Getting your head around VAT calculations in the UAE doesn't have to be complicated. At its core, the formula is surprisingly simple: take the VAT you've collected on your sales (Output VAT) and subtract the VAT you've paid on your business expenses (Input VAT). The difference is what you owe the Federal Tax Authority (FTA).

That’s it. Understanding this single principle is the key to staying on the right side of your tax obligations.

Your First UAE VAT Calculation Explained

When VAT arrived in the UAE back in 2018, it marked a major shift for businesses across Dubai, Abu Dhabi, and the other Emirates. For anyone new to the region, whether you're an international entrepreneur or a local start-up, figuring out that first calculation can feel a bit intimidating. But once you break it down, it's a very logical process.

The entire system is built around taxing consumption, and businesses essentially act as tax collectors for the government. Your main job is to keep a close watch on two specific types of VAT during each tax period.

- Output VAT: This is the 5% tax you add to your invoices when selling goods or services. It's the VAT you collect from your customers.

- Input VAT: This is the 5% tax you pay when buying things for your business—think office supplies, professional fees, or raw materials. This is the VAT you can often reclaim.

The Basic Formula in Action

Let’s walk through a practical example. Imagine you’ve just set up a consulting firm on the Dubai mainland.

You send an invoice to a client for your services for AED 10,000. On top of that, you add 5% VAT, which comes out to AED 500. The total invoice your client pays is AED 10,500. That AED 500 is your Output VAT.

Now, during that same month, you bought new accounting software for your business costing AED 2,000. The supplier’s invoice included AED 100 in VAT (5% of AED 2,000). This AED 100 is your Input VAT, and it's recoverable.

The VAT you need to pay to the FTA is calculated like this:

AED 500 (Output VAT) – AED 100 (Input VAT) = AED 400

This net figure of AED 400 is what you’ll send to the tax authority. It’s a straightforward system where VAT is applied at each step of the supply chain, but businesses can claim back the VAT they've paid, ensuring only the end consumer bears the final cost.

To give you a clearer picture, here’s a quick summary of the components in a typical calculation.

VAT Calculation At a Glance

| Component | Description | Example (AED) |

|---|---|---|

| Sales Value | The base price of your goods or services before adding VAT. | 10,000 |

| Output VAT | The 5% VAT you charge on your sales (Sales Value x 0.05). | 500 |

| Purchase Value | The base price of business expenses before adding VAT. | 2,000 |

| Input VAT | The 5% VAT you pay on your business purchases (Purchase Value x 0.05). | 100 |

| VAT Payable | The final amount owed to the FTA (Output VAT – Input VAT). | 400 |

As you can see, the logic holds for any standard transaction.

This fundamental concept is the bedrock of all VAT accounting in the UAE. To explore this topic with even more examples and edge cases, check out this a detailed guide on how to calculate VAT in UAE. Getting this basic calculation right from the start is your first and most important step towards keeping your business compliant and avoiding any potential fines down the road.

Getting VAT Right on Your Sales Invoices

For any business operating in the UAE, calculating VAT on sales invoices is a daily task. The first thing you need to pin down is the taxable value of your goods or services. This isn't always just the price tag; it's the base amount you charge before adding the standard 5% VAT. Think of it as your net price—it includes any extra fees but comes after you’ve applied any discounts.

Getting this number right is the bedrock of a compliant tax invoice. Whether you're a mainland company in Dubai or a startup in a freezone, your invoices must meet the standards set by the Federal Tax Authority (FTA), and that starts with an accurate taxable value.

A Real-World Example: Calculating VAT for a Service

Let's look at a common scenario. Imagine you run a marketing consultancy in Abu Dhabi and you've just closed a project for a fee of AED 5,000.

To figure out the VAT, you simply apply the 5% rate to that fee:

- VAT Amount: AED 5,000 x 0.05 = AED 250

Your invoice must clearly break this down for your client: the subtotal (AED 5,000), the VAT amount (AED 250), and the final total due, which comes to AED 5,250. This transparency isn't just good practice; it's a legal requirement for UAE tax invoices.

How it Works for Selling Goods

The logic is exactly the same when you're selling physical products. Say your retail shop in Sharjah sells a gadget for AED 750. The VAT calculation is just as simple.

- VAT Amount: AED 750 x 0.05 = AED 37.50

The total you charge the customer at the till will be AED 787.50. It's absolutely critical that your point-of-sale system or invoicing software is set up to handle these calculations automatically and without errors.

My Pro Tip: The formula works the same for goods and services. Always calculate VAT on the net price before tax. If you need a quick way to find the total VAT-inclusive price, just multiply the base price by 1.05.

What Happens When Discounts Are Involved?

Discounts can sometimes throw a wrench in the works, but the rule is straightforward: VAT is calculated on the price after the discount is applied.

Let's go back to that AED 750 gadget. If you offer a 10% discount, the math changes slightly.

- Work out the discount: AED 750 x 0.10 = AED 75

- Find the new taxable value: AED 750 – AED 75 = AED 675

- Calculate VAT on the new, lower value: AED 675 x 0.05 = AED 33.75

The final invoice total would be AED 708.75 (AED 675 + AED 33.75). Making sure your invoices show this sequence clearly is essential for keeping the FTA happy and maintaining trust with your customers.

As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we know how vital it is to get these financial processes right from the start. Mastering these small details is the first step to enjoying the UAE tax benefits for international entrepreneurs.

Getting Your Money Back: A Practical Guide to Input VAT Recovery

Calculating VAT in the UAE isn't just about adding 5% to your sales invoices. The real power for your business lies in reclaiming the VAT you've already paid on your expenses. This is where you can seriously boost your cash flow and lighten your tax load.

Think of it this way: the VAT you collect on sales (Output VAT) belongs to the government. But the VAT you pay on legitimate business purchases (Input VAT) is money you can—and should—get back from the Federal Tax Authority (FTA). When you get this right, VAT stops being a cost and becomes a tax that simply flows through your business.

What Can You Actually Claim Back?

The rule of thumb is pretty simple: if you paid VAT on something you bought specifically for your business, you can almost certainly recover it. This covers a huge range of day-to-day costs for companies across Dubai, Abu Dhabi, and the other Emirates.

Here are some of the most common things you’ll be claiming for:

- Your Workspace: The VAT on your office rent and those DEWA or utility bills is a major one.

- Tools of the Trade: Buying new laptops, office desks, or specialised machinery? The VAT on those is recoverable.

- Professional Advice: That invoice from your accountant, lawyer, or consultant has VAT on it that you can claim back.

- Stock and Materials: If you're a trading business, the VAT paid on goods you buy to resell is a direct and recoverable cost.

Tracking these expenses isn't just good housekeeping; it's a direct line to your profitability. Every dirham of Input VAT you miss is a dirham straight out of your pocket.

To make sure you catch every eligible claim, setting up effective expense tracking from day one is non-negotiable.

A Real-World Example: A Dubai Trading Company

Let’s put this into perspective with a typical scenario. Imagine a trading company on the mainland that imports and sells electronics.

Here’s a snapshot of one of their tax periods:

- They billed customers and collected AED 50,000 in Output VAT.

- In that same timeframe, they bought new stock from a local supplier and paid AED 30,000 in Input VAT.

- Their warehouse rent included AED 1,500 in Input VAT.

- They also had legal fees with AED 500 of Input VAT.

First, we add up all the VAT they paid: AED 30,000 (stock) + AED 1,500 (rent) + AED 500 (legal) gives a total recoverable Input VAT of AED 32,000.

Now, to figure out what they owe the FTA, the calculation is straightforward:

AED 50,000 (Output VAT) – AED 32,000 (Total Input VAT) = AED 18,000

Just by carefully tracking and claiming their expenses, this company slashed its tax payment from AED 50,000 down to a much more manageable AED 18,000.

Watch Out: What You Can't Claim

It's not a free-for-all, though. The FTA has clear rules about certain expenses to prevent businesses from claiming personal or non-essential costs. One of the most common mistakes we see is businesses trying to claim VAT on things like client entertainment or items that blur the line between personal and business use.

Be extra careful with these categories, as they are generally non-recoverable:

- Client Entertainment: Taking a client out for a fancy dinner? The VAT on that bill is typically not something you can recover.

- Personal Use Items: If the company buys a car that an employee can use for personal trips, the Input VAT on that purchase is blocked from recovery.

Getting this wrong can cause headaches. If the FTA audits your records and finds you’ve misclassified an expense, you could be facing corrections and even penalties. It pays to know the difference.

Tackling the Trickier Side of UAE VAT

While the standard 5% rate seems straightforward, the reality of running a business in the UAE often involves transactions that don't fit neatly into that box. This is where things can get complicated. If you're involved in international trade, real estate, or financial services, you'll quickly encounter supplies that are zero-rated, exempt, or even completely out-of-scope.

Getting the classification wrong isn't just a minor bookkeeping error. It can lead to an incorrect VAT return, which might attract unwanted attention and penalties from the Federal Tax Authority (FTA). More than that, it directly impacts your cash flow by determining whether you can recover the VAT you've paid on your business expenses.

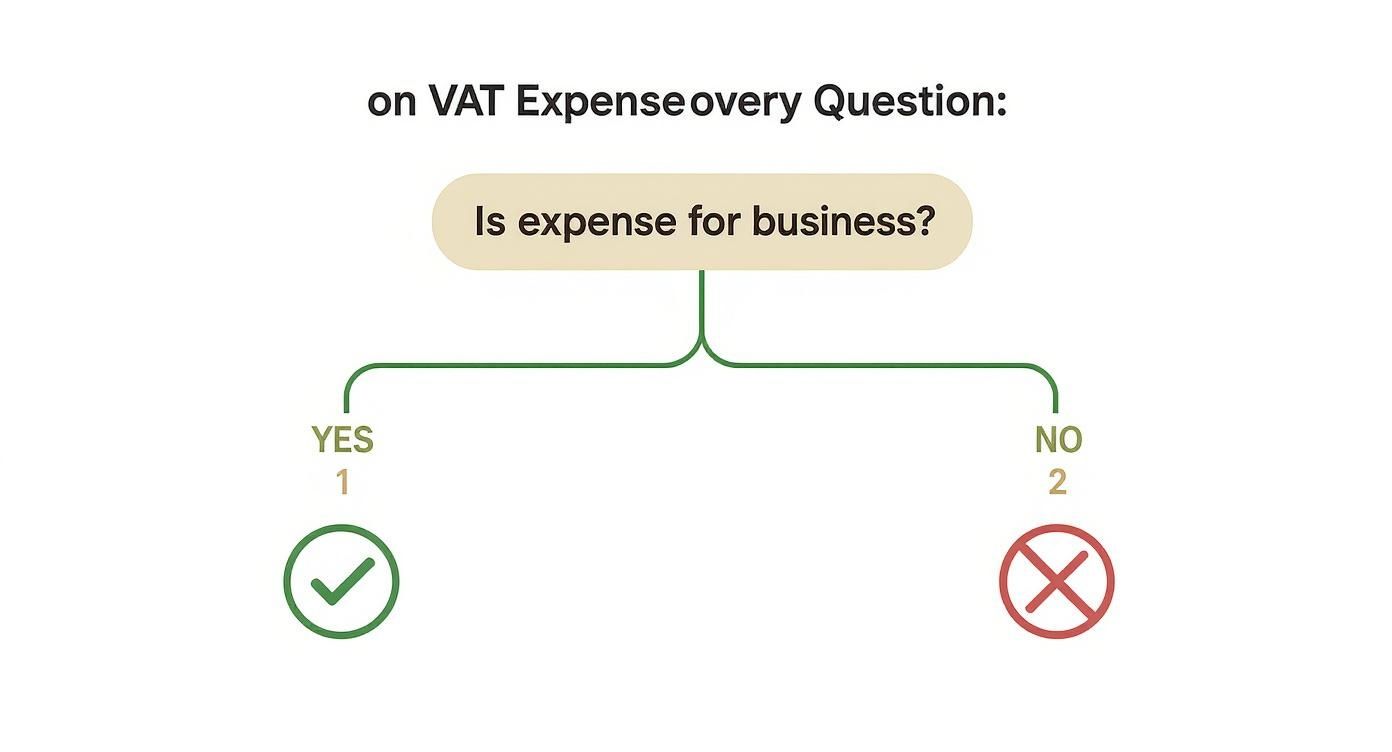

This simple decision tree can help you think through whether you can claim back VAT on an expense.

Ultimately, the rule is simple: the expense must be for a genuine business purpose. This is the bedrock principle for recovering any input VAT.

A Closer Look at Zero-Rated Supplies

A zero-rated supply is technically a taxable supply, but the tax rate applied is 0%. It might sound like a contradiction, but this is a critical concept that helps UAE businesses stay competitive, especially on the global stage.

The biggest benefit? Even though you don't charge any VAT to your customer, you can still claim back all the input VAT you paid on the costs related to making that sale.

Here are a few classic examples:

- Exporting Goods: A mainland company in Dubai sells its products to a customer in the UK. That sale is subject to 0% VAT.

- International Transport: This includes services for transporting passengers and goods that either start, end, or simply pass through the UAE.

- Specific Educational Services: Services and related goods from qualifying schools and universities are often zero-rated.

Unpacking Exempt Supplies

Exempt supplies are a different story altogether. They are not subject to VAT, which means you don't charge VAT on them. However, and this is the crucial part, you cannot recover the input VAT you paid on any costs associated with that exempt supply. This distinction can have a massive impact on your bottom line.

You'll commonly see exempt supplies in these areas:

- Certain Financial Services: Things like providing loans, credit, or mortgages are generally exempt.

- Residential Buildings: The sale or lease of a residential property after its first supply is typically exempt.

- Bare Land: The supply of undeveloped land also falls under this category.

To make the distinction crystal clear, let's compare them side-by-side. The key difference always comes down to whether you can recover your input tax.

VAT Treatment Comparison: Zero-Rated vs. Exempt Supplies

| Feature | Zero-Rated Supplies | Exempt Supplies |

|---|---|---|

| VAT Rate Charged | 0% (It is a taxable supply) | No VAT is charged (Not a taxable supply) |

| Input VAT Recovery | Allowed. You can claim back VAT on related costs. | Not allowed. You cannot claim back VAT on related costs. |

| Impact on Cash Flow | Positive. Full VAT recovery protects your margins. | Negative. Irrecoverable VAT becomes a business cost. |

| Reporting on VAT Return | Yes, reported as a taxable supply. | Yes, reported as an exempt supply. |

As you can see, while both result in the end customer paying no VAT, the internal financial implications for your business are completely different.

For businesses that deal in a mix of standard-rated and exempt supplies, things get tricky. You'll need to apportion your input VAT, claiming only the portion that relates to your taxable sales. This is a common area where businesses make mistakes, so it pays to be careful.

What About Out-of-Scope Supplies?

Finally, there are some transactions that fall completely outside the UAE VAT system. We call these out-of-scope supplies. Because they aren't considered a "supply" for VAT purposes, no VAT is charged, and they don't even need to be reported on your VAT return.

A classic example is a transaction that happens entirely outside the UAE between two companies that are not based here.

For anyone planning a mainland company formation in Dubai or Abu Dhabi, getting a handle on these nuances from the start is non-negotiable. It’s why our team provides cost-effective business setup solutions with 24/7 support—to ensure you classify everything correctly from day one and can fully enjoy the tax benefits of operating in the UAE.

Getting to Grips With the Reverse Charge Mechanism for Imports

When your UAE business starts purchasing goods or services from outside the country, you'll inevitably run into something called the Reverse Charge Mechanism (RCM). It can sound a bit complicated at first, but it’s a core part of the UAE VAT system. Its whole purpose is to make sure tax is properly accounted for when an overseas supplier isn't registered for VAT here.

In a normal local transaction, your supplier adds VAT to the bill. With RCM, that responsibility gets flipped—or reversed—onto you, the buyer. You essentially wear two hats on your VAT return: you act as both the supplier and the customer for that one transaction.

Think of it this way: RCM levels the playing field between local and international suppliers. Without it, overseas services would seem 5% cheaper, creating an unfair price advantage.

How Does RCM Actually Work in Practice?

Let’s walk through a common real-world scenario. Imagine your Dubai-based business subscribes to an international software service from a company in the US. The annual subscription costs AED 10,000.

Because the US company isn't registered for VAT in the UAE, their invoice won't include it. This is your cue that the Reverse Charge Mechanism applies.

Here’s how you handle it on your VAT return:

- Calculate the 'Deemed' VAT: First, calculate the 5% VAT on the service as if you were the one selling it. So, AED 10,000 x 0.05 = AED 500.

- Declare it as Output VAT: You report this AED 500 in the output tax section of your VAT return. This is the tax you would have collected.

- Claim it as Input VAT: At the same time, you claim that same AED 500 back as input tax, provided the software is used for making taxable supplies (which it usually is).

For most businesses, the net effect on your cash flow is zero. You declare AED 500 as tax due and immediately reclaim the exact same amount. The goal isn’t to collect more tax from you, but to ensure the transaction is correctly reported within the UAE's tax framework.

A Worked Example of the RCM Calculation

Let's put the numbers into a typical VAT return calculation. Say your business had the following activity during a tax period:

- Local sales that generated AED 2,000 in Output VAT.

- Local purchases with AED 800 in recoverable Input VAT.

- That AED 10,000 software subscription from the US (subject to RCM).

Here’s how the final VAT payable to the Federal Tax Authority (FTA) is calculated:

- Total Output VAT: AED 2,000 (from local sales) + AED 500 (from RCM) = AED 2,500

- Total Input VAT: AED 800 (from local purchases) + AED 500 (from RCM) = AED 1,300

- VAT Payable to FTA: AED 2,500 – AED 1,300 = AED 1,200

See how the AED 500 RCM amount was added to both sides and effectively cancelled itself out? The final tax you owe is based purely on your local business activity.

Getting this process wrong is a common mistake that can lead to under-declaring tax, which is something the FTA actively looks for. For any business with international suppliers, mastering the RCM is a non-negotiable part of staying compliant.

Getting Your VAT Registration and Filing Right: A Practical Checklist

Calculating VAT correctly is one thing, but that’s really just the starting point. To stay fully compliant in the UAE, you need to get a firm grip on your registration duties and filing deadlines. Let's walk through a practical checklist to make sure your business is always on good terms with the Federal Tax Authority (FTA).

The first thing to get right is your registration threshold. Ever since VAT was introduced back on 1 January 2018 at the standard 5% rate, the rule has been clear. If your company's annual revenue goes over AED 375,000 (which is about USD 102,000), you are legally required to register for VAT. This isn't optional; it's a mandatory step to ensure your business is compliant. You can actually read a great overview of the journey of VAT in the UAE on dhruvaconsultants.com to see how it has evolved.

To Register or Not to Register? That is the Question.

Now, it gets interesting. Even if you're not at the mandatory AED 375,000 mark, you have the option to register voluntarily if your turnover falls between AED 187,500 and AED 375,000. So, why would you volunteer to enter the tax system? The big reason is cash flow. Voluntary registration lets you claim back the Input VAT you pay on your business expenses. This is a huge benefit, especially if you're a startup with significant initial costs or if most of your customers are other VAT-registered businesses. For international entrepreneurs, this can make a real difference right from the start.

Making the call between mandatory and voluntary registration is a major strategic move. As specialists in Mainland Company Formation in Dubai & Abu Dhabi and Freezone Company Formation across the UAE, our team can help figure out which route makes the most sense for your business plan and financial goals.

The Nitty-Gritty: Filing and Keeping Records

Once you're registered, your main job becomes filing accurately and on time. VAT returns are usually due quarterly and are submitted through the FTA’s online portal. I can't stress this enough: do not miss these deadlines. The penalties for late filing can be steep, so get those dates into your calendar immediately.

Just as critical is keeping your paperwork in order. UAE law requires you to hold onto all tax invoices, credit notes, and any related accounting documents for at least five years. Think of these records as your evidence if the FTA ever decides to conduct an audit.

Here’s a simple breakdown to keep you on track:

- Keep an eye on turnover: Always know where your revenue stands in relation to the AED 375,000 threshold.

- File without fail: Get your VAT returns in electronically before the deadline, which is always the 28th of the month after your tax period ends.

- Maintain perfect records: Have a solid system for organising all your financial documents and keep them safe for a minimum of five years.

- Don't guess: If you're ever unsure about something, our 24/7 Support Service is always here when you need us.

Feeling a bit overwhelmed with managing your VAT compliance? 💬 WhatsApp Us Today for a Free Consultation.

Answering Your Top VAT Questions

Even once you get the hang of the basics, some real-world situations can still trip you up. Let’s tackle some of the most common questions that pop up for business owners dealing with VAT in the UAE, with straightforward answers to keep you on the right track.

How Do I Calculate VAT From a VAT-Inclusive Price?

You've probably seen prices listed with VAT already baked in. To figure out the original price and the VAT portion, you don't need to be a maths whiz. There's a handy shortcut for the standard 5% rate.

Just divide the total VAT-inclusive price by 21.

Imagine an item is priced at AED 210, all-inclusive. Here’s how it works:

- VAT Amount: AED 210 / 21 = AED 10

- Original Price: AED 210 – AED 10 = AED 200

This little trick is a huge time-saver, especially for retailers or when you're double-checking a supplier's invoice that doesn't clearly break down the numbers.

What Happens If I Make a Mistake on My VAT Return?

It's a sinking feeling, but finding an error after you've filed doesn't have to be a disaster. The Federal Tax Authority (FTA) has a process for this, and your next step depends on the size of the mistake.

- If the underpayment is less than AED 10,000, you can usually just correct it in your next VAT return.

- If the underpayment is over AED 10,000, you need to submit a voluntary disclosure to the FTA as soon as you find the error.

The most important thing is to act fast to minimise any potential penalties. If you're even slightly unsure, it's always best to get professional advice. The FTA looks much more favourably on businesses that are proactive and honest about their mistakes.

Do I Charge VAT on Services for Clients Outside the UAE?

This is a common one. When you provide services to a client who is based outside the GCC, it's generally treated as an "export of services," which means it's zero-rated. You'll apply a 0% VAT rate on your invoice.

The key here is documentation. You absolutely must have solid proof that your client is located and using the service outside the region. This evidence is what will satisfy the FTA if they ever conduct an audit. The best part? Even though you're charging 0% VAT, you can still reclaim all the input VAT you paid on your own business costs to deliver that service, which is great for your bottom line.

Getting the details of UAE VAT right is a crucial part of running a successful business here, whether you're a mainland startup or a freezone company. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, our team provides practical, cost-effective business setup solutions tailored to your needs. We help you make the most of the UAE's tax advantages with the peace of mind that comes from knowing your compliance is handled properly.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation or learn more on the 365 DAY PRO Services website.