A Dubai offshore company is a special type of legal entity registered in the UAE, but it’s built purely for international business. Think of it as a global business tool that happens to be based here. It allows for 100% foreign ownership and offers a fantastic degree of privacy, making it a go-to structure for entrepreneurs focused on protecting their assets and managing their international tax affairs efficiently.

What Is a Dubai Offshore Company Really?

Let’s use an analogy. Imagine your business assets are valuable cargo. A Dubai offshore company is like a secure, private vessel you use to sail the seas of international commerce, completely separate from your home port. It’s not designed to trade or do business within the UAE market. Instead, its real power lies in its role as a holding company, a special purpose vehicle, or a private vault for your worldwide assets.

This separation is the key takeaway. A mainland or free zone company is set up to tap into the UAE's bustling economy. An offshore entity, on the other hand, is legally ring-fenced from it. You can't lease a physical office, hire local staff, or sell directly to customers in Dubai using this structure. Its strength is its international focus.

The Strategic Purpose of an Offshore Entity

So, who actually needs one of these? The reasons almost always come down to smart financial planning and creating operational efficiency on a global scale. A Dubai offshore company is most commonly used for:

- Asset Protection: It builds a solid legal wall between your personal wealth and your business liabilities. This is crucial for safeguarding your assets from potential legal claims or creditors down the line.

- International Trading: You can invoice clients anywhere in the world and manage global trade transactions without getting entangled in the regulations of your home country.

- Holding Company: It's a perfect way to consolidate ownership of your international assets—be it real estate, intellectual property, or shares in other companies—all under one secure, easy-to-manage entity.

- Estate and Succession Planning: It makes inheritance much simpler. Instead of dealing with the hassle of transferring individual assets spread across different countries, you can just transfer the company shares.

The Rise of the UAE as a Premier Offshore Hub

The UAE's journey into the offshore world has been nothing short of a masterstroke. From the early 2000s, Dubai and the wider Emirates have transformed from a relatively unknown option into a top-tier global hub for setting up offshore companies, now standing shoulder-to-shoulder with traditional offshore centres.

In fact, industry analysis consistently shows that the UAE, thanks to jurisdictions like the Jebel Ali Free Zone (JAFZA) and Ras Al Khaimah International Corporate Centre (RAK ICC), is often ranked among the top three preferred locations worldwide for new offshore incorporations. You can find more data on the UAE's competitive edge over at GWS Offshore.

This stellar reputation isn't an accident. It's built on a bedrock of political stability, a modern and robust legal system, and a firm commitment to meeting global compliance standards. For an international investor, this means a Dubai offshore company isn't just a smart financial move; it's a globally respected one.

Here at 365 DAY PRO, we are specialists in Mainland, Freezone, and Offshore company formation. We help you create the right corporate structure that is not only cost-effective but also perfectly aligned with your international ambitions.

Choosing Your Jurisdiction: JAFZA vs. RAK ICC

Picking the right jurisdiction for your Dubai offshore company is probably the single most important decision you'll make right at the start. It’s not a simple case of which one is "better" but which one is built for what you need to do. Think of it like this: you wouldn't take a high-performance sports car on an off-road adventure. The two heavyweights in the UAE are the Jebel Ali Free Zone Authority (JAFZA) and the Ras Al Khaimah International Corporate Centre (RAK ICC).

Each has carved out its own niche. JAFZA Offshore is the specialist's choice, deeply woven into Dubai's economic and legal fabric. This makes it the undisputed champion for one key purpose: holding real estate in Dubai. Its direct recognition by the Dubai Land Department and major banks makes property deals incredibly straightforward.

On the other hand, RAK ICC is the versatile, globally-minded workhorse. It delivers fantastic flexibility and is very cost-effective, making it the default choice for a huge range of international business activities. If your plans involve international trade, holding assets outside the UAE, or setting up Special Purpose Vehicles (SPVs), RAK ICC provides a solid, efficient framework.

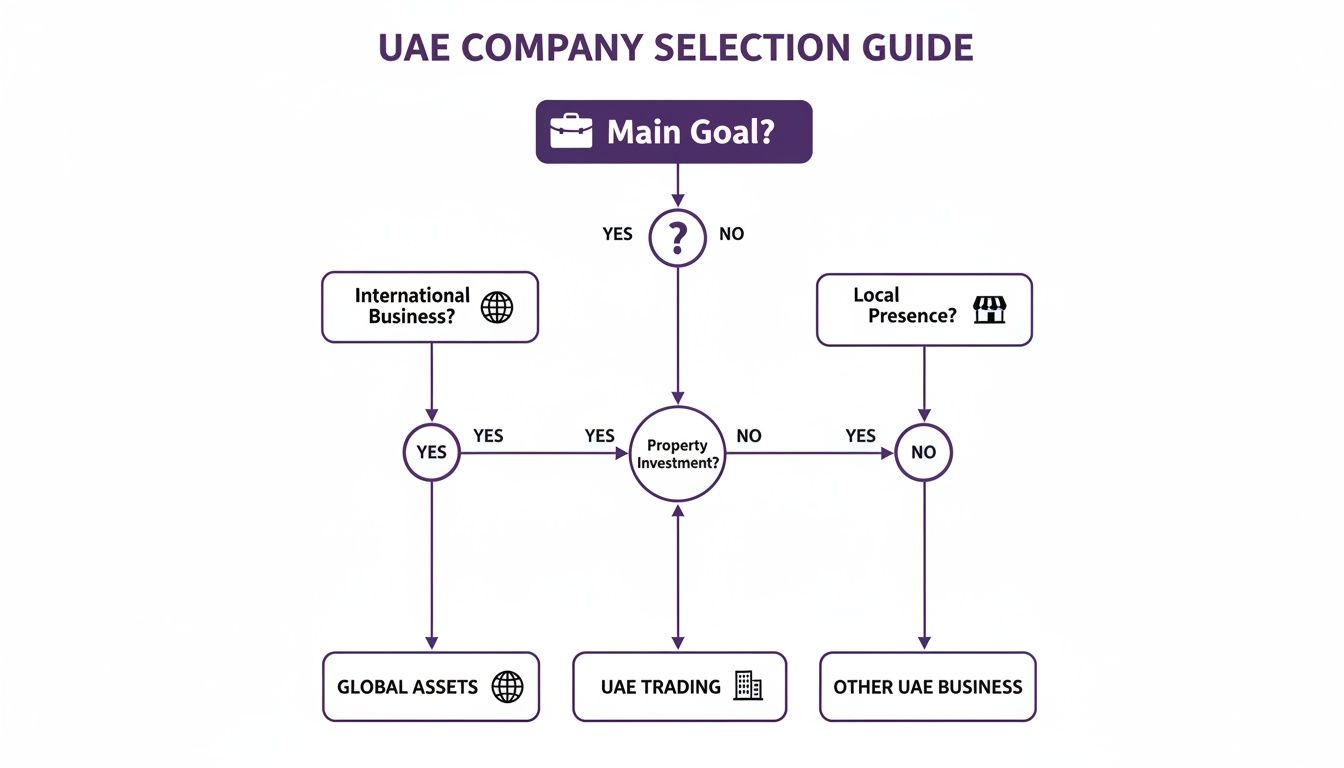

This flowchart helps to map out which company structure makes the most sense based on your main goal.

The takeaway is simple: your primary objective—whether it's owning a local property or managing a global portfolio—should steer you directly to the right corporate structure.

When to Choose JAFZA Offshore

JAFZA’s real power comes from its direct link to Dubai. If owning property in the emirate is your main play, then the decision pretty much makes itself.

A JAFZA offshore company is the only offshore structure fully approved by the Dubai Land Department (DLD) to own freehold real estate within Dubai. This direct approval streamlines the entire process, from purchase to inheritance planning.

Let’s put that into a real-world context. Say your goal is to buy a villa in Dubai Marina or an apartment overlooking the Burj Khalifa. Using a JAFZA offshore company is the cleanest, most secure way to do it. It simplifies future succession planning, adds a valuable layer of privacy to your ownership, and is a structure local mortgage lenders know and trust. For anyone zeroing in on Dubai's property market, JAFZA is the purpose-built solution.

When to Choose RAK ICC

RAK ICC shines because of its international standing and sheer adaptability. It has successfully positioned itself as a modern, common-law jurisdiction that’s highly respected by international banks and legal systems. This makes it a powerful option for any business that isn't specifically tied to Dubai real estate.

Its reputation for being flexible is well-deserved. The registry is focused on being a world-class hub for international business, which is a massive confidence booster when you're operating across borders.

Take another example. Imagine you need a holding company to manage a global portfolio of stocks, bonds, and intellectual property. For something like that, RAK ICC offers unmatched flexibility and cost-effectiveness. It's the perfect vehicle for international entrepreneurs who need a credible, tax-efficient structure to manage assets spread across multiple countries.

A Head-to-Head Comparison

To make the choice even clearer, let's break down the key differences.

-

Primary Use Case:

- JAFZA: The go-to structure for holding Dubai real estate assets.

- RAK ICC: The flexible choice for international holding companies, global trade, and SPVs.

-

Reputation and Recognition:

- JAFZA: Unbeatable recognition within Dubai, especially with authorities like the DLD.

- RAK ICC: A strong global reputation, widely recognised by international financial institutions.

-

Cost Structure:

- JAFZA: Generally has higher setup and renewal fees, which reflects its premium, specialised role.

- RAK ICC: Much more cost-effective, making it a great option for a wider range of international business needs.

Getting this choice right is the foundation of your entire offshore strategy. Making sure your jurisdiction aligns with your specific goals from day one is essential for long-term success. As the best corporate service provider in Dubai, 365 DAY PRO specialises in guiding international entrepreneurs through this crucial decision, ensuring your Dubai offshore company is perfectly structured for your needs.

Strategic Benefits vs. Real-World Limitations

A Dubai offshore company can be a game-changer for international entrepreneurs, but it's vital to see it for what it is: a specialised tool, not a magic wand for every business need. To use it effectively, you have to appreciate its incredible strengths and, just as crucially, understand its clear operational boundaries.

This structure delivers some serious advantages for global business, asset management, and financial privacy. At the same time, it’s legally ring-fenced to prevent it from operating within the local UAE economy. Getting your head around this duality is the first step to building a corporate structure that’s both successful and fully compliant. Let's look at both sides of the coin.

The Core Benefits of a Dubai Offshore Company

The upsides of setting up an offshore company in the UAE are substantial, tailored specifically for international business activities. They’re all about giving you security, control, and financial efficiency as you operate on a global stage.

- Absolute Foreign Ownership: This is a big one. Unlike many mainland setups, an offshore company guarantees 100% foreign ownership. You have total control over your business and its assets, with no need for a local partner or sponsor.

- Robust Asset Protection: For many, this is the main draw. An offshore company acts as a legal firewall, separating your business assets from your personal finances. This is your shield against potential commercial claims, creditors, or other financial threats.

- Enhanced Privacy and Confidentiality: Your details as a shareholder or director are not published on a public register. This level of discretion is crucial for high-net-worth individuals and family offices who need to manage their assets privately and securely.

- Tax Efficiency: Offshore companies are built for financial efficiency. When structured correctly, international entrepreneurs can enjoy the full scope of UAE tax benefits, including 0% corporate tax on international profits and no capital gains or withholding taxes.

Think of an offshore company like a secure digital vault for your international assets. The vault is physically located in a stable and highly reputable jurisdiction—the UAE—but its contents are strictly for use in the global arena, kept private and protected from outside risks.

This powerful mix of control, security, and financial perks makes a Dubai offshore company a foundational element in modern international business strategy.

Understanding the Real-World Limitations

Knowing what an offshore company can't do is just as important as knowing what it can. These aren't defects; they're the legal guardrails that define its very purpose as a non-resident entity. Being crystal clear on these limitations will save you from making expensive mistakes down the road.

The main rule is that a Dubai offshore company is prohibited from conducting business directly inside the UAE. This means you cannot:

- Trade with UAE-Based Customers: You're not allowed to sell goods or services to people or companies based in the UAE mainland or any of its free zones.

- Lease a Physical Office: An offshore entity is essentially a "paper company." It can't rent or own a physical office in the Emirates; it operates solely through its registered agent’s address.

- Sponsor Residency Visas: Since it has no physical presence or local operations, an offshore company cannot apply for or sponsor UAE residency visas for its owners or staff.

These limitations are non-negotiable. If your plan involves setting up a physical base, hiring people in the UAE, or selling to the local market, then an offshore company simply isn't the right fit. But that doesn't mean you've hit a dead end.

For entrepreneurs who need the best of both worlds—international asset protection and UAE residency—a hybrid solution is often the perfect answer. We regularly set up structures that combine an offshore company with an affordable free zone entity. This gives you a secure vehicle for your global assets alongside a separate, fully licenced company that can grant you a UAE residence visa.

Our team at 365 DAY PRO are experts in crafting these kinds of intelligent, cost-effective business setup solutions. We’ll take the time to understand your specific situation and design a corporate structure that’s both effective and perfectly aligned with your business and personal goals.

💬 WhatsApp Us Today for a Free Consultation to discuss your specific requirements.

Navigating Modern Tax and Compliance Rules

The world of international finance has changed. The old-school idea of a completely anonymous, opaque offshore company is a relic of the past. Today, a modern Dubai offshore company operates in a world that values transparency, and honestly, that’s a good thing. The UAE’s commitment to a strong regulatory framework is precisely why it's now seen as a top-tier, stable, and reputable place to do business.

Think of these international standards not as a burden, but as a major advantage. They ensure your offshore company isn't just secure from penalties but is also respected by banks and business partners across the globe. Getting to grips with these rules is simple when you have the right guidance, turning what might seem complicated into a clear strategy for success.

Understanding the UAE Corporate Tax Framework

The biggest recent shift was the introduction of a federal corporate tax, which kicked in on 1 June 2023. This was a landmark change. A Dubai offshore company is now legally classified as a "juridical person" and therefore falls under the new tax law, which sets a standard 9% corporate tax rate on business profits.

But here’s the crucial detail for most offshore company owners: a 0% rate generally applies to income earned from activities outside the UAE. So, for the classic offshore uses—like holding international assets, managing foreign investments, or global invoicing—your tax efficiency is still very much intact. You can dig into some of the finer points on tax mechanics on Dubai Freezone's official site.

This balanced 9%/0% system lets the UAE adhere to global tax norms while keeping its core appeal for international entrepreneurs. When you pair this with the UAE’s zero personal income tax, you have a powerful foundation to enjoy the full scope of UAE tax benefits.

Demystifying ESR and UBO Requirements

Beyond tax, there are two other key compliance pillars you need to know about: the Economic Substance Regulations (ESR) and the Ultimate Beneficial Ownership (UBO) register. These aren't meant to trip you up; they're in place to prevent the misuse of company structures and bring the UAE in line with global best practices.

Economic Substance Regulations (ESR)

ESR is all about proving your company has a genuine economic presence in the UAE if it conducts certain "Relevant Activities," like being a holding company or managing intellectual property.

- For a Dubai offshore company, this is usually straightforward and satisfied by showing it's directed and managed from within the UAE.

- Compliance involves filing an annual notification and, if necessary, a substance report.

- It's a box-ticking exercise we handle seamlessly at 365 DAY PRO to make sure you never miss a deadline.

Ultimate Beneficial Ownership (UBO)

The UBO register simply requires companies to declare who ultimately owns or controls them. It’s a move towards transparency, but with privacy firmly in mind.

- This information is filed in a confidential, non-public register.

- Only government authorities can access it, and only through strict international protocols.

- It strikes the perfect balance between protecting the privacy of legitimate owners and cracking down on illicit financial flows.

Compliance isn't about creating obstacles; it’s about building a foundation of trust. By adhering to global standards like ESR and UBO, a Dubai offshore company gains legitimacy and ensures smooth relationships with international banks and partners.

These regulations are exactly what elevates the UAE into a premier jurisdiction. They signal to the world that your offshore company is a credible vehicle for legitimate international business. For those looking at the bigger picture, understanding how a Dubai offshore company works is just one part of building sophisticated high net worth tax strategies to protect family wealth.

With our 24/7 support service, we are always here when you need us. We take care of all these compliance matters for you, ensuring your company stays in perfect legal standing so you never have to lose sleep over complex paperwork or regulatory updates.

📞 Call Us Now: +971-52 923 1246 to discuss your compliance needs.

Your Step-by-Step Formation Blueprint

Turning the idea of a Dubai offshore company into a real, working entity might seem daunting, but it's really just a series of well-defined steps. When you break it down, the process is quite logical. This blueprint clears away the complexity, giving you a predictable roadmap from your initial decision right through to holding your official company documents. With the right guide, each step flows smoothly into the next.

Our job is to walk you through this path, handling the paperwork and talking to the authorities so you don't have to. We turn potential headaches into simple items on a checklist, letting you stay focused on your bigger global strategy.

The Six Key Milestones in Offshore Formation

Setting up an offshore company follows a predictable sequence. While there are slight differences between jurisdictions like JAFZA and RAK ICC, the core stages are essentially the same. Think of it like building a house—each phase has to be completed properly to support the next, resulting in a solid, reliable structure.

Here’s the typical journey we take with our clients:

-

Strategy and Consultation: It all begins with a simple conversation. We’ll sit down to understand your goals, make sure an offshore company is genuinely the best move for you, and help you pick the right jurisdiction for your specific needs.

-

Name Approval and Application: Next, we submit your preferred company names to the registry. Once one is approved and reserved, we get the formal application package ready to go.

-

Document Preparation and Submission: This is where you provide the basics, like passport copies and proof of address. Our team takes it from there, drafting the Memorandum & Articles of Association and all the other legal forms the registry needs.

-

Issuance of Corporate Documents: Once everything is approved, the registry issues the official company documents. This package includes your Certificate of Incorporation, Share Certificates, and the company's legal charter.

-

Registered Agent and Office Services: An offshore company legally needs a registered agent and office address in the UAE, so we arrange this as a standard part of the setup. While the rules differ by country, this guide offers a good primer on understanding registered agent services.

-

Corporate Bank Account Opening: With the company officially formed, we tackle the final, and often most critical, step: getting a corporate bank account opened here in the UAE.

Overcoming the Bank Account Challenge

Let's be frank: opening a corporate bank account is frequently the toughest part of the process for a new Dubai offshore company. UAE banks have incredibly strict due diligence checks to meet global anti-money laundering (AML) and know-your-customer (KYC) standards. This is where having professional help is no longer a luxury—it's a necessity.

The success of a bank account application hinges on meticulous preparation and presentation. A professionally compiled profile that clearly outlines the company's business model, source of funds, and beneficial ownership structure significantly increases the chances of a swift approval.

Getting this right involves more than just filling out forms. It requires a deep understanding of what each bank is looking for, their specific risk tolerance, and their preferred documentation format. Our long-standing relationships with the top UAE banks give our clients a real edge. We know what the bankers need to see and prepare a comprehensive file that answers their questions before they even ask them.

Our hands-on approach includes:

- Advising on the right bank based on your specific business activities and profile.

- Preparing a detailed business profile that presents your company clearly and professionally.

- Assisting with all application forms to guarantee accuracy and avoid delays.

- Coordinating directly with the bank's compliance team to help move the review process along.

At 365 DAY PRO, we specialise in turning this potential roadblock into a smooth, final step. Our 24/7 support means we're always here when you need us, making sure your journey to launching a fully operational Dubai offshore company is not just successful, but surprisingly simple.

💬 WhatsApp Us Today for a Free Consultation to start your formation process.

Your Questions, Answered

Stepping into the world of international business structures naturally brings up questions. We get it. To help clear things up, here are some straight answers to the most common queries we hear about setting up and running a Dubai offshore company. This is all about helping you make the right call with total confidence.

Getting your corporate structure right from day one is everything. It needs to support where you're heading long-term. Truly understanding what an offshore company can—and can't—do is the key to unlocking its power for your global business or investment portfolio.

Can I Get a UAE Residence Visa with an Offshore Company?

In a word, no. An offshore company is specifically designed as a non-resident entity. It's a fantastic tool for holding international assets or conducting global trade, but it's not meant for establishing a physical base or sponsoring visas in the UAE. Its entire legal framework is built on this non-resident principle.

That said, many of our clients need residency, and there's a brilliant solution. We often set up hybrid structures, giving you the best of both worlds. This means pairing your Dubai offshore company (for rock-solid asset protection) with an affordable free zone company that can issue residency visas. As specialists in Freezone company formation across the UAE, we can tailor a cost-effective business setup solution just for you.

What Are the Annual Renewal Costs?

One of the big draws of an offshore company is how cost-effective it is to maintain. Year on year, the renewal costs are much lower than for a mainland or most free zone companies. Why? Because you're not paying for a physical office lease or a heavy-duty operational licence.

The annual fees really just cover two things:

- Government Renewal Fee: This is the standard charge from either JAFZA or RAK ICC to keep your company officially registered and active.

- Registered Agent Services: As your legal point of contact in the UAE, our fee covers maintaining your registered address and handling all official communications and compliance paperwork.

The whole process is seamless. Our team at 365 DAY PRO handles it all for you, sending reminders well in advance and managing all the filings. This includes critical updates like ESR and UBO declarations, and with our 24/7 support service, you can be sure your company stays in perfect legal health without you having to worry about a thing.

Is My Information Kept Private?

Absolutely. A high degree of confidentiality is baked into the very DNA of a Dubai offshore company. The names of directors and shareholders are not listed on a public register, which is a massive plus for anyone seeking legitimate asset protection and privacy.

But let's be clear: this isn't about secrecy. The UAE operates within a modern, transparent global system and is fully committed to international standards against illicit finance. A private register of the Ultimate Beneficial Owner (UBO) is securely maintained. This information is only shared with government authorities if they make a formal, official request under strict international protocols. It’s the perfect balance: you get legitimate privacy, while the jurisdiction maintains its excellent global reputation.

How Does an Offshore Company Help with Owning Property?

Using a JAFZA offshore company to hold real estate in Dubai is a game-changer. It's the only offshore structure fully approved by the Dubai Land Department for this purpose, making it a secure and streamlined vehicle for property ownership. The benefits are huge.

For starters, it puts a layer of protection between the property and your personal name. But the real masterstroke is how it simplifies inheritance and succession planning.

Imagine your heirs having to navigate a complex and potentially expensive property transfer through local courts. With an offshore structure, they don't have to. Ownership is passed on by simply transferring the company shares—a process that is faster, more private, and far more efficient.

Our property specialists can handle this whole process for you, from setting up the JAFZA company to registering the title deed with the Dubai Land Department. We make it smooth and secure from start to finish.

Ready to build a powerful international corporate structure? As the best corporate service provider in Dubai, Abu Dhabi, and Sharjah, the expert team at 365 DAY PRO is here to guide you. We are specialists in Mainland, Freezone, and Offshore company formation, offering cost-effective business setup solutions tailored to your needs with a 24/7 support service.

💬 WhatsApp Us Today for a Free Consultation to explore how a Dubai offshore company can protect your assets and optimise your global strategy.