Starting a business in Dubai doesn't have to break the bank. Forget the myth that you need a huge pile of cash. The truth is, a low-cost business setup in Dubai is entirely within reach, and many entrepreneurs get started for under AED 15,000.

It all comes down to making smart, informed decisions right at the beginning, especially when it comes to your company's structure and where you choose to operate.

Your Dubai Business Dream on a Realistic Budget

When people hear "Dubai," they often think of towering skyscrapers and equally high costs. But that's an outdated picture. While Dubai is a global business powerhouse, the government has worked hard to create clear pathways for startups and SMEs to launch and grow successfully.

You don't need the backing of a multinational corporation to enjoy UAE tax benefits for international entrepreneurs. This pro-business attitude has fostered a competitive environment among different jurisdictions, which is great news for you.

Why a Low-Cost Setup is More Than Just a Possibility

The secret to keeping costs down is knowing the landscape. You have two main routes: a Mainland company or a Free Zone company. Each comes with its own cost structure, rules, and advantages. A Mainland setup lets you trade directly within the local UAE market, which is essential for certain businesses. On the other hand, Free Zones are incredibly popular for a reason—they offer major perks like 100% foreign ownership.

The best path for you depends entirely on what your business does.

For instance, if you're an e-commerce entrepreneur selling to a global audience or a consultant working with international clients, a Free Zone licence combined with a virtual office is an extremely cost-effective solution. But if you plan to open a local cafe or a retail store, you'll need a Mainland licence to serve the public directly.

This guide is here to walk you through these choices. We'll draw on real-world expertise from specialists in Mainland company formation in Dubai & Abu Dhabi and specialists in Freezone company formation across the UAE to help you find the most affordable path that fits your business perfectly.

Dubai is solidifying its reputation as a top spot for low-cost business setup in the UAE, thanks to government reforms and smart infrastructure. A key sign of this is the boom in new companies—over 8,000 new businesses are registering every single month. This surge shows incredible entrepreneurial spirit and investor confidence, driven largely by the city's affordable free zones. These zones allow for 100% foreign ownership, zero personal and corporate tax, and straightforward licensing designed to keep your overheads low. Learn more about Dubai's business environment.

To give you a clearer picture, let’s look at some of the most popular and budget-friendly options. This table breaks down what you can expect in terms of starting costs and benefits for each path.

Affordable Dubai Business Setup Options at a Glance

| Setup Option | Estimated Starting Cost (AED) | Ideal For | Key Benefit |

|---|---|---|---|

| Free Zone Company | 12,500 – 20,000+ | Consultants, E-commerce, Global Traders | 100% foreign ownership and zero tax |

| Mainland LLC | 20,000 – 35,000+ | Local Services, Retail, Restaurants | Unrestricted access to the entire UAE market |

| Freelance Permit | 7,500 – 15,000 | Individual Professionals, Creatives | Lowest entry cost and quick setup |

| Virtual Company Licence | 9,500+ | Digital Nomads, Foreign Investors | Operate legally in Dubai without residency |

Keep in mind these are starting estimates. The final cost will depend on your specific business activity, visa requirements, and the jurisdiction you choose. However, it clearly shows that a Dubai business licence is more accessible than many think.

Choosing Your Path: Mainland vs. Free Zone

When you're aiming for a low cost business setup in Dubai, your first big decision is whether to go for a Mainland or a Free Zone company. Honestly, this is the most important choice you'll make at the start. It's not just a technicality—it dictates who you can sell to, what your ownership looks like, and how much you'll pay to keep the lights on. Get this right, and you're set up for savings and smooth sailing.

Our team has helped countless entrepreneurs navigate this choice, and we offer a 24/7 support service because we know how much rides on this decision. We've seen it all and can help you pick the jurisdiction that truly fits what you want to achieve.

The Mainland Advantage: Direct Market Access

Think of a Mainland company as your all-access pass to the UAE market. If your plan is to open a café, a retail store, or any business that deals directly with the public in Dubai or Abu Dhabi, this is your route. You'll be registered with the Dubai Department of Economy and Tourism (DED), which gives you the freedom to trade anywhere in the UAE and even bid on government contracts.

Now, you might have heard that this requires a local partner. That used to be the case, but things have changed. For most professional licences, you’ll just need a Local Service Agent (LSA). This person doesn't own any part of your business; they simply act as your representative for government paperwork in exchange for an annual fee. It’s a straightforward and manageable part of the process.

The Free Zone Route: Global Reach and Affordability

For most entrepreneurs coming from abroad, a Free Zone is usually the most affordable and direct path to setting up in Dubai. These are special economic areas created specifically to pull in foreign investment, and the perks are significant: 100% foreign ownership, zero corporate and personal taxes, and the freedom to send all your profits home.

There are over 40 Free Zones in the UAE, and many have a specific industry focus. For example:

- IFZA (International Free Zone Authority) is a huge favourite for its budget-friendly packages. It's a go-to for consultants, service providers, and startups trying to keep initial costs down.

- Meydan Free Zone is another excellent choice, especially if you want a prestigious Dubai address without the hefty price tag that usually comes with it.

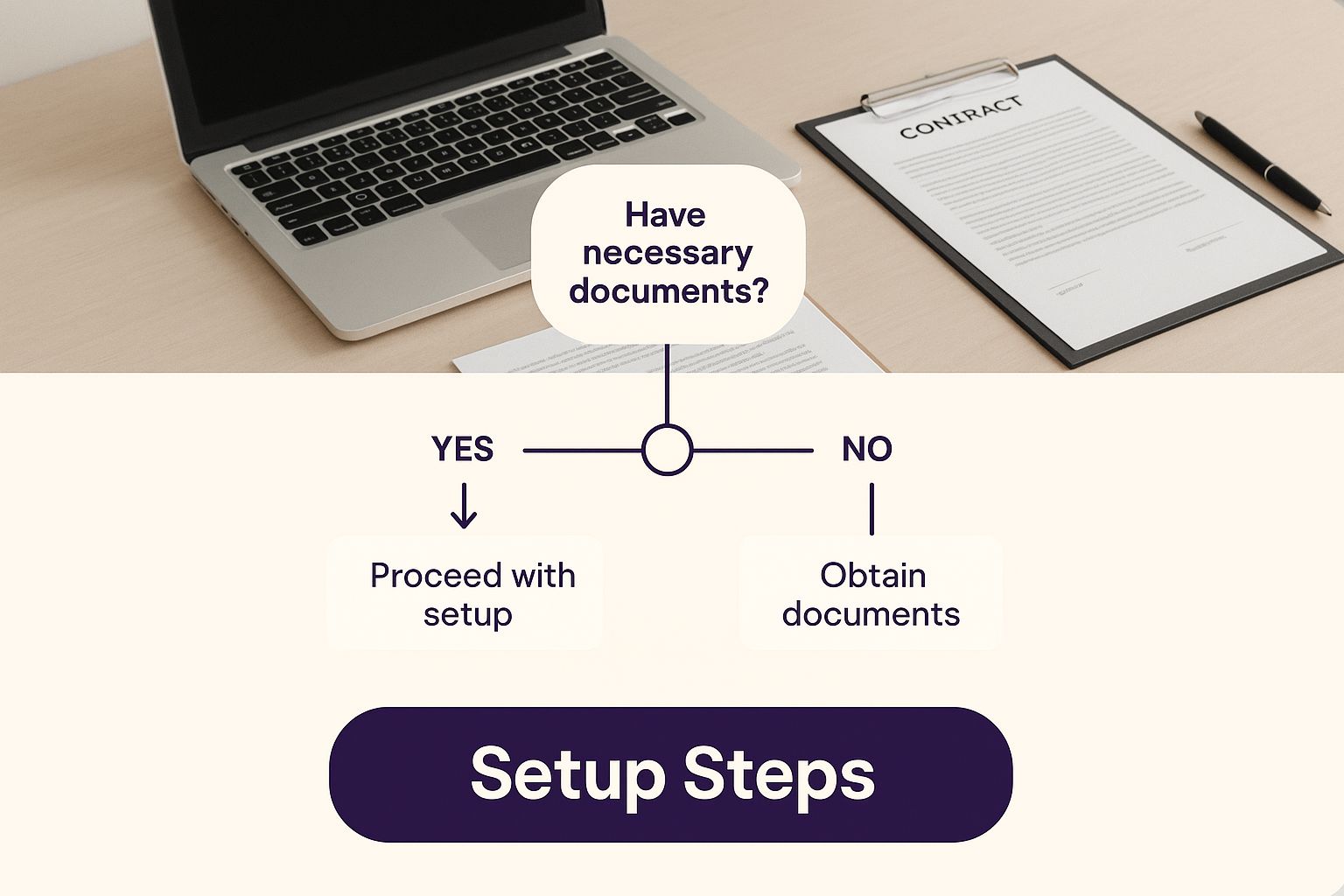

This chart breaks down the thought process you should follow when weighing your options.

Here's a simple real-world example: an international marketing consultant would be perfectly at home in a Free Zone, benefiting from low costs and easy international invoicing. But if that same person wanted to open a physical marketing agency in the heart of Dubai to serve local clients, they would absolutely need a Mainland licence. Picking the wrong one creates headaches and costs you don't need.

The rise of free zones and their flexible licence options has really brought down the cost of entry for new businesses in Dubai. For a small startup in a Dubai free zone, you're typically looking at a starting cost of around AED 10,000 to AED 15,000. This generally covers your trade licence, registration, and basic visa fees, which is why thousands of entrepreneurs jump on this opportunity every year. Discover more insights about affordable setups on smartzone.ae.

At the end of the day, your choice has to match your business plan. By working with people who live and breathe the details of both Mainland and Free Zone setups, you can lay a solid foundation for your company's future in Dubai.

Navigating Licences, Documents, and Timelines

So, you've picked between Mainland and a Free Zone. Now comes the part that can feel a bit daunting: the paperwork. Frankly, this is where a low cost business setup in Dubai can go off the rails if you're not careful. But with a bit of preparation, it’s a straightforward path. The real goal here is to get everything right the first time to avoid frustrating delays and extra fees.

As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we can tell you that sharp document preparation is non-negotiable. This is where having round-the-clock support truly makes a difference—it means you can get quick answers and prevent a tiny mistake from snowballing into a major headache.

Assembling Your Core Documents

No matter which jurisdiction you’ve chosen, there’s a foundational set of documents you'll need to gather. Think of this as your application starter pack. Getting these organised from the get-go will make everything that follows feel much less stressful.

Here are the essentials you’ll almost always need:

- Passport Copies: Make sure you have clear, colour copies for every shareholder and the person you've appointed as manager.

- Visa Status Copies: If you're already a UAE resident, you'll need to provide a copy of your current residence visa and Emirates ID.

- Business Plan: Some Free Zones, in particular, will ask for a brief business plan. Don't overthink it—just clearly outline your business goals, who you plan to sell to, and some basic financial projections.

- Application Forms: Every authority, whether it's the Dubai Department of Economy and Tourism (DED) for a Mainland company or a specific Free Zone, has its own set of forms. Filling these out with 100% accuracy is crucial.

A classic rookie mistake? Submitting blurry scans or half-filled forms. It’s the surest way to have your application bounced back, which can easily add weeks to your timeline.

Understanding the Timelines and Visa Process

One of the best things about setting up a business in Dubai today is how quickly things move. The days of waiting around for months on end are long gone. For many Free Zones, you could have your trade licence in hand in as little as 2-5 working days after submitting a complete and correct application. Mainland setups might take a fraction longer, but the government's digital portals have massively sped things up across the board.

"Securing your trade licence is just the first step. The next is obtaining your residency visa, which is what allows you to live and work in the UAE legally. A professional service provider can package these processes together, creating a seamless transition from company formation to residency."

The visa process kicks off right after your licence is issued. Your company first gets an Establishment Card (sometimes called an Immigration Card), which essentially authorises your business to start sponsoring visas. From there, you can apply for your own investor or employee visa. This involves a straightforward medical test and a biometrics appointment for your Emirates ID. All in, this stage usually takes another 2-4 weeks.

Of course, a massive draw for entrepreneurs is the ability to enjoy UAE tax benefits for international entrepreneurs. This incredible tax environment, paired with an efficient setup process, is what makes Dubai such a magnetic place to build a global business. With the right guidance, the entire journey—from that initial application to getting the visa stamped in your passport—can often be wrapped up in less than a month.

Here is the rewritten section, designed to sound like it was written by an experienced human expert.

A Realistic Breakdown of Your Setup Costs

Let's talk about the numbers. When you're aiming for a low cost business setup in Dubai, the last thing you want are hidden fees popping up out of nowhere. Getting a clear, honest picture of your expenses from day one isn't just good practice—it's essential for making smart decisions and avoiding any nasty financial surprises.

I always tell my clients to think about their costs in two distinct buckets: the money you need to get the doors open (one-time fees) and the money you'll need to keep them open (recurring expenses). Understanding both is the key to building a business that lasts.

Your Initial One-Time Investment

This first bucket covers all the administrative and legal hurdles you need to clear to get your company officially registered and ready to operate. Think of it as the foundation of your business. The final figure will shift based on your specific licence, visa needs, and whether you go for mainland or free zone, but the core components are pretty standard.

Here’s what you’re generally looking at for that initial outlay:

- Trade Licence Fee: This is the big one. The cost can vary quite a bit, depending on whether you need a simple professional services licence or something more involved, like a commercial or industrial one.

- Registration and Name Approval: These are the standard government charges for getting your chosen company name reserved and officially on the books.

- Establishment Card Fee: This is a non-negotiable. The establishment card is what allows your new company to start applying for residency visas for you and any future staff.

- Initial Visa Costs: This covers the full process for your first visa—usually your own investor visa—including the application, medical fitness test, and Emirates ID processing.

If you’re setting up on the mainland, you'll also have a fee for your Local Service Agent (LSA), which is an annual cost. But the main takeaway here is that these initial fees are an investment. Get them right, and you're building on solid ground.

Understanding Your Ongoing Expenses

Once you're up and running, your focus shifts to the annual costs required to keep your business compliant and in good standing. This is where I see a lot of new entrepreneurs get caught off guard. It's so important to factor these recurring fees into your business plan right from the start.

Here are the main recurring costs you need to budget for:

- Annual Licence Renewal: Every year, your trade licence needs to be renewed. This will be your biggest recurring government fee.

- Visa Renewals: Any residency visa linked to your company has an expiry date, typically every one to two years. Each one needs to be renewed.

- Office or Desk Space: Even the most basic setup with a flexi-desk or virtual office comes with an annual fee to maintain it.

- Corporate Bank Account: While opening the account is a one-time thing, be aware that many banks have minimum balance requirements. If you dip below that, you could face monthly fees.

The right setup partner does more than just fill out forms. A truly experienced consultant helps you find cost-effective business setup solutions tailored to your needs. They'll help you anticipate these recurring costs and often suggest ways to minimise them, like locking in savings with a multi-year licence package.

To give you a clearer idea, here's a sample cost breakdown for a very common scenario I see with new e-commerce entrepreneurs.

Sample Cost Breakdown for a Free Zone E-Commerce Licence

Here is an example breakdown of typical one-time and recurring costs for a popular low-cost business setup scenario in a Dubai free zone.

| Expense Item | Estimated Cost (AED) | Frequency | Notes |

|---|---|---|---|

| Trade Licence Package | 12,500 | One-Time | Includes registration, name approval, and flexi-desk. |

| Establishment Card | 1,500 | One-Time | Required for visa processing. |

| Investor Visa | 4,000 | One-Time | Includes medical test and Emirates ID. |

| Total Initial Cost | ~18,000 | – | – |

| Annual Licence Renewal | 8,000 | Annual | Usually lower than the initial fee. |

| Annual Visa Renewal | 2,500 | Every 1-2 Years | Cost per visa renewal. |

As you can see, when you break it all down, the numbers become much more manageable. This level of detail is what turns your goal of a low cost business setup in Dubai from a vague idea into a calculated, confident investment.

Thriving as an SME Beyond the Initial Setup

Getting that trade licence in your hands feels like a massive win, and it is. But in reality, it’s just the starting line. The real work begins now, as you lay the groundwork for a business that’s built to last in the UAE. Moving from a successful launch to long-term growth means tackling a few critical steps that many new entrepreneurs, especially those running SMEs, often overlook.

One of the first hurdles you'll encounter is opening a corporate bank account. It sounds simple, but it’s often a surprisingly complex process thanks to the UAE's strict due diligence requirements. This is one of those times when having a seasoned corporate service provider on your side—with a 24/7 support service so we're always here when you need us—can be a lifesaver. They’ll help you get your application right the first time, ensuring everything is in perfect order to meet the bank's criteria.

Setting Up Your Financial Framework

With your licence sorted, your immediate priority shifts to your financial infrastructure. This isn't just about getting a bank account; it's about embedding compliant financial practices into your business from day one to head off any trouble down the road.

There are two areas you need to focus on right away:

- Opening a Corporate Bank Account: Don’t push this to the bottom of your to-do list. Banks in the UAE want to see a legitimate, well-thought-out business. You’ll need a polished business profile, all your corporate documents perfectly organised, and you should be prepared to clearly explain your business model and projected cash flow.

- VAT Registration and Compliance: If you project your annual revenue will cross the AED 375,000 threshold, registering for Value Added Tax (VAT) is mandatory. Even if you don't expect to hit that number, voluntary registration can be a smart move, particularly if you'll be working with other VAT-registered companies.

Getting these financial pillars right from the start is non-negotiable. It allows you to operate professionally, manage your money effectively, and stay compliant with federal tax laws—all crucial for building a sustainable business.

Specialists in Mainland company formation in Dubai & Abu Dhabi and specialists in Freezone company formation across the UAE can offer cost-effective solutions tailored to ensure you're not just set up, but also fully compliant for the long haul.

Leveraging Dubai’s Supportive SME Ecosystem

Your low-cost business setup in Dubai is more than just a licence; it's your entry ticket into one of the most dynamic economic environments in the world. The city is buzzing with an energy and optimism that’s incredibly contagious for new companies.

And this isn't just a feeling—the data backs it up. The Mastercard SME Confidence Index, for instance, found that a staggering 91% of UAE SMEs were optimistic about their expansion prospects, with 90% expecting to either grow or maintain their revenue. What's more, a full 92% of these SMEs have already integrated digital payment systems, showing just how quickly businesses here adapt to what customers want. You can dive deeper into the growth potential of UAE SMEs.

This blend of digital readiness and sheer optimism creates the perfect environment for growth. By getting your financial house in order immediately and plugging into this pro-business ecosystem, you’re setting up your SME not just to survive, but to truly flourish.

Answering Your Top Questions on Setting Up a Business in Dubai for Less

When you're looking to start a business in Dubai, especially on a tight budget, you’re bound to have a lot of questions. It's completely normal. After helping hundreds of entrepreneurs get off the ground, I’ve heard just about every question imaginable – often at all hours of the day, which is why our team is available with a 24/7 support service.

Let's dive into some of the most common things people ask when they're aiming for a low cost business setup in Dubai. My goal here is to give you straight, clear answers so you can move forward feeling confident.

Can I Really Start a Business for Under AED 15,000?

Yes, you absolutely can. This is probably the biggest myth we have to bust for new entrepreneurs. The trick is all in the planning.

Many free zones, especially places like IFZA and Meydan Free Zone, have fantastic packages designed for startups that fit comfortably within this budget. These typically cover your trade licence, registration, and even a flexi-desk facility. It’s a very realistic target. Just remember that your residency visa and the costs associated with opening a corporate bank account are usually separate, so be sure to budget for those on top.

Do I Need a Physical Office for a Low-Cost Setup?

Not always. In fact, skipping the traditional office lease is one of the smartest moves you can make to keep your startup costs low. Most free zones offer virtual office or flexi-desk packages. These give you the official business address you need for your licence without the hefty price tag of a dedicated space.

This approach is a perfect fit for many modern businesses:

- Consultants and coaches who work with clients remotely.

- E-commerce store owners who don’t need a physical shopfront.

- Digital marketers and other online service providers.

Of course, there are exceptions. If your business involves direct public interaction—think retail shops, clinics, or restaurants—you will legally need a physical location, and that usually means setting up on the mainland.

"A common mistake is thinking a low-cost setup means cutting corners. In reality, it means making smart choices, like opting for a virtual office, which directly aligns your expenses with your actual business needs without compromising on legitimacy or professionalism."

How Long Does the Entire Business Setup Process Take?

It can be surprisingly quick. If you have all your documents in order and submit them correctly, you could have your free zone trade licence in hand in as few as 2-5 business days. This speed is one of the best things about the UAE's business-friendly environment.

Once your licence is issued, the next phase is getting your company's Establishment Card and then applying for your residency visa. This part of the journey, which includes a medical test and providing biometrics for your Emirates ID, usually adds another 2-4 weeks. A mainland setup can sometimes take a little longer, but the process is still incredibly efficient. Working with an expert here is key, as they'll make sure your application is perfect, preventing delays that cost both time and money.

What Is the Biggest Hidden Cost to Watch Out For?

From my experience, the most common surprise for new business owners is the corporate bank account. It’s not a "hidden fee" in the traditional sense, but the process can be tricky. Banks in the UAE have very strict due diligence checks and often require you to maintain a significant minimum balance in your account. For a startup, hitting these thresholds can be tough, and failing to do so can result in monthly penalty fees.

Another thing to keep an eye on is licence amendments. If you decide to add or change your business activities down the line, there will be fees. The best way to sidestep these issues is to plan your business activities carefully from the very beginning and to work with a consultant who has good relationships with SME-friendly banks.

Ready to turn your business idea into a reality without breaking the bank? The team at 365 DAY PRO Corporate Service Provider LLC are specialists in creating cost-effective business setup solutions for entrepreneurs just like you. We handle everything from mainland and free zone company formation to visas and bank account assistance, ensuring a smooth and affordable launch.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation