Getting to grips with the UAE's corporate tax system all starts with a single, foundational step: registration. This isn't just a formality for massive corporations; it's a mandatory process for practically every business operating here, from mainland setups to free zone entities and even individual entrepreneurs. Think of it as your official introduction to the Federal Tax Authority (FTA) and the cornerstone of your entire compliance strategy.

Your First Steps in UAE Corporate Tax Registration

Whether you're setting up shop in Dubai, Abu Dhabi, or Sharjah, understanding your tax obligations right from the start is non-negotiable. Registering for corporate tax establishes your business's legal and financial identity with the government, a crucial move regardless of whether you're a mainland company or based in a free zone.

Since the UAE Corporate Tax Law came into effect on 1 June 2023, the rules have become very clear. The law requires every entity conducting business activities to register for corporate tax. This applies even if your business isn't yet profitable or is operating at a loss.

In fact, the obligation is so firm that even if a business is dissolved during its first tax period, it still needs to register and file a final return for that short period.

To help clarify who needs to take action, here’s a quick breakdown of the requirements.

Who Must Register for Corporate Tax in the UAE

| Entity Type / Scenario | Registration Requirement | Key Consideration |

|---|---|---|

| Mainland Companies | Mandatory | All LLCs and other mainland legal forms must register. |

| Free Zone Companies | Mandatory | Includes Free Zone Persons, who must register to claim 0% tax benefits. |

| Individuals with a Business Licence | Mandatory | If you have a trade licence or permit, you're considered a "Taxable Person". |

| Foreign Legal Entities | Mandatory | If the entity has a Permanent Establishment or is managed from the UAE. |

| Non-Resident Individuals | Mandatory | If they earn UAE-sourced income exceeding AED 1 million per year. |

As you can see, the net is cast wide, covering nearly every form of commercial activity in the country.

Why Timely Registration Is So Important

Getting your registration sorted out early isn't just about ticking a box; it's a smart business decision. It keeps you on the right side of the FTA and helps you sidestep potential headaches and penalties down the road.

Here’s why it matters:

- It’s a Legal Requirement: Plain and simple, this is a non-negotiable part of doing business in the UAE.

- You Avoid Fines: The authorities impose significant penalties for late or non-registration.

- It Paves the Way for Growth: A solid compliance record is essential for everything from opening a corporate bank account to securing investment.

Navigating these new rules can be complex. Integrating robust compliance management solutions from the outset can make a world of difference in keeping your business on track.

Working with an expert can ensure your registration is handled accurately from day one. We are the ✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, offering cost-effective solutions tailored to your needs.

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Gathering Your Documents for a Flawless Submission

A successful corporate tax registration doesn't start on the EmaraTax portal. It begins with getting your paperwork in order. I've seen countless applications get delayed by simple, avoidable document errors, so taking the time to prepare everything meticulously upfront is the smartest move you can make. It's the difference between a smooth submission and weeks of frustrating back-and-forth.

First, let's cover the absolute must-haves. These are the foundational documents for your application, and they need to be current, valid, and clearly scanned.

Essential Business Paperwork

- Trade Licence Copy: Make sure this is the most recent, valid licence for your business, whether you're on the mainland or in a free zone.

- Passport and Emirates ID: You'll need clear copies for every single partner and shareholder named on that trade licence.

- Memorandum of Association (MOA): This is especially important for mainland LLCs or any company structure with multiple shareholders.

Once you have those basics, you'll need a few more specific items. The Federal Tax Authority (FTA) needs to know who is officially submitting this application. You have to provide proof of authorisation, which is usually a formal Power of Attorney or a board resolution that names the individual as the authorised signatory.

A common pitfall I see is businesses forgetting to define their financial year. You must clearly state the start and end dates of your company's accounting period. This is crucial because it sets the schedule for all your future tax periods.

The UAE has built a strong reputation as a business-friendly hub in the MENA region, partly because of its efficient digital processes. This commitment to efficiency shines through in how corporate registrations and tax filings are handled.

Getting all this paperwork ready can feel like a lot. To make it easier, you can explore tools for document processing automation that help organise and manage everything digitally. As ✅ specialists in Freezone Company Formation across the UAE, we're here 24/7 to make sure you have every 'i' dotted and 't' crossed.

Let us handle the details for you.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Getting to Grips with the EmaraTax Portal

Think of the EmaraTax portal as your command centre for all things related to corporate tax. It’s the official digital platform where you'll handle your registration. While it’s a fairly modern system, I've seen plenty of business owners get tripped up by the sheer number of fields and declarations. Let's break it down so you can get through it correctly the first time.

First things first, you need to create an account. It’s a straightforward sign-up process using your email and a password. Once you're verified and logged in, you’ll land on your dashboard. This is where you'll launch your registration and manage all your future dealings with the Federal Tax Authority (FTA).

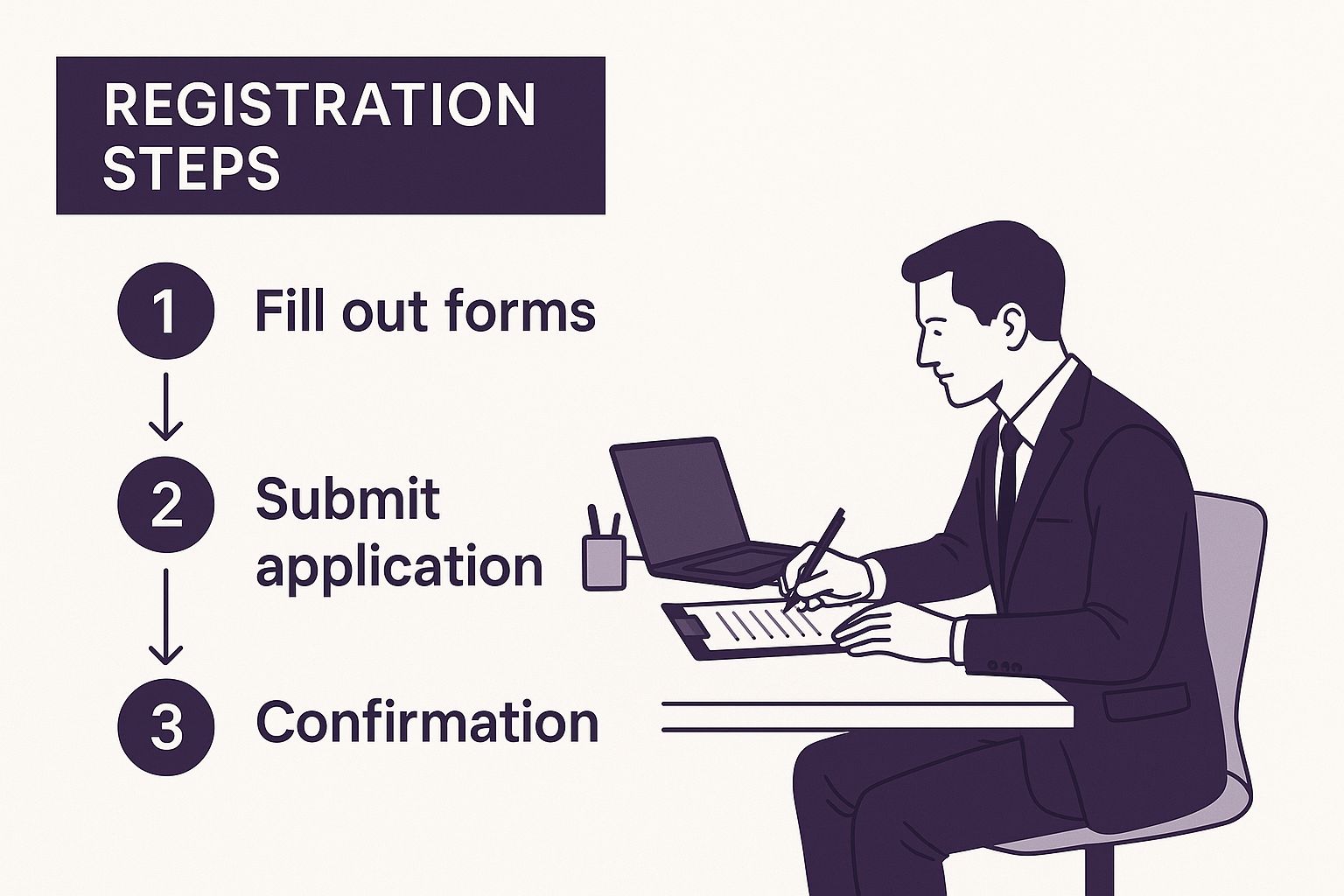

The image below gives you a bird's-eye view of the registration journey from start to finish.

As you can see, it's a step-by-step process. The key is to be methodical and accurate at every stage.

Kicking Off Your Corporate Tax Application

Once you're on the dashboard, find and select the option to register for Corporate Tax. This will open up the main application form, which is split into different parts. My best advice? Don't rush. Rushing is how small, avoidable errors creep in, and those errors are what cause delays in getting your crucial Tax Registration Number (TRN).

One of the first things you'll be asked for is your entity's details—your trade licence information and business activities. This is a common stumbling block. The details you type in must be a perfect match to what's on your official documents. Even a tiny mismatch can get your application sent back for corrections.

Making Sense of the Tricky Declarations

As you get deeper into the form, you'll hit some of the more complex sections that tend to cause the most confusion. These declarations are vital as they map out your company's links to other people and businesses.

- Connected Persons: This is where you declare anyone related to the business. Think owners, directors, or even other companies under the same corporate umbrella. Transparency is non-negotiable here.

- Ultimate Beneficial Owner (UBO): The FTA needs to know which individual (or individuals) ultimately owns or controls your company. This isn't just a local requirement; it’s about meeting global transparency standards.

Here's a piece of advice based on real-world experience: Pay very close attention to your accounting period declaration. Getting this wrong can mess up your tax filing deadlines for years to come. If you have any doubt, it's always better to get professional advice than to take a guess.

As ✅ specialists in Mainland Company Formation in Dubai & Abu Dhabi, we’re here to help you navigate these details. Our goal is to make sure your registration is done right from the start, so you can focus on enjoying the tax advantages of being an international entrepreneur in the UAE. We offer ✅ 24/7 support because we know these questions don't always come up during business hours.

Feeling stuck on the portal or unsure about a declaration?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Don't Miss Your Deadline: Corporate Tax Registration Timelines and Penalties

When it comes to UAE corporate tax, one thing is certain: deadlines are absolute. The Federal Tax Authority (FTA) has set up a very specific system to make sure businesses register on time, and slipping up on your date isn't just a minor issue—it comes with a hefty penalty.

So, what's your deadline? It's not one-size-fits-all. Your company's corporate tax registration deadline is tied directly to the month your trade licence was originally issued, no matter which year it was. The FTA did this to spread out the registrations and prevent a last-minute rush, giving everyone a clear window to get their affairs in order.

For instance, if your business licence was issued in January or February, your deadline was 31 May 2024. If it was issued in March or April, you had until 30 June 2024. You need to check your licence's issue month to know your exact due date.

The Price of Procrastination

Failing to register on time has a clear and painful consequence. The FTA isn't messing around with this, and the penalty for being late is steep.

If you miss your deadline to submit your corporate tax registration application, you will be hit with an administrative penalty of AED 10,000.

This isn't a slap on the wrist. It’s a significant fine that is completely avoidable with a bit of proactive planning. Think of it less as an administrative task and more as a crucial financial obligation.

Whether you're an international entrepreneur setting up shop or a long-standing local business, taking advantage of the ✅ UAE Tax Benefits for International Entrepreneurs starts with getting compliance right from day one. As experts in both mainland and free zone company formation, we help businesses navigate these requirements with ✅ Cost-Effective Business Setup Solutions tailored to your needs. Our ✅ 24/7 support service is here to make sure you hit every deadline and sidestep these costly penalties.

Don't let a simple deadline turn into a AED 10,000 mistake. Let our team help you get it right.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

A Closer Look at Free Zone and Foreign Company Tax Rules

The UAE's corporate tax landscape isn't one-size-fits-all, especially when it comes to businesses set up in Free Zones or foreign companies with a local presence. Getting your head around these specific rules is the first step to a smooth and correct corporate tax registration, even if you end up with a zero tax liability.

What Free Zone Businesses Need to Know

If your business is based in one of the UAE's many Free Zones, you've probably heard the term “Qualifying Free Zone Person” (QFZP). This is a crucial designation. Achieving QFZP status allows your business to enjoy a 0% corporate tax rate on its qualifying income—a significant benefit.

But here's a point that trips many people up: this fantastic tax break doesn't mean you can skip registration. It's the other way around. Registration is mandatory for every single Free Zone entity. It's how you formally apply for and confirm your QFZP status with the authorities.

Make no mistake: registration is not optional. The Federal Tax Authority (FTA) mandates that every Free Zone business must register for corporate tax. This is how they assess your eligibility for the 0% rate. Skipping this step, even if you owe no tax, can result in penalties.

The Rules for International and Regional Operations

For international companies, the big question is whether you have a “Permanent Establishment” (PE) in the UAE. Think of a PE as a fixed base of operations—like a branch office or a management centre—from which you conduct business here. If your foreign company has a PE in Dubai, Abu Dhabi, or any other emirate, you're on the hook for UAE corporate tax and must register.

The regulatory web also extends across the region. For larger multinational groups, for example, the GCC has implemented strict frameworks like Country-by-Country (CbC) reporting. This requires extensive financial disclosures to promote tax transparency and highlights just how vital detailed, accurate record-keeping has become. If you're part of a larger international operation, it's worth digging into the details in this comprehensive MESA tax guide.

Sorting through these requirements for Free Zone and foreign entities can feel complex. As ✅ specialists in Mainland Company Formation in Dubai & Abu Dhabi and Free Zone setups, we offer practical, ✅ cost-effective business setup solutions designed for your specific business structure, all with ✅ 24/7 support.

Let's make sure your specialised registration is handled correctly from the start.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Is It Worth Handling Corporate Tax Registration Yourself?

While you can certainly tackle the UAE corporate tax registration on your own, the real question is whether that's the best use of your valuable time. The process seems straightforward, but a simple mistake—like declaring the wrong accounting period or misclassifying your entity type—can create major compliance headaches later on.

Getting professional guidance isn't just about avoiding errors; it's about gaining peace of mind. This is especially true if you're dealing with more complex structures, like a Free Zone Person or an international business with UAE ties. We’ve worked with countless businesses on both Mainland and Free Zone setups across Dubai, Abu Dhabi, and Sharjah, so we know exactly where the common pitfalls are. Our support lets you focus on what you do best: growing your business.

It's More Than Just Filling Out Forms

A smart business setup goes far beyond simply submitting the registration paperwork. It’s about strategically positioning your company to take full advantage of the ✅ UAE Tax Benefits for International Entrepreneurs. We make sure your registration isn't just compliant, but that it's also built for your long-term success.

Our support is designed around what you actually need:

- Customised Setup: We don’t do one-size-fits-all. We build business setup packages that align with your specific goals.

- Always on Hand: With our ✅ 24/7 support service, you can rest assured that we're here whenever a question comes up.

- Deep Expertise: Our specialisation in both ✅ Mainland and ✅ Freezone Company Formation means a seamless process from start to finish.

Getting your registration right the first time is crucial. It’s not just about avoiding inconvenience; it's about preventing costly and time-consuming fixes down the line. A solid foundation from day one makes all the difference.

As you get comfortable with your new obligations, looking into professional tax preparation services can also provide a clear roadmap for staying compliant in the future.

Let our team of experts handle the complexities for you.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Common Questions on UAE Corporate Tax Registration

When it comes to UAE corporate tax, a lot of business owners are understandably asking the same questions. Let's clear up a couple of the most frequent queries we hear from our clients.

What’s the Damage for Registering Late?

Don't miss your deadline. The Federal Tax Authority (FTA) has made it very clear that failing to register on time comes with a hefty penalty.

If you submit your application after your specific deadline—which is determined by the month your trade licence was issued—you're looking at a flat fine of AED 10,000. This is a significant and, frankly, completely avoidable cost. Pinpointing your deadline and getting the application in on time is crucial.

Do Free Zone Companies Genuinely Have to Register?

Yes, they do. This is a big one we see a lot of confusion around. Every single entity in the UAE, including those located in a Free Zone, must register for corporate tax. No exceptions.

Your business might very well qualify for the 0% tax rate as a "Qualifying Free Zone Person," but you can only claim that status after you’ve registered. Think of registration as the mandatory first step for everyone. Skipping it will lead to penalties, even if you ultimately owe no tax.

It's tempting to handle the registration yourself on the EmaraTax portal, but be careful. You're making legal and financial declarations that stick with your company. A simple mistake, like choosing the wrong entity type or accounting period, can create major compliance headaches later.

Getting an expert to handle it ensures everything is declared correctly from the start, especially if you have a more complex setup like a Free Zone company or international ownership. As the ✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we manage these registrations day-in and day-out, offering affordable solutions with ✅ 24/7 support.

Let the experts at 365 DAY PRO Corporate Service Provider LLC take this off your plate, ensuring your setup is smooth and fully compliant. WhatsApp Us Today for a Free Consultation.