Navigating corporate tax in the UAE is the new reality for every business owner. Since the federal regime kicked off on 1 June 2023, getting to grips with your obligations, registering with the Federal Tax Authority (FTA), and preparing for your annual tax return on the EmaraTax portal has become a critical part of running a company here.

Getting to Grips with the New UAE Corporate Tax Law

The introduction of a federal corporate tax is a massive shift for the UAE's business environment, bringing it in line with global standards. This move signals a change from the nation's long-standing tax-free reputation to a more structured system where nearly every business, big or small, has a role to play.

Whether you're operating on the mainland or in a free zone, understanding the fundamentals of this new law isn't optional. It’s been designed to keep the UAE competitive and attractive for investment while also building up national revenue.

To give you a quick overview, here are the core components you need to know:

UAE Corporate Tax At a Glance

This table breaks down the essentials of the UAE's new corporate tax system. It’s a handy reference for any business owner looking for a quick summary.

| Component | Key Detail |

|---|---|

| Who Pays Tax? | Any 'taxable person'—basically any legal entity or individual doing business in the UAE. This covers mainland and free zone companies. |

| The Tax Authority | The Federal Tax Authority (FTA) is in charge. They handle everything from administration and collection to enforcement. |

| The Online Portal | EmaraTax is the FTA's digital platform. All your tax activities, from registration to filing, happen here. |

| Tax Rate | 0% on taxable income up to AED 375,000. A standard 9% rate applies to any income above that threshold. |

Think of this as your starting point. Each of these components has nuances that we'll explore, but having a solid grasp of the basics is the first step.

Understanding the Tax Rates

One of the most talked-about features of the new law, Federal Decree-Law No. 47 of 2022, is the two-tiered tax rate. This structure is a game-changer for smaller businesses and startups.

Your taxable income up to AED 375,000 is taxed at 0%. That's a huge relief for SMEs. Anything over that amount is taxed at a flat 9%.

This competitive rate has clearly resonated with the business community. The FTA has already reported over 640,000 registrations, a testament to how quickly companies are adapting via the EmaraTax platform. You can read more about this record compliance and see how the business landscape is responding.

The real challenge isn't just about ticking the compliance box. It's about weaving this new financial obligation into the fabric of your business strategy. If you get ahead of it, you can manage your tax liabilities smartly and keep your business competitive.

First Things First: Your Tax Status and Registration

Before you even touch a tax form, the very first thing you need to do is figure out where your business fits into the new corporate tax landscape. Getting clear on your status as a 'Taxable Person' isn't just paperwork; it dictates your entire journey with corporate tax filing in the UAE, from whether you need to register to what you’ll eventually owe.

The net is cast pretty wide. If you’re a legal entity holding a commercial licence in the UAE—be it a Mainland LLC, a partnership, or even a sole trader—you’re almost certainly considered a Taxable Person. This means you have an obligation to engage with the Federal Tax Authority (FTA).

Are You a Taxable Person?

The law is designed to be comprehensive. If your company is a juridical person incorporated in the UAE, like a Limited Liability Company (LLC) or a Public Joint Stock Company (PJSC), then you are automatically a Taxable Person. It's that straightforward.

But it doesn't stop there. Even foreign companies can be pulled into the UAE tax system if they are effectively managed and controlled from within the country. The real question is: where are the big decisions being made? If the strategic, commercial, and management calls happen here, the FTA will likely view your business as subject to UAE corporate tax.

The Special Case of Free Zone Companies

This is where things get a bit more complex, and where many businesses trip up. While Free Zone entities are considered Taxable Persons, they can potentially become a 'Qualifying Free Zone Person' (QFZP). This is the goal for many, as it unlocks a 0% corporate tax rate on what's known as 'Qualifying Income'.

But getting and keeping QFZP status isn't automatic. You have to meet a strict set of conditions:

- Maintain adequate substance: You need a genuine office and staff, conducting your core business activities within the Free Zone. A brass plate on a door won't cut it.

- Derive Qualifying Income: This income must come from specific sources, like transactions with other Free Zone businesses or exporting goods and services.

- Meet De Minimis requirements: Your 'non-qualifying' income (like revenue from the mainland) can't exceed a specific, small threshold compared to your total revenue.

- Prepare audited financial statements: This is non-negotiable. Without an audit, you lose your QFZP status.

We've seen this happen time and again: a Free Zone company that primarily sells to Mainland customers assumes they'll get the 0% rate. They don't realise that this specific income stream is typically taxed at the standard 9%, even if they meet every other QFZP rule. It’s a costly oversight.

Getting Registered on the EmaraTax Portal

Once you've confirmed your status, your next move is to register on the FTA's digital platform, EmaraTax. This is your command centre for all things tax—from getting your Tax Registration Number (TRN) to filing your annual return. Don't put this off; the deadlines are firm, and the penalties for late registration are real.

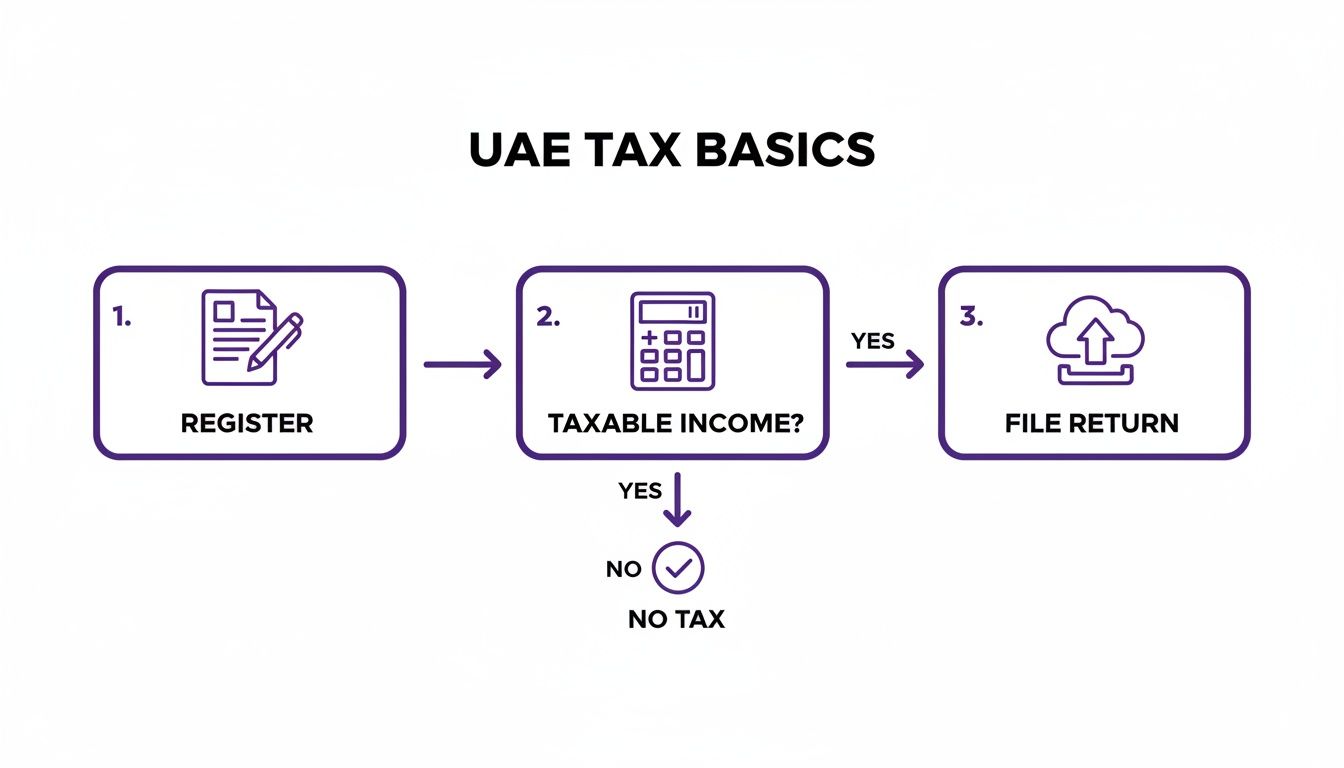

This flowchart gives you a bird's-eye view of the entire tax journey, showing how registration is the essential first step.

To make the process as painless as possible, get your documents in order before you start. You'll need:

- A copy of the company's trade licence

- Passport and Emirates ID copies of the owner(s) or partners

- Your company's contact details and physical address

- A copy of the Memorandum of Association (MOA)

Let's be honest, this can feel overwhelming, particularly if you're an international entrepreneur or have a more intricate setup with a Free Zone company. As specialists in both Mainland and Freezone company formation, we help businesses navigate these exact steps every single day. Our team makes sure your registration is done right and on time, giving you a solid foundation for compliance. We provide practical, cost-effective support with 24/7 availability, so you can focus on running your business, not worrying about tax forms.

Getting Your Financial House in Order

Getting corporate tax right in the UAE isn't a last-minute scramble. It’s the result of diligent, year-round financial record-keeping. The Federal Tax Authority (FTA) is crystal clear on this: your tax return needs to be backed by solid, verifiable evidence. This is where the theory of tax law meets the practical reality of daily business operations.

Think of your financial records as the complete story of your business's financial year. Every invoice, expense, and transaction is a crucial part of that narrative. The FTA wants to be able to read this story from start to finish, and they expect it to be accurate and ready for inspection at any time.

The Must-Have Document Checklist

The FTA requires businesses to maintain a specific set of financial records, and this isn't just good practice—it's a legal obligation under Article 56 of the Corporate Tax Law. Missing documents can lead to hefty penalties, even if your tax calculations turn out to be spot-on.

Here’s a practical breakdown of what your finance team should be keeping meticulously organised:

- Core Financial Statements: Your Balance Sheet, Profit and Loss Statement, and Cash Flow Statement are non-negotiable. They must be prepared according to International Financial Reporting Standards (IFRS).

- Invoices and Receipts: Keep everything. Every sales invoice you issue, every purchase invoice you receive, and every receipt for expenses—from major equipment down to minor office supplies.

- Contracts and Agreements: Any legal document with a financial component needs to be on file. This includes client contracts, supplier agreements, tenancy contracts, and loan agreements.

- Bank Records: All business bank account statements are essential for reconciling your books and proving the flow of cash. For businesses with a high transaction volume, tools like bank statement converter software can be a lifesaver for digitising and organising this data efficiently.

A critical point many overlook is the retention period. The law is explicit: you must keep all these records for a minimum of seven years after the end of the tax period they relate to.

When Do You Need Audited Financials?

Not every business needs to bring in a certified public accountant for a formal audit, but you absolutely need to know the triggers. An audit requirement is a major compliance step that needs planning.

The main trigger is revenue. If your company's revenue tops AED 50 million in a tax period, audited financial statements become mandatory. Additionally, any Qualifying Free Zone Person must have their financials audited—regardless of revenue—to keep their coveted 0% tax rate.

My advice? Don't wait until you're nearing the AED 50 million threshold to think about an audit. Engaging an auditor early helps establish strong financial governance and makes the official audit process far less painful when it becomes mandatory.

Setting Up Your Accounts for a Painless Tax Season

Good organisation isn't just about staying compliant; it makes your life exponentially easier when it's time to file your tax return. When your accounts are set up correctly from the start, you can accurately calculate taxable income, spot all eligible deductions, and sidestep costly errors.

One of the most common trip-ups I see is the confusion between capital and revenue expenditure.

- Capital Expenditure: This is money spent on major assets that will benefit the business for a long time, like a new vehicle, machinery, or an office fit-out. You can't deduct the full cost at once; instead, it's depreciated over the asset's useful life.

- Revenue Expenditure: These are your everyday running costs—think salaries, rent, utilities, and marketing. These are typically fully deductible in the year you pay them.

For example, buying a new delivery van is a capital expense. The fuel you put in it each month is a revenue expense. Getting these mixed up can seriously skew your taxable profit.

Likewise, if you have transactions between related companies (inter-company transactions), you need specific documentation to meet Transfer Pricing rules. You must be able to prove that the prices you charge each other are fair "arm's length" prices, just as you would with an unrelated customer. This means having clear invoices, internal agreements, and a documented pricing policy ready to show.

By structuring your chart of accounts to clearly separate these categories from day one, you’ll be able to generate tax-ready reports without the headache, turning a daunting annual task into a straightforward, manageable process.

Calculating and Submitting Your Tax Return

With your financial records organised, it’s time to get down to the numbers. The core task is to determine your taxable income by subtracting all your deductible expenses from your total revenue. This final figure is what your corporate tax liability is built on.

Working Out Your Taxable Income and Deductible Expenses

First, you’ll need to tally up every stream of revenue your business generated during the tax period. This could be anything from sales and service fees to rental income. Once you have that total, you can start identifying the expenses you’re allowed to deduct.

Typically, these include:

- Operating costs like office rent, utility bills, and employee salaries.

- Marketing and advertising spend, as long as you have the receipts to back it up.

- Professional fees for services from consultants, lawyers, or auditors.

Think of it this way: if your e-commerce business brought in AED 1.2 million in sales but paid out AED 600,000 in wages, those wages are fully deductible. Getting these categories right is crucial; it prevents you from either underpaying or overpaying your tax.

The bedrock of an error-free tax return is the accurate classification of your revenues and costs. Don't rush this part.

Navigating Special Adjustments and Non-Deductible Costs

Some expenses aren't as straightforward and need a closer look before you finalise your calculations. The FTA has specific rules for certain costs, and you need to be aware of them.

Here are a few big ones to watch out for:

- Entertainment and hospitality adjustments

- Interest expense capping as per Article 17

- Disallowed items like government fines, penalties, and purely personal expenses

For example, if you spent AED 50,000 on client entertainment, you can only deduct the first AED 20,000. Similarly, interest capping rules limit how much you can deduct for borrowing costs to 30% of your EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortisation). Make sure you keep all loan agreements handy to justify your interest claims and set aside any receipts for fines – they can’t be deducted.

| Adjustment Type | Deductible Limit | Documentation Required |

|---|---|---|

| Entertainment | AED 20,000 | Itemised invoices and guest list |

| Interest Capping | 30% of EBITDA | Loan agreements and bank statements |

| Fines & Penalties | None | Excluded from expense ledger |

Getting to Grips with the EmaraTax Portal

With your numbers finalised, you’re ready to tackle the EmaraTax portal. The online form is designed to be user-friendly, breaking down the return into clear sections for income, deductions, and a final summary. Each field even has helpful tooltips to guide you.

- Start by entering your TRN (Tax Registration Number) correctly at the top.

- Your taxable income goes into field C3 under the gross revenue section.

- Any special adjustments you made should be declared in field D4, along with any reference numbers.

After you’ve calculated your return, a key concern is the secure and efficient distribution of information to regulatory authorities. This is especially important when handling sensitive financial data, and it pays to understand best practices for compliance and data protection.

Final Submission and Payment Timeline

Before you hit submit, the portal will show you a declaration screen with a summary of your return. Double-check the taxable income and the total tax due. Once you're confident everything is correct, click Submit. The clock then starts: payment is due within 30 days of this submission.

- You can pay via bank transfer, credit card, or the e-Dirham system.

- Always save a copy of the payment acknowledgement for your records.

- Be aware that late payments attract interest at 1% per month, so it’s best to be on time.

A Real-World Filing Example

Let’s look at an Abu Dhabi-based consultancy. They billed AED 2 million for the year. Their expenses included AED 800,000 in staff costs, AED 50,000 in client entertainment, and AED 100,000 in interest on a business loan.

After applying the capping rules for entertainment and interest, their final taxable income was AED 1,050,000. At the 9% corporate tax rate, their tax liability came to AED 94,500. They uploaded their supporting documents directly to the portal and had the whole submission done in less than 10 minutes. The instant PDF acknowledgement from EmaraTax was filed away, giving them clear proof of a timely submission.

Why Choose Us

- ✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

- ✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

- ✅ Specialists in Freezone Company Formation across the UAE

- ✅ 24/7 Support Service – Always here when you need us

- ✅ Cost-Effective Business Setup Solutions tailored to your needs

- ✅ Enjoy UAE Tax Benefits for International Entrepreneurs

By following these steps with care, you can handle your UAE corporate tax filing with confidence. Our specialists are ready to guide you through every calculation and click.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Don't Miss the Deadline: A Guide to Timelines and Penalties

Getting your numbers right is only half the battle. When it comes to UAE corporate tax, timing is everything. The Federal Tax Authority (FTA) has set firm deadlines, and missing them can lead to a world of financial pain and compliance issues that are hard to shake off.

Mark your calendar: your corporate tax return and payment are due nine months after the end of your financial year. It’s a hard deadline. So, if your business follows a standard calendar year ending on 31 December, your submission and payment must be completed by 30 September of the following year.

The Real Cost of Getting it Wrong

The FTA isn't lenient when it comes to non-compliance. The penalties are designed to be a serious deterrent, not just a slap on the wrist. They want to make sure every business takes its tax obligations seriously.

Ignoring the rules can set off a chain reaction of fines:

- Late Registration: The very first misstep you can make is failing to register for corporate tax on time. It's an easily avoidable penalty, but one that catches many out.

- Late Filing: If you submit your return after the nine-month window closes, you'll face a penalty for every month (or part of a month) that it's overdue.

- Late Payment: Filed on time? Great. But if the payment doesn't also arrive by the deadline, a separate set of penalties will start to accumulate.

These fines can snowball, quickly turning what was a manageable tax bill into a significant financial headache.

Tackling the Tricky Stuff: Transfer Pricing and Tax Groups

Once you've got the basics down, you might find yourself dealing with more complex rules. For many businesses, Transfer Pricing and the option to form a Tax Group are two of the biggest hurdles. These areas demand specialised expertise and meticulous records.

What is Transfer Pricing?

If your company does business with ‘Related Parties’ – think sister companies, a parent entity, or even major shareholders – then you need to know about Transfer Pricing. The fundamental rule is that every transaction must happen at "arm's length." In simple terms, you have to charge the same price you would if you were dealing with a completely independent, third-party company.

You'll need to keep detailed documentation, including a master file and a local file, to prove your pricing is fair. If the FTA decides your pricing isn't at arm's length, they can recalculate your taxable income, which almost always means a higher tax bill and potential penalties.

Should You Form a Tax Group?

Do you have a parent company with several subsidiaries in the UAE? Forming a Tax Group could be a smart move. It allows the entire group to file one consolidated tax return, which can simplify the administrative process. To qualify, the parent company must own at least 95% of the share capital and voting rights in its subsidiaries. While it streamlines compliance, it comes with its own set of strict rules that must be followed perfectly.

Navigating the complexities of Transfer Pricing and Tax Group rules is where professional advice becomes invaluable. A small error in these areas can have major financial consequences. As specialists in mainland and free zone company formation across Dubai, Abu Dhabi, and Sharjah, we've seen where things can go wrong and know how to structure businesses for watertight compliance.

The Bigger Picture: How Global Tax Rules Affect the UAE

For large multinational enterprises (MNEs) operating here, compliance doesn't stop at the UAE's borders. The country has aligned with the OECD's Pillar Two framework, which aims to establish a global minimum tax rate.

As part of this, the UAE introduced a Domestic Minimum Top-up Tax (DMTT). This applies a 15% minimum effective tax rate for MNEs with consolidated annual revenues over EUR 750 million. So, while the UAE's headline corporate tax rate is 9%, massive MNEs might need to top up their tax to hit that 15% mark if their global effective rate falls short. You can learn more about these global tax developments to understand their full impact.

It’s a clear sign that staying compliant means keeping an eye on both local regulations and the international tax landscape. With our 24/7 support, our team is always on hand to help you make sense of these advanced and ever-evolving topics.

Getting It Right the First Time: Why Expert Help Matters

Let's be honest: navigating the UAE's new corporate tax landscape can be a real headache. One missed detail or misunderstood rule can quickly lead to hefty penalties, and nobody wants that. This is where bringing in a seasoned corporate service provider can make all the difference, taking the weight of compliance off your shoulders.

Think of it as having a dedicated tax team in your corner. The process usually starts with a deep dive into your specific situation – are you on the mainland? In a free zone? What are your unique obligations? From there, an expert will manage your entire FTA registration, making sure every document is perfect before it's submitted. They'll then handle the nitty-gritty of bookkeeping, calculate your tax liability with precision, and ensure your return is filed well before the deadline.

The real value, though, comes from their specialised knowledge. Understanding the subtle but crucial differences between mainland and free zone regulations is key to avoiding compliance traps and making the most of any available tax benefits. It’s about being proactive, not just reactive.

Choosing the right partner isn't just about outsourcing paperwork. It's an investment in your peace of mind. You get a team dedicated to protecting your company's financial health, freeing you up to do what you do best: grow your business.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we're here to offer practical, affordable solutions backed by 24/7 support. If you'd like to see how we can make your corporate tax filing straightforward, let's have a chat.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Your UAE Corporate Tax Questions Answered

Even with the best preparation, you're bound to have questions about filing corporate tax in the UAE. It’s completely normal. Here, I'll tackle some of the most common queries we get from business owners, giving you straightforward answers to help you handle your obligations with more confidence.

Does Every Company in the UAE Need to File a Corporate Tax Return?

The short answer is yes, pretty much every business with a commercial licence has to register for corporate tax and file a return each year.

This is a big one that catches people out: you must file even if your taxable income is below the AED 375,000 threshold. Filing a return is mandatory, whether you owe tax or not. This applies to companies on the mainland and in free zones alike.

Think of it this way: the requirement to file is separate from the requirement to pay. Skipping the submission of a 'nil' return can still land you with penalties from the Federal Tax Authority (FTA). Only a handful of organisations, like government bodies or those in natural resource extraction, are typically exempt.

What Is a Qualifying Free Zone Person for Tax Purposes?

This is where things get interesting. A mainland company pays the standard 9% corporate tax on taxable income over AED 375,000. But a 'Qualifying Free Zone Person' (QFZP) can get a 0% tax rate on their 'Qualifying Income'.

It's a fantastic benefit, but you have to earn it by meeting some very strict conditions:

- Real Substance: You need a genuine physical presence and must be doing your main business activities inside the free zone.

- Qualifying Income: Your income has to come from specific sources, like doing business with other free zone companies.

- No Opt-Out: You can't have chosen to be treated like a mainland company for tax purposes.

If any of your income doesn't meet these 'qualifying' rules, it gets taxed at the standard 9% rate. It's not an all-or-nothing deal for your entire business, but you have to get the details right.

What Common Mistakes Should I Avoid During Tax Filing?

From what I’ve seen, the most frequent slip-ups come from messy bookkeeping. It's the root cause of inaccurate calculations. Another classic mistake is simply missing the deadline, which is nine months after your financial year ends.

I also see businesses struggle with classifying expenses correctly—what’s deductible and what isn’t—and getting tangled up in the Transfer Pricing rules for deals between related companies.

A critical mistake, and one that happens right at the start, is failing to register for corporate tax on time. That single oversight comes with its own penalties before you've even started the filing process.

The simplest way to steer clear of these expensive errors is to work with someone who handles corporate tax filing in the UAE every day.

Getting UAE corporate tax right takes real expertise and attention to detail. We offer specialised support for both mainland and free zone companies, making sure your business stays compliant without the headache. Our team is here to provide practical, cost-effective solutions and 24/7 support so you can enjoy all the tax advantages of being an international entrepreneur.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation: https://365dayproservices.com