Opening a bank account in Dubai from your laptop used to be a distant dream, but now it's very much a reality. It's a direct, practical process built for both new residents settling in and entrepreneurs looking to plant a flag in the region.

The first thing to get clear on is the core distinction: resident accounts versus non-resident accounts. If you have a UAE residence visa and an Emirates ID, the full suite of banking features is open to you. For non-residents, options are available, but they often come with certain limitations. This guide will walk you through the entire digital journey, making sure you know exactly what to expect.

A Practical Overview of Dubai Online Banking

The ability to open a bank account in Dubai online is a direct result of the UAE's push towards a high-tech, digital-first economy. The city’s financial system is engineered for speed and global accessibility. What this means for you is less time wasted in bank queues and more time dedicated to what really matters—your life or your business.

For international entrepreneurs, this is a game-changer. You can kickstart the entire financial setup from your home country, giving you a massive head start before your feet even touch the ground in Dubai. But the path you'll take hinges entirely on your residency status and your company’s structure.

Key Distinctions for Applicants

Your residency status is the single biggest factor determining your banking options. While it's possible for a non-resident to open a savings account, getting a full-feature current or corporate account almost always demands a valid residence visa. This is often where people get stuck and where professional guidance becomes less of a luxury and more of a necessity.

This is where a corporate service provider can step in and manage the entire process. As specialists in Mainland Company Formation in Dubai & Abu Dhabi or Freezone setups, we can secure your trade licence and residence visa first. Think of these documents as the foundational pillars upon which your corporate bank account will be built.

The real advantage of partnering with an expert is turning a complex, multi-step process into a single, managed project. They handle the administrative burden, allowing you to focus on your business strategy.

This kind of support is often available 24/7, a huge relief for entrepreneurs operating across different time zones. The ultimate goal is to find a cost-effective business setup solution that’s right for you, from the initial company registration all the way to activating your new bank account, letting you enjoy the UAE's tax benefits.

To give you a clearer picture, here’s a quick breakdown of what to expect for personal versus corporate accounts.

Personal vs. Corporate Bank Accounts in Dubai at a Glance

This table offers a side-by-side comparison, highlighting the key differences in requirements and features when opening a personal or corporate account online.

| Feature | Personal Account | Corporate Account |

|---|---|---|

| Primary Requirement | UAE Residence Visa & Emirates ID | Valid Trade Licence (Mainland or Free Zone) |

| Typical Use | Salary transfers, daily expenses, savings, personal investments | Business transactions, invoicing, payroll, trade finance |

| Documentation | Passport, visa, Emirates ID, proof of address, salary certificate | All shareholder/manager documents, trade licence, MOA, business plan |

| Account Opening Timeline | 1-3 business days (with all documents ready) | 2-4 weeks (due to extensive KYC and due diligence) |

| Minimum Balance | Often AED 3,000 – AED 5,000; some digital-only banks have no minimum | Varies significantly; typically starts from AED 25,000 to AED 250,000+ |

| Key Challenge | Proving a stable source of income or employment | Demonstrating business substance and a clear operational plan |

As you can see, corporate accounts involve a more rigorous vetting process due to compliance standards, but both are entirely achievable with the right preparation.

Leveraging Dubai's Digital Transformation

Dubai's commitment to a digital-first economy has made the online banking experience incredibly smooth. Imagine setting up your mainland company and opening a corporate account without ever stepping into a branch—this is the new reality. Dubai's Cashless Strategy is aiming for a massive 90% of all transactions to be digital by 2026, which is projected to add over AED 8 billion to the economy annually. This is a core part of the wider Dubai Economic Agenda (D33), building on the fact that 97% of government services were already digital by 2024.

For businesses, this means efficiency. When you work with the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, they navigate this digital ecosystem for you. They handle everything from DED approvals to making the right introductions at the bank, ensuring your LLC with 100% foreign ownership gets its corporate account without a hitch. You can learn more about Dubai's leap toward a digital-first economy.

You’ll also notice how technology like conversational AI, and specifically chatbots in banking, is used to provide instant support and guide you through processes. This tech integration is a hallmark of the modern Dubai banking experience.

In the end, whether you're an individual taking advantage of the UAE's tax benefits or a business owner establishing a foothold in a world-class free zone, the online banking system is there to support you. With the right preparation and expert help, you can get your financial foundation in Dubai set up efficiently and with total confidence.

First Things First: Are You Eligible to Bank in Dubai?

Before you even think about filling out an application to open a bank account in Dubai online, you need to get a clear picture of where you stand. The entire process hinges on one key factor: your status as either a UAE resident or a non-resident. For businesses, it’s all about your company’s legal setup.

While it's a relatively smooth ride for anyone holding a valid Emirates ID, international entrepreneurs and those without residency often find the path a bit more complex. Think of eligibility not as a simple checklist, but as the very foundation of your application. UAE banks operate under tight regulations, so they need to be absolutely certain about who you are and, if you're a business, the legitimacy of your operations. Getting your legal status right from the start is non-negotiable.

Are You a Resident or a Non-Resident?

This is the biggest fork in the road for personal banking. If you're a UAE resident with an active visa and Emirates ID, pretty much every bank in Dubai will be happy to talk to you. Your Emirates ID is the golden ticket, making the whole Know Your Customer (KYC) process much simpler for the bank.

For non-residents, the options narrow considerably. It's not impossible to open an account, but what you get is usually a savings account with some strings attached. Expect higher minimum balance requirements, limits on what you can do with your money, and forget about getting a chequebook or credit. These accounts are really just for parking funds, not for running your day-to-day life or business.

A lot of people assume they can open a full-featured business account without having any real presence here. The reality is that UAE banks will only open a corporate account for a legally registered local business, and they often expect the people signing the cheques to be residents too.

This is exactly why a bit of forward-planning is so crucial. If your end goal is to run a business from Dubai, the most solid path to getting the banking you need is to set up a company and secure residency first.

How Your Company Structure Shapes Your Banking Options

When it comes to corporate banking, your company's legal DNA is what matters most. In the UAE, you’re generally looking at two main setups: mainland or free zone. Each has a big impact on your banking journey.

- Mainland Company (LLC): Setting up on the mainland with the Department of Economic Development (DED) gives you full access to the local UAE market. Banks tend to look very favourably on these companies because they require a physical office, which shows a serious commitment to operating in the country.

- Freezone Company: This is a hugely popular choice for international businesses, thanks to major perks like 100% foreign ownership and tax breaks. UAE banks are very comfortable working with free zone companies and have well-established procedures for them.

Your choice between mainland and free zone will point you towards certain banks and dictate the exact paperwork you'll need. Some banks just have better working relationships with specific free zones, which can make the whole process a lot smoother. This is where getting some expert advice can really pay off.

A Real-World Example: From European Startup to Dubai Hub

Let's walk through a common scenario. Imagine a European tech startup wants to set up a base in Dubai to expand into the Middle East. They opt for a Freezone Company Formation to take advantage of the tax benefits and operational ease. The problem? The founders are still in Europe and aren't sure how to satisfy the bank's demands for residency and a tangible local presence.

This is where a partner like us steps in. We’d start by handling the entire free zone company formation from A to Z—registering the business, getting the trade licence, and sorting out the founders' residence visas.

Once the company is licensed and the founders have their Emirates IDs in hand, we tap into our network of partner banks. We review the application before it's even submitted, making sure everything from the business plan to the shareholder agreements is exactly what the bank wants to see. This turns a confusing, drawn-out process into a clear, manageable project. The result? The startup gets its corporate account approved, no fuss. And with our 24/7 Support Service, we're always on hand to answer questions, making the entire journey seamless for our international clients.

Preparing Your Documents for a Flawless Application

Trying to open a bank account in Dubai online without your paperwork in order is a recipe for disaster. I've seen it time and time again—the entire process lives or dies by the quality of your documents. A single missing file or a tiny error can get your application sidelined, leading to weeks of frustrating delays.

Think of this as the most crucial step. UAE banks are incredibly thorough, and their compliance departments scrutinise every detail. Getting your documents right the first time doesn't just make things faster; it shows the bank you're serious and professional from the get-go.

The Essential Checklist for Personal Accounts

If you're an individual with a UAE residence visa, the document list is fairly straightforward. That said, there’s zero room for error. The bank will check everything.

Here’s the core set of documents you’ll need to have scanned and ready to upload:

- Valid Passport Copy: Get a clear, high-resolution scan. Make sure it shows your photo page, personal details, and signature.

- UAE Residence Visa Page: This is the page stamped inside your passport that confirms you're a legal resident.

- Emirates ID Copy (Front and Back): This is your primary ID in the UAE. Banks rely on it heavily for verification, so make sure both sides are scanned clearly.

- Proof of Address: Usually, a recent utility bill (like a DEWA bill) or your registered tenancy contract (Ejari) will do the trick, as long as it's in your name.

- Salary Certificate or Proof of Income: Your employer can provide a letter confirming your salary. This is especially important if you plan on applying for a credit card or loan down the line.

My advice? Create a dedicated folder on your computer with all these files before you even start filling out the application. It will save you a massive headache.

Corporate Account Documentation: The Deeper Dive

Okay, this is where things get much more complex, particularly for entrepreneurs setting up a mainland or free zone company. The bank isn't just vetting you; it's doing a full due diligence check on your entire business.

Your corporate documents need to tell a clear, compelling story about a legitimate and viable business. On top of the personal documents for every shareholder and signatory, you'll need to prepare a comprehensive company file.

Key corporate documents always include:

- Valid Trade Licence: This is your company's birth certificate, proving it exists legally.

- Memorandum of Association (MOA) / Articles of Association (AOA): These legal documents spell out what your company does, who owns it, and how it’s run.

- Shareholder and Director Documents: You'll need passport, visa, and Emirates ID copies for every single person who owns a piece of the company or has signing authority.

- Company Profile or Business Plan: A straightforward document explaining your business activities, who your customers are, and your basic financial projections.

Your business plan is far more than just a formality; it’s your chance to convince the bank your venture is credible and low-risk. From my experience, a weak or generic business plan is one of the top reasons corporate accounts get rejected.

This is exactly where getting expert help makes a huge difference. As specialists, we excel at developing business plans that tick all the boxes for UAE banks. We know how to present your business model in a way that gives the bank’s compliance team immediate confidence.

The Critical Hurdle of Attestation and Translation

For international companies, the document attestation requirement is often the biggest roadblock. If any of your key corporate documents (like a parent company’s certificate of incorporation) come from outside the UAE, they have to be legally attested.

It’s a specific, multi-step process: verification by the Ministry of Foreign Affairs in the document's home country, then by the UAE Embassy there, and finally by the Ministry of Foreign Affairs (MOFA) here in the UAE. Miss one step, and you’re stuck. On top of that, any document that isn't in English or Arabic needs to be legally translated by a certified professional.

Getting this wrong will stop your application in its tracks. It's a precise and often lengthy process. Our team handles the entire attestation and translation chain for our clients. We know the system inside and out, which means we get it done right and fast, removing a major source of stress from your plate.

Tackling the Online Application from Start to Finish

With your documents prepped and ready, it's time to dive into the actual online application. This is where all that groundwork really pays off. Think of this process less like filling out a form and more like making a formal introduction—presenting yourself or your company to the bank in the most professional and compliant light possible.

From picking the right bank to handling the final verification call, every step matters. You'll find that UAE banks offer wildly different digital experiences. Some have slick, modern interfaces that make applying a breeze, while others can feel a bit dated and clunky. The trick is knowing what's coming and being ready for it.

Finding the Right Digital Banking Platform

Your first big decision is choosing a bank. Don't get swayed by a flashy advertisement. The best fit really depends on your situation—are you opening a personal account, setting up a mainland company in Dubai, or launching a free zone business?

Here’s what I tell clients to look for when comparing their options:

- Ease of Use: How intuitive is their online portal? A clean, straightforward platform makes a world of difference and saves you a lot of headaches.

- Must-Have Features: Look for essentials like multi-currency accounts, simple international transfers, and a solid mobile app. For any international business, these aren't just nice-to-haves; they're critical.

- Real Human Support: How quickly can you get help when you need it? Access to 24/7 support can be a real lifesaver, especially if you're managing things from a different time zone.

- Business-Type Friendly: Some banks are just better with startups or specific industries. This is where inside knowledge helps—as a specialist, we know exactly which banks are the best match for various business models.

To get a feel for the process from the bank's perspective, it helps to understand customer onboarding best practices. Knowing why they ask for certain things in a specific order can make the entire journey feel much more logical.

Filling Out the Application with Precision

That online form is your first direct conversation with the bank's compliance team. Every single field is important, and there’s zero room for error. You'll need to provide detailed information about your personal background and, for a corporate account, a clear picture of your business activities.

A classic mistake I see all the time is mismatched information. If your trade licence is for "General Trading" but you describe your business as a "fintech consultancy," you're going to raise immediate red flags. Make sure every detail you provide lines up perfectly with your official documents. This isn't just about ticking boxes; it's about building trust from the very first click.

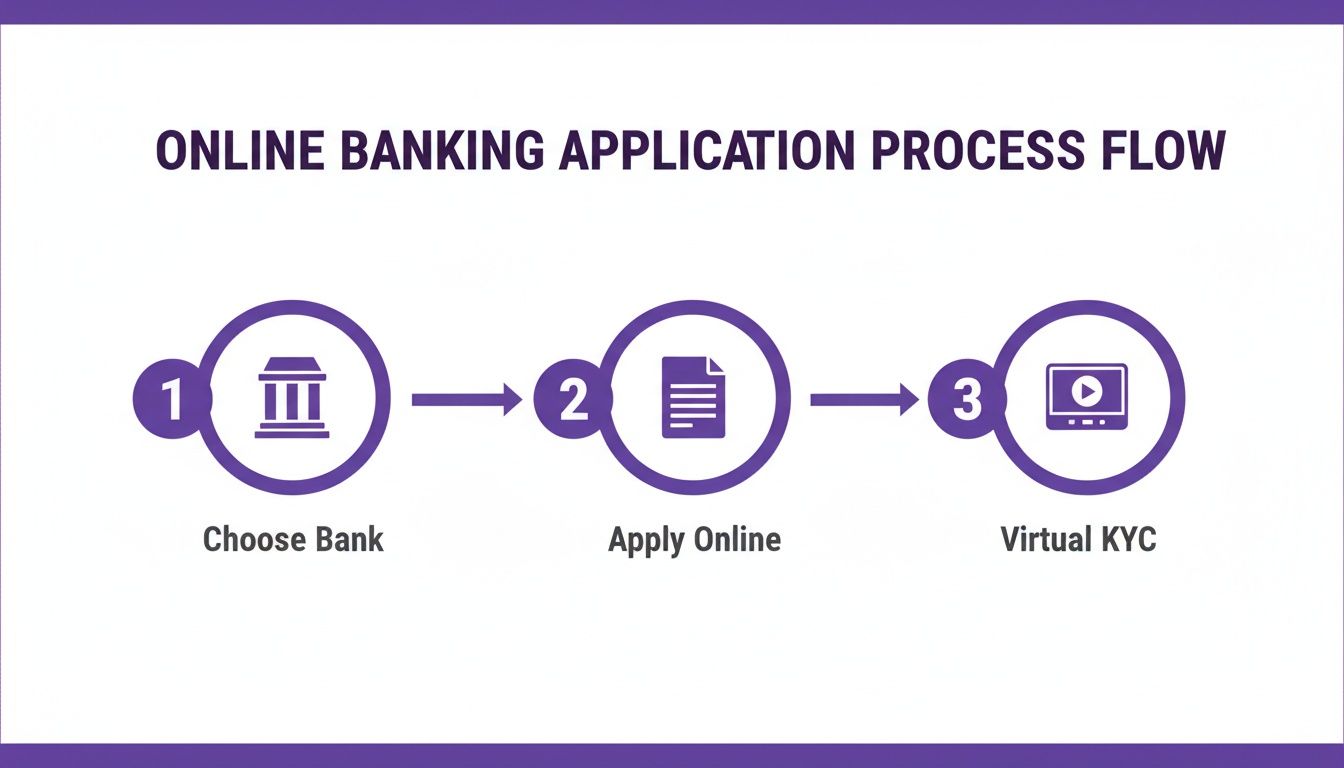

Acing the Virtual Know Your Customer (KYC) Call

Once you've submitted everything, the next major step is the virtual KYC call. This is a mandatory video conference where a bank officer verifies who you are and asks a few questions. It's their way of putting a face to the application and confirming everything is legitimate.

Here’s how to handle it like a pro:

- Be Ready to Show ID: Have your original passport and Emirates ID (if you have one) within arm's reach. They will ask to see it on camera.

- Choose a Professional Setting: Take the call in a quiet, well-lit space. A busy coffee shop is not the right vibe.

- Know Your Story: Be prepared to confidently discuss your source of funds, what your business does, who your main clients are, and your expected turnover.

The KYC call is your chance to make a great first impression. I always tell my clients to treat it like a professional interview. The relationship manager is gauging your credibility, not just checking your paperwork.

Why Professional Representation is a Game-Changer

Let's be honest—this whole process can be complex and incredibly time-consuming. This is exactly where partnering with a corporate service provider gives you a serious edge. We do more than just help you gather documents; we manage the entire application from start to finish. Our consultants personally vet your application package, making sure it's perfect before it even lands on the banker's desk.

We talk directly to the bank's relationship managers for you, using our established connections to solve potential problems before they can cause delays. This hands-on approach consistently speeds up approval times, transforming what could be a multi-week ordeal into a much smoother, faster process.

The UAE’s banking sector is incredibly strong, with gross assets recently hitting 5.25 trillion AED ($1.43 trillion). This fuels a dynamic environment for lending and investment, making it an ideal place for your business. Our job is to make sure you can plug into that potential without getting tangled up in the red tape.

How to Avoid Common Application Pitfalls

Trying to open a bank account in Dubai online can feel straightforward, but it’s surprisingly easy to get derailed. I’ve seen countless applications hit a wall for reasons that were entirely preventable. While the digital process is convenient, you have to remember that UAE banks operate under some of the strictest compliance standards in the world. Knowing where people usually slip up gives you a huge advantage.

The roadblocks almost always fall into one of three buckets: messy paperwork, a business model that makes the bank nervous, or failing the rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) checks. A mistake in any of these areas can bring the entire process to a screeching halt.

Incomplete Documentation and Unclear Business Models

The number one reason for rejection? An application that isn't absolutely perfect. This isn't just about forgetting a document. It’s about providing information that’s vague, inconsistent, or just plain confusing. Banks are looking for a crystal-clear, low-risk snapshot of you and your company.

A classic misstep is submitting a generic, copy-pasted business plan. Your plan has to be tailored to your UAE operations, clearly defining your target market, your core activities, and the types of transactions you expect. An activity line like "general trading" is an instant red flag for any compliance officer. They need to know exactly what you’re trading, who you're trading with, and where.

As you can see, from the moment you select a bank to the final virtual KYC interview, every single step is a critical due diligence checkpoint.

Passing the Bank’s Due Diligence and AML Checks

UAE banks are under enormous global pressure to combat illicit finance. This has made them incredibly cautious, particularly with international businesses or sectors they view as high-risk. Your application will be put under a microscope.

Here’s what they’re really looking at during their due diligence:

- Source of Funds: You must provide clear, undeniable proof of where your initial capital and ongoing funds are coming from. A fuzzy explanation is a deal-breaker.

- Ultimate Beneficial Owner (UBO): Banks demand full transparency on who ultimately owns and controls the company. Trying to hide behind layers of corporate structures is a non-starter.

- High-Risk Activities: If your business touches cryptocurrency, precious metals, or deals with sanctioned nations, expect intense scrutiny. You have to be an open book.

- Transaction Patterns: Your business plan must realistically forecast the nature, size, and geographic spread of your incoming and outgoing payments.

Working with a corporate service provider is like having an insider review your application first. We pre-vet every document and every statement to make sure it aligns perfectly with the bank’s expectations before you even click ‘submit’. It’s about preventing problems, not just fixing them.

Because we handle both mainland and free zone company formation, we know the subtle differences in what banks are looking for depending on your business licence. We help you build a compelling case that screams 'compliant and trustworthy' from the get-go.

Maintaining a Healthy Banking Relationship Post-Approval

Getting the account open is just the first hurdle. The real challenge is keeping it active and in good standing. Banks are constantly monitoring for red flags, and one wrong move can lead to a frozen account or, worse, a forced closure.

To keep things running smoothly, you need to:

- Understand Transaction Monitoring: Be ready for the bank to flag large, unusual, or out-of-character payments. Always have invoices or contracts ready to explain significant transfers.

- Stick to the Minimum Balance: This sounds simple, but many people forget. Dipping below the required minimum can trigger steep monthly fees and could eventually lead to the bank closing your account.

- Communicate Proactively: Is your business model evolving? Are you planning to work with clients in a new region? Tell your relationship manager before you do it. Transparency builds trust and prevents your account from being flagged for suspicious activity.

By sidestepping these common mistakes and fostering a transparent relationship with your bank, you ensure your Dubai financial operations stay on solid ground. With our 24/7 Support Service, we’re always here to help you navigate these waters, letting you focus on what really matters—growing your business. For a free chat, WhatsApp us today.

Got Questions About Dubai Banking? We've Got Answers

Stepping into Dubai's banking world can feel a bit like navigating a maze, especially when you're trying to get everything sorted online. Let's clear up some of the most common questions we hear from clients every day.

Can I Really Open a Dubai Bank Account from Abroad?

The short answer is yes, but with a few catches. For non-residents, the options are usually limited to savings accounts, which come with their own set of restrictions. If you need a fully-fledged business account with all the features, the banks will almost always require you to have a UAE company and a residence visa. That's just part of their strict "Know Your Customer" (KYC) rules.

This is exactly where having an expert on your side makes a difference. As specialists in Freezone Company Formation across the UAE, we can walk you through setting up a free zone company first. This is the key that unlocks your residency, which in turn opens the door to the full range of corporate banking services. For any serious entrepreneur looking to do business here, it's the smartest first move.

What’s the Real Story on Minimum Balances for Business Accounts?

This is a big one, and the figures can be all over the place. You might find accounts with minimum balance requirements as low as AED 25,000, while others might ask for upwards of AED 200,000. It really boils down to the bank, the account type, and what your business actually does. We are seeing some digital banks shake things up with low- or zero-balance options, but you'll want to read the fine print for other potential limitations.

My best advice? Get this confirmed in writing before you sign anything. If your balance dips below the required amount, you could be hit with hefty monthly penalties that can eat into your funds. During a free chat, we can help you size up different banks against your expected cash flow, so you find an account that actually fits your business instead of draining it.

How Long Will I Be Waiting to Get My Corporate Account Open?

Honestly, the timeline can be a bit of a moving target. If your application is straightforward and you have every single document in perfect order, you could be looking at two to four weeks. However, if you have a more complex international structure or operate in an industry the banks consider "high-risk," be prepared for it to stretch into several months.

The biggest bottleneck is always the bank's own internal due diligence and compliance checks.

This is where working with a professional can genuinely speed things up. When we submit an application, the bank knows it's been vetted by an experienced team. Our established relationships and perfectly prepared paperwork help you get to the front of the compliance queue.

Do I Have to Rent an Office Just to Open a Business Bank Account?

Not necessarily! This is a common worry, but there’s a very practical solution. If you set up your company in one of the UAE’s free zones, a flexi-desk or virtual office package is often enough to meet the legal address requirement for banking. It’s a hugely popular, cost-effective approach that most major banks are perfectly happy with.

On the other hand, if you're setting up on the mainland, you will generally need a physical office lease backed by an official Ejari certificate to prove you have a real presence. As experts in both mainland and free zone company formation, we can advise you on the smartest, most compliant path for your business, making sure you tick every box from day one.

Figuring out the ins and outs of company formation and banking in Dubai is what we do best. We are specialists in Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, providing Cost-Effective Business Setup Solutions so you can enjoy UAE Tax Benefits for International Entrepreneurs. Plus, with our 24/7 Support Service, we're always here when you need us.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation