Thinking about setting up a company in Dubai? You've picked a fantastic place to start. Dubai has really cemented its reputation as a global hub for entrepreneurs, and it's easy to see why—its strategic location, tax perks, and a genuinely supportive government make it incredibly attractive.

The first big decision you'll face is choosing the right structure for your venture. Your options generally fall into three buckets: Mainland, Free Zone, or Offshore. Each has its own playbook and is designed for different business goals.

Your Guide to Starting a Business in Dubai

Dubai’s business-friendly vibe didn't happen by chance. It’s the product of years of smart, strategic planning aimed at pulling in global talent and investment. For someone like you, this means real-world advantages, like major tax benefits and direct access to a buzzing international market. The trick is to figure out which setup fits your business model like a glove.

This guide will walk you through the three main structures for a company setup in Dubai. We’ll get into the practical benefits of each so you can see which one makes the most sense, whether you're a consultant, a global trader, or an investor looking to protect your assets.

Understanding the Core Jurisdictions

Each of the three options comes with its own set of distinct advantages.

- A Mainland company is your ticket to trading directly within the vibrant UAE market. If your customers are here, this is often the way to go.

- A Free Zone company is perfect for international trade, offering 100% foreign ownership and simplified customs procedures.

- An Offshore company isn't for local trading; instead, it’s a powerful vehicle for protecting assets and managing international investments.

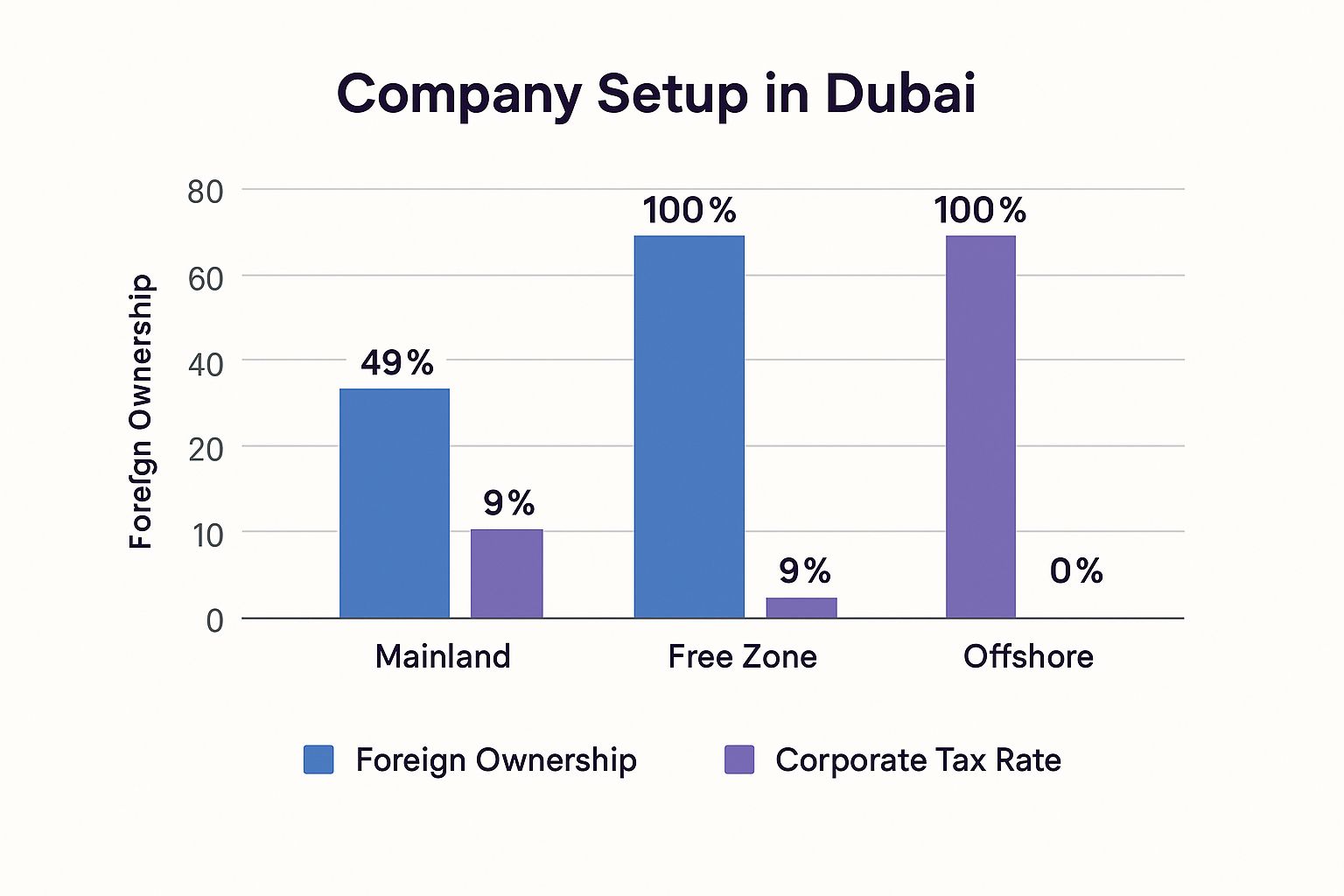

The infographic below breaks down how these jurisdictions stack up on two of the most important factors: foreign ownership and corporate tax.

As you can see, while Mainland companies have opened up to greater foreign ownership recently, Free Zones and Offshore setups still offer that complete control. For offshore companies, you’re looking at zero corporate tax. These differences are fundamental and will shape how you operate for years to come.

Dubai Company Setup Options at a Glance

Choosing the right path for your business can feel overwhelming. This table offers a comparative overview of Mainland, Free Zone, and Offshore company structures to help simplify your decision.

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Business Scope | Can trade anywhere in the UAE and internationally | Primarily trades within the free zone and internationally | Can only conduct business outside the UAE |

| Ownership | Up to 100% foreign ownership for most activities | 100% foreign ownership | 100% foreign ownership |

| Office Space | Mandatory physical office space required | Requires an office or flexi-desk within the zone | No physical office required; virtual office is enough |

| Visas | Visa eligibility depends on office size | Eligible for visas | Not eligible for residency visas |

| Corporate Tax | 9% on profits over AED 375,000 | 0% corporate tax (with conditions) | 0% corporate tax |

| Best For | Local trade, retail, service providers | Import/export, international trade, consulting | Asset protection, holding company, international investment |

Each structure has its place. Your choice will ultimately hinge on who your customers are, where they're located, and what your long-term financial goals look like.

A Thriving Economic Landscape

The appeal of setting up shop in Dubai is stronger than ever. In the first half of 2025 alone, Dubai registered a staggering 35,500 new companies. That’s a massive vote of confidence from investors worldwide, driven by the emirate’s proactive economic policies and top-tier infrastructure.

Choosing the right jurisdiction isn't just a legal formality—it's the foundational strategic decision for your business. It dictates your market access, ownership structure, and long-term tax liabilities, directly impacting your operational freedom and profitability.

Ultimately, your choice boils down to what you want to achieve. It’s also worth remembering that getting to grips with the broader legal frameworks in the UAE for market success is crucial, no matter where you decide to register. A smart decision now will pave the way for sustainable growth in this incredibly dynamic region.

Launching Your Dubai Mainland Company

Setting up a mainland company in Dubai is your ticket to the entire UAE market. It’s a completely different ball game compared to a free zone, which is really designed for international trade. A mainland business gives you the freedom to operate anywhere across the Emirates, deal directly with government bodies, and even bid on those big public sector contracts.

This is the go-to option if you plan to serve the local community. Think retail stores, restaurants, or professional services like marketing agencies and consultancies. You get unmatched access to the market, which is perfect for building a strong local brand. The whole process is managed by Dubai's Department of Economy and Tourism (DET), the authority that handles licensing and makes sure everyone plays by the rules.

Defining Your Business Activity and Legal Structure

First things first, you need to pinpoint your exact business activity from the DET's list, which has over 2,000 options. This decision is more important than you might think, as it directly determines the type of licence you'll need—commercial, professional, or industrial—and the legal frameworks available to you.

For instance, if you're in logistics and moving goods around the UAE, that’s a commercial licence. But if you’re a digital marketing agency offering specialised services, you'll need a professional licence. Getting this right from the start is crucial because it affects ownership rules and other key requirements down the line.

After you've locked in your activity, it's time to pick a legal structure. Most entrepreneurs I work with go for a Limited Liability Company (LLC). It’s a flexible setup that shields your personal assets from business liabilities. And here’s the best part: thanks to recent changes, most businesses can now have 100% foreign ownership, so you no longer need a UAE national to hold a majority share.

The Role of a Local Service Agent

That said, 100% foreign ownership isn't a blanket rule. If you're providing professional services—think doctors, lawyers, or consultants—you'll likely still need a Local Service Agent (LSA).

It's really important to understand what an LSA is, and more importantly, what they are not.

- No Shares in Your Business: An LSA has zero ownership stake in your company. You maintain full control over operations and keep all the profits.

- A Government Liaison: Their main job is to be your representative for government paperwork, like processing visas or renewing your licence.

- A Fixed Annual Fee: You pay the LSA a set fee each year. It’s a fixed cost, not a cut of your earnings.

Essentially, an LSA is an administrative facilitator. They help you navigate the local bureaucracy without taking a slice of your business, allowing you to operate with full autonomy while staying compliant.

Navigating Key Formation Milestones

Once you’ve got your activity and structure sorted, the real work begins: getting the official approvals and legal documents in place. A methodical approach here will save you a world of headaches.

Your journey starts with getting an Initial Approval from the DET. This is basically the government giving you a nod of approval for your business idea and letting you move forward. It’s the green light you need for the rest of your company setup in Dubai.

Securing the Initial Approval is a pivotal moment in the mainland setup process. It validates your business concept with the authorities and unlocks the ability to reserve your trade name and draft your legal documents.

Next up is your Memorandum of Association (MOA). This is the legal backbone of your company, spelling out everything from business goals and share capital to the roles of each partner. For an LLC, all partners have to sign this document in front of a public notary.

Finally, you can't have a mainland company without a physical office. You’ll need a valid tenancy contract registered with Ejari, Dubai’s online lease registration system. This official lease agreement is a non-negotiable requirement for your final trade licence, as it proves your business has a genuine physical address in the emirate.

Why a UAE Free Zone Could Be Your Best Move

For entrepreneurs looking to plant a flag in the Middle East, the UAE's Free Zones are often the most magnetic entry point. Think of them as specialised economic districts, purposefully built to attract foreign investment by offering powerful incentives you simply won't find on the mainland. A company setup in Dubai within one of these zones isn't just a registration; it's a strategic decision that unlocks a host of benefits designed for international business.

The biggest draw, without a doubt, is the promise of 100% foreign ownership. This is a massive deal. In the past, certain mainland business structures required a local partner, but in a Free Zone, you retain complete control of your enterprise from the get-go. This autonomy is priceless for founders and investors who want to protect their equity and steer their own ship.

On top of that, the tax environment is incredibly appealing. Businesses operating inside a Free Zone benefit from exemptions on import and export duties. If you're in trading, logistics, or manufacturing, that's a game-changer that directly slashes your operational costs and sharpens your competitive edge in the global market.

Finding the Right Home for Your Business

With over 40 Free Zones scattered across the UAE, picking the right one is a make-or-break decision. These aren't just generic business parks; they are curated ecosystems, each fine-tuned to support specific industries. This creates an environment ripe with networking opportunities and connects you with a community of peers who speak your language.

Let me give you a few real-world examples so you can see what I mean:

- Dubai Multi Commodities Centre (DMCC): This is the global epicentre for commodities trading. If your business deals in anything from gold and diamonds to coffee and tea, DMCC is where you need to be.

- Dubai Internet City (DIC) & Dubai Media City (DMC): These are the stomping grounds for tech startups, digital marketing agencies, and media production companies. The whole vibe is innovation and creativity.

- Jebel Ali Free Zone (JAFZA): As one of the world's largest logistics hubs, JAFZA is the undisputed champion for anyone in the import/export, manufacturing, or distribution game.

Choosing the right Free Zone isn't about chasing the cheapest option. It's a strategic play to embed your business in an environment where it can truly flourish—surrounded by potential clients, partners, and the exact talent you need to hire.

When you align your business with the right zone, you're getting far more than a trade licence; you're plugging into an entire industry network.

The Formation Process: Fast and Focused

One of the most refreshing things about a Free Zone company setup in Dubai is how efficient the process is. These zones operate under their own independent authorities and regulations, which means you'll encounter far less bureaucracy and enjoy quicker turnaround times compared to a mainland setup.

It all kicks off when you submit a detailed application and a clear business plan to your chosen Free Zone authority. This document is your chance to lay out your business activities, financial forecasts, and operational strategy. Once they give you the initial nod, you'll move on to choosing the right licence—commercial, professional, or industrial—that matches what your business actually does.

Nailing Down Your Licence and Office Package

After securing that initial approval, it's time to finalise your licence and decide on your physical footprint. Free Zones are brilliant at offering flexible office solutions that cater to every budget and business size, which is a lifesaver for startups and solo entrepreneurs.

Here’s a quick rundown of the typical options you’ll come across:

- Flexi-Desk: This is your most budget-friendly choice, giving you access to a shared workspace. It’s perfect for freelancers or anyone just testing the waters, as it satisfies the physical address requirement for your licence and gets you visa eligibility without the expense of a private office.

- Serviced Office: Got a small team? A serviced office gives you a private, furnished space with shared perks like a receptionist and meeting rooms. It projects a professional image and gives you a bit of room to grow.

- Physical Office Space: For larger teams or operations needing more room, leasing a dedicated office is the way to go. This gives you total control over your workspace and is often necessary if you plan on applying for a larger number of employee visas.

The package you select has a direct impact on both your operating costs and the number of residency visas you can secure. This is where getting some expert advice from a corporate service provider can be invaluable. They'll help you pick a package that fits not just where you are today, but where you plan to be tomorrow.

Getting a Handle on Your Business Setup Costs

Let’s talk numbers. A solid financial plan is the absolute bedrock of any new venture in Dubai. Before you get swept up in the excitement, it’s crucial to get a realistic picture of the full spectrum of costs—not just what it takes to get the doors open, but what it takes to keep them open.

The total investment can swing wildly depending on where you set up (mainland or free zone), what your business actually does, and how big you plan to be from the get-go. Mapping this all out isn't just a box-ticking exercise; it saves you from nasty financial surprises later on.

The Upfront Investment: What It Really Takes to Get Started

First things first, you've got the one-time fees to get your company legally registered and licensed. These are the foundational expenses that officially get your business off the ground.

As a general rule of thumb, you should budget somewhere between AED 20,000 and AED 30,000 (roughly US$5,450–US$8,200) for the initial setup. This chunk of change typically covers the essentials like your trade licence, registration fees, and a basic office lease. But be warned, this number can easily creep up if your business activity needs special approvals from other ministries or if you’ve set your heart on a foreign trade name. If you want to dive deeper, there are some great insights into the UAE's business environment on nomadcapitalist.com.

Here’s a quick rundown of what you’re paying for initially:

- Trade Licence Fee: This is the big one—the main government fee for your specific business activity.

- Registration and Initial Approval: These are the charges from the Department of Economy and Tourism (DET) for a mainland setup, or the relevant Free Zone authority.

- Trade Name Reservation: A small but necessary fee to make sure your company name is officially yours.

- Office Lease Agreement: Whether it's registering your tenancy contract (Ejari) on the mainland or grabbing a flexi-desk package in a free zone, you need a physical address.

- Memorandum of Association (MOA) Attestation: Think of this as the notary fees to make your company's founding documents legally binding.

Don't Forget the Ongoing Costs

Getting set up is just the first hurdle. Your financial plan absolutely must account for the recurring annual costs. These are the expenses that keep your company in good standing and ensure you can operate without a hitch, year after year.

The most significant recurring cost is, without a doubt, the annual trade licence renewal. It’s not a one-and-done payment. Every year, you have to renew it to stay legal. Beyond that, you need to budget for office rent, any staff salaries, utility bills, and the renewal fees for your own visa and those of your employees.

A classic mistake I see new entrepreneurs make is underestimating the annual renewal and compliance costs. Factoring these into your projections from day one is what separates a sustainable business from one that hits a cash flow crisis in its second year.

The Big Advantage: UAE Corporate Tax

Now for the good news. One of the most significant financial factors to consider is the UAE's corporate tax system. While the country has introduced a federal corporate tax, it’s been cleverly designed to maintain the UAE’s competitive edge.

The headline rate is 9%, but here's the kicker: it only applies to taxable income over AED 375,000 (about US$102,000). This means any profits your business makes below that threshold are effectively taxed at 0%. It’s a huge leg-up for startups and SMEs, making Dubai an incredibly attractive place for entrepreneurs looking for tax efficiency. Working with a good corporate service provider can ensure you stay fully compliant while taking full advantage of these benefits.

Estimated Startup Cost Comparison Mainland vs Free Zone

To give you a more concrete idea of how these costs stack up in the real world, let's look at a sample breakdown for two common setups. This comparison really highlights how your choice of jurisdiction and licence type can directly impact that initial investment.

| Cost Item | Mainland Professional Licence (Approx. AED) | Free Zone E-commerce Licence (Approx. AED) |

|---|---|---|

| Trade Licence & Registration | 15,000 – 20,000 | 12,000 – 18,000 |

| Local Service Agent (LSA) Fee | 5,000 – 10,000 | N/A |

| Office Lease (Virtual/Flexi-Desk) | 5,000 – 15,000 | 5,000 – 12,000 |

| Establishment Card | 2,000 | 2,000 |

| Investor Visa (Excluding Medical) | 3,500 – 5,000 | 3,500 – 5,000 |

| Total Estimated First-Year Cost | 30,500 – 52,000 | 22,500 – 37,000 |

A quick note: Treat these figures as a guide. They are estimates and can definitely change based on your specific business needs and any updates to government fees.

As you can see, the free zone option often comes out a bit cheaper in the first year, largely because you avoid the Local Service Agent fee that’s mandatory for certain mainland professional licences.

Navigating Visas and Building Your Team

With your company officially registered and your trade licence in hand, the focus pivots from paperwork to people. This is where your venture truly starts to take shape—it’s time to secure your own residency and begin building the team that will drive your success.

Getting your UAE residency visa is more than just an administrative step; it’s the key that unlocks your life here. It allows you to open a personal bank account, sign a long-term lease for a home, and access the country's incredible healthcare and education systems. For any entrepreneur moving here, this visa is the foundation for genuine stability.

First Things First: The Establishment Card

Before you can sponsor anyone's visa (including your own), your company needs an Establishment Card. You can think of it as your company's official immigration file with the General Directorate of Residency and Foreigners Affairs (GDRFA).

Applying for this card is one of the very first things you'll do after getting your licence. It’s a straightforward but absolutely critical step. Without it, your company simply doesn't have the legal capacity to sponsor visas for investors, partners, or employees.

The Three Core Stages of Visa Processing

Once that card is active, you can get started on the actual visa applications. The process itself is quite logical and follows a predictable path, whether it's for you as the investor or for your first employee.

Breaking it down, it looks like this:

- The Entry Permit: This is the initial green light. It’s a permit that allows a person to enter the UAE for residency purposes. If they're already in the country on a tourist visa, this document is used to change their status without having to exit and re-enter.

- The Medical Fitness Test: Every new resident over 18 must undergo a government-mandated medical screening. The test checks for specific communicable diseases, a standard public health measure here in the UAE.

- Emirates ID & Visa Stamping: After a successful medical test, the applicant provides their biometrics for the Emirates ID card. The final piece of the puzzle is the visa stamping, where the residency permit is physically affixed to a page in their passport. At that moment, they are officially a UAE resident.

Securing your residency visa is the point where your company setup in Dubai feels truly real. It’s no longer just a business plan; it's the start of your new life and your freedom to build a future in one of the world's most exciting cities.

Office Size and Its Link to Your Visa Quota

Here’s a practical detail that catches many new entrepreneurs by surprise: the size of your office is directly tied to the number of employee visas you’re allowed. It makes sense when you think about it—the authorities need to see that you have a legitimate, properly-sized workspace for the team you intend to hire.

This is especially true for mainland companies. The general rule of thumb is that you need a certain amount of office space per visa you want to apply for.

- Flexi-Desk or Small Office: Perfect for solo founders or very small startups. These options usually come with a limited visa quota, often just one to three.

- Larger Physical Office: If you have big hiring plans, you’ll need to lease a more substantial office. This not only gives your team a place to work but also secures the higher visa allocation you’ll need.

This is why a bit of forward-thinking is so important. Working with an experienced corporate service provider can be invaluable here. They can help you find a setup that fits your budget today but doesn't box you in tomorrow, advising on the right office package based on your hiring forecast. That kind of expert guidance ensures you won't hit a wall just when you’re ready to grow.

Managing Your Business After Setup

Getting your trade licence in hand feels like crossing the finish line, but in reality, you've just reached the starting blocks. This is where the real work of running a successful Dubai business begins. Now, the focus shifts from setup to the day-to-day rhythm of managing finances, keeping up with renewals, and making sure you’re playing by the rules.

The very first thing on your to-do list? Open a corporate bank account. This isn't just a suggestion; it's absolutely essential for separating your business funds from your personal money. Without it, you can't properly receive payments, manage your cash flow, or build credibility with clients and suppliers. Your business is basically on hold until this is done.

Opening Your Corporate Bank Account

I've seen many new entrepreneurs get tripped up by the banking process here. UAE banks are incredibly thorough with their Know Your Customer (KYC) checks to combat financial crime, so walking in unprepared is a recipe for delays. Your best bet is to have every single document in order before you even book an appointment.

Here's a quick rundown of what they'll almost certainly ask for:

- Company Paperwork: Have your trade licence, Memorandum of Association (MOA), and any share certificates ready.

- Personal IDs: Passport copies, residence visa pages, and Emirates IDs for all company shareholders.

- Proof of Operations: A well-thought-out business plan is a must. They'll also want to see details on your anticipated transactions, and sometimes even signed contracts or invoices to prove you're a legitimate operation.

Choosing the right bank is just as important. Look beyond the familiar names and compare things like minimum balance requirements (these can be surprisingly high), international transfer fees, and how good their online banking portal is. Some banks are known for being much friendlier to SMEs than others, so a bit of homework here will pay off down the road.

Staying Compliant and Renewing Your Licence

Your company setup in Dubai is not a 'set it and forget it' affair. It needs regular attention to stay in good legal standing. The biggest annual task is renewing your trade licence. Missing the deadline can lead to some eye-watering fines and, in serious cases, could get your company blacklisted.

But it's more than just the licence. You need to stay on top of a couple of key regulations:

- Ultimate Beneficial Ownership (UBO): You are required to keep an up-to-date register of who ultimately owns and controls your company and declare this to the authorities. It’s all about financial transparency.

- Economic Substance Regulations (ESR): If your business is involved in certain activities—think banking, investment fund management, or distribution centres—you have to prove you have a real economic footprint in the UAE.

As you navigate the responsibilities of your new business, understanding the broader landscape is crucial. For a comprehensive overview, a practical guide to compliance at work offers some fantastic insights.

Focusing on Growth and Long-Term Success

Once you have your operational and compliance foundations solidly in place, you can finally turn your attention to the reason you started this journey: growing your business. And the timing couldn't be better. The economic outlook here is buzzing with positivity. The Mastercard SME Confidence Index found that an incredible 91% of UAE SMEs are optimistic about what's ahead, with 90% expecting their revenues to either grow or remain stable.

This confidence is being driven by a massive digital shift. A staggering 92% of SMEs have now embraced digital payment systems. You can read more about the bright future for UAE businesses on tme-services.com.

Remember, staying on top of your annual renewals and compliance isn't just about ticking boxes to avoid fines. It's about building a resilient, reputable business that can truly flourish in Dubai's dynamic market for years to come.

Got Questions About Setting Up Your Company?

You're not alone. The path to setting up a company in Dubai is filled with questions, especially for newcomers. Let's tackle some of the most common ones I hear from entrepreneurs just like you.

Do I Really Need a Local Sponsor for a Dubai Company?

This is probably the most frequent question I get, and the answer has changed a lot in recent years. The good news is that for most businesses on the Dubai Mainland, the old 51% Emirati partner rule is gone. Today, you can have 100% foreign ownership for the vast majority of commercial and industrial licences.

However, there's a small catch for professional services – think consultancies, law firms, or medical clinics. For these, you'll need a Local Service Agent (LSA). Don't worry, this isn't a sponsor. An LSA has zero shares and no say in your business; they simply act as your official go-between for government paperwork, and you maintain full control.

And in the Free Zones? It's even simpler. 100% foreign ownership has always been the standard there, giving you complete autonomy from day one.

What's the Minimum Capital I Need to Start?

Thankfully, the days of needing a huge chunk of capital just to get started are mostly behind us. On the Dubai Mainland, there's no longer a mandated minimum share capital for most company types. You just need to state a reasonable amount in your company's official documents that makes sense for your business operations.

Free Zones are a different story, as each one sets its own rules. It's a real mixed bag. Some zones require no capital at all, while others might ask for anything from AED 50,000 up to AED 1,000,000 or more. It all comes down to which free zone you choose and what kind of business you're running.

How Long Does It Actually Take to Get Set Up?

The timeline really hinges on where you decide to set up shop.

- Free Zone Company: This is usually the quickest option. I’ve seen these get done in as little as 1 to 2 weeks. Free zones are built for speed and efficiency.

- Mainland Company: Setting up on the mainland takes a bit more time, typically around 2 to 4 weeks. The main reason is that some business activities require extra approvals from various government ministries, which can add to the timeline.

A quick tip from experience: working with a setup specialist can shave a significant amount of time off either process. We know the system inside and out, ensuring your paperwork is spot-on the first time and avoiding the common pitfalls that cause delays.

Can I Run My Dubai Company While Living Abroad?

Absolutely. It's quite common, especially for Free Zone companies, to be managed from another country. But there are a couple of key things you need to be aware of.

First, you can't open a corporate bank account remotely. At least one of the company's signatories has to be physically in the UAE to meet the bankers and sign the final paperwork.

Second, to properly benefit from the UAE's tax advantages and stay compliant with Economic Substance Regulations (ESR), your company needs to have legitimate "substance" here. This means having things like a physical office, local employees, and showing that management decisions are being made within the country.

Ready to turn your business idea into a Dubai reality? It can seem like a complex journey, but you don't have to figure it all out on your own. We are the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, with specialists in both Mainland and Freezone company formation across the UAE. Our 24/7 support service and cost-effective, tailored solutions ensure you can enjoy all the UAE tax benefits for international entrepreneurs. We handle everything from licences to visas, so you can focus on what really matters—growing your business.

📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.