Thinking about setting up an LLC in Dubai? It’s one of the smartest decisions an entrepreneur can make right now. The city offers a clear path into a booming economy, packed with financial benefits like a friendly tax system. Plus, recent changes now allow for 100% foreign ownership in most sectors, which has completely changed the game.

Why Dubai Should Be Your Next Business Hub

Dubai isn't just a regional player anymore; it's a global financial powerhouse, and that makes it a magnet for entrepreneurs with big ambitions. Its location is a massive advantage—it's the perfect crossroads between East and West, giving you incredible access to markets in Europe, Asia, and Africa.

This strategic position is backed by some of the best infrastructure in the world. We're talking top-tier ports, airports, and digital connectivity that make global trade incredibly smooth.

For most international business owners, the numbers are what really seal the deal. The UAE's tax system is a huge draw. There's zero personal income tax, and the corporate tax is a competitive 9%, which only kicks in on profits over AED 375,000. This gives startups and SMEs a massive advantage, letting them pour more money back into growing the business.

A Government That Wants You to Succeed

The UAE government is serious about creating a pro-business environment that pulls in foreign investment. The recent legal reforms have been nothing short of revolutionary for entrepreneurs.

The biggest change? The update to the Commercial Companies Law. It did away with the old rule requiring an Emirati partner to own 51% of the company for most mainland businesses. Now, you can have 100% foreign ownership of a mainland LLC, which means you have complete control over your company's equity and direction.

This commitment to making business easier is clear in the setup process itself. Government services are now largely digital, making things like reserving a trade name or getting initial approvals faster and more straightforward than ever. As specialists in both mainland and free zone formations, we work with these systems every single day, which helps us make the process seamless for our clients.

It's More Than Just the Money

The appeal of setting up a business in Dubai goes way beyond the balance sheet. The city offers an incredible quality of life, a safe environment, and a vibrant, multicultural society that makes it easy to attract top talent from all over the world.

A Dubai LLC also comes with some powerful operational perks:

- Trade Anywhere: A mainland licence gives you the freedom to do business directly with any customer or government body across the entire UAE.

- Grow Your Team: The number of residency visas you can get is directly tied to your office size, so you can scale up as your company expands.

- A Global Reputation: Having a Dubai-based company instantly boosts your brand's credibility on the world stage.

At 365 DAY PRO, we see ourselves as your expert guide through this whole process. We handle everything from DED approvals to sorting out your visas, freeing you up to concentrate on what you do best—running your business. We build practical, cost-effective packages designed for your specific needs, all with 24/7 support.

Choosing Your Path: Mainland vs. Free Zone

Right out of the gate, you’ll face one of the biggest decisions in your Dubai business journey: where to set up. Will you plant your flag on the Mainland or in one of the many Free Zones? This isn't just a box-ticking exercise; it's a strategic move that will define who you can do business with, where you can operate, and how your company can grow.

Think of it this way: a Mainland LLC gives you a license to operate anywhere and everywhere in the UAE. It’s the go-to choice if your business needs to interact directly with the local market. We're talking about retail shops in busy neighbourhoods, cafés serving the community, or a consulting firm aiming to win government tenders. With a Mainland license, the entire UAE is your marketplace.

On the other hand, a Free Zone company is your ticket to the global stage. These specialised economic hubs are perfect for businesses focused on international trade, like import/export operations, global consulting firms, or tech companies serving clients outside the UAE. The big draws here have always been benefits like 100% foreign ownership (though this is now common on the mainland too), exemptions from customs duties, and a much simpler setup process.

Unlocking the Mainland Advantage

For many entrepreneurs I work with, the Mainland is the only choice that truly fits their vision. It gives you the freedom to set up your office or shop anywhere in Dubai, whether that’s a storefront on a bustling high street or a corporate suite in a prime business district. If your customers are here in the UAE, you need to be here, too.

The numbers back this up. We saw a massive 25% jump in new business registrations in the UAE in 2024 compared to the year before, and a huge chunk of those were Mainland setups. This isn't a coincidence. It speaks to Dubai's incredible pull for entrepreneurs, a trend that experts like us at 365 DAY PRO are seeing firsthand as we guide clients through the DED approvals and visa processes. You can dig deeper into this growth in the full report from the Dubai Chamber of Commerce.

A Mainland license also gives you more room to grow. If you're dreaming of opening multiple branches across the Emirates or expanding your services down the line, a Mainland LLC provides the solid legal foundation you need to do it without hitting any geographical walls.

When a Free Zone Makes Perfect Sense

So, when is a Free Zone the smarter play? It’s a compelling option if your business doesn't rely on the local UAE market. For instance, if you're running a software company with clients scattered across Europe and Asia, or an e-commerce store shipping products worldwide, a Free Zone offers a tax-efficient and streamlined base of operations.

Dubai has over 40 Free Zones, and many are laser-focused on specific industries, creating powerful ecosystems for businesses.

- Dubai Media City: The hub for media, advertising, and marketing firms.

- Jebel Ali Free Zone (JAFZA): A global powerhouse for logistics and trading.

- Dubai International Financial Centre (DIFC): The premier destination for finance and fintech.

Setting up in one of these zones means you’re surrounded by peers, potential partners, and clients. For an international entrepreneur, that kind of built-in network can be a game-changer.

Choosing the right jurisdiction is about matching your business model to the regulatory environment. A Mainland setup is for conquering the local market, while a Free Zone is your launchpad to the world. As specialists in both, we provide clear, unbiased advice to ensure your foundation is built for success.

Mainland vs. Free Zone LLC At a Glance

To help you see the differences more clearly, let's put them side-by-side. This table cuts through the noise and lays out the core distinctions so you can see which path aligns with your business goals.

| Feature | Mainland LLC | Free Zone LLC |

|---|---|---|

| Market Access | Unrestricted trade across the entire UAE. | Primarily international trade; local trade is restricted. |

| Office Location | Can be located anywhere in Dubai. | Must be located within the specific Free Zone's territory. |

| Government Approvals | Primarily from the Department of Economic Development (DED). | From the specific Free Zone authority (e.g., JAFZA, DMCC). |

| Ownership Structure | 100% foreign ownership now available for most activities. | 100% foreign ownership has always been a key feature. |

| Visa Eligibility | Directly tied to the physical office space size. | Often linked to pre-defined license packages. |

| Ideal For | Retail, restaurants, local services, government contractors. | International trade, consulting, tech, e-commerce. |

Getting this choice right from the start is crucial—it saves you from a lot of headaches and costly changes later on. By thinking carefully about your target market, day-to-day operations, and long-term vision for your Dubai LLC company setup, you can confidently pick the jurisdiction that will truly set you up for success.

Bringing Your Dubai LLC to Life: The Step-by-Step Playbook

Alright, you've decided on the "where"—now comes the "how." Moving from the big-picture decision to the nitty-gritty of setting up your Dubai LLC involves a series of practical steps. This isn’t just a checklist; it's a real-world game plan we've refined over years of helping entrepreneurs launch their ventures. Every decision from here on out builds the legal and operational foundation of your business.

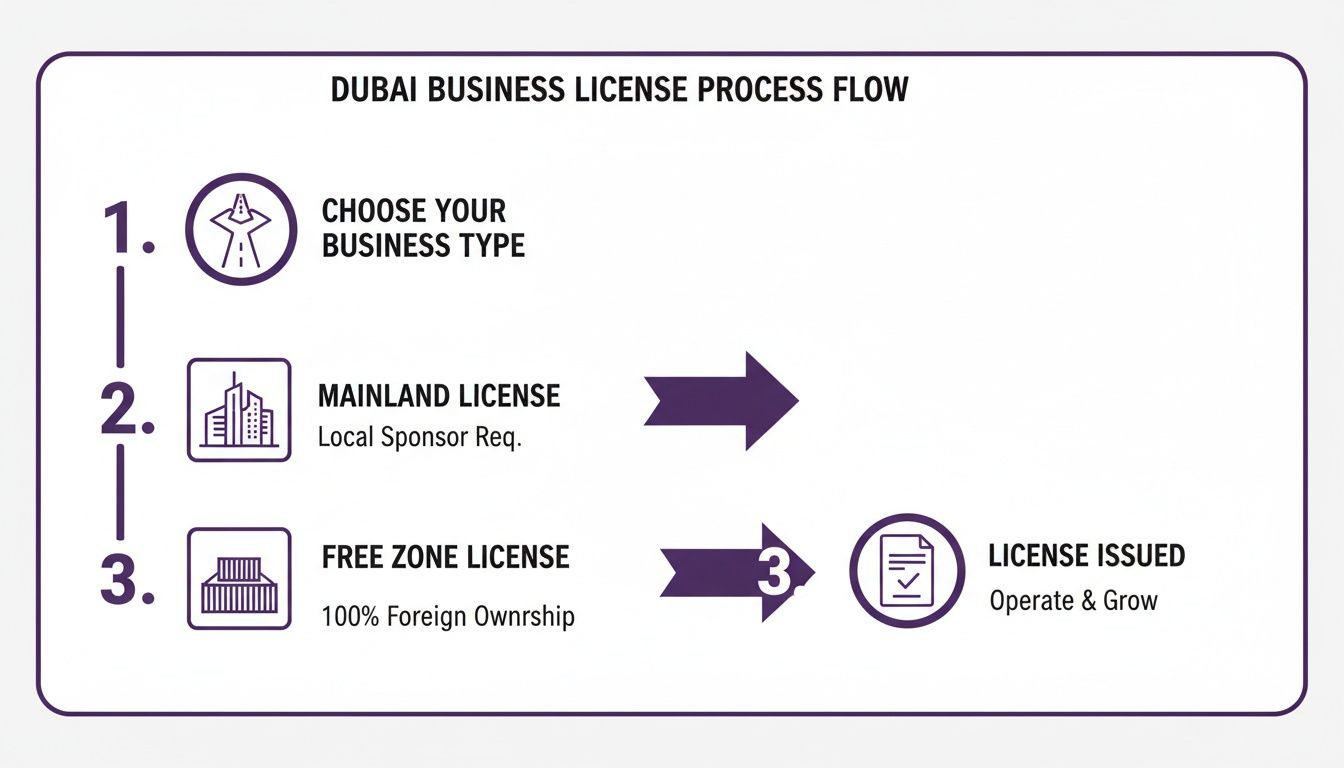

The journey is structured, but it's not always straightforward. The flowchart below gives you a bird's-eye view, highlighting that critical fork in the road between a Mainland and a Free Zone setup.

As you can see, that initial choice of jurisdiction really does shape everything that follows, from the authorities you deal with to how you can operate. Our job is to make navigating this flow feel less like a maze and more like a managed, predictable process.

First Things First: Nailing Down Your Business Activities

Before you even dream up a company name, you have to get crystal clear on what your business will actually do. This is non-negotiable because your activities dictate the type of trade license you’ll need—Commercial, Professional, or Industrial.

The Department of Economic Development (DED) has a massive list of over 2,000 approved business activities. You can bundle multiple activities under one license, but they usually need to fall within the same group.

For example, a tech consultancy would pick activities under a Professional license, like "IT Infrastructure Consultancy." A trading company, on the other hand, needs a Commercial license for things like "General Trading" or something specific like "Electronics & Accessories Trading." Getting this wrong can lead to hefty fines for operating outside your licensed scope, so it’s a step worth getting right the first time.

Reserving Your Company's Trade Name

Once your activities are locked in, it's time to pick a unique and compliant trade name. The DED has some very specific rules here, and your name must get their stamp of approval.

Here are a few key rules to keep in mind:

- It must be unique. The name can't already be taken anywhere in the UAE.

- Keep it clean. No offensive words or anything that goes against public morals.

- No misleading names. The name should give some hint about your business.

- The right ending. It must have a legal suffix, like "LLC."

Our team can help you brainstorm names that not only tick all the official boxes but also fit your brand. We run the checks for you, which helps avoid the frustration of a rejection.

A classic mistake we see is choosing a name that sounds great but breaks an unspoken rule, like using the name of a city without proper justification. This is where having a corporate service provider in your corner saves you a ton of time and back-and-forth with the authorities.

Drafting the Memorandum of Association (MOA)

The Memorandum of Association (MOA) is the legal backbone of your company. It’s the formal agreement between all shareholders and spells out exactly how your business will run.

Think of it as your company's constitution. It lays out the essentials:

- The partners and their shareholdings.

- The company's goals and activities.

- The total share capital.

- How the business will be managed and how profits (and losses) will be shared.

A well-drafted MOA is absolutely critical. For a trading company with multiple international partners, it needs to be airtight on decision-making and profit repatriation. For a solo founder starting a tech consultancy, it’s simpler but still needs to be done meticulously. Once drafted, this document must be notarised to become legally binding.

Securing a Physical Address and Your Ejari

A Mainland LLC in Dubai must have a physical office address. This isn’t just for show; it’s a legal requirement to prove you have a legitimate presence. Once you’ve found a space, you have to register the tenancy contract with the Ejari system.

The Ejari certificate is the official document that validates your lease, and you absolutely cannot finalise your trade license without it. It's also a prerequisite for getting visa quotas for your future employees.

But don't panic—this doesn't mean you need a huge, expensive office right away. There are plenty of cost-effective business setup solutions. Flexi-desks and shared office spaces in approved business centres are fantastic options for international entrepreneurs and startups. They satisfy the legal requirement for an Ejari without the heavy financial overhead.

Working with Government Authorities

This is where things can get tricky. Your main point of contact will be the DED for your license, but you’ll also be dealing with centres like Tasheel for labour matters and Amer for immigration.

Here’s where a professional PRO (Public Relations Officer) service becomes your best friend. Our team becomes your official liaison, handling all the submissions, follow-ups, and approvals. We make sure every document is correct and submitted to the right department, cutting through the red tape.

For example, getting an industrial license requires extra approvals from bodies like Dubai Municipality—a completely different path than a standard professional license. As specialists in mainland company formation, we know these nuances inside and out. We manage the bureaucracy with 24/7 support, so you can stay focused on your business.

A Realistic Look at Costs and Timelines

When you're planning to set up an LLC in Dubai, vague estimates just don't cut it. You need real numbers to budget properly and manage your expectations. Let’s break down exactly what you can expect to invest, both in time and money, so you can plan your launch with confidence.

The total cost isn't a single line item. It’s a mix of government fees, administrative charges, and essential operational expenses that pop up at different stages. Our entire approach is built on transparency, so we lay everything out on the table from day one.

The Core Government and Administrative Fees

The starting point for your budget will always be the mandatory government charges. These are the non-negotiable fees required to get your company legally on the books and ready to operate. While the exact amounts can shift slightly depending on your business activity, they almost always include a few key components.

Here’s a practical breakdown of what you're looking at:

- Trade Name Reservation: Securing your company name with the Department of Economic Development (DED).

- Initial Approval Certificate: This is the DED giving you the green light to proceed with your business idea.

- Trade Licence Fee: The main government cost, which varies quite a bit based on what your business actually does.

- MOA Attestation: The fee for getting your Memorandum of Association legally notarised.

- Market Fees: A small percentage of your office's annual rent, paid directly to the Dubai Municipality.

These costs make up the bulk of your initial government outlay. As mainland company formation specialists, we handle all these payments for you, making sure every dirham is accounted for and every submission is spot-on.

A common trap we see people fall into is getting hit with hidden fees halfway through the process. That's why we provide a detailed, itemised quote upfront. You’ll know exactly where every dirham is going, with absolutely no surprises down the line.

Factoring in the Essential Operational Costs

Beyond the government paperwork, there are a few other must-haves you need to budget for to complete your Dubai LLC company setup. Think of these as the practical costs of getting your business off the ground.

First up is your physical office space. Every mainland LLC needs a registered office with a valid Ejari (the official tenancy contract). This might sound like a huge expense, but it doesn't have to be. Smart, cost-effective options like flexi-desks or shared co-working spaces start from just a few thousand dirhams a year and tick all the legal boxes.

Then you have the visa processing fees. This covers everything from the company's establishment card to your entry permit, medical test, Emirates ID application, and the final visa stamp in your passport. It also applies to any staff you plan to hire. Lastly, don't overlook potential costs for document attestation, especially for foreign corporate documents or personal qualifications that need to be officially recognised here in the UAE.

Sample Packages and Average Investment

Getting a mainland LLC in Dubai is more accessible than ever. On average, you can expect the total formation cost to be between AED 25,000 and AED 27,000. The final figure really depends on your specific business activity—a professional services licence will be on the lower end, while a trading business might need more share capital.

With providers like 365 DAY PRO, the process is straightforward. We bundle everything you need, from DED registration to office agreements, and some of our most cost-effective business setup solutions start from as low as AED 6,010. For a deeper dive, you can find more insights about Dubai company setup costs on centuroglobal.com.

Understanding the Formation Timeline

Your time is just as important as your money, so let's talk about the schedule. The timeline can range from unbelievably quick to a few weeks, depending on how complex your business is and what external approvals are needed.

- The Instant Licence: For many professional and commercial activities, Dubai offers an "Instant Licence" that can be issued in as little as 1.5 hours. This lets you hit the ground running while the other formalities are sorted out.

- Standard Timeline: For most businesses, you should plan for about 1 to 2 weeks from the moment we reserve your name to when you have the final trade licence in your hands.

- Full Operational Setup: To get completely set up—we’re talking visa stamped in your passport and a corporate bank account opened—it typically takes 3 to 4 weeks.

Our job is to steer this entire process, anticipating bottlenecks before they happen. With our 24/7 support, we make sure there are no unnecessary delays holding you back.

Life After Your License: Visas, Banking, and Tax

Getting your trade license is a huge milestone, but let's be honest—it’s the starting line, not the finish. The real work starts now. This is where you pivot from paperwork to building an actual, functioning business. It’s time to bring people on board, get your finances in order, and make sure you're squared away with all the local laws.

This is the phase where a lot of new entrepreneurs start to feel the heat. Suddenly, it's not about forms and applications anymore; it's about navigating the real-world complexities of visas, banking requirements, and tax rules. As specialists who handle both mainland and free zone setups every day, we're here to walk you through these next critical steps without the stress.

Securing Residency Visas for Owners and Staff

With your company’s establishment card finally in hand, you can now sponsor residency visas—for yourself as the investor and for any employees you’re ready to hire. The process is very structured, but it has several moving parts.

Here’s a look at what the journey to residency involves:

- Entry Permit: First, we apply for an e-visa. This allows you or your employee to be in the UAE specifically for employment purposes.

- Change of Status: If you're already in the country on a tourist visa, there's no need to fly out and back in. We can handle an in-country "change of status" to smoothly transition you.

- Medical Fitness Test: This is a standard requirement for everyone. It’s a straightforward health screening at a government-approved centre, involving a blood test and a chest X-ray.

- Emirates ID Biometrics: Next, you'll visit a Federal Authority for Identity & Citizenship centre. They'll take your fingerprints and photo for your official Emirates ID card.

- Visa Stamping: The final piece of the puzzle. Your passport is submitted to immigration, and they physically stamp the residency visa inside, officially making you a UAE resident.

Our PRO team lives and breathes this process. We manage the entire workflow, making sure every application is spot-on and every appointment is booked to keep things moving.

Opening Your Corporate Bank Account

This is, without a doubt, the most underestimated challenge for new business owners in Dubai. UAE banks have very strict due diligence protocols. Just showing up with a new trade license simply isn't enough to get an account opened quickly.

They'll want to see a solid business plan, proof of your physical address (your Ejari), and they'll ask detailed questions about your expected transactions. This is where our long-standing relationships with major local and international banks really come into play. We know what they’re looking for. We help you prepare a complete file, anticipate their questions, and introduce you to the right people, which turns a potentially frustrating marathon into a streamlined sprint.

A corporate service provider can be your best ally when opening a bank account. We make sure your story is clear, your documents are perfect, and your business case is presented professionally. It builds the bank's confidence and dramatically speeds up their approval process.

Understanding Your Tax Obligations

The UAE’s tax-friendly environment is a massive draw, but that doesn't mean you can ignore compliance. Two key areas every business needs to have on its radar are Value Added Tax (VAT) and the new Corporate Tax.

VAT Registration

You are legally required to register for VAT if your company's taxable turnover exceeds AED 375,000 over the previous 12 months. You can also register voluntarily if your turnover is more than AED 187,500, which can be beneficial for some businesses.

Corporate Tax

Introduced in 2023, the UAE's Corporate Tax rate is a very competitive 9%. But here's the key detail: this rate only applies to taxable profits above AED 375,000. For many startups and small businesses, this means you’ll likely fall below that threshold and pay 0% corporate tax.

Once your license is issued, the focus shifts to growth. It's time to implement effective small business growth strategies and start building your market presence, all while keeping your financial house in order. We can provide clear advice on these tax matters to ensure you're compliant from day one.

The Path to the UAE Golden Visa

For many international entrepreneurs, setting up a company in Dubai is also a strategic move towards long-term residency via the prestigious UAE Golden Visa. This 10-year, self-sponsored visa provides unparalleled stability for you and your family.

Establishing a business that meets certain criteria is one of the clearest paths to qualifying. Dubai’s speed is a huge advantage here. With programmes like the Instant License, a DED registration can take as little as 1.5 hours, meaning you can be fully operational in less than a week. This incredible efficiency is a major reason why UAE company registrations jumped by 25% in 2024, as investors took advantage of 100% foreign ownership across more than 2,000 business activities.

We specialise in helping you understand how your new LLC can be structured to support a future Golden Visa application, helping you build a secure and prosperous future in the UAE. And with our 24/7 support, we’re always just a call away.

Your Top Dubai LLC Setup Questions Answered

Setting up a company in Dubai is a big step, and it's natural to have questions. Even with a solid plan, a few things can seem confusing at first. We get these questions all the time from entrepreneurs just like you, so let's clear up some of the most common points right now.

Do I Absolutely Need a Physical Office for a Mainland LLC?

Yes, you do. A registered physical address with a proper Ejari (the official tenancy contract) is non-negotiable for a Dubai Mainland licence. But don't let that make you think you need to sign a lease on a massive, expensive office from day one.

Most new businesses we work with start smart by using cost-effective flexi-desks or shared office spaces in government-approved business centres. This approach satisfies the legal requirement for an Ejari without the huge financial commitment, getting your business licenced and ready to operate quickly.

Once you're up and running, you can look into smart tools to help you manage your operations, like advanced AI chatbot services in Dubai which can really boost how you interact with customers.

How Many Visas Can My New Company Actually Get?

Visa allocation isn't just a number you pick out of thin air; it’s directly linked to the size of your office and what your business does. The authorities have a general rule of thumb: you get one visa for every 80 to 100 square feet of office space.

So, if you rent a small 200 sq. ft. office, you’ll likely be eligible for two or three visas. Planning to build a bigger team? You’ll need to secure a larger space to increase your visa quota. We always guide our clients on finding that sweet spot—an office big enough for their immediate needs with room to grow, so the visa process is never a bottleneck.

Here's a key piece of advice for anyone moving to Dubai: think of your office as more than just a space. It's a strategic asset that dictates your budget and your hiring potential. The goal is to balance today's costs with tomorrow's growth.

What’s the Real Difference Between a Local Sponsor and a Local Service Agent?

This is a big one, and the confusion is understandable, especially with recent rule changes.

A 'Local Sponsor' used to be an Emirati partner who legally had to own 51% of the shares in most mainland companies. That era is largely over. Thanks to reforms allowing 100% foreign ownership for most business activities, this is no longer a requirement for the majority of new setups.

A 'Local Service Agent' (LSA) is a completely different role and is still mandatory for professional licences—think consultants, doctors, lawyers, and other service-based professions. An LSA is an Emirati national or a UAE-owned company whose function is purely administrative.

Here’s what you need to know about an LSA:

- They own zero shares in your business. You maintain 100% ownership.

- They have no say in your operations or any decision-making authority.

- Their job is simply to act as your official representative with government departments.

- You pay them a fixed annual fee for their service, not a cut of your profits.

Getting this structure right from the beginning is crucial. We make sure you’re set up correctly, whether that means qualifying for full foreign ownership or appointing the right LSA, giving you complete control and total peace of mind.

Ready to make your UAE business a reality? The team at 365 DAY PRO Corporate Service Provider LLC are experts in both mainland and freezone company formation, focused on finding the most efficient and cost-effective path for you.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com