Setting up a company in Dubai is a smart move for any entrepreneur looking to tap into a global business hub that’s incredibly tax-efficient. From the get-go, you'll face a few key decisions: choosing between a mainland or free zone setup, registering your trade name, getting the right business license, and opening a corporate bank account. It can sound like a lot, but we’re here to make the whole process straightforward and affordable.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why Dubai Is the Right Move for Your Business

Dubai’s appeal goes way beyond its famous skyline. The city has intentionally built an ecosystem that’s all about helping businesses thrive on a global scale. This isn't just a happy accident; it's the product of smart government planning and a real vision for a diversified economy.

Take the Dubai Economic Agenda, or D33, for example. It's a bold plan to double the city's economy in the next ten years. The focus is on bringing in foreign investment, giving a leg up to small and medium-sized businesses (SMEs), and solidifying Dubai's spot as one of the top three cities in the world for business. For someone like you thinking about setting up shop here, that means real opportunities and a stable, future-focused environment.

A Tax Environment Built for Growth

Let’s be honest, one of the biggest draws for setting up in the UAE is the tax situation. The financial perks for international entrepreneurs are tough to beat anywhere else in the world.

- Zero Personal Income Tax: That’s right. You keep 100% of what you earn personally.

- Low Corporate Tax: The UAE's corporate tax rate is one of the lowest globally, meaning you get to reinvest more of your profits back into your business.

- No Capital Gains Tax: If you sell off business assets or shares, those profits are generally not taxed.

This setup is a foundational piece of the UAE's business appeal. It provides a massive financial incentive that helps both startups and large corporations grow faster and more efficiently.

The proof is in the numbers. The Dubai Chamber of Commerce, for instance, welcomed an impressive 35,532 new member companies in just the first half of the year. That's a 4% jump from the year before, which clearly shows the growing confidence investors have in the city's economic future.

This consistent growth isn't just a blip on the radar; it shows a deep-seated trust in Dubai's business climate. To get a better handle on the market forces at play, you can find some great insights from micro-economic analysis that can help shape your strategy. Our team is also on standby 24/7 to guide you through this dynamic market.

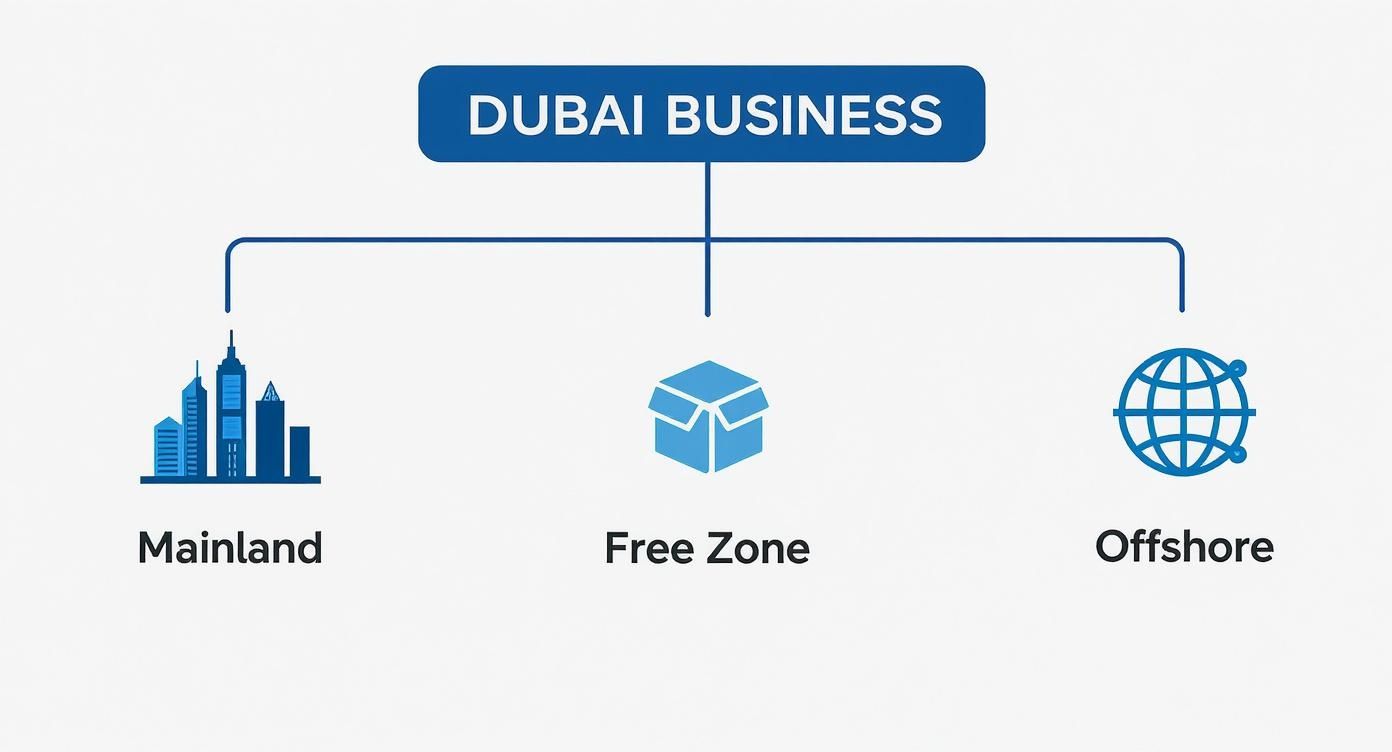

Choosing Your Jurisdiction: Mainland vs. Free Zone

Getting your jurisdiction right is the single most important decision you'll make when setting up a business in Dubai. It’s the foundation upon which everything else is built. This choice will define where you can legally operate, who you can sell to, and what your ownership structure looks like. Essentially, you’re choosing between two main paths: Mainland or a Free Zone. Each has its own playbook, and picking the wrong one can box you in or create operational headaches you just don't need.

Let's cut through the jargon and look at this from a practical standpoint. I've seen countless entrepreneurs grapple with this choice, and the best way to decide is to align your business goals with the right legal framework from the get-go. We specialize in both Mainland and Free Zone setups across Dubai, Abu Dhabi, and Sharjah, so we know the nuances that can make or break a new venture.

This visual guide quickly breaks down which path—Mainland, Free Zone, or even Offshore—makes the most sense for different business ambitions.

The key takeaway here is that your target market is the real driver. If you’re aiming to serve the local UAE market directly, a Mainland setup is almost always your best bet. If your sights are set on global trade, a Free Zone is likely where you'll want to be.

The Dubai Mainland Advantage

Think of a Mainland license, issued by the Department of Economy and Tourism (DET), as your all-access pass to the entire UAE economy. It gives you total operational freedom. You can trade directly with any customer on the mainland, set up your shop or office anywhere you like in Dubai, and—this is a big one—bid on lucrative government contracts.

This unrestricted market access is what truly sets the Mainland apart. If your business model is built on direct client interaction within the UAE—say, you're a consultant, opening a retail store, or running a local service company—then a Mainland license is practically non-negotiable.

Here’s a real-world scenario: a marketing agency wants to work with local hotel chains and real estate developers. They need a Mainland setup. This allows them to plant their flag in a central hub like Business Bay, meet clients freely across the city, and get in on government tenders, which are off-limits to Free Zone companies.

Exploring the Power of UAE Free Zones

Now, let's talk about Free Zones. These are specific economic areas designed to pull in foreign investment with a very attractive set of benefits. Dubai alone has over 40 of them, many of which are tailored to specific industries like tech, media, or commodities.

So, what's the appeal? Here’s why so many entrepreneurs flock to them:

- 100% Foreign Ownership: You keep full control of your business. No local partner needed.

- Tax Exemptions: Most Free Zones guarantee 0% corporate and personal income tax for decades.

- Customs Perks: If you’re in the import-export game, you’ll enjoy significant customs duty exemptions.

- Total Profit Repatriation: You can send 100% of your profits and capital back home, no questions asked.

These zones are the engine of Dubai's international business scene. Last year, over 20,000 new businesses launched in Dubai’s free zones, a testament to their appeal for global entrepreneurs. A popular choice like SPC Free Zone reported registering more than 5,000 new companies in a single year. You can dig into these trends on the SPC Free Zone official blog.

The bottom line for international entrepreneurs: Free Zones provide a cost-effective, tax-friendly, and supportive launchpad for businesses targeting regional or global customers.

Imagine a tech startup building a SaaS product for a worldwide audience. For them, setting up in Dubai Internet City (a tech-focused Free Zone) is a no-brainer. They get top-tier infrastructure, a built-in network of other tech firms, and can operate with zero corporate tax—all while owning the company outright. Since they don't need to sell directly within the UAE mainland, the Free Zone is the perfect, lean choice.

In-Depth Comparison: Mainland vs. Free Zone

To really understand the trade-offs, it helps to see the two options side-by-side. The decision isn't about which one is "better" in a general sense, but which one is the right fit for your specific business activities and target market.

| Feature | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market and globally. | Primarily operates within its designated Free Zone and internationally. |

| Ownership | Now offers 100% foreign ownership for most business activities. | 100% foreign ownership is the standard. |

| Office Location | Can rent a physical office or shop anywhere in Dubai. | Must operate from a physical or virtual office within the Free Zone. |

| Government Tenders | Fully eligible to bid on lucrative UAE government contracts. | Not eligible to bid directly on government projects. |

| Visas | Visa eligibility is often tied to the square footage of your office. | Visa packages are typically pre-defined and linked to your license. |

Ultimately, your business strategy has to lead the way. A well-thought-out jurisdiction choice ensures your company formation in Dubai is built on a solid legal foundation that will support, not hinder, your long-term vision. Our team is here to provide practical, cost-effective solutions and guide you with 24/7 support.

Getting Your Business License and Registration Sorted

Alright, you've picked your battleground—mainland, free zone, or offshore. Now comes the nitty-gritty: turning that great idea into a real, legal business entity in Dubai. This is where the paperwork really starts, but if you approach it methodically, it’s a clear path from A to B.

The first thing to nail down is the exact scope of your business operations. This isn't just a box-ticking exercise; what you define here directly impacts your license type and the rules you'll have to play by. Our team has specialists who live and breathe both Mainland and Free Zone formations, so we can give you the right advice from day one.

First Things First: Define Your Business Activities

Before you even dream up a catchy trade name, you need to select your business activities from an official list. In Dubai, this list is managed by the Department of Economy and Tourism (DET), and it’s massive, covering just about any operation you can think of.

Getting this right is crucial. For instance, if you select "Web Design" but you also plan to offer "Digital Marketing Consultancy," you might need both activities listed on your license. A mismatch here can lead to fines or restrictions on what you can actually do later on. Don't gloss over this step.

Naming Your Venture and Getting the Green Light

With your activities locked in, it's time to choose a unique trade name. Your chosen name has to follow UAE regulations—it can't be offensive, misleading, or sound too much like a company that already exists. We can help you check if your preferred name is available and get the application submitted for you.

Once the name is reserved, the next milestone is getting Initial Approval. Think of this as a preliminary nod from the authorities, confirming they have no objections to your proposed business. This piece of paper is your ticket to move forward with the more serious stuff, like drafting legal documents and signing a lease.

What's driving all this administrative activity? A massive wave of global investment. The UAE's foreign direct investment (FDI) inflows have exploded from US$11 billion to US$21 billion—a 90.9% jump in just one year. This shows just how much confidence international entrepreneurs have in the UAE's pro-business reforms. You can dig into the numbers yourself in the official UAE Foreign Direct Investment Report.

Drafting Your Legal Blueprint and Finding a Home Base

After you have the Initial Approval, you’ll need to draft and sign a Memorandum of Association (MoA). This is the legal backbone of your company, spelling out the ownership structure, share capital, and how the business will be run. If you're setting up a Limited Liability Company (LLC), this document is mandatory and must be notarized.

At the same time, you have to find an office space. Whether it's a physical office or a flexi-desk, you'll need a valid tenancy contract (called an Ejari for Mainland companies) to get your final license. This is a non-negotiable requirement. We offer cost-effective solutions to help you find a compliant space that fits your budget and visa allocation needs.

Which License Is Right for You?

The final move is to pull all your documents together and submit them to receive your trade license. The business activities you chose earlier will place you into one of three main license categories.

- Commercial License: This is your go-to for any business that involves trading, buying, or selling goods. Think e-commerce stores, general trading outfits, or real estate brokerages.

- Professional License: If you're in a service-based business or offering your personal expertise, this is the one for you. This covers business consultants, marketing agencies, IT specialists, designers, and other professionals.

- Industrial License: Needed for any business that is manufacturing, producing, or processing goods. A furniture maker, a food processing unit, or a metal fabrication workshop would all fall under this category.

Each license has its own specific rules and might require extra approvals. For example, a doctor's clinic would need a Professional License, but it would also need the green light from the Dubai Health Authority (DHA). This is where having a corporate service provider in your corner makes a real difference—we handle all these moving parts to prevent delays and make sure your company formation is a smooth ride. And with our 24/7 support, you're never on your own.

Securing Your Corporate Bank Account And Visas

Getting your trade license is a huge milestone when you're setting up a company in Dubai. But let's be honest—your business isn't really open for business until you have a corporate bank account and the right visas for you and your team. These are the two areas where I see entrepreneurs get bogged down the most, but they don't have to be roadblocks.

Opening a corporate bank account in the UAE is all about preparation. The banks here have very strict "Know Your Customer" (KYC) and anti-money laundering rules. You can't just walk in with your new license and expect an account. You need to present a complete, professional profile that tells the story of your business. This is where having an experienced partner guide your application can be the difference between a quick approval and months of frustration.

Your Essential Bank Account Checklist

To avoid the endless back-and-forth that drives so many new business owners crazy, get your paperwork in order from day one. Banks need to see that your company is legitimate, well-thought-out, and low-risk.

Here’s a practical checklist of what you'll almost always be asked for:

- Complete Company Documents: This means your trade license, Memorandum of Association (MoA), share certificates, and your office tenancy contract (Ejari).

- Shareholder and Manager Profiles: Have passport and visa copies ready for all partners. The main account signatory will also need to provide a brief CV or professional profile.

- A Solid Business Plan: It doesn't need to be 100 pages, but a clear summary of your business model, target customers, and revenue projections is essential.

- Proof of Business Activity: This is key. Show them you're real. This could be existing contracts, invoices from past work, or even a professionally built company website.

Having all this organized and ready to go shows the bank you're a serious entrepreneur, which makes the whole process smoother. Our cost-effective solutions include helping you prepare these documents to meet the bank's exact standards.

Navigating The UAE Visa Process

With your company legally formed, the next big step is getting your residency. The visa process is a well-defined, multi-stage journey. It officially kicks off when you apply for your company's Establishment Card from the immigration department. Think of this card as registering your new business in the immigration system, which gives it the power to sponsor visas.

Once that card is in hand, you can apply for your own investor visa or start the process for your employees. This begins with an entry permit, which allows the person to be in the UAE while the rest of the paperwork is completed.

For so many entrepreneurs I work with, securing residency is a major reason for company formation in Dubai. It's not just about living and working in a tax-free environment; it's about creating a stable base where you can sponsor your family and give them access to the same high quality of life.

From Medical Tests to Emirates ID

After the entry permit is issued, you’re on the home stretch. These final steps are mandatory for every new resident and are handled very efficiently here.

- Medical Fitness Test: This is a standard health screening for communicable diseases. It's a quick, routine procedure done at government-approved health centers.

- Emirates ID Biometrics: Next, you'll visit an Emirates ID service center to give your fingerprints and have your photo taken. This data is used to create your official UAE residency card.

- Final Visa Stamping: Once you've passed the medical test and your biometrics are in the system, your passport is submitted to have the residency visa stamped inside. This is the final step that officially makes you a UAE resident.

Trying to manage this sequence while also launching a new business can feel like juggling too many balls at once. This is where our 24/7 support service really shines. We’re always here when you need us, managing every appointment and document submission so you can stay focused on what you do best—building your business.

Keeping Your Business Thriving: Ongoing Compliance and Growth

Getting your trade license and visas is a huge milestone—you've officially launched your business. But the work doesn't stop there. Now, the focus shifts from setup to sustainability. Keeping your company in good standing with the UAE authorities is an ongoing commitment.

Honestly, dropping the ball on these administrative and legal duties can be a costly mistake. We're talking hefty fines, business disruptions, or even having your trade license suspended. This is where having a dedicated partner really pays off. Our team can handle these essential tasks, so you can pour all your energy into what you do best: growing your business.

Staying on Top of Annual Renewals

Think of your trade license not as a one-time purchase but as a subscription that needs to be renewed every year. This isn't just about paying a fee; it's a check-in to make sure everything about your company is still compliant.

For starters, you absolutely must have a valid tenancy contract (Ejari) for your office. Without it, the authorities won't even look at your renewal application. Missing the deadline is a big no-no, as the penalties for being late can stack up fast. We handle this whole renewal process, making sure every box is ticked and every deadline is met, so you don't have to sweat it.

Getting a Handle on Corporate Tax and Accounting

The introduction of the UAE Corporate Tax regime has definitely changed the game for businesses here. It’s vital to get a grip on your obligations right from the start to avoid headaches down the road. Every business is required to register with the Federal Tax Authority (FTA) and get a Tax Registration Number (TRN).

Keeping clean, organized financial records is no longer just good practice—it's the law. Meticulous bookkeeping is the backbone of filing your annual Corporate Tax returns correctly and making sure you can take full advantage of all the tax benefits the UAE offers to international entrepreneurs.

This is a new reality for many business owners. We provide straightforward, cost-effective solutions for your accounting and tax compliance, ensuring your financial reports are accurate and filed on time, every time.

The Power of Professional PRO Services

As your company expands, so does the mountain of government paperwork. Whether it's renewing staff visas, updating details on your trade license, or getting official documents attested, these tasks can eat up a shocking amount of your time. This is where professional Public Relations Officer (PRO) services become a lifesaver.

A great PRO team is your official liaison, managing all your interactions with government departments, including:

- Ministry of Human Resources & Emiratisation (MOHRE)

- General Directorate of Residency and Foreigners Affairs (GDRFA)

- Department of Economy and Tourism (DET)

By handing these tasks over, you free yourself from trying to figure out complex government procedures. Our specialists know the ins and outs of both Mainland and Free Zone regulations, ensuring every document is submitted correctly and efficiently. This prevents frustrating delays and lets you focus on the bigger picture. And with our 24/7 support service, you can rest assured that we're always here to handle any government-related task, whenever you need us.

Frequently Asked Questions About Company Formation In Dubai

Diving into the world of company formation in Dubai always brings up a lot of questions. We've been there, and we've helped countless entrepreneurs navigate this process. So, we've put together some of the most common queries we hear to give you clear, straightforward answers and help you move forward with confidence. Whether you're looking at a Mainland or Free Zone setup, consider us your guide.

How Long Does The Company Formation Process Take In Dubai?

Honestly, the timeline can vary quite a bit. The biggest factors are your choice of jurisdiction—Mainland versus Free Zone—and the specific business activity you're getting into.

A simple Free Zone setup, for example, can sometimes be wrapped up in just a few days. On the other hand, if you're setting up a Mainland company that needs special approvals from external government bodies, you could be looking at several weeks. Getting an expert involved from day one ensures your paperwork is perfect from the start, which is the single best way to speed things up.

Can I Get A UAE Residence Visa If I Open A Company?

Yes, absolutely. For many international entrepreneurs, starting a company here is the most direct route to securing a UAE residence visa. As the business owner, you're eligible to apply for an investor or partner visa.

Once your own visa is sorted, your company can then sponsor residence visas for your employees and even your family. The number of visas your company can issue usually depends on things like your business plan, license type, and the size of your office.

Securing residency is often a key motivator for setting up a business in Dubai. It’s not just about enjoying the UAE tax benefits; it's about establishing a stable, long-term base for you, your family, and your business operations in a thriving global hub.

What Is The Minimum Investment To Start A Business In Dubai?

This is a common question, but there's no single, legally required minimum investment that applies to every business. The real cost to get started is a mix of several factors unique to your specific plans.

Your total investment will really come down to:

- License Type: The fees for commercial, professional, and industrial licenses all differ.

- Jurisdiction: Costs can vary significantly between the Mainland authorities and the different Free Zones.

- Office Needs: Your expenses could be anything from a low-cost flexi-desk to a large physical office.

- Share Capital: For many Limited Liability Companies (LLCs), this can be more of a symbolic amount than a major cash outlay.

Many Free Zones offer incredibly cost-effective packages that are perfect for startups and solo entrepreneurs. Our job is to help you piece together a solution that fits your budget and your goals.

Do I Still Need A Local Partner For A Mainland Company?

For the vast majority of business activities on the Dubai Mainland, the answer is no. 100% foreign ownership is now permitted, which is a huge shift from the old rules. This means you no longer need an Emirati sponsor holding 51% of your company's shares.

There are, however, a handful of strategic or highly regulated sectors that might still have specific ownership rules. We always provide the most up-to-date guidance based on your chosen business activity to make sure you're fully compliant from the get-go.

Ready to start your journey? At 365 DAY PRO Corporate Service Provider LLC, we offer cost-effective, expert solutions for your company formation in Dubai, backed by 24/7 support.

📞 Call Us Now: +971-52 923 1246 or Get your free consultation today!