If you're looking to do business in Dubai, the very first thing you'll need is a Dubai trade license. This isn't just a piece of paperwork; it's the official government green light that makes your company legal. Think of it as your business's passport—without it, you can't legally operate, open a corporate bank account, or sponsor visas for your team.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Your First Step in the Dubai Business World

Getting started in Dubai is an exciting journey, but it all begins with that one crucial document: the trade license. This is the foundation of your entire operation, proving that you're a legitimate business and giving you the legal standing to succeed.

Without a valid license, your business is effectively at a standstill. It’s the key that unlocks everything else, from signing contracts and renting an office to hiring employees and managing your finances. Having one shows you’re serious about following the rules, which builds immediate trust with customers, partners, and the authorities.

Mapping the Business Landscape

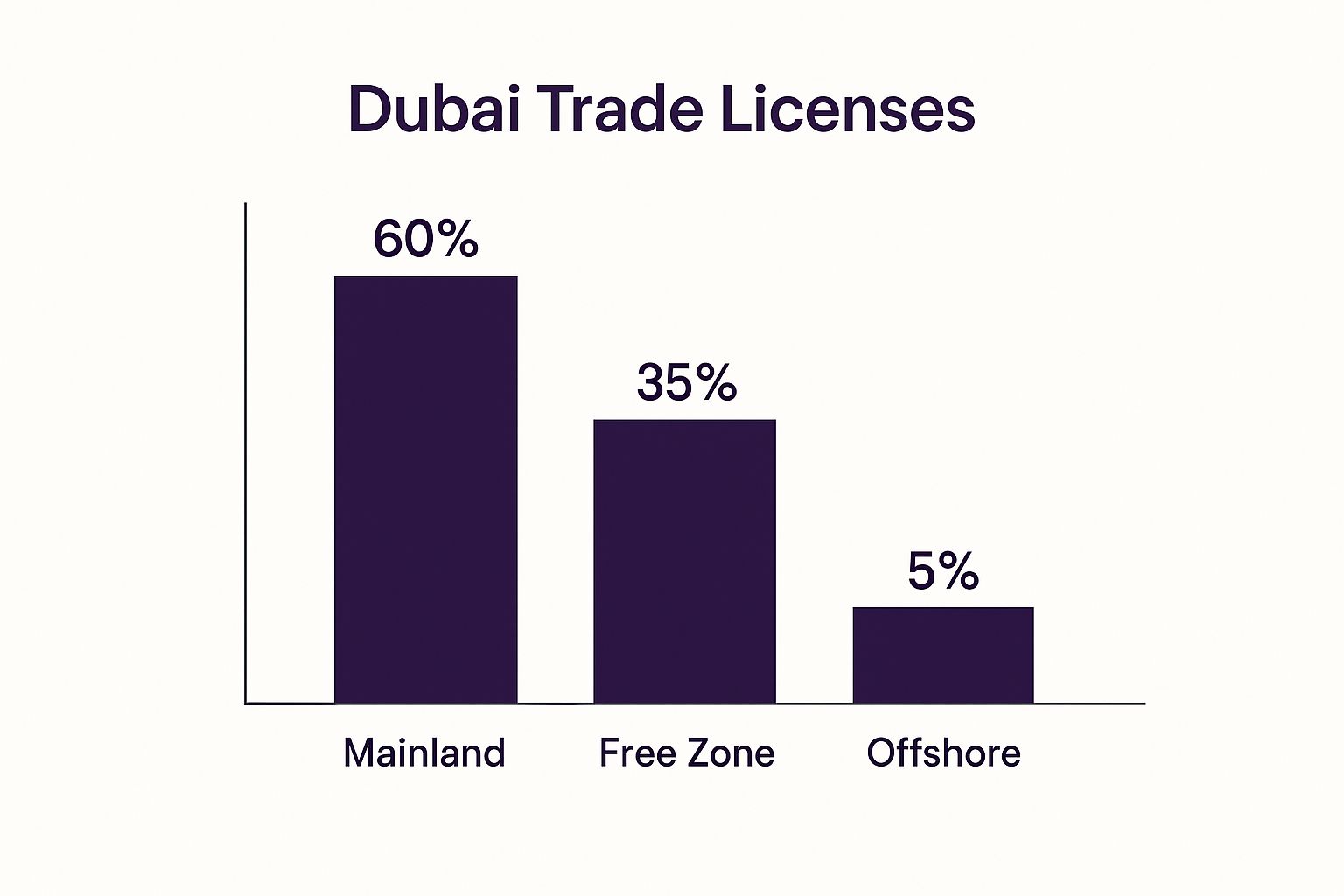

Before you jump into any applications, you need to understand the lay of the land. Dubai’s business world is divided into three main jurisdictions, each with its own set of rules and benefits. The one you choose will have a huge impact on what your company can do, who can own it, and where you can operate.

-

Mainland License: This is your ticket to the entire UAE market. It gives you the freedom to trade with any customer, anywhere in the country, and even bid on lucrative government projects.

-

Free Zone License: Perfect for businesses focused on international trade. You get perks like 100% foreign ownership and tax exemptions, but your business activities are generally limited to your specific free zone and markets outside the UAE.

-

Offshore License: This isn't for day-to-day operations. It's a tool for international business, typically used as a holding company to own assets, protect investments, or manage international invoicing without a physical presence in the UAE.

To give you a clearer picture, here’s a look at how these licenses are typically distributed among businesses in Dubai.

As you can see, the majority of entrepreneurs opt for a mainland setup. This reflects a clear desire to tap directly into the vibrant local economy. Getting your head around these three options is the absolute first step in choosing the right path for your venture.

Choosing Your Jurisdiction: Mainland vs. Free Zone

When you’re setting up in Dubai, the single biggest decision you’ll make is where to plant your flag: on the Mainland or in a Free Zone. This isn’t just a detail; it's the foundation of your entire business. It determines where you can legally operate, who your customers can be, and how your company is owned.

Let's use an analogy. A Mainland company is like opening a shop on a busy high street, with the freedom to sell to anyone and everyone who walks past. A Free Zone company, on the other hand, is like a specialised warehouse in an international port—perfect for global trade but with limited access to the local neighbourhood.

The UAE's business landscape is absolutely electric right now, thanks to some smart reforms making it easier than ever to get started. The country recently hit a record high with over 1.5 million active commercial licenses. In just the last year, around 200,000 new licenses were issued, with sectors like e-commerce, general trading, and logistics leading the charge. You can read more about this incredible growth and what's driving it.

The Dubai Mainland Advantage

A Mainland Dubai trade license, issued by the Department of Economy and Tourism (DET), gives you the ultimate freedom to operate. It’s your all-access pass to the entire UAE market, from Abu Dhabi to Fujairah.

This is the path you want if your plan is to sell directly to local customers or work with other UAE-based companies. More importantly, a Mainland license is your ticket to bid on lucrative government contracts—a massive opportunity many businesses build their success on.

Here’s what you get:

- Total Market Access: Trade freely with any customer or business, anywhere in the UAE.

- Government Contract Eligibility: Position yourself to win valuable government tenders and projects.

- No Business Activity Restrictions: Access thousands of business activities without the limitations common in Free Zones.

- Room to Grow: Easily open new branches and expand your physical footprint across the Emirates.

While it used to be that you needed a local sponsor, recent legal changes have opened the doors for 100% foreign ownership for most business activities, making the Mainland route more appealing than ever for international entrepreneurs.

The Free Zone Appeal

Dubai and the wider UAE are home to over 40 specialised Free Zones. Think of them as independent economic hubs, each with its own rules designed to attract foreign investment with some very compelling perks.

These zones are a magnet for businesses focused on import/export and international services. They offer a much simpler setup process and a supportive ecosystem, often built around specific industries like technology, media, finance, or logistics.

The real draw of a Free Zone is the combination of complete foreign ownership and huge tax benefits. It’s an ideal structure for entrepreneurs planning to operate globally without needing direct access to the local UAE market.

The core benefits of a Free Zone licence include:

- 100% Foreign Ownership: You maintain full control of your business, no local partner required.

- Tax Exemptions: Enjoy 0% corporate and personal income taxes.

- Full Repatriation of Profits: Send all your capital and profits back home without any restrictions.

- Simplified Setup: Get up and running faster with less complex paperwork for your company and visas.

Mainland vs Free Zone: A Head-to-Head Comparison

To make the right call, you need to see how these two options stack up side-by-side. This table breaks down the key differences, helping you match the jurisdiction to your specific business goals.

| Feature | Mainland License | Free Zone License |

|---|---|---|

| Trading Area | Unrestricted trade across the entire UAE and internationally. | Primarily within the Free Zone and internationally; local trade is restricted. |

| Ownership | 100% foreign ownership now available for most activities. | 100% foreign ownership guaranteed for all license types. |

| Office Space | A physical office space with an Ejari (lease) is mandatory. | Flexible options available, including virtual offices and flexi-desks. |

| Government Work | Eligible to bid on and execute government contracts. | Generally not permitted to work directly on government projects. |

| Visa Eligibility | Depends on the size of the office space. | Typically allocated a set number of visas, which can be increased. |

| Business Scope | Wide range of activities available across all sectors. | Activities may be restricted to the specific industry of the Free Zone. |

Choosing your jurisdiction is a strategic move, not just a logistical one. As specialists in both Mainland and Free Zone formations, we can guide you to ensure your Dubai trade license is a perfect fit for your ambitions, providing cost-effective solutions that work for you.

The Dubai Trade License Application Process Step-by-Step

Getting your Dubai trade license can feel a bit daunting at first, but it’s really just a series of logical steps. Once you understand the sequence, the whole process becomes much clearer and less intimidating. Let's break it down into a straightforward checklist you can follow.

Think of it like building a house. You wouldn't put up the walls before pouring the foundation, right? It's the same here. Each step builds on the last, ensuring your business has a solid legal structure from day one.

Step 1: Finalise Your Business Activity and Legal Form

First things first: you need to decide exactly what your business is going to do. This is a critical starting point. The Department of Economy and Tourism (DET) has a list of over 2,000 approved business activities, and your choice will directly dictate whether you need a Commercial, Professional, or Industrial license.

This isn't a detail you can gloss over. For instance, if you're planning to import and sell gadgets, you'll need a Commercial License. But if you’re setting up a marketing consultancy, that falls under a Professional License. Getting this right from the start saves you from potential roadblocks later on.

With your activity defined, you then choose a legal form. This is all about the ownership structure of your company. Will you be a Sole Establishment as a single owner? Or perhaps a Limited Liability Company (LLC) with partners? This decision is fundamental to your Mainland Dubai trade license.

Step 2: Reserve Your Company Trade Name

Your company’s name is its brand, but in Dubai, it also has to pass a few official checks. The authorities have strict guidelines to ensure names are unique and appropriate.

You'll need to submit your proposed name to the DET for approval. My advice? Have a few alternatives ready to go. It’s not uncommon for a first choice to be unavailable or to not meet the specific criteria.

A few rules of thumb to remember:

- The name can't already be taken by another company.

- It must not violate public morals or the country's public order.

- It should make sense for the type of business you’re running.

Once your name gets the green light, it’s officially reserved for you, clearing the way for the next phase.

Step 3: Obtain Initial Approval

This step is a major milestone. The Initial Approval is essentially a 'no-objection' certificate from the DET. It’s the government's way of saying, "We've reviewed your proposal and have no issue with you setting up this business."

Getting this approval unlocks your ability to tackle other important tasks, like finalising your legal documents and leasing an office. This certificate is valid for six months, which gives you a comfortable window to get everything else in order.

Think of the Initial Approval as getting permission to draw up the blueprints for your business. It's not the final construction permit, but it's the official go-ahead to start planning the serious details.

Step 4: Draft Foundational Legal Documents

Now that you have your Initial Approval, it’s time to get your company's core legal paperwork in order. If you’re setting up an LLC, the key document here is the Memorandum of Association (MOA).

The MOA is the formal agreement between all the partners. It’s incredibly important as it lays out all the critical details of your business relationship, including:

- The company’s objectives and activities.

- Share capital and how ownership is split among partners.

- The management plan and how profits or losses will be distributed.

This document needs to be drafted with care, signed by every partner, and then legally notarised. For some professional activities, you might need a Local Service Agent (LSA) agreement instead, which serves a similar purpose.

Step 5: Secure a Physical Office Lease

A Mainland Dubai trade license requires a physical address. You can’t just use a P.O. box. You must lease a commercial space and officially register the tenancy contract through Ejari, Dubai's online registration system.

Your Ejari certificate is the non-negotiable proof of your business address that the authorities require. It’s also worth noting that the size of your office can influence how many employee visas you’re eligible to apply for. This is where professional guidance can be really valuable, helping you find a compliant and cost-effective space without overspending.

Step 6: Submit Your Final Application

You're at the finish line! This is where all your preparation comes together. You'll gather all your documents and submit the complete package to the DET.

Typically, your submission will need to include:

- The filled-out application form.

- Passport copies for all owners and partners.

- Your Initial Approval certificate.

- The notarised Memorandum of Association (MOA).

- The Ejari-registered tenancy contract for your office.

After the authorities review and approve your file, they'll issue a payment voucher for the license fees. Once you've settled that, your official Dubai trade license is issued. Congratulations—your company is now legally open for business

Understanding Dubai Trade License Costs

Before you can get your business off the ground, you need a solid, realistic budget. This is especially true when it comes to getting your Dubai trade license. To plan properly and avoid any nasty surprises down the line, it’s crucial to understand the full financial picture. The final bill isn't just one single fee; it's a mix of one-time payments, annual renewals, and other related expenses that all depend on your specific business setup.

At first glance, the costs can seem a bit overwhelming. But once you break them down, you’ll see a clear, logical structure. The initial investment covers all the government fees needed to get your company legally registered, while the ongoing costs ensure you stay compliant and operational. Thinking about all these expenses from the start lets you build an accurate financial forecast for your new venture.

Breaking Down the One-Time Government Fees

The first hurdle is the one-time government fees for the initial setup of your Dubai trade license. Think of these as the foundational payments required by the Department of Economy and Tourism (DET) and other authorities to process your application and officially get your company on the books.

Here’s what those initial fees typically cover:

- Trade Name Reservation: A fee to secure your unique company name, making sure no one else can use it.

- Initial Approval Certificate: This is the payment for the no-objection certificate, which gives you the green light to lease an office and get your legal documents drafted.

- License Issuance Fee: The main cost for the trade license itself. The price tag here changes based on your business activities and legal structure.

- Government Service Fees: Various smaller charges for administrative processing, often called Tasheel or service centre fees.

For a Mainland LLC, these initial government costs generally fall somewhere between AED 15,000 to AED 25,000. But remember, this is just the starting point.

Planning for your trade license cost is about more than just the license itself. It involves forecasting all related expenses, from your office lease to visa processing, to create a truly comprehensive budget that sets your business up for financial stability from day one.

Factoring in Recurring and Associated Costs

Beyond the initial setup fees, you need to budget for the recurring and associated expenses that are just as important for your business. These costs aren't technically part of the license fee, but they are mandatory for keeping your company legal and running smoothly.

The biggest recurring cost is almost always your office rent. If you're setting up on the Mainland, a registered tenancy contract (known as an Ejari) is an absolute must. Naturally, the cost will vary wildly depending on the location and size of your office.

Other essential costs to keep in mind include:

- Visa Processing: You'll have fees for your own investor visa and for any employees you decide to hire.

- Legal Document Fees: This covers the cost of drafting and notarising your Memorandum of Association (MOA) or, if applicable, a Local Service Agent (LSA) agreement.

- Establishment Card: This is a mandatory card that registers your company with the immigration authorities, which is what allows you to apply for visas in the first place.

- Market Fees: Some jurisdictions also add a small fee calculated as a percentage of your annual office rent.

Cost Ranges for Different Setups

The total cost for your Dubai trade license is going to look very different depending on where you set up—Mainland or a Free Zone—and the type of license you need. As specialists in both Mainland and Free Zone company formation, we know how to find cost-effective solutions that fit your business perfectly.

For example, a Free Zone license often comes with a lower starting price, sometimes beginning around AED 10,000, especially if you opt for a virtual office package. On the other hand, a Mainland professional license might have a different cost structure than a commercial one. By working with experts who offer 24/7 support, you can explore these options and find the smartest financial path for your business, allowing you to take full advantage of the UAE's incredible tax benefits.

Why Partnering with a Setup Consultant Is a Smart Move

You can go it alone when getting your Dubai trade license, but be warned: it’s a journey often bogged down by confusing paperwork and unexpected delays. This is where bringing in a corporate services provider changes the game entirely. It’s the difference between a stressful ordeal and a smooth, straightforward launch.

Think of a business setup consultant as your seasoned guide for a tricky mountain climb. They've walked the path hundreds of times, know every shortcut, and have friends in all the right places to help clear the way. This isn't just about avoiding a few headaches; it's about getting your business up and running faster so you can focus on what you do best—growing your company, not wrestling with admin.

Expertise That Accelerates Your Launch

The best Dubai trade license specialists offer far more than just filling out forms. They bring a deep well of practical knowledge to the table. They live and breathe the nuances of both Mainland and Free Zone company formations across the UAE, understanding the subtle differences that can make or break your business structure.

From getting your trade name approved to drafting the perfect Memorandum of Association, they manage all the intricate details. More importantly, their established relationships with government bodies like the Department of Economy and Tourism (DET) can significantly cut down processing times. It's not just support; it's a real head start.

A Tailored and Cost-Effective Approach

It’s a common myth that hiring a consultant is just an extra cost. The truth is, it’s often the most cost-effective business setup solution because it helps you sidestep expensive mistakes. A good consultant doesn't offer a one-size-fits-all package; they create a plan specifically for your business.

Their focus is on finding the most efficient path to your Dubai trade license. This means:

- Pinpointing the perfect jurisdiction that aligns with your business goals.

- Framing your application to ensure the best chance of a quick approval.

- Making sure you're fully compliant with all local laws, saving you from future fines.

When you partner with a consultant, your energy shifts from battling bureaucracy to building your business. With dedicated, 24/7 support, you have a team on standby to solve problems, letting you take full advantage of the UAE's tax benefits right from the start.

Thanks to recent government initiatives, setting up in Dubai has never been easier. As part of its ambitious D33 agenda to double the city's economy by 2033, Dubai has rolled out major trade license reforms. These changes have already led to a huge spike in new business registrations, solidifying the city's reputation as a global business hub. It's worth exploring how these reforms are simplifying the setup process for entrepreneurs like you.

Ultimately, working with an expert is an investment in peace of mind. You’re not just hiring help; you’re gaining a partner who is genuinely committed to seeing you succeed, ensuring your entry into the Dubai market is as smooth and successful as possible.

So You've Got Your Licence. What Now?

Getting that Dubai trade licence in your hands feels like crossing the finish line, but really, it’s just the starting gun firing. The real work of building a successful business begins now, with a new focus on staying compliant and plotting your growth. Your mindset has to shift from the one-off tasks of setup to the ongoing responsibilities of running a legal, thriving company.

First and foremost is your annual licence renewal. It’s a simple process, but it is absolutely non-negotiable. Missing that date can lead to a world of headaches, from hefty fines and business interruptions to having your corporate bank account frozen. You don’t want that.

Your Immediate To-Do List

With your licence secured, a new checklist immediately takes its place. These aren't just administrative hoops to jump through; they are the foundational steps that turn your legal entity into a living, breathing business.

Here’s what should be at the top of your list:

- Open a Corporate Bank Account: This is non-negotiable for managing your finances properly and is a requirement for every licensed business in the UAE.

- Sort Out Employee Visas: If you’re hiring, you'll need to get registered with the immigration and labour departments to sponsor visas for your staff.

- Stay on Top of Regulations: The UAE has specific compliance rules, like the Ultimate Beneficial Owner (UBO) registration, where you must formally declare who truly owns and controls the company.

A Solid Foundation for Future Growth

The UAE isn't just a place to launch a business; it’s designed to be a place where you can grow it for the long haul. The government is constantly rolling out initiatives to create a secure and welcoming environment for international entrepreneurs. This commitment to stability is clearly paying off. The UAE's economy is on a steady upward trend, with a projected 4% real GDP increase, largely thanks to its booming non-oil sectors. You can read more about the UAE's strong economic performance here.

Think about it: recent policy changes, like extending work permits to three years and introducing long-term residency options like the five-year Green Residence Visa, are a clear message. They're telling investors, "We want you to build something that lasts here."

Navigating all these post-setup steps—from renewals to visa quotas—can feel like a full-time job in itself. That's where having an expert partner with 24/7 support makes all the difference. We handle the red tape and keep you compliant so you can stay focused on what you do best. Our job is to provide straightforward, cost-effective support that lets international entrepreneurs like you take full advantage of the UAE’s tax benefits and grow your business with confidence.

Your Dubai Trade License Questions Answered

When you're looking to set up a business in Dubai, a few key questions always pop up. Let's walk through the most common ones we hear from entrepreneurs just like you, so you can get a clearer picture of the road ahead.

How Long Does It Take to Get a Trade License in Dubai?

This is the million-dirham question, and the honest answer is: it depends. The timeline hinges on where you set up (your jurisdiction) and what your business actually does.

If you’re going for a Mainland license and all your paperwork is perfectly in order, you could be looking at a turnaround of just 1-2 weeks. Some Free Zone setups are even faster, with licenses sometimes issued in a matter of days.

But, and this is a big but, if your business needs special approvals—think healthcare, education, or food-related activities—you’ll need a green light from other government bodies, which adds extra time to the process.

Expert Tip: Working with a setup specialist can genuinely speed things up. We know the common pitfalls and ensure your application is flawless from the get-go, helping you sidestep those frustrating and time-consuming delays.

Can I Get a Dubai Trade License Without a Physical Office?

Yes, you often can! This is a huge advantage for many modern businesses. Most Free Zones are well-known for offering flexible solutions like 'flexi-desks' or virtual office packages. These are a cost-effective way to meet the legal requirement for a business address without committing to a full-time office lease.

For a Mainland business, the rules have traditionally been stricter, usually requiring a physical office registered with Ejari. However, things are changing. Certain activities, especially in e-commerce or for social media influencers, now have more flexible options. It’s absolutely essential to check the specific requirements for your particular business activity before making any decisions.

What Is the Difference Between a Professional and Commercial License?

This really boils down to what your business offers: goods or services.

A Commercial License is for any business involved in trading. Think buying and selling physical products. This could be anything from a retail store or a general trading company to an import-export operation.

On the other hand, a Professional License is for individuals or companies providing expertise and services. We're talking about consultants, designers, accountants, artisans, and other skilled professionals.

The biggest practical difference often comes into play on the Mainland. With a professional license, a foreigner can often have 100% ownership of their company. The catch? You'll need to appoint a UAE national as a Local Service Agent (LSA), but they won't hold any shares in your business.

Ready to get your Dubai trade license without the headache? The experts at 365 DAY PRO Corporate Service Provider LLC offer personalised, affordable business setup solutions with 24/7 support, guiding you through every single step. Start your journey today.