Thinking about starting a business in the UAE? It's a smart move. You're not just setting up a company; you're opening a gateway to global markets. The very first—and most critical—decision you'll make is choosing the right jurisdiction. This choice really boils down to one question: are you targeting the local Emirati market, or is your focus on international trade? Your answer will point you toward a Mainland, Free Zone, or Offshore setup.

Understanding the UAE Business Landscape

Setting up a company in the UAE is an exciting journey. For years, I've seen entrepreneurs from all over the world drawn here, and for good reason. The UAE isn't just a strategic crossroads between East and West; it's a nation built on a business-first mindset. You feel it in the world-class infrastructure, the political stability, and the incredible diversity of talent you can tap into.

But getting started on the right foot means understanding the fundamental structure of doing business here. The UAE has three distinct jurisdictions, and each one is designed for a specific kind of business.

Mainland, Free Zone, or Offshore

Picking the right jurisdiction is everything. I can't stress this enough. It will define your company's ownership, who you can sell to, and what your ongoing obligations will be.

- Mainland Company: This is your go-to if you want to trade directly within the UAE market. If you plan on bidding for government contracts or setting up a shop in a local neighborhood, a mainland license from the Department of Economic Development (DED) is what you need.

- Free Zone Company: This is the most popular option for international entrepreneurs. It gives you 100% foreign ownership, zero taxes, and the ability to send all your profits home. With over 40 free zones, many catering to specific industries like tech or media, you can find a community that fits your niche.

- Offshore Company: Think of this as a non-resident entity. It's an excellent tool for holding assets, owning property, or managing international trade without having a physical presence in the UAE. You can't do business inside the Emirates, but it offers incredible confidentiality and efficiency for global operations.

To give you a clearer picture, I've put together a quick comparison table that breaks down the core differences at a glance. It's a handy reference when you're weighing your options.

Mainland vs Free Zone vs Offshore At a Glance

| Feature | Mainland Company | Free Zone Company | Offshore Company |

|---|---|---|---|

| Ownership | Up to 100% foreign ownership | 100% foreign ownership | 100% foreign ownership |

| Market Access | Unrestricted access to the entire UAE market | Can trade within the free zone and internationally | Cannot trade within the UAE |

| Office Space | Mandatory physical office space required | Options range from flexi-desks to physical offices | No physical office required (registered agent only) |

| Visas | Visa eligibility depends on office size | Visa eligibility is based on the package chosen | No visas are issued |

| Corporate Tax | 9% on profits above AED 375,000 | 0% for qualifying income, 9% otherwise | 0% corporate tax |

| Auditing | Mandatory annual audit | Required for most free zones | Generally not required |

This table should help you quickly see which structure aligns best with your business model, whether you're focused on local growth, international trade, or asset management.

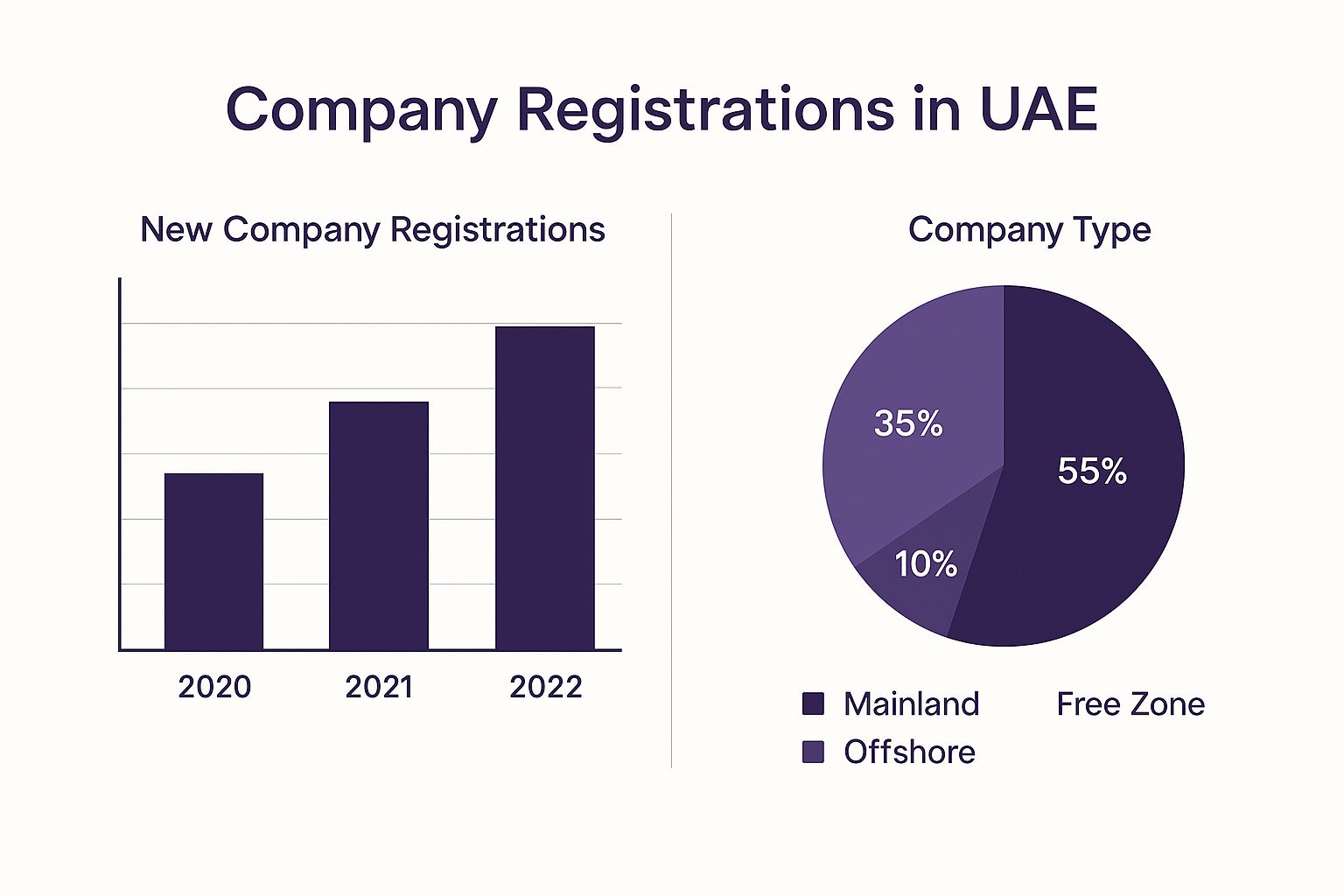

As you can see from recent registration data, both mainland and free zone setups are incredibly popular, which speaks volumes about investor confidence in the UAE's economy.

A Transformed Economic Environment

The UAE's economic story is one of incredible vision. The government made a strategic choice years ago to move beyond its reliance on oil, and the results are stunning. Today, non-oil sectors drive over 70% of the GDP, which has crossed the AED 2 trillion mark for the first time.

This isn't just an abstract number. It signals a robust and diversified market, which is fantastic news for any new business. It means you're entering a stable ecosystem that isn't vulnerable to the ups and downs of a single industry. This confidence is reflected globally, with the UAE ranking 15th on Kearney's Foreign Direct Investment Confidence Index—placing it ahead of giants like Singapore.

I always tell my clients that this economic diversification is their safety net. It means your business has a stronger foundation for long-term security and growth because it’s part of a much larger, more resilient economic picture.

Of course, the appeal goes beyond the balance sheets. To get the full picture, it helps to look into the compelling reasons why many choose to live in Dubai. You quickly realize the UAE isn't just a place to do business—it's a place where people genuinely want to build a life.

Your Blueprint for Mainland Company Formation

So, you're looking at setting up a mainland company in the UAE. This is a big move, and a smart one if you want to tap directly into the local market. It gives you the freedom to trade with anyone, bid on those big government contracts, and set up shop anywhere you like—be it Dubai, Abu Dhabi, or any other Emirate.

As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we’ve walked countless entrepreneurs through this exact process. It's more than just a checklist; it's about navigating the system intelligently to avoid the common pitfalls I see all the time. Think of this as your insider's guide.

Defining Your Business Activities

First things first: you need to be crystal clear about what your business actually does. This isn't just for your business plan; you have to choose from a list of over 2,000 official business activities recognized by the Department of Economic Development (DED).

Your choice here has real consequences. It determines whether you get a commercial, professional, or industrial license. For instance, if you're opening an electronics store, you'll need a commercial license. If you're a marketing consultant, you're looking at a professional license.

Getting this wrong from the start is a classic rookie mistake. Go too narrow, and you might box yourself in later. Go too broad, and you could face higher fees and a lot of red tape you don't need. It's all about finding that sweet spot that matches your vision.

Reserving Your Trade Name and Getting Approvals

Once your activities are sorted, it's time to pick a name for your company. The UAE is pretty specific about this. Your name can't be offensive, it can't be the same as another registered business, and you'll need to steer clear of any religious or political references.

After the DED approves and reserves your name, you'll apply for your Initial Approval. This is a huge step. It’s basically the government giving you a thumbs-up, saying they have no objection to your business idea. This nod allows you to move forward with the rest of the setup.

Don't mistake this for your final license, though. The Initial Approval is the green light that lets you start drafting legal documents and hunting for an office.

Crafting Legal Documents and Securing a Physical Office

Now for the paperwork. The key document you'll be working on is the Memorandum of Association (MOA). This lays out everything about your company—who the shareholders are, how it’s structured, and the rules it will operate by. It needs to be drafted with care and then officially attested by a notary public.

When charting your course, it is crucial to understand the essential legal documents for startups that form the bedrock of your enterprise. A solid MOA can save you a world of headaches and shareholder disputes down the line.

At the same time, you have to find a physical office. A mainland company needs a real address—no exceptions. You'll need a tenancy contract, known as an Ejari, registered with the Real Estate Regulatory Agency (RERA). Pro tip: the size of your office can directly affect how many employee visas you can get, so plan accordingly.

Final Submission and Receiving Your Licence

You've got your Initial Approval, your notarized MOA, and your registered Ejari. Great. Now you're ready to submit everything to the DED for the final review. This is also when you'll pay the fees for your trade license.

You usually have 30 days to make the payment after you receive the voucher. Once that’s done and everything checks out, the DED issues your official trade license. This is the moment your business officially exists. You can finally open a corporate bank account, start your operations, and get the visa process rolling for you and your team.

Yes, it can seem like a lot of steps. But with the right guidance, it’s a straightforward path. Our whole goal is to handle these complexities for you, offering cost-effective business setup solutions tailored to your needs so you can focus on what really matters—building your success in the UAE market.

Tapping into the Power of UAE Free Zones

For entrepreneurs from around the world, UAE free zones offer a compelling alternative to a mainland business setup. Think of them as special economic hubs, specifically engineered to attract foreign investment with a very persuasive package: 100% foreign ownership, zero personal or corporate income tax, and the freedom to repatriate all your profits.

As specialists in Freezone Company Formation across the UAE, we have guided countless clients through this process and have seen firsthand how these zones can be a launchpad for global success.

The fundamental appeal of a free zone is its business-friendly ecosystem. The rules are simpler, and the setup process is remarkably efficient—often much faster and with less red tape than a mainland registration. It’s the perfect route for businesses focused on international trade, consulting, or any service that doesn't need to bill clients directly on the UAE mainland.

Finding the Right Free Zone for Your Business

With over 40 free zones across the UAE, picking one can seem daunting. But this variety is actually a massive advantage. Many zones are built around specific industries, creating powerful clusters of expertise and invaluable networking opportunities. The trick is to find the one that truly clicks with your business activity.

For instance, a logistics company would be a natural fit for the Jebel Ali Free Zone Authority (JAFZA), which is directly connected to one of the world's busiest ports. On the other hand, a tech startup or a creative agency would feel right at home in a place like Dubai Internet City or Sharjah Media City (SHAMS), surrounded by potential partners and clients in the same field.

Here are a few prominent examples to show you what I mean:

- Jebel Ali Free Zone Authority (JAFZA): The go-to hub for global trade, logistics, and manufacturing. If you're importing, exporting, or building things, this is a top contender.

- Dubai Multi Commodities Centre (DMCC): One of the world's most prestigious free zones, ideal for commodities trading, financial services, and a huge range of professional consultancies.

- Sharjah Media City (SHAMS): A fantastic, cost-effective choice for entrepreneurs in media, creative fields, and e-commerce. The setup here is known for being quick and straightforward.

A classic mistake I see entrepreneurs make is choosing a free zone based purely on the initial price tag. While cost is obviously a factor, the right strategic fit will pay you back ten-fold through industry connections, relevant infrastructure, and a supportive regulatory environment.

The Refreshingly Simple Free Zone Setup

Starting a company in a free zone is typically much more direct than its mainland equivalent. The free zone authority itself acts as your one-stop shop, handling nearly all the registration and licensing tasks in-house. This centralized model is a game-changer, slashing the bureaucracy you'd otherwise face.

The first step is usually picking a license package. These are often tiered based on how many visas you'll need and what kind of office space you want—anything from a simple flexi-desk to a fully furnished physical office.

After you've selected your package and reserved a company name, you'll submit the required documents for the shareholders. The free zone authority reviews everything, and once approved, they issue your business license. It's that direct.

This efficiency is a huge magnet for foreign investors. Emirates like Dubai have pioneered highly digital setup procedures that minimize paperwork and fast-track approvals. Major free zones like JAFZA and DMCC offer streamlined registration and licensing services that have been instrumental in attracting foreign investment. The entire process, from reserving a trade name online to getting your license in hand, is designed to be as smooth as possible. You can explore more about these advantages and what they mean for your business growth.

How Businesses Thrive in a Free Zone

Let's look at a real-world scenario. An e-commerce entrepreneur wants to sell fashion accessories to customers across the Middle East and Europe. Setting up in a free zone like SHAMS or Dubai CommerCity is the perfect play. They get an e-commerce license, enjoy 100% ownership, and can manage global logistics without ever needing a physical shop in the UAE.

Or take a UK-based software firm looking to build a regional team. They can establish a base in Dubai Internet City, giving them access to a world-class talent pool, incredible infrastructure, and the credibility of a premium business address—all while enjoying the significant tax benefits of the free zone. These environments are purpose-built to help international businesses hit the ground running and flourish.

Getting Down to Business: What Happens After You Get Your License?

Getting that trade license in your hands is a huge win, but it’s really just the starting whistle. The real game begins now. Your focus has to shift from getting approvals to actually building a functioning business here in the UAE. This next phase is all about tackling the practicalities and staying on the right side of the law. For many new entrepreneurs, this is where things can feel a bit overwhelming, but it’s a well-trodden path.

Think of it this way: you've just laid the foundation. Now it's time to build the rest of the house—hooking up the utilities (your bank account), getting the keys (your visas), and making sure you follow the community rules (compliance).

Bringing Your Company to Life

One of the first, and frankly, sometimes trickiest steps is opening your corporate bank account. Don't underestimate this. UAE banks are incredibly thorough with their due diligence, thanks to global anti-money laundering (AML) rules. You'll need to show up with your new trade license, memorandum of association, and copies of passports and visas for every single shareholder.

But it doesn't stop there. Be ready to present a solid business plan. They'll want to know about your projected transactions, who your main clients are, and even who you'll be buying from. This isn't just bureaucracy; they need to genuinely understand your business model. Putting together a clean, professional file beforehand can shave weeks off the approval time.

A word of advice: Don't just walk into the nearest bank branch. Every bank has a different risk appetite and varying comfort levels with new businesses or certain industries. We’ve seen firsthand how choosing the right bank can make or break this process. We can point you toward the ones most likely to welcome a business like yours.

At the same time you're dealing with the banks, you need to get your company registered with the immigration authorities. This means applying for an Establishment Card. It’s a critical document that officially puts your business on the immigration department's radar, and you absolutely cannot sponsor any visas without it.

Once that card is issued, you can finally start the visa process for:

- Investor or Partner Visas for yourself and other owners.

- Employee Visas for the team you're bringing on board.

This involves a sequence of medical fitness tests, biometrics for the Emirates ID, and the final visa stamping in your passport. It’s a very structured process, but it has a lot of moving parts that need to be managed carefully.

Staying Compliant and Keeping the Doors Open

With your team in place and money flowing through your bank account, your attention has to turn to long-term health: compliance. The UAE's regulatory framework is serious, and staying compliant isn't a "nice-to-have." This is where our 24/7 support service becomes a lifeline, because we are always here when you need us, and questions will pop up that require answers you can trust.

First and foremost, you have to get your head around taxes. Depending on what your business does and how much it earns, you’ll need to manage:

- Value Added Tax (VAT): The magic number here is AED 375,000. If your annual revenue crosses this threshold, you are legally required to register for VAT, file regular returns, and charge the standard 5% on your goods and services.

- Corporate Tax: The UAE now has a federal corporate tax. You'll pay 9% on any annual profits that exceed AED 375,000. This makes clean accounting absolutely non-negotiable for calculating your taxable income correctly.

- Economic Substance Regulations (ESR): This applies to companies in specific fields like banking, insurance, or investment fund management. If you are, you'll need to prove you have a real operational presence here by filing an annual ESR notification and report.

Beyond taxes, diligent financial record-keeping is the bedrock of a healthy business. Start by implementing essential bookkeeping tips for small businesses from day one. Keeping clean books isn't just good practice; it's a legal requirement and your best friend if you ever face an audit. More importantly, it gives you the clear financial picture you need to make smart decisions, drive growth, and truly enjoy UAE tax benefits for international entrepreneurs.

Budgeting for Your Launch and Tapping Into UAE Tax Perks

Let's be honest: setting up a business in the UAE isn't just about the paperwork. The real foundation is a solid financial plan. Before you even think about a trade name, you need a crystal-clear picture of all the costs involved—not just the big-ticket license fee, but every single government charge and operational expense you'll face down the line.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, our approach is all about transparency. We build cost-effective business setup solutions tailored to your needs. That means no hidden fees or last-minute surprises—just a straightforward, itemized breakdown of your investment from the get-go.

What Goes Into Your Initial Investment?

The final bill for your business setup depends on a few key decisions: your jurisdiction (mainland vs. free zone), your specific business activity, and how many visas you'll need. But from my experience, the costs almost always fall into these main buckets.

Here's what you should budget for:

- Trade License Fees: This is the main expense and varies widely. The cost is set by the issuing authority, whether that’s the DED for a mainland company or a specific free zone authority.

- Government & Registration Fees: Think of these as the administrative costs. They cover things like reserving your trade name, getting your initial approval, and other essential processing fees.

- Visa Costs: You'll need to budget for your own investor visa plus any employee visas. This includes the Establishment Card, mandatory medical tests, and Emirates ID processing for each person.

- Office Space: A mainland company absolutely needs a physical office with a registered tenancy contract, known as an Ejari. Free zones, on the other hand, offer much more flexibility, with options ranging from affordable flexi-desks to full-blown offices.

When you work with a specialist, you get a detailed quote right at the start. This simple step is crucial. It gives you a realistic financial outlook from day one, helping you avoid budget blowouts and channel your capital where it will make the biggest impact.

Making the Most of the UAE's Tax Benefits

The UAE’s tax system is a massive draw for international entrepreneurs, and for good reason. The benefits are significant and designed to fuel business growth, especially for small and medium-sized companies.

The biggest win? The 0% personal income tax. It means you and your employees take home 100% of your salaries, with zero deductions. This is an incredibly powerful incentive for attracting top talent from anywhere in the world.

The corporate tax system is just as attractive. While the UAE introduced a corporate tax in June 2023, it's structured in a very business-friendly way. A 9% federal tax is applied, but only on business profits that exceed AED 375,000 per year. After this change, over 94% of businesses noted the increased complexity, but the government also made things easier by liberalizing foreign ownership rules. This move alone led to a 67% jump in foreign investment approvals. You can get more details on these corporate law changes and compliance trends.

That AED 375,000 profit threshold is a game-changer. It means a huge number of startups and small businesses operate completely tax-free, allowing them to pour every dirham of their early profits right back into the company.

This setup gives you a serious competitive advantage, freeing up capital for innovation, expansion, and scaling your operations much faster than you could elsewhere.

Structuring Your Business for Maximum Financial Advantage

Smart, strategic planning is how you truly cash in on these financial perks. The way you structure your company from day one has a direct and lasting impact on your profitability and tax obligations.

For instance, a free zone company that generates "Qualifying Income" can still benefit from a 0% corporate tax rate. This makes it the perfect vehicle for businesses focused on international trade or providing services to clients outside the UAE. Our team knows the ins and outs of these regulations and can help you structure your setup for optimal tax efficiency.

At the end of the day, a successful launch is about making an informed investment, not just getting a license. With our 24/7 support service, we're here to offer guidance not only during the setup process but for the long haul as your business grows.

Ready to get a personalized financial plan? Let's talk.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Answering Your Top Questions About Setting Up a Company in the UAE

When you’re thinking about starting a business in a new country, you’re bound to have questions. It’s only natural. After years of helping entrepreneurs set up shop in Dubai, Abu Dhabi, and Sharjah, we've pretty much heard them all. Our goal is to cut through the jargon and give you the straightforward answers you actually need.

Let’s dive into some of the most common questions we get about company formation in the UAE.

Can I Get a UAE Residency Visa by Opening a Company?

Yes, you absolutely can. In fact, this is one of the most reliable ways to get a UAE residency visa. When you establish a company, you, as the owner, are eligible to apply for an investor or partner visa.

These visas are typically valid for two years, but depending on how much you invest and where you set up, you could even qualify for a longer-term option like the 10-year Golden Visa. Once your company gets its Establishment Card from immigration, you can then sponsor your own family and employees, making it a comprehensive path for relocating your life and business to the UAE.

This is a massive plus for international entrepreneurs. Tying your residency directly to your business gives you a solid foundation, both personally and professionally, so you can really focus on growing in the UAE's dynamic market.

Do I Still Need a Local Emirati Partner for a Mainland Company?

For most businesses, the answer is no—that rule has changed. The UAE government made some game-changing updates to the Commercial Companies Law, which now allows 100% foreign ownership for over 1,000 different business activities right on the mainland. This single change has completely opened the doors for foreign investment.

Now, it's not a blanket rule for every single industry. A handful of strategic sectors, like those in oil and gas or with national security implications, might still require an Emirati partner or have different ownership rules. As specialists in mainland company setups, we can quickly tell you the exact ownership requirements for your specific business idea, making sure you start on the right foot.

What's the Minimum Capital I Need to Start a Business?

This is a huge point of concern for many, but I've got good news: for the vast majority of mainland and free zone companies, there is no longer a legally required minimum share capital. This gives startups and smaller businesses incredible flexibility.

Instead of a fixed amount, the general rule of thumb is that your capital should be "sufficient" to get your business off the ground and cover its initial costs.

- For a Mainland LLC: The law says you must state the share capital in your Memorandum of Association (MOA), but you typically don't have to deposit it upfront.

- For a Free Zone Company: While many free zones have dropped the minimum capital rule, some highly specialized zones or certain license types (think high-risk activities) might still have their own internal policies.

A big part of what we do is create cost-effective setup plans. We'll help you figure out a realistic capital amount that works for your business plan and ticks all the boxes for the specific jurisdiction you choose.

How Long Does It Actually Take to Form the Company?

The timeline for company formation in the UAE really hinges on two things: which jurisdiction you pick (mainland vs. free zone) and how complex your business activity is.

A free zone setup is usually the fastest route. They have their own streamlined processes, so you can often get your license in just a few working days, maybe a week at most. They are built for speed.

A mainland company, on the other hand, takes a bit more time. You should probably plan for a two-to-four-week process. The reason it takes longer is that you need approvals from several different government departments—like the Department of Economic Development, a notary public for your legal documents, and sometimes other ministries depending on what you do.

Our experience is built on knowing exactly how to navigate these government channels efficiently. We handle the paperwork and follow up with the right people to keep things moving and get you up and running as fast as possible. And with our 24/7 support service, we’re here for you long after the license is issued.

Ready to put these answers into practice? The team at 365 DAY PRO Corporate Service Provider LLC is here to walk you through every part of your UAE business journey, from the initial idea to your long-term growth. We make complicated processes feel simple.

Get Your Free Consultation and Start Your UAE Business Today