Thinking about freelancing in Dubai? You'll need a freelancer license. This is the official permit that lets you legally live and work in the UAE as your own boss. It’s your golden ticket to managing your own projects and clients in one of the world's most exciting business cities.

Launching Your Dubai Freelance Career

Jumping into the freelance scene in Dubai is a smart move. The market is buzzing with opportunities, but it's not a free-for-all. You have to navigate a few legal hoops, and the first thing you need to get your head around is the freelancer license Dubai. It’s much more than just a piece of paper—it’s the legal backbone of your entire operation.

Think of it this way: without a license, you can't legally send an invoice, get a residency visa, or open a business bank account. For most expats, securing that UAE residence visa is a top priority, and a freelance permit is one of the most direct ways to make that happen.

Why a Freelance License is Non-Negotiable

Trying to work without a license is a recipe for disaster. You're looking at hefty fines and serious legal trouble. But beyond that, major corporate clients in Dubai won't even consider working with you unless you have the proper paperwork. Having a license shows you're a serious professional, not just a hobbyist.

The perks go well beyond just staying on the right side of the law. A Dubai freelance license opens up a whole host of benefits, especially for international professionals:

- Tax Benefits: The big one. The UAE has no personal income tax, letting international entrepreneurs enjoy significant tax benefits.

- Residency and Sponsorship: Your license is your ticket to applying for a residency visa for yourself. You can also sponsor your family members to join you.

- Business Credibility: It gives you the legitimacy you need to pitch and win work with big-name companies and even government departments.

Your Two Primary Pathways

So, how do you get one? You have two main routes: setting up on the Mainland or in a Free Zone. Each has its own set of pros and cons, and the right choice really depends on your business goals. A Mainland license gives you the freedom to work with any client across the UAE, while Free Zones offer perks like 100% foreign ownership and communities built for specific industries.

Choosing between a Mainland and a Free Zone setup is one of the most important decisions you'll make. It directly impacts who you can work for, your operational scope, and your overall business strategy. As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we've helped hundreds of freelancers make this call, providing practical advice that aligns your license with your career ambitions.

Once you have your license sorted, the next challenge is finding clients. Getting a handle on choosing the right freelancing platform can be a massive help in landing those first few crucial projects.

At 365 DAY PRO, we guide you through this entire maze. Our 24/7 support service and cost-effective business setup solutions are tailored to your needs, helping you sidestep common mistakes and get up and running in Dubai’s vibrant gig economy as quickly as possible.

Choosing Your Path: Mainland vs. Free Zone Licenses

The first big decision you'll make on your freelance journey in Dubai is a classic fork in the road: should you go for a Mainland license or a Free Zone permit? There's no single right answer here, just the one that fits your specific business goals. This choice really sets the stage for who you can work with, where you can operate, and the whole structure of your freelance business.

To make the right call, you need to look past the initial setup fees and think about your long-term vision. For instance, if you're a social media manager looking to sign up local cafes and retail shops across Dubai, the wide-open market access of a Mainland license is a massive advantage. On the other hand, a tech consultant whose clients are mostly international might find the focused community and 100% foreign ownership of a Free Zone a much better fit.

The Freedom of a Mainland License

A Mainland license, typically issued by the Department of Economy and Tourism (DET), gives you the ultimate freedom to operate anywhere in the UAE. It’s your legal green light to do business with any client, anywhere in the country—whether it's a government department, a private company, or an individual customer, with no strings attached.

This is the path to take if your target market is squarely within Dubai and the other Emirates. Let's say you're a freelance graphic designer who wants to land contracts with ad agencies in Dubai Media City or event companies in Abu Dhabi. A Mainland license tears down all those jurisdictional walls, letting you invoice and work with them directly.

One of the easiest ways to get started is with the DED e-Trader licence, a smart, budget-friendly option built for people working online. Imagine launching your freelance career in Dubai without the eye-watering costs of a traditional business setup. That's exactly what the e-Trader licence offers, available from Dubai’s DET for just Dh1,070 as of 2024. It’s perfect for anyone offering services online or selling products through social media, letting you operate legally without needing a physical office. The freelance scene here has blown up, with registrations jumping by a staggering 142% from 2022 to 2023, showing just how keen Dubai is to bring in global talent. For more context, you can check out the latest on the UAE's freelance licence landscape and see how Abu Dhabi now offers 100 business activities for freelancers.

The Focused Advantage of a Free Zone Permit

On the flip side, Free Zones come with their own set of powerful perks. These are special economic areas, each built to support a specific industry like media, tech, or design. Think of them as dedicated business hubs. Dubai Media City, for example, is teeming with creatives, while Dubai Internet City is the go-to for tech pros.

Choosing a Free Zone drops you right into a ready-made ecosystem of potential clients, collaborators, and industry-specific resources. It's the perfect environment for a specialist. A freelance video editor would feel right at home in Dubai Media City, literally surrounded by production houses and marketing agencies.

Key Takeaway: The main trade-off with a Free Zone permit is that you're generally limited to working with clients inside that same Free Zone or outside the UAE. If you want to work with a Mainland company, you usually have to go through a local agent, which can add a layer of hassle.

Still, Free Zones offer some serious draws for international entrepreneurs:

- 100% Foreign Ownership: You keep full control of your business. No local partner needed.

- Tax Exemptions: You get to enjoy zero corporate and personal income tax, a huge financial win.

- Simplified Setup: The registration and licensing process is often much faster and more straightforward than on the Mainland.

To help you figure out which path is truly best for you, we've put together a quick comparison.

Mainland e-Trader vs Free Zone Permit: A Quick Comparison

This table breaks down the key differences to help you decide between a Mainland DET e-Trader license and a Free Zone freelance permit.

| Feature | Mainland (DET e-Trader) | Free Zone Permit |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market | Primarily for clients within the same free zone or internationally |

| Ownership | 100% foreign ownership is possible for many activities | 100% foreign ownership is standard |

| Office Space | No physical office required (for e-Trader licence) | Typically no physical office required |

| Visa Eligibility | Usually does not include a visa; separate application needed | Often includes eligibility for a residence visa |

| Business Activities | Limited to specific online/social media-based services | Wider range of professional activities, specific to the free zone's focus |

| Annual Cost | Generally lower, starting from AED 1,070 | Varies by free zone but can be higher, often starting around AED 7,500 |

Ultimately, the right choice depends on your client base and growth plans. If you're aiming for the local UAE market, the Mainland e-Trader is a fantastic, low-cost entry point. If your focus is international and you want to be part of a specialised industry hub, a Free Zone permit is likely your best bet.

As specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, our team at 365 DAY PRO can give you practical advice to help you weigh these options. We don't just fill out forms; we help you build a strategy. With our 24/7 support service – we’re always here when you need us – you'll have an expert to talk to, making sure the choice you make is the perfect one for your ambitions.

Getting Your Paperwork and Application in Order

So, you’ve made the big decision: Mainland or Free Zone. Now comes the part that trips many people up—the actual application and paperwork. Getting this right from the very beginning is the secret to a hassle-free process. It’s less about speed and more about being meticulous with every single detail.

The journey to getting your freelancer license Dubai has a few crucial steps, from gathering your personal documents to getting that final stamp of approval. Every document needs to be precise, because even one missing signature or an incorrectly verified certificate can stop your application in its tracks.

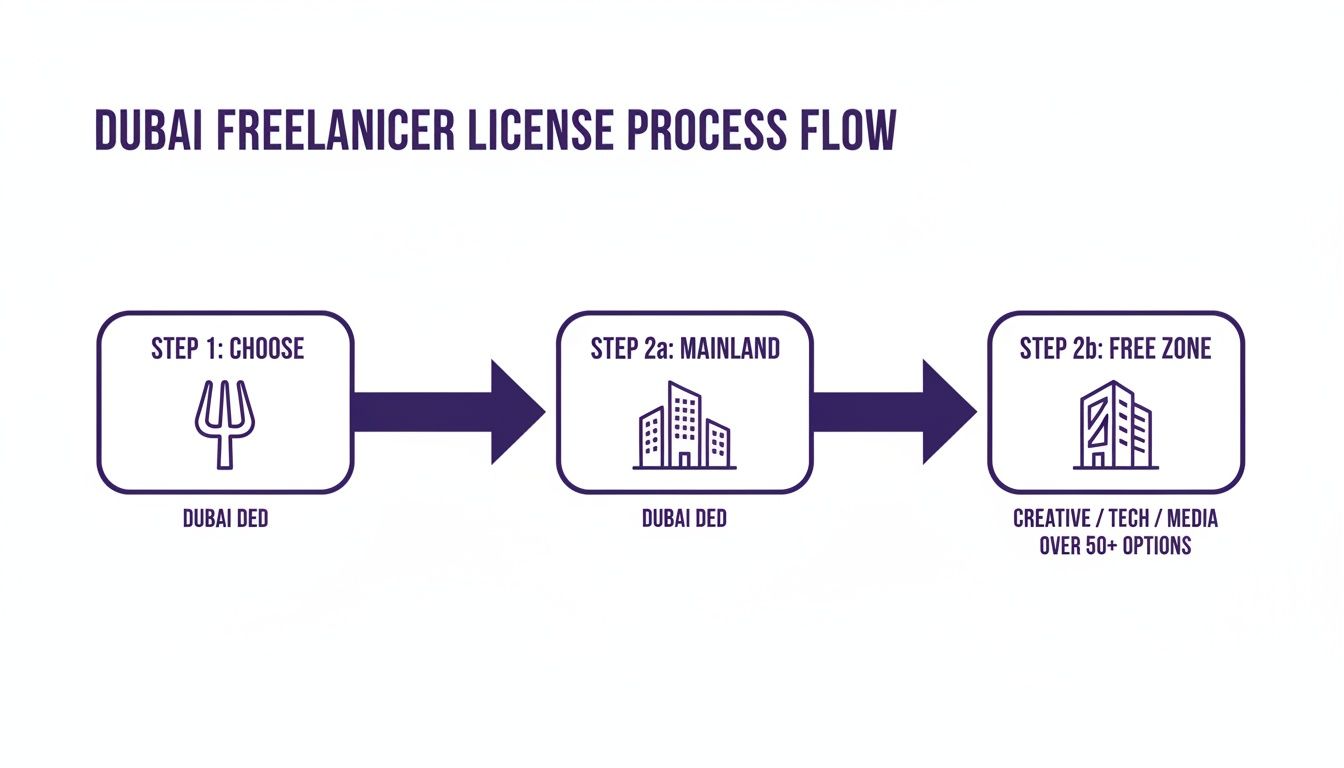

This flowchart gives you a bird's-eye view of how that initial decision shapes the path ahead.

As you can see, choosing between a Mainland or Free Zone setup sends you down a specific administrative road, each with its own set of forms and required approvals.

Your Essential Document Checklist

Before you even touch an application form, your first task is to build your document portfolio. Think of this as the foundation of your entire application. Having everything ready to go will save you an incredible amount of time and headaches later on. While the exact list might change slightly depending on the jurisdiction, the core requirements are pretty standard across the board.

Here’s what you’ll almost certainly need:

- A Completed Application Form: This is the official starting point, which you’ll get directly from the relevant authority (the DET for Mainland or the specific Free Zone office).

- Passport and Visa Copies: You'll need clear, colour copies of your passport (with at least six months of validity left) and your current UAE visa page if you already have one.

- Passport-Sized Photographs: These need to follow specific UAE government standards—usually a clear photo against a plain white background.

- Your Professional CV or Portfolio: This is your chance to showcase your expertise and prove you have the experience for your chosen freelance activity.

- Educational Certificates: For many professional roles, like consulting, engineering, or education, your degree certificates will need to be officially attested.

- A Bank Reference Letter or Statement: This is simply to show proof of your financial standing.

A word of warning on document attestation—it’s a common stumbling block. If your degree was issued outside the UAE, it has to be authenticated first by the UAE Embassy in your home country and then by the Ministry of Foreign Affairs (MOFA) here in the UAE. This process can easily take weeks, so it’s something you need to start immediately.

Key Stages of the Application Process

Once your documents are all in order, you can kick off the application journey. The process is logical, but you have to complete each stage in the right sequence. Trying to skip a step is a sure-fire way to create delays.

The first major checkpoint is getting initial approval. This is where the authorities review your profile and the freelance activity you want to pursue to make sure you're eligible. With that preliminary green light, you can then reserve your trade name. For most freelancers, this is simply your own name, but it still has to be officially registered and approved.

After your trade name is secured, you'll submit the final, complete application package. This includes all the documents you gathered earlier, plus the initial approval and trade name certificate. This is the final submission before your freelancer license Dubai is officially issued.

How Professional PRO Services Make a Difference

Trying to navigate all of this on your own can feel overwhelming, especially when you're dealing with different government portals and very specific procedures. This is where a professional corporate services provider really shows their value. At 365 DAY PRO, our PRO services are built to handle this entire process for you.

We don't just guide you; we do the legwork. Our team has years of hands-on experience with the requirements of both the DET and all the major Free Zones.

Here’s how we make it simple:

- Flawless Document Prep: We go through every document with a fine-tooth comb to ensure it meets the exact standards, preventing rejections over small errors.

- Smooth Government Liaison: We manage all the submissions and follow-ups, saving you the time and stress of dealing with government portals or waiting in queues.

- Proactive Problem-Solving: If any issue comes up—say, a question about your qualifications—we handle it directly to keep your application moving without a hitch.

During the application process, you might come across forms that need an electronic signature. It's a useful skill to learn how to electronically sign PDF documents directly from your computer, which can definitely speed things up.

Partnering with 365 DAY PRO means you’re not just getting admin support; you're getting a dedicated partner committed to getting your freelance license issued. With our 24/7 support and cost-effective business setup solutions tailored to your needs, you can focus on what you do best—planning your business—while we handle the red tape.

Understanding the Costs and Timelines

One of the first, and biggest, questions on any aspiring freelancer’s mind is, "What will this actually cost me?" Getting a clear financial picture is vital, and it’s about looking beyond just the initial license fee. A realistic budget for your freelancer license Dubai setup needs to cover everything from government fees to your visa processing.

Transparency is everything. Let's break down the typical expenses and how long you can expect the process to take. This will help you plan your finances properly and avoid any last-minute surprises, ensuring your freelance journey in Dubai kicks off on the right foot.

Building a Realistic Budget for Your Setup

The total investment for your freelance setup can swing quite a bit depending on where you choose to register (Mainland vs. Free Zone) and the kind of visa package you need. Think of it less as a single fee and more as a collection of costs that come together to form your total price.

Here’s a look at the essential components you need to budget for:

- License Fee: The core cost for the permit itself. This is where you'll see the biggest difference between free zones and the DET.

- Establishment Card: This is a mandatory card that registers your freelance entity with the immigration authorities, which is your green light to apply for visas.

- Visa Application Fees: If you're an international freelancer, this is likely a key goal. These fees cover the processing of your residency visa.

- Medical Fitness Test: A standard health screening that everyone must pass to secure a residency visa.

- Emirates ID Application: The fee for issuing your mandatory national identity card.

Putting these pieces together gives you a complete financial picture, with options ranging from low-cost entry points to more comprehensive packages that might include multi-year visas.

Expected Costs: A Clear Breakdown

Getting started as a freelancer in Dubai is more accessible than most people assume. While a full-blown commercial license can set you back AED 10,000–30,000, freelance permits are a much more affordable way in. Comprehensive packages in popular free zones often land somewhere between AED 7,500 and AED 15,000. These usually bundle in essentials like flexi-desk access and a visa allocation, making them ideal for consultants, marketers, and tech professionals.

If you're on a tighter budget, some free zones even offer basic permits for as low as AED 4,000. These are designed for small-scale activities where you don't need a physical office. For a deeper dive, you can discover more about the cost and benefits of a Dubai freelance visa on rfz.ae.

At 365 DAY PRO, we specialise in crafting cost-effective business setup solutions that fit your specific freelance activity. We’ll guide you to the package that delivers the best value, making sure you only pay for what you actually need to launch.

Planning ahead is everything. So many freelancers only budget for the license fee, forgetting about the other costs like the visa, Emirates ID, and medical test. We provide a fully transparent, all-inclusive quote right from the start, so you know the exact total investment from day one. No surprises.

Setting Realistic Timelines

Just as important as the cost is knowing how long the whole process will take. A realistic timeline helps you manage your transition smoothly, especially if you're moving to Dubai or switching your visa status.

Generally, you can expect the entire process—from initial application to getting the visa stamped in your passport—to take anywhere from two to four weeks. This timeline can be influenced by a few things, like the efficiency of the specific authority and how quickly you can get all your documents in order.

A typical timeline looks something like this:

- Initial Approval & License Issuance: This is usually the quickest part, taking between 2-5 working days.

- Establishment Card & Entry Permit: Once the license is issued, this next stage can take another 5-7 working days.

- Medical Test, Biometrics & Visa Stamping: The final stretch. This typically takes another 5-7 working days to complete.

From our experience, delays almost always happen because of simple mistakes—incomplete forms or documents that haven't been properly attested. Working with a professional team like 365 DAY PRO helps minimise these risks. We manage all the government liaison to keep your application moving. Plus, our 24/7 support service means we're always available to push things forward.

Planning for Ongoing Obligations

Getting your license and visa is the biggest hurdle, but it's not the end of the road. To maintain your legal status as a freelancer in Dubai, you need to be aware of your ongoing responsibilities.

The most important one is the annual license renewal. This is a recurring cost you must budget for each year to keep your freelance permit active and your business legitimate.

Beyond that, you need to keep your tax obligations in mind. While the UAE has incredible tax benefits, you still have to comply with federal regulations. If your annual freelance income crosses the AED 375,000 threshold, you are legally required to register for Value Added Tax (VAT). Understanding these commitments from the beginning helps you plan your long-term finances and ensures you stay fully compliant.

Securing Your Visa and Bank Account

Getting your freelancer license in Dubai approved is a huge win, but don't pop the champagne just yet. You're on the home stretch, but there are two crucial steps left: finalising your residency visa and opening a corporate bank account.

Honestly, this is where a lot of new freelancers get tripped up. The paperwork seems done, but these final hurdles can be tricky. With a bit of know-how, though, you can sail right through them.

Your license gives you the legal right to work, but it's the residency visa that lets you actually live here. Think of it as the final piece of your "official resident" puzzle.

Finalising Your UAE Residency Visa

Once your establishment card is issued (it usually comes with your license), you can kick off the visa process. This isn't a single step but a sequence of appointments managed by different government bodies. You have to follow the order precisely.

First on the list is the medical fitness test. It’s a standard requirement for all new residents—nothing to worry about. You'll go to a government-approved health centre for a quick health check and a blood test, and the results are usually ready in about 24 hours.

Next up, biometrics for your Emirates ID. This involves giving your fingerprints and having a photo taken. Your Emirates ID is your all-purpose identification card in the UAE, used for everything from banking to getting a phone plan. You’ll need to book an appointment at a Federal Authority for Identity and Citizenship (ICA) service centre for this.

The last part of the process is the visa stamping. This is when you hand over your passport, and the immigration authorities place the official residency visa sticker inside. With that sticker in your passport, you are officially a UAE resident. Welcome!

Visa Validity and Sponsoring Your Family

Your freelancer visa will typically be valid for one to three years, depending on which authority or free zone you went with. The great news is that as long as you keep your freelance license active, you can renew your visa.

One of the biggest perks for many freelancers is the ability to sponsor their families. Once your own visa and Emirates ID are sorted, you can start the application process to bring your spouse, children, or even your parents to live with you in Dubai. It’s what makes freelancing here a really sustainable, long-term move for families.

The Challenge of Opening a Business Bank Account

Okay, license and visa in hand, you’re ready to get paid. But for that, you need a corporate bank account, and this can be surprisingly tough. UAE banks have very strict "Know Your Customer" (KYC) and due diligence protocols to combat financial crime. As a result, solo entrepreneurs often face an extra layer of scrutiny.

I've seen many freelancers get rejected simply because they weren't prepared. You can't just walk into a bank branch with your new license and expect them to open an account on the spot.

Here’s what you need to do to massively improve your chances:

- Gather your new freelance license and establishment card.

- Have clear copies of your passport, new visa, and Emirates ID.

- Put together a professional CV or a portfolio of your work.

- Draft a simple business plan. It just needs to outline your services, who you plan to work with, and your expected income.

- If you have them, include reference letters or signed contracts from potential clients.

The goal is to show the bank you're a legitimate professional with a viable business. The more organised and prepared you are, the more seriously they'll take you. A well-prepared file speaks volumes.

This is exactly where having an experienced partner can make all the difference. At 365 DAY PRO, our specialists in both Mainland and Freezone company formation have built strong relationships with the major UAE banks over the years. We know what they're looking for.

We'll help you prepare a solid application, walk you through the bank's questions, and even introduce you to the right people. Our goal is to help you sidestep the common frustrations and delays. With our 24/7 support service, we make sure you get your bank account opened quickly so you can start sending invoices and growing your business.

Your Freelancer License Questions Answered

When you're looking to start freelancing in Dubai, a lot of practical questions pop up. Getting the right answers from the start can make all the difference. Let's walk through some of the most common queries we handle every day, giving you the clear, straightforward advice you need to get going.

Can I Have a Full-Time Job and a Freelancer License?

Yes, you absolutely can. It's actually quite common for professionals here to run a side hustle alongside their day job.

The key piece of paper you'll need is a No Objection Certificate (NOC) from your current employer. This is simply a formal letter stating they're aware of and approve your freelance work. The specific rules can differ slightly from one jurisdiction to another, so it’s always a good idea to double-check the requirements for your chosen free zone or the mainland authority. We guide clients through this all the time at 365 DAY PRO to ensure everything is above board.

What Kind of Work Can I Do?

A freelance license opens up a huge range of professional services, especially in hot sectors like media, tech, education, and consulting.

We see a lot of freelancers in fields like:

- Graphic Design and Web Development

- Content Creation and Copywriting

- Digital Marketing Consultancy

- Private Tutoring and Coaching

- Business and Management Consulting

The official list of approved activities will vary between the mainland (DET) and the different free zones. For example, Dubai Media City is tailor-made for media pros, while Dubai Knowledge Park is geared towards educators. Choosing the right activity code is a crucial step, and our specialists can help you pinpoint the exact one that matches what you do.

Do I Need to Rent an Office for This License?

No—and this is one of the biggest perks of going the freelance route in Dubai. Whether you choose a DET e-Trader license for the mainland or a permit in a free zone, you won't be forced to lease a physical office.

This single factor drastically cuts your startup costs, making it incredibly accessible for independent professionals. Most freelance packages come with access to a flexi-desk or co-working space, which is enough to satisfy the legal requirements for your license and visa. It’s the perfect setup for consultants, creatives, and anyone who works remotely.

What Are the Tax Implications for a Freelancer?

The UAE's tax environment is a massive draw for entrepreneurs worldwide. As a freelancer, you’ll benefit from 0% personal income tax. What you earn is what you keep, allowing you to fully enjoy UAE tax benefits for international entrepreneurs.

That said, there are two important taxes to keep on your radar to stay compliant:

- Value Added Tax (VAT): If your freelance income tops AED 375,000 in a year, you must register for VAT. This means you'll need to add a 5% charge to your invoices.

- Corporate Tax: Depending on your annual net profit, your business might also fall under the UAE's Corporate Tax rules.

Getting a handle on these obligations is key for your financial planning. The tax system can seem intimidating at first, but our specialists offer advice specific to your freelance business to make sure you're meeting all Federal Tax Authority (FTA) rules from day one.

Is Health Insurance Mandatory for My Visa?

Yes, it is. You cannot get a residency visa in Dubai without valid health insurance. The authorities require proof of a DHA-compliant plan before they’ll even process your visa application.

As a freelancer, you're on your own for medical coverage—you won't have an employer's group policy to fall back on. Your plan must meet the Dubai Health Authority (DHA) minimums, which include an annual coverage limit of at least AED 150,000. Not having proper coverage can lead to fines and will stop you from renewing your visa.

At 365 DAY PRO Corporate Service Provider LLC, we’re here to support you through the entire freelance journey, from picking the right license to ticking every legal box. Our specialists in Mainland and Freezone company formation offer practical, cost-effective solutions built around you.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com