Figuring out the cost of setting up a business in Dubai isn't as simple as looking at a single price tag. The total investment can swing wildly, from around AED 20,000 for a straightforward Free Zone company to well over AED 100,000 for a more complex Mainland operation. The final number really depends on your choices: the jurisdiction you pick, your specific business activity, and how many visas you'll need.

It's better to think of it as building your business from a set of cost components, rather than a one-size-fits-all fee.

Your Guide to Dubai Business Setup Costs

Starting a business in Dubai is an exciting move, but let's be honest—the first question on every entrepreneur's mind is, "What's this going to cost me?" The answer is a mix of different expenses, heavily influenced by the foundational decisions you make at the very beginning. Are you setting up on the Mainland or in a Free Zone? What exactly will your company do? How many people need residency visas?

This guide is designed to break down every single expense, step-by-step, giving you a clear picture of the real numbers involved in company formation. Consider these initial costs your ticket into a tax-friendly, global business hub that’s brimming with opportunity. As a leading Corporate Service Provider across Dubai, Abu Dhabi, and Sharjah, our expertise lies in creating smart, cost-effective setup solutions that fit your specific goals.

Understanding the Initial Investment

To get a rough idea, let's talk ballpark figures. For an international entrepreneur looking to set up a company and secure a residency visa for just themselves, the total cost often lands somewhere between USD 8,000 and USD 9,000. This amount usually bundles the company registration and initial visa fees, especially with promotional packages. If you're bringing a partner on board, you can expect that figure to climb to around USD 11,000 for a two-person setup.

But these government and visa fees are just the beginning. Your budget needs to account for the tools and platforms that will power your operations. When you're adding up the total business setup costs, don't forget essentials. For example, if you're launching an online store, you’ll need to research different e-commerce platform pricing models to find one that fits your budget and business needs.

At a Glance Estimate of Setup Costs

To give you a clearer visual, I’ve put together a table that offers a quick snapshot of what a typical small business might invest. It breaks down the main expenses and compares the two primary jurisdictions, helping you see the financial commitment for each path. Of course, for a precise quote tailored to you, our specialists in both Mainland and Freezone Company Formation are here to help.

Quick Estimate of Dubai Business Setup Costs

| Cost Component | Estimated Free Zone Cost (AED) | Estimated Mainland Cost (AED) |

|---|---|---|

| Trade Licence & Registration | 15,000 – 25,000 | 25,000 – 40,000 |

| First Year Office Solution | 5,000 – 15,000 (Flexi-Desk) | 20,000 – 50,000+ (Physical Office) |

| Establishment Card Fee | 1,500 – 2,500 | 2,000 – 3,000 |

| Residency Visas (Per Person) | 4,000 – 6,000 | 5,000 – 7,000 |

Keep in mind, these are estimates. Your actual costs will hinge on the specifics of your business, but this gives you a solid starting point for your financial planning.

Choosing Between Mainland and Free Zone

The very first fork in the road when calculating the cost of setting up a business in Dubai is deciding on your jurisdiction. This isn't just a box-ticking exercise; it's a decision that will dictate your budget, your freedom to operate, and how you can grow. It really comes down to two paths: Mainland or Free Zone.

Think of it this way. A Mainland company is like opening a shop on a bustling city street. You're free to trade with anyone and everyone across the entire UAE market, no restrictions. This is perfect for local service providers, retailers, or any business that needs direct access to customers right here in the country.

On the other hand, a Free Zone company is more like setting up in a specialised, high-tech business park. These zones are built to pull in foreign investment, offering incredible perks like 100% foreign ownership, no import/export duties, and the freedom to send all your profits home. The trade-off? Your direct business activities are usually confined to that specific Free Zone and international markets.

The Financial Implications of Your Choice

The cost gap between these two options can be pretty wide. Mainland setups generally come with higher upfront fees. This is because you’ll need approvals from several government bodies, chiefly the Department of Economic Development (DED). Plus, you're almost always required to have a physical office, which adds a hefty leasing cost right from the start.

Free Zones, however, are often a more budget-friendly starting point, especially for new entrepreneurs. They're known for their all-in-one packages that bundle the trade licence, registration, and sometimes even a basic workspace like a flexi-desk. This makes them a magnet for consultants, global traders, and tech startups. As you weigh your options, it's also smart to see how Dubai stacks up against other global hubs and find the best countries for offshore company setup for your specific model.

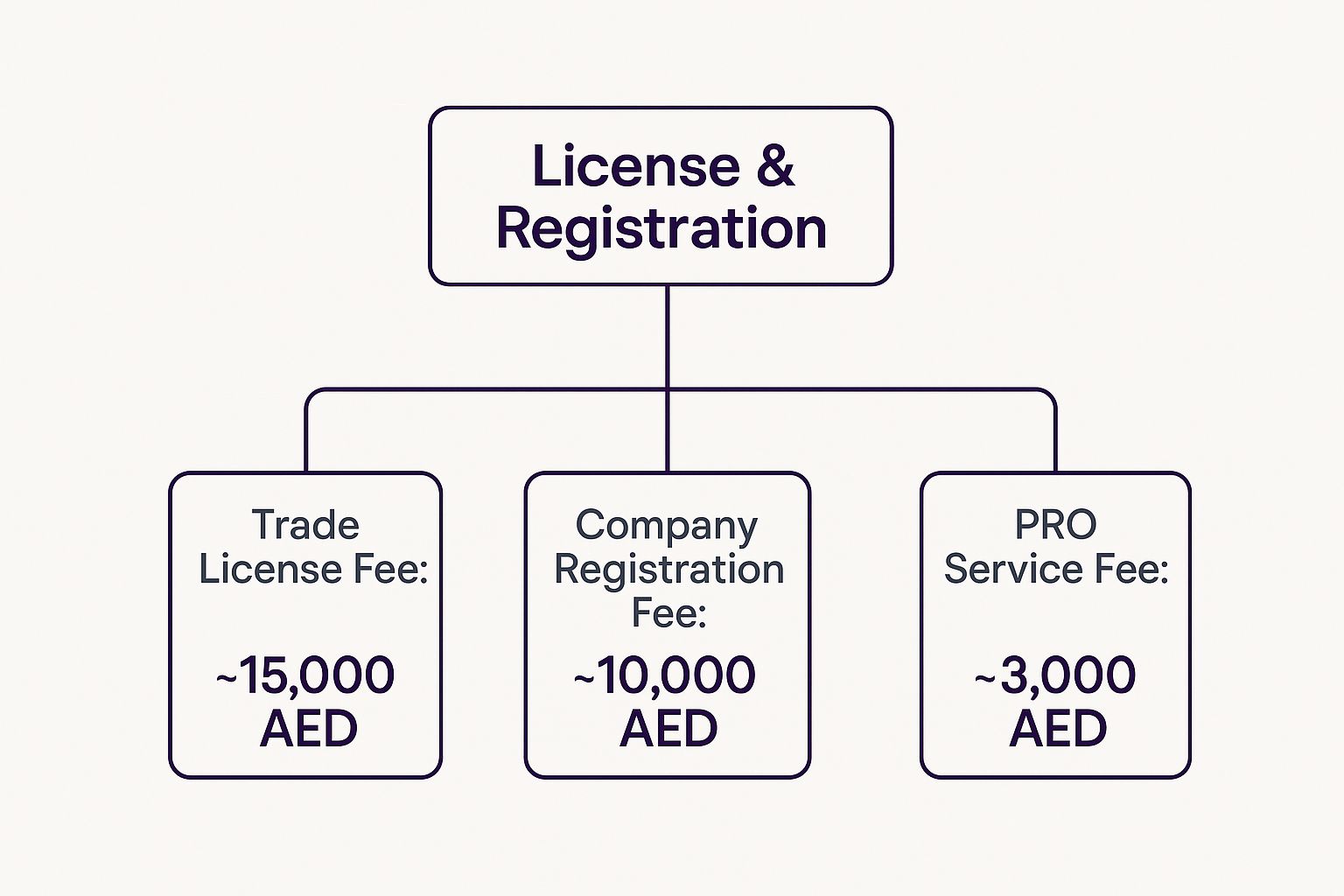

This infographic gives a clear picture of the main fees involved in getting your business licence, which you'll encounter in some form with both setups.

As you can see, the trade licence is the biggest piece of the pie, but the registration and essential PRO service fees also contribute significantly to that initial investment.

Aligning Jurisdiction with Business Goals

Don't let cost be your only guide. The decision has to match your business model. Ask yourself one simple, crucial question: Where are my customers? If your target market is right here in the UAE, a Mainland setup, even with its higher price tag, is probably an essential investment.

But if your business is all about international trade, e-commerce, or serving clients outside the UAE, a Free Zone's financial incentives can dramatically slash your operating costs. The tax benefits and ownership structure are often the perfect fit for entrepreneurs with global ambitions.

Choosing the right jurisdiction is the cornerstone of a cost-effective business setup. A mismatch between your business activity and your chosen zone can lead to unnecessary expenses and operational roadblocks down the line.

Ultimately, this choice affects everything—from licence fees and office space to your very ability to scale. Getting expert advice on both Mainland Company Formation in Dubai and Freezone Company Formation across the UAE is the best way to ensure you make the right call. We can help you find a cost-effective solution that fits your unique needs, allowing you to take full advantage of UAE tax benefits from day one. With our 24/7 support, you’ll know your business is being built on a solid foundation.

Breaking Down Trade Licence Fees

When budgeting for your new venture, the trade licence will almost certainly be your single biggest upfront expense. It’s also where a lot of confusion comes from. Think of it as your official permission slip from the government to do business. Its price isn’t a flat rate; it’s a calculation based on several moving parts, which makes the cost of setting up a business in Dubai so unique to each company.

The final figure really hinges on your specific business activity and the type of licence that activity requires. The UAE government organises businesses into three main buckets, and each comes with its own price tag and set of rules.

Getting a handle on these categories is the first real step to accurately forecasting your costs and making sure there are no nasty surprises down the line.

The Three Main Licence Types

What your business does determines which licence you’ll need. Each one is built for a different corner of the economy.

-

Commercial Licence: This is your ticket if you’re involved in trading—basically, buying and selling goods. It's a massive category, covering everything from a local retail shop to a major import-export firm. A general trading licence, which gives you the flexibility to deal in a wide variety of goods, will usually be at the higher end of the cost spectrum.

-

Professional Licence: This one is for service-based businesses where you're selling your expertise. We're talking about consultants, designers, accountants, and IT specialists. The licence is often tied to the qualifications and skills of the owners themselves.

-

Industrial Licence: If you're making, processing, or assembling products, you'll need an industrial licence. This involves a much more detailed approval process from various authorities to ensure you meet all production and environmental safety standards.

The licence you choose has a direct and significant impact on your setup costs. For example, a Professional Licence for a freelance marketing consultant will almost always be more affordable than a Commercial Licence for a general trading company. The government fees are just different.

Unpacking the Component Fees

That final number you see on your trade licence invoice isn’t just one charge. It’s actually a collection of several smaller government fees, each for a specific step in the registration process. As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we help entrepreneurs make sense of these charges every single day.

Your total trade licence fee is a sum of its parts. Understanding these individual government charges—from trade name reservation to market fees—is the key to building an accurate and transparent budget.

Some of the common fees that get bundled into your total licence cost include:

- Trade Name Reservation: A fee to lock in your unique business name.

- Initial Approval Certificate: The charge for getting the official nod from the Department of Economic Development (DED) to move forward.

- Memorandum of Association (MOA) Attestation: Fees for getting your company's core legal document notarised.

- Market Fees: This is a charge based on a percentage of your office's annual rent, mainly for Mainland businesses.

These individual costs can add up fast, which is why a cost-effective business setup solution is so important. We give you a clear, line-by-line breakdown so you can see exactly where every dirham is going.

While we focus on Dubai, it’s helpful to see the regional picture. For perspective, the cost of setting up a business in Abu Dhabi, the UAE's other major hub, typically lands between AED 15,000 and AED 50,000 for a two-year licence. It just goes to show how costs can differ, even within the Emirates. You can discover more insights about Abu Dhabi business setup costs to get a broader view.

With our 24/7 support, we’re always on hand to answer your questions and demystify the financial side of things. Our goal is to make sure you can fully enjoy UAE tax benefits for international entrepreneurs without any hidden costs creeping up on you.

Budgeting for Visas and Office Space

Once your trade licence is in hand, you'll face two other major expenses: residency visas and office space. This is a classic chicken-and-egg situation that trips up many new entrepreneurs. In Dubai, the two are often linked—the size of your office can dictate how many employee visas you’re allowed. You really have to plan for them together.

Getting this part of your budget wrong can create some serious financial headaches down the line. So, let's break down exactly what you can expect to pay for visas and walk through the different types of office spaces available. This way, you can build a realistic financial plan for your team and your workspace without any nasty surprises, giving you a clear picture of the total cost of setting up a business in Dubai.

Deconstructing the Cost of Each Visa

Getting a residency visa isn't a single transaction; it's more like a series of small, mandatory payments to different government departments. While the final amount can differ slightly between a Mainland setup and a Free Zone, the basic steps are always the same.

We handle this process day-in and day-out for our clients, so we know how to make it predictable and smooth. Here’s what’s involved:

- Establishment Card: Think of this as your company's official ID with the immigration and labour departments. You can't apply for any visas without it. Expect to pay between AED 1,500 and AED 2,500.

- Entry Permit (Employment Visa): After getting the establishment card, you apply for this permit. It’s what allows you or your employee to enter the UAE for work.

- Medical Fitness Test: A standard requirement for all residents. It's a mandatory health screening for certain communicable diseases.

- Emirates ID Application: This is the UAE’s national identity card, essential for anyone living here.

- Visa Stamping: The final step, where the visa sticker is officially placed into the passport.

All in, you’re looking at a total cost of somewhere between AED 4,000 and AED 7,000 for one residency visa. Just multiply that number by how many founders and staff you're bringing on board to get a solid budget estimate.

Finding the Right Office Solution

Your choice of office is another huge factor in your overall setup cost, and it's heavily tied to whether you choose a Mainland or Free Zone business. The options run the gamut from super-affordable shared desks to premium private offices, and the prices vary just as much. As specialists in both Mainland Company Formation in Dubai and Freezone Company Formation across the UAE, we help founders find the right fit for their budget and business model.

A Free Zone company, for example, gives you a lot more flexibility to start small.

The concept of a 'flexi-desk' is a game-changer for startups. It's a shared desk facility within a business centre that fulfils your legal requirement for a physical address without the high cost of a private office lease.

This is the perfect route for consultants, freelancers, or small teams who want to keep their overheads as low as possible. On the other hand, most Mainland businesses are legally required to lease a physical office space and register it with Dubai’s Ejari system. The annual rent for that becomes a significant fixed cost you need to account for.

Typical Visa and Office Costs in Dubai

To give you a clearer idea of what to budget for, here’s a table that lays out the average costs for both visas and the most common types of office solutions in Dubai.

| Item | Cost Range (AED) | Key Considerations |

|---|---|---|

| Residency Visa (Per Person) | 4,000 – 7,000 | Includes entry permit, medical test, Emirates ID, and visa stamping. |

| Flexi-Desk (Free Zone) | 5,000 – 15,000 (Annually) | A budget-friendly option suitable for startups and solo entrepreneurs. |

| Serviced Office | 20,000 – 60,000+ (Annually) | Offers a private, furnished space with shared amenities like reception and meeting rooms. |

| Traditional Office Lease (Mainland) | 30,000 – 100,000+ (Annually) | Required for most Mainland businesses; costs vary hugely based on size and location. |

Having these numbers in mind allows you to make a smart decision that works for your budget now while still leaving room for future growth. Our team is always here with 24/7 support to help you put together a package that fits your specific needs, so you can focus on what matters—like how to best enjoy UAE tax benefits for international entrepreneurs.

Planning for Annual Running Costs

Getting that trade licence and the first round of visas feels like crossing the finish line, doesn't it? It’s a huge milestone. But in reality, the initial setup is just the first part of your financial journey in Dubai. To build a company that lasts, your focus needs to shift from those one-time setup fees to the recurring costs that keep the lights on and your business legal.

It’s a classic mistake I see all the time: entrepreneurs get so focused on the launch that they forget to budget for the yearly running costs. This can put an otherwise healthy business under serious, unnecessary strain. Think of it like buying a car. The purchase price is just the beginning; you still have to plan for annual insurance, registration, and maintenance. Your business is no different—it needs ongoing investment to stay in good standing.

Getting your head around these financial commitments right from day one is absolutely crucial for long-term survival. A clear budget for these predictable expenses means you're never caught off guard and can concentrate on what really matters: growing your business.

Essential Annual Renewal Costs

Let's talk about the big one: your trade licence renewal. This is non-negotiable. It’s the single most significant recurring expense you'll have, and it’s mandatory to operate legally anywhere in the UAE. The renewal process is basically confirmation that your business continues to meet the standards set by the authorities, whether you’re a Mainland Company Formation in Dubai or based in a free zone.

Every single company, from DIFC and DMCC powerhouses to mainland LLCs, has to keep its trade licence active. You can typically expect this to cost between AED 10,000 and AED 25,000 each year, depending on your specific licence and business activities. On top of that, residency visas need renewing every two years, which usually runs between AED 3,500 and AED 5,000 per person. You can read more about the recurring costs of running a UAE business for a more detailed breakdown.

Alongside the licence, a few other renewals will pop up on your calendar:

- Establishment Card Renewal: This little card is your company's link to the immigration and labour departments, and it needs to be renewed every year.

- Office Lease/Flexi-Desk Renewal: Whether you have a physical office or a flexi-desk arrangement, that agreement will have an annual or multi-year renewal fee.

- Sponsor/Corporate Service Agent Fees: For mainland companies, the annual fee for your Local Service Agent or Corporate Sponsor is another key running cost to factor in.

Mandatory Accounting and Tax Compliance

Beyond the standard renewals, the UAE has very specific financial reporting rules that will add to your annual budget. Good bookkeeping isn't just a smart business practice anymore; it's a legal requirement for every company in the country. This means you’ll need to set aside a budget for professional accounting services.

The introduction of Value Added Tax (VAT) and now Corporate Tax has made professional financial oversight more critical than ever. All businesses are required to keep accurate financial records for at least five years. You might also need to register for VAT and submit quarterly returns, depending on your turnover and jurisdiction.

Neglecting your accounting and auditing obligations can lead to significant fines and penalties. Budgeting for these professional services is not an expense—it is a critical investment in your company’s compliance and long-term security.

What’s more, many free zones and all mainland LLCs must submit an audited financial report when they renew their licence each year. This involves hiring a licensed third-party auditor to go through your books. The cost for an annual audit can start at AED 5,000 and go up to AED 20,000 or more, depending on how complex your business is.

Working with a corporate service provider can open up cost-effective business setup solutions that include solid advice on these financial duties. This helps you enjoy UAE tax benefits while making sure you're always playing by the rules.

Getting the Most Value for Your Setup Investment

When you're trying to figure out the cost of setting up a business in Dubai, it’s easy to get bogged down in a simple tally of licence fees and visa charges. But the real key to a cost-effective launch isn't just about the initial numbers on a spreadsheet; it's about smart planning that prevents expensive missteps down the road.

Going it alone can feel like the cheaper option, but it’s a common trap. Missed deadlines, incorrectly filed paperwork, or choosing the wrong jurisdiction can easily double your startup budget in the long run. These aren't just headaches; they're real, costly delays that drain your resources.

That’s where bringing in an expert team comes in. Think of it not as an extra expense, but as an investment in getting things done right the first time. This is genuinely the most effective way to keep your costs predictable and under control. Whether you’re looking at a Mainland Company Formation in Dubai & Abu Dhabi or a Freezone Company Formation across the UAE, we focus on building a structure that fits your budget and your vision from day one.

The Real Value of Professional Guidance

Imagine trying to build a house without an architect. You might save money on the blueprint, but you could end up with a building that’s not up to code, structurally weak, or simply doesn't work for you—leading to a hugely expensive rebuild. A business setup consultant plays a similar role for your company's foundation.

We design a setup plan that steers you clear of the common financial traps and bureaucratic dead-ends that many new entrepreneurs fall into.

A cost-effective setup isn't about chasing the cheapest licence package. It’s about creating a solid, compliant business framework that minimises your long-term costs. This means avoiding future fines, restructuring fees, and operational bottlenecks.

Our entire approach is built around creating practical, cost-effective solutions that help international entrepreneurs make the most of the UAE's incredible tax advantages. With deep-rooted experience across Dubai, Abu Dhabi, and Sharjah, we know the most efficient routes for different business activities, whether you’re better suited for the Mainland or a Free Zone.

With our dedicated 24/7 support service, you're never in the dark. We handle every single detail—from securing initial approvals to the final visa stamping—ensuring your launch is smooth, fully compliant, and stays within your budget. Let us navigate the complexities so you can concentrate on what you do best: growing your business.

Ready to build a smart, cost-effective plan? WhatsApp us today for a free consultation.

Frequently Asked Questions

Setting up a business in Dubai is exciting, but it's natural to have a lot of questions about the costs involved. Let's tackle some of the most common queries we hear from entrepreneurs just like you. Getting these answers straight can make all the difference when you're putting together your budget.

Whether you're leaning towards a Mainland company or a Free Zone, these points will help you get a much clearer picture of the real investment required.

Can I Set Up a Business in Dubai Without an Office?

Yes, you absolutely can, but it all comes down to where you register and what your business does. Many Free Zones are built for modern businesses and offer things like flexi-desks or virtual office packages. These are fantastic, cost-effective ways to get a legitimate business address without being locked into an expensive traditional lease—perfect for startups, consultants, or solo entrepreneurs.

Things are a bit different on the Mainland, though. For the most part, a Mainland business needs a physical office space that’s registered with the Ejari system. As experts in both Mainland and Freezone Company Formation, we can help you figure out the smartest option that works for your business model and your wallet.

What Is the Cheapest Free Zone in the UAE?

It’s a moving target, but generally, some of the most budget-friendly options are found in the northern Emirates, like RAKEZ in Ras Al Khaimah or Sharjah Media City (Shams). If you're set on Dubai, IFZA often has some very competitive packages.

But remember, "cheapest" isn't always best. The real value comes from finding the right fit. A slightly more expensive package that includes more visas might actually save you money and headaches down the road compared to a bare-bones option that doesn't meet your needs.

Are There Any Hidden Fees I Should Be Aware Of?

This is a great question. While any good setup consultant will aim for total transparency, there are a few smaller, mandatory costs that can catch people by surprise. Once you’ve accounted for the big-ticket items like your licence, office, and visas, you still need to budget for a few other things.

You'll almost always run into these:

- Company Stamp: You’ll need this official stamp for pretty much all your company documents.

- Establishment Card: Think of this as your company's pass to apply for employee visas. You can't process visas without it.

- Medical Tests & Emirates ID: Every person applying for a residency visa has to go through these steps, and they come with their own fees.

And don't forget the costs that pop up every year. Your trade licence renewal is the main one, but you might also have audit fees or need advice on corporate tax to stay compliant and make the most of the UAE tax benefits for international entrepreneurs. We make it a point to give you a full cost breakdown from day one, so you know exactly what to expect.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation