Getting your business license in the UAE is the first, and most crucial, step on your entrepreneurial journey. It all starts with choosing where to set up shop, and in the UAE, you have three main options: Mainland, Free Zone, or Offshore. Each path is designed for different business models, and picking the right one from the start can make all the difference.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we’ve guided countless international entrepreneurs through this process. We specialize in creating cost-effective business setup solutions tailored to your unique needs, helping you take full advantage of the UAE's incredible tax benefits.

Your UAE Business License Explained

Think of it like choosing a location for a new restaurant. A Mainland license is like opening on a busy high street in the heart of the city. You have complete freedom to serve any customer who walks by, cater local events, and expand anywhere you like within the country.

A Free Zone license is more like setting up in a dedicated international food court at a major airport. You're surrounded by other global businesses, benefit from special rules like 100% foreign ownership and tax exemptions, and are perfectly positioned for international trade.

Finally, an Offshore license isn't a restaurant at all—it's the head office that owns the global franchise rights. It doesn't serve customers directly in the UAE but manages international assets, investments, and intellectual property with maximum privacy and tax efficiency.

Getting this choice right is fundamental. It sets the stage for everything that follows, from your ownership structure to your ability to trade locally. This guide will walk you through the specifics of each, helping you align your business vision with the right legal framework.

Mainland, Free Zone, and Offshore Jurisdictions

The UAE's business scene is absolutely electric right now, and that's no accident. The government has been rolling out strategic reforms and digital initiatives to make the country a magnet for global entrepreneurs. The numbers speak for themselves: the UAE has now blown past 1.5 million active commercial licenses, with a massive surge in new registrations just in the last few months.

This boom, which you can read more about in this analysis of UAE business registrations, isn't just happening in Dubai. Emirates like Abu Dhabi, Sharjah, and Ajman are seeing record growth, signalling a robust and confident economy that’s ripe for new ventures.

To find your place in this thriving ecosystem, let's break down the core differences between the three jurisdictions.

- Mainland License: This is your ticket if you plan to trade directly with customers anywhere in the UAE, bid on government contracts, or set up a physical shop or office without restrictions. It offers the ultimate freedom to operate within the local economy.

- Free Zone License: Perfect for international businesses, consultants, and anyone who wants 100% foreign ownership without needing a local partner. There are over 40 specialised free zones, creating powerful industry ecosystems for everything from tech and media to commodities and logistics.

- Offshore License: This is a non-operational holding company. It can't trade within the UAE but is an excellent tool for managing international assets, owning real estate, or holding shares in other companies. It provides a layer of confidentiality and significant tax advantages.

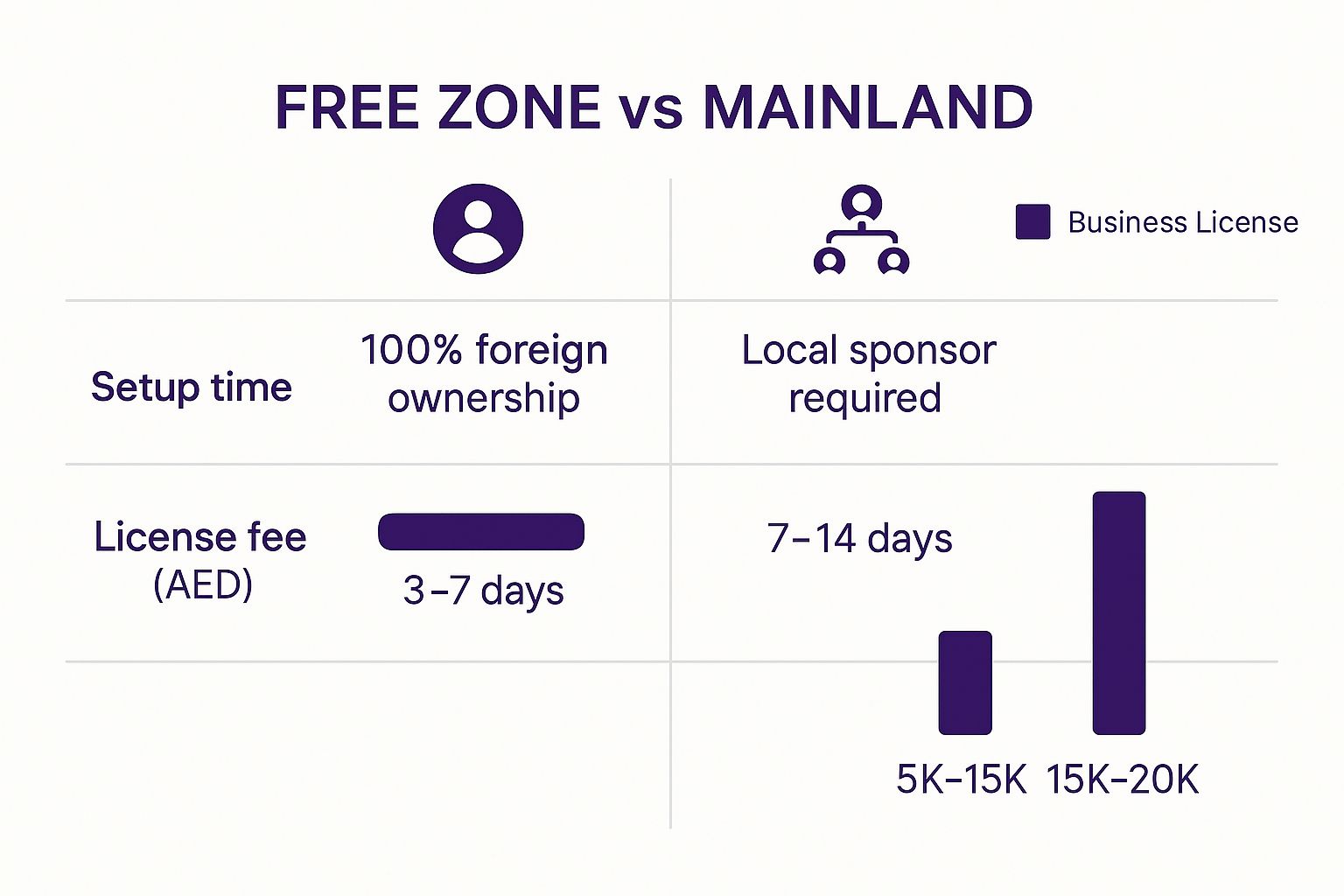

This infographic breaks down some of the key differences between a Free Zone and Mainland setup, covering things like ownership, setup times, and typical costs.

As you can see, the data highlights that Free Zones often provide a quicker path to getting started, with the major draw of complete foreign ownership baked right in.

Your choice of jurisdiction is the single most important decision you'll make when forming your UAE company. It directly impacts your ownership, operational scope, tax liabilities, and future growth potential.

To give you a clearer picture, let's look at a side-by-side comparison.

UAE Business License At a Glance

This table simplifies the core differences between the three license types, helping you quickly see which one aligns best with your business goals.

| Feature | Mainland License | Free Zone License | Offshore License |

|---|---|---|---|

| Market Access | Unrestricted access to the entire UAE market. | Limited to the specific free zone and international trade. | Not permitted to trade within the UAE. |

| Ownership | 100% foreign ownership for most activities. | 100% foreign ownership is standard. | 100% foreign ownership is standard. |

| Office Space | Physical office space is mandatory. | Flexible options, including virtual offices. | No physical office is required. |

| Visas | Visa eligibility depends on office size. | Visa eligibility is linked to the chosen package. | No visas are issued. |

Each option is a powerful tool when used for the right purpose. The key is to match the jurisdiction’s features—its freedoms and its limitations—with your specific business model from day one.

Choosing Your Path: Mainland vs. Free Zone

When you're ready to get your business license UAE, the first big decision you'll make is where to set up shop: on the Mainland or in a Free Zone. Think of it like deciding between opening a boutique on a bustling high street or setting up a specialised workshop in a high-tech business park. Both spots are fantastic, but they cater to very different business models and ambitions.

A Mainland company gives you the freedom to operate anywhere and everywhere in the United Arab Emirates. It's the go-to choice if you plan to trade directly with the local market, open a physical shop, or bid on potentially lucrative government contracts.

On the flip side, a Free Zone company is based within a specific economic territory that has its own rules. This route is a magnet for businesses focused on international trade or services, especially those looking for the major perks of 100% foreign ownership and specific tax benefits. Let’s dig into the key differences to figure out which path is the right one for your venture.

Understanding Market Access and Scope

The biggest thing that separates a Mainland from a Free Zone licence is how and where you can operate. A Mainland licence is essentially your key to the entire country, letting you set up and do business without any geographical fences.

If your dream is to open a café in Abu Dhabi, run a consultancy in Sharjah, or launch a retail store in a Dubai mall, then a Mainland setup is the only way to go. You need that direct line to your customers and the wider UAE consumer base.

Free Zone companies, however, are really built for international or business-to-business activities that are run from within their designated zone. If you want to sell directly to the Mainland market from a Free Zone, you'll generally need to team up with a local distributor or agent.

- Mainland Operations: You have the green light to trade goods and services across all seven Emirates without restriction.

- Free Zone Operations: Your business activities are usually contained within the free zone itself or are pointed towards international markets.

This isn't a minor detail; it's a critical strategic choice. A Mainland licence is for conquering the local market, while a Free Zone licence is for building a global footprint. As specialists in Mainland Company Formation in Dubai & Abu Dhabi, we can give you advice tailored specifically to who you want to sell to.

Ownership Structures and Legal Forms

It wasn't long ago that Mainland companies required a UAE national to hold a 51% share. That's all changed. Recent legal reforms have opened the doors for 100% foreign ownership in over a thousand commercial and industrial activities, making the Mainland option more appealing than ever for international entrepreneurs.

Even with these changes, keep in mind that some strategic sectors might still have specific ownership rules. It’s always best to double-check the regulations for your particular business activity.

Free Zones, on the other hand, have always been the champions of complete foreign ownership. This has long been their main draw, giving expatriate entrepreneurs full control of their business without needing a local partner. It's this straightforward ownership that makes Free Zones the first stop for many international firms entering the region.

The decision on jurisdiction directly influences not just your market reach but the fundamental control you have over your company's equity and future direction.

Office Requirements and Visa Eligibility

Your choice of jurisdiction also determines your need for a physical office, which in turn affects how many employee visas you can get. For any Mainland business license UAE, having a physical office space registered with Ejari is a must.

The size of your office is directly tied to your visa quota—the bigger the space, the more employee visas you're eligible for. The system is designed to make sure companies have the right infrastructure to support their team.

Free Zones are a different story; they offer a lot more flexibility. Entrepreneurs can pick from a range of cost-effective setups that fit their needs, including:

- Flexi-desks or Co-working Spaces: Perfect for freelancers and startups. These give you a professional address and usually come with one or two visas.

- Serviced Offices: These are ready-to-go, fully-equipped offices that come with a larger visa quota.

- Physical Offices and Warehouses: For bigger operations, Free Zones have scalable office and industrial spaces with plenty of visa allocations.

This adaptability makes Free Zones a smart, cost-effective business setup solution for startups and small businesses testing the waters. We can help you sort through these choices, whether you need a Mainland office or a flexible Free Zone package. For a quick chat, feel free to WhatsApp Us Today for a Free Consultation.

Exploring Top UAE Free Zones

Choosing a free zone for your business license UAE isn't just a box-ticking exercise; it's a strategic move that places your company right in the heart of a purpose-built, industry-specific ecosystem. With over 40 free zones dotted across the country, each one acts as a specialised hub designed to help businesses in particular sectors connect, innovate, and grow.

Think of it like choosing the right neighbourhood for your home. If you're a financial powerhouse, you want to be close to the buzz of the financial district. A fashion designer? You'd naturally gravitate towards the design district. UAE free zones work on that very same principle, creating powerful clusters where like-minded businesses don't just coexist—they thrive together.

This model is a massive magnet for both ambitious startups and established global firms. They offer more than just a licence; they provide a full-service operational base, often with one-stop-shop services that simplify everything from registration to visas.

Industry-Specific Hubs of Innovation

The real magic of the free zones is their specialisation. This sharp focus cultivates an environment packed with industry-specific talent, endless networking opportunities, and regulators who genuinely understand your business's unique needs.

This specialisation is attracting a whole new generation of entrepreneurs. We're seeing a clear trend: new business licences are flocking to these innovation clusters. It's especially noticeable in places like DMCC, which has become a hotspot for commodities and crypto, or Dubai CommerCity (DCC), which has seen explosive growth from e-commerce and AI logistics firms. Meanwhile, JAFZA continues its reign as a titan of industrial trade. E-commerce, fintech, and AI-focused companies are leading the charge in new registrations, and founders consistently report that online portals and flexible co-working options have made setting up easier than ever. You can dive deeper into these emerging UAE free zone trends on emiratesebcs.com.

Let’s look at a few leading examples:

- Dubai Multi Commodities Centre (DMCC): True to its name, DMCC is a global trading powerhouse for everything from gold and diamonds to tea and coffee. It has also brilliantly pivoted to become a world-leading ecosystem for crypto and blockchain technologies.

- Dubai CommerCity (DCC): As the region's first free zone built exclusively for e-commerce, DCC offers complete, end-to-end solutions. This includes state-of-the-art warehousing, logistics, and last-mile delivery, making it the perfect launchpad for online retailers.

- Masdar City, Abu Dhabi: A true trailblazer in sustainability, Masdar City is the premier destination for businesses dedicated to green technology, renewable energy, and creating the sustainable cities of tomorrow.

As specialists in Freezone Company Formation across the UAE, we know these zones inside and out and can help you pinpoint the perfect one for your venture.

Choosing the right free zone means your business isn't just registered; it's positioned for success within a supportive and dynamic community. It's about finding an environment that speaks your industry's language.

Flexible and Cost-Effective Setups

Another huge plus for entrepreneurs is the sheer flexibility that free zones offer. Forget the traditional mainland requirement for a physical office; free zones provide a whole menu of scalable and cost-effective business setup solutions that are perfect for businesses of any size.

This flexibility is a game-changer, especially for startups and international firms wanting to test the waters. You can start lean and expand your footprint as your business grows, all without being shackled to expensive, long-term leases right from the start.

These flexible options typically include:

- Flexi-Desks: The go-to affordable solution. It gives you a professional address and access to shared workspaces, making it ideal for freelancers and solo entrepreneurs. This option usually comes with eligibility for one or two visas.

- Serviced Offices: For small teams that need a professional base without the setup hassle, these fully-furnished, ready-to-use offices are perfect. They also come with a higher visa quota.

- Customisable Office and Warehouse Spaces: Larger operations can secure dedicated offices, warehouses, or even industrial plots. These spaces can be tailored to your exact needs and come with significant visa allocations.

This adaptable approach keeps your initial investment low and lets you pour your resources into what really matters—growing your business. Our team can put together a package that fits your budget and vision. For a personalised plan, WhatsApp Us Today for a Free Consultation.

Popular UAE Free Zones and Their Specialisations

To give you a clearer picture, we've put together a table highlighting some of the most sought-after free zones and what they're known for. This should help you see how each zone is tailored to support specific industries with unique benefits.

| Free Zone | Primary Industry Focus | Key Benefits |

| :— | :— | :— | :— |

| Dubai Multi Commodities Centre (DMCC) | Commodities, Crypto, Blockchain, Professional Services | World-class infrastructure, vast networking community, leading crypto ecosystem. |

| Jebel Ali Free Zone (JAFZA) | Logistics, Trading, Manufacturing, Industrial | Direct access to Jebel Ali Port, excellent global connectivity, expansive warehousing. |

| Dubai International Financial Centre (DIFC) | Banking, Finance, FinTech, Wealth Management | Independent legal framework (Common Law), top-tier regulatory environment. |

| Dubai CommerCity (DCC) | E-commerce, Logistics, Digital Marketing | Turnkey e-commerce solutions, advanced logistics, dedicated support. |

| Abu Dhabi Global Market (ADGM) | Financial Services, Asset Management, Private Banking | English common law jurisdiction, robust regulatory framework, strategic location. |

| Masdar City, Abu Dhabi | Renewable Energy, Sustainability, Clean Tech | Innovation hub for green tech, R&D facilities, strong government support. |

| Ras Al Khaimah Economic Zone (RAKEZ) | Manufacturing, Trading, Services, Education | Cost-effective solutions, wide range of licences, business-friendly environment. |

Finding the right free zone is about matching your business's DNA with the zone's speciality. When you get that alignment right, you're not just setting up a company; you're plugging into a powerful engine for growth.

How to Secure Your Business License

Getting your hands on a business license UAE can seem like a daunting task, but the reality is that the process has become surprisingly straightforward. Let's walk through the journey step-by-step, turning a complex-looking puzzle into a clear, manageable roadmap.

The entire approach to setting up a company in the UAE has shifted thanks to a major digital push. Forget the old days of mountains of paperwork and standing in long queues. Now, it’s all about unified government portals and e-signatures, which has seriously cut down on waiting times and made everything far more transparent.

As specialists in Mainland Company Formation in Dubai & Abu Dhabi and free zone setups, we know this process inside and out. Our goal is to get you comfortable with each stage so you can handle the requirements without feeling overwhelmed.

Step 1: Nailing Down Your Business Activities and Legal Structure

First things first: you need to decide exactly what your business is going to do. Every single business license UAE is linked to a list of specific, approved activities managed by authorities like the Department of Economic Development (DED). Whether you’re importing goods, offering consultancy, or launching an online shop, your activities will dictate your license type and legal setup.

With your activities defined, you’ll choose a legal form. This is your company's official structure—think Sole Proprietorship, Limited Liability Company (LLC), or perhaps a branch of an existing foreign company. This decision is critical as it affects everything from ownership to personal liability, so it needs to match your long-term vision.

Step 2: Reserving a Trade Name and Getting the Initial Go-Ahead

Your trade name is your business’s identity, so it needs to be unique. It also has to follow UAE naming rules—for instance, it can't be offensive or use religious names. You’ll submit your preferred names through the DED or the relevant free zone’s online portal for approval.

Once your name is cleared, the next big milestone is the Initial Approval. This is essentially a preliminary green light from the authorities, confirming they’re on board with your business idea. It’s a vital step that unlocks the ability to move forward with drafting legal documents and other formalities.

The Initial Approval is a crucial checkpoint. It signals that your business concept and trade name are accepted, clearing the path for the more formal legal and administrative work to begin.

Step 3: Drafting Legal Documents and Securing an Office

With the Initial Approval in your pocket, it's time to get your legal paperwork in order. For most companies, this involves drafting a Memorandum of Association (MoA), which is the constitutional document for your business. It lays out all the key details: who the shareholders are, their ownership stakes, and what the company aims to do.

The UAE’s business world has gone digital in a big way. Most Emirates and free zones now accept Digital Memorandums of Association (MoA) and e-signatures, which means entrepreneurs can often complete the whole incorporation process from anywhere in the world. This digital shift has slashed processing times, with some major free zones now registering a business in just 1 to 5 working days. Unified online portals are the new standard, letting you handle licensing, payments, and even visa renewals online. It's this speed and transparency that entrepreneurs point to as a key advantage, making the UAE a top spot for setting up a business without the usual hassle. You can read more about these UAE business registration changes on garant.ae.

At the same time, you'll need a physical address for your business. For a mainland license, this means leasing an office and registering the contract with Ejari. Free zones, on the other hand, often provide more flexible and cost-effective business setup solutions, like flexi-desks or virtual offices.

Step 4: Submitting the Final Application

You’re at the final hurdle. Now you just need to pull all your documents together and submit them for the final license. This package will typically include:

- Application Form: The main, completed license application.

- Legal Documents: Your signed Memorandum of Association.

- Approvals: The trade name certificate and your Initial Approval.

- Personal Documents: Passport copies for every shareholder and manager.

- Office Lease: Your registered tenancy contract (Ejari for mainland).

Once the authorities have verified everything and you've made the final payment, your business license UAE will be issued. This is the official document that gives you the legal right to start operating. With our 24/7 support service, we’re here to help you through every submission, making sure it’s a smooth run from start to finish. For immediate help, Call Us Now: +971-52 923 1246.

Cracking the Code on Your Business Setup Costs

Let's talk money. Budgeting is everything when you're launching a new venture, and getting a real handle on the costs for your business license in the UAE is the first, most critical step. It can feel like a maze of different fees at various stages, but it doesn't have to be. We’re going to lay it all out for you, so you can build a solid financial plan without any nasty surprises down the road.

Our job is to map out the most cost-effective business setup solutions for you, making sure there are no grey areas from the get-go. The goal is to make your entry into the UAE market as smooth as possible. When you know what to expect, you can manage your cash flow smartly and give your business the best possible start.

Breaking Down the Main Fees

Getting your license isn't a single payment; it's a series of mandatory government fees, each tied to a specific milestone. Think of it like building a house: you pay for the foundation, then the frame, and finally the interior. Each part is crucial to the final product.

These aren't just random charges. They cover the essential administrative work to get your company legally registered and compliant with UAE regulations. Whether you're looking at a Mainland Company Formation in Dubai & Abu Dhabi or a free zone, our team can give you a precise quote tailored to your specific business.

Here are the key fees you’ll need to factor into your budget:

- Trade Name Registration: This is the fee for securing your unique business name.

- Initial Approval Certificate: A payment for the preliminary green light from the relevant economic department.

- License Issuance Fee: The big one. This is the main cost for your trade license, and it changes depending on your business activities and where you set up.

- Office Rent/Lease Agreement: A major expense for mainland companies. Free zones, on the other hand, offer more budget-friendly options like flexi-desks.

Mainland vs. Free Zone: A Cost Showdown

The total bill for your business license in the UAE will look very different depending on whether you go for a mainland or a free zone setup. A mainland company gives you the freedom to trade anywhere in the UAE, but it usually comes with a higher price tag upfront, mostly because you have to rent a physical office.

Free zones are a different story. They're built to attract foreign investors and startups with competitive, often all-in-one, packages. This makes them a much more accessible entry point for many entrepreneurs.

Your choice between mainland and a free zone isn't just about operations—it's a major financial decision. A free zone might be cheaper to start, but a mainland license could be the smarter long-term play if your main goal is to sell directly to the local UAE market.

Let's put the typical costs side-by-side:

| Cost Component | Mainland Setup | Free Zone Setup |

|---|---|---|

| License Fee | Varies widely based on your activity and DED fees. | Usually part of a package, with tiers based on how many visas you need. |

| Office Space | A physical office with Ejari registration is mandatory. | Flexible choices, from virtual offices to full-sized warehouses. |

| Visa Costs | Tied to your office size and government rules. | Often included in the package (e.g., 1-2 visas with a flexi-desk). |

| Sponsorship Fees | Required for some professional licenses (a Local Service Agent fee). | Not an issue – you get 100% foreign ownership. |

As the table shows, free zones generally offer more straightforward, predictable pricing. As specialists in Freezone Company Formation across the UAE, we can help you pinpoint the perfect package that fits your budget and vision for growth.

Ready to get a clear picture of your costs? WhatsApp Us Today for a Free Consultation.

Staying Compliant After Your License Is Issued

Getting your business license in the UAE is a huge win, but it’s really just the starting line. Now the real work of keeping your company in good legal standing begins. Think of it like buying a new car; you get the keys and you're excited, but you still need to handle the insurance, registration, and regular servicing to keep it running smoothly.

Staying on top of your compliance obligations from day one is the only way to avoid fines and build a business that lasts. These aren't just one-off tasks; they're ongoing responsibilities that kick in the moment you receive that license. Our 24/7 support service is here to make sure you have a partner to help you manage everything without a hitch.

Key Compliance Responsibilities

Your ongoing duties are pretty straightforward, but they are absolutely non-negotiable. They show you're serious about operating within the UAE's legal framework and are crucial for keeping your business running without interruption.

Here’s what you’ll need to manage every year:

- Annual License Renewal: Every trade license has an expiry date. You’ll need to renew it annually by submitting the right paperwork and paying the fees to your licensing authority, whether that's the DED for a mainland setup or a specific free zone authority.

- Corporate Tax Registration: Since the UAE introduced corporate tax, every licensed business must register with the Federal Tax Authority (FTA). This is a mandatory step, even if you don't expect your profits to hit the taxable threshold.

- Maintaining Proper Records: Keeping clean, accurate financial books is essential. This isn't just good business practice; it's a legal requirement for things like Economic Substance Regulations (ESR) and Anti-Money Laundering (AML) reporting.

Maintaining Good Standing

Beyond the big-ticket renewals, a handful of other administrative tasks are just as important for keeping your operations smooth. These details ensure your company’s structure, staffing, and documentation are always up-to-date with UAE regulations.

Proactive compliance isn't just about dodging penalties. It's about building a solid, trustworthy foundation for your business. It tells your clients, partners, and the authorities that you operate with integrity and you're in it for the long haul.

You also have to stay on top of your team's legal status. This means managing visa renewals, making amendments when roles change, and handling cancellations when employees leave. It's also vital to keep your corporate documents, like the Memorandum of Association (MoA), updated to reflect any changes in ownership or management.

As your business scales, you'll also need to ensure data security and compliance with wider regulations. A good corporate service provider can take this administrative load off your shoulders, letting you focus on what you do best—running your business. For expert help staying compliant, Call Us Now: +971-52 923 1246.

Common Questions About UAE Business Licences

When you're looking into getting a business licence in the UAE, a lot of questions pop up. It's completely normal. As company formation specialists, we've heard just about every question in the book from entrepreneurs like you. Getting straight answers is the best way to clear up any confusion and help you move forward with confidence.

Let's dive into some of the most common questions we get, with practical answers to help you make your final decisions.

Can I Get a UAE Business Licence Without a Physical Office?

Absolutely. This is a very common setup, especially in the free zones. Many free zones have come up with clever, cost-effective business setup solutions like 'flexi-desks' or co-working space packages.

These are perfect for startups, freelancers, and consultants because they give you a registered business address and all the necessary facilities without the hefty price tag of a dedicated, full-time office.

For a mainland licence, the rules have traditionally been stricter, usually requiring a physical office registered with Ejari. Even then, our team can walk you through the most affordable options that still tick all the legal boxes for your specific business.

How Many Visas Can I Get With My Trade Licence?

There's no single answer to this one—it really depends. The number of visas your licence is eligible for is tied directly to your jurisdiction (mainland vs. free zone), the size of your office space, and the type of business you're running.

- Free Zone Visas: The visa allocation is usually linked to the office package you choose. A simple flexi-desk setup might get you 1-2 visas, whereas a proper physical office will naturally allow for a much larger team.

- Mainland Visas: Here, the quota is typically calculated based on the square footage of your registered office. The bigger the space, the more visas you can apply for.

We always advise clients to think about their hiring plans early on. That way, we can make sure the licence package you select is ready to support your team as it grows.

The core difference is simple: Commercial licences are for trading goods, while Professional licences are for providing services. This distinction impacts ownership structure, especially on the mainland.

Think of it this way: a Commercial Licence is for any business that buys and sells physical products. On the other hand, a Professional Licence is for service-based experts—think auditors, doctors, or business consultants.

A key benefit on the mainland is that a professional licence can allow for 100% foreign ownership. In this case, you simply need to appoint a UAE national as a Local Service Agent (LSA), who has no shares in your company and no say in its operations.

Figuring out these details is what 365 DAY PRO Corporate Service Provider LLC does best. As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we offer advice that’s tailored to your specific goals, ensuring your business is set up to enjoy UAE tax benefits for international entrepreneurs. For a smooth and straightforward experience, see what we offer at https://365dayproservices.com.