Before you can even think about filling out forms on the Federal Tax Authority (FTA) portal, you need to answer one fundamental question: does your business actually need to register for VAT in the UAE?

Getting this wrong can lead to some hefty penalties and a lot of unnecessary stress down the line. It's not as simple as looking at your total revenue; what truly matters is the value of your taxable supplies.

Understanding Your VAT Registration Obligations

When Value Added Tax (VAT) was introduced back on 1st January 2018, it changed the game for businesses across the country. The system was set up with two key thresholds to accommodate businesses of all sizes, from small startups to large enterprises.

Your obligation to register hinges on your turnover from taxable supplies and imports. If your business turnover hits AED 375,000, you are legally required to register. For businesses with a turnover above AED 187,500, registration becomes a strategic option.

Mandatory vs Voluntary Registration

The UAE's tax rules give you two distinct paths for VAT registration, and the one you take depends entirely on your turnover. You need to look at your financial performance over the past 12 months, or what you realistically project for the next 30 days.

-

Mandatory Registration: This is non-negotiable. If the value of your taxable supplies and imports has crossed AED 375,000 in the last 12 months, you have a legal duty to register. This also applies if you have solid grounds to believe you'll hit that number in the next 30 days.

-

Voluntary Registration: This is where things get interesting for smaller, ambitious businesses. If your turnover is above AED 187,500 but still under the mandatory limit, you can choose to register. Why would you? A big reason is the ability to reclaim the VAT you pay on your own business purchases, which can be a real boost for your cash flow.

A classic rookie error is only checking turnover at the end of the financial year. The FTA looks at a rolling 12-month period. This means you need to keep a constant eye on your numbers to avoid missing your registration deadline.

Here's a quick reference to make sense of these thresholds.

UAE VAT Registration Thresholds at a Glance

This table breaks down the two key turnover levels that dictate your VAT registration status in the UAE.

| Registration Type | Annual Taxable Supplies Threshold (AED) | Who It Applies To |

|---|---|---|

| Mandatory | Exceeds AED 375,000 | Any business whose taxable supplies and imports in the past 12 months (or next 30 days) are above this limit. |

| Voluntary | Exceeds AED 187,500 | Any business whose taxable supplies and imports are above this limit but below the mandatory threshold. |

Understanding where you fit is the absolute first step in your VAT compliance journey.

Calculating Your Annual Turnover Correctly

Figuring out your turnover for VAT isn't just a matter of adding up all your sales. The calculation must only include the value of your taxable supplies—that is, the goods and services that are subject to either the standard 5% VAT rate or the 0% rate.

Let's walk through a practical example. Say you run a consultancy firm in Abu Dhabi. Over the last 12 months, you've brought in AED 400,000. Digging deeper, you see that AED 350,000 came from local clients (standard-rated at 5%) and AED 50,000 was from a project for a client outside the GCC (zero-rated).

Both of these revenue streams count towards your taxable turnover. Since your total (350,000 + 50,000) is AED 400,000, your firm has officially passed the mandatory AED 375,000 threshold and must register for VAT.

Crucially, any income from exempt supplies—like certain financial services or the sale of bare land—is excluded from this calculation. It's a fine distinction, but one that can make all the difference. While based on UK law, this guide can help you think through how to determine if your business needs to register for VAT—just be sure to apply the specific UAE thresholds. For any entrepreneur, especially those setting up a business in Dubai or Abu Dhabi, mastering this calculation is key to staying compliant and avoiding penalties from day one.

Preparing Your Documents for a Flawless Application

So, you've confirmed that your business needs to register for VAT in the UAE. What’s next? The single most important step you can take right now is to get all your paperwork in order. I can’t stress this enough.

Rushing into the online application without having every document prepared, scanned, and correctly formatted is the number one reason we see applications get delayed or flat-out rejected. A successful submission starts with meticulous preparation, not with logging into the portal.

Think of it this way: you’re building a case for the Federal Tax Authority (FTA). You need to provide clear, undeniable proof of your business's identity, its legal standing, and its operations. Any missing or inconsistent document immediately raises a red flag and puts your application on the slow track.

The Core Documents Every Business Needs

No matter where your business is based—be it on the mainland, in a free zone, or if you're a sole trader—the FTA has a list of foundational documents they need to see. These are non-negotiable and form the backbone of your entire application.

Before you even think about starting the online form, make sure you have clear, high-resolution digital copies of these essentials:

- Valid Trade Licence: This is your primary proof of legal operation. Double-check that it hasn't expired.

- Passport Copies: You'll need scans for the business owner and every single partner or shareholder.

- Emirates ID Copies: Same as above—copies are required for the owner and all partners.

- Proof of Authorised Signatory: This is typically a power of attorney or a similar legal document that officially names the person who can act on the company’s behalf.

- Company Bank Account Details: You need to provide your official IBAN. Make sure it's on a formal letterhead from your bank.

Getting all of this ready before you even visit the Federal Tax Authority's e-Services portal will make the actual submission process infinitely smoother.

Tailoring Your Checklist to Your Business Structure

Beyond the basics, the paperwork you need will change depending on your company's legal structure. The requirements for a Mainland LLC are different from those for a Free Zone establishment, which are different again for a sole proprietorship. This is a common trip-up point for many applicants.

For a Mainland LLC in Dubai or Abu Dhabi:

- Memorandum of Association (MOA): Your company's foundational legal document. It outlines the business structure and the relationship between shareholders.

- Company Contact Information: This includes your official registered address, P.O. Box, and primary contact numbers.

For a Free Zone Company:

- Certificate of Incorporation: The official registration certificate issued by your specific free zone authority.

- Customs Registration Details (if applicable): If you import goods, you must provide your customs code and related registration information.

For a Sole Proprietorship:

- Proof of Income: The FTA needs to see evidence that supports your turnover declaration. This could be audited financial statements, unaudited accounts, or even a detailed revenue forecast if your business is brand new.

Common Pitfalls That Lead to Application Rejection

As specialists who have guided countless businesses through this process in Dubai, Abu Dhabi, and Sharjah, we've seen it all. The good news is that by knowing the common mistakes, you can easily avoid them and save yourself weeks of frustrating back-and-forth with the FTA.

A rejected application is rarely about the viability of the business itself. It’s almost always about the quality of the submission. Mismatched names, blurry scans, or an expired trade licence are simple, avoidable errors that bring the entire process to a grinding halt.

Pay very close attention to these details:

- Poor Quality Scans: Every document must be scanned in high resolution and be perfectly legible. A blurry passport copy is an instant rejection.

- Expired Documents: Before you upload anything, check the validity dates on your trade licence, passport, and Emirates ID. An expired document guarantees a rejection.

- Mismatched Information: The owner's name must be written exactly the same way across the trade licence, passport, and bank account details. Even a minor variation will cause a problem.

- Incomplete Financials: Your turnover declaration isn't just a number you type in; it has to be backed by solid proof. Vague or unsupported figures will trigger a request for more information, adding weeks to your registration timeline.

By assembling a complete and accurate document package from the get-go, you set the stage for a quick, smooth approval. If you're feeling unsure about any requirement, our team is on hand with 24/7 support to guide you, making sure your application is perfect right from the start.

Alright, with all your documents gathered and ready to go, it’s time to tackle the main event: the online application through the Federal Tax Authority (FTA) portal.

First-timers often find the portal a bit intimidating, but once you get into it, you'll see it's a pretty logical process. Think of it less as a complex government form and more as a detailed conversation about your business. We’re going to walk through it step-by-step, focusing on the sections where people usually get tripped up. The goal here is to get it right the first time and avoid those frustrating back-and-forth emails with the FTA.

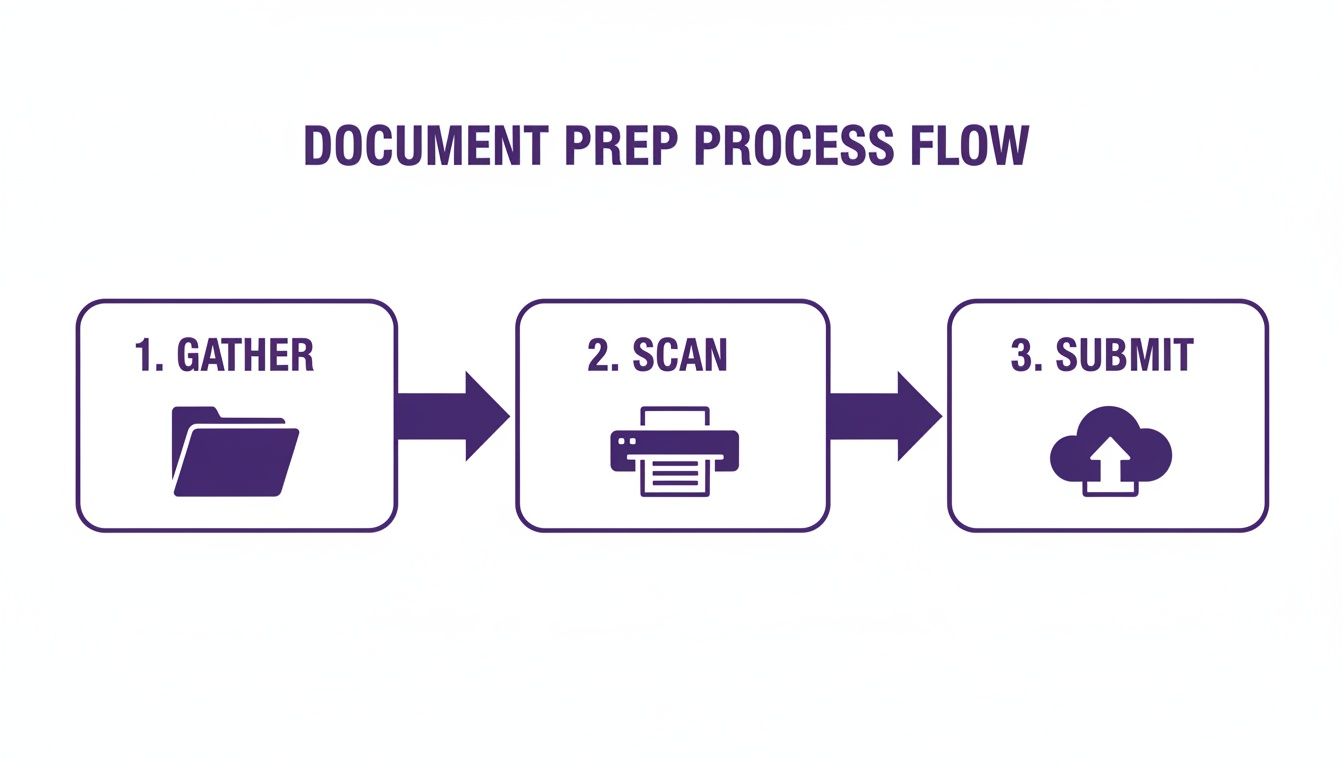

Before you even log in, remember the groundwork you've already done.

This simple flow is key. Having everything scanned and correctly labelled beforehand makes the online part surprisingly quick. The real work happens offline.

Getting Started: Your e-Services Account

The first thing you’ll do on the FTA’s e-Services portal is create a new user account. It's the usual drill: username, email, password, and a few security questions. Once you click the verification link in your email, you’re in.

Inside the dashboard, you'll spot the option to register for VAT. Clicking this kicks off the application form. A word of advice from experience: hit the 'save progress' button often. You don't want to lose your work if your internet drops or you get distracted.

The Core Sections of the Application

The form is broken down into several parts. Let’s look at the most important ones.

1. About the Applicant

This is where you introduce your business to the FTA. You'll need to state if you're a "natural person" (like a sole proprietorship) or a "legal person" (an LLC, Free Zone company, etc.). The most critical detail here is your company's legal name—it must perfectly match the name printed on your trade licence, character for character.

2. Details of the Applicant

Now it's time to upload those documents you prepared. This is where you'll attach your scanned trade licence, certificate of incorporation (if you’re in a free zone), and any proof of ownership documents like the Memorandum of Association (MOA).

A Quick Pro Tip: Don't just upload files named "scan123.pdf." Name them something clear like "Trade_Licence_2024.pdf" or "Owner_Passport_Copy.pdf." It helps you keep track and, believe me, the FTA officer reviewing your file will appreciate the organisation.

3. Contact Details

You’ll need to provide the official business address exactly as it appears on your trade licence. Even if you're a fully remote or online business, the system requires a physical UAE address. You'll also nominate a primary contact person here.

Where People Often Get Stuck

Some fields in the application require more than just copy-pasting information; they need a bit of thought. These are the spots where a small mistake can lead to a big delay.

Business Activities Details

The portal asks you to describe what your business actually does. Don't be vague. Instead of just putting "Trading," be more specific, like "General Trading of Electronics and Home Appliances." You’ll also be able to select from a list of official activity codes. Make sure everything you list here directly aligns with the activities on your trade licence to avoid any discrepancies.

The Turnover Declaration

This is, without a doubt, the most crucial part of the entire application. You’ll have to declare:

- Your total turnover for the past 12 months.

- Your expected turnover in the next 30 days.

- Whether you anticipate crossing the mandatory registration threshold soon.

You can't just put numbers in here; you have to back them up. Be ready to upload proof, which could be anything from audited financial statements to a detailed sales report from your accounting software or even signed contracts that guarantee future income. Accuracy and honesty are non-negotiable here.

Customs Registration Information

Does your business import goods into the UAE? If so, you’ll need to enter your Customs Registration Number, which is issued by the customs authority in the relevant emirate. If importing isn't part of your business model, you can simply select 'No' and move on.

Once every section is filled out, you get one final chance to review everything. Take your time. Read through each field, check for typos, and double-check that every required document is uploaded correctly.

After you finally hit 'submit', the review process begins. The FTA typically processes applications within 20 business days. If everything is in order, you'll receive your Tax Registration Number (TRN), and you'll officially be VAT registered. The whole process is digital, which is incredibly efficient when you get it right. For a closer look at the rules, you can learn more about the UAE's VAT framework and what it means for businesses like yours.

Navigating the portal is the final step to becoming VAT compliant. With a bit of careful prep, you can get through it smoothly. Of course, if you'd rather focus on running your business, our team is always here with 24/7 support to handle the entire process for you.

So, you’ve uploaded every document, triple-checked all the fields, and hit that final ‘submit’ button on the FTA portal. It feels like the hard part is over, but what really happens next? Now, your application enters the review phase with the Federal Tax Authority (FTA).

Officially, the FTA gives itself about 20 business days to review your submission. During this time, someone at the authority will go through every single piece of information you've provided. They’re checking everything from the dates on your trade licence to making sure your turnover calculations are accurate and well-supported. Their job is to confirm that your business truly needs to be registered for VAT.

The FTA Review: What to Expect and Why Delays Happen

Once submitted, your application joins a queue for verification. If everything is in perfect order—documents are crystal clear, details match across the board, and your figures are logical—the process can be surprisingly smooth. You'll likely get your Tax Registration Number (TRN) within that 20-day window.

However, it's very common for applications to get flagged for clarification. Knowing what these common roadblocks are can save you a lot of time and hassle. We see the same issues pop up again and again:

- Mismatched Details: This is a big one. Maybe the owner's name is slightly different on their Emirates ID compared to the trade licence. Even a small inconsistency will halt the process while they ask for an explanation.

- Vague Proof of Turnover: You can't just declare your revenue figures. If the bank statements or sales reports you've uploaded are hard to follow or don't clearly support the number you've claimed, the FTA will definitely come back with questions.

- Conflicting Business Activities: The description of your business activities on the application must be exactly what's written on your trade licence. If there's any difference, it raises a red flag for the reviewer.

If the FTA needs more from you, you won't get a phone call; you’ll get a notification directly in your e-Services portal. It’s crucial to keep an eye on your account and respond to these queries as quickly and accurately as possible.

How to Handle FTA Requests for More Information

Getting a notification asking for clarification can be stressful, but it's a normal part of the process. The trick is to give them exactly what they’re asking for, nothing more and nothing less. Read their request carefully.

For instance, if they're questioning your turnover, don't just re-upload the same documents. Instead, provide a clear, concise breakdown or a supporting letter from your accountant that walks them through the numbers. If it’s a name discrepancy, a formal affidavit might be required. A direct, professional, and clear response is the fastest way to get your application moving again.

Don't underestimate the consequences of getting this wrong. The administrative penalty for failing to register for VAT on time is a steep AED 20,000. This fine highlights just how critical it is to submit a complete and accurate application that won't face delays pushing you past your deadline.

The High Cost of Late Registration

Failing to register for VAT within the legal timeframe after your business crosses the mandatory threshold comes with a hefty price tag. That AED 20,000 penalty isn't just a slap on the wrist; it's a serious financial blow that is entirely avoidable.

And remember, this fine isn’t just for businesses that completely forget to register. It can also be applied if your initial application is rejected because of errors and you don’t manage to fix it and resubmit successfully before your deadline. This is exactly why getting it right the first time is so vital. At 365 DAY PRO, our expertise across Dubai, Abu Dhabi, and Sharjah is focused on making sure our clients' applications are perfect from the start, securing their TRN without any drama and protecting them from these kinds of costly fines.

Managing Your Ongoing VAT Responsibilities

So, you’ve got your Tax Registration Number (TRN). It’s a big step, but think of it as the starting line, not the finish. The real work of VAT compliance is woven into the day-to-day fabric of your business operations. Nailing the registration is one thing; managing your ongoing duties is what keeps you in the FTA's good books and avoids those painful penalties down the road.

This is where many businesses trip up—the shift from a one-off application to constant, careful management. It's about much more than just charging the right tax. It demands diligent record-keeping, flawless invoicing, and on-the-dot reporting.

The Golden Rule of Record-Keeping

Let's be clear: under UAE law, you absolutely must maintain a complete set of financial records for a minimum of five years. This isn't a gentle suggestion; it's a legal requirement the FTA takes very seriously. These records are the foundation of every VAT return you file and your first line of defence in an audit.

Your files need to tell the whole story, detailing things like:

- Every single sale and import of goods and services.

- All tax invoices you've sent out and all you've received.

- A record of any goods or services taken for personal or non-business use.

- All credit and debit notes issued or received.

This isn’t just about ticking boxes. This level of detail is critical for proving your VAT returns are accurate. In fact, a huge part of staying compliant is simply being ready for an audit at any time. A solid ultimate audit preparation checklist can be a lifesaver here, making a potentially stressful process much more manageable.

Issuing Compliant Tax Invoices

The moment your TRN is active, your invoicing has to change. Every bill you issue for a taxable supply must be a proper, compliant tax invoice. It’s a legal document with a very specific checklist of required information. Getting this wrong creates a domino effect of problems for you and your clients, who need that valid invoice to claim back their own input VAT.

A valid tax invoice absolutely must include:

- The words "Tax Invoice" displayed prominently.

- Your full business name, address, and, of course, your TRN.

- The recipient's details: name, address, and TRN (if they are also registered).

- A unique and sequential invoice number.

- The date the invoice was issued and the actual date of supply.

- A clear description of what was sold.

- A breakdown showing the unit price, quantity, the VAT rate applied, and the payable amount in AED.

- The total gross amount payable in AED.

If you forget even one of these—especially your TRN—the invoice is invalid for VAT purposes. No exceptions.

Filing Your Periodic VAT Returns

At the heart of your ongoing compliance is the VAT return. For most businesses here in the UAE, this is a quarterly task, though some larger firms might file monthly. The FTA will assign your filing schedule when you register.

The process is done entirely online through the same e-Services portal you used to register. You'll declare your total sales (output tax) and total purchases (input tax) for that period. The difference between the two determines whether you owe the FTA money or if you're due a refund.

A word of warning: Missing a VAT return deadline or paying late triggers immediate penalties. The system is automated, so there's no grace period to speak of. Staying organised isn't just good advice; it's your best defence.

The UAE's tax rules are constantly evolving. For example, Decision No. 8 of 2024 brought in a new Voluntary Disclosure process, giving taxpayers a way to correct past errors without it affecting their due tax. This highlights just how important it is to keep up with FTA announcements. Successfully managing your responsibilities after you register for VAT in the UAE really just comes down to building good, disciplined habits from day one.

Let 365 DAY PRO Handle Your UAE VAT Registration

Feeling a bit tangled up in the red tape of UAE VAT registration? It’s a common feeling. The process, from gathering the right documents to navigating the FTA portal, is loaded with potential snags that can stall your application or, worse, lead to fines. But you don’t have to go it alone.

This is exactly where having an expert in your corner pays off. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we live and breathe this stuff. Our specialists in both Mainland and Freezone Company Formation can manage the entire process for you. We’ll turn what feels like a bureaucratic headache into a smooth, simple exercise. We handle the paperwork, the submission, and all the back-and-forth with the Federal Tax Authority (FTA).

More Than Just Registration—We're Your Compliance Partner

We’ve built our reputation on providing Cost-Effective Business Setup Solutions tailored to your needs, helping international entrepreneurs enjoy the full range of UAE Tax Benefits. Our support doesn't just stop once the application is submitted.

We know that questions can pop up at any time, which is why our 24/7 support service is here for you. You'll never be left wondering about the status of your application or what comes next. That’s the peace of mind you get when you know your VAT compliance is being handled by professionals.

Let us take care of the VAT complexities. It frees you up to concentrate on what truly matters: building and growing your business, whether you're in Dubai, Abu Dhabi, or Sharjah.

Ready to get this off your to-do list?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Your VAT Registration Questions, Answered

Even with the clearest instructions, navigating tax regulations can leave you with a few lingering questions. It’s completely normal. We’ve been helping businesses with this for years, and we've put together answers to some of the most common queries we hear.

Can I Register for VAT if My Turnover Is Below the Mandatory Threshold?

Yes, you absolutely can. This is a common point of confusion, but the FTA has a clear system for it.

If your annual turnover from taxable supplies and imports is over AED 187,500 but hasn't yet hit the mandatory AED 375,000 mark, you can register voluntarily. Many savvy businesses do this. Why? The big advantage is that you can start reclaiming the VAT you pay on your own business expenses, which can be a real boost for your cash flow. It also tends to signal to larger clients that you're an established, serious business, as many big companies prefer working with VAT-registered suppliers.

What Happens if I’m Late Registering for VAT?

The penalties for late registration are steep and not something you want to deal with. The Federal Tax Authority (FTA) issues a fixed administrative penalty of AED 20,000 for failing to register on time.

This isn't a slap on the wrist; it's an automatic fine. That's why we always tell our clients to keep a close eye on their turnover every single month. The moment you see you're getting close to the mandatory threshold, it's time to act. Don't wait until you've already crossed it.

How Long Does It Take to Get My Tax Registration Number (TRN)?

After you've submitted your application on the FTA portal, you can generally expect a turnaround time of about 20 business days. This assumes, of course, that every document is in order and all the information you provided is accurate and consistent.

Once the FTA gives your application the green light, they'll issue your official Tax Registration Number (TRN). This number is your key to everything VAT-related from that point on—you’ll need it to issue proper tax invoices and file your returns.

Do Businesses in Free Zones Need to Register for VAT?

They certainly do. Businesses based in UAE free zones follow the same VAT rules as mainland companies. If your taxable supplies cross the mandatory or voluntary thresholds, you need to register.

There's a crucial exception here, though: "Designated Zones." The rules get a bit more specific for these areas. For instance, certain transactions involving goods that happen within or between these Designated Zones might be considered outside the scope of UAE VAT. It’s vital to understand if your free zone is on this list and how these unique rules affect your operations.

Getting your VAT registration right is a foundational step for your business in the UAE. At 365 DAY PRO Corporate Service Provider LLC, our team lives and breathes this stuff. We handle all the details, making sure your registration is smooth, accurate, and free of penalties, leaving you to do what you do best: run your business.

Ready to get this sorted without the headache? Get in touch for a free chat about how we can help. Visit us at https://365dayproservices.com to get started.