Thinking about starting a business as a foreigner? Dubai should be at the top of your list. It’s a strategic decision that gives you 100% company ownership, incredible tax advantages, and a direct line to global markets. The entire system here is backed by a government that actively encourages business and infrastructure that's second to none. It's no wonder it's become a magnet for entrepreneurs from all over the world.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we are specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE. Our team provides cost-effective business setup solutions tailored to your needs, ensuring you can fully enjoy UAE tax benefits for international entrepreneurs. Plus, with our 24/7 support service, we're always here when you need us.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why Dubai Is the Right Choice for Your Business

Choosing where to set up your company isn’t just about picking a trendy spot on the map. It’s about finding an ecosystem built for real growth. Dubai has spent years carefully crafting itself into a global business powerhouse, offering practical benefits that directly boost your bottom line and make running your business smoother.

This city is more than just a bridge between East and West; it's a bustling marketplace on its own. Its geographic sweet spot gives you incredible access to markets in the Middle East, Africa, Asia, and Europe. This is all supported by world-class infrastructure, from top-ranked airports to massive seaports, ensuring your logistics and supply chain just work.

The Pro-Business Environment

The UAE's dedication to business is undeniable. The government goes out of its way to support startups and SMEs with serious investment and business-friendly policies. This isn't just talk—the proof is in the numbers. For the fourth year running, the UAE ranked first globally in the Global Entrepreneurship Monitor (GEM) Report for 2024-2025. You can discover more about the UAE's top entrepreneurship ranking and see how massive initiatives like the $8.7 billion "Project of the 50" are driving innovation forward.

One of the biggest game-changers for foreign investors was the legal reform that now allows 100% foreign ownership of mainland companies. This completely removed old hurdles, giving international entrepreneurs full control over their business, its finances, and its future.

Key Advantages for Foreign Entrepreneurs

The perks of setting up shop in Dubai go far beyond legal structures and location. You instantly tap into a diverse, highly skilled international talent pool, which makes building a top-notch team much easier. Plus, the city’s networking scene is always buzzing with industry events, trade shows, and expos, creating endless opportunities to connect and grow.

Here’s a quick look at what makes Dubai such a smart move:

- Enjoy UAE Tax Benefits: The tax situation is a huge draw. With 0% personal income tax, you get to keep more of what you earn.

- Diverse Jurisdictions: You have the flexibility to choose between a Mainland or Free Zone setup, each with distinct benefits designed for different types of businesses.

- Unmatched Support: There's a whole industry of company formation specialists ready to help, offering everything from affordable packages to round-the-clock assistance.

This powerful mix of strategic location, forward-thinking government policies, and solid infrastructure makes starting a business in Dubai an incredibly attractive option for long-term success.

Choosing Your Business Jurisdiction: Mainland vs. Free Zone

Your very first, and most critical, decision when setting up a company in Dubai is choosing where to plant your flag: on the Mainland or in a Free Zone. This isn't just a bit of paperwork; it’s a strategic choice that will define who you can do business with, how your company is structured, and your overall operational freedom. Get this right, and you've laid a solid foundation for growth.

The easiest way to think about it is to ask yourself one simple question: where are my customers? If your answer is "right here in the UAE," you're likely looking at a Mainland setup. If your clients are primarily international, a Free Zone is probably your best bet.

A Mainland company, registered directly with the Department of Economic Development (DED), gives you the keys to the entire UAE market. In contrast, a Free Zone company operates within a designated economic area, a model built for businesses with an international focus.

The Case for a Dubai Mainland Company

If your business needs to trade directly with the local market, a Mainland license is essential. Think retail stores, restaurants, local consultancies, or trading companies selling goods across the emirates. There's no substitute.

A Mainland setup gives you the flexibility to locate your office anywhere in Dubai, bid on valuable government contracts, and expand with multiple branches. For a long time, this came with a major catch—the need for an Emirati sponsor. Thankfully, that's changed.

Recent landmark reforms have opened the doors for 100% foreign ownership across most sectors. This was a game-changer, removing the old rule that a local partner had to hold 51% of the shares for over 1,000 different business activities. This shift means foreign entrepreneurs can now have complete control. You can find out more about full foreign ownership in Dubai and its benefits.

Unpacking the World of Free Zones

The UAE is home to more than 40 specialised Free Zones, each one a thriving ecosystem for specific industries. You’ll find hubs dedicated to tech (like Dubai Internet City), media (Dubai Media City), finance (DIFC), and commodities (DMCC). This creates an incredible concentration of talent and networking opportunities.

For international entrepreneurs, the advantages of a Free Zone are hard to ignore:

- 100% Foreign Ownership: This has always been the cornerstone of the Free Zone model.

- 0% Corporate and Personal Income Tax: A massive financial incentive.

- Full Repatriation of Profits: You can send all your capital and profits home without any restrictions.

- Import and Export Duty Exemptions: A huge benefit for logistics and trading businesses.

A Free Zone is the perfect home for a software company with global clients, an e-commerce store shipping worldwide, or a creative agency. The one major rule to remember is that you can't trade directly with the UAE Mainland market from a Free Zone; you'd typically need a local distributor for that.

Choosing a jurisdiction isn't just a legal formality; it's a strategic business decision. Aligning your choice with your operational model from day one prevents costly restructuring down the line and positions you for sustainable growth.

Let’s put this into practice. An entrepreneur planning to open a specialty coffee shop in Jumeirah needs to be on the Mainland. There's no other way they can serve local customers directly. But a financial consultant whose clients are in London and Singapore? They could thrive in a financial-focused Free Zone, enjoying the tax benefits and industry-specific infrastructure.

To help you decide, here’s a quick comparison of the two options.

Mainland vs. Free Zone: Key Differences at a Glance

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Ownership | 100% foreign ownership for most activities. | 100% foreign ownership as a standard feature. |

| Market Access | Unrestricted access to trade anywhere in the UAE and internationally. | Primarily for international trade; local trade requires an agent/distributor. |

| Office Location | Can rent an office anywhere in Dubai. | Must have a physical or virtual office within the specific Free Zone. |

| Government Tenders | Eligible to bid on lucrative government contracts. | Not eligible to bid on government contracts directly. |

| Visas | Visa eligibility is linked to office size; no theoretical limit. | Number of visas is usually limited by the size of the office/package chosen. |

| Registration Body | Department of Economic Development (DED). | The respective Free Zone Authority (e.g., DMCC, IFZA). |

This table makes it clear how your business model—local or global—should guide your decision. Each path has distinct benefits designed for different commercial goals.

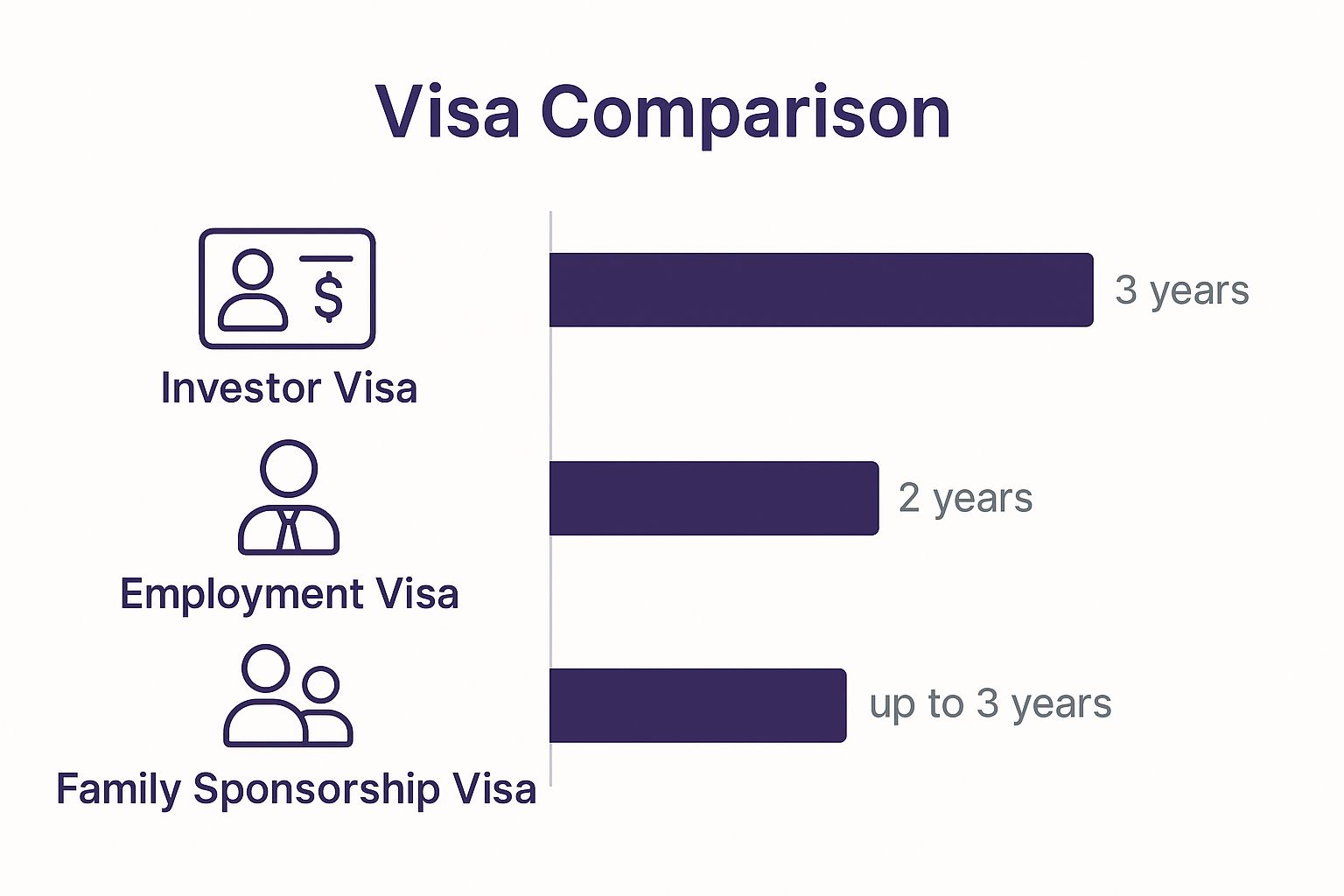

The infographic below offers a clear comparison of the validity periods for common visa types you'll encounter as you get set up.

As you can see, Investor and Family Sponsorship visas often come with longer validity, offering more stability for you and your loved ones as you build your business in Dubai.

Ultimately, your choice boils down to your specific business activities and long-term vision. With deep experience in both Mainland and Free Zone formations, we can help you find the most direct and cost-effective path. A quick, free consultation is often all it takes to clarify which structure will set your venture up for success from the very beginning.

Securing Your Trade Licence and Company Registration

Alright, you've picked your jurisdiction. Now comes the part where your business idea officially becomes a legal entity in the UAE. This is the nitty-gritty of paperwork, and I can't stress this enough: precision is everything. One small mistake on a form can send you back to square one, costing you both time and money.

Think of this stage as laying the legal foundation of your company. The decisions you make here—from your company name to the specific services you’re allowed to offer—will define your business for years. Especially for a foreigner setting up in Dubai, getting this right from the start is non-negotiable.

Defining Your Business Activities

First things first, you need to clearly define what your business does. You'll select your specific business activities from a pre-approved list, either from the Department of Economic Development (DED) for a mainland setup or from your chosen free zone authority.

This choice is far more than a formality. It dictates the type of trade licence you'll get—commercial, professional, or industrial. It also has a direct ripple effect on your setup costs, how many visas you're eligible for, and the services you can legally bill for. For example, picking a "Marketing Management" activity lets you consult, but it won't let you actually run the advertising campaigns for a client. That’s a completely different activity, and getting it wrong can cripple your business model or land you with hefty fines.

A classic mistake I see is entrepreneurs choosing an activity that sounds close enough but doesn't truly cover their full scope of work. Working with a specialist ensures you nail this from day one, giving you a rock-solid legal platform to operate and grow.

Reserving Your Trade Name

With your activities locked in, it’s time to give your company a name. The UAE has very specific rules about this, and your name must be approved before you can move forward.

Essentially, your proposed name must:

- Be completely unique and not already taken.

- Contain nothing offensive or contrary to public morals.

- Have no references to religious figures, deities, or political groups.

- Reflect your legal structure (e.g., adding "LLC" if it's a Limited Liability Company).

My advice? Come prepared with a list of three to five names you like. Your first choice might be taken, and having backups ready saves a lot of frustrating back-and-forth with the authorities.

Drafting Legal Documents and Gaining Approvals

Now we get to the core legal paperwork. For a mainland company, the cornerstone document is the Memorandum of Association (MOA). This is your company's constitution, detailing everything from shareholder structures and ownership percentages to the rules of operation.

If you’re setting up a mainland business with a professional licence, you might need a Local Service Agent (LSA) agreement instead. In either case, these documents must be drafted perfectly in both English and Arabic, then officially notarised. There's no room for error here.

This is also when you'll get your Initial Approval. It’s basically a green light from the authorities, a no-objection certificate stating they're happy with your proposed business and will issue the licence once all the legal boxes are ticked. If you're in a specialised field like healthcare or education, you'll need extra approvals from specific government ministries at this point, too.

Trying to manage this web of documents, attestations, and submissions is where many entrepreneurs get stuck. Each step has its own quirks and potential pitfalls. This is honestly where having an expert in your corner makes all the difference.

As specialists in Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, we live and breathe this process. We handle everything for you—from drafting a bulletproof MOA to securing every last approval. Our team knows exactly how to get every document right the first time, steering you clear of the common mistakes that cause delays. You get to focus on building your business while we handle the bureaucracy.

Grounding Your Business: Finding an Office and Getting Your Visa

You’ve done the paperwork and your company is officially registered. Congratulations! Now it's time to make it real—to plant your flag in the UAE by setting up your physical presence and securing your own legal right to live and work here. This is where your business moves from a concept on paper to a tangible operation, and it all hinges on your office and your visa.

These two things are completely intertwined. Your choice of office, for instance, is directly dictated by your business licence and where you set up. If you're a Mainland company, you’ll almost always need a physical office space, validated by an official tenancy contract known as an Ejari. Free Zones, however, are a different story. They were built for modern business, offering a lot more flexibility and cost-effective solutions.

What Does an "Office" Really Mean in Dubai?

When people hear "office," they often picture a traditional room with desks and chairs, but in Dubai, the concept is far more fluid. The right choice for you really comes down to your budget, how you operate, and crucially, how many visas you need.

Let’s look at what's actually on the table:

- Virtual Offices: This is the go-to for many startups, consultants, and freelancers. It’s incredibly cost-effective and gives you a professional business address for your licence and mail handling, all without the expense of a physical space.

- Flexi-Desks: Think of this as the next step up. A flexi-desk gives you access to a shared co-working space for a set number of hours each month. In many Free Zones, this is the minimum you need to secure one or two employee visas.

- Serviced Offices: These are a fantastic plug-and-play solution. You get a fully-furnished, private office in a business centre, complete with reception services, meeting rooms, and IT support. It’s a professional setup from day one.

- Traditional Leased Space: If you have a larger team or a specific Mainland licence that requires it, leasing your own dedicated office is the path to take. You get full control, but you're also on the hook for the fit-out, utilities, and all the associated responsibilities.

Choosing your office isn't just about picking a location; it's a strategic move. This decision directly impacts your visa allowance, your annual renewal costs, and the image you project. Getting good advice here is critical to make sure your choice fits not just today's needs, but your plans for future growth.

Navigating the UAE Visa Process

Securing your investor visa is the moment it all becomes official—you are now a resident of the UAE. While the process itself is a clear sequence of steps, it’s not something you want to get wrong. The timelines are strict, the details matter, and having an expert guide you through it removes all the guesswork.

Here’s a snapshot of the journey to getting your visa:

- The Entry Permit: Once your company's Establishment Card is issued, the first thing we do is apply for your entry permit. This is the document that allows you to be in the UAE specifically for the purpose of getting your residency sorted.

- Changing Your Status: If you're already in the country on a tourist visa, we'll handle an "in-country" status change. This is a common procedure that adjusts your status without you needing to leave the UAE.

- The Medical Fitness Test: Everyone applying for a residence visa has to do this. It’s a straightforward process at a government-approved medical centre involving a blood test and a chest X-ray.

- Emirates ID Biometrics: Next, you'll visit a service centre to have your fingerprints and photo taken for your Emirates ID. This will become your official identification card for everything in the UAE.

- Visa Stamping: This is the final step. We submit your passport to the immigration authorities, and they place the official residence visa sticker inside.

Of course, setting up your life here involves more than just official paperwork. Moving your entire operation can be a massive undertaking, and a solid business relocation checklist can be a lifesaver for managing all the practical details.

Once your own visa is stamped and in your hands, you can start sponsoring your family and building out your team. With our 24/7 support service, we’re here to manage every one of these steps, turning what can seem like a daunting process into a simple, predictable one.

Opening Your Corporate Bank Account in Dubai

You’ve got your trade licence in hand and your residence visa stamped in your passport. It feels like you've crossed the finish line, right? Not quite. There's one more hurdle that often proves to be the most challenging for international entrepreneurs: opening a corporate bank account.

This isn't just another form to fill out. UAE banks conduct a rigorous due diligence process, and they scrutinise every single detail of a new company. Getting this right is absolutely essential for managing your finances, taking payments, and running your business legally.

What the Banks Are Really Looking For

Many newcomers are caught off guard by the sheer intensity of the bank's vetting process. It’s a world away from opening a personal account. They aren't just checking for a valid trade licence; they need to see a legitimate, functioning business with real substance.

Think of it less like an application and more like a business pitch. You have to present a complete, compelling package that proves your company is credible, well-thought-out, and ready to go. The more buttoned-up your documentation is, the smoother the process will be.

Here’s a look at what they’ll expect:

- Your Full Company File: This means everything—your trade licence, Memorandum of Association (MOA), and any share certificates.

- Founder & Manager Details: Have copies of passports, visas, and Emirates IDs for everyone involved. A residence visa for at least one shareholder is pretty much non-negotiable.

- Proof of a Real Business: The bank needs to see you’re not just a paper company. An office tenancy agreement (your Ejari), utility bills, or even signed contracts with initial clients or suppliers go a long way.

- A Solid Business Plan: This is your chance to tell your story. A well-written plan should clearly outline your business model, target audience, realistic financial projections, and the background of your management team.

Expert Tip: One of the quickest ways to get a rejection is to submit an incomplete file or a generic, copy-pasted business plan. Banks can spot those a mile away. They want to see authenticity and a genuine understanding of the UAE market. Take the time to make your application truly reflect your business.

Finding the Right Bank for Your Business

Not all banks in Dubai are created equal, and the best fit really depends on your business. Some are fantastic for companies dealing with high-volume international transfers, while others have brilliant digital platforms or specialise in lending to SMEs. Doing your homework here is critical.

Look into a bank's reputation, dig into its fee structure, and see how much experience it has with international entrepreneurs in your field. It's also worth noting that some of the newer, more modern financial institutions are offering more flexible options, which is a great sign of Dubai's evolving business landscape.

The entire financial and real estate environment in Dubai is shifting to better support foreign investors. Banks have responded by offering more adaptable corporate accounts and startup-friendly business loans, particularly for businesses in tech, energy, and services. You’ll also find that digital onboarding and faster approvals are becoming more common. To get a better feel for these shifts, you can discover more insights about Dubai's evolving business environment.

Cracking the banking code is a huge part of the puzzle when starting your business in Dubai. We specialise in cost-effective business setup solutions, and that absolutely includes helping you get your bank account sorted. We’ll help you prepare the perfect application, introduce you to the right banking contacts, and guide you through the entire process to give you the best possible shot at a fast, successful approval.

Keeping Your Business on Track for the Long Haul

Getting your business off the ground is a huge win, but it's really just the first step. The real challenge of starting a business in Dubai as a foreigner is keeping up with all the ongoing compliance, renewals, and rule changes. Staying on top of this administrative work is what allows you to focus on growing your company instead of getting buried in paperwork.

This is exactly where a professional Public Relations Officer (PRO) becomes your most valuable asset. Think of a PRO as your company's dedicated link to every UAE government department. They're the ones who handle the crucial, often tedious, tasks that keep your business in good standing, from renewing your trade licence each year to processing all your employee visas.

Why You Need Ongoing PRO Support

Compliance in the UAE isn't something you handle once and then forget about. It's a continuous cycle of renewals, document submissions, and staying in sync with various authorities. If you're not on top of it, a simple missed deadline or an incorrectly filled form can lead to hefty fines—or worse, bring your operations to a screeching halt.

A reliable corporate service provider takes all of this off your plate. They'll typically manage:

- Annual Trade Licence Renewal: Making sure your licence is renewed on time, every time, without you having to worry about it.

- All Things Visa: Handling new applications, renewals, and cancellations for yourself, your family, and your entire team.

- Document Legwork: Managing the attestations, translations, and submissions required by bodies like the Ministry of Labour and Dubai Immigration.

- Regulatory Heads-Up: Keeping you in the loop about any changes in local laws that might affect your business, so you can adapt before it becomes a problem.

Having a partner who provides a 24/7 support service is a game-changer. It gives you incredible peace of mind knowing that whether you have an urgent visa question late at night or need clarity on a new rule, someone is always there to help.

With the administrative side handled, you can pour your energy into what truly matters for growth: building strong client relationships. It's worth exploring proven customer engagement best practices to get this right from day one.

A Partnership Focused on Your Growth

The right support is about much more than just ticking compliance boxes. As specialists in Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, we focus on providing cost-effective business setup solutions that deliver real, long-term value. Our job is to handle the complexities behind the scenes so you can continue to enjoy UAE tax benefits for international entrepreneurs.

This kind of partnership frees you up to do what you actually set out to do: run and grow your business. Forget spending your valuable time waiting in government offices. You can be out there focusing on strategy, innovation, and closing your next big deal.

Ready to build a business in Dubai that's not just successful, but also secure and compliant? Let us take care of the administrative load so you can focus on your vision.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Your Questions Answered

When you're thinking about starting a business in Dubai as a foreigner, a lot of questions pop up. It's completely natural. Here are some of the most common ones we hear from entrepreneurs, with straightforward answers based on our hands-on experience.

Can I Start a Business in Dubai Without Living There?

Yes, you can absolutely own a Dubai company without being a resident. The system is designed for it, especially in the Free Zones, which allow for 100% foreign ownership and let you run your business from anywhere on the globe.

But there's a practical hurdle you need to know about: banking. While registering the company from abroad is possible, almost every bank in the UAE will require the primary shareholder to have a residence visa to open a corporate bank account. So, while you can own the company remotely, you'll likely need to become a resident to actually operate it financially.

What's the Minimum Investment Required?

This is the classic "how long is a piece of string?" question. There’s no single, fixed number because the cost to set up shop in Dubai depends entirely on the path you take.

Your total initial investment really comes down to a few key decisions:

- Where you set up (Jurisdiction): A Mainland company with a physical office in a prime location will have a much higher barrier to entry than a simple Free Zone package.

- What you do (Business Activity): Some professional services or industrial activities have specific capital requirements or costly external approvals.

- Your company's scale: Many Free Zones offer incredibly affordable freelancer permits or flexi-desk options. We've seen people get started with these for just a few thousand dirhams.

The only way to get a real number is to map out your specific business plan. A quick chat with a setup consultant can give you a detailed cost breakdown in no time.

How Long Does It Take to Get Registered?

The timeline can be surprisingly fast, particularly if you have an expert guiding you. We often see a Free Zone company licence issued in just a few days, sometimes up to a week, provided all the paperwork is in perfect order from the start.

Setting up on the Mainland takes a little more legwork, so you should budget for anywhere between one and four weeks just for the licence to be issued. When you add the time for your visa processing and opening the bank account, the whole A-to-Z process usually lands somewhere in the one-to-two-month range.

Do I Still Need a Local Partner in Dubai?

For most entrepreneurs, the answer is a firm no. Thanks to a massive legal update, foreigners can now have 100% ownership of Mainland companies for over a thousand different business activities. This was a game-changer, completely removing the old 51% local sponsorship rule for the majority of businesses.

And of course, Free Zones have always offered complete foreign ownership—it's one of their main attractions. While a handful of very specific, strategic sectors on the Mainland might still require a local partner, for almost everyone else, full control is now the standard.

Figuring out these details is what we live and breathe. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, 365 DAY PRO Corporate Service Provider LLC is here to make your business setup journey a success.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com