Gone are the days when opening a bank account in the UAE meant locking up a significant amount of cash just to meet a minimum balance. Now, you can get a zero balance account opening online, a game-changer for freelancers, new residents, and lean startups who need financial flexibility without the high-stakes commitment.

Let’s walk through exactly how you can navigate this process like a pro.

Your Guide to Opening a Zero Balance Account in the UAE

So, what exactly is a zero balance account? Simply put, it's a current or savings account that doesn't penalise you for letting the balance drop. You aren't required to maintain a specific average amount each month, which completely removes the stress of facing penalty fees if your funds dip temporarily.

This is a huge relief for anyone with a variable income or those just getting a business off the ground. For the UAE’s vibrant mix of expatriates, entrepreneurs, and gig economy professionals, this kind of accessible banking is not just a convenience—it’s essential. Best of all, the entire process has moved online, meaning you can skip the long queues and endless paperwork at a physical branch.

What to Expect from the Digital Process

Banks and fintech companies have invested heavily in making the zero balance account opening online incredibly smooth. Forget the old way of doing things. The modern digital application is built for speed and simplicity.

Here’s a snapshot of what the journey usually looks like:

- A Quick Online Form: You'll start by filling in your basic personal and contact information on the bank’s website or, more commonly, their mobile app.

- Uploading Your Documents: Have your documents ready. You'll need to upload clear digital copies or photos of your key IDs, like your Emirates ID and visa page.

- Swift Verification: This is where the magic happens. Most institutions use slick tech for their Know Your Customer (KYC) checks. This often just involves taking a selfie or hopping on a brief video call to confirm it's really you.

This digital-first model isn’t just about saving you a trip to the bank; it’s a reflection of the UAE's broader vision for a seamless financial future. It puts you in control, letting you access vital banking services whenever and wherever you need them.

Knowing what’s coming makes the whole experience much smoother. You’re not just applying for an account; you're stepping into a modern banking ecosystem designed around your convenience. This guide will break down every part of it, so you're fully prepared to get your account up and running with zero fuss.

Why Choose a Zero Balance Account in the UAE?

Think of a zero balance account as more than just a bank account; it's a launchpad for financial agility here in the UAE. The most obvious win? You're completely free from the pressure of keeping a minimum amount of money in your account each month. Right away, that removes a layer of financial stress for just about everyone, from individuals to new businesses.

This is a game-changer in such a fast-paced economy. If you're a startup founder watching every dirham or a freelancer whose income ebbs and flows, not having to worry about penalty fees is a huge relief. It means your cash isn't just sitting there to satisfy a bank rule—it’s liquid and ready for whatever you need, whether that’s investing in growth, buying stock, or handling personal expenses.

Unlocking True Financial Flexibility

For entrepreneurs and small business owners, this kind of flexibility is everything. A traditional account might force you to lock away thousands of dirhams, but a zero balance account puts that capital back in your hands. You can reinvest it, cover an unexpected bill, or simply operate with a bit more breathing room.

This model is a perfect fit for the UAE's booming startup scene and gig economy. In response, many banks have rolled out zero balance options, making them a go-to solution. This shift has blown the doors open for banking access, which is especially helpful for the estimated 88% of the UAE's population made up of expatriates and residents with all sorts of income streams. You can learn more about how these accounts support UAE residents on Stashaway.

The core benefit is simple yet powerful: you get all the essential banking services you need without the financial headache of maintaining a specific balance. It really makes banking accessible to a much wider range of people.

The Clear Advantage for Expats and Digital Nomads

The UAE is a magnet for global talent, and if you're new to the country, getting your finances sorted quickly is right at the top of the list. A zero balance account opening online cuts through the usual red tape, giving you a clean, simple path to getting banked.

The digital setup process is a massive plus. Forget spending half a day at a branch with a folder full of paperwork; you can get the whole application done from your phone or laptop. That convenience is priceless when you’re trying to settle into a new country or run a business. It streamlines everything from day one and typically includes features like:

- No Maintenance Fees: Most of these accounts don't have monthly charges, which saves you a decent amount of money over time.

- Essential Banking Tools: You're not missing out on anything. You still get a debit card, a proper online banking portal, and a mobile app to manage your money on the go.

At the end of the day, opting for a zero balance account is a smart, strategic move. It’s a banking choice that actually fits the reality of modern life and work in the UAE, giving you a cost-effective and flexible foundation for your financial journey.

Comparing Top Banks for Online Zero Balance Accounts

Choosing the right bank for your zero balance account opening online can feel a bit overwhelming. The UAE market is packed with options, from the big, traditional banking names to the newer, more agile digital players. It’s easy to get lost in the marketing noise, so let's cut through it and focus on what actually matters for you or your business.

The "zero balance" feature is just the starting point. I always tell clients to look deeper. How good is their mobile app? Can you easily handle different currencies if you do business internationally? Are there any sneaky requirements hidden in the small print? A great zero balance account should make your financial life easier, not more complicated.

Traditional Banks Go Digital

The old guard, like First Abu Dhabi Bank (FAB) and Mashreq, haven't been sitting still. They’ve poured a lot of resources into their digital offerings, which is great news for us. Now, you get the trust and reliability of a major institution combined with the convenience of opening and managing your account from your phone.

This has been a real game-changer. Gone are the days of queuing up in a branch. Major banks now offer instant digital onboarding. The FAB iSave Account is a perfect example—you can open it right from the FAB mobile app with no minimum balance. Mashreq is another strong contender, offering interest rates up to 2.40% per annum on AED accounts and 1.20% on USD, all through a completely digital signup. You can find more detailed comparisons of UAE banking options on Dubai Resident Guide.

The Rise of Digital-Only Platforms

At the same time, we've seen a wave of digital-only banks and fintech platforms enter the scene. These are companies built for a mobile-first world. Their apps are often incredibly slick, and they pack in features specifically designed for freelancers, startups, and modern entrepreneurs.

They might not have a physical branch you can walk into, but their online customer support and app functionality are usually excellent.

The best choice really depends on who you are. A freelancer who just needs to get paid by local clients without fees might find a fintech app is perfect. But an entrepreneur who might need a business loan down the line could benefit from building a history with an established bank like FAB or Mashreq.

To make things clearer, I've put together a table comparing some of the top options available right now.

Comparison of Top UAE Zero Balance Accounts

This table breaks down some of the leading zero balance accounts you can open online. I’ve focused on the features that are most important for entrepreneurs and residents here in the UAE, cutting through the fluff to show you what each option really offers.

| Bank/Platform | Account Type | Key Feature | Interest Rate (p.a.) | Online Opening Process |

|---|---|---|---|---|

| Mashreq | NEO Account | Multi-currency support (AED & USD) | Up to 2.40% (AED) | Fully digital via app; instant activation |

| FAB | iSave Account | High savings potential, trusted brand | Variable | Instant opening via FAB Mobile app |

| Wio Bank | Wio Business | Integrated invoicing & VAT tools for SMEs | N/A | 100% digital, app-based onboarding |

| Zand | Personal Account | Focus on high-yield savings, digital-first | Up to 2.00% | Quick sign-up through the Zand mobile app |

After you’ve had a look, think about which one aligns best with your day-to-day needs and long-term goals. Each one has its own strengths, whether it's the high-interest rates from a digital player or the comprehensive services from a traditional bank.

To help you narrow it down even further, here are the key things I always check when comparing accounts:

- How easy is it to sign up? A good platform will have you up and running in minutes, not days. The verification process should be smooth and intuitive.

- Do they support multiple currencies? If you work with international clients, an account that holds USD, EUR, or GBP without charging crazy conversion fees is an absolute must.

- What are the hidden fees? Look carefully at the costs for using your debit card, making local transfers, or sending money abroad. Those small charges can really add up.

- Can it connect to your other tools? For business owners, integration with accounting software like Xero or QuickBooks is a massive time-saver. It automates your bookkeeping and keeps everything organised.

Ultimately, you're looking for a reliable financial partner. By comparing these specific features, you can move past the marketing slogans and choose the account that will genuinely support your growth in the UAE.

Getting Your Online Application Done Right

Alright, you’ve weighed your options and are ready to pull the trigger on a zero-balance account. This is where you get to see just how much easier banking has become. Forget the days of waiting in line with a folder full of papers; now, it’s a quick digital process you can knock out from your couch.

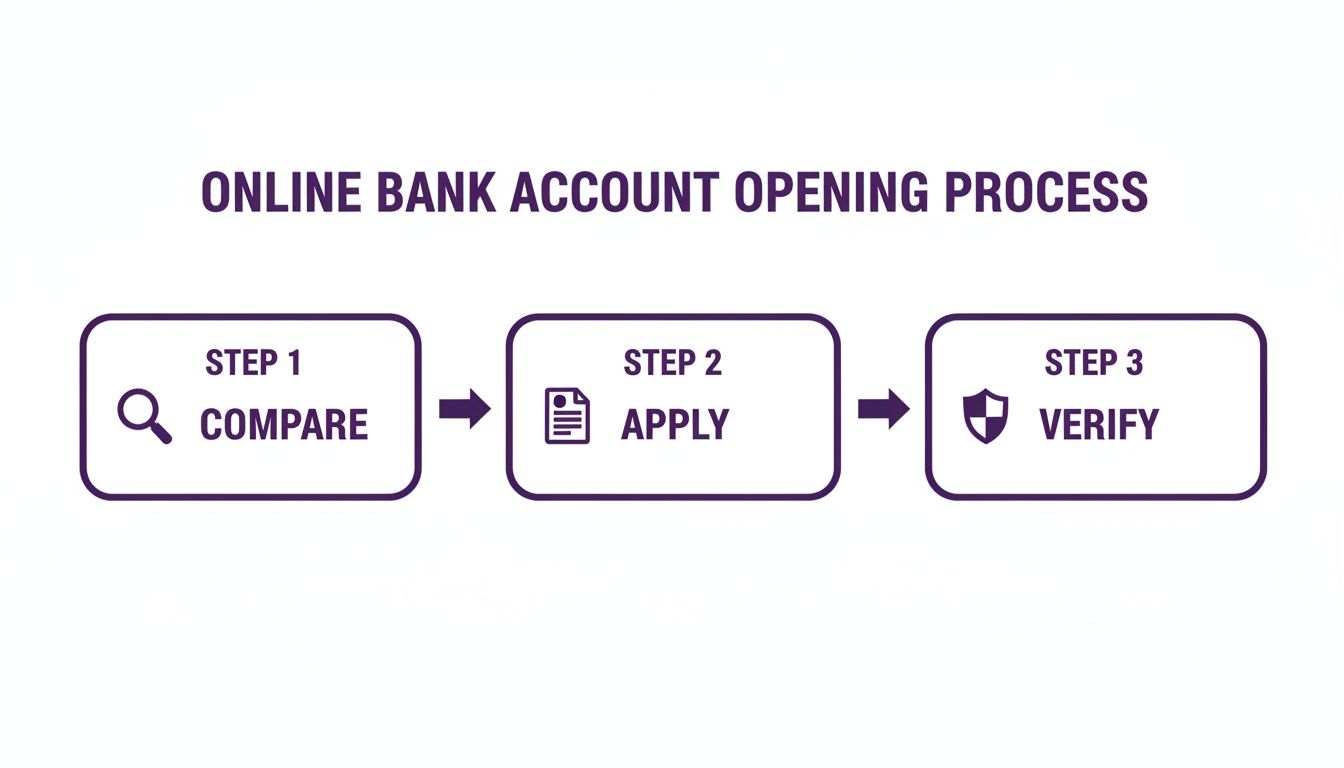

The whole thing usually unfolds in three simple stages. First, you'll get your documents ready. Next, you'll fill out the actual application. Finally, you'll do a quick digital verification to confirm your identity. If you've got everything prepped, you could have your new account details in less than an hour.

This image pretty much sums up the modern, streamlined approach to opening an account online.

It’s a clear visual that shows how a once-daunting task has been simplified into a few straightforward actions.

Get Your Digital Documents in Order First

Before you even think about starting the application, do yourself a huge favour and gather your documents. Seriously, this one move will save you so much hassle and stop you from getting timed out of the application halfway through. Banks need to confirm who you are and where you live, and they’ll ask for clean, digital copies.

Here’s a quick checklist of what you'll almost certainly need for a personal account:

- Emirates ID (Both Sides): Make sure it's not expired. The photos need to be crystal clear, without any weird reflections or blurry text.

- Passport & Visa Page: A clear copy of your passport's photo page and the UAE residence visa page is non-negotiable.

- Proof of Address: Usually, a recent DEWA bill or your tenancy contract (Ejari) works perfectly. If the bills aren't in your name, some banks are flexible and might accept a confirmation letter from your employer.

My advice? Use your phone in a room with good light, take sharp photos of everything, and save them in a folder you can easily find. When the app asks for an upload, you'll be ready to go in seconds.

The Final Step: KYC Verification

After uploading your documents, you'll hit the Know Your Customer (KYC) part of the process. This isn't just red tape; it's a crucial security check required by law, but the good news is that it’s now super fast and done entirely online.

Think of KYC as the digital handshake that keeps your money safe. It’s a vital security step that protects both you and the financial institution from potential fraud, and doing it online makes it secure and incredibly convenient.

This verification is almost always biometric. The bank's app will ask for permission to use your phone’s camera for a live selfie. You might even be asked to record a short video of yourself turning your head from side to side or saying a specific phrase. The system then uses this to match your live image with the photo on your Emirates ID, confirming it's really you.

As you move through the final stages of the application, you'll often need to provide an electronic signature to make things official. It’s worth getting familiar with the best electronic signature software platforms to see how these tools create secure, legally-recognised digital agreements.

Once your identity is confirmed and the forms are signed, your account is typically activated almost instantly. You’ll get your new IBAN right away and can start using your account.

Navigating Common Roadblocks in Your Application

Even with a seemingly perfect application, hitting a snag when opening a zero balance account online is more common than you'd think. An unexpected error or a document rejection can be a real headache, but the good news is, these are almost always easy fixes. If you know what to look out for, you can sidestep these issues entirely.

Most application hiccups boil down to a few usual suspects: blurry documents, failed biometric checks, or a simple technical glitch on the bank's end. One of the most frequent reasons for a delay? A poorly lit photo of your Emirates ID. It’s not a flat-out rejection; the system just couldn't read what it needed to.

Another classic mistake is a name mismatch. If the name on one document doesn't perfectly align with your passport, it raises a red flag. Keeping all your details consistent across the board is the simplest way to avoid these frustrating, and entirely preventable, delays.

What to Do When KYC Verification Fails

The digital Know Your Customer (KYC) check—that part where you take a selfie or a quick video—is a common stumbling block. This is a high-tech security step designed to prevent fraud, so it’s understandably picky. If it doesn't work the first time, don't worry.

Here’s how to nail it on your next attempt:

- Let There Be Light: Good lighting is non-negotiable. Face a window or a bright light source. Strong backlighting is your enemy, as it will cast your face in shadow.

- Keep the Background Simple: A plain, neutral-coloured wall is ideal. A cluttered background can easily confuse the facial recognition software.

- Steady Hands: Hold your phone still and at eye level. If you're asked to move your head, do it slowly and deliberately.

- Ditch the Accessories: Take off any hats, sunglasses, or large headphones that might obscure parts of your face.

Tried a few times with no luck? It could just be a temporary glitch in the app. My advice is to take a ten-minute break, completely restart the app, and then give it another go. If you're still stuck, it's time to reach out to their support team.

Fixing Document and Business Detail Discrepancies

For anyone opening a corporate account, there are a few more documents in the mix, which means a little more room for error. A frequent issue I see is a mismatch between the details on the trade license and what was entered into the application form.

It's amazing how a single typo in the company's legal name or a slightly incorrect trade license number can bring the entire process to a screeching halt. Always, and I mean always, double-check that every detail you enter is an exact match to your official paperwork.

And let's not forget about tech problems. Banking apps are sophisticated pieces of software, but they're not infallible. If a page freezes or an upload button refuses to work, the problem is most likely with the app, not you. Instead of trying to troubleshoot it yourself, get in touch with the bank's technical support. A quick chat can often resolve the issue in minutes and get your application moving again. Knowing about these potential bumps in the road beforehand makes for a much smoother journey.

Let 365 DAY PRO Handle Your Business Banking Setup

Opening a personal zero balance account online is usually a breeze. But when you’re setting up a corporate account in the UAE, you're playing an entirely different ballgame. The paperwork is heavier, the rules are far stricter, and one small mistake can lead to frustrating, expensive delays. This is exactly where having an expert in your corner makes all the difference.

Here at 365 DAY PRO, we are the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah. As specialists in Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, we know that a fast, successful bank account opening is tied directly to getting your company structure right from the start. Our cost-effective business setup solutions are tailored to your needs, helping you enjoy UAE tax benefits for international entrepreneurs.

Why Expert Help is Crucial for Corporate Accounts

Think of it this way: when you apply for a corporate account, the bank isn't just vetting you. They’re putting your entire business under a microscope—its ownership, its activities, its legitimacy. One missing signature or a poorly filled-out form can send you right back to the beginning, costing you weeks of lost momentum.

Our team is here to make sure that never happens.

- Spot-On Documentation: We live and breathe this stuff. We'll prepare and double-check every single document, from the trade licence and Memorandum of Association to shareholder resolutions, ensuring everything is perfectly compliant.

- Smart Bank Matching: Not every bank is the right fit. We've seen it all. Based on what your business actually does, we’ll guide you to the banks that are most likely to say "yes" without a fuss.

- Established Bank Relationships: Our strong connections with key banking partners help us cut through the red tape, sidestep common roadblocks, and speed up the entire approval process.

From our experience, the smartest thing any entrepreneur can do is tackle company formation and bank account opening together. It turns a disjointed, confusing puzzle into one streamlined project, saving you a world of headaches and guaranteeing you’re compliant from day one.

A Holistic Approach to Setting Up Your Business

Your company is more than just a licence; it needs a rock-solid financial foundation to thrive. Trying to handle company registration and bank accounts as separate tasks almost always creates friction. While it's useful to research various business banking solutions to see what's out there, understanding the specific nuances of the UAE system is what truly matters.

With our 24/7 Support Service, we are always here when you need us. We manage the whole journey for you with solutions tailored to your specific needs. This unified approach ensures your business structure is built to meet banking requirements from the get-go, helping you tap into all the tax benefits available to international entrepreneurs in the UAE.

Let us worry about the paperwork and the process. You focus on what you’re here to do: build a great business.

Ready to set up your company and corporate bank account without the hassle?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Or visit 365 DAY PRO Corporate Service Provider LLC at https://365dayproservices.com to get started.