Thinking about setting up a business in Dubai? One of the first, and biggest, decisions you'll make is where to set up. A mainland business setup gives you the ultimate freedom to trade directly across the entire UAE market, with zero restrictions. It’s the go-to structure for anyone serious about targeting local customers, landing government contracts, and expanding their physical footprint across the Emirates.

Unlike setting up in a free zone, a mainland licence puts your business right in the heart of the UAE’s vibrant economy.

Why Choose a Mainland Business Setup

This isn't just about picking a location on a map; it's a strategic move that defines the very scope and ambition of your business. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we've seen first-hand how a mainland setup is the ticket to full integration into the local economy.

Your licence will be issued by the Department of Economy and Tourism (DET), giving you the green light to operate anywhere in the UAE. That means no barriers, no middlemen, and no limits on your reach within the country.

Unrestricted Market Access

The single biggest draw for a mainland company is the complete freedom to do business across all seven emirates. You can sell products, offer services, and work with customers directly, whether they're in Dubai, Abu Dhabi, or Sharjah.

Think about a retail brand dreaming of opening stores in different malls across the country. A mainland licence isn't just helpful—it's essential. The same goes for a consultancy firm wanting to serve clients in various cities; a mainland setup is the only practical way. This direct market access cuts out the hassle and cost of needing a local distributor, which is a common hurdle for free zone companies.

For international entrepreneurs, this structure also allows you to Enjoy UAE Tax Benefits for International Entrepreneurs, all while operating within a globally respected regulatory environment.

Bidding on Government Projects

Here’s another game-changer: the ability to compete for highly profitable government contracts. UAE federal and local government bodies are massive clients, always on the lookout for top-tier products and services from the private sector.

A mainland licence is the non-negotiable key that unlocks government tenders. This opens up a massive revenue stream that is simply off-limits to most free zone companies, handing mainland businesses a powerful competitive advantage.

Imagine you run an IT firm that specialises in cybersecurity. With a mainland licence, you can bid on contracts to protect the digital infrastructure of government ministries. A construction company? You can tender for major public works projects, from new schools to essential infrastructure. As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we’ve seen how this kind of access can completely change a company's growth trajectory.

Operational Flexibility and Growth

A mainland business offers incredible flexibility when it comes to your physical location and expansion plans. You are free to lease an office, a warehouse, or a retail shop anywhere on the mainland that makes sense for your business.

This freedom is absolutely critical for any business that relies on a physical presence.

- Retail Businesses: You can snag a prime spot in a busy shopping mall or a high-street storefront to attract maximum foot traffic.

- Logistics Companies: A mainland licence lets you set up a warehouse near key transport hubs for seamless distribution.

- Service-Based Firms: You can establish your office in a central business district, putting you right next to your corporate clients.

On top of that, a mainland structure makes it much easier to hire staff and sponsor an unlimited number of visas, which is crucial for supporting your growth. As your team gets bigger, your mainland licence grows with you, free from the visa restrictions you often find in free zones. Our goal is to make this journey smooth with Cost-Effective Business Setup Solutions tailored to your needs and a 24/7 Support Service from start to finish.

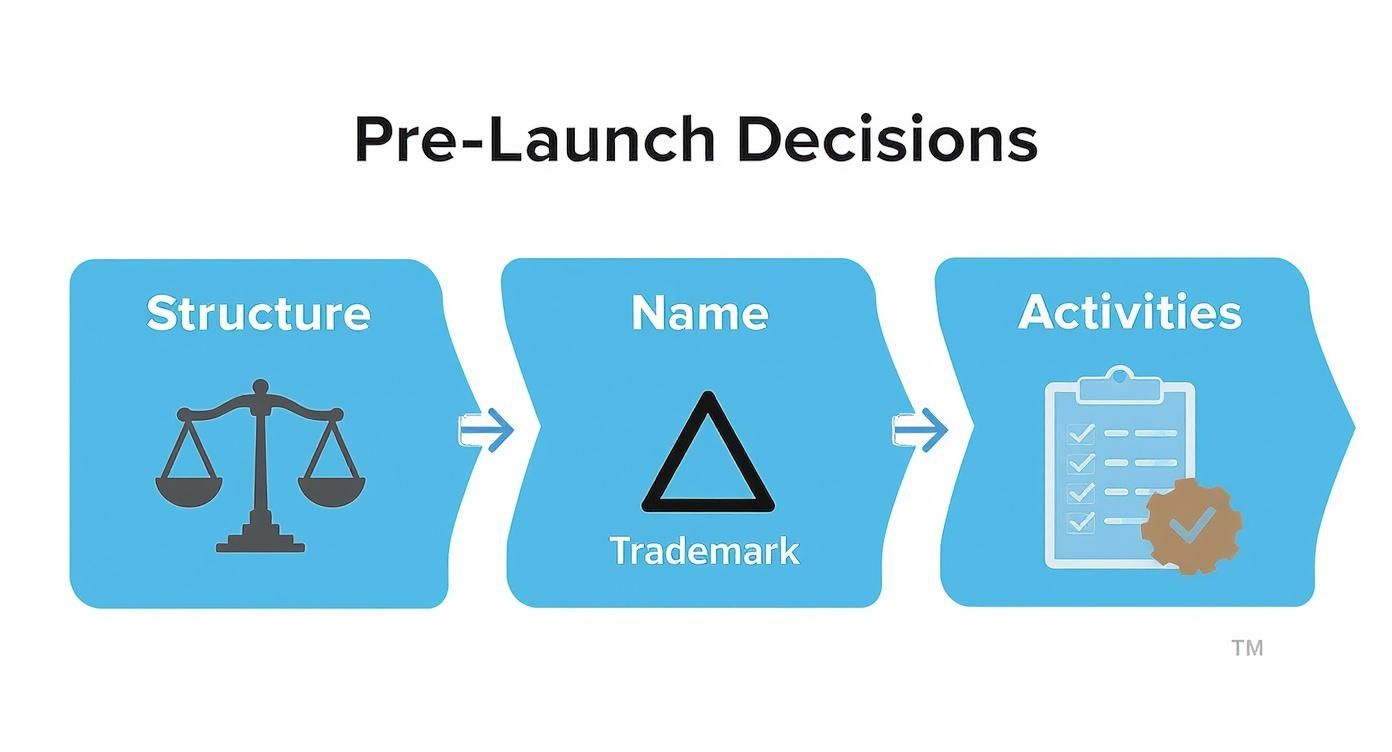

Getting the Foundations Right Before You Launch

Setting up a business on the Dubai mainland isn't just about filling out forms. The decisions you make before you even think about submitting an application are what truly set you up for success. Getting these fundamentals right from the get-go saves you from a world of headaches, costly changes, and bureaucratic runarounds later on.

Think of it as building the foundation of a house. You need a solid, compliant base that can actually support your long-term ambitions.

Choosing Your Legal Structure

First things first: what kind of company are you building? Your choice of legal structure is a big one, affecting everything from personal liability and ownership to how you’re taxed. It’s a decision with real, lasting consequences.

When you're looking at setting up on the mainland, you'll find that the Limited Liability Company (LLC) is the go-to for most foreign entrepreneurs, and for good reason. It puts a protective wall between your personal assets and your business debts. For many, that peace of mind is non-negotiable. You can even find highly specialised versions, like a Family Limited Liability Company, for specific needs.

Another popular route, especially for individual professionals, is the Sole Establishment. It gives you 100% ownership, which is a huge plus, but it comes with a major catch: it offers zero liability protection. Your personal assets are on the line if the business runs into trouble. Understanding that trade-off is absolutely crucial.

To help you see the differences more clearly, let's break down the most common options.

Choosing Your UAE Mainland Legal Structure

This table gives a quick overview of the most common legal forms for mainland businesses, highlighting the key differences to help you decide which is the best fit for your venture.

| Legal Structure | Ownership Requirements | Liability | Best For |

|---|---|---|---|

| Limited Liability Company (LLC) | Can be 100% foreign-owned for most activities. | Limited to the capital invested in the company. Personal assets are protected. | Trading, retail, and general commercial activities involving multiple partners. |

| Sole Establishment | Owned by a single individual (expat professionals require a Local Service Agent). | Unlimited. The owner is personally liable for all business debts. | Individual consultants, freelancers, and service-based professionals. |

| Civil Company | Owned by two or more professional partners (e.g., doctors, lawyers, engineers). | Unlimited liability, shared among partners. | Professional service firms, clinics, and legal consultancies. |

Ultimately, the right structure depends entirely on your business model, your tolerance for risk, and your long-term goals.

Defining Your Business Activities

Once you've landed on a legal form, your next job is to get crystal clear on every single activity your business will perform. This isn't just a minor detail—it's the very core of your trade license application. It dictates your license fees and flags any extra approvals you might need from other government bodies.

The Department of Economy and Tourism (DET) has a massive list of over 2,000 approved business activities. You have to pick the specific codes that perfectly match what you do. For example, a digital marketing agency wouldn't just pick "consulting"; they'd need to list specific activities like "Marketing Management" and "Social Media Marketing Services." If you're too vague or choose the wrong codes, your application will be rejected flat out.

Something else to keep in mind here is the new corporate tax. With the introduction of a 9% tax on profits over AED 375,000, entrepreneurs are now thinking much more strategically about how they structure their operations for maximum tax efficiency while staying fully compliant.

Selecting a Compliant Trade Name

Your company name is more than just a brand—it’s a legal marker that has to follow some pretty strict rules. This is a common tripwire for new entrepreneurs, but it’s easy to avoid if you know the guidelines.

The secret to getting your trade name approved is to be unique and compliant. Your name can't be a carbon copy or even sound too similar to an existing company, and it absolutely must not contain anything that could be considered offensive or violate public morals.

Here are a few quick tips from my experience:

- DO check the DET’s online portal for name availability before you get your heart set on one.

- DON'T use acronyms unless they spell out your full name. For instance, "J. Smith Consulting" works, but just "JSC" on its own won't fly.

- DO make sure the name aligns with your business activities. You can't call yourself "Dubai Trading" if you're a tech consultancy.

- DON'T use names of God or references to any religious or political groups.

Nailing these three decisions—legal structure, business activities, and trade name—is a powerful first step. It shows the authorities you’ve done your homework and are serious about building a legitimate, lasting business in Dubai.

Diving into the Mainland Licensing Process

With your foundational decisions locked in, it’s time to bring your company to life legally. This is where your planning meets official procedure, culminating in that all-important trade licence from the Department of Economy and Tourism (DET). It might seem like a maze of paperwork, but understanding each piece of the puzzle makes the whole journey much clearer.

The very first official hurdle is securing your Initial Approval Certificate (IAC). Think of this as the government's preliminary nod—a green light confirming they have no objection to your proposed business. It essentially validates your trade name, activities, and legal structure, allowing you to move forward.

Getting the Key Approvals and Documents Sorted

Obtaining the Initial Approval is your gateway to the rest of the process. Once you have it, the focus shifts to creating your company's core legal document: the Memorandum of Association (MOA).

The MOA is your company's constitution. It lays down the rules of engagement between shareholders, spells out how profits and losses are distributed, and details the management hierarchy. This document needs to be drafted with meticulous care to accurately reflect your business arrangement before it gets notarised by a public notary in Dubai.

An expertly drafted MOA isn't just a formality; it's a critical tool for preventing future shareholder disputes. It provides a clear, legally binding framework for how the business will operate, protecting everyone involved from potential misunderstandings down the road.

With a notarised MOA in hand, the next piece you need is a physical address for your business.

Finding a Compliant Commercial Space

Every mainland business in Dubai must have a physical office address registered with the authorities. This isn't just a PO box; it has to be a genuine commercial property. The government needs to see a tangible lease agreement to prove you have a legitimate base of operations.

This brings us to a crucial requirement known as Ejari. Ejari is the government's mandatory online registration system for all tenancy contracts in Dubai. You simply cannot get your final trade licence without a registered Ejari for your office. It's a non-negotiable step that officially links your business to its physical location.

Navigating External Government Approvals

While the DET is the main licensing body, many business activities require a thumbs-up from other specialised government departments. Honestly, this is one of the trickiest parts of setting up on the mainland and often causes major delays for people who aren't prepared. This is where our experience as Specialists in Mainland Company Formation in Dubai & Abu Dhabi really comes into play, as we help clients get their documents right from the very start.

The specific approvals you'll need are tied directly to what your business actually does. For instance:

- Healthcare Clinic: You’ll need the go-ahead from the Dubai Health Authority (DHA).

- Restaurant or Foodstuff Trading: Clearance from the Dubai Municipality (DM) is essential.

- Educational Institution: You must get a permit from the Knowledge and Human Development Authority (KHDA).

- Logistics or Transport Company: This requires approvals from the Roads and Transport Authority (RTA).

Each of these ministries has its own strict set of requirements, document checklists, and even inspection protocols. Getting it right depends on submitting a flawless application and coordinating between the different government offices. One small error or a missing document can send you right back to the beginning, adding weeks or even months to your timeline.

This infographic shows the foundational decisions you need to make before getting into the weeds of the licensing process.

These early choices have a direct impact on how complex the next steps will be.

The Final Submission and Licence Issuance

Once you've gathered everything—the Initial Approval, notarised MOA, registered Ejari, and any external approvals—you’re on the home stretch. It’s time for the final payment and submission. You'll need to submit your complete application file to the DET.

After a successful review, the DET will issue a payment voucher for your trade licence fees. Once that's paid, your mainland trade licence is issued! This official document is your legal permission to start operating your business in Dubai and across the UAE. The whole process, from that first application to holding your licence, can take anywhere from one to four weeks. The timeline really depends on the complexity of your business and how smoothly you can secure those external approvals.

Bringing Your Business to Life: Visas and Operations

Holding your brand-new trade licence feels like a massive achievement, and it is! But it’s really the key that unlocks the next critical phase: turning your legal entity into a living, breathing business. This is where you activate your company with immigration and labour, secure residency for yourself and your team, and get your corporate bank account up and running.

First thing’s first: you need an Establishment Card. This small but mighty card is your company's official registration with the immigration authorities. Without it, you simply cannot hire anyone or sponsor visas, which would stop your plans dead in their tracks.

Think of it as your company's passport. It's the document that allows your business to interact with the General Directorate of Residency and Foreigners Affairs (GDRFA) and the Ministry of Human Resources and Emiratisation (MOHRE).

Navigating Residency Visas for Owners and Employees

With your Establishment Card in hand, you can start the visa process. It might seem daunting from the outside, but it’s a very structured sequence of events. Whether it's for yourself as the investor or for your first key hires, the journey is basically the same.

It all starts with an entry permit, which lets the individual stay in the UAE while their residency is being finalised. Once that’s issued, they have to complete a mandatory medical fitness test—a standard screening for certain communicable diseases required for all residents.

After a clear medical result, the next stop is an Emirates ID centre for biometrics. This is where fingerprints and a photo are taken for the national ID card, your primary form of identification across the UAE.

The final piece of the puzzle is the visa stamping. Your passport is handed over to immigration, and a residency visa sticker is placed inside. This officially confirms your legal status as a UAE resident and completes the process.

Opening Your Corporate Bank Account

While you’re sorting out visas, opening your corporate bank account should be a parallel priority. This isn't just a quick trip to the bank; it’s a rigorous compliance process. I’ve seen many entrepreneurs get bogged down here because they weren't prepared for the level of scrutiny.

Banks in the UAE are legally obligated to conduct thorough due diligence. They need to understand your business model, verify your source of funds, and know who your clients will be. You'll need a full file of company documents ready to go, including your trade licence, Memorandum of Association (MOA), and passports for all shareholders.

The compliance interview often catches people by surprise. A bank representative will dig into the specifics of your business plan:

- Who exactly is your target customer?

- Which countries will you be sending or receiving money from?

- What's your realistic projected annual turnover?

Your answers must be sharp, confident, and perfectly aligned with the activities on your trade licence. If your licence says "IT Consultancy" but you start talking about importing physical goods, you're going to hit a wall. Banks are meticulous about this, and any inconsistency can lead to major delays or even an outright rejection.

Getting these final steps right is crucial for a smooth launch. If you need a hand navigating the details of your business setup in mainland, feel free to Call Us Now: +971-52 923 1246. We can help ensure you start on a solid, compliant foundation, ready for success.

Keeping Your Business Compliant and Thriving

Getting your trade licence is a huge milestone, but it's really just the starting whistle. The real challenge—and where successful businesses separate themselves—is in managing the day-to-day legal and financial duties that come next. Staying on top of compliance is what keeps your mainland Dubai company running smoothly and protects you from some pretty hefty penalties.

Think of it this way: the initial setup is like building a brand-new car. Compliance is the ongoing maintenance that keeps it roadworthy and performing at its best. It’s all about staying vigilant with renewals and keeping up with regulatory shifts.

Your Core Annual Renewals

First up, and most importantly, is your annual trade licence renewal. This one is non-negotiable. You’ll typically need to show a valid lease agreement (your Ejari) for your office space to get it done. If you let this slide, you’re looking at fines, and worse, the authorities could freeze your company's bank account and halt all visa processing.

At the same time, you'll need to renew your company's Establishment Card. This little card is your direct link to the immigration and labour departments, so it’s absolutely essential for sponsoring employee visas. An expired Establishment Card means all your visa activities simply stop.

Navigating the UAE's Tax Landscape

Recent tax changes have added a new layer of financial responsibility for mainland companies. Getting a handle on these duties isn't just a good idea anymore; it's a core part of doing business here.

The biggest one is the UAE Corporate Tax. Your business has to be registered for Corporate Tax with the Federal Tax Authority (FTA). This means you need to keep accurate financial records and solid bookkeeping all year long to figure out your taxable income. Filing an annual tax return is mandatory, and you have to know your deadlines.

Meticulous financial records aren't just good business practice—they are a legal necessity in today's UAE. Proper bookkeeping does more than just get you ready for tax season; it gives you a clear view of your company’s financial health, helping you make smarter, more strategic decisions.

On top of Corporate Tax, you also need to keep an eye on Value Added Tax (VAT). If your company's turnover from taxable goods and services crosses the AED 375,000 threshold in a year, you are legally required to register for VAT. From that point on, you’ll need to charge VAT on your sales and file regular VAT returns with the FTA.

UBO and Other Key Responsibilities

Another critical area is the Ultimate Beneficial Owner (UBO) declaration. Every company in the UAE must keep a register of the individuals who ultimately own or control it. You have to submit this information to the authorities, a measure designed to increase transparency and fight financial crime. Not complying can lead to some serious fines.

This robust regulatory environment is actually a huge plus. It builds trust and stability. In fact, a recent survey found that 71% of Swedish companies in the UAE view the business climate as good or very good, and 67% are projecting higher turnover. This kind of confidence speaks volumes about the opportunities on the mainland. You can read more about the positive business climate in the UAE.

Juggling these responsibilities can feel like a lot, especially since regulations can be so different from one country to another. For context, just look at these comprehensive UK compliance guidelines to see how detailed these frameworks can be. This is why many business owners choose to partner with a corporate service provider. They can make sure you never miss a deadline and stay ahead of changes, freeing you up to focus on what you do best: growing your business.

Common Questions About Setting Up a Mainland Business in Dubai

Getting into the nitty-gritty of a mainland business setup in Dubai always stirs up a lot of questions. It's completely normal. To help you move forward with confidence, I’ve put together some straightforward answers to the questions we hear most often from entrepreneurs just like you.

What’s the Real Difference Between Mainland and Free Zone?

It all boils down to one thing: market access. Think of a mainland company, licensed by the Department of Economy and Tourism (DET), as having an all-access pass. You can trade directly with any customer anywhere in the UAE and, crucially, bid on those valuable government contracts.

A free zone company, on the other hand, operates within a designated geographical area. As Specialists in Freezone Company Formation across the UAE, we know their primary focus is usually on international trade or business within a specific zone. If you want to tap into the broader UAE market from a free zone, you'll almost always need to partner with a local distributor, which adds a layer of complexity and cost.

Do I Still Need a Local Emirati Sponsor for a Mainland Company?

This is a big one, and the rules have changed for the better. For the vast majority of business activities today, 100% foreign ownership is now standard for mainland LLC companies. The old rule requiring a UAE national to hold a 51% share is gone for most commercial and industrial licences.

However, it's not a blanket rule. Certain strategic sectors or professional service licences—think consultancies or legal firms—might still require a Local Service Agent (LSA). An LSA is not a shareholder; they don't own any part of your business. Instead, they act as your official liaison for government paperwork in return for a set annual fee.

It's absolutely critical to be crystal clear on your specific business activity from the start. This single detail determines whether you can have full ownership or need to appoint an LSA, which fundamentally shapes your setup strategy.

How Long Does It Realistically Take to Get a Mainland Licence?

The timeline can shift a bit, mostly depending on your business activity. If you need special approvals from other government bodies—like the Health Authority or the Telecommunications Regulatory Authority—that will add some time.

For a standard LLC, though, the process is surprisingly quick. We can often get the initial approvals sorted out within a day. The full journey, from submitting the first application to holding your final trade licence, typically takes anywhere from one to four weeks. Things like getting your Memorandum of Association notarised and registering your office lease (Ejari) are the main variables. As we are Always here when you need us, our team is available with 24/7 Support Service to keep things moving without any unnecessary delays.

What’s a Realistic Budget for a Mainland Business Setup?

There’s no single price tag for a mainland setup; the final cost really depends on your company's legal structure, your specific business activities, and, of course, your office rent.

Here are the main expenses you'll need to account for:

- DED Licence Fees: This is the core government fee for your trade licence.

- Trade Name Reservation: A small fee to make sure your company name is unique and available.

- Initial Approval Certificate: The charge for getting that first green light from the government.

- MOA Attestation: Fees paid to a notary public to make your company's founding document official.

- Office Rent (Ejari): This is often the biggest variable. Your location and the size of your space will heavily influence this cost.

- Visa Processing: Don't forget to budget for the costs associated with your investor visa and any employee visas you'll need.

As a rough guide, a simple professional licence might start from around AED 20,000. A more complex general trading licence will naturally be higher. The only way to get a truly accurate figure is with a custom quote. If you want to explore the most cost-effective options for your specific idea, feel free to WhatsApp Us Today for a Free Consultation.

At 365 DAY PRO Corporate Service Provider LLC, our entire focus is on making your mainland business setup smooth and straightforward. Our experts handle all the details—from licences and visas to making sure you stay compliant—so you can concentrate on what you do best: growing your business. Discover how our tailored business setup solutions can help you succeed in the UAE.