When you're setting up a business in Dubai, the first big question you'll face is: Free Zone or Mainland? The answer really boils down to who your customers are. If you want to tap into the entire local UAE economy, trade directly with consumers, and bid on government projects, then a Mainland company is your ticket. But if your focus is on international trade, a Free Zone company is built for you, offering 100% foreign ownership and great tax advantages, though it limits your direct access to the local market.

Choosing Your Dubai Business Structure

Starting a business in Dubai is packed with opportunity, but it all starts with one crucial decision that will shape your company's future. Deciding between a Mainland setup or one of the UAE's many specialised Free Zones isn't just a formality; it's the strategic foundation of your entire operation.

This choice is about far more than just your office location. It determines who you can legally sell to, what your ownership structure looks like, and the specific regulations you'll need to follow. Each option is designed with a different economic purpose in mind, offering distinct benefits for different kinds of businesses.

Mainland and Free Zone Foundations

Think of a Mainland company, licensed by the Department of Economy and Tourism (DET), as being fully plugged into the UAE’s local economy. This is the setup you need if you want to operate without any geographical restrictions, open a high-street shop, or work directly with the buzzing domestic market.

Free Zones, on the other hand, are special economic areas, each managed by its own authority. With over 40 Free Zones across the UAE, they often specialise in certain industries—like Dubai Media City for media companies or DMCC for commodity traders. They are incredibly popular with international entrepreneurs, mainly because of the financial perks.

The core trade-off is simple: go Mainland for unrestricted market access, or choose a Free Zone for 100% ownership and tax benefits geared towards global business. Getting this right from the start is the key to matching your business setup with your actual goals.

To make the right call, you need to look at your business plan from all angles. Here’s a quick breakdown to get you started before we dive deeper into each option.

| Factor | Mainland Company | Free Zone Company |

|---|---|---|

| Primary Market | Unrestricted access to the entire UAE local market | Primarily international trade and within the specific Free Zone |

| Ownership | 100% foreign ownership available for many activities | Always 100% foreign ownership, no local sponsor needed |

| Office Location | Can operate from anywhere in Dubai or the UAE | Must operate from a physical or virtual office within the zone |

| Regulatory Body | Department of Economy and Tourism (DET) | Individual Free Zone Authority (e.g., DMCC, JAFZA) |

| Government Tenders | Eligible to bid on lucrative government contracts | Generally not eligible to bid on government projects |

As specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, we offer cost-effective business setup solutions built around your needs. Our 24/7 support service means you have an expert to guide you at every stage, helping you make the most of the UAE's tax benefits for international entrepreneurs. For a free consultation, WhatsApp Us Today for a Free Consultation or call us at +971-52 923 1246.

Understanding a Dubai Mainland Company

Think of a Mainland company as your all-access pass to the entire UAE domestic market. These businesses are licenced by the Dubai Department of Economy and Tourism (DET) and are built for anyone who wants to fully integrate and grow within the local economy. Simply put, a Mainland setup offers a level of market access and operational freedom that no other structure can.

Unlike a Free Zone business, a Mainland company isn't restricted to a specific geographical area. This gives you the freedom to open your office, showroom, or shop anywhere in Dubai. Even more importantly, it gives you the legal authority to trade directly with customers and other businesses across all seven emirates, all without needing a local agent or distributor.

This direct market access is the core advantage. It makes a Mainland licence the obvious choice for businesses that depend on local customers—think retail stores, restaurants, professional service firms, and construction companies.

The Evolution of Ownership and Control

For a long time, the central point in the free zone vs mainland dubai debate was ownership. Mainland companies used to require a UAE national to hold a 51% stake. But recent, game-changing legal reforms have completely flipped this script, making a Mainland setup far more appealing to foreign entrepreneurs.

Today, 100% foreign ownership is permitted for an extensive list of commercial and industrial activities. This means international investors can now have full control over their Mainland business, enjoying the same ownership benefits that were once exclusive to Free Zones.

While most business activities are now wide open, a few strategic sectors still have specific rules. For example:

- Professional Services: If you’re setting up a consultancy or a law firm, you’ll likely need a Local Service Agent (LSA). An LSA doesn't own any shares in your company; they act as your official representative for licensing and compliance in exchange for a fixed annual fee.

- Regulated Activities: Certain industries, like finance or healthcare, might have unique ownership regulations set by federal law. In some cases, this could still mean partnering with a UAE national.

The shift to 100% foreign ownership for most commercial licences is a massive deal. It truly offers the best of both worlds: complete control over your operations combined with unrestricted access to the lucrative UAE market, including valuable government contracts.

Legal Structures and Market Dominance

Mainland companies can be set up under different legal forms, but the most common are the Limited Liability Company (LLC) and the Sole Establishment. An LLC is a versatile structure that’s perfect for most commercial and industrial businesses, as it shields its owners from personal liability. A Sole Establishment, on the other hand, is typically for professionals who offer services under their own name.

The economic weight of these companies is enormous. Mainland businesses, regulated by Dubai's Department of Economic Development (DED), can operate anywhere in Dubai and across the wider UAE. They are the engine of the local economy, contributing around 70% of Dubai’s non-oil GDP, which highlights just how vital they are. You can find more detail on the economic contribution of Mainland companies on persianhorizon.com.

As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we are the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, focusing on clear, cost-effective solutions to guide you through the entire licensing process.

So, What Exactly is a Dubai Free Zone Company?

Think of a Free Zone company as a business operating within a special economic area. These zones are self-governed districts, each with its own specific rules designed to attract foreign investment. They are a massive part of the UAE's economic strategy, offering a welcoming environment for international entrepreneurs.

With over 40 Free Zones scattered across the UAE, you’ll find that most are built around specific industries. This creates powerful, synergistic ecosystems where businesses in the same field can connect and grow together. Dubai Media City, for instance, is the go-to hub for creative agencies, while the Dubai Multi Commodities Centre (DMCC) is a world-renowned hub for commodities trading.

This industry-specific approach means you get the right infrastructure and talent pool right out of the gate. It's a critical point to consider when weighing up free zone vs mainland dubai for your business setup.

The Big Draws for International Business Owners

The main reason so many foreign entrepreneurs flock to Free Zones is the incredibly attractive financial and operational setup. For years, Free Zones have championed foreign investment by offering benefits you simply couldn't find on the Mainland.

The advantages that consistently pull in global business owners are clear:

- 100% Foreign Ownership: You own your business outright. There’s no requirement for a local partner or sponsor, giving you full control.

- Full Repatriation of Profits: You can send 100% of your capital and profits back to your home country, no questions asked.

- Major Tax Incentives: Free Zone companies benefit from huge tax breaks, including exemptions from corporate and personal income taxes.

These incentives create a predictable and stable financial environment, letting you focus on maximising profits and fuelling growth. As specialists in Freezone Company Formation across the UAE, our job is to help entrepreneurs match these benefits with the most practical and cost-effective setup for their specific business.

A Free Zone is essentially a launchpad for international business. It's built to slash red tape and reduce financial burdens, making it the perfect choice for companies whose focus is on global trade and services, not necessarily selling directly into the local Dubai market.

How They Operate and Access the Market

While the benefits are compelling, you have to understand the operational limits. A Free Zone company is licensed to do business within its own zone and internationally. However, they've traditionally been restricted from trading directly with the UAE Mainland market.

For example, a trading company based in a Free Zone can't just sell its goods to a retail shop in a Dubai mall. To reach local customers, it would usually need to go through a Mainland distributor or agent. This is one of the most fundamental differences in the free zone vs mainland dubai debate.

This structure makes Free Zones the ideal environment for businesses like:

- Global consultancies with an international client base.

- E-commerce companies using Dubai as a logistics hub to serve the wider region.

- Import/export businesses managing complex global supply chains.

The strategic role of these zones in Dubai's economy is hard to overstate. Since the Jebel Ali Free Zone was established back in 1985, Dubai has continued to build specialised zones to nurture key sectors. Today, Dubai's Free Zones account for around 60% of the city's total goods exports, proving their vital role in international trade. You can read more about the impact of these economic zones on the UAE embassy's website.

Comparing Mainland vs. Free Zone Setups

Choosing between a Mainland and a Free Zone setup is easily the most critical decision you'll make when launching your business in Dubai. To get it right, you have to look past the marketing slogans and dig into the factors that will shape your daily operations, your budget, and your future growth. This is where we break down the real-world differences in the ongoing free zone vs mainland dubai debate.

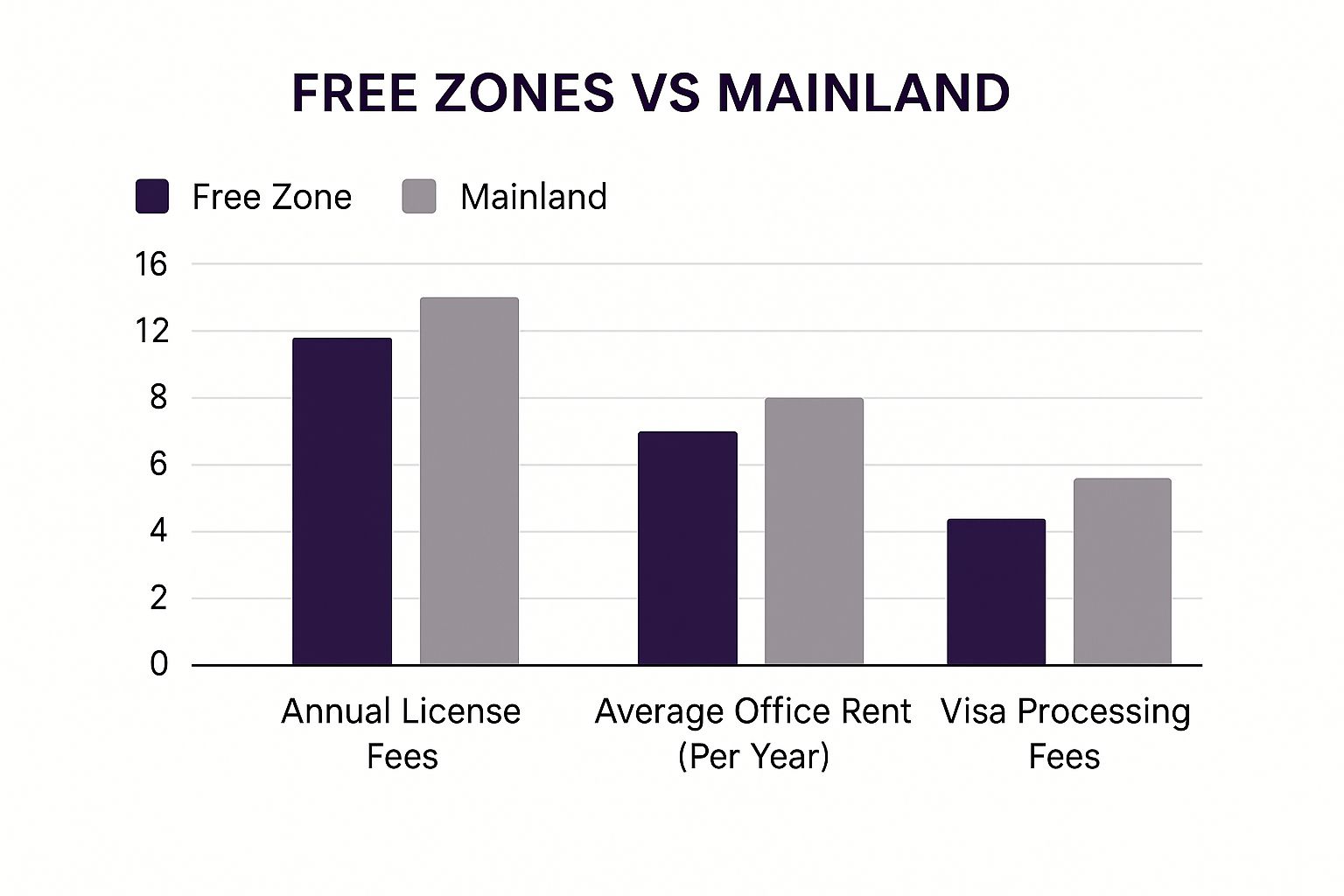

The following visual gives you a quick snapshot of the typical cost variations for annual licences, office rent, and visa processing in each jurisdiction.

As you can see, Free Zones often present a more budget-friendly starting point, especially with their initial licensing fees and flexible office options. Mainland setups, on the other hand, typically require a more significant upfront investment, particularly for physical office space.

To help you understand the nuances, let's unpack these differences with a side-by-side comparison.

This table offers a clear, at-a-glance view of the fundamental distinctions.

Key Differences: Mainland vs. Free Zone Company Setup

| Factor | Mainland Company | Free Zone Company |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market. Can trade directly with any business or customer across all seven emirates. | Restricted to operating within the specific Free Zone and internationally. Requires a local distributor or agent to trade on the mainland. |

| Ownership | 100% foreign ownership for most commercial and industrial activities. Governed by federal UAE laws and the DED. | 100% foreign ownership is standard. Governed by the rules of the individual Free Zone Authority (e.g., DMCC, IFZA). |

| Office Space | Mandatory physical office space registered with Ejari. Minimum size requirements often apply. No virtual offices allowed. | Highly flexible options, including flexi-desks, co-working spaces, and serviced offices. Ideal for startups and SMEs. |

| Visa Quotas | Visa eligibility is directly tied to the size of your physical office (typically 1 visa per 80-100 sq. ft.). Scalable. | Visas are allocated based on pre-defined packages tied to your licence and office type (e.g., a flexi-desk package may include 1-3 visas). |

| Business Scope | Can engage in a wide range of activities and directly bid for government contracts. | Activities are often specialised and linked to the theme of the Free Zone (e.g., media, tech, commodities). |

Ultimately, the best choice depends entirely on your business model and long-term goals. Now, let's explore these points in more detail.

Market Access and Scope of Business

The most fundamental difference comes down to one simple question: where can you legally do business? A Mainland company gives you the keys to the entire UAE kingdom. You can open a shop in a bustling mall, lease an office in any commercial district, and deal directly with any client or company across the seven emirates.

A Free Zone company, in contrast, is licensed to operate within its designated geographical area and internationally. To sell products or provide services directly on the Mainland, you’ll almost always need to go through a local distributor or agent. This structure is perfect for international trading but can be a major hurdle for a locally-focused service provider.

For instance, a consulting firm with a Free Zone licence can advise clients all over the world. But if they want to bid for a contract with a Dubai-based company located outside their zone, they can't do it directly. A Mainland-licensed competitor faces no such barriers.

Ownership Structure and Governance

While both setups now offer 100% foreign ownership for most business activities, the regulatory framework they operate under is entirely different. A Mainland company is registered with the Department of Economy and Tourism (DET) and is subject to federal UAE laws. This is non-negotiable for businesses that need to interact with government entities, like bidding for public sector tenders.

Free Zone companies, however, answer to their specific Free Zone Authority (like DMCC or JAFZA). Each authority has its own independent rules and regulations, which often creates a simpler, self-contained operational ecosystem. The trade-off is that your business is effectively firewalled from the wider UAE economy, which can be a limitation for certain types of businesses.

The key takeaway on ownership is this: while both offer 100% foreign control, a Mainland setup integrates you into the national economy. A Free Zone setup places you within a specialised, semi-independent jurisdiction built for international business.

Office Space and Physical Presence

Your choice of jurisdiction has a direct and immediate impact on your office requirements. Mainland companies are required to lease a physical office, and the DET often specifies a minimum size. A physical address registered with Ejari—the official tenancy contract portal—is a mandatory step for getting your licence. Virtual offices simply aren't an option.

Free Zones, on the other hand, offer incredible flexibility. Entrepreneurs can pick and choose from a menu of options:

- Flexi-desks or co-working spaces for a low-cost, low-commitment entry point.

- Serviced offices for a professional, ready-to-go environment.

- Physical office units for larger teams that need their own space.

This flexibility makes Free Zones a magnet for startups, freelancers, and international businesses that want to test the market before committing to major overheads.

Visa Quotas and Eligibility

Visa allocation is another area where the two jurisdictions diverge significantly. For Mainland companies, the number of employment visas you qualify for is directly linked to the size of your office. The general rule of thumb is about one visa for every 80-100 square feet of space, providing a clear and scalable path for growing your team.

In Free Zones, visa quotas are typically determined by the licence and office package you buy. A basic flexi-desk package might come with an allocation of one to three visas, while renting a physical office will grant you more. This pre-packaged approach can be simpler at the start but might feel restrictive as your team expands, possibly forcing you into an expensive upgrade just to get more visas.

As a Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we specialise in helping entrepreneurs navigate these critical decisions. Our teams are experts in both Mainland Company Formation in Dubai and Freezone Company Formation across the UAE, ensuring you get a practical, cost-effective solution that fits your business model perfectly. With our 24/7 support service, we're always here to help you make the most of the UAE's tax benefits.

📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.

Which Business Setup Is Right for You?

Choosing between a free zone and the mainland isn't just a box-ticking exercise; it's a strategic decision that needs to align perfectly with your business model, target audience, and future goals. Moving from theory to practice is key. By looking at a few real-world examples, you can see how this choice plays out for different types of businesses.

Let's walk through four distinct scenarios to make this crystal clear.

Scenario 1: The International E-commerce Retailer

Imagine you’re running an online store selling artisan goods to customers in the Middle East, Europe, and Asia. Your success hinges on smooth logistics, low tax exposure, and simple international banking.

In this case, a Free Zone is the obvious choice. Setting up in a logistics-heavy zone like Jebel Ali Free Zone (JAFZA) puts you right at the heart of world-class sea and air freight operations. You get the benefit of 100% foreign ownership and can take all your profits out of the country, which is a massive win for a global business. When you're managing international payments and operations, having a solid grasp of effective cash flow management is fundamental for growth.

Scenario 2: The Local Law Firm

Now, picture a law firm that wants to represent clients right here in Dubai. They need to be in a central location, meet clients face-to-face, and deal with local government departments.

Here, a Mainland licence is the only way to go. It's the only setup that allows you to trade directly within the local UAE market and open an office wherever you want. Although it requires appointing a Local Service Agent (LSA), it gives the firm the legal authority it needs to practice law and serve the domestic market without any barriers.

Scenario 3: The Global SaaS Startup

Think about a tech startup building a new software-as-a-service (SaaS) platform for users around the world. The team is international, the customers are everywhere, and the main objective is to scale quickly with as little red tape as possible.

A tech-centric Free Zone like Dubai Internet City provides the perfect ecosystem. It delivers that all-important 100% foreign ownership, puts you in a community of fellow innovators, and offers modern office solutions like co-working spaces. This environment makes it easy to attract top talent from anywhere and operate with major tax advantages, letting you pour your money into building a great product instead of navigating local regulations.

Choosing the right jurisdiction isn’t about which one is 'better.' It’s about picking the right tool for the job. Free Zones are built for international trade and services, while the Mainland is designed for deep integration into the UAE’s economy.

Scenario 4: The Construction and Contracting Firm

Finally, consider a construction company aiming to bid on large government infrastructure projects in Dubai. This type of business needs direct access to the local supply chain, the ability to sponsor a large workforce, and the credentials to work with government bodies.

For this, a Mainland setup is the only viable path. It grants the necessary licence from the Department of Economy and Tourism (DET), allowing the company to operate anywhere in the UAE. Crucially, it makes them eligible to compete for valuable government contracts.

It's also worth noting that the lines between these setups are beginning to blur. Recent rules, like Executive Council Resolution No. (11) of 2025, now create official ways for Free Zone companies to tap into the Mainland market without opening a full-blown branch, offering more flexibility than ever before.

Partnering With Experts for Your UAE Launch

Choosing between a free zone and the mainland is a huge step, but the real work starts when you have to turn that decision into a functioning company. Launching a business in the UAE isn't just about having a great idea; it's a precise legal and administrative dance, and one wrong move can set you back weeks and cost you money. This is exactly why bringing a corporate service provider on board can change the game entirely.

Whether you go for a mainland or free zone setup, the path from an idea to opening your doors involves a few key milestones. You’ll need to reserve your trade name, get initial approvals, draft legal documents like the Memorandum of Association (MoA), secure an office space, and finally, submit everything to the right authority—either the Department of Economy and Tourism (DET) or the specific free zone administration.

Navigating Common Formation Challenges

While that might sound simple enough, the reality is often full of unexpected hurdles. I’ve seen countless entrepreneurs get tripped up by selecting the wrong business activities, which causes major compliance headaches down the road. Others get bogged down in the finer details of visa processing and document attestation.

Getting the necessary approvals from different government departments can also become a real bottleneck. For most people, this is the moment they realise that professional help isn't a luxury—it's essential. A good consultant isn't just filing papers for you; they're your strategic partner.

Partnering with a specialist takes the risk off your shoulders. They make sure every single step, from the first form to the final visa stamp, is handled correctly and quickly. This frees you up to focus on what actually matters: running and growing your business.

As specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, we focus on delivering cost-effective business setup solutions that fit what you actually need. Our experience means you can fully enjoy UAE tax benefits for international entrepreneurs without worrying about compliance.

Your Strategic Partner for a Seamless Launch

Choosing the right partner is about more than just getting paperwork done. It’s about having a team that knows the local system inside and out, has built relationships with government authorities, and is there to guide you from start to finish. Our goal is to make your business launch smooth, compliant, and fast.

We provide hands-on support that covers:

- Expert Guidance: We'll help you pinpoint the perfect jurisdiction and legal structure for your specific business model.

- Efficient Processing: Our team handles all the paperwork and communicates directly with government bodies to speed up your setup.

- Ongoing Support: With our 24/7 support service, we’re always just a call or message away if you have questions or need help.

As you get your business structure sorted, don't forget that a strong online presence is non-negotiable for a successful launch in the UAE. Many new companies work with professionals for services like web development services for startups in the UAE to make sure their digital footprint is solid from the get-go.

Your business journey in the UAE should begin with confidence, not confusion. Let us handle the complexities so you can focus on what you do best.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When you're weighing up a free zone versus a mainland setup in Dubai, a lot of questions come to mind. Getting straight answers is key to making a smart decision for your business. Let’s tackle some of the most common ones we hear from entrepreneurs.

Can I Convert My Free Zone Company to a Mainland Company Later?

Yes, you can absolutely make the switch. Traditionally, the most straightforward route is to liquidate the free zone entity and then set up a brand new mainland company. It's essentially starting the formation process from scratch.

However, the rules are always being updated. New options are appearing, like special permits that make it easier for free zone companies to do business on the mainland. As specialists in both Mainland and Free Zone company formation, we can walk you through the most practical and budget-friendly way to make this move based on the latest regulations.

Do I Have to Pay VAT If My Company Is in a Free Zone?

Once your company's annual taxable turnover hits the AED 375,000 mark, you must register for VAT. This applies to everyone, whether you're in a free zone or not. While free zones give you fantastic perks like 0% corporate tax, VAT is a federal law that covers the entire UAE.

There are some nuances. Certain transactions happening within specific "Designated Zones" might be treated as 'out of scope' or zero-rated, but this depends heavily on the exact nature of the business. Getting this right from day one is vital to avoid any fines.

A lot of people think a free zone licence is a get-out-of-jail-free card for all taxes. It's not. Federal laws like VAT still apply, and overlooking this common misconception can cause serious compliance headaches down the line.

Can I Have Both a Free Zone and a Mainland Licence?

Definitely. In fact, running a dual-licence structure is a clever and popular strategy. It allows you to have the best of both worlds. For example, you could manage your international trade from a free zone to maximise tax advantages, while a separate mainland LLC handles all your local sales and contracts.

This kind of setup gives you incredible flexibility, letting you fine-tune your operations for both broad market access and financial efficiency. Our team can help you map out a corporate structure that fits your specific goals. We offer cost-effective business setup solutions built to help international entrepreneurs fully enjoy UAE tax benefits, and our 24/7 support service means we're always on hand to help.

Ready to launch your business in the UAE with confidence? As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we are specialists in both Mainland and Free Zone company formation. Let us handle the complexities so you can focus on success.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com