✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

So, what does it actually cost to get a business licence in Dubai? The truth is, there's no single price tag. You're looking at a range that can start from AED 5,500 and climb to over AED 30,000. The final figure all comes down to the choices you make about your business activity, where you set up, and your company's legal structure.

Your Guide to Dubai Business Licence Costs

Starting a business in Dubai is a thrilling prospect, but let's be practical—the first question on every founder's mind is, "How much will this cost?" Getting your business licence is one of the biggest upfront investments, and the figures can seem confusing at first. This guide is here to clear things up and give you a financial roadmap for a smooth company formation.

Think of it this way: you're not buying an off-the-shelf product. You're building a custom package. Every piece, from your legal structure to the specific industry you're in, contributes to the final cost. Understanding these components helps you make smart decisions that fit your budget and your business vision.

To give you a clearer picture from the get-go, here’s a quick breakdown of what you can expect.

Quick Overview of Estimated Starting Costs in Dubai

| Jurisdiction | Typical Starting Cost Range (AED) | Best For |

|---|---|---|

| Dubai Mainland | AED 15,000 – AED 30,000+ | Businesses targeting the local UAE market and government contracts. |

| Dubai Free Zone | AED 5,500 – AED 20,000+ | International trade, startups, and companies seeking 100% foreign ownership. |

As you can see, where you choose to set up shop makes a huge difference. Let's dig into why.

Key Factors Influencing Your Licence Cost

Several big decisions will steer the total cost of your licence. The most important one is your jurisdiction: are you setting up on the Dubai Mainland or in one of the city's many specialised Free Zones?

-

Mainland Setup: This is your ticket to the entire local UAE market. It gives you the freedom to trade directly with any other business in the country and bid on lucrative government projects.

-

Free Zone Setup: Perfect for international entrepreneurs, Free Zones offer incredible perks like 100% foreign ownership and major tax advantages. They often provide more affordable, industry-specific packages.

Of course, covering these initial costs is a major step. It's smart to have a solid financial plan in place. Understanding how to apply for a business loan can be a game-changer, giving you the capital needed not just for licensing but for fuelling your company's growth down the road.

The Bottom Line: That wide cost spectrum is a defining feature of Dubai's business environment. For 2024-2025, a small business licence could cost anywhere from AED 5,500 to AED 30,000. The choice between a Mainland and Free Zone setup is the biggest driver of this difference, with Free Zones often rolling out very competitive pricing and great benefits to attract new businesses.

Breaking Down Dubai Mainland License Costs

Setting up on the Dubai Mainland is your ticket to the entire local UAE market. It means you can trade directly with other local businesses and even throw your hat in the ring for lucrative government contracts. But what does this level of access really cost? Let's get specific and build a clear financial picture, piece by piece.

Your starting point is the Department of Economy and Tourism (DET), the main governing body for mainland licenses. Pretty much every step of their process comes with a fee, and all these small charges add up to your total setup cost. Knowing what these are ahead of time is the key to avoiding any nasty surprises down the road.

Core Government Fees

First up are the mandatory government service fees. You can think of these as the essential, non-negotiable building blocks for your company.

- Initial Approval: This is where the DET gives your business idea and company structure the official green light.

- Trade Name Reservation: You need a unique name for your business, and securing it involves a registration fee.

- Memorandum of Association (MOA): If you're forming a Limited Liability Company (LLC), your MOA needs to be professionally drafted and notarised. This process has its own set of costs.

These initial fees are just the beginning, but they represent a core part of the Dubai business license cost for any mainland company.

The total first-year cost for a mainland setup can range from approximately AED 50,920 up to AED 107,520. This figure includes initial registration fees from the Department of Economic Development (DED), which are typically between AED 10,000 to 15,000, plus additional costs for name reservation, document notarisation, and mandatory office rent. You can find more insights about Dubai trade license costs on Safaristar.me.

Essential Operational Costs

Once the initial government paperwork is sorted, you’ll run into a few operational costs that are mandatory for getting your mainland license approved. These are tied to proving you have a legitimate physical and legal presence in Dubai.

The big one here is your office lease, which has to be officially registered through the Ejari system. Unlike some Free Zone setups where a simple flexi-desk might do, a mainland license almost always requires a proper physical office. Naturally, the price tag on this will swing wildly depending on the size and location you go for.

The legal structure you choose for your company also makes a big difference. A Limited Liability Company (LLC) is a very popular option, but it has a different cost profile than a Sole Establishment. Each legal form comes with its own set of rules and fees that directly affect your total budget. Working with a setup specialist can help you navigate these options and find the most cost-effective path for your specific business.

Navigating Dubai Free Zone License Costs

Dubai's network of over 40 Free Zones is a massive draw for international entrepreneurs, and for good reason. They roll out the red carpet with perks like 100% foreign ownership and an incredibly attractive tax environment. But when it comes to the cost of a business licence, there’s no single price tag. The variation between zones can be huge.

Think of choosing a Free Zone like picking the right tool for a job—what works for a global commodities trader won't be the best fit for a freelance graphic designer. The Dubai business license cost is anything but a one-size-fits-all figure. Each zone has its own pricing, often designed to attract specific industries. A tech hub like Dubai Silicon Oasis will have a completely different cost structure than a global trading powerhouse like DMCC or a creative cluster like Dubai Media City.

Key Cost Components in Free Zones

To really get a handle on what you'll be spending, you need to break down the total cost into its core parts. Generally, you’re looking at four main expenses to get your Free Zone company up and running.

First, there's a one-time company registration fee, which usually starts from around AED 9,000 in some of the more popular zones. Then comes the annual business licence fee, a recurring cost that can swing anywhere from AED 10,000 to AED 50,000 depending on the complexity of your business activities.

You'll also need a registered office space. This is mandatory, and you can expect to budget between AED 15,000 and AED 20,000 per year for a basic solution. Lastly, there's the minimum share capital. This can range from a token AED 1,000 all the way up to AED 1,000,000, though thankfully, many zones are quite flexible here. If you want to dig deeper into these numbers, you can find some great insights on Free Zone costs at DMCC.ae.

It’s also important to see how these fees are presented. Some Free Zones bundle everything into a neat, all-inclusive package, which makes budgeting a breeze. Others operate on an à la carte basis, where you pay for each component separately.

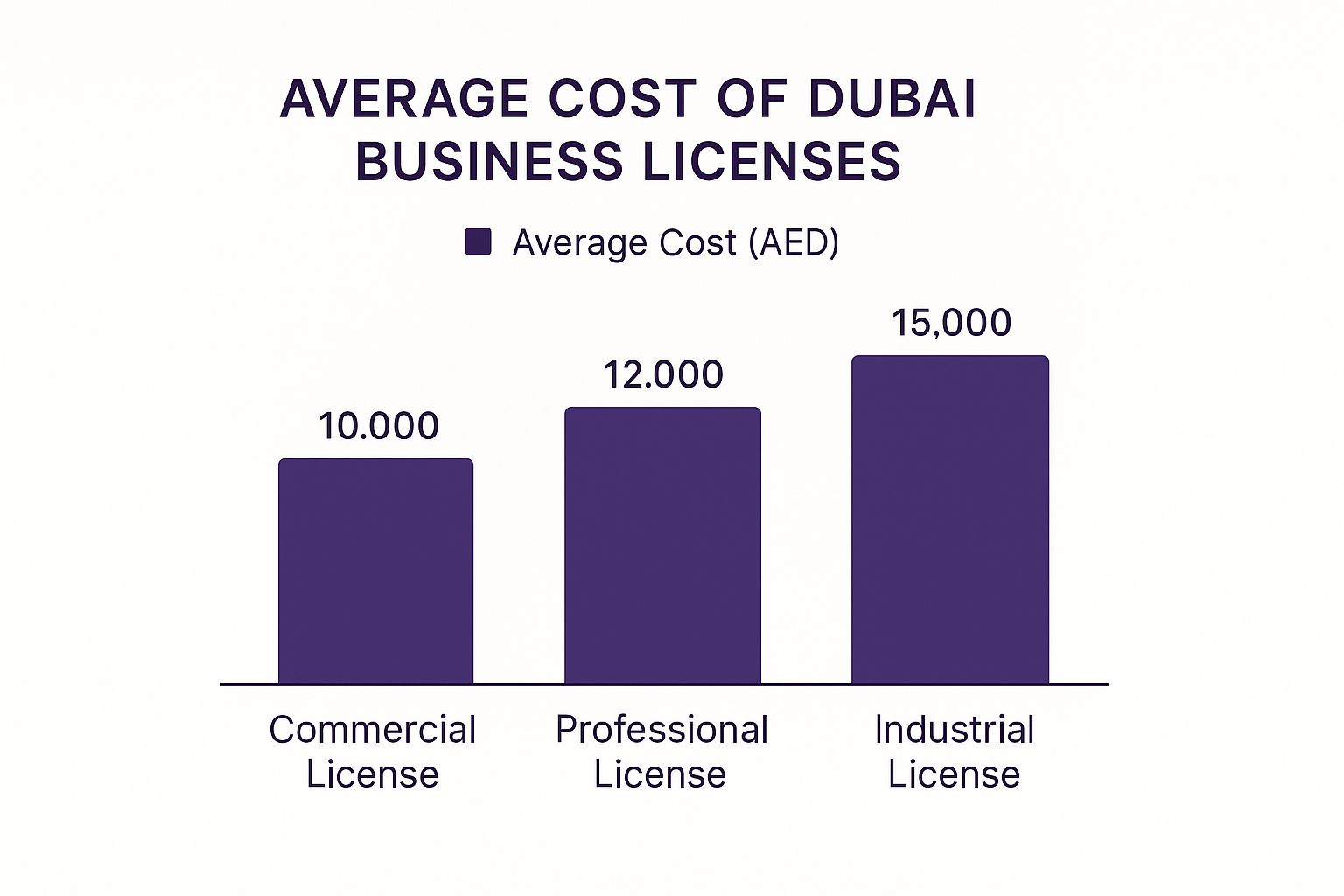

The type of licence you need is another major factor that drives the final cost, as this chart clearly shows.

As you can see, Industrial Licences tend to be on the higher end. This is simply because they involve more complex infrastructure, safety approvals, and regulatory oversight for manufacturing.

A Quick Look at How Costs Can Vary

To give you a real-world sense of the differences, here’s a sample comparison of estimated first-year costs. Remember, these are just illustrative figures to show you the potential range—actual quotes will depend on your specific business activities and needs.

Cost Comparison of Popular Dubai Free Zones (Sample)

| Cost Component | Free Zone A (e.g., DMCC) | Free Zone B (e.g., IFZA) | Free Zone C (e.g., Meydan) |

|---|---|---|---|

| Registration Fee | ~AED 9,020 | Included in package | Included in package |

| Annual Licence Fee | ~AED 20,320 (1 activity) | ~AED 12,900 (up to 3 activities) | ~AED 12,500 (1 activity) |

| Office Solution (Flexi-Desk) | ~AED 18,500 | Included in package | Included in package |

| Establishment Card | ~AED 2,000 | ~AED 2,000 | ~AED 2,000 |

| Share Capital | Min. AED 50,000 (not paid up) | No minimum required | No minimum required |

| Estimated First-Year Total | ~AED 50,000 | ~AED 15,000 – 20,000 | ~AED 15,000 – 20,000 |

This table makes it clear just how much your choice of Free Zone impacts the initial investment. A premium, specialised zone like DMCC has higher individual costs but offers a world-class trading ecosystem, whereas zones like IFZA or Meydan provide incredibly cost-effective packages perfect for startups and service-based businesses.

Office Solutions and Share Capital

Every company in a Free Zone legally needs a registered address, but don't panic—this doesn’t mean you have to lease a massive office from day one. There are some very practical and affordable options:

- Flexi-Desks: This is the go-to for startups and solo entrepreneurs. You get access to a shared workspace when you need it and, crucially, the formal business address required for your licence.

- Serviced Offices: When your team starts to grow, these private, ready-to-use offices are the next logical step, offering more space and professional amenities without the headache of a long-term commercial lease.

Finally, let's clear up the confusion around share capital. This is the capital you declare for your business, but in many cases, you don't actually have to deposit the full amount into a corporate bank account. This is a game-changer.

For instance, some of the most popular zones today, like IFZA and Meydan, have no minimum paid-up share capital requirement. This dramatically lowers the financial barrier to getting started.

Other zones might require you to show proof of funds, so it's a critical point to check. This is where getting expert advice really pays off—a specialist can quickly match you with a zone that fits your budget and operational needs perfectly.

Uncovering the Hidden Costs of Your Dubai Business

Getting that trade licence in your hands feels like a massive win, and it is. But it’s crucial to know that the number on that invoice isn't the final tally for your setup costs. The advertised Dubai business license cost is really just the starting line, and many entrepreneurs get caught by surprise by the other essential expenses needed to actually get up and running.

Think of it like buying a car. The sticker price is one thing, but you can't legally drive it off the lot without also paying for insurance and registration. It's the same with a business licence in Dubai. You have the licence, but you still need a few more things to legally operate and bring your team on board. A smart financial plan bakes these costs in from the very beginning.

Beyond the Licence Fee Itself

One of the biggest chunks of your setup budget, right after the licence itself, will be visa processing for yourself, your partners, and any employees you plan to hire. This isn't just a single payment; it's a process with several steps, and each one has its own price tag. This is where those "hidden costs" can really start to pile up if you haven't planned for them.

Typically, the visa process involves:

- Entry Permit: This is the first document needed. It allows someone to enter the UAE for the purpose of their residency.

- Medical Fitness Test: Everyone needs to go through a mandatory health check here in the UAE, which includes a blood test and chest X-ray.

- Emirates ID Application: This is the official residency card. The application is a separate step that includes a trip for biometrics, and the fees can change depending on how quickly you need it processed.

Just these three steps can easily add thousands of dirhams per person to your total bill.

Mandatory Administrative Costs

On top of visas, you’ll have a few key administrative costs to cover before your company is a fully functional legal entity. One of the most critical is the Establishment Card. This little card is a big deal—it’s issued by the immigration department and is what officially allows your company to sponsor visas for anyone, including yourself. You can't hire anyone without it, and it comes with an annual fee.

Also, don't forget about translations. If your company's official documents, like the Memorandum of Association, are in English, you'll need to pay for them to be legally translated into Arabic by a certified translator. Government departments will only accept these official versions, so it's another expense to factor in.

A common pitfall is focusing only on the licence fee while overlooking the combined cost of visas, medical tests, and administrative cards. A good setup partner will give you a fully itemised quote, showing you every single cost upfront so there are no surprises.

External Government Approvals

Finally, depending on what your business actually does, you might need special permission from other government departments. This isn't for every business, but it's common for specialised industries. For example, if you're opening a medical clinic, you'll need approvals from the Dubai Health Authority (DHA). Opening a school? You'll be dealing with the Knowledge and Human Development Authority (KHDA).

Each of these external bodies has its own set of application fees, and sometimes they require site inspections or additional documents, all of which can add to your total startup investment. Working with an experienced corporate service provider helps you see these requirements coming, so you can avoid delays and stay on budget as you launch your business in Dubai.

How Your Business Activity Shapes Your Licence Costs

What you actually do in your business is probably the biggest factor that will determine your final Dubai business licence cost. Think of it like registering a vehicle. A massive industrial lorry has a very different registration fee than a small personal car, right? The same logic applies here.

The authorities in Dubai group business licences into three main types. Each one has its own cost structure that reflects the complexity, risk, and level of government oversight needed. Getting a handle on these categories is your first step to building an accurate budget.

The Main Licence Categories

Your business activities will slot you into one of these three groups, and that directly influences your setup fees.

- Commercial Licence: This is the go-to for any business that buys and sells goods. It covers everything from a huge general trading company importing a bit of everything to a niche e-commerce shop. Because they often involve logistics and can have a wide impact on the market, these licences tend to sit in the moderate-to-high cost range.

- Professional Licence: This licence is built for service providers, consultants, designers, artists—anyone whose business is based on their expertise. It's all about the intellectual capital you bring to the table. In many cases, especially for a one-person show, this can be a more affordable route to getting started.

- Industrial Licence: If you’re making, processing, or assembling products, this is your category. An industrial licence almost always carries the highest cost. This is because it involves physical factories or workshops, strict safety regulations, and environmental compliance checks.

For example, a General Trading licence lets you deal in a massive range of products. Because its scope is so broad, it costs significantly more than, say, a licence for a marketing consultancy, which is seen as a much narrower and lower-risk activity.

When Extra Approvals Add to Your Bill

Some business activities need a special sign-off from government departments in addition to the standard economic department approval. This is a common tripwire that adds both cost and time to the setup process if you're not prepared.

A food trading business, for example, can't just open its doors. It needs approvals from the Dubai Municipality to prove it meets all the health and safety standards.

Likewise, if you want to open an educational training centre, you'll need the blessing of the Knowledge and Human Development Authority (KHDA). Each of these external approvals has its own set of fees that you absolutely must factor into your budget from the very beginning. Working with a setup expert who knows these ins and outs is crucial—it helps you build a realistic financial plan with no nasty surprises down the road.

Let the Experts Handle the Headaches and Save You Money

Trying to figure out the real cost of a Dubai business license on your own can feel like navigating a maze blindfolded. You've got Mainland, you've got Free Zones, you've got a pile of potential fees, and a whole lot of specific approvals depending on what you want to do. It’s a recipe for expensive mistakes.

This is where bringing in a seasoned corporate service provider changes the game. Think of it not as an added expense, but as an investment in getting it right the first time, saving you money and stress down the line. We live and breathe this stuff, specializing in both Mainland Company Formation in Dubai & Abu Dhabi and Free Zone Company Formation across the UAE. Our day-to-day work involves dealing with these regulations, which means we know the quickest, most cost-effective route for your specific business.

Your Unfair Advantage

Working with a dedicated team isn't just about convenience; it gives you a real, tangible edge that you can see in your bank account and feel in your stress levels.

- No-Nonsense Pricing: We’ll put together a setup plan that actually fits your budget. No more worrying about paying for services you don’t need or getting locked into a package that isn’t right for you.

- Smarter Tax Structure: We’ll make sure your company is structured from the ground up to take full advantage of the UAE tax benefits for international entrepreneurs. This isn’t an afterthought; it’s a core part of maximizing your profits from day one.

- Always on Call: Business questions don't just pop up during office hours. Our commitment to 24/7 support means you've always got someone to turn to when you need answers.

Let us get tangled in the red tape so you don't have to. From the mountain of paperwork to liaising with government departments, we handle the complexities. This frees you up to focus on the one thing that truly matters: building and growing your business.

Ready to get a clear, no-strings-attached quote that finally makes sense of your Dubai business license cost?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When you're sorting out the finances for setting up a business in Dubai, a lot of practical questions are bound to pop up. Getting straight answers is the key to building a solid budget and moving forward with confidence. Here, we'll tackle some of the most common things entrepreneurs ask about the Dubai business license cost and everything that goes with it.

We’ve pulled together the top questions we hear all the time to give you quick, direct insights for finalising your plans. The goal is to cut through the jargon and give you the real-world knowledge you need for a smooth setup.

What Is the Cheapest Business License in Dubai?

If you're looking for the absolute lowest starting price, you'll usually find it in certain Free Zones. Some of them have packages specifically for businesses that don't need a visa or are focused on particular service activities. You can sometimes find deals starting as low as AED 5,000-8,000.

But a word of caution: the "cheapest" license isn't always the best value. It might seem like a bargain, but if it doesn't allow you to get the visas you need, a proper office space later on, or even open a corporate bank account, it can become a very expensive mistake. It's always best to talk with an expert who can find the most cost-effective solution that actually fits your business goals.

Can I Get a Dubai Business License Without an Office?

Yes, absolutely. While you always need a registered business address, that doesn't mean you have to rent a traditional, physical office. For a Mainland company, there are options like the DED Trader license, which works well for certain home-based businesses.

In the Free Zones, the go-to solution is a "flexi-desk" or a spot in a co-working space. This is a brilliant way to meet the legal requirement for an address without the hefty price tag of a private office. For startups, freelancers, and consultants, it's the perfect, budget-friendly choice.

How Much Does It Cost to Renew a Trade License in Dubai?

Good news here – your annual renewal is almost always cheaper than the initial setup. That’s because you don't have to pay all those one-time registration and approval fees again. Your renewal cost is mainly made up of the license fee itself, renewing your Establishment Card, and your tenancy contract (whether it's an Ejari for a physical office or your flexi-desk agreement).

As a rule of thumb, you can expect your annual renewal to cost somewhere around 70-90% of your first year's license fee. Of course, this can shift depending on your jurisdiction and if you've made any changes to your company.

Are There Any Hidden Fees I Should Know About?

This is a smart question to ask. It's wise to budget for more than just the number you see on a license package advertisement. There are a few other common costs you should definitely plan for:

- Visa Application Fees: This applies to owners, partners, and any staff you bring on board.

- Medical Tests & Emirates ID: Every person applying for a residency visa has to go through this mandatory process.

- External Government Approvals: If your business is in a regulated field like healthcare (Dubai Health Authority) or education (KHDA), you'll need special approvals.

- Document Services: Things like legal translation for your documents or getting them officially attested come with their own fees.

A good business setup consultant will never surprise you. They should give you a completely transparent, itemised quote from day one that lists every single potential cost, so you know exactly what to expect.

Figuring out the Dubai business license cost is a whole lot easier when you have an expert on your side. At 365 DAY PRO Corporate Service Provider LLC, we specialise in clear, cost-effective business setup solutions that are built around you, making the entire process predictable and stress-free. Start your journey with us today.