If you're serious about capturing the full potential of the UAE's dynamic economy, setting up a mainland company formation in Dubai is a powerful strategic move. This isn't just about getting a business licence; it's about gaining unrestricted access to the local market, positioning yourself to bid on lucrative government contracts, and building a truly credible, long-term presence in the Emirates.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi

✅ Specialists in Freezone Company Formation across the UAE

✅ 24/7 Support Service – Always here when you need us

✅ Cost-Effective Business Setup Solutions tailored to your needs

✅ Enjoy UAE Tax Benefits for International Entrepreneurs

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation

Why a Dubai Mainland Company Is Your Best Move

When you're first planning your business setup here, the big question is always: mainland or free zone? While free zones are great for international trade, a mainland licence gives you something they can't: the freedom to operate anywhere and everywhere within the UAE.

This is a crucial distinction. It means you can open your office, a retail shop, or a warehouse in any location you choose across Dubai and the other Emirates. It allows your company to directly engage with a huge, diverse, and affluent customer base, from individual consumers to the biggest local corporations.

Gaining a Competitive Edge in the Local Market

One of the most significant perks of a mainland setup is the ability to compete for high-value government contracts. The UAE's public sector projects are a massive opportunity for growth, and only companies registered on the mainland can bid for them. For businesses in fields like construction, technology, or consulting, this alone can be a complete game-changer.

Beyond that, a mainland presence inherently builds credibility and trust. It sends a clear signal to local partners, suppliers, and clients that you are serious about your commitment to the region. In the local business culture, that kind of trust is invaluable and often leads to stronger, more sustainable relationships.

The Impact of 100% Foreign Ownership

The rules for mainland company formation in Dubai have undergone a massive shift for the better. It used to be that you needed a local Emirati sponsor holding 51% of your company's shares. However, a landmark policy change in 2020 opened the doors to 100% foreign ownership for a vast number of business activities.

This was a deliberate move to attract more foreign investment, and it has made the mainland option more appealing than ever. You can learn more about how these ownership laws benefit entrepreneurs on the Start Any Business website. Now, international founders can have complete control over their business operations and profits while still enjoying all the advantages of direct market access.

For international entrepreneurs, this change offers the best of both worlds: total operational control and the ability to tap into the UAE's robust domestic economy. This setup is ideal for those seeking to maximise UAE tax benefits while building a powerful local brand.

As specialists in both mainland and free zone formations across the UAE, we provide cost-effective business setup solutions tailored to your specific needs. Our 24/7 support ensures you have expert guidance at every stage, helping you make the best strategic move for your venture.

Getting into the Nitty-Gritty: Legal Structure and Business Activities

Now that you’ve decided the mainland is the right place for your business, it’s time to start laying the groundwork. This is where your vision truly starts taking shape. The next couple of decisions are foundational: choosing your company's legal structure and nailing down exactly what your business will do.

For most entrepreneurs coming from abroad, the Limited Liability Company (LLC) is the go-to legal structure here in Dubai. And for good reason. An LLC is treated as its own legal entity, completely separate from its owners. This creates a vital firewall, protecting your personal assets from any company debts. In simple terms, your personal financial risk is capped at the amount you've put into the business.

Pinpointing Your Business Activities and Licence Type

Before anything else, you need to state precisely what your company will be doing. The Department of Economy and Tourism (DET) maintains an official list of over 2,000 approved business activities, and your selections are crucial. Why? Because the activities you choose directly dictate the type of trade licence you'll be issued.

Think of it as matching your business plan to the right regulatory bucket. This step is far more than a simple box-ticking exercise; it defines what you can and can't do legally.

To help you figure out where you fit, here’s a look at the most common licence types you'll come across.

Comparison of Common Mainland Licence Types

| Licence Type | Best For | Common Activities | Ownership Structure Notes |

|---|---|---|---|

| Commercial | Businesses buying and selling goods or specific services. | General trading, e-commerce, real estate, retail shops. | Typically allows for 100% foreign ownership for most activities. |

| Professional | Service-based companies and skilled professionals. | IT consultancy, marketing agencies, design studios, training centres. | Allows for 100% foreign ownership but requires a Local Service Agent (LSA). |

| Industrial | Companies involved in manufacturing and production. | Food processing, metal fabrication, plastics manufacturing. | Requires specialised approvals and often a physical factory or workshop. |

As you can see, choosing the right activities from the start sets the entire tone for your setup journey, influencing everything from costs to the need for external government approvals. It's something you want to get right the first time.

Reserving Your Trade Name

With your activities defined, the next task is picking a name for your company. This isn't just about branding—it's a legal step that requires approval and reservation through the DET’s official portal.

To avoid getting your application bounced back, you have to play by the rules. The name can't be offensive or already taken. It also can’t include religious references or names of government bodies. Thinking of using your own name? It has to be your full name, and you must be a partner in the company. Getting this sorted early on saves a lot of headaches and prevents delays.

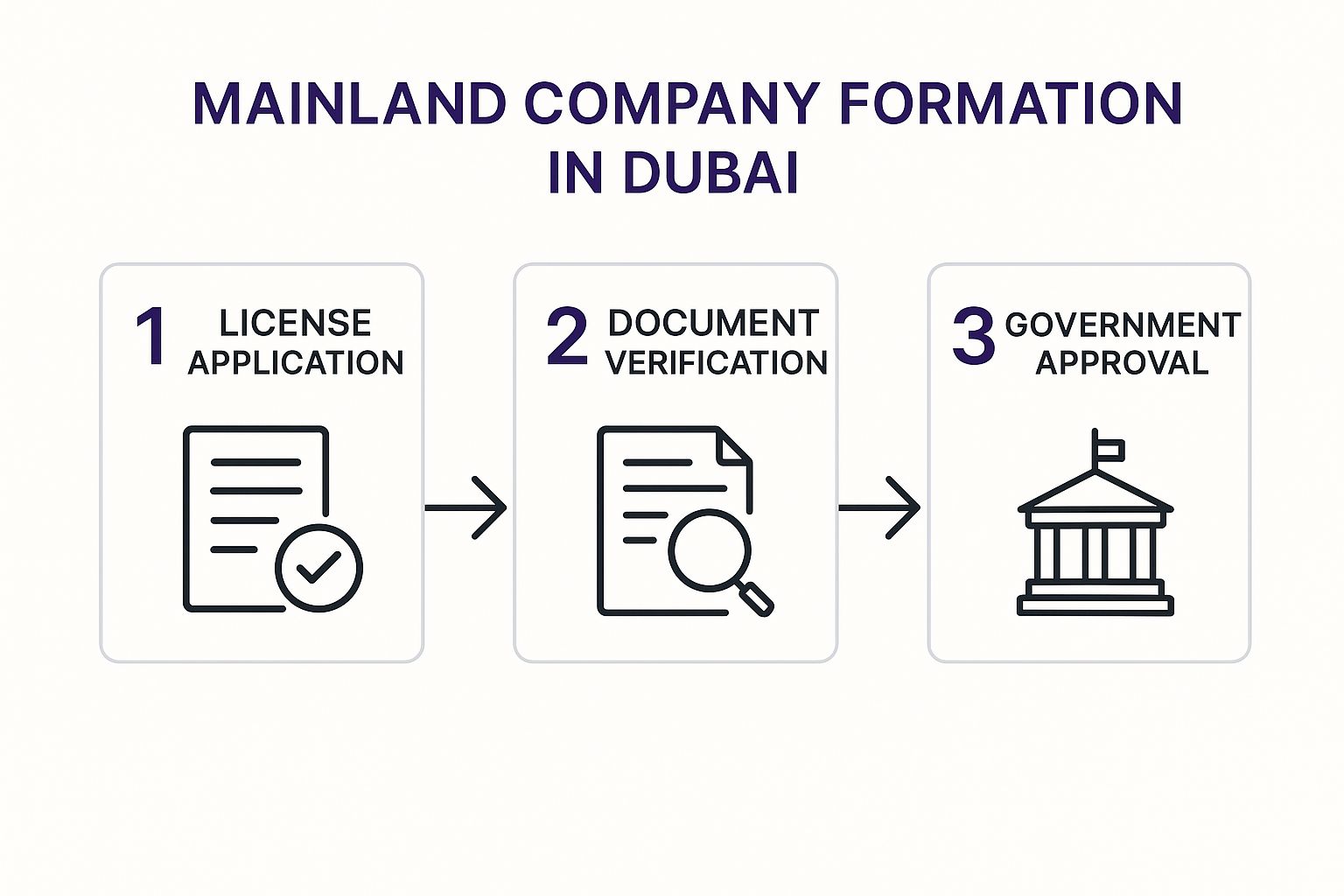

The entire initial process is a sequence of dependent steps, as you can see below. Each one clears the path for the next.

This flow really just shows that the process is logical. You build your company’s legal foundation piece by piece, ensuring you’re compliant at every turn.

Securing the Initial Approval

Once your trade name is reserved and activities are locked in, you’ll apply for what’s called an "Initial Approval" from the DET. Think of this as the government’s green light, confirming they have no objection to your business being established.

This certificate is the key that unlocks the next phase. With it, you can move on to drafting your company’s Memorandum of Association (MOA) and signing a commercial lease. To get here, you’ll submit all your foundational documents, including shareholder information and contracts. You can find more details in this complete guide to company formation.

Getting these early steps right is absolutely critical. We navigate these details daily, making sure every document and decision aligns perfectly with UAE regulations. It's about building your business on a solid foundation from day one.

Securing Your Trade Licence and Physical Office

Alright, you’ve got your initial approvals. Now comes the part where your business really takes shape—moving from a concept on paper to a tangible, legal entity in Dubai. This stage is all about two critical pieces: finalising your legal paperwork and securing a physical office space.

Getting these next steps right is essential. This is the foundation of your company's legal structure and its compliance with UAE law. It’s about building a solid base that won’t cause you headaches down the road.

Drafting Your Memorandum of Association

Think of the Memorandum of Association (MOA) as your company's constitution. It's the official rulebook that defines how your business will operate and governs the relationship between its owners. This isn't just a formality; it's a legally binding document that everyone signs up to.

A well-drafted MOA leaves no room for ambiguity. It must clearly outline:

- Shareholder Details: Who owns what? This section specifies each partner and their exact share percentage.

- Business Activities: A precise list of the commercial activities you're licensed to carry out, matching what was in your initial application.

- Capital Contribution: The total capital of the company and a breakdown of each partner's investment.

- Profit and Loss Distribution: The agreed-upon formula for how you'll share the financial ups and downs.

Spending time to get this document right from the start can prevent serious disputes later on. Once drafted, it has to be signed in front of a public notary in Dubai before you can move forward with your licence application.

The Role of a Local Service Agent for Professional Licences

If your company provides professional services—think consultancy, IT support, or a marketing agency—you'll need a Local Service Agent (LSA). This is a mandatory requirement for professional licences on the mainland, even though you maintain 100% foreign ownership.

It's really important to understand what an LSA does and, more importantly, what they don't do. An LSA is a UAE national (or a fully UAE-owned company) who acts as your official liaison with government departments. They’re the ones who handle administrative processes like renewing your licence or processing visas.

An LSA holds no shares in your company, has no say in its management, and takes no portion of your profits. You pay them a fixed annual fee for their service, and that’s it. You retain complete control over your business.

This setup is a perfect solution, giving international entrepreneurs full operational freedom while satisfying a key local regulation. As part of our service, we connect you with trusted, reliable LSAs so you have total peace of mind.

Securing Your Physical Office with an Ejari

For a mainland company in Dubai, a physical office is non-negotiable. The authorities need to see a legitimate commercial address to issue your trade licence. This isn't just about having a place to work; it's a fundamental legal requirement.

The key document here is your tenancy contract, which must be registered with Ejari. This is the official online system for all lease agreements in Dubai. Without a valid Ejari certificate, your trade licence application will come to a hard stop.

Your choice of office space has a direct impact on how many employment visas your company can apply for. The rule of thumb is simple: a bigger office means a bigger visa quota. Authorities typically allocate one visa for every 80-100 square feet of office space.

Practical Office Solutions for Every Budget

The need for a physical address doesn’t mean you have to sign an expensive, long-term lease for a huge office right away. Dubai’s commercial property market is incredibly flexible and offers smart solutions for new businesses.

- Co-working Spaces and Business Centres: These are fantastic for getting started. You can rent a desk or a small serviced office, which satisfies the legal requirement for a registered address and gets you an Ejari, all while keeping your initial costs low.

- Dedicated Commercial Offices: If you need more room, privacy, or want to establish a more significant presence, leasing your own traditional office is the way to go. This gives you complete control and a much larger visa allocation to build your team.

We can walk you through the pros and cons of each option, helping you find a space that fits your budget and your future hiring plans. And with our 24/7 support, we'll make sure you secure an office that not only ticks the box for your licence but also works for your business.

Getting Your Company Up and Running: Visas and a Bank Account

Your trade licence is in hand, which is a huge milestone. On paper, your company is officially a legal entity. But the real work begins now: turning that piece of paper into a living, breathing business. This is where you get the keys to operate—securing permits to hire people, getting residency for yourself and your team, and setting up your company's finances with a corporate bank account.

Honestly, this is the stage where many entrepreneurs hit their first real snag. The details matter immensely when dealing with immigration rules and the rigorous compliance checks at UAE banks. A little preparation goes a long way here.

First Things First: The Establishment Card

Before you can even think about sponsoring a visa, your company needs what's called an Establishment Card. It’s essentially your company's official file with the immigration authorities. Think of it as the master key that unlocks your ability to hire and sponsor anyone, including yourself.

Getting this card is a non-negotiable first step. Once it's issued, the government officially recognises your company as a legitimate UAE employer, and you're ready to start building your team.

The Visa Journey: From Entry Permit to Stamped Passport

Whether it's for you as the business owner or for your first employee, the residency visa process follows a very specific sequence. It’s a well-trodden path, but one where you have to tick every box correctly to avoid frustrating delays.

Here’s how it typically unfolds:

- Entry Permit: It all starts with an electronic visa (e-visa) that allows the person to enter the UAE for the purpose of residency.

- Medical Fitness Test: Once in the country (or after an in-country status change), a mandatory medical screening is next. It’s a standard procedure at a government-approved health centre to check for certain communicable diseases.

- Emirates ID Biometrics: After the medical test, the applicant heads to a government service centre to provide their fingerprints and have a photo taken for their Emirates ID card.

- Visa Stamping: With a passed medical test and biometrics done, the final step is getting the actual residence visa sticker placed in the passport.

This process is the same for everyone. It’s straightforward, but a missing document or a missed appointment can send you right back to the beginning of a step, costing you valuable time.

We see it all the time—a small mistake in a visa application can cause weeks of delays. It’s one of the most common frustrations for new businesses and can seriously impact your timeline for getting boots on the ground.

The Big One: Opening Your Corporate Bank Account

This is often the most underestimated challenge in the entire setup process. Opening a corporate bank account in the UAE is not just a formality; it's a deep dive into your business's legitimacy. Banks here have incredibly strict ‘Know Your Customer’ (KYC) and anti-money laundering (AML) protocols.

Don't assume your new trade licence is enough to get an account open. You need to walk in with a file that tells the complete story of your business.

What the Banks Want to See

To avoid a "no" from the compliance department, you need to be over-prepared. The bank's goal is to understand exactly what your business does, where your money is coming from, and who your clients will be.

Have these documents ready from the start:

- The Basics: Your trade licence, Memorandum of Association (MOA), and office tenancy contract (Ejari).

- Personal Details: Passport, visa, and Emirates ID copies for all shareholders, plus a recent utility bill from your home country as proof of address.

- Your Business Story: A well-written business profile explaining your operations, target market, and projected revenue.

- Proof of Experience: Be ready to back it up with a professional CV or profiles of your other businesses.

Choosing the right bank is just as important. Some are fantastic for startups and SMEs, while others are geared towards massive corporations. Since we work with these banks every day, we can point you to the right one for your specific profile and make sure your application file is exactly what they're looking for. With our 24/7 support, we're here to guide you through these critical final hurdles.

Navigating Post-Setup Compliance and Growth

Getting your mainland company formation in Dubai over the line is a huge milestone, but it's really just the starting point. The real work begins now, shifting from the one-off tasks of setup to the ongoing rhythm of running a successful, compliant, and growing business in the UAE.

This new phase is all about building good habits. It's about staying on top of your administrative duties and getting to grips with the local financial landscape. The goal is to transform that brand-new trade licence into a thriving business poised for real success.

Meeting Your Ongoing Compliance Duties

Your first priority should be creating a solid routine for managing your company's legal and financial responsibilities. These aren't just boxes to tick once; they're recurring duties that are absolutely essential for keeping your company in good standing with the authorities.

Here's what you'll be managing year after year:

- Annual Licence Renewal: Your trade licence needs to be renewed annually with the Department of Economy and Tourism (DET). This means making sure your office lease (Ejari) is current and paying all government fees on time.

- Establishment Card Renewal: This card is the key to processing visas, and it also needs renewing every year to keep your company's immigration file active.

- Financial Auditing: While not every LLC is required to have an annual audit, it’s a smart move. Banks often ask for audited financials, and they're invaluable for good governance.

A word of advice from experience: don't let these deadlines sneak up on you. A missed renewal can lead to fines, a block on your ability to process visas, and other headaches that are so easy to avoid with a bit of forward planning.

As specialists in this area, we provide cost-effective business setup solutions that include ongoing support, precisely so you never have to worry about missing a critical deadline.

Understanding the UAE Corporate Tax Framework

The introduction of UAE Corporate Tax is a game-changer for mainland businesses, and you need to be ready for it from day one. The system applies a standard rate of 9% on any taxable profits that go above AED 375,000 a year.

The good news for startups and smaller businesses is that profits below this threshold are taxed at 0%. This is a massive advantage.

What this means for you is that meticulous bookkeeping is no longer optional. You'll need to register your company with the Federal Tax Authority (FTA) and prepare for annual tax filings. Even with this new framework, the tax benefits in the UAE remain incredibly attractive for international entrepreneurs.

Unlocking Growth Pathways on the Mainland

So, why go through the mainland setup process? The potential for physical expansion is one of the biggest reasons. A mainland company gives you the unique ability to open new branches anywhere in Dubai and across the other Emirates without jumping through major licensing hoops.

This flexibility is a primary driver behind the 15-20% annual growth in mainland business registrations. It means you can open multiple shops, service centres, or offices to reach new customers directly. Once your Dubai business is on solid footing, you can begin exploring broader global growth strategies to scale even further.

We're also seeing innovative licensing structures emerge. The dual licence, for example, allows a mainland company to also operate within certain free zones. It’s a hybrid model that truly offers the best of both worlds—unrestricted access to the local UAE market combined with the unique benefits of a free zone. Our specialists are here with 24/7 support to help you explore these more advanced strategies when you're ready to grow.

Got Questions? We've Got Answers

Setting up a mainland company in Dubai is a big move, and it's natural to have questions. We hear a lot of the same ones from entrepreneurs just like you, so we've put together some straight-to-the-point answers to clear things up.

Mainland vs. Free Zone: What's the Real Difference?

This is the big one. The key difference boils down to one thing: market access.

A mainland company, registered with the Department of Economy and Tourism (DET), gives you a golden ticket to trade anywhere in the UAE. You can work directly with local businesses, open up a shop in a mall, and most importantly, bid on those valuable government contracts.

A free zone company, on the other hand, is generally limited to operating within its specific zone or trading internationally. While mainland setups used to mean finding a local sponsor, that's old news. Recent changes now allow for 100% foreign ownership for most business activities, making it a game-changer for international investors wanting a piece of the local market.

How Quickly Can I Get My Mainland Company Up and Running?

It’s probably faster than you think. While the exact timeline depends on your specific business activity—some require extra approvals from ministries—the core process moves quickly.

If you have all your paperwork in order, you can often get your Trade Name and Initial Approval sorted out in a day. Realistically, you should expect the entire process, from that first application to holding your final trade licence, to take somewhere between one and three weeks. The main variables are usually things like getting documents attested or finalising your office lease.

Do I Absolutely Need a Physical Office for a Mainland Company?

Yes, this is non-negotiable. The government requires every mainland company to have a physical office address registered with an Ejari, the official lease registration system. This is for licensing, verification, and regulatory purposes.

Think of your office as more than just a requirement—it's a strategic asset. The square footage of your office directly determines how many employment visas your company is eligible for. A bigger office means more room to grow your team.

What's the Ballpark Cost for a Mainland Setup?

There’s no magic number here, as the cost to set up a mainland company in Dubai is completely tailored to your business. The final figure is a mix of several key expenses.

You’ll have the trade licence fee (which changes based on your business activity), various government fees for approvals, your annual office rent (Ejari), and the costs for processing visas for yourself and your staff.

Because it varies so much, the only way to get a real number is to get a detailed quote. We can build a custom breakdown for you, showing exactly where every dirham goes, ensuring it fits your budget and business plan.

Ready to make your move? At 365 DAY PRO Corporate Service Provider LLC, we live and breathe mainland company formation and offer 24/7 support to make it happen. Let our expert team guide you to a seamless setup and all the tax benefits the UAE has to offer. Get your free consultation today!