Opting for a Dubai freezone company formation isn't just a tick-box exercise in registration; it’s a strategic choice that hands international entrepreneurs a serious competitive advantage. This path opens up a world of benefits, from 100% foreign ownership and huge tax perks to the freedom of repatriating all your profits without a single restriction. It's a foundational move for any business with global ambitions.

Why a Dubai Freezone Is Your Strategic Advantage

For sharp entrepreneurs, setting up shop in a Dubai freezone is a calculated play for growth and control. Unlike a mainland company, the freezone model completely removes the need for a local Emirati partner. This gives you absolute command over your company's equity and its future. For international investors, this level of autonomy is a game-changer.

The financial upside is just as persuasive. Businesses operating within these zones are exempt from both corporate and personal income taxes. This lets you plough profits straight back into growing your venture. On top of that, you can repatriate 100% of your capital and profits, meaning your hard-earned money never gets tied up by local currency rules.

A Hub Built for Business Acceleration

Dubai's reputation as a global business powerhouse didn't happen by chance. Its world-class infrastructure, a prime location connecting East and West, and genuinely pro-business government policies have created the perfect environment for companies to flourish.

The city's freezones are essentially purpose-built ecosystems, each one fine-tuned for specific sectors like tech, media, finance, or logistics. This clustering effect sparks collaboration and innovation while giving you direct access to a concentrated pool of talent and industry resources.

The numbers speak for themselves. The Dubai International Financial Centre (DIFC), for example, saw a massive 32% jump in company registrations in the first half of the year alone. This surge underscores how well Dubai's modernised business setup system works, with over 60 percent of new registrations now coming from international founders.

Choosing the right freezone is a pivotal decision. It does more than just give you a licence; it places your business in an environment specifically engineered for your industry, acting as a launchpad for both regional and global growth.

As you plan your new venture, it's crucial to successfully navigate the risks of strategic management to make sure your chosen freezone becomes a genuine asset, not a liability.

Making the right choice between a freezone and a mainland setup is one of the first, and most important, decisions you'll make. Each has distinct advantages depending on your business model and long-term goals.

Dubai Freezone vs Mainland At a Glance

| Feature | Freezone Company | Mainland Company |

|---|---|---|

| Ownership | 100% foreign ownership permitted. | 100% foreign ownership for most activities. |

| Business Scope | Can operate within the freezone and internationally. | Can trade directly anywhere in the UAE and internationally. |

| Office Space | Must have a physical or virtual office within the freezone. | Requires a physical office with an Ejari (lease registration). |

| Visas | Visa eligibility is often tied to the size of the office space. | Visa allocation depends on business activity and office size. |

| Taxation | 0% corporate and personal income tax. | 9% corporate tax on profits over AED 375,000. |

| Customs Duty | No customs duty on goods imported into the freezone. | 5% customs duty on imported goods. |

Ultimately, a freezone is often the perfect fit for businesses focused on international trade or providing services outside the UAE. If your primary market is within the UAE itself, a mainland company might be the better route. Weighing these differences carefully will set you on the right path from day one.

Choosing the Right Free Zone and Licence

With more than 40 free zones in Dubai, it's easy to get overwhelmed. The sheer number of options can feel paralyzing. But here’s something I’ve learned over years of helping entrepreneurs: choosing where to set up your Dubai free zone company is less about cost-cutting and more about finding a genuine home for your business. Think of it as picking a strategic partner, not just a postcode.

A classic rookie mistake is grabbing the cheapest option available. Six months later, you discover its rules or location are actively holding your business back. The real secret is to dig deeper and match the free zone’s industry focus, location, and infrastructure to what you actually do and where you want to go.

Match the Zone to Your Business

Every free zone is essentially a purpose-built city for a specific industry. Getting this alignment right means you're instantly plugged into a network of potential customers, partners, and talent who already understand your world. Choosing a generic zone just doesn't offer that same powerful shortcut.

Let’s look at a few real-world examples:

- You're a commodities trader? Don't even think about going anywhere other than the Dubai Multi Commodities Centre (DMCC). It’s the epicentre for the industry, complete with a dedicated trading platform and a community of over 21,000 businesses. Being there gives you immediate credibility.

- Running a creative agency or media company? You’ll want to be in Dubai Media City (DMC) or Dubai Design District (d3). These zones are buzzing with studios, production houses, and global ad firms. The collaborative energy there is something you just can't replicate elsewhere.

- In e-commerce or logistics? The Jebel Ali Free Zone (JAFZA) is the champion. Its direct connection to the massive Jebel Ali Port and its world-class logistics setup make it the ultimate base for any business moving physical goods.

The right free zone does more than just give you a licence—it puts your business in an ecosystem built to help it succeed. It’s a powerful growth accelerator if you choose wisely.

Getting Your Licence Right

Okay, so you've narrowed down your free zone options. The next piece of the puzzle is your business licence. This document is what legally defines everything your company is allowed to do. Picking the wrong activities can lead to fines or, worse, force you to stop a profitable part of your operation.

Most free zones boil their licences down to three main types:

- Commercial Licence: This is your go-to for any kind of trading. If you’re buying, selling, importing, or exporting physical goods, this is the one for you.

- Professional Licence: Built for service-based businesses. Think consultants, marketing specialists, designers, and IT advisors. Your business is based on your skills and expertise, not on selling a product.

- Industrial Licence: This is for businesses that make things. Manufacturing, processing, assembling, or packaging products all fall under this category. These are typically found in free zones with specialised warehouses and industrial parks.

Getting this right from day one is absolutely crucial. For example, an e-commerce store needs a Commercial Licence with a specific e-commerce activity, not a Professional Licence. This is where getting good advice really pays off. A seasoned corporate service provider can look at your entire business model and pinpoint the exact licence activities you need, saving you a world of headaches and extra costs down the road. It's one of the most important steps in the whole Dubai free zone company formation process.

The Real Financial Edge of a Free Zone

Let’s be honest, the main reason most entrepreneurs flock to a Dubai free zone is the money. It's not just about paying less tax; it's about what you can do with the capital you save. These financial perks aren't just minor benefits—they are the very foundation of the UAE's pro-business environment, designed specifically to help your company grow faster.

When you look past the shiny brochures, the numbers tell a powerful story. The ability to keep more of what you earn gives you a massive competitive advantage. Think about it: money that would have gone to the taxman can now be funnelled straight back into your business—fuelling your marketing, helping you hire top talent, or accelerating your product development.

The Power of Zero Corporate Tax

The headline grabber is, of course, the tax situation. For qualifying income, free zone companies pay zero corporate tax. This is a huge deal, especially now that mainland businesses face a 9% corporate tax rate on any profits over AED 375,000. That exemption isn't just a number; it's a direct injection of cash into your company's bank account.

And it doesn’t stop there. The UAE has no personal income tax. As the business owner, that means the salary you draw and the dividends you pay yourself are all yours. This one-two punch of corporate and personal tax advantages creates an incredibly powerful financial environment for entrepreneurs. For a deeper dive into this, you can find great insights into Dubai's investment landscape on startdxb.ae.

Full Ownership and Taking Your Profits Home

Another game-changer is 100% foreign ownership. In the past, setting up on the mainland often meant finding a local partner, which could get complicated. Free zones cut through all that, giving you complete control over your company. You own all the equity, you make all the decisions, and you keep all the profits.

This freedom is backed by 100% repatriation of capital and profits. You can move your money out of the UAE to your home country or anywhere else in the world, whenever you want. There are no currency restrictions or hidden government fees to worry about. This is crucial for anyone running a global business and managing cash flow across borders.

Having complete ownership combined with the freedom to move your profits without restriction gives you a level of financial control and security that’s hard to find anywhere else.

Finally, if you're in the business of moving goods, there's another major perk: customs duty exemptions. Any products you import into a free zone for trading, storage, or processing are exempt from standard customs duties. For logistics, e-commerce, and trading businesses, this slashes operational costs and is a key reason why hubs like JAFZA have become global powerhouses.

Getting Your Company Off the Ground

Setting up a Dubai freezone company isn't the bureaucratic nightmare many people imagine. The process has been fine-tuned over the years, becoming a clear, digital-first journey. It’s designed to get you from idea to licensed company quickly so you can focus on what really matters: your business.

Your first move is to pick and reserve your company’s trade name. This is more than just a creative decision—your name has to follow the rules of your chosen free zone. Names that are already taken, could be misleading, or are considered offensive are off the table.

From experience, it’s always smart to come prepared with three to five name options. Your first choice isn't always available, and having backups ready saves you time and frustration.

After your name gets the green light, you'll need initial approval for your business activity. This just means submitting your foundational documents to the free zone authority for their review.

What Documents Will You Need?

Think of your application package as your business's official introduction. While the exact list can differ slightly from one free zone to another, there's a core set of documents you'll almost certainly need.

Here are the usual suspects:

- Passport Copies: For every shareholder and manager involved.

- A Simple Business Plan: Nothing too complex, just a clear outline of your goals, who you plan to sell to, and your basic financial forecasts.

- The Official Application Form: Provided by the free zone itself.

- Proof of Address: For each shareholder.

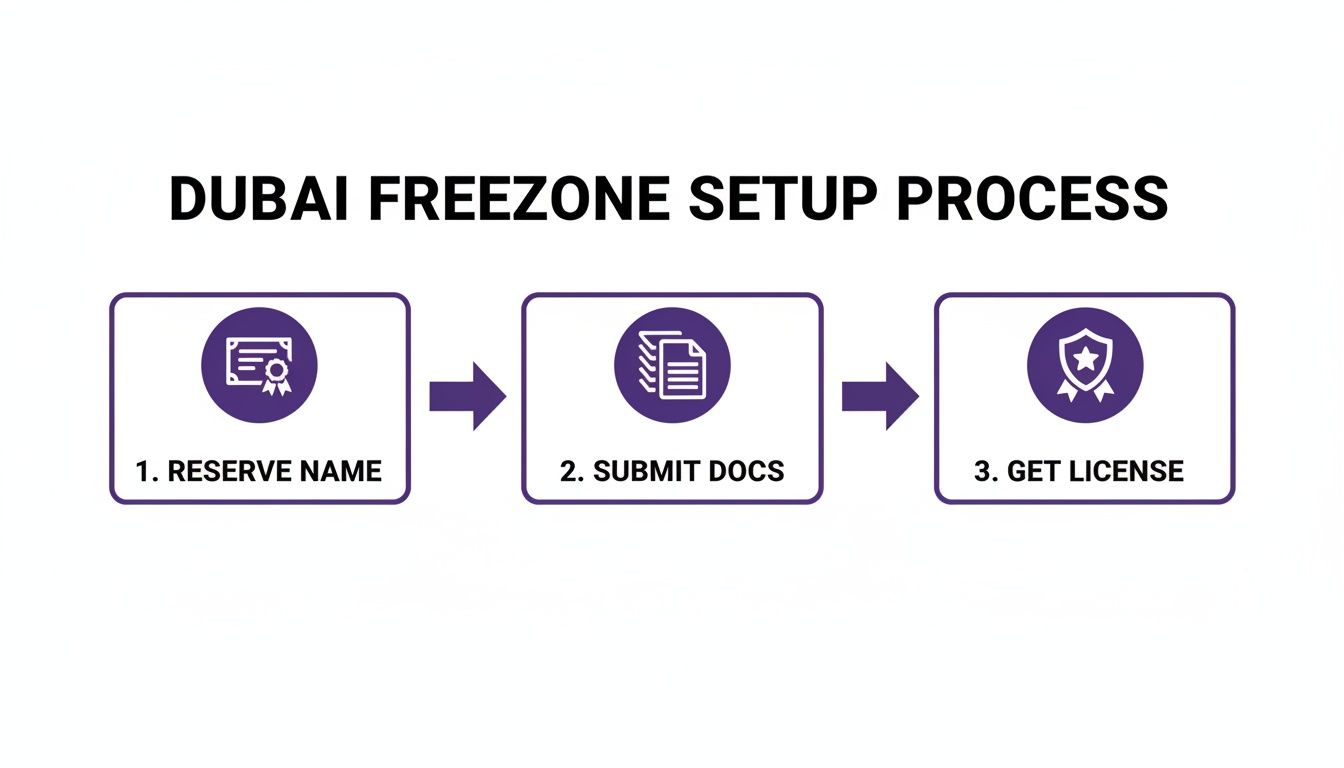

This diagram gives you a bird's-eye view of the typical workflow. It’s a straightforward, three-part journey designed to cut out the old-school delays.

As you can see, the modern approach is direct and gets rid of a lot of the unnecessary steps that used to slow things down.

The Final Stretch: Signing and Licensing

Once your documents are submitted and you've received that initial approval, you're on to signing the official incorporation papers, like the Memorandum of Association (MOA). One of the biggest perks for entrepreneurs abroad is that this can usually be handled remotely.

It’s now possible to incorporate many free zone companies in just a few days. This speed is a huge advantage, as the process often bypasses the need for notarisation—the free zone staff prepares and manages the signing process for you. You can read more about these business setup trends on chambers.com.

The speed of the modern Dubai free zone formation process can’t be overstated. Going from application to a fully licensed company in under a week means you can start trading, invoicing, and making money almost immediately.

The last hurdle is paying the government fees, after which your trade licence is issued. This is the document that makes it all official. It’s your ticket to operating legally, opening a corporate bank account, and sponsoring residency visas for yourself and your team. Working with a specialist turns this whole journey into a smooth and predictable experience, ensuring every 'i' is dotted and every 't' is crossed correctly from day one.

So, You've Got Your Licence. What's Next?

Holding your brand-new trade licence is a fantastic milestone in your Dubai freezone company formation journey. But it's important to see it for what it is: the starting line, not the finish. Now, the real work of building a fully operational and compliant business begins.

Too many entrepreneurs celebrate getting their licence and then find themselves stuck, unsure of the crucial next steps. This post-licensing phase is where you secure your residency, build your financial foundations, and cement your legal presence in the UAE. Getting this right from the outset makes all the difference.

Sorting Out Your UAE Residency Visas

Your trade licence is the golden ticket to UAE residency for yourself and any staff you plan to hire. It's not just a single application, though; it’s a carefully sequenced process that involves several government departments.

First up, your company needs an Establishment Card. Once that’s in hand, you can apply for entry permits for yourself and your team. These permits allow you to be in the UAE specifically to finalise the visa process, which involves a few key appointments:

- A medical fitness test: This is standard procedure and includes a blood test and a chest X-ray.

- Biometrics and Emirates ID application: Your photo and fingerprints are captured for your official residency card.

- Visa stamping: The final, satisfying step where the residence visa is officially stamped into your passport.

The process is methodical but unforgiving of errors. A small mistake on a form can lead to frustrating delays. This is exactly why our cost-effective business setup solutions include complete visa assistance. Our specialists, who handle freezone company formation across the UAE day in and day out, make sure every document is perfect the first time.

Opening Your Corporate Bank Account

This is, without a doubt, the hurdle that trips up most new business owners. UAE banks are incredibly diligent due to strict international anti-money laundering (AML) regulations. Walking in with just a trade licence simply isn't enough to get an account opened.

You need to come prepared with a comprehensive file. Banks will ask for your trade licence, Memorandum of Association (MOA), passport and visa copies for every shareholder, and a robust business plan. They need to understand exactly what your business does, where your money will come from, and who your clients will be.

Choosing the right bank is half the battle. Some are more comfortable with freezone companies and certain industries than others. Working with a corporate service provider like us, who already has strong relationships with business-friendly banks, can make this process infinitely smoother.

Keeping Your Business Compliant for the Long Haul

Your obligations don't stop once the doors open. The UAE has brought its regulatory framework in line with global standards, and compliance is absolutely mandatory. Two critical areas you need to keep on your radar are Economic Substance Regulations (ESR) and Anti-Money Laundering (AML) compliance.

Depending on your business activities, you might need to file an annual ESR notification and submit a report to prove your company has genuine economic substance in the UAE. Similarly, you must understand and fulfil your AML duties.

We offer 24/7 support to help our clients manage these ongoing requirements, ensuring their businesses stay in excellent standing. This proactive approach lets you focus on growth and enjoy the full UAE tax benefits without worrying about compliance headaches down the road.

Why Working With a Specialist is a Smart Move

Let's be honest, trying to figure out a Dubai freezone company formation on your own can be a real headache. The rules, the paperwork, the different jurisdictions—it’s a lot to take in, especially when you're focused on getting your business off the ground. This is exactly where bringing in a corporate service expert stops being a cost and becomes your best investment.

A good partner doesn't just fill out forms. They act as your guide, turning what looks like a mountain of confusing steps into a clear, straightforward path. We’ve been through this process hundreds of times, whether it’s for a freezone setup or a mainland company in Dubai, Abu Dhabi, or Sharjah. That experience means we can help you avoid common—and often expensive—mistakes right from the very beginning.

Think of it this way: instead of spending your valuable time chasing documents and trying to understand local regulations, you have a team handling all the heavy lifting. We take care of the government paperwork, compliance checks, and all the back-and-forth communication.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

When you have professional expertise on your side, you can take full advantage of the UAE's tax benefits with complete confidence, freeing you up to focus on what you do best: building your business.

And what happens when you have a question at an odd hour? With our 24/7 support, you’re never left waiting. Our team is always on hand to give you the answers you need, offering genuine peace of mind that every detail—from your trade license and visas to opening your corporate bank account—is handled correctly.

Ready to get started without the stress?

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Your Questions, Answered

Setting up a company in a Dubai free zone for the first time naturally brings up a lot of questions. We get them all the time from entrepreneurs just like you. Here are some quick, straightforward answers to the most common queries we see.

Can I actually run my company from outside the UAE?

Yes, you absolutely can. This is one of the biggest attractions of a Dubai free zone setup. You can manage your entire operation from your home country, or anywhere else in the world for that matter.

In many cases, the entire registration process can be handled remotely, so you don't even need to be physically in the UAE to get started. It gives you a legitimate UAE-based company with all the tax benefits, but with the freedom to operate globally.

How long does it really take to get set up?

The timeline can shift a bit depending on which free zone you choose and what exactly your business does. But honestly, things move pretty fast here. Thanks to modern, digital systems, most free zone companies are officially incorporated and ready to go within a few days to a couple of weeks.

The single biggest factor that slows things down? Paperwork. Any delays we see are almost always because of incorrect or incomplete documents. Getting it right the first time is the key to a speedy setup.

The most common mistake we see entrepreneurs make is picking a free zone just because the initial setup fee looks cheap. You have to think long-term. Look at the approved business activities, the industry focus, and what the annual renewal fees are. A free zone that costs a bit more upfront but is a perfect match for your business is always the smarter investment.

Working with a specialist from the start ensures your application is flawless, which is the fastest way to get your trade licence in hand and start operating. Our team focuses on providing practical, cost-effective setup solutions that fit what you actually need.

Ready to get your Dubai business off the ground with a team that has your back? Let 365 DAY PRO Corporate Service Provider LLC take care of all the details.

Contact us today for a free consultation and see how our 24/7 support can help.