Think of a UAE offshore company as your global business passport. It's a powerful tool that lets international entrepreneurs manage worldwide trade, hold global assets, and protect their wealth—all with exceptional privacy and major tax benefits. Essentially, it's a legal entity registered in a specific non-resident jurisdiction, like RAK ICC or JAFZA, built exclusively for business conducted outside the Emirates.

What Is a UAE Offshore Company

Let's break it down. Picture a company that is legally registered and based in the UAE but is designed to operate solely on the international stage. That's the core idea behind a UAE offshore company. Unlike mainland or free zone companies that are set up to do business within the local economy, an offshore entity is a non-resident vehicle. Its main job is to act as a strategic tool for your global activities, giving you a prestigious and stable base without getting tangled in local trading rules.

This structure is a game-changer for international investors, high-net-worth individuals, and multinational businesses. Many use it as a holding company to own shares in other corporations around the world, manage valuable intellectual property rights, or even hold real estate assets in designated areas. The crucial distinction is its operational boundary: it is legally not allowed to conduct any business inside the UAE.

The Purpose and Appeal

So, why are so many people drawn to setting up an offshore company here? The appeal comes down to a powerful mix of benefits. These setups are about much more than just tax efficiency; they offer a solid framework for protecting your assets and maintaining confidentiality.

Here are the main reasons people choose a UAE offshore structure:

- Asset Protection: It acts like a legal firewall, separating your personal wealth from your business liabilities. This is vital for safeguarding your assets against potential legal disputes or instability in other regions.

- Confidentiality: The names of shareholders and directors are not listed on a public register. This provides a level of privacy that is hard to find elsewhere.

- Tax Optimisation: Income earned outside the UAE is generally not subject to local corporate tax. This makes it an incredibly efficient way to structure international profits.

- Global Credibility: The UAE has a rock-solid reputation as a secure, well-regulated global business hub. Having a company registered here instantly gives your operations a stamp of credibility.

The UAE's forward-thinking economic reforms have cemented its status as a premier destination for global entrepreneurs. This makes an offshore setup more than just a smart tax decision—it's a strategic move for long-term stability and growth.

A Growing Global Hub

The UAE's economy is diversifying at an impressive pace, making it an ever-more attractive base for international operations. By 2025, the nation hit a major milestone with over 1.4 million registered companies—a staggering 118.7% jump since mid-2021. Even more telling is that the non-oil sector now makes up 77.5% of the GDP, proving the economy is robust, stable, and perfectly suited to the needs of global investors. You can discover more insights about the UAE's company growth and what it signals for offshore setups.

For any entrepreneur looking to navigate this landscape, working with a specialist is key. At 365 DAY PRO, we provide cost-effective business setup solutions and the expert guidance you need to establish your offshore company without a hitch.

Choosing Your Jurisdiction: RAK ICC vs JAFZA Offshore

Picking the right jurisdiction for your offshore company in the UAE is the single most important decision you'll make at the start of this journey. It's about much more than just a mailing address; it's about choosing a legal framework that perfectly aligns with where you want to take your business.

While there are a few options out there, the conversation almost always comes down to two heavyweights: RAK International Corporate Centre (RAK ICC) and Jebel Ali Free Zone Authority (JAFZA) Offshore.

Think of it like choosing between two high-performance vehicles. Both are engineered for excellence, but one might be a nimble sports car built for speed and efficiency, while the other is a luxury SUV designed for power and specific, rugged tasks. Your choice depends entirely on your destination—your budget, your need for privacy, and whether you plan to hold assets like Dubai real estate.

Let's break them down to see which one is the right fit for you.

RAK ICC: The Smart Choice for Efficiency and Privacy

Based in Ras Al Khaimah, RAK ICC has quickly earned a reputation as the go-to option for entrepreneurs who value affordability, operational flexibility, and rock-solid confidentiality. It’s widely seen as a modern, efficient, and user-friendly registry.

One of its biggest selling points is the cost. Both the initial setup and the annual renewal fees for an RAK ICC company are noticeably lower than in JAFZA. This makes it a fantastic starting point for startups, SMEs, and individual investors who want an international footprint without a massive upfront cost.

But it’s not just about the price tag. RAK ICC is also known for its commitment to privacy. The official register of company directors and shareholders isn't open to the public, creating a strong layer of confidentiality. This is a massive plus for anyone using the company for asset protection or wealth management.

Here’s what makes RAK ICC stand out:

- Lower Costs: More budget-friendly for both registration and yearly maintenance.

- Airtight Privacy: Confidentiality is a top priority, with private company registers.

- Global Acceptance: RAK ICC companies are recognised and trusted by banks and institutions worldwide.

- Versatile Structure: Perfect for a huge range of activities, from international trading to acting as a holding company.

JAFZA Offshore: The Dubai Prestige and Property Advantage

Operating from within the world-renowned Jebel Ali Free Zone, a JAFZA Offshore company offers something different: the power and prestige of the Dubai brand. If your business benefits from being associated with a major global financial hub, a JAFZA registration speaks volumes.

The undisputed trump card for JAFZA, however, is its unique ability to own freehold real estate in designated areas of Dubai. This is a complete game-changer. For international investors looking to hold property within a corporate structure for asset protection or tax planning, JAFZA is the only offshore jurisdiction in the UAE that allows this directly.

While the costs are higher than RAK ICC, that investment unlocks this exclusive benefit. The credibility of a Dubai-based entity, combined with the right to own property, makes it the premier choice for certain investment strategies.

A JAFZA offshore company is the only vehicle of its kind that can hold direct title to real estate in approved Dubai developments. This unique feature makes it an indispensable tool for international property investors.

This choice is backed by a booming ecosystem. The UAE's free zones, now numbering over 45 and home to more than 150,000 companies, have become a global centre for offshore and hybrid structures. The growth is staggering; DIFC alone registered 1,081 new active companies in H1 2025—a 32% jump from the previous year. This reflects the intense demand for UAE offshore setups like JAFZA, which offer benefits like 100% profit repatriation and strong privacy shields. You can explore the latest Dubai business statistics to get a better sense of this momentum.

RAK ICC vs JAFZA Offshore At a Glance

To put it all in perspective, here's a straightforward comparison to help you weigh the key differences between the two leading jurisdictions. This table cuts through the noise and focuses on what truly matters for your decision.

| Feature | RAK ICC (Ras Al Khaimah) | JAFZA Offshore (Dubai) |

|---|---|---|

| Primary Advantage | Cost-effectiveness, high confidentiality, and flexibility. | Prestige and the exclusive ability to own property in Dubai. |

| Setup Cost | Generally lower than JAFZA. | Generally higher than RAK ICC. |

| Annual Renewal | More affordable. | Higher due to its premium location and benefits. |

| Property Ownership | Cannot own real estate in Dubai. | Permitted to own freehold property in designated areas. |

| Confidentiality | Very high; shareholder and director details are private. | A high level of confidentiality is maintained. |

| Location Prestige | Well-respected internationally. | Associated with the global brand and powerhouse of Dubai. |

| Ideal For | Holding companies, global trade, and asset protection. | Real estate investment, high-prestige holding companies. |

So, what's the verdict? It really comes down to your specific business plan.

If your main goal is to create a private, flexible, and cost-effective company for international business or asset holding, then RAK ICC is an outstanding choice. But if your strategy revolves around owning Dubai real estate, or if the global reputation of a Dubai-based entity is crucial for your brand, then JAFZA is clearly the way to go. Working with a professional can help you map out your needs and make sure you choose the perfect jurisdiction from day one.

The Real-World Advantages of a UAE Offshore Company

Setting up an offshore company in the UAE isn't just about paperwork; it's a strategic move to build a stronger, more private, and flexible foundation for your global business ventures. For international entrepreneurs and investors, this structure offers some compelling, practical benefits that are hard to ignore.

Let's break down exactly why this is such a powerful tool. These aren't just abstract concepts—they are tangible advantages you can use to protect your assets, run your business more efficiently, and improve your bottom line.

Gaining Full Control and Financial Freedom

One of the biggest draws right out of the gate is 100% foreign ownership. This is a huge deal. It means you call all the shots. You don't need a local Emirati partner or sponsor, giving you complete and total control over your company's direction, strategy, and day-to-day operations.

This control naturally extends to your money. With complete profit repatriation, you’re free to move your capital and profits wherever you need them. Unlike other places that can tie your hands with red tape, a UAE offshore company lets you transfer 100% of your earnings back home or reinvest them anywhere in the world, without restrictions. That's real financial freedom.

Building a Fortress for Your Assets

In a world full of economic uncertainty, protecting what you've built is non-negotiable. A UAE offshore company is a legal firewall, creating a clean separation between your business's liabilities and your personal wealth.

Think of it like a secure vault. You can place your valuable assets inside this corporate structure—things like shares in other businesses, intellectual property, or international real estate. If a legal claim or financial threat arises in one part of your life, the assets inside this "vault" are shielded. This separation means your personal savings and home are kept safe, which is a massive relief for any business owner.

An offshore company in the UAE is more than just a business entity; it’s a strategic instrument for wealth preservation. It allows you to build a protective barrier around your most valuable assets, safeguarding them for the future.

This structure also provides a serious layer of confidentiality and privacy. In most UAE offshore jurisdictions, the names of the company’s directors and shareholders aren't published on a public database. For many high-net-worth individuals, this discretion is essential for keeping their financial affairs private and avoiding unwanted attention.

Achieving Powerful Tax Efficiency

Now, let's talk about tax. The UAE recently introduced a Corporate Tax, but the way it applies to offshore companies is a game-changer for international business. In short, an offshore company in the UAE that earns all its income from outside the Emirates is generally not subject to the 9% Corporate Tax.

This creates an incredibly tax-efficient setup. You can run an international trading business, offer consulting services to clients across the globe, or manage a portfolio of investments without paying local tax on that foreign-sourced income. It allows you to keep more of what you earn and plough it back into growing your business.

A Versatile Tool for Global Operations

Beyond these core benefits, a UAE offshore company is an incredibly flexible vehicle. It’s very commonly used as a holding company, a central entity to own and manage a diverse portfolio of international assets under one secure and reputable roof.

Here are a few real-world examples of how it works:

- Holding International Investments: An investor could use a RAK ICC offshore company to hold a mix of stocks, bonds, and private equity stakes in companies across Europe, Asia, and the Americas.

- Owning Intellectual Property: A software developer can register their patents and trademarks under an offshore entity. They can then license that IP to other companies worldwide and collect royalties in a highly tax-efficient way.

- Facilitating Global Trade: An import-export business can use its offshore company to handle invoicing and payments between a supplier in China and a customer in Brazil, streamlining the transaction without getting caught in the tax systems of either country.

When you see how these benefits play out in practice, it’s easy to understand why an offshore company in UAE has become a go-to strategy for modern international business. To find out how these advantages could work for your specific situation, reach out to our specialists for a free consultation.

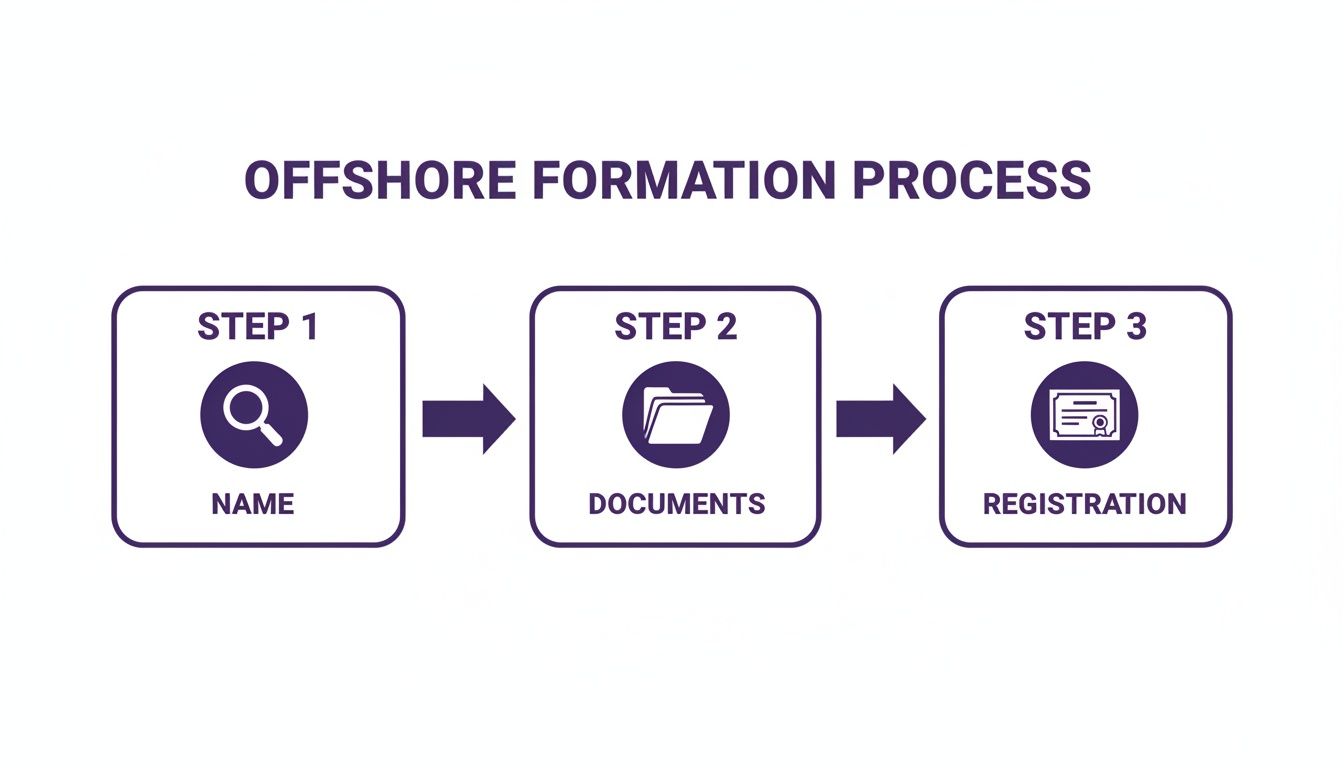

Your Step-By-Step Offshore Formation Roadmap

Setting up an offshore company in the UAE isn't some complex puzzle. When you break it down, the process is actually quite direct and can be wrapped up surprisingly quickly. Let's walk through the exact steps you'll take, from the first conversation to holding your official company documents in hand.

With all your paperwork lined up correctly, the entire setup can often be completed in just a few business days.

Phase 1: Strategy and Name Reservation

First things first, we need a solid plan. This initial consultation is arguably the most important step. It’s where you’ll sit down with a specialist, like our team at 365 DAY PRO, to make absolutely sure an offshore company is the right tool for what you want to achieve. We'll talk through your business activities to confirm they're a good fit for an offshore licence and help you decide on the best jurisdiction – usually between RAK ICC and JAFZA.

Once we’ve got the strategy locked down, it’s time to pick a name. You'll need to choose a unique name for your company that follows the specific rules of the registry. We’ll help you check for availability and then submit your preferred options for approval. As soon as one is approved, we get it reserved for you immediately.

Phase 2: Getting Your Documents in Order

With the company name secured, we move on to the paperwork. The documents needed are fairly standard across the board, but there can be small differences between RAK ICC and JAFZA. We'll give you a precise list.

Generally, you'll need to have these items ready for each shareholder and director:

- Clear Passport Copies: A high-quality, colour copy of each person's passport.

- Proof of Residential Address: A recent utility bill or bank statement (issued within the last 3 months) that clearly shows your name and home address.

- A Detailed Business Plan: This doesn't need to be a novel, just a concise summary of what your new offshore company in UAE will be doing.

- Curriculum Vitae (CV): A brief professional background for each shareholder.

This is where working with an expert really pays off. We go over every single document with a fine-tooth comb to make sure it’s perfect before submission. This simple check prevents the common back-and-forth delays that can happen from small mistakes. From there, we handle the entire submission for you.

Phase 3: Final Registration and Receiving Your Documents

Once we've submitted your application and the offshore authority has verified everything, they move to final registration. The registrar gives your file one last review and, upon approval, issues your official company documents. At this point, your company is officially and legally born.

You'll receive a package containing your new corporate paperwork, which typically includes:

- Certificate of Incorporation: The official birth certificate of your company.

- Memorandum and Articles of Association (MOA & AOA): These are the rulebooks for your company, defining its purpose and how it will be run.

- Register of Shareholders and Directors: An official list of who owns and manages the company.

From our first chat to the final handover of your documents, the team at 365 DAY PRO manages every detail. We take care of the admin, talk to the authorities, and make the whole process smooth so you can stay focused on your business goals.

Ready to get started? For a free consultation, 💬 WhatsApp Us Today.

Navigating Bank Accounts and Ongoing Compliance

So, your offshore company in the UAE is officially registered. Congratulations! But don't pop the champagne just yet. The truth is, the paperwork of incorporation is just the beginning. The real test comes next: opening a corporate bank account and keeping up with your annual compliance duties.

Many entrepreneurs get this wrong. They see the trade licence as the finish line, but the long-term health and success of your company truly depend on getting these next two steps right.

The Banking Challenge and How to Overcome It

Let's be direct: opening a UAE bank account for an offshore company isn't always a walk in the park. UAE banks are incredibly thorough. They have to be, to meet global anti-money laundering standards. For them, a non-resident entity raises questions, and they'll want clear, verifiable answers about your business model and where your funds are coming from.

This translates into a rigorous due diligence process that can feel slow and demanding if you're not prepared. You'll find a lot of useful guidance on opening foreign bank accounts that can help set expectations for expats and international business owners.

This is precisely where working with a seasoned corporate service provider makes all the difference. At 365 DAY PRO, we've spent years building solid relationships with the major banks here. We know exactly what each bank's compliance team is looking for, which documents they need, and how to present your application for the best chance of a quick approval. We help you turn a potential month-long headache into a smooth, straightforward process.

While banking and compliance come next, the initial setup follows a clear path.

This simple roadmap—from choosing a name to filing your documents and getting registered—is the foundation for the crucial compliance phase that follows.

Demystifying Your Annual Compliance Obligations

Once your bank account is up and running, your focus needs to shift to keeping your company in good legal standing. The UAE has seriously ramped up its regulatory game to align with international best practices. For an offshore company owner, this means you have a few non-negotiable annual tasks. Dropping the ball here can result in steep fines or even having your licence frozen.

Here’s what’s on your annual checklist:

- Economic Substance Regulations (ESR): If your company is involved in certain activities, like being a holding company or a distribution hub, you have to prove it has a real economic pulse in the UAE. This involves filing an annual ESR notification and, in some cases, a more detailed report.

- Ultimate Beneficial Ownership (UBO): Transparency is key. You must maintain a private register of the real people who ultimately own or control your company. This UBO register has to be filed with the authorities to show who is behind the corporate structure.

- Anti-Money Laundering (AML): You're expected to have systems in place to ensure your company isn't used for financial crime. This means assessing your risks and being prepared to report suspicious transactions.

Think of ongoing compliance as the essential maintenance for your corporate vehicle. Just as a car needs regular servicing to run smoothly, your offshore company requires annual checks and filings to remain legally sound and operationally effective.

It sounds like a lot to manage, but it doesn’t have to be. As your registered agent, we provide 24/7 support to make sure you're always ahead of deadlines. We take care of the annual renewals, ESR filings, and UBO updates so you can focus on what you do best. Let us handle the admin, while you enjoy the asset protection and tax advantages of your offshore structure with total peace of mind.

For a free consultation on how we can manage your compliance needs, 📞 Call Us Now: +971-52 923 1246.

Getting It Right From the Start With 365 DAY PRO

Setting up a UAE offshore company isn't just about filling out forms; it's about getting the structure right from day one. One small mistake can lead to frustrating delays and unexpected costs. This is where having an experienced hand to guide you makes all the difference. At 365 DAY PRO, our job is to turn a potentially complicated process into a simple, clear-cut path forward.

We're here for you every step of the way, from the initial decision of choosing the best jurisdiction—whether that's RAK ICC or JAFZA—right through to making sure every single document is prepared and submitted perfectly. We know the ins and outs of each authority, which means your application gets done right the first time.

More Than Just Paperwork

Once your company is registered, the real work often begins. One of the biggest hurdles for any new offshore entity is opening a corporate bank account. Thanks to our long-standing relationships with major banks across the UAE, we can help you navigate their due diligence requirements, significantly improving your chances of getting the account opened quickly.

Think of us as your on-the-ground team in the UAE. We specialise in creating cost-effective setup packages built around what you actually need. We pride ourselves on being transparent and focused on the needs of international entrepreneurs who can't afford to waste time. Whether it’s Mainland, Freezone, or Offshore, our specialists handle the details for you.

Partnering with 365 DAY PRO means you're not just hiring a service provider; you're gaining a partner who is genuinely invested in your success. We take on the administrative headaches so you can concentrate on the bigger picture—growing your business.

And because questions can pop up at any time, our 24/7 support service means you're never left waiting for an answer. We're always here to offer clarity and guidance whenever you need it.

Ready to explore your options? Let's talk. Reach out for a free, no-strings-attached consultation to get started. You can Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.

Frequently Asked Questions

When you're exploring international business structures, a lot of questions pop up. It's completely normal. To cut through the confusion, we've put together some straight answers to the most common queries we hear from entrepreneurs about setting up an offshore company in the UAE. Think of this as your quick-reference guide to making smarter decisions.

Can I Get a UAE Residence Visa with an Offshore Company?

This is probably one of the biggest points of confusion, so let's clear it up right away: no, you can't. An offshore company is specifically designed as a non-resident entity. Its purpose is to hold international assets or conduct business outside the Emirates, so it's not set up to sponsor visas for anyone—not owners, directors, or employees.

If getting a UAE residence visa is a key part of your plan, you'll need to look at a different structure, like a free zone or mainland company. We set those up all the time and can easily walk you through which option makes the most sense for achieving your residency goals.

Is an Offshore Company Subject to UAE Corporate Tax?

This is a fantastic question, and the answer has some important details. For the most part, if your offshore company earns 100% of its income from outside the UAE, it won't be subject to the 9% Corporate Tax. This is precisely why so many international business owners find this structure so attractive.

But here's the catch: the moment your company starts earning any income from the UAE mainland, things change. That income could fall under the tax net. That’s why getting solid tax advice from the get-go is so important; it ensures you’re set up correctly to maintain that tax-efficient status without any surprises.

The rule of thumb is simple: keep your business activities and income streams strictly international, and your offshore company should stay outside the scope of UAE Corporate Tax. It all comes down to proper structuring.

Can My Offshore Company Own Property in Dubai?

Yes, absolutely—but only through one specific jurisdiction. A JAFZA offshore company has the unique ability to own freehold property in certain designated areas across Dubai, though it's always pending final approval from the Dubai Land Department. For international real estate investors, this is a game-changer for protecting their assets.

It's crucial to know that a RAK ICC offshore company does not have this capability. This is one of the biggest differences between the two main offshore authorities and often the deciding factor for our clients.

What Are the Annual Renewal Requirements?

Keeping your offshore company active and in good standing is pretty straightforward, but you can't just set it and forget it. There are a few annual tasks you need to stay on top of to avoid fines or, worse, having your licence suspended.

Every year, you'll need to handle:

- Annual Renewal Fees: This involves paying the required fees to both the government registrar and your registered agent. It’s non-negotiable.

- Maintaining Records: You are required to keep accurate accounting records. A full-blown audit isn't always mandatory, but the books need to be in order.

- Regulatory Filings: Keeping up with Economic Substance Regulations (ESR) and maintaining the Ultimate Beneficial Ownership (UBO) register is a must.

This is where a good corporate service provider makes all the difference. At 365 DAY PRO, we manage all these renewals and filings for you, giving you 24/7 support so you never miss a deadline and your company stays perfectly compliant.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

For a free consultation on our cost-effective solutions tailored to your needs, visit 365 DAY PRO Corporate Service Provider LLC at https://365dayproservices.com.