Whether you're moving to the UAE for a new job or launching your dream business, one of the very first things on your to-do list will be opening a bank account. It’s absolutely essential. For individuals, it's how you get paid. For businesses, it's a legal must-have for managing every dirham that comes in and goes out.

The process itself isn't rocket science, but it does require careful preparation. You'll need to pick the right bank, gather a specific set of documents, and get through the bank's standard checks.

Your Gateway to the UAE's Financial World

Think of a UAE bank account as your key to the local economy. It’s how you’ll handle everything from paying your DEWA bill and rent to accepting payments from clients and running payroll for your staff. Without one, you’ll find that day-to-day life and business operations grind to a halt pretty quickly.

We've put this guide together to walk you through the entire journey, step-by-step. Our goal is to cut through the jargon and make what can seem like a daunting task feel straightforward. With the right know-how, opening a bank account here is completely achievable.

Personal vs. Corporate Accounts: What’s the Difference?

First things first, you need to know which type of account you need. They serve very different functions and have completely different application requirements.

- Personal Accounts: These are for your day-to-day life. You'll use it for your salary, groceries, savings, and personal bills. The required documents are usually simple: your passport, residence visa, and Emirates ID are the main ones.

- Corporate Accounts: These are strictly for business. All your company's revenue, expenses, and investments flow through this account. The paperwork is much more detailed, requiring your trade licence, articles of association, and shareholder information.

Mainland, Free Zone, or Offshore? It Matters to the Banks.

If you’re opening a corporate account, where your company is registered makes a big difference. Banks view mainland, free zone, and offshore companies through different lenses when they're doing their checks.

A mainland company, registered directly with an authority like the Department of Economic Development (DED), often has an easier time. The direct government registration gives banks a clear line of sight.

On the other hand, free zone and offshore companies can expect more questions. Banks will dig deeper to understand the business model and ensure it has real, legitimate operations in the UAE. This is where many applications get stuck.

A lot of applications stumble right here, on the nuances between jurisdictions. Having an expert who understands the specific bank requirements for your company structure—be it mainland, free zone, or offshore—can make all the difference between a quick approval and a frustrating, drawn-out rejection.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Choosing the Right Bank for Your Needs

Picking a bank in the UAE is far more than just a box-ticking exercise. It's a foundational business decision that directly affects your cash flow, international transactions, and day-to-day sanity. The banking scene here is a blend of heavyweight local institutions and major global players, and each has its own distinct personality, risk tolerance, and service quality.

The sector is incredibly healthy, with forecasts showing net interest income hitting a massive US$29.56 billion by 2025. With Central Bank data confirming total bank assets at AED 595,003 million, there's immense liquidity in the system, which is a huge draw for entrepreneurs. The challenge isn't a lack of options; it's finding a banking partner that genuinely gets your business model. You can dig into more of the UAE's banking market projections on Statista.

Local Champions vs International Giants

On one hand, you have the dominant local banks like Emirates NBD, Abu Dhabi Commercial Bank (ADCB), and First Abu Dhabi Bank (FAB). Their strength lies in their massive branch networks and deep-rooted understanding of the local economy. From experience, they can often be more accommodating for straightforward mainland company setups.

On the other hand, international banks like HSBC, Standard Chartered, and Citibank offer unparalleled global connectivity. They are the go-to for complex trade finance or companies with intricate international ownership structures. Be warned, though: their compliance and due diligence processes are notoriously strict. They can be particularly cautious with free zone or offshore companies that don't have a clear physical footprint in the UAE.

Key Factors for Your Decision

When you're figuring out how to open a bank account in the UAE, you need to look past the fancy logos and focus on what really matters to your business.

- Minimum Balance Requirements: This is the big one. Corporate accounts often demand average monthly balances anywhere from AED 25,000 to over AED 250,000. If you drop below that magic number, you’ll get hit with painful monthly penalties. Make sure the bank’s requirement is realistic for your business.

- Account Fees and Charges: Get your hands on their schedule of charges and read the fine print. Look at fees for transfers (local and international), cheque book issuance, and general account maintenance. These "small" costs can seriously add up.

- Digital Banking Quality: In this day and age, a clunky online portal is a deal-breaker. A smooth, intuitive digital platform is essential for managing payroll, paying suppliers, and keeping a close eye on your finances without endless trips to a branch.

- Business Structure Appetite: This is absolutely critical. Some banks are known for being "free zone friendly," while others aren't. Be upfront about your company’s structure—whether it's mainland, free zone, or offshore—and see how they react. A good business setup consultant’s advice here is worth its weight in gold.

The biggest mistake we see is clients choosing a bank based on reputation alone, without confirming if that bank is a good fit for their specific free zone or business activity. This mismatch is a leading cause of application rejection.

The Rise of Islamic Banking

Don't overlook Islamic banking. Institutions like Dubai Islamic Bank (DIB) and Abu Dhabi Islamic Bank (ADIB) are major players and operate on Sharia-compliant principles. This means they completely avoid interest-based transactions (riba).

Instead of traditional loans, they use financing structures like Murabaha (cost-plus financing) or Ijara (leasing). For savings and investments, they use profit-sharing models like Mudarabah. It's an ethical approach to finance that appeals to many business owners, regardless of their personal faith.

As you weigh your options, think long-term. Choosing a bank that can support future goals, like financing investment property, can save you a lot of hassle down the road.

To make things clearer, let's break down the main banking categories you'll encounter.

Comparing UAE Banking Options

This table gives a side-by-side look at the different types of banks to help you see where your business might fit best.

| Bank Type | Key Features | Best For | Typical Minimum Balance (AED) |

|---|---|---|---|

| Local UAE Banks | Extensive branch/ATM network, strong local market knowledge, often more flexible with SME applications. | Mainland companies, residents, businesses focused primarily on the UAE market. | 25,000 – 100,000 (Corporate) |

| International Banks | Global network, excellent multi-currency and trade finance solutions, strong brand recognition. | Multinational corporations, companies with complex international shareholding, frequent overseas transactions. | 50,000 – 250,000+ (Corporate) |

| Islamic Banks | Sharia-compliant products, ethical investment principles, profit-sharing models instead of interest. | Individuals and businesses seeking ethical banking, specific financing structures (e.g., Murabaha). | 20,000 – 75,000 (Corporate) |

Ultimately, the best bank is the one that aligns with your specific business activities, transaction volume, and international needs. Take the time to compare these factors carefully before you commit.

Getting Your Paperwork in Order: The Definitive Checklist

If there’s one golden rule for opening a UAE bank account, it’s this: preparation is everything. One missing document can stall your entire application, leading to weeks of frustrating back-and-forth. To avoid the headache, you need to know exactly what the bank expects, and the requirements are worlds apart for personal and business accounts.

Opening a personal account is usually a quick sprint. A corporate account? That’s more of a marathon, with far more regulatory hurdles to clear.

Documents for a Personal Bank Account

For personal accounts, the process is fairly straightforward. Banks are mainly focused on verifying who you are and confirming your legal residence in the UAE. If you're a salaried employee, it's designed to be quick.

Here's the essential paperwork you'll need on hand:

- Passport & UAE Residence Visa: This is the absolute first thing they'll ask for. Make sure you have the original passport and a clear copy of your visa page.

- Emirates ID Card: Your original EID is mandatory. No bank in the UAE will proceed without it.

- Salary Certificate: A recent letter from your employer (in English or Arabic) stating your job title and monthly salary.

- Proof of Address: This is typically your tenancy contract (Ejari) or a recent utility bill, like a DEWA or SEWA invoice, with your name on it.

As a tip, if you’re brand new to the country, some banks might ask for your last few months of bank statements from your home country just to get a sense of your financial background.

Documents for a Corporate Bank Account

This is where the real work begins. Banks in the UAE take their anti-money laundering (AML) and Know Your Customer (KYC) obligations very seriously. The checklist is extensive, and there are no shortcuts.

A common pitfall is thinking a trade licence is all you need. In reality, that’s just the ticket to get in the door. Banks need a complete picture of your company's legal framework, ownership, and operational purpose.

You’ll be asked to assemble a detailed company file. Get ready to provide:

- Trade Licence: A valid, up-to-date copy is the first requirement.

- Certificate of Incorporation/Registration: This proves your company is legally registered.

- Memorandum of Association (MOA) & Articles of Association (AOA): These are the core constitutional documents of your business, outlining its purpose, share structure, and internal rules.

- Share Certificates: Official proof of who owns the company and how the shares are divided.

- Board Resolution: A formal, signed document from the board of directors that specifically authorises the opening of the bank account and names the individuals who can sign on its behalf.

- Passport and Visa Copies: Clear copies for every shareholder, director, and authorised signatory.

- Proof of Business Address: This is a big one. Banks want to see a physical office lease agreement (like an Ejari for mainland companies) to prove your business has real substance in the UAE.

It's also crucial to remember that any documents issued outside the UAE will almost certainly need to be professionally translated. This is where using certified document translation services becomes essential for your application to be accepted.

Proving Your Business Is the Real Deal

Beyond the legal documents, the bank needs to understand what your business actually does. This is especially true if you’re operating from a free zone or have an offshore company.

Be prepared to present a solid business plan, explain your primary source of funds, and even provide profiles of your main clients or suppliers. They want to see a legitimate, functioning enterprise.

Think about it: while a YouGov survey shows that 94% of UAE residents have a bank account, reflecting the nation's high rate of financial inclusion, expat business owners often face a different reality. Incomplete KYC documentation is a top reason for rejection. This is where a professional PRO team can make all the difference, ensuring every document is perfectly prepared and liaising with the bank to smooth the path to approval.

✅ We are experts in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, and we make sure your banking application is flawless.

✅ Our 24/7 support is here when you need us.

✅ We provide cost-effective business setup solutions tailored to your needs.

📞 Call us now at +971-52 923 1246 and let's get it right the first time.

From Paperwork to Payday: What to Expect During the Application Process

You’ve picked your bank and spent hours gathering every single document. Now what? Kicking off the application is where things get real. Knowing the path from submission to activation will save you a lot of guesswork and stress, especially when setting up a corporate account.

First things first: how do you even submit the application? While a few banks are moving online, the reality on the ground, particularly for business accounts, is that you’ll almost certainly need to show up in person. Think of it less as a formality and more as the first step in building a relationship with your bank.

The All-Important Submission and Due Diligence Phase

Whether you start online or walk into a branch, hitting 'submit' triggers the bank's deep dive into your file. This is the critical 'Know Your Customer' (KYC) and compliance stage. A relationship manager will pour over everything—your trade licence, shareholder passports, business plan—to build a complete picture of your company. They aren't just being nosy; they're following strict UAE Central Bank rules designed to prevent financial crime.

For any corporate account, a face-to-face meeting with a bank representative is pretty much unavoidable. This is your chance to sell them on your business. You need to be ready to clearly and confidently explain:

- Your Business Model: What do you actually do?

- Transaction Profile: Where will money be coming from, and where will it be going?

- Business Geography: Who and where are your key clients and suppliers?

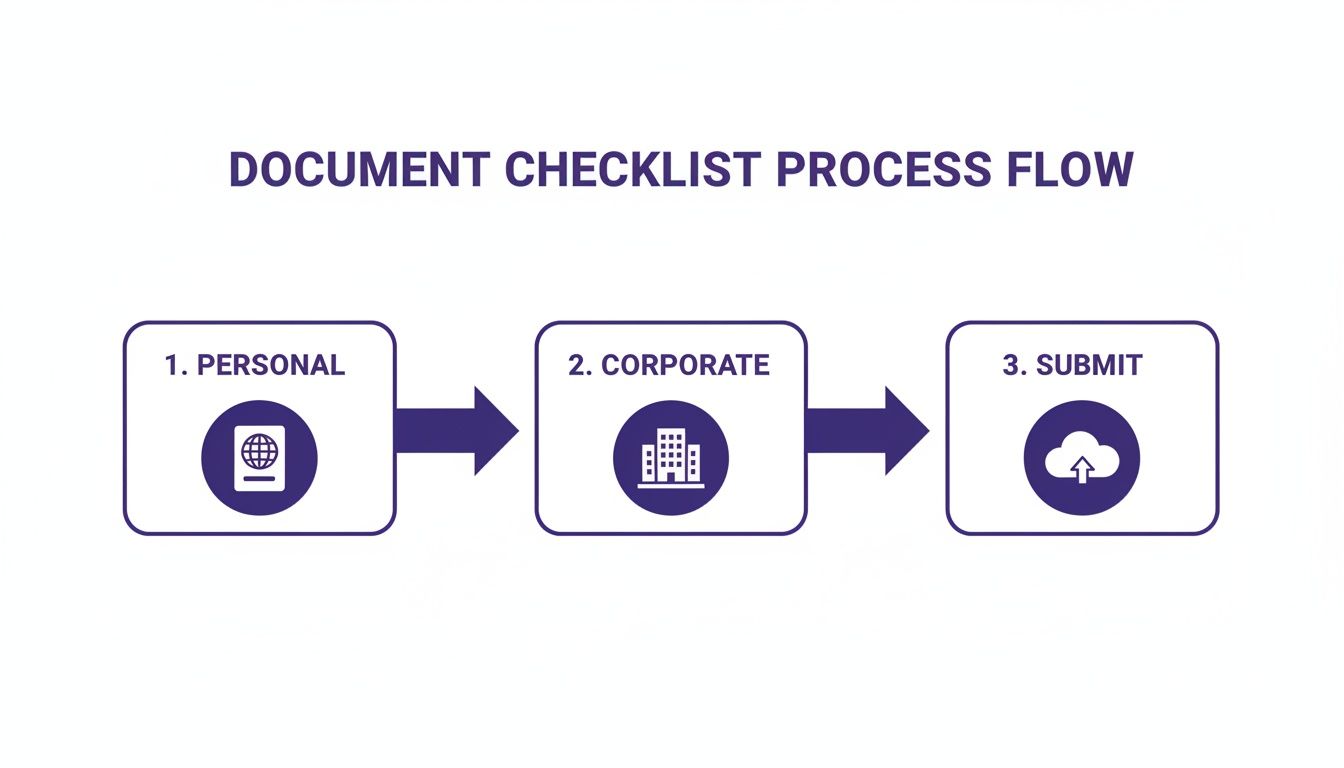

This flow chart gives you a quick visual on how the document requirements stack up for personal versus corporate accounts right from the start.

As you can see, the corporate path is far more complex from the get-go, demanding a much more robust set of documents before you can even think about submitting.

How Long Does It Really Take?

If you’re learning how to open a bank account in the UAE, the number one lesson is patience. This is especially true for businesses. The timelines can swing wildly depending on who you are and what you do.

For a personal account, especially if you're a salaried employee with a straightforward profile, you could be up and running in as little as 2-5 working days.

Corporate accounts are a different beast entirely. Because of the intense due diligence, you need to set your expectations accordingly. For a standard mainland or free zone company, you're looking at two to four weeks. If your business has a more complex structure—maybe multiple international shareholders or you're in an industry the banks consider "high-risk"—the process could easily stretch to six weeks or even longer.

It's completely normal for the bank to come back with follow-up questions during the review. Don't panic. They might ask to see supplier contracts, client invoices, or a more granular business plan to back up your initial application.

This is exactly where having an expert in your corner makes a world of difference. As specialists in Mainland and Freezone Company Formation, we know what questions the banks will ask and build your file to answer them proactively. Our cost-effective business setup solutions are designed to handle this entire maze for you.

Getting the Green Light: From Approval to Activation

The email confirming your account approval is a huge relief. From that point, it’s just a few final steps to get you fully operational. The bank will immediately provide your account details and IBAN, so you can start receiving funds right away.

A few days later, your welcome kit will arrive. Inside, you’ll typically find:

- Your corporate debit card

- A fresh cheque book

- Login details for your online and mobile banking portals

Activating your online banking is the final piece of the puzzle. Once that’s done, you have 24/7 control over your company’s finances. With our own round-the-clock support, we can guide you through any part of this journey. WhatsApp Us Today for a Free Consultation, and let’s get your UAE business banking sorted.

Why Bank Accounts Get Rejected (And How to Avoid It)

Nothing stalls your business launch faster than a rejected bank account application. It’s a frustrating roadblock, but it’s almost always avoidable. The secret to learning how to open a bank account in the UAE successfully is to think like a bank's compliance officer. Banks here are meticulous, and they're looking for red flags. Understanding what they are is the key to getting a swift approval.

A rejection isn’t personal; it's about risk management. The bank needs a crystal-clear, verifiable picture of your business. If there are any gaps or inconsistencies, they'll simply say no. The trick is to anticipate their questions and build an application that leaves no room for doubt.

Messy Paperwork and Inconsistent Details

This is, by far, the most common reason for a rejection right out of the gate. Submitting an application with a missing trade licence, a board resolution that hasn't been signed, or shareholder names that don't match perfectly across documents is a guaranteed failure. Every single document needs to be current, complete, and consistent.

Another classic mistake is not getting foreign documents properly attested. A bank won't even look at them without the right legalisation stamps—first from the UAE embassy in the document's country of origin, and then from the Ministry of Foreign Affairs (MOFA) here in the UAE.

From the bank's point of view, a sloppy application suggests a sloppy business. They’re left wondering if you’ll manage your finances with the same lack of attention. Your paperwork has to be flawless from day one. It's non-negotiable.

Vague Business Plans and Unclear Money Trails

Banks need to know exactly what your company does and where the money is coming from. If your business plan uses vague terms like "general trading" or "consultancy" without getting into the specifics, it raises immediate suspicion. You need to be ready to paint a detailed picture.

- What specific services or products are you selling?

- Who is your target market? Can you name potential key clients?

- How will you make money? What does your cash flow look like?

- Where is the initial capital coming from? Be transparent about the ultimate source.

Having a physical office address, particularly for mainland companies, adds a huge amount of credibility. It shows the bank you have a real presence and a serious commitment to operating in the UAE.

High-Risk Activities or Nationalities

Some business activities are automatically flagged as high-risk. This often includes things like cryptocurrency trading, dealing in precious metals, or operating with complex international structures that involve offshore entities. If your business is in one of these areas, prepare for a much more intense level of scrutiny.

Likewise, shareholders from nationalities that appear on international high-risk or sanctioned lists will trigger what's called "enhanced due diligence." This doesn't mean you'll be rejected outright, but the compliance process will take longer and be far more rigorous. In these cases, total transparency is your best strategy.

The good news is that the UAE’s economy is incredibly solid. The country's current account surplus recently hit an impressive USD 79.97 billion, and with dirham deposits reaching AED 698,653 million, banks have plenty of liquidity. They are actively seeking reputable corporate clients. This strong financial footing means that if your business is legitimate and your documents are in order, banks are ready to approve you. You can dive deeper into the UAE's economic indicators and surplus data on FRED.

Working with experts in Mainland and Freezone Company Formation across the UAE like us means we’ve seen these issues before. We know which banks are more open to specific business models and nationalities, and we can guide your application to the right place from the start.

Call us now at +971-52 923 1246 to sidestep these common pitfalls.

Letting an Expert Handle the Heavy Lifting

Trying to open a UAE bank account on your own can feel like navigating a maze blindfolded. It's a notoriously frustrating and time-consuming process. One tiny mistake on a form or a failure to meet a bank's unwritten rules for certain business types can set you back weeks.

This is exactly where bringing in a seasoned corporate service provider changes the game, turning what could be a major headache into a smooth, predictable step.

At 365 DAY PRO, we take the guesswork and stress completely out of the picture. Think of us as your guide on the ground, making sure every detail is handled correctly from the very beginning. We start by helping you pick the right bank—one that actually understands and fits your specific business, whether it's mainland, free zone, or offshore. Getting this first choice right is half the battle won.

We Manage Everything, From Start to Finish

Once we’ve pinpointed the best bank for you, our team takes over the entire application process. We're specialists in both Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, so we know precisely what documents each bank wants to see for every kind of company.

Here’s how we make it happen:

- Perfect Paperwork: We meticulously prepare and double-check every single document, from your MOA to the board resolution, ensuring there are no compliance issues.

- Direct Bank Communication: We don't just submit forms. We leverage our strong, established relationships with bank managers to present your application professionally, anticipating their questions before they even ask.

- Always-On Support: Questions pop up. We get it. Our team is available 24/7 to give you updates and clear answers, so you’re never left wondering what’s going on.

We’ve seen it time and again: by managing the entire process, we save our clients weeks, sometimes even months, of wasted effort and anxiety. We turn a tangled bureaucratic mess into a simple, straightforward success.

Our cost-effective business setup solutions are designed so you can focus on what you do best—growing your business—while we lock in your financial foundation. With our deep local knowledge and proven track record, you can confidently set up your company’s finances and tap into the significant UAE tax benefits for international entrepreneurs.

Don’t let banking red tape slow down your ambitions in the UAE. Take the first step with a team that knows the way.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Frequently Asked Questions

When it comes to UAE banking, a few questions pop up time and time again. Getting these sorted from the start can save you a world of headaches and make your application process much smoother. Let's dive into the most common queries we handle for entrepreneurs and new residents.

Can I Open a UAE Bank Account Without a Residence Visa?

This is a big one. For a standard personal account—the kind you need for daily life with a debit card and a cheque book—a valid UAE residence visa and an Emirates ID are almost always mandatory. Banks are very strict about this.

While you might hear about "non-resident" savings accounts, be cautious. These are heavily restricted. They typically demand a very high minimum balance, offer no credit facilities, and won't give you a cheque book, making them impractical for actually living and working here.

The story is a bit different for corporate accounts. Your company must be legally registered in the UAE, of course. However, it's possible for non-resident shareholders to be authorised signatories on the account. Just be prepared for a much deeper level of scrutiny. The bank's due diligence process will be intense, as they need to thoroughly vet anyone who isn't a UAE resident.

What Is the Typical Minimum Balance for a Corporate Account?

The answer here really depends on the bank and the type of account you need, so it’s a critical factor to consider.

For a basic business account aimed at a startup or a small company, you’re often looking at an average monthly balance of around AED 25,000. If you're going for a more premium corporate account that comes with a dedicated relationship manager and other perks, that number can easily climb to over AED 250,000.

Expert Tip: Remember, this is an average monthly balance. If your funds dip below the required threshold during the month, the bank will hit you with a penalty fee, usually somewhere between AED 150 and AED 500. Always get this figure in writing before you sign anything.

How Long Does It Take to Open a Corporate Bank Account?

Patience is a virtue here, because the timeline can be unpredictable.

In a best-case scenario—where your business model is straightforward and all your paperwork is in perfect order—you can expect the process to take roughly two to four weeks from the day you submit your application.

However, several things can slow it down considerably. If your company has a complex ownership structure, involves shareholders from multiple countries, or operates in what the bank deems a "high-risk" industry, you're looking at a much longer wait. The bank's enhanced due diligence for these cases can easily stretch the timeline to six to eight weeks, sometimes even more.

This is where working with a professional can make a real difference. At 365 DAY PRO, our specialists in mainland and freezone company formation know exactly what banks are looking for. We make sure your application is complete and correctly positioned from day one, using our established relationships to help move things along.

Trying to figure out the UAE's banking system can feel overwhelming, but you don't have to tackle it alone. At 365 DAY PRO, we live and breathe business setup in Dubai, Abu Dhabi, and Sharjah. From company formation to making sure your corporate bank account application is spot-on, our team is ready to help 24/7.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation