So, you're ready to set up your business in Dubai? It's a fantastic decision. You're stepping into one of the most vibrant and forward-thinking business hubs on the planet, a place that truly serves as a gateway between East and West. Setting up a Limited Liability Company (LLC) here is your ticket to accessing Middle Eastern, European, and Asian markets, all from a tax-friendly and highly supportive base.

Your Blueprint for a Dubai Business Launch

The excitement of launching a business in Dubai is backed by real, tangible advantages. The government has worked hard to create an environment that doesn't just welcome foreign investment but actively encourages it with incredible infrastructure and a refreshingly direct approach to company registration. It's no wonder ambitious founders and major corporations have flocked here.

The biggest pull, of course, is the bottom line. Entrepreneurs enjoy zero personal and corporate income taxes, the freedom to repatriate all capital and profits, and the security of a stable political landscape. Recent legal changes have only sweetened the deal, making the entire setup process more straightforward than ever before.

Mainland vs Free Zone: Your First Big Decision

Before you get into the nitty-gritty, you have a crucial choice to make: will you set up on the Dubai Mainland or in one of the city's 40+ Free Zones? This isn't a minor detail; it fundamentally shapes your company's future, impacting everything from who you can do business with to your ownership structure.

Making the right call here is essential. A Mainland licence offers unrestricted access to the local UAE market, while a Free Zone is often the perfect, cost-effective base for international operations.

Here's a quick breakdown to help you see the difference:

Mainland vs Free Zone: Your First Big Decision

| Feature | Mainland LLC | Free Zone LLC |

|---|---|---|

| Market Access | Can trade directly anywhere in the UAE and internationally. | Primarily for international trade; local trade has restrictions. |

| Ownership | 100% foreign ownership for most commercial activities. | 100% foreign ownership is standard. |

| Office Space | Must have a physical office with a valid Ejari (lease). | Flexible options, including virtual offices, are often available. |

| Government Contracts | Eligible to bid on government projects. | Generally not eligible to work directly with government bodies. |

| Approvals | Requires approvals from the Department of Economy and Tourism (DET). | Governed by its own independent authority. |

Ultimately, the best choice depends entirely on your business model. Are you planning to sell products and services directly to people and businesses inside the UAE? Mainland is likely your answer. Is your focus on exporting, importing, or serving clients outside the country? A Free Zone will probably be a better fit.

Why Dubai's Business Environment Thrives

The numbers speak for themselves. A staggering 59% of all commercial licences issued across the entire UAE come from Dubai. This isn't an accident. It's the direct result of a relentless drive to make things easier for entrepreneurs, spearheaded by the Department of Economy and Tourism (DET), where initiatives like instant licensing have dramatically cut down approval times. You can read more about Dubai's leading role in business registration to see the full picture.

This is exactly why having an expert on your side makes all the difference. As a corporate service provider, we navigate the complexities of both Mainland and Free Zone setups daily. We know the shortcuts, the potential pitfalls, and how to create a cost-effective plan. Our job is to turn what can feel like a complicated journey into a clear, manageable path to launching your business successfully.

Getting the Ownership and Legal Structure Right

One of the first, and most important, conversations we have with any entrepreneur looking to set up here is about the legal structure. Getting this right from the very beginning is absolutely fundamental to a smooth LLC formation in Dubai. For a long time, the rule was simple but daunting for foreign investors: you needed an Emirati sponsor who would hold 51% of your mainland company. That was a huge hurdle for many.

Thankfully, the ground has shifted dramatically.

Recent legal reforms have completely changed the game for company ownership, making Dubai an even more compelling place for international business. Getting your head around these new rules is the first real step toward building a business that’s not just legally compliant, but commercially powerful. This isn’t just about paperwork; it's about setting up your company for maximum control and future growth.

A New Chapter: 100% Foreign Ownership on the Mainland

The biggest news in recent years has undoubtedly been the shift to 100% foreign ownership for mainland LLCs. The entire landscape for LLC formation in Dubai was reshaped by the 2021 Commercial Companies Law reforms. For many businesses, this completely removed the need for a 51% local sponsor, which was a massive win for international investors and high-net-worth individuals. You can find more detail on this transformative legal shift on centuroglobal.com.

What does this mean for you? It means that for a huge list of business activities, you no longer have to give away majority ownership to a UAE national. You get to keep full control over your operations, your profits, and the direction your company takes. This change applies across a broad spectrum of commercial and industrial licences, finally giving you a direct line to the lucrative UAE domestic market without a local partner.

This has been a game-changer for entrepreneurs who wanted to tap into the local customer base and bid on government projects but were understandably wary of the old ownership restrictions. A good corporate service provider can quickly analyse your specific business activities and confirm if you qualify for 100% ownership, making sure you start off on the strongest legal foundation possible.

What Is a Local Service Agent?

While the 51% sponsor is mostly a thing of the past for trading and industrial companies, there's another role you need to know about, especially if your business is in professional services. Think IT consultancies, marketing agencies, design studios, or management services.

For these kinds of professional licences on the mainland, you’ll need a Local Service Agent (LSA).

It's really important not to mix up an LSA with the old sponsor model. They are completely different:

- Zero Ownership: An LSA has absolutely no shares in your company.

- No Operational Control: They can't tell you how to run your business or make decisions for you.

- Purely Administrative: Their job is simply to be your company’s official representative when dealing with government departments for licensing and compliance.

The best way to think of an LSA is as an administrative middleman, not a business partner. You pay them a fixed annual fee for their services, and they provide that essential link to the local authorities without ever touching your autonomy.

Key Takeaway: For professional licences on the mainland, an LSA is a mandatory requirement. They fill a specific procedural role that allows you to maintain full ownership and operational control of your business. It’s the perfect compromise: you get full access to the mainland market with total independence.

Share Capital and Shielding Your Personal Assets

When you're forming your LLC, you'll need to state its share capital in your company's official charter, the Memorandum of Association (MoA). The good news is that Dubai's regulations often don't demand a minimum amount that you have to pay upfront and deposit into a bank. However, you still have to declare a credible and realistic capital amount.

This number should make sense for the kind of business you're running. A small consultancy might declare a capital of AED 100,000, for example, while a larger trading firm handling significant inventory might declare AED 1,000,000.

The real power behind the LLC is right there in the name: "Limited Liability." This structure creates a solid legal wall between the business itself and you, the owner. It means your personal assets—your house, your car, your savings—are protected from any business debts or legal claims. If the worst happens, creditors can only go after the company's assets, not your personal wealth. This peace of mind is one of the biggest reasons so many entrepreneurs choose the LLC structure for their ventures.

Getting Your Dubai Trade Licence: From Paperwork to Reality

Alright, we’ve covered the big picture—choosing between mainland and a free zone. Now, let's get into the nitty-gritty of actually securing your trade licence. This is where your plan to set up an LLC in Dubai transitions from an idea into a tangible, legal entity. It's a series of official steps that, if you know the sequence, can be surprisingly straightforward. But miss a step, and you could find yourself tangled in delays.

The entire process for a mainland company is overseen by Dubai's Department of Economy and Tourism (DET), which you might still hear people refer to by its old name, the DED. They're the central authority for every business registration on the mainland, acting as the gatekeepers to ensure every new company is set up correctly before it can start trading.

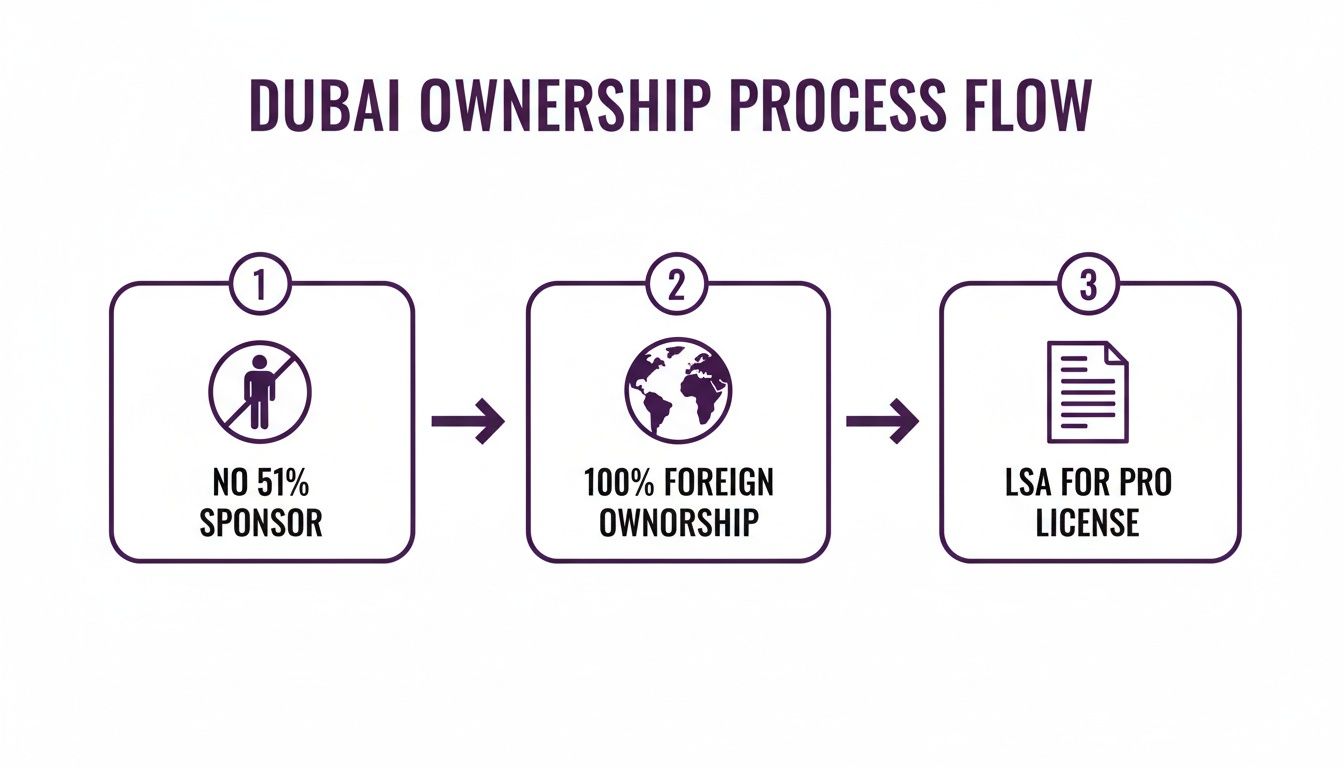

This flowchart maps out the modern ownership journey for entrepreneurs in Dubai. You'll notice it's become much more direct over the last few years.

The big takeaway here is the shift away from mandatory local partners. The path to 100% foreign ownership has opened up significantly, making Dubai an even more attractive hub for international business owners.

Defining Your Business Activities and Trade Name

First things first: you need to decide exactly what your business is going to do. I can't stress this enough. You'll have to pick your specific business activities from a massive DET-approved list of over 2,000 options. This choice is foundational because it directly influences the type of licence you get (commercial, professional, or industrial) and flags any extra approvals you'll need from other government bodies.

For instance, if you're setting up a general trading company, the process is quite standard. But if you plan to open a medical clinic, you'll need separate approvals from the Dubai Health Authority (DHA). Nailing this down at the start saves a world of headaches and extra costs later on.

Next up is reserving your trade name. This isn't just about branding; it's a formal process with strict rules set by the DET.

Here are a few guidelines to keep in your back pocket:

- It must be unique: The name can't already be registered anywhere in the UAE.

- Keep it professional: No offensive or blasphemous terms are allowed.

- It needs to make sense: The name should logically connect to your business activities.

- No personal names (usually): You typically can't use a person's name unless it's your own, and you're a listed partner in the company.

A quick name check by a professional can tell you instantly if your preferred name is available and compliant, which is much faster than submitting it and waiting for a potential rejection.

Securing Initial Approval and Crafting Your MoA

Once your trade name is green-lit, you'll apply for the Initial Approval Certificate. Think of this as the DET giving you a preliminary nod, confirming they have no objections to your business concept. This piece of paper is your key to moving forward with everything else, from drafting your legal documents to signing an office lease.

With that initial approval secured, it's time to formalise your company's structure by drafting the Memorandum of Association (MoA). For an LLC, this is the cornerstone legal document. It clearly lays out:

- The names of all partners and shareholders.

- The ownership percentage for each partner.

- The company’s objectives and all approved business activities.

- How the company will be managed and how profits or losses will be distributed.

The MoA needs to be drafted in both Arabic and English, and then officially notarised by a public notary here in Dubai. This is a non-negotiable step that makes the agreement legally binding for all partners involved.

The Importance of a Physical Office and Ejari

Every mainland LLC in Dubai is required to have a physical office address. This isn't just a box to tick; it's a firm legal requirement. You can't use a P.O. Box or a virtual office address for a mainland licence—it has to be a real, physical space.

After you've found your spot and signed the tenancy contract, the next critical step is registering it with Ejari. This is the online registration system managed by the Real Estate Regulatory Agency (RERA), and it makes your lease official in the eyes of the government.

The Ejari certificate is one of the most vital documents you will submit. Without a valid Ejari, the DET simply will not issue your trade licence. It’s a common hurdle that catches many people out, but it's easy to handle when you know it's coming.

So, once you have your approved trade name, Initial Approval, notarised MoA, and Ejari certificate in hand, you’re on the home stretch. You'll submit this complete package of documents to the DET. After a final review, they'll issue a payment voucher for the licence fees. Once that's paid, your official trade licence is printed, and congratulations—your company is officially registered and ready to do business in Dubai.

Getting a Real Handle on Your Business Setup Costs

One of the first, and most critical, steps in forming your LLC in Dubai is getting a firm grip on the budget. The last thing you want is a surprise bill throwing a spanner in the works right as you’re trying to launch. When you know exactly what costs to expect—from the non-negotiable government fees to the more flexible operational expenses—you can plan your investment with total confidence.

Honestly, a lot of entrepreneurs are pleasantly surprised by how affordable setting up in Dubai has become. It’s a far cry from the old days and is incredibly competitive when you stack it up against other major business hubs around the world.

The Fixed Government Fees: What Everyone Pays

Right out of the gate, you'll encounter a set of standard, one-time government fees. These are the fixed costs every new mainland LLC has to cover with the Department of Economy and Tourism (DET) and a few other authorities. Think of them as the official paperwork and processing charges to get your company legally on the books.

While the exact figures can shift from time to time, here’s a quick rundown of the main government costs you'll need to budget for:

- Trade Name Reservation: A fee to lock in your unique business name.

- Initial Approval Certificate: This is the charge for getting the official thumbs-up to move forward with your chosen business activity.

- Licence Issuance Fee: This is the big one—the main cost for your trade licence. It can vary a bit depending on what your business actually does.

- Notary Fees: You’ll need to have your Memorandum of Association (MoA) legally attested, and this covers that.

- Market Fees: A small percentage of your office's annual rent, which is paid directly to the government.

The main online portal for Dubai's Department of Economy and Tourism is where you’ll handle many of these initial payments and submissions. It’s a crucial touchpoint in the setup process, so getting familiar with it is a good idea.

The Variable Costs: Where Your Choices Matter

Once you get past the standard government charges, you’ll run into a few variable costs that really depend on the specific choices you make for your company. This is where your budget can swing one way or the other, so it pays to be strategic.

Without a doubt, the biggest variable is almost always your physical office. For a mainland LLC, you have to have one. The cost here isn't just the annual rent; you also have to factor in security deposits and any agent fees. The location you pick, the size of the space, and the quality of the building will all have a major impact on this number.

Another variable pops up if your business is in a regulated field like healthcare, education, or food trading. You might need special approvals from other ministries or government departments, which come with their own set of fees.

A Pro Tip from Experience: Don't forget that the size and specs of your office can directly influence how many employee visas you're allowed. If you map out your team's potential growth from day one, you can choose an office that fits your budget now and has room for your future team, saving you the headache and expense of a move later on.

The Myth of Minimum Share Capital

Here’s something that trips up a lot of new entrepreneurs: share capital. Your LLC's Memorandum of Association has to state a specific share capital amount—let’s say AED 300,000 for example. But here's the good news: for most LLCs in Dubai, you don’t actually have to deposit that money into a bank account.

The declared capital is really more of a formality to show the company's financial standing on paper and to define the limit of liability. This is a huge advantage. It completely removes a massive financial hurdle that exists in many other countries and makes the whole startup process much more cash-flow friendly. You can put your funds to work in the business instead of having them locked away.

This practical approach has made setting up an LLC in Dubai incredibly cost-effective. Today, average formation costs can run anywhere from AED 25,000 to AED 27,000. However, savvy providers like 365 DAY PRO Corporate Service Provider LLC have been able to create packages that start from just AED 6,010. You can find some great insights on the affordability of Dubai LLCs that break it down even further.

Why a Cost-Effective Setup Package Just Makes Sense

Sure, you could try to manage every single payment and application yourself. But honestly, this is where leaning on a corporate service provider can save you a world of time, money, and stress. We bundle all the government fees, admin charges, and our professional services into a single, upfront, and transparent package. It doesn't just lead to significant savings; it gives you a predictable budget from the get-go.

Instead of juggling multiple payment portals and chasing down different government departments, you make one simple payment, and we take care of everything else. Our team knows the process inside and out, which means everything gets paid correctly and on schedule. That prevents costly delays and gives you the freedom to focus on what you should be focusing on: building a great business.

Life After the License: Getting Your Business Running

Holding your brand-new trade licence is a fantastic feeling. It's the official green light, the proof that your business legally exists in Dubai. But this is where the real work begins—turning that piece of paper into a fully operational, revenue-generating company.

This next phase is all about activation. It involves a series of mandatory steps to bring your company to life, allowing you to hire staff, open a bank account, and operate in full compliance with UAE law. Let's walk through what comes next.

Activating Your Company With the Establishment Card

The very first document you'll need after your trade licence is the Establishment Card. Don't let its small size fool you; this little card is the key that unlocks the entire visa system for your company.

Issued by the immigration authorities, this card officially registers your business with the General Directorate of Residency and Foreigners Affairs (GDRFA). Without it, you can't sponsor anyone—not yourself as an investor, and certainly not any employees. Think of it as your company's passport. Getting this sorted is your immediate priority.

Navigating the Visa and Emirates ID Process

Once your Establishment Card is secured, you can start the visa process. This journey usually begins with your own Investor Visa, which solidifies your residency status as a business owner in the UAE. From there, you can sponsor visas for your employees.

The path for each visa is pretty standard, but it has several moving parts:

- Entry Permit: First, an electronic permit is issued. This allows the person to enter or remain in the UAE for the purpose of their residency application.

- Medical Fitness Test: Every applicant must pass a mandatory medical screening, which includes tests for specific communicable diseases.

- Emirates ID Biometrics: Next is a trip to an official service centre to provide fingerprints and a photograph for the Emirates ID card.

- Visa Stamping: With a passed medical test and completed biometrics, the residence visa is physically stamped into the applicant's passport. This is the final step.

It can feel like a lot of paperwork and appointments, but it's a well-defined process. Working with a specialist who understands the nuances for both mainland and free zone setups ensures everything is handled correctly, preventing frustrating delays.

Unlocking Your Business Finances: Corporate Bank Account Opening

Ask any seasoned entrepreneur in Dubai what one of the biggest post-licensing challenges is, and they'll likely say "opening the corporate bank account." UAE banks are incredibly thorough, driven by strict international compliance and anti-money laundering regulations. You can't just walk in with a trade licence and expect an account to be opened on the spot.

Success here is all about preparation. You need to present a rock-solid application file that gives the bank complete confidence in your business. This typically includes:

- All your official company documents (licence, MOA, share certificates).

- Passport and visa copies for every shareholder.

- A comprehensive business plan detailing your model, target customers, and financial forecasts.

- Proof of your physical address (your Ejari).

- Sometimes, they'll ask for your professional CV or even copies of contracts with potential clients or suppliers.

Insider Tip: Never underestimate the power of a good business plan. A clear, well-written document that shows you've thought through your operations and financials can be the deciding factor for a bank. It proves you're a serious professional, not just a hopeful applicant.

Some banks are far more receptive to new ventures and certain industries than others. An advisor with established banking relationships can make introductions and help you craft an application package that ticks all the boxes, dramatically improving your chances of a quick approval.

To help you keep track of all the post-licence to-dos, here’s a quick checklist of the essential operational steps you'll need to take.

Your Operational Checklist After Getting Licensed

| Task | Purpose | Key Authority or Entity |

|---|---|---|

| Get Establishment Card | Registers your company with immigration, allowing you to sponsor visas. | GDRFA (Immigration) |

| Apply for Investor Visa | Secures your personal residency status as the business owner. | GDRFA / Relevant Free Zone Authority |

| Open Bank Account | Enables you to manage business finances, accept payments, and pay expenses legally. | Your Chosen UAE Bank |

| Hire Staff & Get Visas | Builds your team and ensures all employees have the legal right to work and reside in the UAE. | Ministry of Human Resources & Emiratisation (MOHRE), GDRFA |

| Register for Taxes | Ensures compliance with federal tax laws (VAT and Corporate Tax) to avoid penalties. | Federal Tax Authority (FTA) |

| Renew Trade Licence | Keeps your business in good legal standing and allows you to continue operating without interruption. | DED / Relevant Free Zone Authority |

Following these steps methodically will ensure a smooth transition from a paper company to a thriving business.

Staying Compliant for Long-Term Success

Once you're up and running, your focus will naturally shift towards growth. But it's crucial to keep compliance on your radar to ensure long-term success and avoid hefty fines.

The two big areas to monitor are tax and your annual licence renewal. You are legally required to register for Value Added Tax (VAT) if your annual turnover is projected to exceed AED 375,000. Similarly, you must register for Corporate Tax, which is levied on net profits that exceed AED 375,000.

Finally, don't forget your trade licence has an expiry date. It must be renewed every year, a process that involves submitting your updated Ejari and any other required documents. Missing the deadline can result in fines and a halt to your operations. As your company grows, you might also find it beneficial to explore common outsourced services to handle tasks like accounting or IT, letting you focus on your core business.

Common Questions on Dubai LLC Formation

Setting up a business in Dubai for the first time brings up a lot of questions. It’s completely normal. As you get started with your LLC formation in Dubai, you need clear, straightforward answers. Let's tackle some of the most common queries we hear from entrepreneurs just like you.

Can I Get 100% Ownership of a Mainland LLC in Dubai?

Yes, for most business activities, you absolutely can. Thanks to major updates in the UAE Commercial Companies Law, foreign investors can now own 100% of a mainland LLC. This change has been a game-changer, removing the old requirement for a local Emirati sponsor.

However, there are still a few exceptions. Certain strategic sectors—think oil and gas or key public services—have their own specific ownership rules. It's always best to confirm upfront. A quick chat with a business setup consultant can verify if your specific business activity qualifies for full foreign ownership, making sure you start on the right foot.

What Is the Difference Between a Local Sponsor and a Local Service Agent?

This is a critical point and one that often causes confusion. Let's break it down.

A Local Sponsor used to be the mandatory 51% Emirati shareholder for most mainland companies. This rule is now largely a thing of the past for commercial and industrial businesses. The sponsor held a majority stake and had significant legal say in the company's operations.

A Local Service Agent (LSA) is a completely different role. You'll need one if you're setting up a professional services business on the mainland—like a consultancy, an IT firm, or a marketing agency—and you have 100% foreign ownership. An LSA holds no shares in your company and has zero management control. Their job is simply to be your official link with government departments, and they do this for a fixed annual fee. They handle paperwork, not your business strategy.

Do I Need a Physical Office to Set Up an LLC in Dubai?

If you're setting up on the mainland, then yes, a physical office is a must. You'll need a valid Ejari—the official lease registration from the Real Estate Regulatory Agency—to get your trade licence. You can't just use a virtual office address for a mainland company. The size and location of your office also often determine how many employee visas you can apply for.

Free zones, on the other hand, offer much more flexibility. Many provide options like co-working spaces, flexi-desks, or even virtual office packages. For startups or businesses that don't need a physical footprint in the local market, this can be a much more budget-friendly route.

Key Insight: Your choice between mainland and a free zone has a direct impact on your office needs. Mainland requires a physical lease as part of the application, while free zones offer adaptable, lower-cost solutions that are perfect for international or remote-first businesses.

How Long Does the Entire LLC Formation Process Take?

The good news is that forming an LLC in Dubai is faster than ever. The initial steps, like getting your trade name reserved and securing the initial approval, can often be done in just a day or two.

From submitting the full application to having the final trade licence in your hands, you're typically looking at about one to two weeks. After that, you have the post-setup tasks: processing visas and opening your corporate bank account, which can take another two to four weeks. Working with an experienced team can really speed things up, as they'll make sure every document is correct the first time, helping you sidestep those common delays.

Ready to turn your business idea into a reality in Dubai? The process can be surprisingly smooth when you have the right experts in your corner. As the best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we specialise in both Mainland and Freezone company formation across the UAE.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com