Think of the Certificate of Incorporation UAE as your company's official birth certificate. It’s the foundational legal document, issued by the relevant government authority, that proves your business officially and legally exists in the United Arab Emirates.

Quite simply, without it, you're not in business. You can't open a corporate bank account, you can't sign contracts, and you certainly can't hire employees. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we've guided countless entrepreneurs through this critical first step.

What Exactly Is a UAE Certificate of Incorporation?

This certificate is far more than just a piece of paper; it's the cornerstone of your entire business venture in the UAE. It confirms that your company has been properly formed under the country's laws and is recognised as its own legal entity, completely separate from its owners.

That separation is a huge advantage. It creates a protective barrier for shareholders and directors, separating their personal assets from the company's debts and legal responsibilities. It’s one of the key reasons the UAE is such a magnet for entrepreneurs from around the globe.

This certificate is non-negotiable, regardless of where you set up shop. Whether you're undertaking a Mainland company formation in Dubai or Abu Dhabi or choosing one of the UAE's many dynamic Free Zones, this is your first official milestone. The specific authority that issues it depends on your jurisdiction—it could be the Department of Economic Development (DED) for a Mainland company or the relevant Free Zone authority.

Your Business's Passport to Operate

If the birth certificate analogy doesn't click, try this: think of the certificate as your company's passport. An individual needs a passport to travel, access services, and prove who they are. Your company needs its Certificate of Incorporation for the very same reasons.

Here’s what it unlocks:

- Legal Operations: It’s the ultimate proof that you have the right to conduct business.

- Corporate Banking: No bank will even talk to you without seeing proof of your legal registration.

- Visa Processing: It’s a mandatory document when applying for visas for your staff, directors, and their families.

- Contractual Agreements: It gives your company the legal capacity to enter into binding agreements with clients, suppliers, and partners.

The details printed on the certificate are your company's identity. Your official name, registration number, legal structure, and approved business activities are all spelled out, defining the scope of what you can do and your initial compliance responsibilities.

Breaking Down the Key Information

Every Certificate of Incorporation contains crucial pieces of data that define your company's legal identity. Understanding what each element means is vital for smooth operations.

| Information Element | What It Means for Your Business |

|---|---|

| Company Name | Your official, registered name. You must use this exact name on all legal documents and contracts. |

| Registration Number | A unique identifier assigned by the authority. Think of it as your company's ID number. |

| Date of Incorporation | The official "birth date" of your company, marking the start of its legal existence. |

| Type of Company (Legal Structure) | Specifies if you are an LLC, FZCO, etc. This dictates your liability, ownership rules, and compliance requirements. |

| Registered Address | The official physical address of your company. All official correspondence will be sent here. |

| Issuing Authority | Identifies the government body that registered your company (e.g., DED, specific Free Zone authority). |

This information isn't just for show; it's the data that banks, government agencies, and business partners will use to verify your company's legitimacy.

Defining Your Legal Structure

The UAE's legal framework is very specific about the types of company structures you can establish. With the introduction of the new Federal Law No. 32 of 2021 on commercial companies, every local business must adopt a recognised legal form.

Since this law came into effect, the Limited Liability Company (LLC) has become the go-to choice for foreign investors, accounting for roughly 80% of new incorporations. You can dive deeper into these corporate laws by reviewing the official legislative guides.

Getting these foundational details right from the start is critical. One small mistake in your documentation can lead to significant delays and unexpected costs. This is precisely why working with a specialist who offers cost-effective business setup solutions can be a game-changer, ensuring a smooth and error-free start to your UAE journey.

Navigating the New Rules of UAE Company Formation

The landscape for setting up a business in the UAE has changed dramatically in recent years. If you're looking to get a certificate of incorporation UAE, you need to know that the rulebook isn't what it used to be. Major regulatory shifts have completely reshaped the environment, affecting everything from who can own a company to how its finances are handled.

For any international entrepreneur or investor, getting a handle on these updates is absolutely crucial. We're not talking about minor tweaks here. Two developments in particular have been game-changers: the introduction of a federal Corporate Tax and the opening up of foreign ownership laws. These represent a fundamental shift in how business gets done in the Emirates.

Think about it: just a few years ago, the idea of a federal tax on profits was completely alien to the UAE's business model. Now, it's a central part of the country's economic strategy and something every new company has to deal with from day one.

The Impact of the New UAE Corporate Tax

The arrival of the UAE Corporate Tax in June 2023 was a truly massive milestone. This isn't just another piece of paperwork; it introduces a whole new layer of financial and compliance duties that are directly linked to your company’s legal status—the very status confirmed by your certificate of incorporation.

Key Takeaway: Getting your certificate of incorporation is no longer just a license to operate. It’s your official entry ticket into a new federal tax system. From the moment your company legally exists, it has specific financial responsibilities you need to manage from the get-go.

So, what does this mean in practice? The law brings in a 9% federal tax on business profits that exceed AED 375,000. While that threshold means many smaller startups might not pay tax right away, they still have to register and, critically, keep perfect financial records to prove it. This need for robust, day-one accounting is a huge change for new businesses.

A New Era of 100% Foreign Ownership

The other transformative change has been to the foreign ownership laws for Mainland companies. For decades, if you wanted to operate on the UAE Mainland, you almost always needed a local Emirati sponsor holding a majority (51%) stake in your business.

That requirement is now largely a thing of the past. Today, international investors can enjoy 100% foreign ownership for a huge list of business activities right on the Mainland, including in major hubs like Dubai and Abu Dhabi. This has opened the floodgates for global entrepreneurs who want direct access to the local UAE market without needing a local partner, making Mainland company formation in Dubai and Abu Dhabi more appealing than ever.

This reform essentially brings Mainland setups closer to the long-standing 100% ownership model found in Free Zones, giving investors far more choice and control. The boom in foreign investment since this change speaks for itself.

These shifts have had a ripple effect across the board. The Corporate Tax introduction in June 2023, with its 9% tax on profits over AED 375,000, has been a major factor. In fact, around 94% of UAE businesses have reported that compliance has become more complex. On the flip side, foreign investment approvals jumped by an incredible 67% after the ownership rules were relaxed. However, corporate legal compliance costs also climbed by about 23%, a clear sign that more detailed documentation is needed to stay on the right side of the law. You can dive deeper into these legal shifts and their effects on compliance trends on kayrouzandassociates.com.

Why Expert Guidance Is Now Essential

Trying to navigate this new terrain on your own can be risky. Today’s certificate of incorporation represents a commitment to a much more sophisticated legal and financial framework than ever before.

Here’s where getting expert support really pays off:

- Tax Registration: We make sure you’re properly registered with the Federal Tax Authority (FTA) from the very beginning, avoiding any early missteps.

- Compliance Strategy: We help you build your accounting practices to be fully compliant with Corporate Tax rules right out of the gate.

- Structure Optimisation: We can give you practical advice on whether a Mainland or Free Zone company best fits your specific business goals under these new regulations.

With our 24/7 support service, you're never left guessing about your obligations. Working as specialists in Mainland and Freezone Company Formation across the UAE ensures you don't just get your certificate, but you're also set up for compliant, long-term success from day one.

Choosing Your Path: Mainland vs. Free Zone Setup

Before you can even think about your certificate of incorporation in the UAE, you'll hit a fork in the road. This first, critical decision—choosing between a Mainland and a Free Zone setup—will define almost every aspect of your business, from who you can sell to and your ownership structure to your day-to-day operations.

Think of it this way. A Mainland company is like buying a rugged 4×4. It gives you the keys to the entire country, allowing you to drive anywhere, set up shop on any street, and do business directly with anyone in the local UAE market. In contrast, a Free Zone company is more like a high-speed bullet train. It’s incredibly efficient for travelling between specific international hubs but operates on a dedicated track, separate from the local road network.

Your choice here isn't just a box-ticking exercise; it's a long-term strategic move. It dictates your operational freedom, compliance duties, and ultimately, your ability to grow. Getting this right from day one is essential, and that starts with truly understanding what sets these two powerful options apart.

The Case for a UAE Mainland Company

A Mainland company, registered directly with the Department of Economic Development (DED) in its emirate, is the classic route for doing business within the UAE. As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we see this as the go-to option for anyone looking to truly embed themselves in the local economy.

The undisputed champion feature of a Mainland setup is total market access. You can trade with any other business or customer anywhere in the UAE, from Abu Dhabi to Fujairah, with zero restrictions. Crucially, it also unlocks the ability to bid on lucrative government contracts—a massive market segment completely off-limits to most Free Zone companies.

So, if you dream of opening a boutique coffee shop in the heart of Dubai or a retail store in a bustling Sharjah mall, a Mainland licence isn't just an option; it's a necessity. It gives you the freedom to set up a physical presence and expand across the Emirates without any intermediaries.

The Allure of a UAE Free Zone Company

On the other side of the coin, you have the UAE's many Free Zones. These are special economic areas, each with its own independent governing authority and rules. For international entrepreneurs, Free Zones roll out the red carpet with a package of benefits that are hard to ignore.

The headline attraction has always been 100% foreign ownership, a benefit Free Zones championed long before the Mainland followed suit. This gives you complete control over your company without needing a local partner. On top of that, many Free Zones offer guaranteed 0% corporate and personal income tax exemptions for decades, which is a major incentive for global businesses.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we often steer clients with global operations towards a Free Zone. It's the perfect structure for an international consulting firm, a tech startup serving the wider region, or an e-commerce business shipping goods worldwide.

The process of getting a certificate of incorporation in the UAE is well-defined in both jurisdictions. Mainland companies register with the DED and almost always need a physical office lease registered with Ejari. Free Zones—and there are over 40 of them—offer faster setups and full foreign ownership but typically limit you to trading within the zone or internationally. For more detail, you can find out how these jurisdictions differ by exploring company formation rules on statrys.com.

A Practical Head-to-Head Comparison

To make the choice crystal clear, let's put them side-by-side. This simple breakdown will help you match your business model to the right jurisdiction.

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE local market, including government tenders. | Restricted to operating within the Free Zone and internationally. Requires a local agent for Mainland trade. |

| Ownership | 100% foreign ownership is now available for most commercial and industrial activities. | 100% foreign ownership has always been the standard and is a core benefit. |

| Office Space | A physical office registered with Ejari is typically a mandatory requirement. | Flexible options available, including virtual offices, flexi-desks, and shared spaces. |

| Visas | Visa eligibility is generally more flexible and not strictly tied to office size. | The number of visas is often directly linked to the size of the office space leased. |

| Tax Benefits | Subject to the standard 9% UAE Corporate Tax on profits over AED 375,000. | Often offers a 0% corporate tax guarantee for a renewable period (e.g., 50 years). |

Ultimately, the right path is dictated entirely by your business plan. We provide cost-effective business setup solutions that are built around your specific needs, ensuring your company’s structure is a perfect fit for your long-term vision. And with our 24/7 support service, we're always here to help you weigh the pros and cons for your unique venture.

Your Step-By-Step Incorporation Playbook

Getting your certificate of incorporation in the UAE isn't a mad dash to the finish line; it’s a methodical process. I always tell my clients to think of it like building a custom home. You wouldn't start hammering without a solid blueprint, and the same principle applies here. This playbook is that blueprint, breaking down the entire journey into clear, manageable stages so you know exactly what’s coming next.

Before you even start, it's a smart move to run through a comprehensive due diligence checklist. This is your foundation—it helps you spot potential issues and make sure all your bases are covered before you commit time and money.

Phase 1: The Strategic Foundation

This first phase is all about the big-picture decisions that will define your company for years to come. Getting these right from the outset is absolutely crucial, as they set the rules of the game for your entire business operation.

-

Select Your Business Activity: First things first, what will your company actually do? You need to be specific here. Your chosen activity has to align perfectly with the official lists provided by the governing authority, whether that's the Department of Economy and Tourism (DET) for a Mainland business or a specific Free Zone authority. This decision directly influences the type of licence you get and whether you'll need approvals from other government bodies.

-

Choose Your Legal Structure: Are you setting up as a Limited Liability Company (LLC), a Free Zone Company (FZCO), or another entity type? This choice has major implications for your personal liability, the rules around ownership, and even how you'll be taxed.

-

Reserve Your Trade Name: Your company name is more than just a brand; it’s a legal asset. You have to get a unique name approved and registered. It needs to comply with UAE naming conventions—nothing offensive, nothing that violates public morals, and it can't be too similar to an existing company's name.

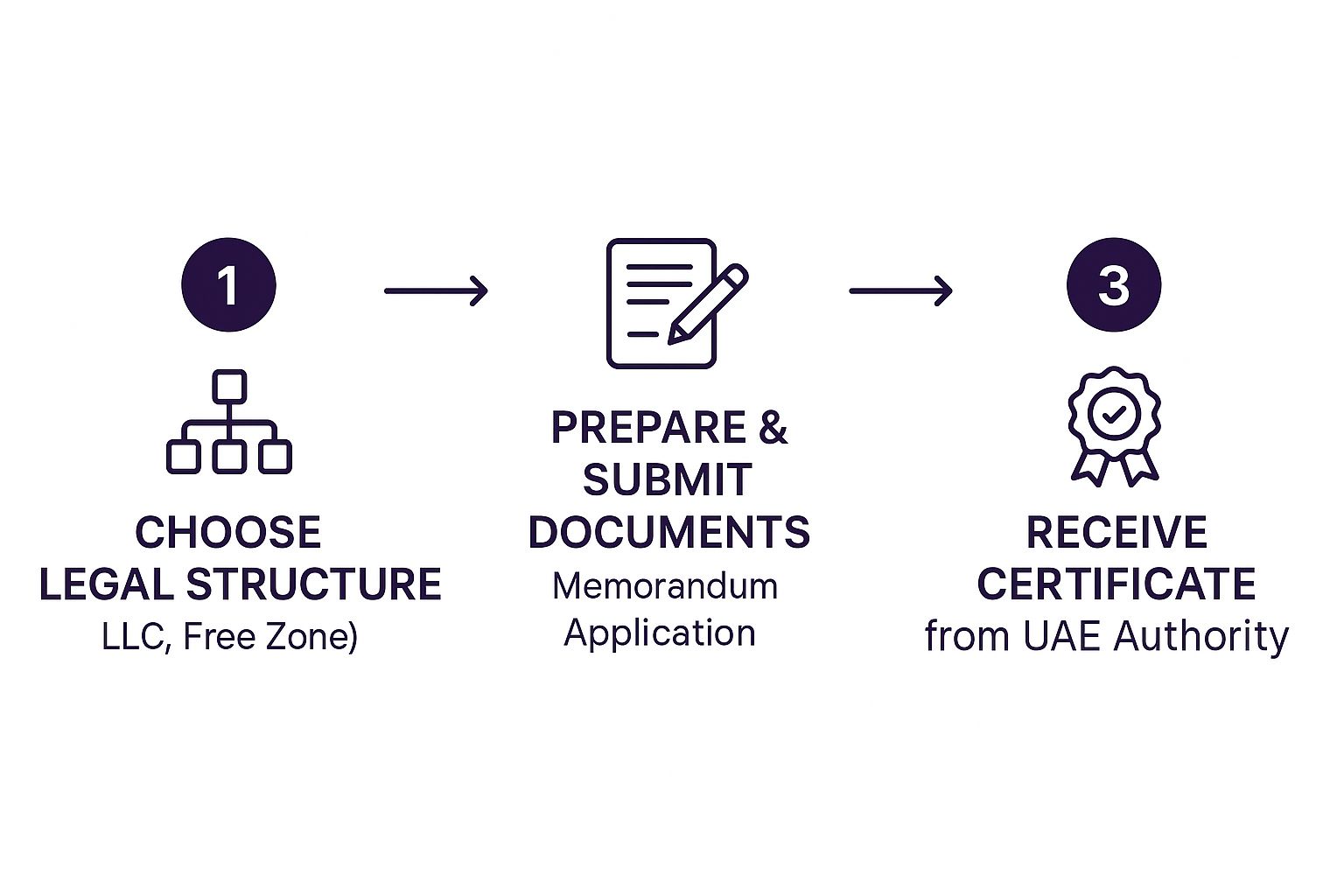

This infographic really simplifies the core journey, showing how you move from planning to paperwork to the final prize.

As you can see, it boils down to three pillars: smart strategic choices, careful paperwork, and official approvals.

Phase 2: Document Preparation and Initial Approvals

With your strategy locked in, it’s time to hit the paperwork and get the initial green light. This stage is all about precision—one small mistake here can cause significant delays.

Your first official step is applying for Initial Approval. Think of this as a "no objection" certificate from the authorities. It basically confirms they're happy with your proposed business and gives you the go-ahead to proceed with drafting your legal documents and securing an office.

Next up is creating your company's foundational legal paperwork. The single most important document here is the Memorandum of Association (MOA).

The MOA is effectively your company's constitution. It lays out everything from your business objectives and share capital to who the shareholders are and how the company will be managed. This document needs to be drafted perfectly and, in most jurisdictions, notarised by a public notary in the UAE.

Once your MOA is signed and sealed, you'll need a physical address. For a Mainland company, this means leasing a commercial space and getting your Ejari (the official lease registration certificate). In a Free Zone, you might have more flexible options, from a full-fledged office to a simple desk space.

Phase 3: Final Submission and Certificate Issuance

You're on the home stretch now. The final phase involves pulling everything together, submitting your complete application, and making the required payments. From our experience as specialists in Mainland and Freezone Company Formation across the UAE, this is where having all your ducks in a row really pays off.

You will assemble and submit your final application package, which generally includes:

- The signed application form

- The Initial Approval Certificate

- Your notarised Memorandum of Association (MOA)

- Passport copies for all shareholders and managers

- The tenancy contract for your office (Ejari)

- Any additional approvals required for your specific business activity

After submission, you'll get a payment voucher for the government fees. Once that's paid, the authorities conduct their final review. Assuming all your documents are in order, they will issue your Trade Licence, and along with it, your official certificate of incorporation in the UAE.

This certificate is the ultimate proof of your company's legal existence—it's the key that unlocks your ability to do business in the Emirates.

The Paperwork and Costs: What to Expect

Getting your certificate of incorporation in the UAE is an exciting step, but it's one that hinges on meticulous preparation. Let's be honest, nobody wants their business launch held up because of a missing document or an unexpected fee. Think of this section as a chat with someone who's been through it all—a straightforward look at the documents you'll need and a realistic breakdown of the costs.

Getting your paperwork in order first is like gathering all your ingredients before you start cooking. With everything on hand, the process is smooth. If you miss something, you'll be scrambling mid-way through.

Your Document Checklist for Incorporation

To get that all-important certificate, you'll need to submit a specific file of documents to the authorities. The exact list can change slightly depending on whether you're setting up on the Mainland or in a Free Zone, but here are the core items you'll almost always need.

For the People Involved (Shareholders & Managers):

- Passport Copies: Clear, valid copies for every single person who will be a shareholder or manager.

- Visa and Emirates ID Copies: This applies to anyone who is already a UAE resident.

- Passport-Sized Photos: Make sure they meet the specific requirements for background colour (usually white) and size.

For the Business Itself:

- The Application Form: This is the official registration form from the governing body, whether it's the Department of Economic Development (DED) for the Mainland or the specific Free Zone authority.

- Trade Name Reservation: This is your proof that the business name you want has been approved and is held for you.

- Initial Approval Certificate: Essentially a "no-objection" letter from the authorities, giving you the green light to move forward.

- Memorandum of Association (MOA): This is a critical legal document. It spells out who owns what, what your business will do, and how it’s structured. It needs to be drafted perfectly and, for most setups, notarised.

- Tenancy Contract (Ejari): For Mainland companies, you must have proof of a physical office lease. Free Zones often have their own lease agreements for their specific office packages.

Having these documents ready to go is the single biggest thing you can do to avoid frustrating delays. As specialists in Mainland and Freezone Company Formation across the UAE, we help clients get their paperwork right the first time, every time.

Breaking Down the Cost of Incorporation

Budgeting properly for your company setup is non-negotiable. The costs generally fall into two buckets: government fees and other related expenses. Once you understand these, you can map out your finances without any guesswork. We focus on providing cost-effective business setup solutions by making sure you see these costs upfront.

A Quick Heads-Up: The final bill will really depend on your specific choices—your jurisdiction (Mainland or Free Zone), your business activity, the legal form of your company, and your office needs. The numbers below are solid estimates to help you start planning.

To give you a clearer picture, here’s a table comparing the estimated costs for a typical Mainland setup versus a Free Zone registration.

Estimated Cost Breakdown for UAE Company Incorporation

This table offers a general overview of the fees you can expect when incorporating your company in the UAE.

| Fee Component | Estimated Cost (Mainland) | Estimated Cost (Free Zone) | Important Notes |

|---|---|---|---|

| Trade Name Reservation | AED 600 – AED 2,000+ | Included in Package / AED 500+ | The cost can go up if you choose a special or non-Arabic name. |

| Initial Approval | AED 150 – AED 250 | Included in Package | This is a standard fee for the initial "no-objection" from the authorities. |

| Trade Licence & Govt Fees | AED 15,000 – AED 30,000+ | AED 10,000 – AED 25,000+ | This is the biggest fee and varies significantly based on your activity. |

| Notarisation of MOA | AED 500 – AED 2,000 | Varies by Free Zone | A must for most Mainland companies and some Free Zones. |

| Office/Lease Fees | Varies Widely | Included in Package (Flexi-Desk) | Mainland setups need a physical office. Free Zones offer cheaper flexi-desk options. |

| Service Provider Fees | Varies | Varies | These are the fees for professional help to ensure the whole process is handled correctly. |

Mapping out your finances with these estimates in mind helps you avoid any nasty surprises down the road. Our commitment is to offer completely transparent pricing and packages that fit your actual needs, ensuring you get fantastic value. For a precise quote based on your unique business plan, our team is always here to help.

So, You Have Your UAE Certificate of Incorporation. What Now?

Holding that new certificate of incorporation in the UAE feels fantastic. It's a huge milestone, but it's not the finish line. It's really the starting pistol. Your company is now legally real, but the work to get it operational is just beginning.

I often tell clients to think of it like getting the keys to a new house. Sure, the property is yours, but you can't live in it just yet. You still need to hook up the water and electricity, move in your furniture, and get things arranged. It's the same with your new company; a few crucial setups are needed before you can actually trade, hire staff, or make any money.

Turning Your Company On

Your first job is to get the practical tools you need to do business. That certificate is the master key, but now you have to unlock several other doors. This means tackling a sequence of administrative and legal tasks that bring your registered company to life.

Right out of the gate, you’ll need to handle these:

-

Apply for an Establishment Card: This is an absolute must-do. The Establishment Card is a small plastic card from the immigration authorities that officially registers your business with them. Without it, you can't hire anyone or process a single visa—not for yourself, your partners, or any employees.

-

Open a Corporate Bank Account: You can't run business transactions through a personal account; it’s not compliant. You must open a dedicated corporate bank account in your company's name. Be prepared, as UAE banks have very thorough "know your customer" procedures. They'll need to see your certificate of incorporation, trade licence, Memorandum of Association (MOA), and details on all the shareholders.

-

Process Visas: Once you have the Establishment Card, you can start applying for residency visas for the company's owners and any staff you plan to hire. This isn’t a one-day affair; it involves medical tests and biometrics, so it pays to get the ball rolling quickly. As specialists in Freezone Company Formation across the UAE, we see this as a critical step for getting the right people on board.

Your New World of Compliance

Getting that certificate also means you've officially stepped into a new role with ongoing responsibilities. The UAE requires businesses to stay on top of their compliance to keep their good standing. Let these things slide, and you could be looking at serious fines or even disruptions to your business.

The moment your company is born, so are your responsibilities. This includes registering for taxes, even if you don't think you'll owe anything right away. Getting ahead of these obligations is one of the smartest things you can do for your long-term success.

The two big compliance items you need to tackle immediately are:

-

VAT Registration: If you expect your company's annual revenue to cross the AED 375,000 threshold, you are legally required to register for Value Added Tax (VAT) with the Federal Tax Authority (FTA).

-

Corporate Tax Registration: This one is for everyone. All companies in the UAE must register for Corporate Tax with the FTA, no matter what their income is. It’s a mandatory step, and there are penalties for not doing it.

Thinking about these things from day one ensures you're ready for the full journey. With our 24/7 support service, we guide clients through these next steps, helping them turn a piece of paper into a fully compliant and successful business. You can also dig deeper into how to enjoy UAE tax benefits for international entrepreneurs by learning more about the favourable financial landscape awaiting you.

Frequently Asked Questions About UAE Incorporation

Embarking on the journey to get your certificate of incorporation in the UAE naturally brings up a lot of questions. We’ve been through this process countless times with clients, so here are some straightforward answers to the questions we hear most often.

How Long Does It Really Take to Get the Certificate?

Honestly, the timeline can vary quite a bit. If you're setting up in a highly efficient Free Zone with a straightforward business activity, you could be looking at just a few working days. It can be remarkably quick.

On the other hand, a Mainland company, especially if it requires special approvals from external government bodies, will take longer—sometimes several weeks. The single biggest factor in speeding things up is having all your paperwork perfectly in order from day one. Flawless preparation is the secret sauce to avoiding delays.

Is the Certificate of Incorporation the Same as a Trade Licence?

That's a great question, and it's a point of confusion for many. While you often receive them together, they are two distinct documents with different jobs.

Here’s a simple way to think about it:

- The Certificate of Incorporation is like your company's birth certificate. It’s the official proof that your business legally exists as a distinct entity.

- The Trade Licence is your permit to do business. It gives you the authority to actually carry out the specific commercial activities you've registered for.

They are issued together because they're two halves of a whole. You need the first to get the second.

You can't get a valid Trade Licence without first having a Certificate of Incorporation. The certificate confirms the legal existence of the company, and that company is then granted the licence to operate. It’s a two-step validation.

Do I Absolutely Need a Physical Office to Get My Certificate?

This really comes down to where you decide to set up shop. For most Mainland businesses, the answer is yes; a physical office space with a registered Ejari (tenancy contract) is non-negotiable.

However, the UAE's Free Zones are known for their flexibility. Many offer "flexi-desk" or virtual office packages that satisfy the legal requirement for a registered address without the expense and commitment of leasing a full-time office. This is a game-changer for startups and solo entrepreneurs.

Having a seasoned expert to guide you through these questions can make all the difference. At 365 DAY PRO Corporate Service Provider LLC, we are specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE. We provide clear, cost-effective support with a 24/7 support service to ensure your business launch is a success.

📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.