So, you're trying to figure out how much a Dubai trade license will set you back. It's one of the first questions on every entrepreneur's mind, and the answer isn't a simple number. For the first year, you could be looking at a total cost anywhere from AED 25,500 to over AED 107,000.

Why such a wide range? Because the final price isn't a single fee. It's a combination of different government and administrative charges that depend heavily on your specific business activity, where you set up (mainland vs. free zone), and your office needs.

Decoding Your Dubai Trade License Cost

Getting a handle on your trade license investment is your first real step toward launching in Dubai's buzzing market. It helps to think of it less like buying a product off the shelf and more like building a custom toolkit for your business. Each tool has its own price, and the final bill depends entirely on what you need to operate legally and efficiently.

Every dirham you spend goes toward building your company's legal foundation. These aren't random fees; they cover crucial registrations and approvals that give your business the green light to operate in the UAE.

As a general guide, mainland licenses for the first year typically fall somewhere between AED 50,920 and AED 107,520. On the other hand, free zone licenses, which are often seen as more streamlined, can range from about AED 25,500 to AED 112,000. You can find more insights on the matter to see how these figures break down.

To give you a clearer starting point, here's a quick look at what you can generally expect.

Estimated First-Year Trade License Costs in Dubai

| Setup Type | Typical Cost Range (AED) | Best For |

|---|---|---|

| Mainland LLC | 50,000 – 100,000+ | Businesses wanting to trade directly within the UAE market and take on government contracts. |

| Free Zone Company | 25,000 – 60,000 | International trade, startups, and businesses that don't require a physical local presence. |

| Professional License | 45,000 – 80,000 | Service-based professionals, consultants, and artisans offering their expertise. |

This table provides a snapshot, but remember, the final cost will always come down to the specific details of your business.

Key Cost Variables to Consider

Several big-ticket items will influence your final trade license cost. Understanding these from the get-go will save you surprises and help you budget properly.

Here are the main factors that make the costs swing one way or the other:

- Your Jurisdiction: This is the big one. Choosing between a mainland and a free zone setup is the single most significant cost driver. Each has its own fee structure, benefits, and rules of engagement.

- Business Activities: What your company actually does matters a lot. Certain activities, like healthcare or engineering, require special approvals from other government ministries, and those approvals come with their own price tags.

- Company Name: Just reserving your business name comes with a fee. If you choose a name that includes certain words or is in a language other than English, you might face extra charges.

- Office Space: A physical office lease, known as an Ejari, is usually a must-have for mainland companies, and this can be a substantial cost. Free zones are much more flexible, offering cost-effective options like flexi-desks or even virtual offices.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we specialise in creating cost-effective business setup solutions tailored to your specific needs, ensuring you only pay for what is essential for your company's success.

By seeing the total price as a sum of its parts, you'll be in a much better position to understand the detailed breakdowns that follow. This initial overview should give you the context you need to make smart decisions and budget accurately for your new Dubai venture.

Breaking Down the Cost of a Mainland Licence

When you decide to set up on the Dubai mainland, one of the first questions is, "What's the real cost?" It's not just one single number. Think of it less like a price tag and more like a bill of materials for building your business; each fee has a specific purpose and is a necessary part of your company's legal foundation.

Understanding where every dirham goes is the key to planning your budget with confidence. By breaking down the trade licence Dubai cost, we can demystify the process and turn a confusing list of charges into a clear roadmap for your investment. No more guesswork, no more surprises.

The Core Government Fees

Let’s look at a common example: a General Trading Licence on the mainland. The initial cost is a combination of several mandatory government fees, each covering a specific administrative step to get you up and running legally.

A typical breakdown of these foundational costs often looks something like this:

- Commercial Licence Fee: AED 600

- Initial Approval Fee: AED 100

- Trade Name Reservation: AED 600

- Base Issuing Fee: AED 15,000

These are the essential building blocks. But they aren't the whole story.

Mandatory Contributions and Ministry Fees

Beyond the core registration fees, your mainland licence also includes payments to other critical authorities that oversee business in Dubai. These aren't optional extras; they're essential for integrating your company into the UAE's economic fabric and ensuring you're fully compliant.

As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we make it our mission to give clients a completely transparent view of every single mandatory fee from day one. This helps you budget properly and avoids any unexpected costs down the line.

You’ll also need to account for payments to bodies like the Dubai Chamber of Commerce and the Ministry of Economy. For an Instant Licence, for example, these extra charges—including AED 1,200 for the Dubai Chamber and AED 3,000 for the Ministry of Economy—are added to the base costs. This brings the approximate total to around AED 34,340. You can explore the official breakdown of these business setup costs to see exactly how it all adds up.

Ready to get a precise quote for your mainland licence? 📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.

Key Factors That Shape Your Final Price Tag

The final trade license Dubai cost isn't a simple, off-the-shelf price. Think of it more like a customised bill where a few critical decisions you make at the very start will determine the final number. Knowing what these variables are is crucial; each choice can dial your setup costs up or down.

So, why does one entrepreneur end up paying AED 20,000 while another's invoice pushes past AED 100,000? It almost always boils down to a handful of core elements. Nailing these from the get-go is the key to aligning your business plan with your budget and avoiding any nasty surprises down the road.

Jurisdiction: The First Major Cost Driver

Your first big decision is where to set up: on the Dubai mainland or within a free zone. This choice is probably the single biggest factor influencing your total investment, as each path has a completely different cost structure.

A mainland licence gives you the freedom to trade anywhere in the UAE market, but it often comes with higher government fees and, in many cases, the need for a physical office. On the other hand, free zones are known for their attractive, all-in-one packages that make budgeting easier, though they might restrict your ability to trade directly with the mainland market. This one decision really sets the financial stage for everything that follows.

Your Business Activities

What your business actually does matters a lot when it comes to cost. A standard general trading license is going to have a very different price tag compared to a specialised technical consultancy or a full-blown industrial operation.

Some professional activities need extra approvals from various government ministries or regulatory bodies. Each of these external approvals adds another line item to your bill. For example, getting a licence for a medical clinic or a school involves far more regulatory hurdles—and therefore higher costs—than opening a simple retail shop.

As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we help you navigate the complexities of business activity selection. Our expertise ensures you choose the most cost-effective path while remaining fully compliant with all regulatory requirements.

Office Space and Visa Allocations

The last key variables are your physical presence and the size of your team. For most mainland companies, a registered office lease, documented with an Ejari, is non-negotiable and represents a significant annual expense. The size and location of your office will directly move the needle on your budget.

What’s more, the number of employee visas you need is often linked to your office space. Every single visa comes with its own government fees for processing, medical tests, and Emirates ID issuance. While the baseline cost to get a trade license can fall between AED 15,000 and AED 50,000, mandatory costs like DED registration, Dubai Chamber of Commerce fees, and visas can quickly inflate the total. You can find more details about these influencing factors to better plan your budget.

Choosing Your Arena: Mainland vs. Free Zone Costs

Deciding between a mainland and a free zone setup is easily one of the biggest financial calls you'll make when starting a business in Dubai. This isn't just about the initial trade license Dubai cost; it's a strategic move that dictates your company's freedom to operate and your financial obligations for years to come. Each path offers a completely different set of advantages, and getting to grips with them is crucial.

A mainland license is your golden ticket to the entire UAE market. While the government fees might look a bit steeper at first glance, this license gives you the unrestricted freedom to trade directly with any local business, bid on valuable government tenders, and set up your shop anywhere you like in Dubai. If your game plan involves deep integration with the local economy, this is the way to go.

On the other hand, a free zone setup often feels like a neat, all-in-one package with a predictable price tag. These specialised economic hubs are built to attract foreign investment, offering juicy perks like 100% foreign ownership and tax exemptions. The trade-off? Your direct business activities are usually confined to the free zone itself or international markets. To reach customers on the mainland, you'll typically need to partner with a local distributor.

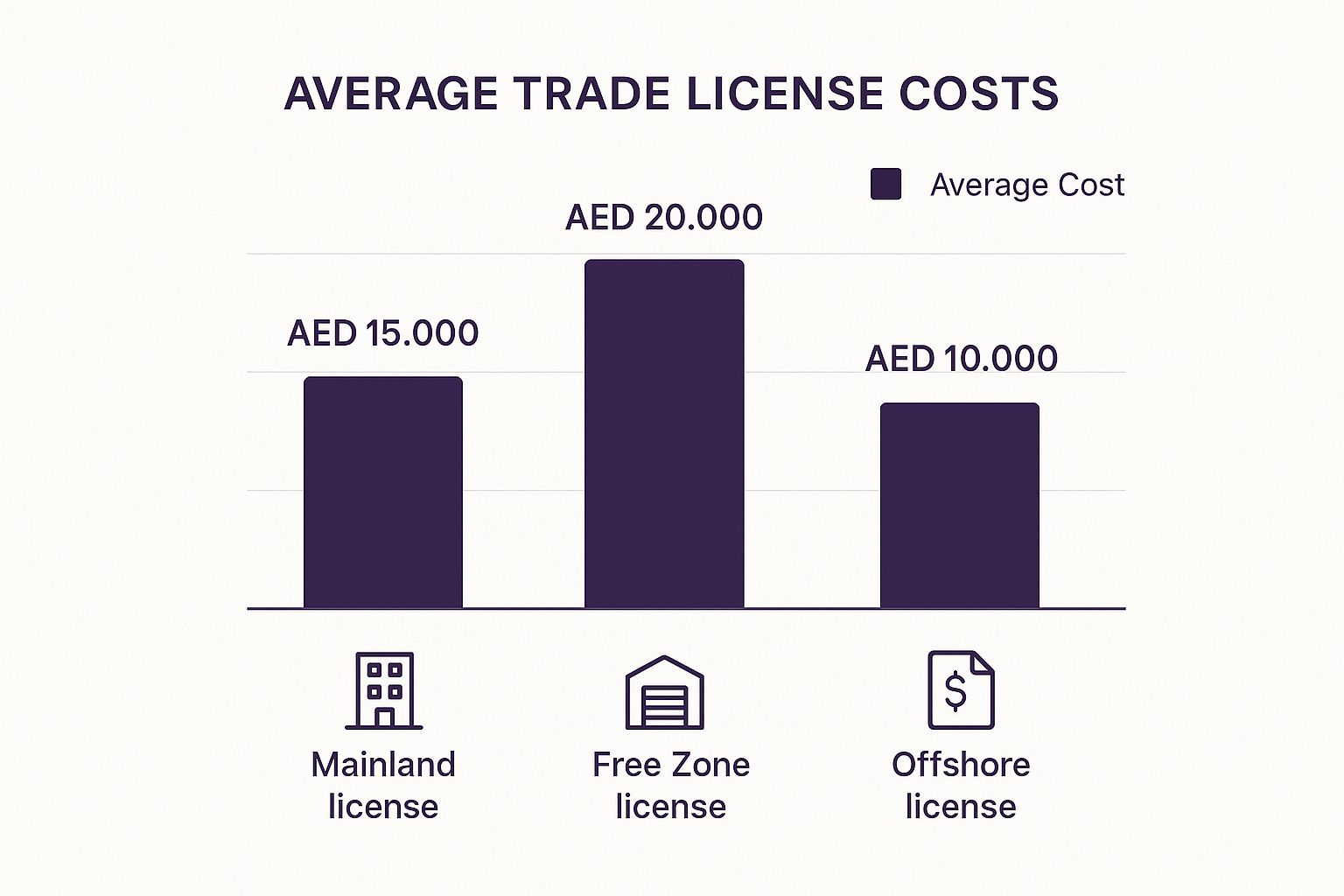

This chart gives you a quick look at the average starting costs you can expect for different license types.

As you can see, the initial outlay can vary quite a bit. Free zones sometimes appear more expensive upfront, but that's often because their fees are bundled into comprehensive packages.

Cost & Benefits Comparison Dubai Mainland vs Free Zone

To really understand the financial and operational differences, it helps to see them side-by-side. This table breaks down the key trade-offs you'll be weighing as you decide which jurisdiction is the right fit for your business goals.

| Feature | Mainland License | Free Zone License |

|---|---|---|

| Market Access | Unrestricted access to the entire UAE market, including government contracts. | Limited to the free zone and international markets; requires a local agent for mainland trade. |

| Ownership | 100% foreign ownership is now possible for most activities, but some strategic sectors may require an Emirati partner. | 100% foreign ownership is standard. |

| Office Space | Mandatory physical office space required anywhere in Dubai (Ejari). | Flexible options, including flexi-desks, co-working spaces, or dedicated offices within the zone. |

| Initial Cost | Lower initial license fee, but additional costs for office rent, approvals, etc. | Higher initial package cost, but often includes office, visas, and utilities. |

| Annual Fees | Separate annual renewal fees for license, rent, and sponsorship (if applicable). | A single, consolidated annual renewal fee is common. |

| Business Scope | Wide range of activities, can deal with any company in the UAE. | Activities are often specific to the free zone's industry focus. |

Ultimately, the table highlights a core choice: Do you prioritise total market freedom (Mainland) or operational simplicity and a predictable cost structure (Free Zone)?

Weighing the Financial Trade-Offs

The financial story doesn't end with the initial license fee. With a mainland setup, you have to budget for a variety of separate costs: your office rent (and the associated Ejari registration), different DED fees, and potentially fees for a local service agent. These can add up.

Free zones take a different approach. They often bundle many of these expenses—like a basic office facility, visa eligibility, and even utility connections—into one annual payment. This makes financial forecasting a whole lot simpler.

As Specialists in Freezone Company Formation across the UAE, we help entrepreneurs navigate the maze of over 40 different free zones. Each has its own unique cost structure and industry specialisation. Our job is to match your business with the jurisdiction that makes the most sense, both financially and operationally.

At the end of the day, it all comes back to your business model. Do you absolutely need direct access to the local market from day one? Or is your focus on international clients and keeping your operations lean? Answering that question will point you toward the path that offers the best return on your investment. That lower mainland license fee might catch your eye, but the total cost of ownership could tell a very different story once you factor in all the moving parts.

Budgeting Beyond Year One: What to Expect for Your License Renewal

Getting that first trade license is a huge win, but it’s just the first step. It's really important to remember that this isn't a one-and-done deal. The trade license Dubai cost is a yearly commitment.

Think of it as the annual subscription fee to keep your business legally operating in the UAE. Missing this payment isn't an option if you want to stay in business. Every year, you’ll need to renew it to stay in good standing with the authorities, whether that's the Department of Economic Development (DED) for a mainland company or your specific free zone authority. This process basically re-confirms that your business is still playing by the rules and is good to go for another year.

Breaking Down the Renewal Cost

So, what are you actually paying for each year? The renewal fee isn't just one arbitrary number; it’s a bundle of different official charges needed to keep everything running smoothly.

While the final figure can shift based on your specific setup, you can generally expect the annual renewal to fall somewhere between AED 8,000 and AED 15,000. Sometimes it's higher, depending on the complexity of your business.

Here’s a look at what typically makes up that cost:

- Commercial Registration Fee: This is the main charge for renewing your company's official registration.

- Office Lease Renewal: If you have a mainland company, you absolutely need an up-to-date tenancy contract (your Ejari) to even begin the renewal process.

- Sponsorship or Agent Fees: For those who require a local sponsor or service agent, this annual fee will be part of the renewal bill.

- Chamber of Commerce Fees: Your membership with the Chamber of Commerce often needs to be renewed at the same time.

Getting a grip on these recurring costs from the start is absolutely crucial for smart financial planning. It helps you build a business model that's truly sustainable here in Dubai.

We specialise in providing Cost-Effective Business Setup Solutions tailored to your needs, ensuring you have a clear financial roadmap from year one and beyond.

The Heavy Price of Missing the Deadline

Let’s be clear: letting your license renewal slide is a bad idea. The consequences are far more expensive and stressful than just paying the fee on time. The penalties are serious and designed to make sure everyone stays compliant.

If you fail to renew on schedule, you could be looking at:

- Hefty Fines: The authorities don't mess around. Late renewal penalties are significant and can grow the longer you wait.

- Frozen Bank Accounts: This is a showstopper. Your corporate bank account can be frozen, which means you can't pay your staff, suppliers, or anyone else. Your business grinds to a halt.

- Visa Problems: An expired license means you can't renew existing employee visas or apply for new ones. Forget about growing your team.

- Blacklisting: In the most serious cases, your company—and even its owners—can be blacklisted. This makes doing any future business in the UAE incredibly difficult, if not impossible.

Smart Ways to Lower Your Setup Costs

Seeing the full breakdown of your potential trade license cost in Dubai is one thing; figuring out how to make that number more manageable is the real challenge. The good news is, launching your dream business doesn't have to break the bank. With a bit of strategic thinking, you can significantly trim your initial expenses without cutting corners on compliance or stunting your company's growth potential.

It all boils down to making smart, informed decisions right from the start. For example, simply choosing a free zone known for its startup-friendly packages can save you thousands of dirhams. These often bundle your registration, a basic workspace, and visa eligibility into a single, predictable annual fee, sidestepping many of the surprise costs that can pop up with a mainland setup.

Fine-Tune Your Operational Choices

One of the biggest line items on any new business budget? Office space. Before you lock yourself into a pricey annual lease for a traditional office, take a look at the more flexible and wallet-friendly options available today.

- Go for a Flexi-Desk: Most free zones offer "flexi-desk" packages. This gives you a legitimate business address and access to a workspace when you need it, but without the hefty price tag of a dedicated, private office.

- Choose Your Business Activities Carefully: Take a hard look at the business activities you've listed. Some activities require special, and often expensive, external approvals from various ministries. If you can focus on core services that don't need these extra sign-offs, you can sidestep a significant cost.

- Start with Just the Visas You Need: It’s tempting to plan for a big team, but only apply for the employee visas you need on day one. You can always add more as you expand. Paying for visa allocations you don't use is just money down the drain.

Partnering with an experienced business setup consultant is often the shrewdest move you can make. We provide Cost-Effective Business Setup Solutions tailored to your needs, finding those hidden savings and making sure you Enjoy UAE Tax Benefits for International Entrepreneurs.

While the core trade license fees are a fixed cost, adopting broader strategies to cut business expenses can make a huge difference to your overall setup budget. An expert can walk you through every choice, ensuring your launch is as financially lean as it is legally sound.

Got Questions About Dubai Trade License Costs? Let's Get Them Answered.

When you're diving into the details of setting up a business in Dubai, the practical questions always start to surface. Getting straight answers is crucial for building a realistic budget and making sure you're on the right track from day one. Let's tackle some of the most common queries we hear from entrepreneurs just like you.

A big one is always, "Do I absolutely need a physical office right away?" The short answer is no. For your first year, you can definitely get your trade license without signing a traditional office lease. The Dubai Instant License was created for this exact scenario, and most free zones have great flexi-desk or virtual office packages that tick all the legal boxes without the hefty price tag.

What's the Most Budget-Friendly Way to Get Started?

Naturally, everyone wants to know what the cheapest license is. If you're just dipping your toes in the market or running a small operation from your social media accounts, the e-Trader license is a fantastic, low-cost starting point. For solo professionals and freelancers, the freelance permits offered in many free zones are also an excellent, affordable way to get up and running legally.

One thing that often catches people by surprise are the "other" fees. They aren't intentionally hidden, but costs for things like legal document translation, official attestation, and getting special approvals from external bodies (think healthcare or education) can add up. A good, transparent consultant will always flag these potential costs for you right from the start.

How Long Does it All Take?

Finally, the timeline. How long until you have that license in your hand? This really depends on the path you choose. An Instant License can live up to its name and be issued in less than 24 hours. A standard mainland license usually takes about one to two weeks. Free zone processing times can vary quite a bit, from just a few days to several weeks, depending on the specific free zone authority you're dealing with.

Our entire approach is built on providing clear, upfront cost breakdowns. We give you the expert guidance you need for a smooth and predictable business setup. Our 24/7 Support Service means we are always here when you need us.

📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.