Setting up your business bank account is a huge milestone for any entrepreneur in the UAE. It’s the moment things get real. And when it comes to choosing a bank, RAKBANK often comes up in conversation, especially for startups and SMEs. Think of it less as just opening an account and more as finding a financial partner that actually gets what businesses here need, from digital tools to accessible funding.

Why RAKBANK Is a Smart Choice for UAE Businesses

Picking the right bank can genuinely make or break your early days. It affects everything from your day-to-day cash flow to your big-picture growth plans. For so many business owners I’ve worked with across Dubai, Abu Dhabi, and Sharjah, the rak bank business account opening process is their first major step towards building a solid financial foundation.

RAKBANK has carved out a solid reputation for itself by really focusing on the SME sector, which, let's face it, is the engine of the UAE's economy.

This isn't just fluffy marketing talk; it’s about real, tangible benefits that business owners actually use. Whether you’re running a mainland LLC in Dubai or a fresh startup in a free zone, RAKBANK has built its services around the specific challenges you're likely to face.

A Focus on Practical Business Needs

What really makes RAKBANK stand out is its down-to-earth approach to business banking. They seem to understand that SMEs need more than a simple account to park their cash; they need a whole support system. This comes through in a few key ways:

- Accounts for Every Stage: They offer things like the RAKstarter account, which comes with no minimum balance—a lifesaver for new ventures. Then you have the Business Elite accounts for more established companies needing more horsepower.

- Solid Digital Banking: Their online and mobile platforms are designed for getting things done quickly. You can handle payroll, sort out your VAT payments, and fire off international transfers without a headache.

- Trade Finance That Makes Sense: If your business is into importing or exporting, RAKBANK provides trade finance solutions that aren't overly complicated, helping you navigate the tricky world of international commerce.

A strong banking relationship isn't a luxury; it's a competitive advantage. RAKBANK’s focus on the SME sector gives you the financial toolkit you need to do more than just get by—it helps you succeed in the UAE's fast-paced market.

A solid bank account is crucial, but it's just one piece of the puzzle. Smart business management also means looking into a full suite of commercial business solutions to build stability and drive growth. As specialists in both mainland and free zone company formations, we've seen time and again how the right bank account, combined with expert corporate services, creates a powerful launchpad for success. Our 24/7 support is here to guide you through every step, from the initial setup to keeping everything compliant down the line.

Confirming Your Eligibility Before You Apply

Before you even think about filling out an application, the first and most critical step is to make sure you actually qualify for a RAKBANK business account. This sounds obvious, but it’s a hurdle where many entrepreneurs stumble, leading to lost time and a whole lot of frustration.

Banks here in the UAE, RAKBANK included, are bound by strict regulations. They need to know exactly who they’re doing business with—a standard practice known as 'Know Your Customer' or KYC. This means they’ll take a close look at your business structure, who owns it, and what you actually do to ensure everything is above board.

Your Business Structure is Key

RAKBANK caters to different types of businesses, but the paperwork and scrutiny change depending on your company's legal setup. The two most common structures we handle are Mainland LLCs and Free Zone companies, and the bank looks at them slightly differently.

-

Mainland LLC: If your business is registered with a Department of Economic Development (DED), the bank will want to see your trade licence and Memorandum of Association (MOA). These documents prove your company is legitimate and clearly outline who the shareholders are.

-

Free Zone Company: For businesses set up in one of the UAE’s free zones, RAKBANK will verify the licence issued by that specific free zone authority. They’ll be particularly interested in making sure your stated business activities match what's permitted on your licence.

Getting this right from the very beginning makes a world of difference. Our team can help you structure your company correctly from day one, which gives you a major advantage when it's time to open your bank account.

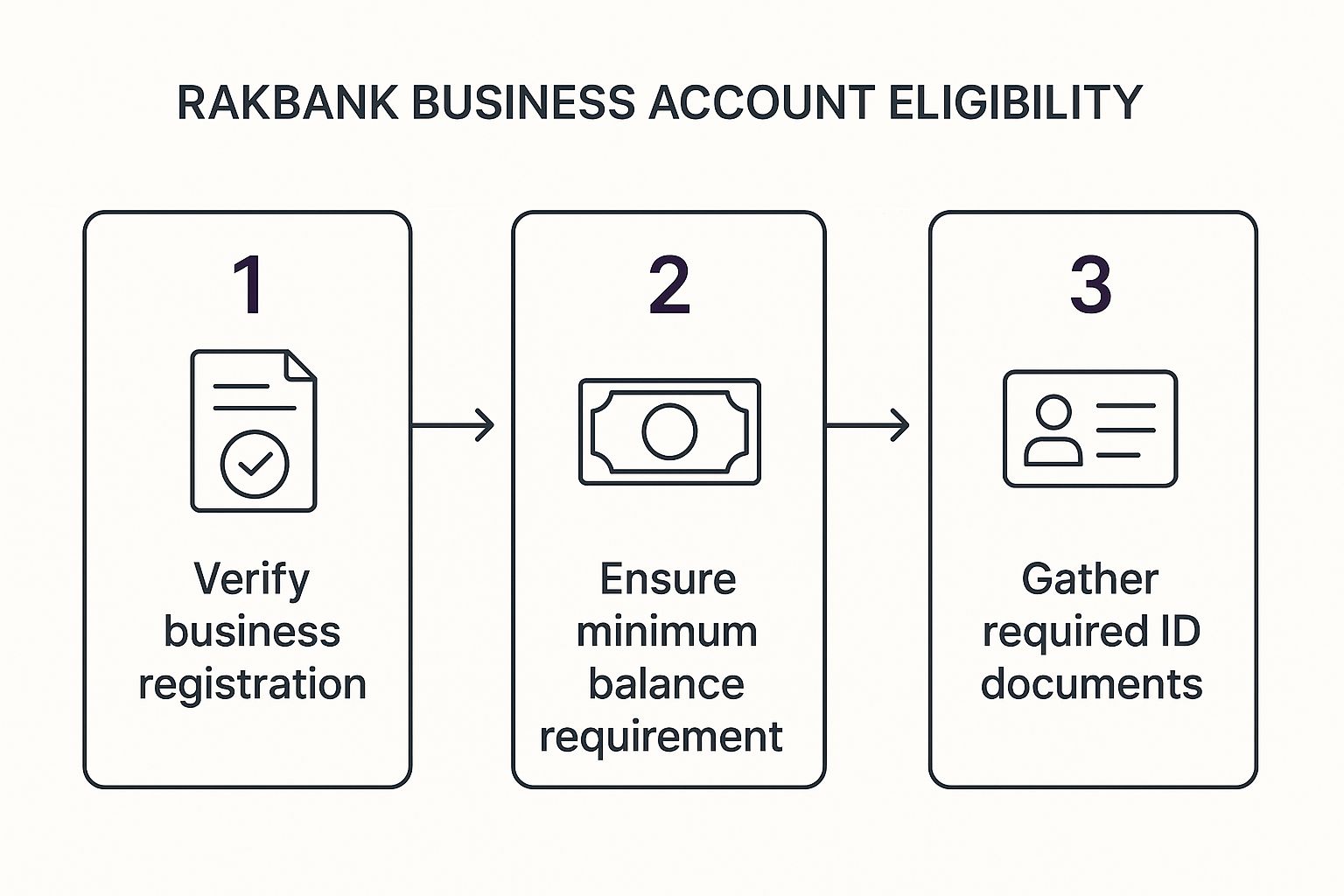

This is a great visual summary of what the bank looks for.

As you can see, it boils down to three core pillars: your company's legal status, your financial standing, and the personal identification of the owners.

To give you a clearer picture, here’s a quick comparison of what RAKBANK typically looks for based on your company type.

RAKBANK Business Account Key Eligibility Factors

| Requirement | Mainland LLC | Free Zone Company | Sole Proprietorship |

|---|---|---|---|

| Trade Licence | Must be valid from the relevant DED. | Must be valid from the specific free zone authority. | Must be valid and issued by the DED. |

| Founding Docs | Memorandum of Association (MOA) is mandatory. | MOA or similar incorporation documents are required. | Not applicable; licence serves as the primary document. |

| Shareholder Status | Residency visa for at least one shareholder is strongly preferred. | Residency visa for at least one shareholder is highly recommended. | Owner must have a valid residency visa. |

| Physical Presence | A registered office address (Ejari) is required. | Proof of office space or flexi-desk within the free zone is needed. | A registered office address is mandatory. |

This table shows that while there are similarities, the specific documentation can vary. Having everything in order for your specific business type is non-negotiable.

Other Factors the Bank Will Check

Beyond your trade licence, RAKBANK will dig into a few other areas. Knowing what they'll ask ahead of time can make the entire process much smoother.

A big one is the residency status of the shareholders. It’s not impossible for a non-resident to open an account for their UAE company, but be prepared for a much deeper level of due diligence. If you or one of your partners has a valid Emirates ID and residence visa, things tend to move a lot faster.

Your declared business activity is another make-or-break factor. Banks classify certain activities as 'high-risk'. This could be anything from general trading where your suppliers and buyers aren't clearly defined, to businesses dealing in precious metals or certain financial services. If your business falls into one of these categories, you'll face more questions about your specific business model.

Taking the time to do a thorough self-check before you apply isn't just a good idea—it's essential. You’ll be ready for the bank’s questions and can avoid starting a process you can't finish.

This is where having an expert in your corner pays off. As a corporate service provider, we specialise in cost-effective business setup solutions that include navigating the bank account opening process. We know how to present your business in a way that meets the bank's strict criteria, helping you access the full UAE tax benefits available to entrepreneurs.

For a free chat about how we can help, WhatsApp Us Today.

Getting Your Paperwork in Order: The Definitive RAKBANK Document Checklist

Let's be honest, pulling together all the required documents is the part of the rak bank business account opening process that trips most people up. It’s where applications grind to a halt, lost in a frustrating loop of emails with the bank. The secret to avoiding this isn't just having a list; it's understanding why the bank is asking for each specific piece of paper.

Think of your application file as the complete biography of your business. Each document you provide adds another chapter, giving the bank’s compliance team the full story. A clean, comprehensive, and well-organised submission doesn't just look professional—it makes their job easier, which means a faster decision for you.

Foundational Company Documents

These are the absolute non-negotiables. They are the legal bedrock proving your company is a legitimate, registered entity in the UAE. Without crystal-clear, valid copies of these, your application won't even get off the ground.

- Valid Trade Licence: This is your golden ticket. Make absolutely sure it’s not expired and that the listed business activities accurately reflect what your company actually does. The bank will scrutinise this to see if your proposed transactions make sense.

- Memorandum of Association (MOA): Crucial for Mainland LLCs and many Free Zone companies, the MOA details who the shareholders are, their ownership stakes, and the company's purpose. The bank relies on this to confirm who has the authority to run the account.

- Share Certificate(s): This is the official proof of ownership. The names and details here must match your MOA and trade licence perfectly. Any discrepancy will raise a red flag.

- Certificate of Incorporation/Registration: This certificate simply proves your company was legally formed according to the regulations of its specific jurisdiction, whether that's a mainland DED or a free zone authority.

Getting these right from day one is key. We specialise in both Mainland and Freezone company formation, and a big part of our job is ensuring these core documents are perfectly aligned from the start to prevent any banking headaches down the road.

Personal Documents for All Shareholders and Signatories

RAKBANK has a strict obligation to verify the identity of every single person who has significant control over the business. This is a central part of their mandatory Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance procedures. There are no shortcuts here.

For every partner, shareholder, and authorised signatory on the account, you’ll need:

- Passport Copy: A sharp, colour copy is a must, and it needs to have at least six months of validity left.

- UAE Residence Visa Page Copy: This is a big one. For expatriate owners, having a valid residence visa can significantly smooth out the approval process.

- Emirates ID Copy (Front and Back): Another non-negotiable for anyone residing in the UAE.

- Recent Utility Bill or Proof of Address: This needs to be recent (within the last three months) and clearly show the individual's name and residential address. It’s how the bank verifies where they actually live.

A classic mistake we see all the time is an incomplete set of personal documents. People often forget the paperwork for a minority shareholder. The rule is simple: the bank needs complete documents for every single partner, no matter how small their ownership stake is.

Supporting Documents That Build a Case for Your Business

This final category of documents helps the bank understand the context of your business—its operating model, its financial standing, and its overall legitimacy. For new companies or those with more complex operations, these documents can easily be the deciding factor between a swift approval and a frustrating rejection.

A truly solid application package will almost always include:

- A Concise Company Profile: Just a one or two-page summary is perfect. Explain what your business does, who you sell to, and where you buy from. This gives the bank a clear picture that a trade licence alone cannot.

- Six Months of Bank Statements: If you're an established business, provide statements from your current or previous bank. If you're a brand new venture, the personal bank statements of the main shareholders are often requested to demonstrate financial credibility.

- Office Tenancy Contract (Ejari): This proves you have a physical base of operations in the UAE, which is a key requirement, especially for mainland companies.

- Board Resolution: This is a formal, signed document where all shareholders agree to open the RAKBANK account and officially name the people authorised to operate it. It provides the bank with the legal assurance that everyone involved is on the same page.

As corporate service providers, we don't just set up companies; we provide cost-effective business setup solutions that include getting you bank-ready. We know exactly what RAKBANK is looking for and can help you frame your business's story in a way that builds immediate trust.

For 24/7 support with your documentation, Call Us Now: +971-52 923 1246.

Navigating the Application and Follow-Up

Once you’ve gathered and perfectly organised your documents, you’re ready to officially kick off the rak bank business account opening process. The next big decision is how you'll submit everything. This choice can genuinely affect how quickly and smoothly things go, so it’s worth a moment of thought.

You really have two main avenues: submitting everything through RAKBANK’s online portal or going in for an old-fashioned, face-to-face meeting at a branch. Both have their pros and cons.

Online Application Versus In-Person Meetings

The online route is, without a doubt, convenient. You can upload all your paperwork from your desk, which saves you a trip and the hassle of finding parking. This is often the best bet for straightforward setups, like a single-shareholder Free Zone company with a common business activity.

On the other hand, an in-person meeting gives you a chance to build a relationship with a bank manager right from the start. This can be a game-changer if your business model is a bit complex or operates in a niche that needs a bit of explaining. Being there in person lets you answer questions before they're even asked, adding a human element that a digital form just can't match.

It really boils down to complexity. For a simple business, the online portal is fast and efficient. For anything outside the box, a meeting can help you get ahead of any potential issues before they cause delays.

Whichever way you go, the bank's compliance team is going to review your application with a fine-tooth comb. Knowing some effective business process improvement methods can be surprisingly helpful here, as it trains you to present your information clearly and logically.

Managing the Follow-Up Process

After you hit 'submit' or walk out of the branch, the waiting begins. You should get an initial acknowledgement from the bank within a couple of business days. The full-blown review, however, usually takes anywhere from two to four weeks. This timeline can stretch depending on how busy the bank is and how complicated your company structure is.

If a week goes by and you haven't heard a peep, it's completely fine to check in. A short, polite email to your contact person at the bank is the best way to do it. Just try to avoid calling them every day—that won't help your case.

A simple and professional follow-up could look something like this:

- Subject: Following up: Business Account Application for [Your Company Name]

- Body: Keep it brief. Mention you're just checking on the status of your application and wanted to see if they needed anything else from you.

- Closing: A simple "Thanks for your time" works perfectly.

This approach shows you're on top of things without being pushy. It keeps your application fresh in their minds and highlights your professionalism, which is exactly what you want as you move closer to getting that account approved.

Navigating Common Roadblocks in Your Application

So you’ve submitted everything perfectly, but then you get that email from the bank. It's a request for more information. Don't panic. This isn’t a rejection; it's a standard part of the due diligence process and, frankly, an opportunity for you to show them you're a serious business owner. Knowing how to handle these queries can be the difference between a stalled application and a successful one.

Often, the bank just needs a bit more context. They might be scratching their heads over a complex business model or raising an eyebrow at revenue projections that look ambitious for a startup. Your job is to respond quickly, professionally, and with clear, solid proof.

Responding When the Bank Asks for More Information

When that request for more documents or a detailed explanation lands in your inbox, how you react is everything. Sending a rushed, vague reply will only create more doubt.

Here’s how we've seen clients successfully handle these requests:

- Clarifying Your Business Model: Let's say you're in a niche field like AI-driven marketing or specialised logistics. The banker reviewing your file might not get it. We advise clients to draft a simple, one-page summary breaking down exactly how the business makes money, who the target customers are, and the flow of funds.

- Explaining Transaction History: If you’re moving an existing business account, a few large or unusual transactions on your old statements can trigger a query. The solution is simple: have the corresponding invoices or contracts ready to go. Show them the paper trail, and the issue usually disappears.

Your relationship manager is your ally, not your adversary. Treat them as a partner. A cooperative and positive attitude goes a long way in getting them to champion your application internally and smooth over any bumps in the road.

What to Do If You're Labelled "High-Risk"

The term "high-risk" can sound scary, but it's a common flag in the banking world. It’s often applied automatically to general trading licences, businesses that handle a lot of international payments, or those with complex shareholder structures across different countries.

If this happens, it’s not the end of the road. Here's a proven approach:

- Understand Their Position: First, acknowledge their concern. Let them know you understand why they need to be thorough.

- Provide Concrete Proof: This is where you get specific. Offer a list of your main suppliers and key clients to show a clear, legitimate business cycle.

- Demonstrate Your Expertise: A well-crafted business plan is your best friend here. It should clearly outline your industry knowledge and, crucially, your own risk management protocols.

Thinking ahead about these potential hurdles is what separates a prepared applicant from a frustrated one. As specialists in mainland and free zone company formation, we’ve seen it all. We offer cost-effective business setup solutions that include getting you ready for the bank’s questions, ensuring a much smoother journey to getting your account approved.

For a free chat about your specific situation, feel free to WhatsApp Us Today.

Your Top Questions About Opening a RAK Bank Account Answered

Even with the clearest instructions, you’re bound to have a few nagging questions. I get it. Opening a business account is a big step, and you want to be sure about the details.

Let’s tackle the most common questions I hear from entrepreneurs who are exactly where you are right now.

What’s the Real Timeline for Approval?

Bank websites can be a bit optimistic. From what I’ve seen on the ground, a clean, well-prepared application for a straightforward business usually takes about two to four weeks from the day you submit it to the day your account is active. That's the ideal scenario.

But what if your company has a more complicated ownership tree, especially with non-resident owners? Or maybe your business activity is considered high-risk? In those cases, you need to be more patient. The timeline can easily stretch to six weeks or even longer as the bank does its extra homework. The best thing you can do to speed things up is to hand them a flawless set of documents right from the start.

Does RAKBANK Have a Minimum Balance?

Yes, this is a non-negotiable for most of their business accounts. The exact amount you need to keep is tied directly to the account package you choose. For example, their standard Business Current Account often requires you to maintain an average monthly balance of AED 25,000. The premium accounts, like Business Elite, will have a much higher threshold.

Don't panic if you dip below the average. They won't shut down your account, but you will get hit with a monthly fee. Be completely transparent with your relationship manager about what your cash flow actually looks like. It’s far better to pick an account with a lower, more realistic minimum balance than to give away your profits in fees every month.

A word of advice: One of the most common missteps I see is new businesses signing up for an account with a minimum balance that’s just too high for their initial phase. Be honest about your numbers to avoid this simple but costly mistake.

Can a Non-Resident Open a RAKBANK Business Account?

It’s tough, but it can be done. The absolute must-have is a legally registered UAE company, like one in a Free Zone. From there, prepare for a deep dive. The bank's background checks on non-resident owners are incredibly detailed—far more so than for residents.

They'll want to see solid proof of your business operations outside the UAE, a crystal-clear trail for your source of funds, and a compelling reason why you need to bank here. Honestly, your success often comes down to how professionally you present your case and your documents.

Navigating these complexities is where expert guidance becomes invaluable. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we transform the daunting task of bank account opening into a clear, manageable process. We are specialists in Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE.

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation: https://365dayproservices.com