Setting up a business in the UAE gives international entrepreneurs a powerful launchpad into global markets. It’s a unique mix of 100% foreign ownership and serious tax advantages, making it a top choice for founders looking to grow their business in a dynamic, pro-business environment.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why Launch Your Next Venture in the UAE?

The United Arab Emirates has spent years carefully building one of the world's most welcoming environments for entrepreneurs and investors. It’s moved far beyond its oil-rich past to become a diversified, knowledge-based economy, creating real opportunities in tech, creative fields, global trade, and finance.

This isn't just about low taxes; it's a deliberate strategy to attract the best talent and the most ambitious companies. For entrepreneurs from around the globe, this shift is a massive advantage. The government has been actively tearing down the usual barriers that slow down growth elsewhere, which is a key reason why setting up shop here is such a smart, strategic move.

A Landscape Built for Business Growth

What you’ll find in the UAE is a stable economy, incredible infrastructure, and a clear vision for the future. Policies like 100% foreign ownership, which used to be restricted to certain areas, are now available across the board, giving founders total control over their businesses. This one change alone has sent investor confidence through the roof.

Dubai is a perfect example of this in action. It has seen explosive growth in foreign direct investment (FDI), thanks in large part to these ownership rules. In fact, a recent UAE Business Climate Survey showed that 71% of businesses rated the local climate as good or very good, and 67% expected their turnover to increase soon. This isn't just hype; it's the real-world optimism you can feel on the ground. You can dig deeper into the drivers of UAE's business climate trends to see the full picture.

Understanding Your Core Options

When you start looking into a business setup in the UAE, you’ll quickly come across three main jurisdictions. Each one is designed for a different kind of business.

- Mainland: This is your go-to if you want to trade directly with customers inside the UAE, open a physical shop or office, or bid on government projects.

- Free Zone: Perfect for international trade, consulting firms, and tech startups. Free zones guarantee 100% foreign ownership and are often built around specific industries, creating powerful business ecosystems.

- Offshore: This is mainly a tool for holding international assets and for tax planning. An offshore company can't trade within the UAE, but it can own assets and investments anywhere in the world.

The very first, and most critical, decision you'll make is picking the right jurisdiction. Your choice between Mainland, Free Zone, or Offshore will define everything from your company's ability to operate and its ownership structure to its potential for future growth.

This framework means you can pick a structure that perfectly fits your business model, whether you're aiming to serve local customers in Dubai or manage international clients from a hub in Abu Dhabi or Sharjah.

Choosing Your Jurisdiction: Mainland vs Free Zone

The very first, and arguably most important, decision you'll make when setting up your business in the UAE is where to base it. This isn't just about a postcode; choosing between a Mainland and a Free Zone jurisdiction fundamentally shapes your entire business. It dictates who your customers can be, the level of ownership you have, and your potential for future growth.

Get this right, and you’re building on solid ground. Get it wrong, and you could face significant hurdles later, even needing a costly restructure. So, let’s break down what this choice really means for you.

What's the Real Difference?

Think of it this way: a Mainland company gives you a golden ticket to the entire UAE market. If your plan is to open a boutique in a Dubai mall, offer consulting services to local businesses, or bid on lucrative government projects, you absolutely need a Mainland licence. You'll be operating right in the heart of the UAE economy, regulated by the Department of Economic Development (DED) in your chosen emirate.

On the other hand, a Free Zone company operates within a specific, designated economic area that has its own set of rules. With over 40 free zones scattered across the UAE, many are tailored to specific industries like media, tech, or finance. They are designed for international business, offering huge benefits like 100% foreign ownership and tax exemptions, making them perfect for entrepreneurs with a global client base.

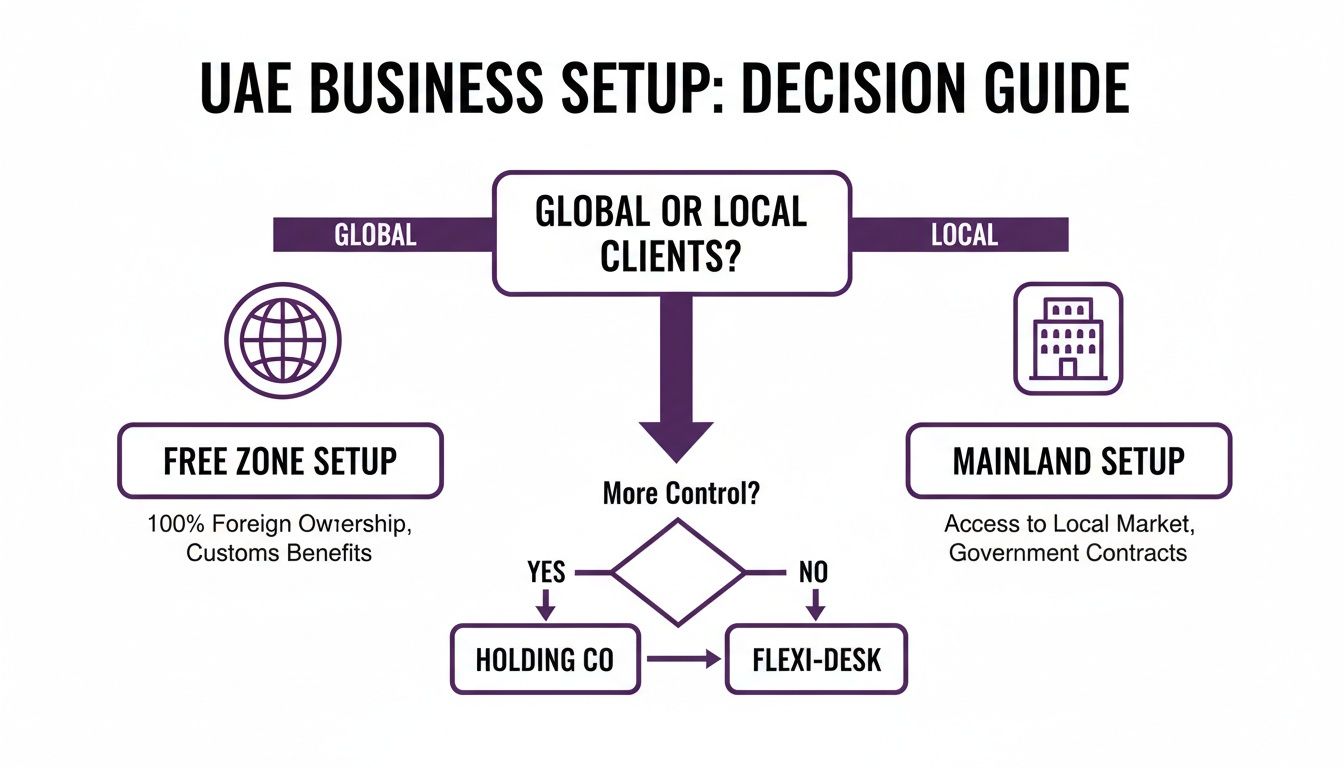

This quick decision guide can help you see which path makes initial sense for your model.

As the flowchart shows, the core question is simple: are your customers primarily inside the UAE or outside? Your answer points you in the right direction.

Mainland vs Free Zone: A Practical Comparison

To make the choice even clearer, let's put the two jurisdictions side-by-side. This table breaks down the fundamental differences to help you decide the best fit for your business set up in UAE.

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Business Scope | Can trade directly with any business or consumer across the UAE. | Restricted to trading within the free zone or internationally. Local trade often requires a distributor. |

| Ownership | 100% foreign ownership is now available for most activities, though some strategic sectors may still require an Emirati partner. | 100% foreign ownership is guaranteed for all business activities. |

| Office Space | Mandatory physical office space required, registered with Ejari. | Flexible options, including flexi-desks, co-working spaces, and full offices. |

| Government Tenders | Eligible to bid for and work on lucrative government contracts. | Generally cannot directly bid on government projects. |

| Visa Eligibility | Visa allocation is typically based on the size of the physical office space. | Visa packages are often pre-defined based on the licence type, but can be flexible. |

| Approvals | Requires approvals from multiple bodies like DED, Ministry of Labour, etc. | A one-stop-shop approach, with the free zone authority handling most approvals. |

Ultimately, the best choice depends entirely on your business model. Mainland offers unparalleled access to the local economy, while a Free Zone provides a simplified, tax-efficient gateway to the world.

When Mainland is the Clear Winner

For some business models, the decision is already made. If your vision involves any of the following, a Mainland setup is the only way forward:

- Direct Local Sales: Think cafes, clinics, retail shops, or any business that deals directly with the public in the UAE.

- Government Contracts: To bid on tenders from UAE government departments, you must be a registered Mainland entity.

- Ultimate Flexibility: You gain the freedom to trade and offer services anywhere in the UAE without needing intermediaries.

- Physical Expansion: It’s much simpler to open branches or offices in different emirates with a Mainland licence.

A real-world example? An architecture firm that wants to work on construction projects in Abu Dhabi would have to be a Mainland company. The same goes for a restaurant brand that wants to open locations in both Dubai and Sharjah.

A key advantage of the Mainland is its flexibility for growth within the UAE. While Free Zones can feel restrictive if your local client base expands, a Mainland company offers an unlimited operational scope across the country.

The Strategic Pull of a Free Zone

There’s a reason Free Zones are so popular with international entrepreneurs. They offer a fast, cost-effective, and straightforward route to establishing a business in the UAE, especially if you’re not tied to the local market.

The benefits are hard to ignore:

- Guaranteed 100% Foreign Ownership: This is the headline act. You have complete control of your business, no questions asked.

- Major Tax Advantages: Free Zone companies benefit from 0% corporate tax on qualifying income and are exempt from import/export duties.

- Total Financial Freedom: You can send 100% of your profits and capital back to your home country without any restrictions.

- Hassle-Free Setup: The registration process is typically faster and involves less red tape compared to a Mainland formation.

Picture a software startup with clients in Europe and Asia. Setting up in a tech-focused hub like Dubai Internet City gives them a prestigious address, a tax-free haven, and the ability to easily sponsor visas for their global team—all without the complexities of the local market. A global logistics company using Dubai as a hub would find a perfect home in Jebel Ali Free Zone (JAFZA) for the same reasons.

Choosing the right jurisdiction is about aligning the rules with your ambition. By understanding these core differences, you ensure your business set up in UAE is built for success from day one.

Your UAE Company Formation Roadmap

Getting a business off the ground in the UAE might seem like a maze of paperwork and regulations, but it’s actually a well-trodden path. Think of it less as a mountain to climb and more as a series of clear, manageable steps. This roadmap is designed to walk you through that journey, turning what can feel like bureaucratic hurdles into a simple, practical checklist.

We'll cover everything from the big-picture decisions that define your licence to the nitty-gritty of getting your name approved and doors open. With the right map in hand, the process is far more straightforward than you might think.

Defining Your Business Activities and Legal Form

First things first: what, exactly, will your company do? You need to pick your specific activities from an official list of over 2,000 options. This isn't just a formality; your choice dictates the type of licence you'll get—Commercial, Professional, or Industrial—and often points you toward the best jurisdiction, whether that’s Mainland or a Free Zone.

For instance, a marketing consultancy needs a Professional licence, but a business importing and selling electronics requires a Commercial one. Nailing this down from the outset saves you from headaches and costly amendments down the line.

With your activities clear, you then choose a legal structure. For most entrepreneurs setting up on the Mainland, the Limited Liability Company (LLC) is the go-to option. It’s popular for a good reason: it creates a legal wall between your personal assets and the business's liabilities, giving you crucial protection. While other structures exist, an LLC provides a solid, flexible foundation for the majority of new ventures.

Securing Your Trade Name and Initial Approval

Now for the fun part—naming your company. You can't just pick any name; the UAE has clear rules. It can't be offensive, use religious references, or be too similar to a name that’s already taken.

You'll submit a short list of your preferred names to the Department of Economic Development (DED) in your chosen emirate or to the specific free zone authority. Once they approve one, it's reserved for you.

Right after your name is secured, you'll apply for Initial Approval. This is essentially a preliminary nod from the authorities, confirming they have no objection to your business idea and its founders. It's a critical checkpoint that gives you the green light to move forward with drafting legal documents and securing an office.

Think of the Initial Approval as the government's green light for your business concept. It signifies that your proposed activity and shareholders are cleared to proceed, paving the way for the more detailed legal and logistical steps ahead.

Drafting Legal Documents and Securing a Business Address

With the initial approval in hand, it's time to formalise your company's structure by drafting its Memorandum of Association (MOA). For an LLC, this document is the backbone of your business. It spells out everything: the roles of the shareholders, how profits and losses will be shared, and the company's objectives.

The MOA has to be drafted in both English and Arabic and then officially notarised by a public notary here in the UAE. This step is a non-negotiable legal requirement that solidifies the agreement between all partners.

At the same time, you need to lock down a registered business address. Every single company in the UAE must have one. The requirements differ based on your jurisdiction:

- Mainland Companies: A physical office is almost always mandatory. You'll need a registered tenancy contract, known as an Ejari. The size of your office can even determine how many employee visas you're eligible for.

- Free Zone Companies: Here, you've got much more flexibility. Options range from affordable flexi-desks and co-working memberships to fully serviced physical offices, so you can pick what fits your budget and operational needs.

How a Corporate Service Provider Makes It Seamless

Juggling all of this—from picking the right business activity and getting documents notarised to dealing with various government departments—demands real, on-the-ground expertise. This is where a specialist corporate service provider becomes your most valuable asset. While you're focused on the setup, don't forget the tools that will power your business, like choosing the right business communication apps to ensure your team is connected from day one.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we act as your guide and fixer, handling all the paperwork and government liaison for you. We are Specialists in Mainland Company Formation in Dubai & Abu Dhabi and Specialists in Freezone Company Formation across the UAE, and our team has built strong relationships with the authorities to ensure a smooth, error-free launch.

We focus on delivering Cost-Effective Business Setup Solutions that are built around your specific goals, helping you Enjoy UAE Tax Benefits for International Entrepreneurs without getting bogged down in administrative tasks. With our 24/7 Support Service, we’re always here when you need us, turning a complex process into a simple, managed journey to launching your successful UAE business.

Handling Visas, Banking, and Taxes Like a Pro

Getting your business licence is a fantastic moment, but it’s really just the starting line. Now comes the part that turns your on-paper company into a real, functioning enterprise: sorting out the visas, banking, and taxes. Getting these three things right is absolutely critical for your long-term success here.

Mapping Out the Residency Visa Process

With your trade licence in hand, you now have the power to sponsor residency visas for yourself, your family, and any staff you hire. It's a very methodical process, and you have to follow the steps in the right order. Think of it as a series of checkpoints you need to clear one by one.

The entire journey kicks off once your company’s Establishment Card is issued by the immigration authorities. This digital card is what officially registers your business in their system, and it's the key that unlocks all visa applications.

From there, the path for each person looks something like this:

- Entry Permit: First, we apply for an entry permit (often called an employment visa). This lets you enter the UAE for work or, if you're already here on a tourist visa, to change your status without leaving.

- Medical Fitness Test: Next up is a mandatory medical test at a government-approved health centre. It’s a standard screening for certain communicable diseases.

- Emirates ID Biometrics: You'll then head to a Federal Authority for Identity & Citizenship (ICA) service centre to give your fingerprints and have your photo taken for the Emirates ID card.

- Visa Stamping: Once you have the all-clear from the medical test and your biometrics are done, your passport gets the final residency visa stamped inside. This stamp is your official permit to live and work in the UAE.

It can look like a lot on paper, but when you have someone guiding you, it’s a straightforward and manageable process.

The Real Story Behind Opening a Corporate Bank Account

This is the one thing that catches almost every new entrepreneur by surprise. Opening a corporate bank account in the UAE is far from a simple formality. Banks here are under immense pressure to comply with global anti-money laundering (AML) rules, so they conduct incredibly thorough due diligence. Just waving your new trade licence isn't going to be enough.

You need to present a credible and compelling case for your business. To steer clear of the frustrating delays and rejections that many face, your application needs to tell the bank a clear story.

Here’s what they are actually looking for:

- A Solid Business Plan: Not a 50-page document, but a crisp summary of what you do, who your customers are, and how you'll make money.

- Proof of "Substance": This is huge. Show them you're a real business. It could be signed contracts, a professional website, or proof of your own track record in the industry.

- Shareholder Profile: They will scrutinise the background and professional history of every shareholder.

- Source of Funds: Be ready to clearly document where your initial investment capital came from.

A common mistake is thinking all banks are the same. They aren’t. Each bank has a different appetite for risk and often prefers certain business activities over others. Working with a setup partner who has strong banking relationships is a game-changer. We can introduce you to the right bank and the right manager for your specific business, which massively improves your chances of a quick approval.

Simplifying the UAE Tax System

For years, the incredible tax environment has been one of the biggest draws for setting up a business in the UAE. While it's no longer a "no-tax" nation, the system is deliberately designed to support startups and SMEs.

In fact, SMEs are the absolute backbone of the country's non-oil economy, contributing an enormous 63.5% to the non-oil GDP. With over 557,000 SMEs in the UAE and a government goal to hit 1 million by 2030, it's clear how much entrepreneurs are valued here. You can explore more about the role of SMEs in the UAE to get a sense of the landscape.

There are really only two taxes you need to get your head around:

- Value Added Tax (VAT): A standard 5% VAT is charged on most goods and services. The key thing to remember is that you only have to register for VAT once your annual turnover hits AED 375,000.

- Corporate Tax (CT): This was introduced in 2023 at a headline rate of 9%. But here's the best part for new businesses: there is a 0% tax rate on annual profits up to AED 375,000. This means most startups won't pay any corporate tax at all in their first few years.

Our 24/7 support service is designed to handle all these post-setup hurdles. From managing visa paperwork to making sure you're compliant with tax rules, we've got your back. Our expertise as Specialists in Mainland Company Formation in Dubai & Abu Dhabi and across all UAE free zones means you have a partner who truly understands the entire journey, helping you Enjoy UAE Tax Benefits for International Entrepreneurs.

What to Realistically Budget for Your Setup

It’s easy to get caught up in the excitement of launching a new business in the UAE, but the real planning starts with the numbers. Vague estimates just won’t cut it when you need to manage cash flow or pitch to investors. You need a clear, realistic picture of the investment required, from the initial government fees to your annual operational costs.

Forget looking for a single magic number. The final cost to get your business off the ground depends entirely on your choices. A Mainland LLC in Dubai will have a very different price tag compared to a tech startup in a Sharjah free zone. To build a venture that lasts, a solid grasp of strategic budgeting and forecasting in the UAE isn't just helpful—it's essential. This breakdown will give you the transparency you need.

Deconstructing the Key Costs

Your total setup investment isn't one lump sum; it’s a mix of several distinct costs. When you understand what each one is for, you can see exactly where your money is going and make smarter decisions from day one.

- Trade Licence & Registration Fees: This is the big one—the core government fee for your licence. The cost swings wildly depending on your jurisdiction (Mainland vs. Free Zone), your chosen legal structure (like an LLC), and the specific business activities you plan to conduct.

- Visa Expenses: Every residency visa you need—for yourself, your partners, or your staff—has its own price. This includes fees for the entry permit, the mandatory medical test, your Emirates ID card, and the final visa stamping in your passport.

- Office Space: Every business needs a registered address, that's non-negotiable. For a Mainland company, this usually means leasing a physical office. In a Free Zone, you’ve got more flexibility with options like flexi-desks or even virtual offices, which satisfy the legal requirement for a fraction of the cost.

- PRO Services & Consultancy Fees: You could try to navigate the paperwork and queues yourself, but hiring a specialist saves you from making expensive mistakes and facing frustrating delays. These fees cover expert guidance, document processing, and liaising with all the different government departments.

Estimated Costs for Business Setup in Dubai

To give you a practical starting point, I’ve put together a table that breaks down the typical costs for two of the most popular setups: a Mainland LLC and a Free Zone company (FZCO).

Keep in mind these are solid estimates, but the final figures can vary based on the specific emirate, the free zone you choose, and your unique business needs.

| Cost Component | Mainland LLC (Estimate) | Free Zone FZCO (Estimate) |

|---|---|---|

| Trade Licence & Registration | AED 25,000 – AED 40,000 (One-time) | AED 15,000 – AED 25,000 (One-time) |

| Residency Visa (Per Person) | AED 6,000 – AED 8,000 (One-time) | AED 5,000 – AED 7,000 (One-time) |

| Physical Office Rent | AED 40,000+ (Annual) | N/A (Included in some packages) |

| Flexi-Desk / Virtual Office | N/A | AED 5,000 – AED 15,000 (Annual) |

| Establishment Card | Approx. AED 2,000 (One-time) | Approx. AED 1,500 (One-time) |

Whether you're looking at Mainland Company Formation in Dubai & Abu Dhabi or exploring Freezone Company Formation across the UAE, our job is to map out the most cost-effective business setup solutions that fit your budget.

Honest Timelines for Your Launch

Cash isn't the only resource you're investing; your time is just as valuable. Having a realistic timeline for your business set up in UAE is crucial. It helps you plan your launch, manage expectations with partners, and avoid sitting around waiting for paperwork to clear.

A common misconception I see is people thinking they can set up a business overnight. While the UAE is incredibly efficient, the process still involves multiple government bodies. Rushing things often leads to small mistakes that cause even bigger delays down the road.

Here’s what you should realistically expect for each key stage:

- Initial Approval & Trade Name Reservation: This first step is usually pretty quick. You can often get this sorted in just 1-3 working days.

- Licence Issuance: Once you’ve submitted all your documents (like the notarised MOA and your tenancy contract), getting the actual trade licence in hand usually takes about 1-2 weeks.

- Establishment Card & Visa Processing: After the licence is issued, the company's establishment card takes a few days. From there, the full residency visa process—from entry permit to the final stamp in your passport—typically takes another 2-4 weeks.

Our 24/7 support service means you’re never left in the dark, as we’re always here when you need us. We manage the entire timeline for you, ensuring a smooth and predictable journey to getting your business fully up and running.

Your Top UAE Business Setup Questions Answered

Setting up a business in the UAE is an exciting journey, but it naturally comes with a lot of questions. We see the same queries pop up time and again from entrepreneurs just like you. Based on our hands-on experience, we've put together some straight-to-the-point answers to clear things up.

Can I Get a UAE Residency Visa Without Renting an Office?

Yes, you absolutely can. This is a common misconception. Many free zones have packages specifically designed for consultants, freelancers, and solo entrepreneurs that don't require a physical office lease.

Think of it as a smart, cost-effective way to get your foot in the door. These options, like flexi-desks or shared facilities, provide you with a legitimate trade licence and the all-important establishment card you need to sponsor your own residency visa. Just keep in mind that for a mainland company, having a physical office address is almost always a non-negotiable requirement. We can help you find the right free zone package that aligns with your business and budget.

What's the Real Difference Between a Professional and a Commercial Licence?

It all boils down to what your business does and how it's owned.

A Commercial Licence is for any business that trades, imports, exports, or sells physical goods. Think e-commerce, retail, or general trading.

On the other hand, a Professional Licence is for service-based businesses. This covers consultants, designers, lawyers, IT specialists, and other professionals selling their expertise. The biggest perk? A professional licence on the mainland allows for 100% foreign ownership. You will, however, need to appoint a UAE national as a Local Service Agent (LSA). They don't hold any shares or have any say in your business; they simply act as your official government liaison for an agreed-upon annual fee.

How Will the New Corporate Tax Affect My Small Business?

The UAE's corporate tax was built with startups and SMEs in mind. For most new businesses, the impact will be minimal, if any.

There’s a 0% tax rate on annual profits up to AED 375,000. This generous threshold means many new companies won't pay a dirham in corporate tax as they get off the ground. Profits above that mark are taxed at a flat rate of 9%. The single most important thing you can do is keep meticulous financial records from day one and register your business with the Federal Tax Authority (FTA).

A Quick Note for Free Zone Companies: You can still enjoy a 0% tax rate on your profits, but only if you meet the ‘Qualifying Income’ criteria. In simple terms, this generally means you aren't doing business directly with the UAE mainland market.

What Exactly Are PRO Services and Do I Really Need Them?

PRO stands for Public Relations Officer, but it has nothing to do with marketing. In the UAE, PRO services are all about managing the government paperwork and administrative hurdles that come with running a business. This covers everything from visa processing and renewals to labour cards and document attestations.

Could you do it yourself? Technically, yes. But you’d be stepping into a minefield of complex procedures, Arabic-only forms, and long queues, pulling you away from actually running your business. Outsourcing to a dedicated PRO firm saves you from fines, delays, and headaches. It’s an investment in peace of mind, ensuring your company stays compliant so you can focus on growth.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Partnering with the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah makes the entire business setup process straightforward and efficient. Our specialists manage every detail, from choosing the right jurisdiction to handling visas and ongoing compliance, setting your business up for success from the very beginning.