Opening a corporate current account in the UAE isn't just a box to tick; it's the foundational step for any serious business here, whether you're a mainland LLC or an international entrepreneur leveraging the region's tax advantages. This account is the very bedrock of your financial operations, keeping you compliant and making sure money moves smoothly.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why a UAE Business Bank Account Is Non-Negotiable

Securing a local business bank account is far more than a simple formality. Think of it as a critical piece of your company's infrastructure in the United Arab Emirates. It gives your business legitimacy in the eyes of regulators, clients, and suppliers, acting as the central hub for every dirham that comes in or goes out. Without one, simple tasks like managing payroll, getting paid, and handling expenses become a logistical nightmare.

This guide is designed to cut through the noise and demystify the entire journey. We'll turn what can feel like a complex, bureaucratic process into a series of clear, manageable steps. Our aim is to give you a practical roadmap, tackling the common sticking points right from the start—from the different banking rules for mainland versus free zone companies to the UAE's strict Anti-Money Laundering (AML) and Know Your Customer (KYC) checks.

The Foundation for Your Business Success

Your corporate account is the financial heartbeat of your company. It creates a clean, auditable trail of all your income and expenses, which is absolutely vital for proper bookkeeping, VAT registration, and getting ready for corporate tax. Trying to run your business through a personal or foreign account is a recipe for disaster, often leading to serious compliance headaches and outright rejection from the banks.

A dedicated UAE corporate bank account isn't just a best practice—it's an operational necessity. It draws a clear line between your business and personal finances, makes you look professional, and is a hard requirement for almost any commercial activity in the region.

Navigating the Modern Banking Environment

The demand for better business banking is exploding across the region. The neobanking market in the Middle East and Africa was valued at around USD 372.35 billion in 2025 and is expected to more than double by 2030, all thanks to a wave of new digital-first banking options. It's telling that business current accounts are the fastest-growing segment, which just shows how much entrepreneurs like you need accessible, modern banking. You can dive into the full research on neobanking trends to see how the market is shifting.

Consider this guide your strategic briefing. It’s here to give you the essential knowledge and confidence you need to start the current account opening process. Our specialists handle this every single day, so we know exactly how to navigate the requirements for any business structure, be it a mainland company in Dubai, a free zone entity in Abu Dhabi, or an international business taking advantage of UAE tax benefits. We offer cost-effective solutions and 24/7 support to ensure your business is built for financial success from day one.

Nailing Your Paperwork: The Secret to a Fast Bank Account Opening

Let’s be honest, getting your documents right from the very start is the single biggest hurdle in opening a business account in the UAE. If you get this wrong, you're in for a long wait. Banks here work under incredibly strict compliance rules, so an application that's messy or missing something is the fastest way to get delayed or flat-out rejected.

Think of your document file as the first handshake with the bank. It needs to be crisp, professional, and leave no room for doubt. This isn't just about ticking boxes; it's about telling a clear, compelling story about your business. Banks are ultimately assessing risk, and a perfectly organised file shows them you’re a serious, legitimate company. I’ve seen applications get stuck for weeks over one missing paper. Don’t let that be you.

The Core Company Documents: Your Non-Negotiables

Every single application, whether you're a mainland company, a free zone startup, or an international business setting up shop, begins with these foundational documents. They are the legal proof of your company's existence in the UAE. Make sure you have crystal-clear, high-resolution copies ready to go.

- Valid Trade Licence: This is your golden ticket. It's your company's primary permit to operate. Double-check that it’s current and that every business activity you plan to do is listed on it.

- Certificate of Registration: This comes from your licensing authority (like a specific free zone or the Department of Economy and Tourism) and officially confirms your company is on the books.

- Memorandum of Association (MOA) / Articles of Association (AOA): This is a big one. It's the constitution of your company, outlining your business goals and who owns what. Banks read the MOA very carefully to make sure the transactions you plan to make align with what your company is legally allowed to do.

- Share Certificate(s): This document provides the official breakdown of who owns the company, listing every shareholder and their percentage stake.

Whether you're a mainland LLC in Dubai or a new free zone entity in Abu Dhabi, these documents are the spine of your application. Any small mismatch between them—a slightly different company name, a variation in listed activities—is an instant red flag for a compliance officer.

Who's Behind the Company? Personal IDs for Everyone

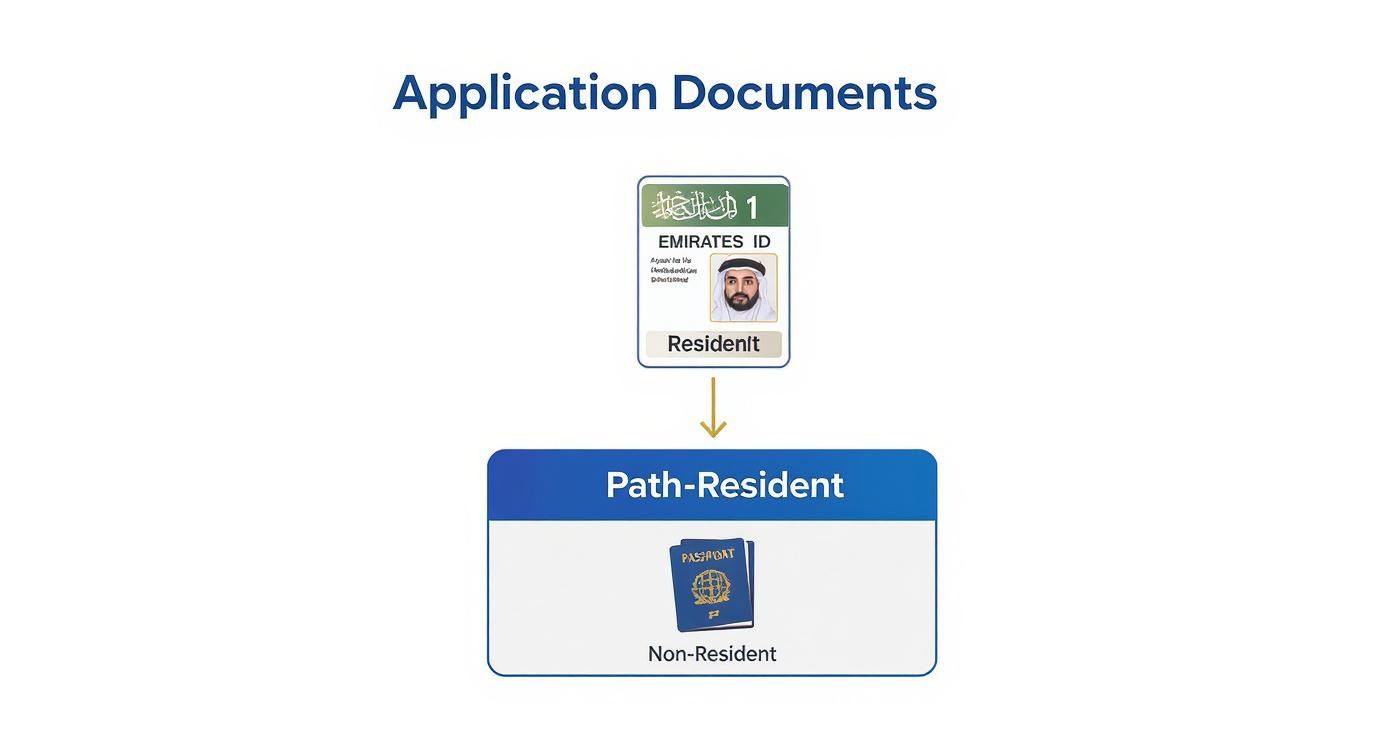

Next, the bank needs to know exactly who they're dealing with. This means verifying the identity of every single person connected to the company: all shareholders, directors, and whoever will be signing the cheques. The requirements change slightly based on residency.

For UAE Residents:

- Emirates ID Copy: A clear, valid copy for every shareholder and signatory is an absolute must.

- Passport Copy with Visa Page: This confirms both their identity and their legal right to reside in the UAE.

For Non-Resident Shareholders/Signatories:

- Passport Copy: A high-quality scan of the main identity page is the starting point.

- Proof of Address: This is a key sticking point. Banks almost always ask for a recent utility bill (electricity, water, or a landline phone bill) from the person's home country. It must be dated within the last three months.

- Bank Reference Letter: Many banks will also want a formal letter from the non-resident's personal bank back home, simply confirming they have an account in good standing.

An Expert's Tip: When a bank asks for a "certified true copy," they don't just mean a photocopy. This usually means the document needs to be stamped by a recognised authority, like a lawyer or public notary, to confirm it's authentic. Always ask the bank exactly what they mean by "certified" to avoid getting your documents sent back.

The Supporting Documents That Tell Your Story

Beyond the legal papers, banks need more information to really understand your business, its legitimacy, and whether it’s financially sound. This is where you build your case, and a well-written business plan is absolutely critical. In my experience, this is one of the most closely examined documents in the whole file.

Your business plan cannot be a generic template you downloaded online. It needs to clearly explain:

- Your Business Model: What do you actually do or sell? Who are your customers?

- Source of Funds: Where is the startup capital coming from? Be specific and have proof ready.

- Expected Transactions: Who will you be paying? Who will be paying you? It helps to name key suppliers or clients, especially if they are international.

- Financial Projections: You need to provide realistic revenue forecasts for at least the first 12-24 months.

On top of that, prepare a concise Shareholder Profile. Think of this as a mini-CV for each owner, highlighting their professional background and any experience that’s relevant to the new venture. This gives the bank confidence in the people running the show. For international entrepreneurs, showing a clear, logical reason for banking in the UAE can make a huge difference. Our specialists at 365 DAY PRO can help you frame all this information perfectly, turning your application from a pile of papers into a compelling case for approval.

How to Choose the Right Bank for Your Business

Picking the right banking partner in the UAE is a huge decision, and honestly, it goes way beyond just finding a place to park your company’s cash. Think of it this way: the bank you choose becomes a central nervous system for your business operations. It’s a choice that deserves some serious thought, because not all banks are cut out to handle the unique grind of a new business.

The good news? The UAE's financial sector is incredibly solid. To give you an idea, Abu Dhabi Islamic Bank’s market capitalisation soared to USD 21.26 billion by mid-2025, which points to the overall muscle of the banking industry here. You can dig deeper into the strength of Middle East and Africa banks if you’re curious.

This healthy competition is great for you. It means you’ve got a real choice, from massive local powerhouses to the big international names you see everywhere. Your job is to cut through the marketing fluff and focus on what will actually help your company grow.

Local Champions vs. International Giants

Your first major fork in the road is usually deciding between a local bank, like Emirates NBD or First Abu Dhabi Bank (FAB), and an international player like HSBC or Standard Chartered. Each has its pros and cons, and the right answer depends entirely on how your business operates.

- Local Banks (e.g., Emirates NBD, ADCB, FAB): These guys live and breathe the local market. They get the nuances of the regulations here and usually have a massive network of branches across Dubai, Abu Dhabi, and Sharjah. That’s a lifesaver if you ever need to do things face-to-face.

- International Banks (e.g., HSBC, Standard Chartered): If your business is all about cross-border trade, these banks are often the smarter play. Their global footprint just makes international payments and trade finance so much smoother and often cheaper.

Let’s make this real. Imagine a mainland trading company in Dubai, importing from China and selling to Germany. They'd likely lean towards HSBC for its powerful trade finance tools. On the other hand, a tech startup in a free zone building an app for the local market might find Emirates NBD’s digital banking platform and API integrations far more useful.

Key Factors for Your Comparison

When you’re weighing your options for a current account opening, you need to look past the fancy logos and get into the nitty-gritty. Here’s a checklist of what you should be comparing.

Minimum Balance Requirements

This is the big one for any new business trying to manage its cash flow. Nearly every bank in the UAE will require you to maintain a minimum average balance each month. This can be anything from AED 25,000 to over AED 250,000. If you dip below it, you’ll get hit with penalty fees. Be brutally honest with your financial projections and pick a bank whose threshold you can actually meet without sweating every month.

Fee Structures

Get your hands on the "schedule of charges" and read the fine print. How much are local and international transfers? Is there a monthly account maintenance fee? What’s the cost for a cheque book? These little charges can bleed a new business dry over time.

As you can see, the documents you need from day one change depending on whether you're a UAE resident or not. Getting this right from the start is non-negotiable.

Digital Capabilities and Support

Let’s be honest, a clunky online banking portal is a deal-breaker. You need to test-drive or at least get a good look at each bank’s digital platform. Can you process bulk payments easily? Can you set different access levels for your team? Does it play nicely with your accounting software? A clean, modern interface will save you countless hours of admin headaches.

A great banking relationship is about more than just transactions; it's about support. The accessibility and expertise of your dedicated relationship manager can make a world of difference when you need to resolve an issue quickly or seek advice on financing options.

Finally, ask about the bank’s appetite for your industry. It’s an inside secret that some banks are just more comfortable with certain sectors, whether it's tech, e-commerce, or general trading. Because we set up companies day in and day out, we have a pretty good feel for which banks are actively looking for businesses like yours. Our team can point you toward a partner that doesn’t just meet your needs today but is ready to back you as you grow.

Getting Through the Bank Application and KYC Maze

So, you’ve hit 'submit' on your bank application. It feels like a major step, but really, the most important part is just getting started. Your meticulously organised file now enters the bank's internal review system, where it’s scrutinised through the lens of strict Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

This part of the process can feel like a bit of a black box if you don't know what to expect. Essentially, your application lands on the desk of a compliance officer. Their entire job is to verify every single detail, cross-reference your documents, and sniff out any inconsistencies that could pose a risk to the bank.

Why Are They Asking All These Questions?

You’re going to get some detailed, sometimes personal-feeling questions during the KYC phase. It's not because they're being nosy; every question is designed to build a complete picture of you and your business to prevent financial crime. To get a better sense of how banks approach this, you can delve deeper into identity verification methods.

They’ll almost always focus on three key things:

- Your Business Model: You need to explain, in detail, how your company generates revenue. Generic answers like "general trading" or "consulting services" are a huge red flag. Be prepared to talk about your target clients, your products or services, and how your supply chain works.

- Source of Funds: Where is the money to start and run the business coming from? Whether it's your personal savings, a loan from family, or investment from another company, you absolutely need a clear, documented paper trail.

- Expected Transactions: The bank needs to understand what "normal" looks like for your account. This means discussing the anticipated volume, value, and geographic origins of your payments. If you say you'll only be dealing with local UAE clients but a large transfer suddenly arrives from a high-risk country, alarm bells will start ringing.

Nailing the Relationship Manager Interview

Once your file passes the initial compliance check, you’ll likely have an interview with a relationship manager. This might be a face-to-face meeting in a branch in Dubai or Abu Dhabi, or more commonly these days, a video call. This is your moment to make a human connection and build real trust.

The manager’s job is to put a face to the name and confirm the story your paperwork tells. This is where all your preparation truly shines. You want to walk into that conversation (virtual or otherwise) able to explain your business clearly and confidently.

My Advice: Don't think of the KYC interview as an interrogation. Treat it like a business pitch. You're essentially selling the bank on the legitimacy of your venture. Confidence, clarity, and total transparency are your best tools here.

The UAE's banking system is as stable as it is for a reason—these checks are non-negotiable. The Central Bank helps maintain a secure deposit rate environment (around 4.35%), which makes current account opening attractive for legitimate businesses.

Ultimately, you have to prove "substance." This is a key concept in the UAE. It means demonstrating a real, tangible business presence and a genuine reason for being here. Talk about your plans for local operations, even if your clients are global. Explain why you chose a specific free zone or mainland jurisdiction. The stronger the link you can create between your business and the UAE, the smoother the process will be. Our team is available 24/7 to help you build this narrative, ensuring it’s consistent, compelling, and perfectly aligned with your documentation for these crucial conversations.

Getting your business bank account application rejected is a massive headache. It’s not just an inconvenience; it can bring your entire launch to a screeching halt, wasting precious time and momentum. Having helped countless entrepreneurs navigate this process, I’ve seen the same avoidable slip-ups derail applications time and time again.

Think of it this way: UAE banks are under immense pressure from regulators. They have zero tolerance for ambiguity. A tiny mistake, from a mismatched document to a confusing business plan, is all it takes to get a hard "no." Knowing the common pitfalls is the best way to steer clear of them.

Mismatched Business Activities And Licence

This one is surprisingly common but so easy to avoid. Your trade licence explicitly lists the business activities you are legally approved to do. Your business plan and your description of your company have to mirror that licence—perfectly. If there's any daylight between the two, a bank's compliance officer will spot it instantly.

Let's say your licence is for "IT Consultancy," but your business plan is full of details about importing and reselling computer hardware. That's an immediate red flag. A bank knows that the cash flow for a service business looks completely different from a trading company. This inconsistency creates suspicion about what your business really does.

Real-World Scenario: We had a client whose "Marketing Management" licence application got bounced. Why? Their business plan talked a lot about organising events and selling tickets, which requires a totally different permit. We worked with them to refocus the plan strictly on their approved marketing activities. The second time around, the application sailed through.

Lack Of Economic Substance

Banks in the UAE need proof that your company is a real, operational business, not just a name on a piece of paper. This is what's known as economic substance. A shell company with no actual presence is a huge money laundering risk, so you have to show a genuine reason for needing a bank account here.

This doesn't mean you need a flashy office in DIFC from day one. But you do need to demonstrate some real connection to the UAE.

- A Physical Address: Even a flexi-desk contract at a reputable business centre is a good start.

- Local Operations: Your business plan should clearly explain why you're in the UAE. Are you serving local customers? Is this your regional hub?

- A Resident Employee or Director: Having at least one key person with a UAE residence visa massively strengthens your case.

Ambiguous Source Of Funds Documentation

"Where did the money come from?" This is the number one question on every banker's mind. If you're vague about the source of your initial capital, your application is dead on arrival. You absolutely must provide a crystal-clear, verifiable paper trail that proves every dirham came from a legitimate source.

If you’re funding the business from your personal savings, be prepared with bank statements showing how you saved that money over time. If you got a loan from your parents, you'll need a signed loan agreement and a statement from their account showing the transfer. Transparency and documentation are everything. To mitigate risks that could lead to account rejection, it's essential to consider strategies for understanding modern data breach prevention to ensure the sensitive financial data you provide is handled securely.

High-Risk Nationalities Or Business Connections

This is a delicate topic, but it’s a reality of global banking. If your company has shareholders, directors, or major clients connected to countries on international high-risk or sanctioned lists, expect a much tougher review.

It’s not an automatic rejection, but the bank's due diligence will be far more rigorous. They'll ask for a mountain of extra paperwork to verify the legitimacy of everyone and everything involved. The most important thing is to be completely upfront about these connections. Hiding them is a surefire way to get rejected and likely blacklisted.

Our team has extensive experience managing these complex applications. We know how to prepare a file that pre-emptively answers the bank's questions, whether your shareholders are in Dubai, Abu Dhabi, Sharjah, or anywhere else in the world.

Navigating these potential roadblocks is crucial for a smooth application process. Here’s a quick-glance table breaking down the most common rejection reasons and, more importantly, how you can get ahead of them.

Common Rejection Reasons and How to Prevent Them

| Reason for Rejection | Why It's a Red Flag for Banks | Preventative Action to Take |

|---|---|---|

| Incomplete or Incorrect Paperwork | Shows a lack of professionalism and raises questions about the legitimacy of the business. | Double-check every single document against the bank's official checklist. Get a second pair of eyes to review it. |

| Mismatched Licence & Business Plan | Creates suspicion that the company might engage in unlicenced, high-risk activities. | Ensure your business plan, website, and all communications align perfectly with your licenced activities. |

| No Clear Economic Substance | The company looks like a "shell company," a major risk for money laundering. | Provide a tenancy contract (even a flexi-desk), utility bills, or proof of a UAE-resident director/employee. |

| Vague Source of Funds | Banks are legally required to verify the origin of all capital. Ambiguity is a deal-breaker. | Prepare a clear paper trail: personal bank statements, loan agreements, investor contracts, etc. Be ready to explain everything. |

| Connections to High-Risk Countries | Triggers enhanced due diligence protocols due to international AML/CFT regulations. | Be 100% transparent from the start. Provide extra documentation and be prepared for a longer review process. |

| Unrealistic Business Projections | Wildly optimistic or unsupported financial forecasts suggest the applicant doesn't have a viable plan. | Base your financial projections on realistic market data and be prepared to explain your assumptions. |

By proactively addressing these points before you even submit your application, you dramatically increase your chances of a quick and successful approval.

Your Top Questions About UAE Business Banking

As you get closer to opening your business bank account, you're bound to have some specific questions. This is where the details really matter. Getting clear answers now can be the difference between a quick approval and a long, drawn-out delay.

We’ve pulled together the most common questions we hear from entrepreneurs setting up shop in Dubai, Abu Dhabi, and beyond. Here’s what you need to know.

Can I Open a UAE Business Account if I’m Not a Resident?

Yes, you absolutely can. It’s a common scenario for international entrepreneurs to open a corporate account here. Just be prepared for a more thorough due-diligence process compared to what a resident goes through.

There's one non-negotiable step: the account signatory has to be physically in the UAE to sign the final paperwork with the bank. It's a standard security check. You’ll also need to provide extra documents to prove who you are and where you live in your home country.

Typically, you'll need to have these ready:

- A recent utility bill: This is the standard for proof of address. Make sure it’s dated within the last three months.

- A personal bank reference letter: Many banks will want a letter from your personal bank back home, simply stating you’re a customer in good standing.

It's also worth knowing that some banks require a higher minimum balance for non-resident-owned accounts. This is where having an expert on your side makes a huge difference. We know which banks are more welcoming to international business owners and can guide you to the right fit.

How Long Does It Realistically Take to Open an Account?

This is the million-dirham question, and the honest answer is: it varies. Once you've submitted a complete and correct application, you should realistically budget for two to six weeks.

Several things can affect this timeline. The bank you choose, how complex your company’s ownership structure is, and, frankly, how organised your documents are. While some of the newer digital banks might seem faster at first, every account still has to clear thorough compliance checks before it’s fully active.

The single biggest cause of delays? Incomplete paperwork or being slow to answer the bank's follow-up questions. The best way to speed things up is to be over-prepared from the start and respond to requests immediately.

What Is the Minimum Balance for a Business Account?

There’s no single answer here, as minimum balance requirements change quite a bit from bank to bank and even between different account types at the same bank.

For a typical SME account, you can expect the required average monthly balance to be somewhere between AED 25,000 and AED 250,000. For higher-tier corporate packages, that figure can easily climb to AED 500,000 or more.

If your average balance dips below the requirement for the month, the bank will hit you with a penalty fee. This is why it’s so important to pick an account where the minimum balance is a comfortable fit for your company’s cash flow. Don't stretch your finances just to get a few extra perks—it can put a lot of pressure on a new business.

Why Should I Use a Professional Service to Help?

You can certainly go directly to the banks yourself, but working with a professional service provider gives you a serious strategic edge. We do more than just help with forms; we manage the entire process to give you the best possible shot at a fast, successful current account opening.

Our team has spent years building solid relationships with the right people—relationship managers and compliance officers—at a wide range of UAE banks. This lets us pre-screen your profile and match you with the bank that is most likely to say "yes" to your specific industry and ownership structure. We know which banks are currently open to a mainland company in Dubai versus a free zone entity in Sharjah.

We make sure your application is perfect from day one, meeting all the bank’s standards. This drastically cuts down the risk of delays or outright rejection. Our experts chase the bank, handle the back-and-forth, and manage all the follow-ups, saving you a massive amount of time and stress. With our 24/7 support service, we're always there when you need us. It turns a potential headache into a smooth, efficient process, letting you focus on what actually matters—growing your business.

Ready to secure your UAE business bank account without the hassle? 365 DAY PRO Corporate Service Provider LLC are specialists in mainland and freezone company formation and bank account assistance across the UAE. Let our experts handle the complexities for you.

Contact us today for a free consultation at 365dayproservices.com