If you're thinking about starting a business in the UAE, you'll quickly run into one very important acronym: LLC. A Limited Liability Company isn't just a popular choice; it's the most flexible and widely used business structure for entrepreneurs in Dubai, Abu Dhabi, and across the Emirates. It hits the sweet spot, offering both operational freedom and crucial protection for your personal assets. As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we've guided countless entrepreneurs through this process.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

What Are LLC Companies in the UAE?

The best way to think of a Limited Liability Company (LLC) is as a legal shield for you, the business owner. It turns your business into its own legal person—a separate entity completely distinct from your personal finances. This separation is the single biggest advantage of an LLC.

What does that mean in practice? If your business runs into debt or faces a lawsuit, your personal assets—your house, your car, your savings—are off-limits. Your financial risk is "limited" to the amount you've put into the business itself. For any entrepreneur, that peace of mind is invaluable.

The Modern Advantage of a UAE LLC

It wasn't always this straightforward. For years, setting up a mainland LLC meant finding an Emirati sponsor who would hold 51% of your company's shares. But that's all changed. Thanks to landmark legal reforms, this requirement has been scrapped for the vast majority of business activities.

Today, foreign entrepreneurs can have 100% ownership of their mainland companies. This has been a complete game-changer, throwing the doors wide open for global investment. The numbers speak for themselves: in the first quarter of 2024, new business registrations in the UAE jumped by a massive 16%, driven largely by the new, more accessible LLC structure.

An LLC structure effectively balances legal protection and operational benefits. It allows you to take advantage of the strengths of both corporate and partnership models, protecting you from personal liability in most instances while offering flexibility.

Why It Is the Preferred Choice

The LLC model is incredibly versatile. It works just as well for a small retail shop in a Dubai mall as it does for a major international trading firm in Abu Dhabi. While there are several business structures to consider, understanding the general principles of limited companies helps highlight why the LLC is so dominant in the UAE.

Its popularity boils down to a few key reasons:

- Asset Protection: It builds a firewall between your business liabilities and your personal wealth.

- Ownership Flexibility: The move to 100% foreign ownership is a massive draw for international investors.

- Market Access: A mainland LLC gives you unrestricted access to trade directly within the lucrative UAE local market.

- Credibility: This structure looks professional and enhances your standing with banks, suppliers, and customers.

Now, let's dig into the different types of LLCs available and figure out which one is the right fit for your ambitions.

Choosing Between a Mainland and Free Zone LLC

Once you’ve settled on the LLC structure, your first big question is where to set it up. This isn’t just about choosing an office; it's a strategic decision that will define your customer base, your operational rules, and ultimately, your company's potential. In the UAE, you’re looking at two main jurisdictions: Mainland and Free Zone.

Each route has its own unique benefits and is built for different business goals. Getting this choice right from day one is absolutely crucial, as it sets the foundation for everything that follows. Think of it like this: a Mainland company is like a retail shop on a bustling high street, while a Free Zone company is like a high-tech warehouse built for global distribution.

The Mainland Advantage: Your Key to the Local Market

A Mainland LLC is your all-access pass to the entire UAE economy. If your plan involves opening a cafe, a clinic, a consultancy, or any business that deals directly with customers and companies inside the Emirates, this is the path for you. You have complete freedom to trade anywhere in Dubai, Abu Dhabi, or the other emirates without needing any intermediaries.

Imagine you want to open a chain of restaurants or bid on a major government construction project. These activities demand a Mainland licence, which is issued by the Department of Economic Development (DED) in the respective emirate. This setup gives you the freedom to grow and establish a physical presence anywhere you see an opportunity across the country.

A Mainland LLC offers total flexibility to operate, trade, and expand anywhere within the UAE’s borders. It’s the go-to structure for anyone serious about capturing a share of the local market.

We are specialists in Mainland Company Formation in Dubai & Abu Dhabi, and we know the DED process inside and out. The core strength of a Mainland setup is this direct market access, positioning your business to fully engage with the vibrant local economy.

The Free Zone Advantage: A Global Hub with Tax Perks

On the other hand, a Free Zone is a special economic area with its own independent governing authority and rules. The UAE has over 40 Free Zones, and many are themed around specific industries like technology, media, logistics, or commodities. An LLC in a Free Zone is a fantastic choice for international trade, e-commerce businesses, or consultancies with a global client base.

Picture a software development company that serves clients in Europe, Asia, and the US. Setting up in a tech-focused hub like Dubai Internet City makes perfect sense. While you can't trade directly with customers on the UAE mainland from your Free Zone base (you’d need a local distributor), the benefits are huge: 100% foreign ownership, 100% repatriation of profits, and no import or export duties. As international entrepreneurs, you can enjoy UAE tax benefits through this structure.

As specialists in Freezone Company Formation across the UAE, we guide international entrepreneurs to the perfect jurisdiction for their business model, helping them tap into the UAE's incredible tax efficiencies.

Mainland LLC vs Free Zone LLC: A Head-to-Head Comparison

To help you visualise the right path for your LLC companies in the UAE, let's put these two powerful options side-by-side. This quick comparison table highlights the fundamental differences you need to know.

Mainland LLC vs Free Zone LLC Key Differences at a Glance

| Feature | Mainland LLC | Free Zone LLC |

|---|---|---|

| Market Scope | Unrestricted access to the entire UAE local market. | Restricted to operating within the Free Zone and internationally. |

| Ownership | Now offers 100% foreign ownership for most activities. | 100% foreign ownership is a standard feature. |

| Office Space | Mandatory physical office space required (Ejari). | Flexible options, including virtual desks and shared facilities. |

| Governing Body | Department of Economic Development (DED) in each emirate. | Independent Free Zone Authority for each specific zone. |

| Visa Eligibility | Generally tied to the size of the physical office space. | Quotas are often pre-approved based on the business package. |

| Customs Duty | Standard 5% customs duty on imported goods. | 0% customs duty on goods imported into the Free Zone. |

Making the right choice is paramount. A Mainland company gives you unrivalled access to the lucrative local market, whereas a Free Zone provides a cost-effective, tax-friendly base for global operations. Our cost-effective business setup solutions tailored to your needs are designed to analyse your specific needs and point you to the jurisdiction that best fits your vision, backed by our 24/7 support service – always here when you need us.

So, Can You Really Own 100% of a Mainland Company?

For a long time, the answer was a firm "no." The rule of the land for mainland businesses was clear: you needed a UAE national as a partner, and they had to hold a 51% majority share. For many international entrepreneurs, this was the biggest hurdle to setting up shop in the UAE.

But things have changed. Dramatically. A landmark legal overhaul has flipped this old model on its head, moving the country away from the mandatory sponsorship system and opening the doors wide for global investors. For most business types, the old rules are simply gone, replaced by a framework that puts you, the foreign investor, in complete control.

The New Reality of Mainland Ownership

The big moment came when the UAE amended its Commercial Companies Law. This single change effectively wiped out the need for an Emirati sponsor for a huge list of business activities. What does this mean for you? It means for most commercial and industrial businesses, you can now own 100% of your mainland LLC. You keep all the profits and have the final say on every single decision.

This wasn't just a small tweak; it was a fundamental shift that has supercharged foreign investment. After the restrictions were lifted between 2021 and 2022, we saw a massive wave of international entrepreneurs setting up mainland companies, including single-person LLCs. This was all formalised by legislation like Cabinet Decision No. 77 of 2022. You can get a deeper dive into these legal shifts from experts like Baker McKenzie, who explain how these changes are shaping business in the UAE in 2025.

Finding Your Place on the "Positive List"

Okay, so how do you know if your specific business idea qualifies for 100% ownership? The key is something often referred to as the "Positive List." Every Department of Economic Development (DED) across the emirates—be it Dubai, Abu Dhabi, or elsewhere—publishes a list of business activities eligible for full foreign ownership.

And this list is incredibly broad, covering well over 1,000 commercial and industrial activities. We're talking about things like:

- General Trading: Importing, exporting, and distributing all kinds of goods.

- Manufacturing: Everything from food products to electronics and machinery.

- E-commerce: Running online stores and handling the logistics behind them.

- Construction: Taking on building projects and other contracting work.

- Hospitality: Opening and running restaurants, cafes, and hotels.

Getting this part right is your first critical step. As specialists in Mainland Company Formation in Dubai & Abu Dhabi, this is our bread and butter. We'll help you pinpoint the exact DED activity code that matches your business, making sure you qualify for 100% ownership from day one.

What About Professional Services? A Different Approach

While the rules have opened up for traders and manufacturers, professional services—like consulting, marketing, or IT support—still have their own unique structure. Here, a UAE national is still involved, but their role has completely changed.

You don’t need a majority shareholder. Instead, you appoint what’s called a Local Service Agent (LSA).

Think of an LSA as an administrative representative, not a partner. They hold zero shares, have no control over your business, and don’t touch your profits. Their job is simply to act as your liaison for certain government paperwork, and for this, they receive a fixed annual fee.

This setup is the best of both worlds. It allows you to maintain 100% ownership and operational control of your professional firm while staying fully compliant. Our team makes sure the LSA agreement is watertight, protecting your interests completely. And with our 24/7 support service, we're always on hand to talk you through these kinds of details.

The Step-by-Step LLC Formation Process

Turning a business idea into a legally registered company in the UAE might seem like a daunting pile of paperwork. In reality, it’s a series of logical, manageable steps. Think of this section as your roadmap for forming an LLC in Dubai, Abu Dhabi, or Sharjah. We’ll walk you through each stage, from initial planning right up to the moment you’re holding your official trade licence.

Following these steps isn't just about ticking boxes; it's about building a solid, compliant foundation for your entire venture. Let's break down the journey into a practical, easy-to-follow guide.

Step 1: Finalise Your Business Activities and Legal Structure

First things first: you need to decide exactly what your business will do. Are you trading goods, offering consultancy, or maybe developing software? The Department of Economic Development (DED) has a massive list of approved activities, and your choice determines the kind of licence you get—commercial, professional, or industrial.

This decision is foundational. It directly impacts your eligibility for 100% foreign ownership. As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we help you pinpoint the precise activities that match your business model, securing your full ownership rights from day one.

Step 2: Reserve Your Trade Name and Get Initial Approval

Your company’s name is its identity, but it also has to play by the UAE's rules. The name can't be offensive, use religious or political references, and most importantly, it must be unique. Once you’ve got a few options, you’ll submit them to the DED for reservation.

At the same time, you’ll apply for your Initial Approval. This is basically a preliminary green light from the authorities, confirming they have no objection to your business concept. Consider it an "approval in principle" that unlocks the next stages, like drafting your legal documents.

Step 3: Draft and Notarise Your Memorandum of Association

The Memorandum of Association (MOA) is the legal constitution of your LLC. It's a critical document that outlines the company's structure, shareholding (even if you own 100%), business objectives, and operating rules. For any mainland LLC, this document has to be drafted in both English and Arabic.

Once it’s drafted, all shareholders must sign the MOA in front of a public notary. This step makes it a legally binding agreement and is non-negotiable. Our team makes sure your MOA is drafted flawlessly to protect your interests and prevent any future headaches.

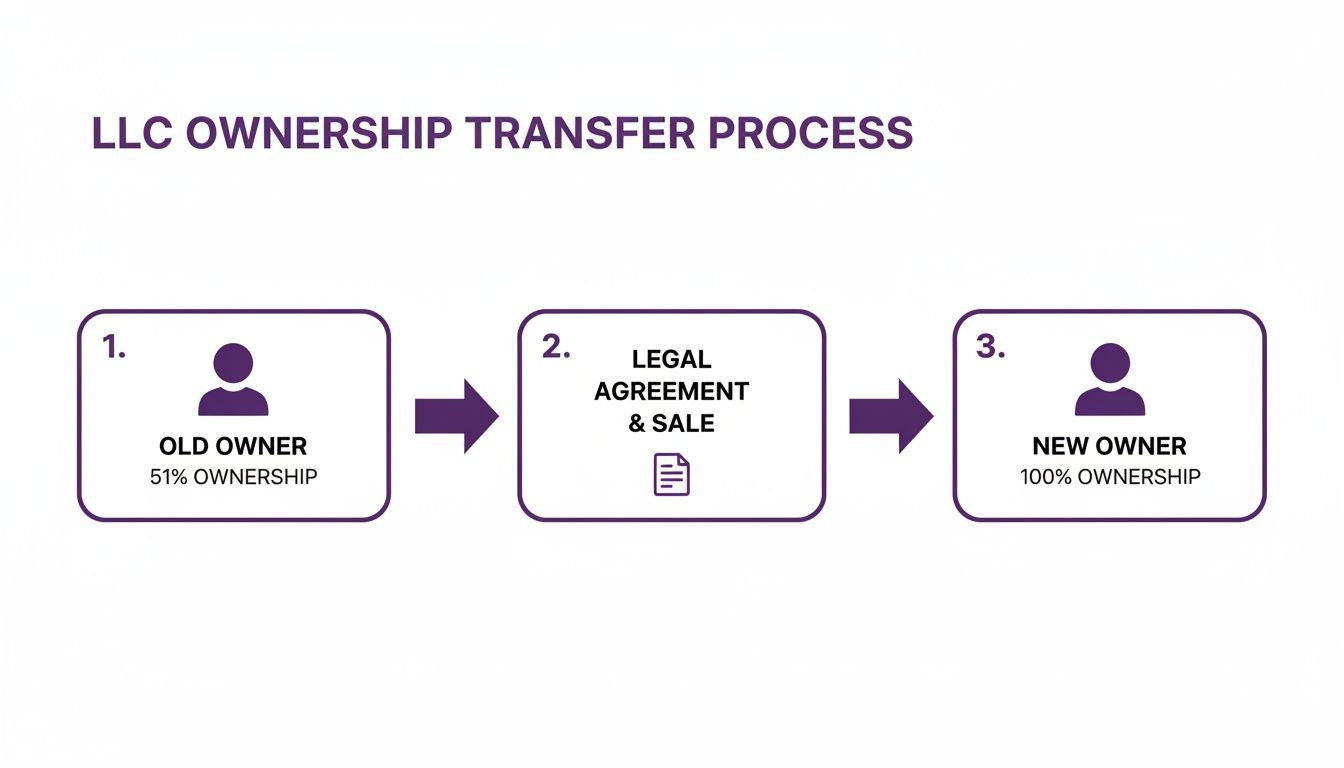

This flowchart shows the pivotal shift from the old shared ownership model to the current 100% foreign ownership structure, a key change impacting the MOA.

This visualisation clearly illustrates how recent legal reforms have empowered international entrepreneurs by removing the need for a mandatory 51% local partner.

Step 4: Secure Your Physical Office and Ejari

Every single mainland LLC in the UAE needs a physical address. There’s no way around it. You’ll have to lease a commercial space and register the tenancy contract with Ejari, the government’s online registration system. The resulting Ejari certificate is the official proof of your physical presence, and it's essential for getting your trade licence.

This isn’t just about having a place to work. Your office size directly impacts how many employee visas you can apply for, making it a strategic decision. We offer cost-effective business setup solutions tailored to your needs that include helping you find and secure a suitable office that meets your budget and operational needs.

Step 5: Submit Final Documents and Open a Corporate Bank Account

With your key documents in hand—Initial Approval, notarised MOA, and Ejari certificate—you’re on the home stretch. You'll make the final submission to the DED. Once they review and approve everything, they'll issue a payment voucher for the trade licence fees. As soon as you pay, your official trade licence is issued.

But you're not quite done. The final, crucial step is opening a corporate bank account, which is mandatory for all LLC companies in UAE to manage business finances legally. A critical part of establishing your LLC involves setting up banking facilities. This guide provides practical steps on how to open a foreign bank account, a necessary step for your UAE operations.

The entire process, from name reservation to licence issuance, can feel complex. Our role is to manage every submission, follow up with every department, and handle all the paperwork, turning a potentially stressful journey into a smooth and predictable path to launch. With our 24/7 support service – always here when you need us, we’re always here when you need us.

Budgeting for Your LLC Setup: Costs and Timelines

Launching a business successfully in the UAE starts with a solid plan, and that means getting a real handle on the money and time involved. When you’re forming an LLC, it's not just one single fee you need to think about. Your total investment is a mix of government charges, third-party costs like office rent, and any professional fees for expert help.

Getting a clear picture of these costs from the get-go is crucial. It stops any nasty surprises from popping up later and lets you budget properly for everything, from getting your trade licence in hand to sponsoring your first employee visa. Think of it as building a strong financial foundation for your new venture.

Breaking Down the Core Costs

The final bill for setting up your LLC will depend on a few things: your specific business activity, the emirate you choose (like Dubai or Abu Dhabi), and how you plan to operate. That said, the expenses generally fall into a few predictable categories. Our cost-effective business setup solutions tailored to your needs are built around giving you total clarity on this, packaging everything into one straightforward quote.

Here’s a look at what you’ll typically need to budget for:

- Government Fees: This is usually the biggest chunk of the cost. It covers reserving your company name, getting the initial approval, and the final issuance of your trade licence from the Department of Economic Development (DED).

- Office Rental and Ejari: A physical office space is a must for a mainland LLC. This cost includes your annual rent and the fee for registering your tenancy contract with the Ejari system.

- Visas and Establishment Card: You'll need to pay for your company’s Establishment Card first. After that come the costs for your own investor visa and any employee visas, which include fees for medical tests and Emirates ID applications.

- Document Attestation and Notarisation: Your Memorandum of Association (MOA) has to be notarised. If you have documents from outside the UAE, they’ll likely need to be legally attested, and both of these services have their own fees.

Getting Your Paperwork in Order

One of the best ways to avoid delays is to gather all your documents before you even start. A single missing or incorrect paper can grind the whole process to a halt. We walk our clients through this step-by-step to make sure everything is perfect before it’s submitted.

For Individual Shareholders:

- Clear passport copies for all partners (make sure they have at least six months of validity left).

- A copy of your UAE residence visa, if you already have one.

- A No Objection Certificate (NOC) from your current sponsor if you're currently employed in the UAE.

For the Company Itself:

- The filled-out application form for initial approval.

- A list of three to five potential trade names for your business.

- The final, agreed-upon draft of your Memorandum of Association (MOA).

Understanding the Setup Timeline

While every business is a little different, having a realistic timeline helps you plan your next steps, like hiring staff or launching your marketing. With our experience and connections, we can often speed things up, but it's good to have a general idea of the standard timeframe.

You can expect the whole process—from reserving your name to holding your official trade licence—to take somewhere between one and three weeks for a mainland company. Keep in mind, if your business activity needs special approvals from other government bodies, that can add extra time. Our job is to stay on top of all that for you.

Here’s a quick look at how the timeline usually plays out:

- Initial Approvals (1-3 days): This is where we reserve your trade name and get the initial nod from the DED.

- MOA and Office Setup (3-5 days): While we’re drafting and notarising your MOA, you’ll be finalising your office lease and getting it registered with Ejari.

- Final Submission and Payment (2-4 days): All documents are submitted to the DED, and the final government payment voucher is issued and paid.

- Licence Issuance (1-2 days): Your official trade licence is issued!

- Post-Licence Formalities (1-2 weeks): With the licence in hand, we apply for the company’s Establishment Card and then start the visa process.

Thanks to our 24/7 support service, we’re always on hand to give you an update. We’ll make sure you know exactly where things stand at every stage, making the whole process feel predictable and smooth so you can focus on the exciting part: getting ready to open for business.

Visas, Compliance, and Keeping Your Business Running

Getting your trade licence is a fantastic first step, but it’s really just the beginning of your journey. Now, the real work starts: bringing people on board, managing visas, and making sure your LLC company in the UAE stays on the right side of the law.

This is the stage where your business truly comes to life. It’s all about navigating the different government departments for residency visas, staying up-to-date with labour laws, and handling your financial reporting. Getting this part right is absolutely critical for the long-term health and success of your company.

Getting Visas for Yourself and Your Team

Whether it's for you as the investor or for the team you’re hiring, getting residency visas is a well-defined process. It takes careful coordination with several government bodies, but each visa follows a clear path from application to the final stamp in your passport. This is where a good PRO service becomes your best friend, handling the entire workflow for you.

Here’s a quick look at the typical visa journey:

- Entry Permit: First, we secure an entry permit. This is the official green light for you or your employee to enter the UAE for work.

- Medical Fitness Test: Once you're in the country, a mandatory medical screening at a government-approved health centre is next.

- Emirates ID Application: This is where biometric data—fingerprints and a photo—is taken for the Emirates ID, which is the official identification card for every resident.

- Visa Stamping: The final step. The passport is submitted to immigration, and the official residence visa is stamped inside.

We handle this whole process from start to finish. It doesn't matter if you're applying for your own investor visa or processing a large batch for a new team; we make sure it all happens without a hitch, avoiding any delays that could throw a wrench in your plans.

Staying on Top of Ongoing Compliance

Running a business here isn’t just about making sales. It requires a constant eye on compliance to meet all the national regulations. Dropping the ball on this can lead to hefty fines, having your operations frozen, and can seriously tarnish your company's reputation.

Think of compliance like regular maintenance for your car. You wouldn't skip an oil change and expect the engine to run forever. Keeping up with renewals and regulations is what keeps your business engine running smoothly and legally.

Your main ongoing duties will include:

- Annual Licence Renewal: Every year, your trade licence needs to be renewed with the relevant economic department or free zone authority. This usually requires submitting updated documents, like your office tenancy contract (Ejari).

- Tax Obligations: You need to keep up with UAE tax laws. This means registering for and filing Value Added Tax (VAT) returns if you cross the revenue threshold, as well as handling your Corporate Tax duties.

- Labour Law Adherence: All your employment contracts and workplace practices must follow the UAE Labour Law, which is overseen by the Ministry of Human Resources and Emiratisation (MOHRE).

We get it—you want to focus on growing your business, not getting buried in paperwork. Our team takes care of all the government liaison and document renewals for you. And with our 24/7 support service – always here when you need us, we’re always on hand to help, ensuring your company stays in perfect legal standing so you can focus on what really matters.

Common Questions We Hear About UAE LLCs

When you're setting up a company in the UAE, the big picture is important, but it's the small, practical details that often cause the most confusion. Let's tackle some of the most common questions entrepreneurs ask us as they get started.

Can I Run My LLC From My Apartment?

This is a very common question, but for a formal Mainland or Free Zone LLC, the answer is generally no. While some very specific freelance permits might allow it, a proper LLC needs a legitimate, physical office space.

The authorities require this, and your tenancy contract (the Ejari) is the official proof they need to issue your trade licence. Think of it as your company's official home base.

How Many Staff Visas Can I Get for My Company?

Your visa quota isn't unlimited; it's directly tied to the size of your office. The general rule of thumb is that you're allocated one visa for every 80-100 square feet of office space you rent.

Of course, your specific business activity and the rules of your chosen jurisdiction (Mainland vs. a particular Free Zone) can also affect the final number.

Your visa allocation is directly linked to your company's physical infrastructure and operational scale. Planning your office space strategically is key to ensuring you can sponsor the team you need to grow.

What’s the Big Deal If I Don’t Renew My Trade Licence?

Failing to renew your trade licence on time is a serious misstep with costly consequences. The government will hit you with significant financial penalties, and these fines grow the longer you delay.

Worse than the fines, an expired licence can get your corporate bank account frozen. You also won't be able to sponsor new employees or renew visas for your existing team, and you risk getting the company—and even its owners—blacklisted.

Do I Really Need a Corporate Bank Account?

Absolutely. Opening a corporate bank account isn't just a good idea; it's a legal requirement once your LLC is registered. All your business transactions must go through this account.

It’s crucial for keeping your finances clean for audits and tax purposes. Trying to run your business through a personal bank account is strictly against UAE regulations and will land you in hot water.

Navigating these rules doesn't have to be a headache. Working with an experienced partner means you don't have to guess. We make sure you have the right office, understand your visa limits, and never miss a critical deadline.

At 365 DAY PRO Corporate Service Provider LLC, we provide clear, practical guidance on every part of your business setup. Contact us today to learn more about our cost-effective solutions for LLC companies in the UAE.