitting papers; it's about building a trustworthy profile. Banks are extremely thorough in their due diligence—it's how they combat financial crime—so having all your ducks in a row is essential.

The UAE banking sector is thriving, with total deposits hitting an impressive AED 2.965 trillion. A significant chunk of this growth comes from an 11% rise in non-resident deposits, underscoring the UAE's position as a global financial hub. This means you’re tapping into a very liquid and active financial ecosystem.

Working with a specialist in Freezone Company Formation across the UAE can be a game-changer. An experienced consultant knows exactly what each bank is looking for and can help you frame your application to avoid the common mistakes that cause delays or even outright rejection.

While we're focused on the UAE here, it's often helpful for global entrepreneurs to understand how processes differ elsewhere. For instance, you might find this guide to opening a US bank account for non-residents offers a useful comparison.

UAE Bank Account Requirements at a Glance

To give you a clearer picture, here's a quick breakdown of what you'll typically need. Think of this as your cheat sheet before you start gathering documents.

| Applicant Type | Key Document | Proof of Address | Minimum Balance (Typical) | Expert Tip |

|---|---|---|---|---|

| Personal (Resident) | Emirates ID | Utility Bill or Tenancy Contract | AED 3,000 – 5,000 | A salary certificate from your employer can significantly speed up the approval process. |

| Personal (Non-Resident) | Passport & Entry Stamp | Utility Bill from Home Country | Varies (often higher) | Provide a 6-month bank statement from your home country to demonstrate a solid financial history. |

| Corporate (Mainland) | Trade Licence | Office Tenancy Contract (Ejari) | AED 25,000 – 150,000+ | Ensure the UBO (Ultimate Beneficial Owner) structure is crystal clear in your company documents. |

| Corporate (Free Zone) | Trade Licence & AoA/MoA | Office Lease or Flexi-Desk Agreement | AED 20,000 – 100,000+ | Some banks have preferred free zones; applying to a bank familiar with your zone can help. |

Keep in mind that these are general guidelines. Every bank has its own specific risk appetite and internal policies, so requirements can and do vary.

Getting Your Paperwork in Order for Personal and Corporate Accounts

Let's be blunt: a successful bank application in the UAE comes down to your paperwork. Banks here are incredibly thorough, and one missing document or a tiny inconsistency can stop your application dead in its tracks. To get beyond the generic advice you see everywhere, we'll build a real-world checklist for both personal and corporate accounts, covering the exact scenarios you're likely to encounter.

Think of preparing your documents as telling a story. You're not just ticking boxes; you're presenting a clear, compliant, and trustworthy profile to the bank. A well-organised application package is your first impression, and it tells the bank you're a serious applicant. Getting this right from the start can make the compliance review so much smoother.

Assembling Your Documents for a Personal Bank Account

The documents you'll need for a personal account vary wildly depending on one thing: your residency status. While the bank's goal is always the same—to verify your identity and financial stability—how you prove it is completely different.

If you're a UAE Resident, the process is fairly straightforward. Your Emirates ID is the key that unlocks everything, as it confirms your legal status and makes you a known quantity in the local system.

- Valid Passport & UAE Residence Visa: This is your primary photo ID. It's non-negotiable.

- Emirates ID Card: You'll need the original card for the bank to scan. If it's still being processed, some banks might temporarily accept the official registration form, but don't count on it.

- Salary Certificate: A simple letter from your employer on company letterhead, confirming your salary and job title. This is how the bank verifies your income.

- Proof of Address: Usually a recent DEWA or SEWA bill, or your tenancy contract (Ejari) with your name on it.

If you're a Non-Resident, the bank needs a lot more convincing. Since you don't have a local file, they'll lean heavily on documents from your home country to build a picture of who you are financially.

- Valid Passport with UAE Entry Stamp: This proves you're in the country legally.

- Bank Statements from Home: Be prepared to provide the last three to six months of statements. They're looking for a healthy, consistent financial history.

- Bank Reference Letter: A formal letter from your bank back home stating you're a customer in good standing.

- Your CV: This always surprises people, but yes, many banks ask for a Curriculum Vitae. It helps them understand your professional background and where your money comes from.

- Proof of Address from Home: A recent utility bill or bank statement showing your residential address abroad is a must.

Here’s the key takeaway for non-residents: the bank's focus is on seeing an established, clean financial history. They want stability and transparency. Providing comprehensive, well-organised documents from your home country is absolutely critical.

Crafting Your Checklist for a Corporate Bank Account

Opening a business account adds a whole new level of complexity. Now, the bank isn't just vetting you; it's vetting your entire company. The specific documents you need will depend on your company structure: Mainland, Free Zone, or Offshore.

A Mainland company, for instance, is registered with the Department of Economic Development (DED) and often has a physical office, which banks tend to view more favourably. A common snag is that banks often require specific pages from your documents. If your proof of address is buried in a 50-page PDF, you'll need to prepare it properly using tools to separate PDF pages before you submit.

Here’s a breakdown of what you'll almost always need, regardless of structure:

- Trade Licence: This is the big one. It's the legal proof that your company is registered to operate in the UAE.

- Memorandum of Association (MoA) / Articles of Association (AoA): These legal documents spell out your company's rules, shareholder structure, and what it's allowed to do.

- Passports for Shareholders & Managers: You'll need clear copies of passports, residence visas, and Emirates IDs (if they have them) for every partner and authorised signatory.

- Board Resolution: This is a formal document that gives a specific person the power to open and manage the bank account on the company's behalf.

- Proof of Business Address: For Mainland and Free Zone companies, this is typically your office tenancy contract or Ejari.

- Company Profile: Don't underestimate this. A short, clear document explaining your business model, target customers, and financial projections can make a huge difference.

For residents, the process is streamlined with key documents like an Emirates ID and a utility bill. Minimum deposits can range from AED 0 for digital banks up to AED 3,000-5,000 for traditional banks. It's clear there's huge demand for accessible banking; Emirates NBD, for example, saw its low-cost current and savings accounts grow by a record AED 48 billion.

Ultimately, whether it's for you or your business, your documentation tells a story. At 365 DAY PRO, our specialists in Mainland and Freezone Company Formation live and breathe this stuff. We make sure that story is compelling and complete, pre-vetting every single document to ensure it sails through the bank's tough compliance checks.

Navigating the Bank Application Process

Alright, you've got all your documents in order. Now comes the part where the rubber meets the road: actually applying for the account. This is where you shift from gathering paperwork to actively engaging with the banks. It's a critical stage, and knowing what to expect can make all the difference.

The experience of applying can vary wildly from bank to bank. Walking into a traditional institution like Emirates NBD means a face-to-face meeting with a relationship manager. On the other hand, applying with a newer digital bank like Wio is done entirely through an app. There's no right or wrong choice here; it really just depends on your personal preference and how complex your needs are.

Choosing Your Application Route: In-Person vs. Online

So, should you book a meeting or just fill out a form online? It often comes down to how comfortable you are with digital processes and the nature of your application.

I often advise clients with unique business models or those who simply value a personal connection to go for an in-person meeting. It’s your chance to sit across from a real person, explain the nuances of your business, and get direct answers to your questions. It helps build a relationship from day one.

Online applications, of course, are all about speed and convenience. If you’re opening a straightforward personal account or have a very simple business structure, the digital route can be significantly faster. The only catch? If the compliance team flags something in your application, the process can hit a wall. Without a direct contact person, getting simple clarifications can sometimes turn into a frustrating back-and-forth over email.

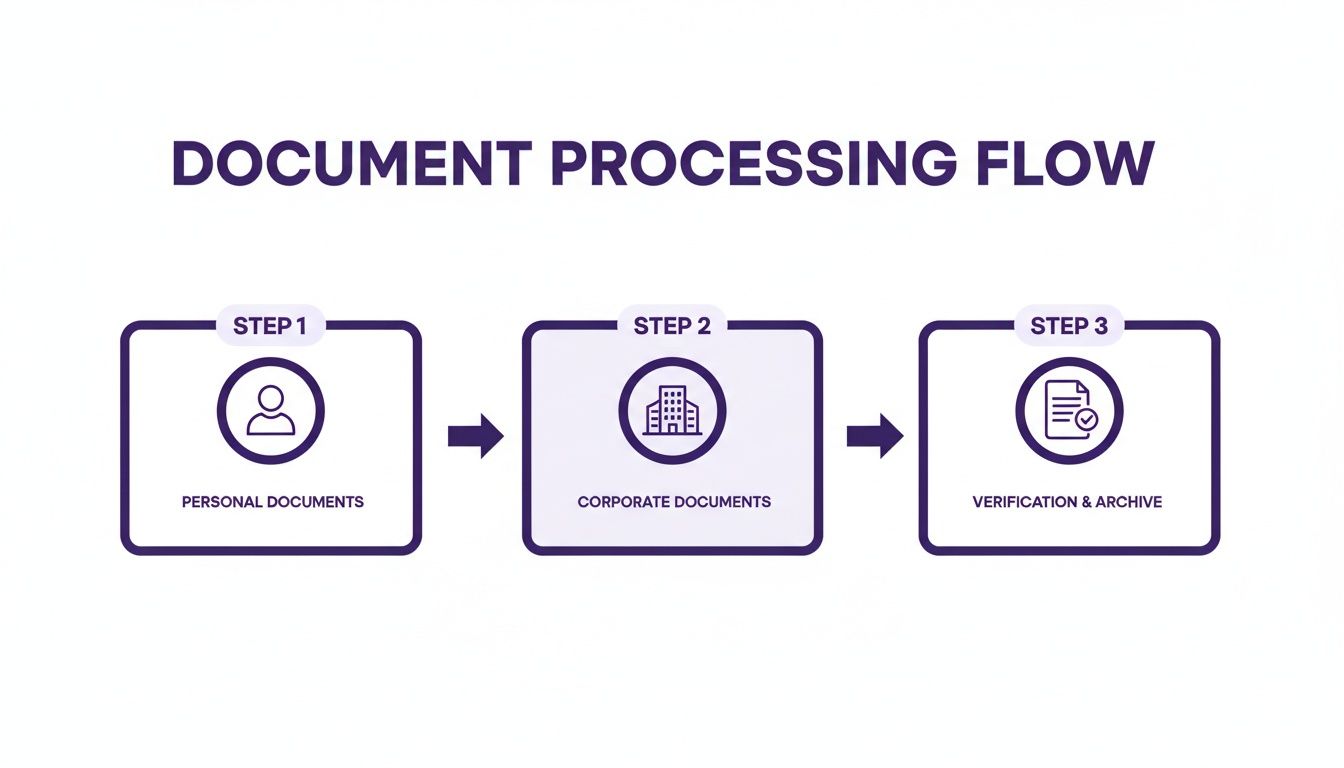

This diagram gives a good overview of the general document workflow, highlighting the different tracks for personal and corporate accounts.

As you can see, both paths start with basic identity checks. But for a corporate account, the bank will dig much deeper into your company's legal standing and financial health.

Preparing for Your Meeting with the Bank

If you do decide on a face-to-face meeting, especially for a corporate account, treat it like an important business interview. The relationship manager’s job is to understand your business and assess whether it aligns with the bank's risk appetite. You absolutely have to be prepared.

Here’s what I’ve seen work best for presenting a convincing business profile:

- Nail Your Business Pitch: Be ready to explain what your company does, who you sell to, and your expected transaction volumes. Keep it simple and clear.

- Know Your Numbers: Have a solid estimate of your monthly turnover and be prepared to name some key suppliers or major clients. It shows you’ve done your homework and have a viable business plan.

- Come with Questions: This isn't a one-way street. Ask about account fees, the features of their online banking platform, and who your direct point of contact will be. It shows you're a serious, engaged professional.

Your main goal is to build confidence. A relationship manager who believes in your business is far more likely to champion your application internally. A professional, well-organised presentation is truly half the battle won.

At 365 DAY PRO, we don’t just assist with Mainland Company Formation in Dubai; we get you ready for these critical meetings. Our team helps you frame your business profile perfectly, often anticipating the bank’s questions before they’re even asked. With our 24/7 Support Service, you’re never navigating this process alone.

Understanding the Application Timeline

Let's talk about timelines, because setting realistic expectations here is key. A simple personal account for a resident might be up and running in a couple of business days. Corporate accounts? That's a different beast altogether.

Once you submit everything, your application goes through an initial check to make sure all the required documents are there. After that, it’s sent to the compliance department for a deep-dive due diligence review. This is where things can slow down.

The compliance review can take anywhere from one to four weeks, and frankly, sometimes longer for businesses with complex ownership structures or those in what are considered high-risk industries. Banks are legally required to perform strict Know Your Customer (KYC) and Anti-Money Laundering (AML) checks, and there are no shortcuts.

During this waiting period, don't be surprised if the bank comes back with a few more questions or asks for extra documents. The best thing you can do is respond quickly and clearly to keep the process moving.

Understanding Bank Fees and Minimum Balance Requirements

Let's talk about something no one enjoys: unexpected bank fees. When you’re opening an account here in the UAE, getting a clear picture of the costs involved is absolutely critical. It’s not just about the one-time setup; it’s the ongoing fees that can really make a difference to your bottom line.

Many people, especially those new to the region, get caught off guard by the various charges. These fees aren't exactly hidden, but they're often buried in the terms and conditions. I want to walk you through the most common costs and explain that all-important minimum balance rule so you can plan your finances properly from the start.

The Minimum Balance Rule, Explained

The "minimum balance" is a classic point of confusion. It's not a fee in itself, but rather a requirement to keep a certain amount of money in your account each month. If you don't, you get hit with a penalty. Think of it as the bank’s way of ensuring your account is worth their while to service.

Dip below that magic number, even for a day, and you could trigger a "fall-below fee." These penalties typically run anywhere from AED 25 to AED 150 per month. The required balance itself changes dramatically based on the type of account you have.

- Personal Accounts: You're usually looking at a minimum monthly average balance of around AED 3,000 to AED 5,000.

- Corporate Accounts: This is where the numbers jump significantly. Expect a starting threshold of AED 25,000, with many standard business accounts requiring AED 50,000 or more.

- Premium or Wealth Accounts: For these, the minimums can easily climb into the hundreds of thousands of dirhams.

It's also worth knowing how the bank calculates this. Some look at your average balance across the entire month, while others might penalise you if your balance drops below the threshold on any single day. This is a crucial detail to confirm with your banker.

Common Fees to Watch Out For

Beyond the minimum balance penalty, a few other charges can quietly eat into your funds if you aren't paying attention. Knowing what they are ahead of time helps you manage your account much more effectively.

Just to give you a sense of the scale, in early 2025, UAE banks cleared a staggering 9.6 million cheques worth AED 603.161 billion. This massive volume shows how vital these banking services are, and understanding the associated costs is key. You can discover more insights about the UAE's banking transaction volume and its economic impact.

Here’s a quick rundown of what to expect:

- Account Opening Fees: Some corporate accounts, especially for more complex company structures, might come with a one-time setup fee.

- Monthly Maintenance Fees: Even if you meet the minimum balance, some accounts have a small monthly admin charge.

- International Transfer Fees: Sending money overseas isn't free. Expect to pay between AED 50 and AED 125 per transaction, and that's before the receiving bank takes its cut.

- Chequebook Costs: Your first book is almost always on the house, but you’ll have to pay for any subsequent ones.

- ATM Withdrawal Fees: Using another bank's ATM is a sure-fire way to incur a small fee with every withdrawal.

The key to avoiding surprise costs is transparency. A good corporate service provider will not only help you open an account but also clarify the complete fee schedule, ensuring the bank you choose aligns with your business's transaction patterns.

How to Keep Your Banking Costs in Check

The good news is that these fees aren't set in stone. With a bit of planning, you can actively manage and minimise them, whether for your personal account or your company's cash flow.

This is where working with specialists can give you a real edge. For instance, at 365 DAY PRO, our expertise in Mainland Company Formation in Dubai & Abu Dhabi extends directly to your banking. Our long-standing relationships with UAE banks mean we can steer you toward accounts with the best terms and sometimes even help secure more favourable conditions based on your business profile.

We pride ourselves on offering cost-effective business setup solutions and being there for you with our 24/7 Support Service. If you’re ready for a straightforward banking experience, WhatsApp Us Today for a Free Consultation.

Why Bank Applications Get Rejected and How to Avoid It

Getting a bank application rejected is more than just a minor setback; it can bring your business to a grinding halt. From my experience, understanding why banks say "no" is the single best way to make sure you get a "yes." It's almost never one big, dramatic reason but a series of small, easily avoidable missteps.

We see it all the time—from tiny inconsistencies in paperwork to a business model that unintentionally sets off alarm bells in the compliance department. The trick is to anticipate these potential pitfalls and address them before you even submit the application.

Inconsistent and Incomplete Documentation

Let's be blunt: this is the number one application killer. UAE banks operate under a microscope of regulatory scrutiny, and their compliance teams have absolutely zero tolerance for mismatched information. Even one small discrepancy can stop your entire application in its tracks.

Think about it from the bank's perspective. If your trade licence lists one business activity, but your company profile describes something completely different, it’s a massive red flag. It signals a potential risk, and they will simply move on to the next applicant.

Common errors we catch before they become problems include:

- Mismatched Names: A shareholder's name is spelled slightly differently on their passport compared to the Memorandum of Association.

- Conflicting Addresses: The utility bill you provide as proof of address shows a different location from what's on the application form.

- Outdated Information: Submitting an expired trade licence or a utility bill that's older than three months.

These might feel like trivial mistakes, but to a compliance officer, they suggest a lack of diligence. Every single document you submit must tell the exact same, consistent story.

Failing to Meet the Bank's Risk Profile

Every bank has its own internal "risk appetite"—a specific set of criteria that outlines the kinds of businesses they’re comfortable onboarding. If your company's profile falls outside these unwritten rules, your application is likely dead on arrival, no matter how flawless your paperwork is.

For instance, a brand-new company with no physical office space can be a deal-breaker for many traditional banks. They want to see a tangible presence in the UAE, as it demonstrates a serious commitment to operating here. Your "flexi-desk" might be perfect for getting your licence, but it can make securing a corporate account much tougher.

A huge part of getting approved is simply choosing the right bank in the first place. This is where having an expert on your side makes all the difference. We can steer you towards a bank whose risk profile actually aligns with your business, saving you the time and frustration of an inevitable rejection.

Working with a specialist in Mainland or Freezone Company Formation is a genuine game-changer. At 365 DAY PRO, we don't just help you fill out forms. We pre-vet your entire business profile, ensuring it's presented in a way that meets the bank's strict compliance standards and massively boosts your chance of a first-time approval.

Unclear Source of Funds and Business Model

Banks are legally required to understand exactly where your money is coming from and how your business makes it. If your business plan is vague or poorly explained, you're creating another major hurdle for yourself. You have to be able to clearly and concisely articulate what your company does.

This scrutiny is dialed up even higher for international businesses. Banks must follow 100% FATCA/CRS reporting standards for non-residents, so any lack of transparency about tax residency or the origin of your funds is a primary reason for rejection. You can learn more about UAE banking regulations and fund transfers here to understand the complexity.

Get ready to provide solid answers to questions like:

- Who are your primary suppliers and biggest clients?

- What is your projected monthly turnover?

- Which countries will you be sending or receiving money from?

Giving clear, verifiable information builds the bank's confidence. With our cost-effective business setup solutions, we help you craft a compelling company profile that answers these tough questions before they’re even asked. If you're ready to do this right the first time, 💬 WhatsApp Us Today for a Free Consultation.

Your Top Questions About UAE Banking Answered

Even with all the steps laid out, you're bound to have some nagging questions. It’s the little details that often trip people up. Here, I'll tackle the most common queries we get from entrepreneurs setting up shop in the UAE, drawing from years of experience helping clients navigate this exact process.

Can I Really Open a UAE Bank Account from My Home Country?

This is a big one. While a few digital banks are changing the game, opening a traditional corporate account in the UAE without ever setting foot in the country is still pretty much a no-go. The reason is simple: the UAE Central Bank has very strict Know Your Customer (KYC) rules to prevent money laundering, and that almost always means an in-person signature and verification at the final stage.

Most major banks will require the account signatory—that’s you—to be physically present to sign the last few forms. But that doesn't mean you have to wait until you land to get started. Far from it.

A good corporate service provider can be your feet on the ground. We handle all the preliminary paperwork, submit the initial application, and work with the bank to get pre-approval. This transforms your trip to the UAE from a stressful, week-long administrative marathon into a quick, focused visit just to sign the final documents.

This hybrid approach is a game-changer. It saves a huge amount of time and gives you peace of mind that when you do travel, the account opening is practically a done deal.

What's the Real Minimum Deposit for a Corporate Account?

Ah, the million-dirham question! The honest answer is: it depends. The number can swing quite a bit based on the bank you choose, your specific business activity, the nationality of the shareholders, and how solid your application looks. You might see some banks advertising low minimums, but it's wise to plan for the reality on the ground.

For most new businesses, a realistic figure for the initial deposit is somewhere between AED 25,000 and AED 50,000. Banks don't just see this as money in an account; they see it as proof of your commitment to the business. In fact, a healthier initial deposit can sometimes add a bit of weight to your application, especially if you're a new company or in a competitive industry.

That said, a professionally prepared business plan and a flawless application can give you some wiggle room. If your company's profile is strong, it can open up a conversation about a more flexible deposit.

How Long Does It Actually Take to Open a Corporate Account?

Setting the right timeline expectations is vital for your business planning. If every single document is perfect and your business is in a standard, low-risk category, you could be looking at two to four weeks. This covers everything from the initial submission and the relationship manager's review to the all-important compliance check.

However, be prepared for potential delays. The bank's compliance team is meticulous and might come back with questions about your business model or where your funds are coming from. If you have a more complex structure, international owners, or operate in what’s considered a higher-risk field, the process can easily stretch beyond a month.

This is where working with a professional service provider makes a huge difference. We make sure the application is buttoned-up and complete from day one, which drastically cuts down on the back-and-forth with the bank that causes most of the delays.

Can I Open an Account on a Tourist Visa?

Generally speaking, no. You can't open a standard resident current account while you're here on a tourist visa. The Emirates ID is a non-negotiable requirement for any resident account that lets you receive a salary, get a chequebook, and operate normally.

Some banks might offer a "non-resident" savings account for visitors, but they're very limited. These accounts usually demand a much higher minimum balance, don't come with a chequebook, and have restrictions on the kinds of transactions you can make. For any serious business owner, it’s just not a practical solution.

The proper, established route is to set up your company first (whether it's Mainland or Freezone), get your residency visa and Emirates ID sorted, and then move on to opening your corporate and personal bank accounts.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation to start your journey with the confidence that every detail is being handled by experts. Learn more at https://365dayproservices.com.