If you’re planning to set up a business in the United Arab Emirates, the very first, non-negotiable step is getting the right business license. This isn't just a piece of paper; it's the official government-issued document that gives you the legal permission to start and run your company. Think of it as your passport to the UAE's thriving commercial world, allowing you to open corporate bank accounts, sponsor visas, and conduct business legitimately.

Your Gateway to the UAE Business World

Starting a company in the UAE is an exciting journey. The country offers a pro-business government, a strategic global location, and incredible infrastructure. But before you can tap into any of that, you need that all-important license. It’s the master key that unlocks every door your new business will need to walk through.

Without it, you can't legally trade, sell services, or manufacture products. The license provides the legal framework for your company, clearly defining what you can and can't do. This formal recognition is what separates a legitimate, protected enterprise from an illegal operation, safeguarding both you and your customers.

The Bedrock of Your Business Operations

Your business license is far more than just a regulatory box to tick—it’s the foundation of your entire corporate structure. It validates your company in the eyes of the government, banks, and potential business partners. For international entrepreneurs, it’s also the key to establishing a credible presence and taking advantage of the significant tax benefits the UAE offers.

A business license in the UAE is not just about compliance. It’s a strategic asset that provides credibility, enables access to banking and financial services, and solidifies your company's legal standing in one of the world's most competitive markets.

Why Is a License So Crucial?

I can't overstate how important getting the right license is. It has a direct impact on your ability to operate smoothly and grow your business. Here’s a breakdown of the fundamental advantages that come with being properly licensed:

- Legal Protection: It ensures your business activities align with federal and local laws, protecting you from hefty fines or, worse, legal action.

- Banking and Finance: You absolutely need a valid license to open a corporate bank account. This is essential for managing finances, accepting payments, and building a credit history for your company.

- Investor Confidence: A license shows you're serious and legitimate. This makes your venture far more attractive to investors, partners, and even clients who need to know they're dealing with a legally sound company.

- Visa Sponsorship: Your license is the prerequisite for applying for residency visas for yourself, your family, and your employees. It's what allows you to build a team and live legally in the UAE.

Navigating the setup process—whether for a Mainland company in Dubai, a Free Zone entity in Sharjah, or an offshore establishment—can be complex. As specialists in company formation across the UAE, we provide cost-effective solutions tailored to your specific needs, backed by 24/7 support.

Choosing Your Business Jurisdiction

Picking the right spot to set up your business in the UAE is the first, and arguably most critical, decision you'll make. Think of it like choosing a neighbourhood for your home. Each area has its own rules, perks, and vibe. This single choice will shape everything from who you can do business with to your company's ownership structure.

The UAE essentially offers three distinct "neighbourhoods" for businesses: Mainland, Free Zone, and Offshore. Each is built for different business models and ambitions. Getting this right from day one sets you up on a solid foundation for growth.

A Look at UAE Mainland Companies

Setting up a Mainland company is like opening a shop right in the heart of the city. It gives you unrestricted freedom to trade directly with anyone in the local UAE market. As specialists in Mainland company formation in Dubai & Abu Dhabi, we've seen this become the top choice for businesses that want to dive deep into the local economy.

A Mainland licence means you can bid for those valuable government contracts and set up your office or store anywhere in the Emirates. This makes it a perfect fit for retail shops, restaurants, construction firms, or any venture that deals directly with local customers and government entities.

The UAE recently celebrated a major milestone, with over one million active business licences now on record. This boom is largely thanks to new rules that allow 100% foreign ownership for most business activities, making a Mainland setup more appealing than ever for international entrepreneurs. You can read more about this impressive economic growth and what it means for the region.

The Perks of Setting Up in a Free Zone

Now, let's talk about Free Zones. Picture them as exclusive business parks, each with a specific industry theme, like tech, media, or finance. With over 40 free zones scattered across the UAE, they are designed to be hubs for international trade and service-based companies.

So, what's the big draw? Entrepreneurs flock to Free Zones for a few powerful reasons:

- 100% Foreign Ownership: You call all the shots. There's no need for a local Emirati partner.

- Tax Efficiency: Most Free Zones offer 0% corporate and personal income tax and exempt you from customs duties on goods you import and export.

- Total Profit Repatriation: You can send 100% of your profits and capital back to your home country, no questions asked.

As specialists in Freezone Company Formation across the UAE, our job is to match you with the perfect zone for your business, ensuring you get the most out of these fantastic benefits.

Understanding the Niche Role of Offshore Companies

Finally, there's the Offshore option. The best way to think of an Offshore company is as a secure financial safe. It's not designed for doing business inside the UAE. Instead, it’s a legal tool for managing international business activities, holding assets, and protecting wealth.

An Offshore company offers a high degree of confidentiality and is a smart vehicle for international tax planning or invoicing global clients. Crucially, it doesn't come with residency visas or let you have a physical office in the UAE. It's strictly a non-resident entity for handling corporate and financial affairs from afar.

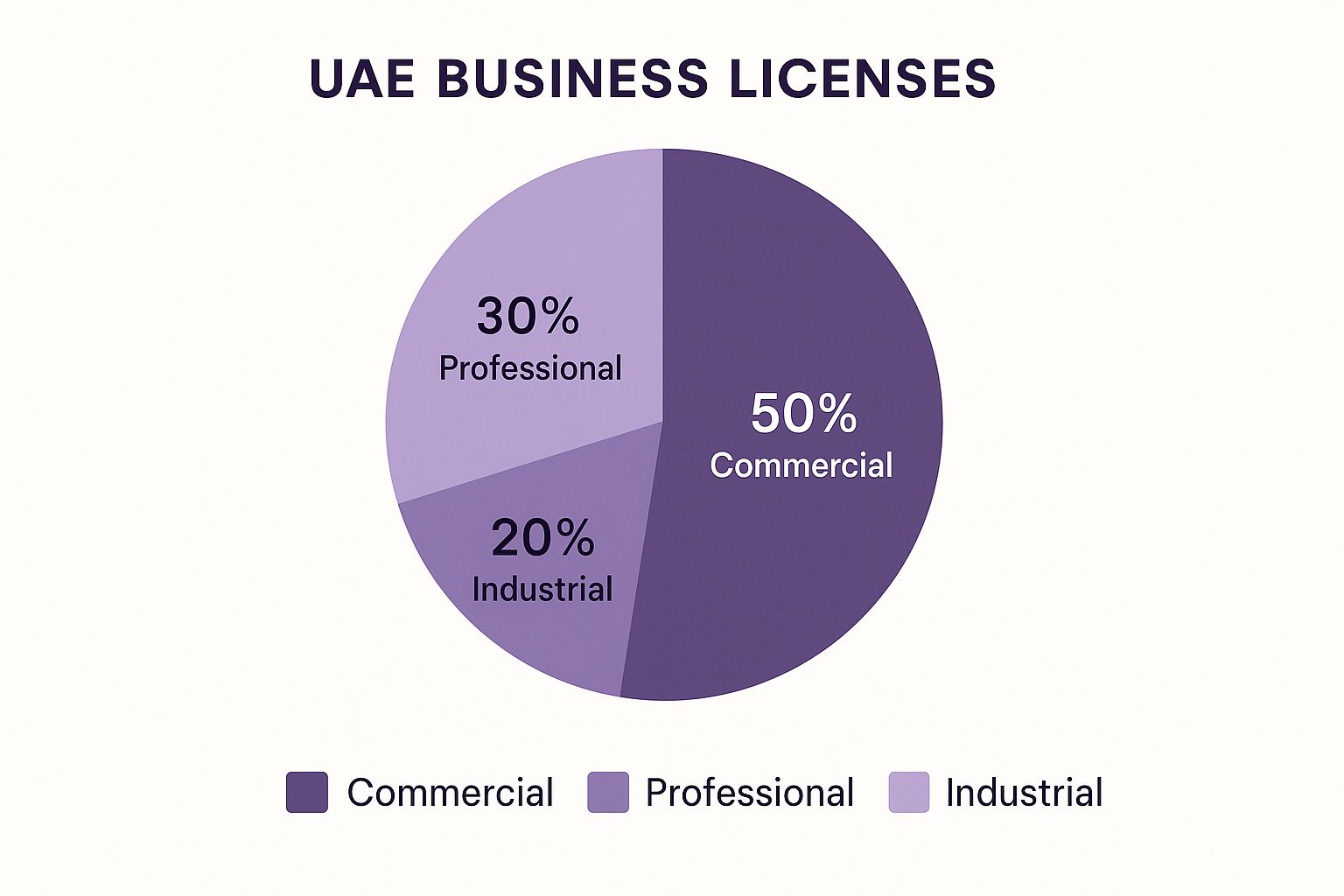

This chart gives you a clear snapshot of which licence types are most popular across these jurisdictions.

As you can see, Commercial licences for trading make up the biggest slice of the pie, which really underscores the UAE's position as a powerhouse for global trade.

To help you get a clearer picture, we've put together a simple head-to-head comparison. This table cuts through the jargon and lays out the core differences between the three jurisdictions.

Mainland vs Free Zone vs Offshore: A Head-to-Head Comparison

| Feature | Mainland | Free Zone | Offshore |

|---|---|---|---|

| Business Scope | Unrestricted trade within the UAE and internationally. Can take government contracts. | Trade primarily within the free zone and internationally. Local trade requires a distributor. | Only permitted to conduct business outside the UAE. |

| Ownership | 100% foreign ownership for most activities. Some strategic sectors may require a local partner. | 100% foreign ownership is the standard for all business activities. | 100% foreign ownership is guaranteed. |

| Visa Eligibility | Eligible for employee and investor visas. The number is tied to office space size. | Eligible for employee and investor visas. The number depends on the chosen package. | Not eligible for any type of UAE residency visa. |

| Office Requirement | A physical office space with a registered Ejari (tenancy contract) is mandatory. | A physical office is required, but flexi-desk and virtual office options are widely available. | No physical office is required or permitted within the UAE. |

Making the right choice here is absolutely fundamental to your future success. Our team delivers cost-effective business setup solutions designed around your specific goals, ensuring you start your journey in the right place. And with our 24/7 support service, we’re always here to help you navigate the process.

Choosing the Right Licence for Your Business

Once you’ve settled on the perfect jurisdiction, the next piece of the puzzle is selecting the specific business licence in UAE that allows you to operate legally. Think of it as choosing the right tool for the job. You wouldn't use a hammer to saw a piece of wood, and you certainly wouldn't get a manufacturing licence to run a consulting firm. It’s all about matching the licence to your actual business activities.

The UAE government has neatly categorised business activities to keep things clear and regulated. Getting this right isn’t just a box-ticking exercise; it’s fundamental to staying compliant and running your business smoothly. The three main categories you’ll come across are Commercial, Professional, and Industrial.

The Commercial Licence for Traders and Merchants

The Commercial Licence is probably the one you'll hear about most often. It’s the go-to for any business involved in trading – that means buying, selling, importing, or exporting goods. This licence is the backbone for general trading companies, retail shops, real estate agencies, and e-commerce stores.

Simply put, if your business involves a tangible product changing hands, this is almost certainly the licence you need.

- Real-World Example: Imagine an entrepreneur planning to launch an online store for handcrafted leather goods. They'd need a Commercial Licence to legally buy their raw materials, sell the finished products to customers across the UAE and beyond, and manage their stock. This licence covers every trading aspect of their operation.

The Professional Licence for Experts and Service Providers

Next up is the Professional Licence. This one is designed for individuals or companies whose business is built on specialised skills, knowledge, or expertise. We're talking about service-based businesses, not those selling physical goods. It's the essential permit for consultants, designers, artisans, accountants, and legal advisors.

A huge advantage of the Professional Licence, especially on the Mainland, is that it often allows for 100% foreign ownership. This is a massive draw for international experts wanting to set up a service business in hubs like Dubai or Abu Dhabi without needing a local partner.

A Professional Licence does more than just let you operate; it validates your expertise. It's the foundation for any business built on intellectual capital, from marketing agencies to IT support firms, and it gives you instant credibility in a very competitive market.

For example, a marketing strategist looking to open their own consultancy in Dubai would go for a Professional Licence. This permit lets them legally provide advisory services, run campaigns, and invoice clients for their expertise, cementing their status as a certified professional. As specialists in company formation, we help entrepreneurs navigate this process to secure the precise professional licence that fits their services.

The Industrial Licence for Manufacturers and Producers

The third main category is the Industrial Licence. You'll need this if your business is involved in manufacturing, producing, processing, or assembling goods. It’s for companies that take raw materials and turn them into finished products. Think furniture makers, food processing plants, or textile factories.

Getting an Industrial Licence is a bit more involved. It usually requires approvals from various ministries and even civil defence authorities to ensure the factory or workshop meets all the necessary safety and environmental standards. But for anyone looking to set up a manufacturing base in the UAE's booming industrial sector, it's the only way to go.

Specialised Licences for High-Growth Industries

Beyond these core three, the UAE also offers specialised licences for its fastest-growing sectors. These are created to support and regulate industries central to the nation's economic strategy, like technology, media, and tourism.

The tourism and hospitality industry, for example, is getting a lot of attention. The government has recently issued around 40,000 new licences specifically for tourism, hospitality, and aviation businesses. This really shows the UAE's commitment to reinforcing its position as a top global destination. You can discover more about the UAE's tourism strategy and what it means for new businesses.

Picking the right licence from day one saves a world of headaches down the line and ensures your business is built on a solid legal foundation. Our cost-effective business setup solutions are here to guide you through this decision, making sure your licence perfectly aligns with your vision.

The Step-by-Step Business License Application Process

Getting a business license in the UAE can feel daunting at first, but it’s actually a very structured journey. Think of it less like a maze and more like a clear roadmap with defined checkpoints. If you follow the steps in the right order, you'll avoid the common headaches and find the process surprisingly straightforward.

This guide breaks down that journey, step by step, from your initial idea to holding the final, approved license in your hand. The core principles are the same whether you're setting up in Dubai, Abu Dhabi, or Sharjah. It all comes down to methodical preparation.

Let's walk through it together.

Stage 1: The Foundation – Initial Approvals and Legal Framework

This first phase is all about getting your ducks in a row and securing the initial green light from the authorities. This is where your business idea officially starts to take shape on paper.

-

Define Your Business Activities: First things first, you need to be crystal clear about what your business will actually do. Every emirate's Department of Economic Development (DED), or the respective Free Zone Authority, maintains a huge list of approved activities. The ones you choose will directly dictate your license type and legal structure, so it's a critical decision.

-

Pick a Legal Form: Based on your activities and who will own the company, you'll select a legal structure. The most common options are a Limited Liability Company (LLC) for mainland setups, or a Free Zone Establishment (FZE) or Free Zone Company (FZC) if you're going the free zone route.

-

Reserve Your Trade Name: Your company name needs to be unique and follow UAE rules. You'll submit it to the DED or Free Zone Authority for approval. They'll check it against their registry and reject anything offensive, religious, or too similar to a well-known brand. This usually only takes a couple of days.

-

Get Initial Approval: This is a huge milestone. You'll submit your application and copies of all shareholders' passports. The authorities review your proposal and, if all is well, issue an Initial Approval Certificate. This document is their official nod, confirming they have no objection to your business being established.

Stage 2: The Paperwork – Documents and Your Office

With the initial approval in hand, it's time to draft the company's core legal documents and sort out a physical address. This is where the details really matter.

A well-drafted Memorandum of Association is more than a legal formality; it's the constitution of your company. It outlines shareholder rights, profit distribution, and operational procedures, preventing future disputes and ensuring clear governance from day one.

The main document you'll need is the Memorandum of Association (MOA). For an LLC, it has to be drafted in both English and Arabic, clearly defining the shareholding structure and business goals. After it's drafted, it needs to be officially notarised by a public notary here in the UAE.

Next up, you need a registered address. This is non-negotiable, even if you plan to work from home.

- Mainland? Get an Ejari: For a mainland company, you have to lease a physical office. That tenancy contract must then be registered through the Ejari system, which is managed by the Real Estate Regulatory Agency (RERA).

- Free Zone? More Options: Free zones are much more flexible. You can often choose from virtual offices, flexi-desks, or fully serviced offices. The package you pick determines how many visas you're eligible for, so you'll confirm this with the Free Zone Authority.

As specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, this is where we really streamline things for our clients. We handle the MOA drafting to make sure it's perfect and help you find an office solution that fits your budget and needs.

Stage 3: The Final Lap – Submission and License Issuance

You're on the home stretch now. The final stage is all about pulling everything together, submitting the complete file, and paying the fees to get your official business license.

You'll bundle up all your documents—the signed MOA, the tenancy contract (Ejari), the initial approval certificate, and shareholder paperwork—and submit them to the governing authority. Once they’ve verified everything and you've made the final payment, they will issue your official business license in UAE.

All in all, the process can take anywhere from a few days to several weeks, depending on the jurisdiction and how complex your business is. Working with a corporate service provider like us, with our 24/7 support service, just means every detail is handled correctly the first time, saving you a ton of time and energy.

Understanding the Costs and Fees Involved

No one likes financial surprises, especially when you’re pouring everything into a new business. Getting a handle on the budget for your business license in the UAE means knowing exactly what you're in for, and the costs really fall into two baskets: the initial, one-time setup fees and the yearly, recurring expenses.

The total amount you’ll spend can swing quite a bit. It all comes down to where you decide to set up (Mainland or a Free Zone), the specific business activities you choose, and what kind of office space you need. A clear financial roadmap is your best friend here.

One-Time Setup Fees: The Initial Investment

These are the upfront costs you’ll pay to get your company legally off the ground. Think of it as laying the foundation for your business’s legal home. While the exact figures can differ, almost every new setup will have to cover these.

Here’s a look at the typical one-time fees:

- Trade Name Reservation: This is the fee to officially lock in your unique company name.

- Initial Approval Fee: A charge from the authorities to give your business plan the green light.

- License Issuance Fee: The main government fee for printing and issuing your official trade license.

- Memorandum of Association (MOA) Notarisation: The cost to have a public notary legally witness and stamp your company's core legal document.

- Establishment Card Fee: This gets your company registered with the immigration department, which is the key to start applying for visas.

You pay these just once at the very beginning, setting the financial stage for your new venture.

Recurring Annual Costs: The Ongoing Commitment

Once you’re officially open for business, there are annual fees you need to cover to keep your license active and compliant. These are not optional; they are crucial for keeping your company in good legal standing. Falling behind can lead to hefty fines or even get your license suspended.

The most common yearly costs include:

- License Renewal Fee: This is usually the biggest recurring cost. You pay it every year to the DED or your Free Zone Authority to keep your license valid.

- Office Rent: Whether you have a physical office, a flexi-desk, or a virtual office package, this is an annual cost that’s directly tied to your license.

- Visa Renewal Fees: Every residency visa for yourself and your employees comes with renewal costs every two or three years.

- Establishment Card Renewal: Your company's immigration file also needs to be renewed each year.

It's just as important to budget for these ongoing costs as it is to fund the initial setup. Staying on top of annual renewals means your business can operate smoothly without any frustrating interruptions or penalties.

Sample Cost Estimate for a Small Business License in Dubai

To bring this all to life, let’s walk through a sample cost breakdown for a professional services company setting up in a Dubai free zone. Keep in mind, these are just estimates to give you a ballpark idea – the final costs can and will vary.

Table: Sample Cost Estimate for a Small Business License in Dubai

| Cost Component | Estimated Cost Range (AED) | Frequency |

|---|---|---|

| Trade Name & Initial Approval | 1,000 – 2,000 | One-Time |

| License Issuance Fee | 10,000 – 15,000 | Annual |

| Virtual Office/Flexi-Desk | 5,000 – 10,000 | Annual |

| Establishment Card | 1,500 – 2,500 | One-Time & Annual |

| Investor Visa (per person) | 4,000 – 6,000 | Every 2 Years |

This table should give you a clearer picture of how the different fees add up.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we pride ourselves on creating cost-effective business setup solutions built around what you actually need. Our entire approach is about giving you a transparent, upfront cost structure so you can manage your budget effectively and give your business the strongest possible start.

Maintaining Your Licence and Growing Your Business

Getting your business licence in UAE is a massive milestone, but think of it as the starting line, not the finish. Now, the real work begins: staying compliant and using that licence to actively grow your venture. This is all about keeping your business in good legal standing so you can focus on what you do best.

First up, annual licence renewals are a must. Missing the deadline isn't an option, as it can result in hefty fines and even halt your operations. It’s vital to get those dates in your calendar well in advance. At the same time, with the UAE's corporate tax now in effect, keeping meticulous financial records has never been more critical. Good bookkeeping is the foundation for accurate tax filing and meeting all your legal obligations.

Unlocking Growth with Your New Licence

Your licence is far more than just a piece of paper—it’s the key that unlocks your business's potential in the UAE. One of the very first things you'll do is open a corporate bank account. This is a crucial step that separates your business finances from your personal ones, builds credibility, and makes managing your money a whole lot easier.

With your licence and establishment card sorted, you can also start sponsoring residency visas for yourself, your family, and your team. This is fundamental for building a strong local workforce and truly planting your roots in the UAE market.

Your UAE business licence is a powerful asset for scaling your operations. It enables you to access the local banking system, build a team through visa sponsorship, and fully capitalise on the pro-business environment.

Staying Compliant and Focused on the Future

By staying on top of the administrative side of things, you free yourself up to concentrate on scaling your business. This really boils down to a few core responsibilities:

- Annual Renewals: Getting the right documents and fees submitted to the correct authority, on time, every year.

- Financial Reporting: Maintaining clean and organised financial records for corporate tax and any potential audits.

- Visa Management: Keeping track of and managing the renewal process for all your sponsored visas, for both employees and investors.

Juggling these ongoing tasks can feel overwhelming, especially when you're trying to build a business. As specialists in company formation, we offer a 24/7 support service so you're never navigating this alone. We're here to help you manage your compliance with confidence, allowing you to grow your business and take full advantage of the UAE tax benefits available to international entrepreneurs.

Frequently Asked Questions

Setting up a business in the UAE can bring up a lot of questions. It's completely normal. Here, I'll tackle some of the most common queries I hear from entrepreneurs, giving you straight answers to help clear things up before you dive in.

Can I Get a UAE Business License Without a Physical Office?

Absolutely. This is actually a very popular and smart way to get started. Many free zones have come up with clever solutions like virtual office packages or flexi-desks.

These packages give you a legitimate, registered business address—which is a legal must-have—but without the hefty price tag and long-term commitment of leasing a full-time office. It's a perfect fit for consultants, freelancers, and global business owners who need a formal presence here but don't need a physical desk every day.

How Long Does It Take to Get a Business License in the UAE?

This is a classic "it depends" situation. If you're going for a straightforward setup in a free zone, you could have your license in hand within a few days to a week. It can be surprisingly fast.

However, a mainland license for a business that needs special sign-offs from various ministries—think healthcare or engineering—will naturally take longer, sometimes several weeks. The biggest factors are your chosen jurisdiction, the type of business you're in, and how well-prepared your paperwork is. Getting it right the first time is the key to moving quickly.

While official timelines can shift, the one thing you can completely control is your application. A clean, accurate, and complete submission is your best bet for avoiding frustrating delays and getting your business off the ground faster.

Do I Need a Local Sponsor for My Business in the UAE?

This is probably one of the biggest misconceptions out there, mostly based on old rules. The short answer is: most likely, no.

In any of the UAE's free zones, 100% foreign ownership is the absolute standard. For mainland businesses, sweeping government reforms have opened up the vast majority of industries to full foreign ownership as well. Only a handful of very specific, strategic sectors still require an Emirati partner. As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we can give you the most current advice for your exact business activity.

What Is the Difference Between a Trade License and a Business License?

In everyday conversation here in the UAE, people use 'trade license' and 'business license' to mean the exact same thing. Both terms refer to the official document that legally allows you to operate.

What really matters isn't the name but the type of license you get. Whether it’s a Commercial, Professional, or Industrial license will define exactly what your company is legally permitted to do. That's the detail to focus on.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation