If you're serious about tapping into the entire UAE market, setting up on the Dubai mainland is the most direct route. It's the key that unlocks the ability to trade freely without any geographical handcuffs, bid on lucrative government contracts, and plant a real, physical flag in the ground. For any entrepreneur with their sights set on genuine local and regional growth, it’s the premier choice.

Why a Dubai Mainland Licence is Your Golden Ticket

When you decide to launch in Dubai, the very first fork in the road is choosing your jurisdiction. It’s a critical decision. While there are plenty of options, a business setup in Dubai mainland offers strategic advantages that are simply unmatched. Think of this choice not just as getting a licence, but as pouring the foundation for unrestricted, long-term success.

A mainland company, registered directly with the Department of Economy and Development (DED), gives you the freedom to operate anywhere you want, both within the UAE and internationally. This isn't a small detail. It means you can open a boutique in a prime shopping mall, set up your headquarters in a prestigious business district, or provide services directly to clients across all seven emirates—all without needing a middleman or local agent.

The Real Power of Full Market Access

Let's put this into a real-world context. Imagine you’re launching a cutting-edge tech firm. Your ideal clients are a mix of private enterprises in Dubai and Abu Dhabi, but you also want a piece of the massive government sector. A mainland licence is the only way to engage with both of these worlds seamlessly. You can respond to government tenders—a multi-billion dollar market that is completely off-limits to most companies based in free zones. This complete market access is what truly sets a mainland establishment apart.

A mainland company doesn't just put you in the market; it makes you part of the local economic fabric. You instantly gain the credibility and flexibility needed to build strong local partnerships, serve a diverse customer base, and scale up without hitting a wall.

This direct access is what positions your business for sustainable, lasting success. You aren't confined to a specific geographical box, which allows for natural expansion as your business finds its feet and grows. Whether your plan is to open multiple branches or just have the freedom to serve any client, anywhere, the mainland framework is built for it.

A New Era: 100% Foreign Ownership is Here

The business landscape in Dubai has undergone a seismic shift, making it more appealing than ever for international entrepreneurs. Landmark reforms have completely changed the game on ownership rules, now allowing foreign nationals to own 100% of their mainland companies across a huge range of business activities.

This change finally did away with the long-standing requirement of having a local Emirati sponsor hold a majority stake. It’s a move that brings Dubai's commercial environment right in line with global powerhouses like Singapore and London. For investors, this means full operational control, better protection for your intellectual property, and a much simpler process for repatriating profits. You can learn more about how to start a mainland company and navigate these pivotal reforms on kgrnaudit.com.

This new level of autonomy puts you firmly in the driver's seat. You have complete control over your company's direction, its finances, and every single decision. For specialists like us who focus on mainland company formation, this has been a game-changer, opening the floodgates for international investors who were once hesitant.

Mainland vs. Free Zone: A Strategic Decision

While both mainland and free zones now often offer 100% ownership, their strategic purposes couldn't be more different. The right choice boils down entirely to your business model and where you see yourself in five years.

-

Dubai Mainland: This is the ideal setup for businesses aiming squarely at the local UAE market. If you want to work with government bodies or need the flexibility to set up shop anywhere in the country, this is for you. It's the go-to for retail, trading, professional services, and manufacturing companies focused on domestic sales.

-

Free Zone: This route is best suited for businesses focused primarily on international trade, re-exporting goods, or serving clients outside the UAE. Operations are generally restricted to within the free zone's geographical boundaries, making it a cost-effective solution for consultants, e-commerce stores, and global trading firms that don't need a physical local presence.

Ultimately, choosing a business setup in Dubai mainland is a declaration of intent. It sends a clear signal that you are here to compete, grow, and become an integral part of one of the world's most dynamic economies.

Your Blueprint for Mainland Company Formation

Setting up a business on the Dubai mainland isn't a leap of faith; it's a structured journey. While the process might seem complex at first glance, it’s really a series of clear, manageable steps. Getting the foundations right from the very beginning is the key to a smooth and fast registration. And it all starts with defining the core of your business.

The first big decision you'll make is choosing the right legal structure. This single choice will influence everything from your personal liability and tax obligations to how you can raise capital down the line. For most entrepreneurs coming to Dubai, the Limited Liability Company (LLC) is the go-to option. It’s flexible and, most importantly, creates a solid barrier between your personal assets and your business debts. If you're a solo professional, a Sole Establishment is a simpler, more direct route.

At the same time, you need to be crystal clear about your business activities. This isn't just paperwork; the activities you list on your licence literally define what your business is legally allowed to do. The Department of Economy and Development (DED) has a list of over 2,000 approved activities, and your selection will determine the specific type of licence you need.

Securing Your Identity and Initial Approvals

Once you know your structure and activities, it's time to name your business. Picking a trade name in Dubai is more than just a creative exercise—it has to follow strict DED rules. The name can't be offensive, already taken, or include religious references. Getting this done early is crucial because you can't move forward with other approvals until your name is officially reserved.

With a name in hand, you’ll apply for your Initial Approval. Think of this as the DED giving you the nod to proceed. It’s an official confirmation that the government has no objections to your proposed business, clearing the way for you to draft legal documents and find an office. It’s a vital checkpoint on your setup journey.

Expert Tip: Don't just gloss over the business activities list. I’ve seen businesses get into trouble for operating outside their licensed scope, leading to fines. We can help you navigate the list to find the perfect combination that covers your business plan without adding unnecessary costs.

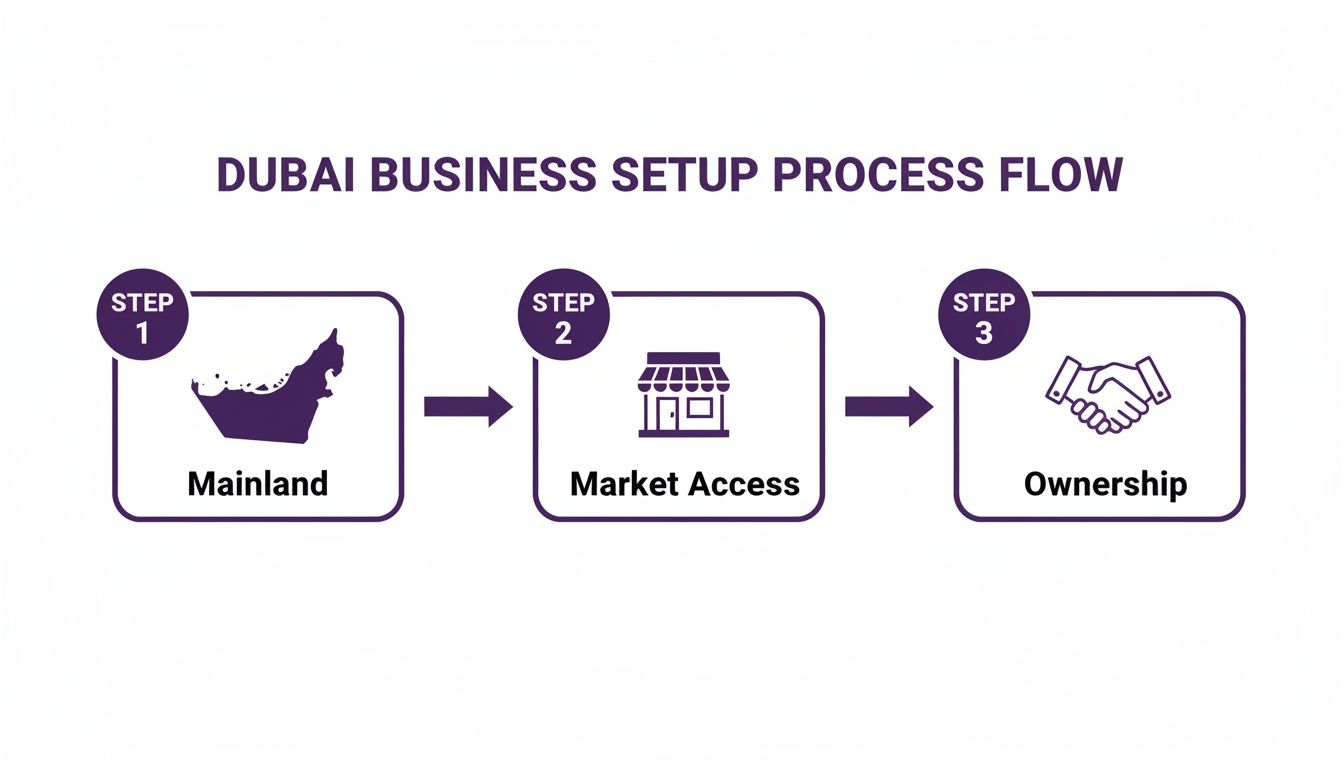

The diagram below really simplifies the value of a mainland setup. It shows how the initial decision to go "Mainland" directly leads to the two biggest benefits: full market access and 100% ownership.

This is why entrepreneurs targeting the local UAE economy almost always choose a mainland company—it unlocks direct access to customers and gives you complete control.

To give you a clearer picture, here's a quick comparison of the most common licence types you'll encounter.

Comparing Common Dubai Mainland License Types

Choosing the right licence is crucial as it defines the scope of your operations. The table below breaks down the main options to help you see which one fits your business model best.

| License Type | Primary Purpose | Example Activities |

|---|---|---|

| Commercial | Trading, buying, and selling goods. | General Trading, Electronics, Vehicle Sales, Retail Shops |

| Professional | Providing specialised, skill-based services. | Consultancy, Auditing, IT Services, Salons, Medical Clinics |

| Industrial | Manufacturing, processing, and assembling products. | Food Production, Metal Fabrication, Furniture Manufacturing |

| Tourism | Activities related to the travel and hospitality sector. | Tour Operator, Hotel Management, Travel Agency |

Each licence type is tailored for a specific business vertical. We can help you pinpoint the exact one you need, ensuring you're fully compliant from day one.

Crafting Your Legal Foundation

Next up is preparing your Memorandum of Association (MOA). This is the constitutional document of your company, and it’s incredibly important. It spells out everything from the company’s purpose and shareholding structure to how profits are distributed. For an LLC, the MOA is a binding legal contract between all the partners, so it needs to be drafted with absolute precision.

While you're working on the company structure, it's also the perfect time to focus on mastering your financial projections. A strong MOA backed by a solid financial plan gives you a clear roadmap for governance and growth.

Once the MOA is drafted, all partners must sign it in front of a Notary Public here in the UAE. This formal step makes the agreement legally official and solidifies the foundation your business will be built on.

Establishing Your Physical Presence

One non-negotiable rule for any business setup in Dubai mainland is having a physical office. Virtual offices just won't cut it. You must have a real, tangible address with a valid tenancy contract to prove it.

This tenancy contract needs to be registered with the Real Estate Regulatory Agency (RERA) to get an Ejari certificate. The Ejari is a mandatory document for your final trade licence submission. It acts as official proof of your company's address and is directly tied to the number of visas you can apply for.

The size of your office matters more than you might think. The DED uses your office’s square footage to determine your visa quota—the total number of employee visas your company is eligible for. A bigger office means you can hire more people, so it's smart to pick a space that fits your team now and has room for future growth.

This is where a good partner makes all the difference. We help our clients find cost-effective office solutions that tick all the boxes, from a simple desk in a business centre to a full corporate office. We make sure you meet every legal requirement without overspending, and with our 24/7 Support Service, we handle everything from drafting the MOA to registering the Ejari flawlessly.

Mastering Visas, Banking, and Tax Compliance

Getting your trade licence is a fantastic milestone, but it’s really just the starting line. Now the real work begins to get your business fully operational. This next critical phase boils down to three pillars: securing residency visas, opening a corporate bank account, and getting your tax affairs in order. Tackling these head-on is the key to a smooth launch.

This is the stage where your company transforms from a legal entity on paper into a living, breathing operation. Each of these components has its own quirks and potential roadblocks, which is where having a team with 24/7 Support Service in your corner makes all the difference.

Demystifying the UAE Residency Visa Process

Your trade licence is your key to residency, but the first thing you need to do is register your company with the immigration authorities. This means applying for an Establishment Card—think of it as your company's official immigration file. You can't apply for a single visa without it.

Once that card is in hand, you can start the visa process for yourself (as the investor) and any employees. The number of visas you're eligible for is directly tied to the size of your office. As a general rule, the authorities allocate one visa for every 80-100 square feet of office space. This is a massive consideration when you’re signing your tenancy contract (Ejari).

The visa quota isn't just a number; it’s a blueprint for your growth. If you underestimate your space needs now, you could seriously hamstring your ability to hire people down the road. We always tell our clients to think one or two years ahead when picking an office.

The visa journey itself has a few clear stages:

- Entry Permit: This is the initial green light, allowing the person to enter the UAE for residency or work.

- Change of Status: If they're already in the country (e.g., on a tourist visa), this step switches their status to resident.

- Medical Fitness Test: A mandatory health screening for all applicants.

- Emirates ID Application: This is where biometric data is captured for the national ID card.

- Visa Stamping: The final step, where the residency visa is physically stamped into the passport.

This process demands precision. Any mistake in the paperwork can lead to frustrating delays or even rejections. As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we handle this entire workflow to ensure every application is spot-on.

Navigating the Corporate Bank Account Challenge

This one catches a lot of people by surprise. Opening a corporate bank account in the UAE can be a real challenge for new companies. Banks here conduct incredibly thorough due diligence and Know Your Customer (KYC) checks to prevent financial crime. You can't just walk in and expect an account; you need to arrive fully prepared.

A strong, well-documented application isn't a nice-to-have, it's a must. The bank will want to see much more than just your licence.

Your Bank Account Application Checklist:

- Company Legal Docs: Your trade licence, Memorandum of Association (MOA), and any share certificates.

- Founder & Shareholder Docs: Passport copies, visa copies, and Emirates IDs for all partners involved.

- Proof of Business: A solid business plan, profiles of the founders, and sometimes even proof of potential clients or supplier contracts.

- Office Tenancy Contract (Ejari): This is crucial evidence of your physical presence in the UAE.

Choosing the right bank is just as important as having the right documents. Some are more welcoming to startups, while others prefer established businesses with a trading history. Our long-standing relationships with various local and international banks mean we can connect you with the right fit for your business model, dramatically increasing your chances of getting your account opened quickly.

Understanding Your Tax Obligations

The UAE is famous for its business-friendly tax system, but that doesn't mean you can ignore it. To stay compliant, you need to be aware of two main taxes, both managed by the Federal Tax Authority (FTA).

Value Added Tax (VAT)

VAT is a 5% tax applied to most goods and services. You must register for VAT once your company's taxable sales exceed AED 375,000 within a 12-month period. You also have the option to register voluntarily once you cross AED 187,500. Staying on top of this from day one helps you avoid any nasty penalties.

Corporate Tax (CT)

Introduced in June 2023, the UAE's Corporate Tax rate is a standard 9%. But here’s the game-changer: this only applies to taxable profits that are over AED 375,000. This incredibly generous threshold means that a huge number of small businesses and startups will pay 0% in corporate tax, reinforcing the UAE’s commitment to being a hub for new ventures. This is a key reason why so many Enjoy UAE Tax Benefits for International Entrepreneurs.

Getting a handle on visas, banking, and tax from the very beginning builds your business on a solid, compliant foundation. Our team is here to guide you through it all, from the first immigration form to your first tax filing, making sure these vital operational steps are handled flawlessly.

Understanding the Real Costs and Timelines

Let's talk about the two most important questions on every entrepreneur's mind: "How much will this actually cost?" and "How long will it take?" Getting a clear, honest answer is crucial. For anyone looking to set up a business on the Dubai mainland, having a realistic grasp of the financial and time investment isn't just helpful—it’s the foundation of a successful launch.

This is where we cut through the noise. We believe in total transparency, turning what can be a source of anxiety into a clear, manageable plan you can actually work with.

Our whole approach is built on providing Cost-Effective Business Setup Solutions tailored to your needs without any last-minute surprises. When you know exactly what to expect, you can move forward and plan your launch with complete confidence.

A Transparent Look at Setup Costs

The final bill for your Dubai mainland company isn't one single number; it's a sum of different parts. You’ve got government fees, essential third-party charges, and of course, professional service fees. When you see them broken down, it becomes much easier to understand where every dirham is going.

So, what expenses should you be ready for? Here are the usual suspects:

- Trade Name Reservation: A fee paid directly to the DED to secure your chosen business name.

- Initial Approval Fee: This is the charge for the DED to give the preliminary go-ahead for your business activity.

- Licence Issuance Fee: This is the main government cost for your trade licence, and the amount can vary quite a bit depending on what your business does.

- Office Rent (Ejari): An unavoidable and essential cost. You can't get a mainland licence without a registered physical office space.

- Notarisation Fees: These are the official charges for legally attesting your company’s Memorandum of Association (MOA).

The single biggest factor influencing the final government fees will be your chosen business activities and legal structure. For example, a general trading licence, with its broad scope, will naturally cost more than a highly specific consultancy licence.

As specialists who live and breathe mainland company formation, we give you a detailed, itemised quote right from the start. No guesswork. This ensures you see every single cost upfront, which is exactly what you need for precise, effective budgeting.

Budgeting for Your Dubai Mainland Company

To give you a clearer picture for your financial planning, here’s a breakdown of the typical costs you’ll likely encounter. Remember, these are estimates and the final figures will depend on your specific business needs.

This table outlines the major one-time and recurring costs that make up the bulk of the investment.

Estimated Costs for Dubai Mainland Company Setup

| Cost Component | Estimated Cost Range (AED) | Frequency |

|---|---|---|

| Trade Licence Issuance | 15,000 – 25,000+ | Annual |

| Establishment Card Fee | 2,000 – 2,500 | Annual |

| Office Tenancy Contract (Ejari) | 15,000 – 50,000+ | Annual |

| Investor/Partner Visa | 3,500 – 5,000 | Per Person (2-3 years) |

| Employee Visa | 5,500 – 7,500 | Per Person (2 years) |

| Professional Service Fees | Varies based on package | One-Time |

The best way to get an exact figure is to have a chat with us. A tailored consultation will give you a precise quote for your unique situation. WhatsApp Us Today for a Free Consultation or Call Us Now: +971-52 923 1246.

Mapping a Realistic Timeline for Your Launch

Time is a currency you can't get back, especially when starting a business. Understanding the sequence of events and the realistic duration for each stage is key to managing your own expectations and planning your market entry. While the process follows a set path, we know how to run certain steps in parallel to speed things up where possible.

From the first form you fill out to the day you're fully operational, you should realistically budget for a timeline of three to eight weeks. This can be broken down into two main phases.

Phase 1: Getting Your Licence (Roughly 1-3 weeks)

This is all about securing that all-important trade licence from the DED. It's a flurry of approvals and paperwork.

- Document Collection: This starts with our initial consultation where we get all the required papers from you.

- Trade Name & Initial Approval: We can usually get this sorted in 1-3 business days.

- MOA Drafting & Notarisation: This is another quick step, typically taking 1-2 days.

- Ejari Registration: The speed here depends entirely on how quickly you find and secure your office.

- Final Licence Issuance: Once all documents are in, the DED usually issues the licence in 2-4 business days.

Phase 2: Post-Licence Essentials (Roughly 2-5 weeks)

Once the licence is in your hands, the focus shifts to getting your company fully up and running.

- Establishment Card: This application usually takes about 3-5 business days.

- Corporate Bank Account: This is often the wild card. From our experience, it can take anywhere from 2 to 4 weeks, depending on the bank and your company's profile.

- Visa Processing: For investors and employees, each visa application process takes around 10-15 business days.

Throughout this entire journey, our 24/7 Support Service means we're always on hand to proactively handle any potential roadblocks, keeping your setup moving forward as efficiently as possible. We are always here when you need us.

Why Global Entrepreneurs Are Flocking to Dubai Mainland

Setting up a business on the Dubai mainland isn't just a logistical choice; it's a strategic play to plug directly into one of the world's most vibrant commercial hubs. For savvy international entrepreneurs, it’s a deliberate move to plant a flag in an environment engineered for serious, sustainable growth.

The numbers speak for themselves. The sheer volume of new business registrations across the UAE signals powerful investor confidence. Dubai mainland consistently leads the pack, grabbing the lion's share of new economic licenses issued nationwide. And this isn't just a Dubai story; the momentum is UAE-wide. Abu Dhabi has seen a 16% jump in new mainland licenses, while Ras Al Khaimah reported a remarkable 28.6% increase in its commercial licenses. You can read more about the increase in business registrations across the UAE on slg-strohallegalgroup.com. This tells us the entire country is focused on attracting foreign investment, making a mainland presence more valuable than ever.

An Ecosystem Built for Success

Dubai's magnetic pull is no accident. It’s the result of decades of meticulous planning to create the perfect conditions for businesses to thrive. The government’s pro-business policies and world-class infrastructure are a potent combination for ambitious founders.

This forward-thinking approach translates into real-world advantages for your company:

- A Diversified Economy: The non-oil sector is booming, opening up countless opportunities in tech, tourism, professional services, and retail.

- World-Class Infrastructure: The operational backbone here is second to none, from hyper-efficient logistics networks to cutting-edge telecommunications.

- Access to Global Talent: As a major global city, Dubai makes it incredibly easy to attract and retain a skilled, multicultural workforce.

Choosing the mainland connects you directly to this dynamic ecosystem. You aren't just registering a company; you're plugging into a network of opportunities, backed by a government that genuinely wants to see you succeed.

Beyond the business landscape, many entrepreneurs are also drawn to Dubai for long-term residency and investment. If you're thinking of putting down roots while you build your empire, it helps to understand the guide to buying property in Dubai for foreigners.

Capitalising on the UAE’s Tax Advantages

Let's be honest: one of the biggest draws for international entrepreneurs is the UAE's incredibly favourable tax regime. A mainland company is the ideal structure to take full advantage of this, making Dubai a smart financial base for your global ambitions.

Here’s a quick look at the major tax benefits:

- 0% Corporate Tax on your annual profits up to AED 375,000.

- A low 9% Corporate Tax rate on any profits above that generous threshold.

- 0% Personal Income Tax, which means you keep everything you earn.

- 100% Repatriation of Profits, giving you total freedom to move your capital.

These aren't just perks; they are core pillars of the UAE's economic strategy. This framework allows you to reinvest a much larger portion of your earnings back into the business, fuelling faster growth and maximising your return. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we focus on creating cost-effective setups that position you perfectly to benefit from every advantage Dubai offers.

Common Questions About Dubai Mainland Setup

When you're looking to set up a business on the Dubai mainland, you're bound to have questions. Everyone does. Getting straight answers is key to making the right calls for your new venture. Let's walk through some of the most common questions we hear from entrepreneurs every day.

Think of this as clearing the fog. We'll tackle the big topics—ownership, office rules, and what really separates mainland from a free zone—so you can move forward with total clarity.

Can I Really Get 100% Ownership for My Business?

Yes, for most activities, but not all. The UAE's move to allow 100% foreign ownership was a game-changer for mainland companies, but there are still a few exceptions.

Certain strategic sectors, like oil and gas, banking, and public utilities, are still ringfenced and require an Emirati partner. The crucial step is to check where your specific business activity falls on the approved list from the Department of Economy and Tourism (DET). We can help you get a definitive answer on this straight away, confirming if you're eligible for full ownership before you even start.

Is a Physical Office Space Actually Mandatory?

It absolutely is. For a Dubai mainland licence, there's no getting around it—you need a registered physical office. The tenancy contract, or Ejari, registered with the Real Estate Regulatory Agency (RERA), is a foundational document for your entire application. What's more, the size of your office directly influences how many employment visas your company can apply for.

Don't let the thought of a traditional office lease intimidate you. You've got options. Dedicated desks in co-working spaces or serviced offices in business centres are perfectly valid and can be a far more Cost-Effective Business Setup Solution to meet this legal requirement.

What’s the Real Difference Between Mainland and a Free Zone?

It all boils down to one thing: market access. Where can you actually do business?

A Dubai Mainland company, licensed by the DET, has the freedom to trade anywhere in the UAE and internationally without restrictions. Critically, this also gives you the green light to bid on lucrative government contracts.

A Free Zone company, on the other hand, is generally confined to operating within its designated zone and internationally. While both now offer 100% foreign ownership for many activities, if your goal is to tap into the local UAE economy, the mainland is your only real choice.

How Long Does the Setup Process Really Take?

This is the million-dollar question, and the honest answer is: it depends. For a straightforward setup, you can expect the trade licence itself to be issued in about 1 to 4 weeks. This period covers getting the trade name, initial approvals, notarising your company's MOA, and registering the Ejari.

But getting the licence isn't the final step. From there, opening the corporate bank account and processing visas will add another 2 to 6 weeks. Working with a seasoned pro can genuinely speed things up. We ensure every document is spot-on the first time, sidestepping the common delays that trip people up, backed by our 24/7 Support Service.

Ready to turn your Dubai business ambitions into reality? The team at 365 DAY PRO Corporate Service Provider LLC are specialists in mainland company formation, providing clear guidance and expert support every step of the way. Start your journey with a free consultation today.