So, you're thinking about starting a business in Dubai? One of the first questions on your mind is probably, "How much is this actually going to cost me?"

The honest answer is that it varies—a lot. You could be looking at anywhere from AED 20,000 to over AED 100,000 to get started. This isn't a single, fixed price; it's a range that depends entirely on the choices you make for your new company. The biggest factors influencing your final bill will be where you decide to set up (Mainland or Free Zone) and the specific type of business licence you need.

Decoding Your Initial Dubai Business Investment

Think of budgeting for your Dubai venture like planning a road trip. The final cost depends on the destination you pick and the car you choose to drive. Whether you're launching a small solo consultancy or a large-scale trading company, getting a firm grip on the main cost components is your first real step toward a successful launch.

Your initial investment won't be a single payment. It’s a mix of mandatory government fees, administrative charges, and operational choices unique to your business. Every decision, from your legal structure to your physical address, has a price tag attached.

Core Cost Categories to Consider

It's helpful to break down the total cost into a few key spending areas. As a new entrepreneur, you’ll need to account for:

- Jurisdiction Fees: This is the big one—choosing between a Mainland and a Free Zone setup. They have completely different pricing models. Mainland costs are tied to the Department of Economic Development (DED), while each Free Zone offers its own packages and fee structures.

- Business Licence Type: What will your company actually do? This determines whether you need a commercial, professional, or industrial licence. Each has its own cost and set of rules.

- Office Space: You must have a registered address. This could be a budget-friendly flexi-desk in a Free Zone or a full-blown physical office on the Mainland. This single choice can dramatically swing your startup costs.

- Visa Processing: You’ll need to budget for your own investor visa and any employee visas. These costs include entry permits, medical tests, and Emirates ID issuance, and they're essential for operating legally.

Budgeting for a Standard Setup

So, what's a realistic starting point for your financial planning? For a standard setup in Dubai or elsewhere in the UAE, it's wise to budget between AED 20,000 and AED 30,000. This figure can creep up if you need special approvals or want a foreign trade name.

The good news is that recent changes have made things easier. The UAE now allows 100% foreign ownership for many business activities, and you don't even need to be a resident to be a shareholder. This has been a game-changer for international investors.

✅ Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah. Our specialists in Mainland and Freezone company formation across the UAE craft cost-effective business setup solutions tailored to your needs. With 24/7 support, we are always here when you need us, helping you enjoy UAE tax benefits for international entrepreneurs.

📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation

As you map out how to cover these initial costs, it's smart to explore different funding options. Taking some time for understanding why businesses take unsecured loans can give you a broader perspective on financial strategies. This kind of preparation helps ensure you have enough capital to get through the setup phase without any nasty surprises.

To give you a clearer idea, here’s a quick overview of what you might expect to spend based on different common business setups.

Initial Business Setup Cost Estimates in Dubai

This table provides a high-level summary of potential starting costs for different business setups in Dubai, illustrating the typical financial range for entrepreneurs.

| Business Setup Type | Typical Starting Cost (AED) | Key Influencing Factors |

|---|---|---|

| Free Zone Freelancer Permit | 15,000 – 25,000 | Choice of Free Zone, number of business activities, visa eligibility. |

| Free Zone Company (1-Visa) | 20,000 – 35,000 | Free Zone location (e.g., IFZA, Meydan), office type (flexi-desk vs. private), licence activities. |

| Mainland LLC Company | 30,000 – 50,000+ | Licence type (commercial vs. professional), office rent (mandatory), approvals required, local service agent fees. |

| Offshore Company (RAK/JAFZA) | 12,000 – 20,000 | Registered agent fees, jurisdiction choice, corporate bank account opening complexity. |

Keep in mind these are estimates. Your final costs will depend on the specific details of your business plan and the partners you choose to work with during the setup process.

A Closer Look at Dubai Mainland Company Setup Costs

Deciding to set up on the Dubai Mainland is a big move. It gives you unrestricted access to the entire UAE market, letting you trade directly with local customers. But this freedom comes with a very specific cost structure, mostly set by government bodies like the Department of Economy and Tourism (DET), formerly DED. Getting a firm grip on these expenses is the first step to building a realistic budget for your new venture.

Think of your Mainland setup budget like a recipe. Each ingredient—from reserving your trade name to getting the final licence in your hands—has a price tag. If you miss one, you simply won't get the finished product: a legally operating business ready to go.

Breakdown of Dubai Mainland Company Setup Costs

To give you a clearer picture, here’s a detailed itemisation of the costs you can expect when setting up a company on the Dubai Mainland. These figures can vary, but this table provides a solid starting point for your financial planning.

| Cost Component | Estimated Cost (AED) | Description & Frequency |

|---|---|---|

| Initial Approval Certificate | AED 267 | A one-time fee paid to the DET to kickstart your application. |

| Trade Name Reservation | AED 767 | A one-time fee to secure your unique business name. |

| Memorandum of Association (MOA) | AED 1,200 | One-time cost for notarisation and legal verification. |

| Contract Drafting | AED 500 | A one-time fee for preparing the legal incorporation documents. |

| Ministry of Economy Registration | AED 3,000 | A mandatory, one-time registration fee. |

| Market Fees (Office Rent) | 2.5% of Annual Rent | An annual fee calculated based on your office lease value. |

| Trade Licence Issuance | Variable | This annual fee depends on your business activity and legal structure. |

This table covers the core government and administrative fees, but remember that other costs like your actual office rent, visa processing, and professional service fees will add to your total initial investment.

Deconstructing the Core Government Fees

The foundation of your Mainland budget is a series of mandatory government fees. These aren't negotiable; they're simply the cost of getting your business legally registered and recognised in Dubai. The journey starts with securing your company’s identity and getting that first green light from the authorities.

You’ll need to account for a few key one-time payments right at the start:

- Initial Approval Fee: This is the very first charge you’ll pay to the DET to get the ball rolling on your application.

- Trade Name Reservation: You have to pay to lock in your chosen business name, making sure it's unique and follows UAE naming rules.

- Memorandum of Association (MOA) Attestation: Your MOA is like your company's constitution. It needs to be professionally drafted, notarised, and attested, and each of those steps has its own cost.

Getting this initial stage right is crucial. Any mistakes here can cause delays and rack up extra expenses later on. It’s not just about paying fees; it's about navigating the administrative path correctly from day one.

The Critical Role of Your Office Lease

One of the biggest variables in the cost of starting a business in Dubai on the Mainland is your physical office space. Unlike many free zones that offer flexi-desk options, a Mainland company nearly always needs a physical office with a registered lease agreement, known as an Ejari.

Your office isn't just a place to work; its rental value is a key factor used by the DET to calculate a portion of your trade licence fee. A higher annual rent often translates to a higher government fee, directly linking your operational overheads to your setup costs.

This rule is in place to ensure every Mainland business has a legitimate physical presence. When you're budgeting, don't just think about the annual rent. You also have to factor in the security deposit and any real estate agent commissions. This expense is often a substantial chunk of your initial outlay.

A Financial Checklist for Mainland Setup

To build an accurate financial picture, you need to list every potential expense. In 2025, the starting cost for a Mainland company in Dubai is around AED 12,000, but the final bill can be much higher depending on your office space, business activity, and other variables. If you want a deeper dive into these numbers, you can find a lot more detail about Mainland company setup costs on startanybusiness.ae.

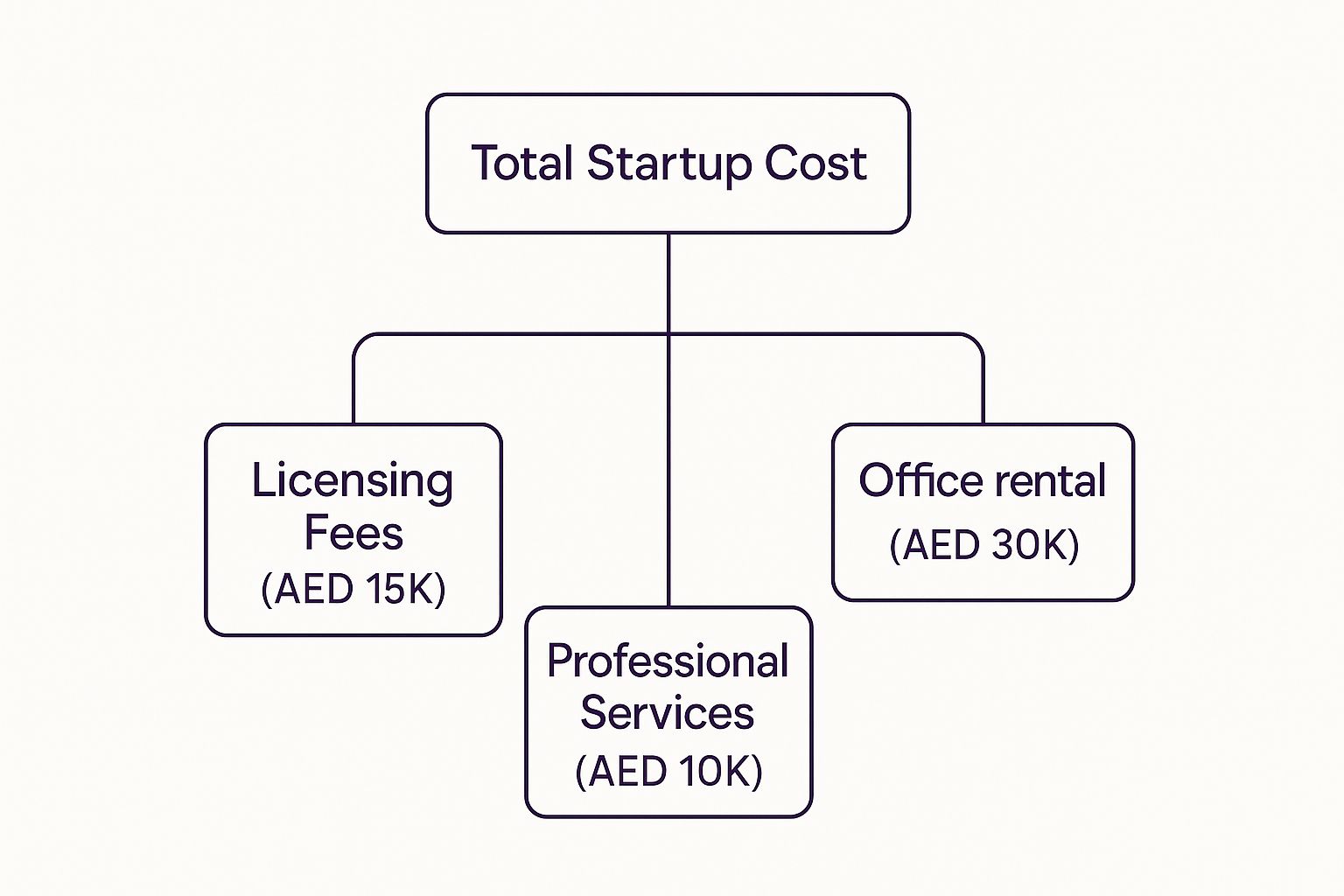

This image breaks down how the major cost categories typically contribute to your total investment.

As you can see, office rental often takes the biggest slice of the pie, followed closely by licensing fees and the cost of professional services to guide you through the process.

✅ Specialists in Mainland Company Formation in Dubai & Abu Dhabi. We are the best corporate service provider in Dubai, Abu Dhabi & Sharjah, offering cost-effective business setup solutions and 24/7 support. Let us help you enjoy the full UAE tax benefits. 📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.

A Look at the Finances of a Free Zone Setup

Dubai’s Free Zones are famous for their all-in-one packages, which makes them a magnet for international entrepreneurs. While these bundles definitely make life easier, it’s crucial to look past the headline price. You need to get a clear picture of what’s included and, more importantly, what isn’t.

Think of it like buying a new car. The base model has an attractive price, but the final cost climbs once you start adding the features you actually need, like a better sound system or advanced safety features. In the same way, the total cost of starting a business in Dubai’s Free Zones is a mix of standard fees and the specific operational choices you make.

Let's break down the different cost categories you'll come across on your financial journey.

One-Time Registration and Annual Licence Fees

Your first major expenses will be the one-time registration fee and the yearly licence fee. The registration fee is a single payment to officially get your company into the Free Zone's records—it’s the paperwork cost of making your business exist.

The annual licence fee, on the other hand, is what you pay every year to keep operating legally. This fee can be wildly different from one Free Zone to another and depends heavily on what your business actually does. A straightforward consultancy licence, for instance, will almost always be cheaper than a complex industrial or general trading licence that needs more regulatory checks.

✅ Specialists in Freezone Company Formation across the UAE. As the best corporate service provider in Dubai, Abu Dhabi & Sharjah, we offer cost-effective business setup solutions with 24/7 support. Let us help you enjoy UAE tax benefits. 📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.

For 2025, the cost structure is pretty clear. One-time registration fees for a new company usually sit between AED 9,000 and AED 10,000, depending on your company's legal structure. Your annual licence fee, a big part of your yearly budget, can be anywhere from AED 10,000 to AED 50,000 based on whether you're in trading, services, or manufacturing. For a deeper dive into these numbers, you can check out this detailed business setup cost analysis on danburitecorp.com.

The Mandatory Office Space Decision

Free Zones offer a ton of flexibility with office space, which is a big departure from the stricter rules on the Mainland. That said, you still need a registered address, and your choice here will directly affect both your startup and ongoing costs.

Here are the most common routes people take:

- Flexi-Desk: This is your most budget-friendly option. It gives you access to a shared desk for a set number of hours a month, ticking the box for a legal physical address without the high cost of a private office. It's perfect for freelancers and small startups just getting off the ground.

- Dedicated Office: If you need a private, lockable office for you and your team, you'll have to lease a dedicated space. These come in all shapes and sizes, but they are a much bigger financial commitment.

- Virtual Office: Some Free Zones provide virtual office packages. These give you a premium business address and mail handling services but don't include any physical desk time.

Your office choice is often directly linked to how many visas you can get. A basic flexi-desk package might only allow for one or two visas, while leasing a larger physical office opens the door to a higher quota of employee visas. This makes your office a strategic decision that shapes not just your budget but your company's growth potential.

Demystifying Share Capital Requirements

The term share capital trips up a lot of new entrepreneurs. In simple terms, it's the amount of money the company's owners have invested into the business. In many countries, this cash has to be deposited into a corporate bank account and left there for a while.

But in Dubai's Free Zones, the rules are all over the place. Some zones don't require any paid-up share capital at all, which makes it incredibly easy to get started. Others might ask for a token amount like AED 1,000, while some—especially those catering to huge industrial or financial firms—could demand AED 1,000,000 or more.

The good news? For most small and medium-sized businesses, the share capital is often just a "paper" requirement or a very manageable sum. It’s absolutely essential to check the specific rules for your target Free Zone before you sign anything, as this can have a huge impact on your initial cash flow. As specialists in Free Zone company formation, we can point you to the jurisdictions that best match your capital structure and business goals, ensuring your setup is as smooth and cost-effective as possible.

Budgeting for Visas and Your Team

Your initial business setup fees are just the first chapter. To get the full picture of the cost of starting a business in Dubai, you have to look past the one-off payments and plan for the ongoing costs of visas and staffing. These aren't optional extras; they're the non-negotiable expenses that let you and your team legally live and work in the UAE.

Think of your business licence as the car and your visa as the fuel. You can't have one without the other. From the owner down to the newest hire, every single person connected to the company needs a valid residence visa, and each one has its own processing fees. Forgetting to budget for these can create serious cash flow problems later on.

The good news is that these costs are predictable, so you can easily plan for them. Let's break down exactly what you need to factor into your budget to keep your business compliant and running smoothly.

Securing Your Investor or Partner Visa

As the business owner, your first job is to sort out your own visa. This will usually be an Investor or Partner Visa, and it's a multi-step process where each stage has a fee. The exact numbers can change slightly between a Free Zone and the Mainland, but the main steps are the same.

The whole thing kicks off with an Establishment Card, which is sometimes called a Company Immigration Card. It’s a mandatory document that officially registers your company with the immigration authorities so you can start sponsoring visas. Expect this to cost somewhere between AED 2,000 and AED 2,500.

With the Establishment Card in hand, you can apply for your entry permit, go for a medical fitness test, and finally get the visa stamped in your passport and receive your Emirates ID.

Here’s a typical breakdown of what you can expect to pay for a single investor visa:

- Entry Permit: Around AED 1,100 to AED 1,500. This lets you enter the country to finalise your residency.

- Medical Fitness Test: This can cost AED 350 for the standard service or up to AED 800 if you opt for the VIP express option.

- Emirates ID Application: Typically costs about AED 370 for a standard two-year visa.

- Visa Stamping: The final step will set you back about AED 900 to AED 1,200.

All in, you should budget between AED 5,000 and AED 7,000 to get your own visa processed from start to finish. This is a foundational cost that needs to be in your setup budget from day one.

Calculating Costs for Employee Visas

The real financial weight of staffing becomes clear when you realise the visa process you just went through has to be repeated for every single person you hire. This is where your headcount directly impacts your operating budget. The process for an employee visa is almost identical to an investor's, though the costs can be a little lower.

On average, plan to spend between AED 4,500 and AED 6,500 per employee for their complete visa and Emirates ID processing. This covers all the same key steps: entry permit, medical test, ID application, and the final visa stamping.

Let's look at a practical example. If you plan to bring on a team of three employees in your first year, you need to set aside an extra AED 13,500 to AED 19,500 just for their initial visas. And remember, that figure doesn't even touch their salaries, mandatory health insurance, or any recruitment fees you might have.

✅ 24/7 Support Service – Always here when you need us. As specialists in both Mainland and Free Zone company formation, we help entrepreneurs map out these financial realities. Understanding visa costs upfront allows you to build a business model that can handle team growth without getting hit by surprise expenses. 📞 Call Us Now: +971-52 923 1246 or 💬 WhatsApp Us Today for a Free Consultation.

Uncovering Hidden Costs and Additional Expenses

When you're budgeting for the cost of starting a business in Dubai, it's easy to focus on the big-ticket items like your trade licence and office rent. But what many new entrepreneurs discover the hard way is that a whole host of smaller, "hidden" expenses are waiting in the wings. While they might seem minor on their own, they can quickly add up and put a real strain on your initial cash flow.

Think of it like buying a car. The sticker price is just the beginning. You still have to account for insurance, registration, and a full tank of petrol before you can actually drive it off the lot. A smart financial plan for your business needs to treat these extra costs with the same importance.

Bank Account and Corporate Tax Essentials

One of the very first things you'll do after getting your licence is open a corporate bank account. The account itself might be free, but here's the catch: many UAE banks require you to maintain a hefty minimum balance. This could be anything from AED 25,000 to over AED 100,000. If your balance dips below that magic number, you could be hit with steep monthly penalties—a painful way to lose money before you’ve even started making it.

On top of that, the UAE now has a corporate tax system. This means you’ll need to register your business with the Federal Tax Authority (FTA). While the registration itself might not cost anything, you'll likely want to pay for professional tax advice to make sure you're set up correctly from day one. It's a small investment that helps you properly access the UAE tax benefits for international entrepreneurs and sidestep any future fines.

The Value of Professional PRO Services

Trying to manage all the government paperwork and administrative hurdles on your own can feel like a full-time job. This is where a Public Relations Officer (PRO) comes in. PRO services are an added cost, but they are often worth their weight in gold, handling everything from visa applications and licence renewals to document attestations.

It’s tempting to try and save a few dirhams by doing it all yourself. But a single mistake or a missed deadline can result in fines and frustrating delays. Think of professional PRO services less as an expense and more as an insurance policy against bureaucratic headaches and expensive errors.

When you work with a corporate service provider that has an in-house PRO team, you get access to experts who know the system inside and out. They make sure everything is filed correctly and on time, which ultimately saves you a lot of stress, time, and money.

Other Potential Expenditures to Anticipate

Depending on your specific business, a few other costs might pop up. It’s vital to figure out which ones will apply to your company.

- Product Registration: If your business involves selling products like cosmetics, supplements, or food items, you’ll need to register each one with authorities like Dubai Municipality. Every registration has a fee attached.

- Legal Attestations: Documents from your home country—like your degree certificate or your parent company's paperwork—often need to be legally attested. This is a multi-step process involving lawyers, notaries, and embassies, and the costs add up with each stamp.

- Customs Fees: For anyone in the import/export game, customs registration and duties are a standard operating cost. You absolutely have to build these into your pricing and profit calculations.

- Branding and Marketing: And of course, there's the cost of building your brand. You'll need a logo, a website, and a marketing plan. For example, knowing how much logos cost helps you set a realistic budget for this crucial launch expense.

By thinking through these potential expenses from the start, you can create a much more accurate and resilient budget. A good partner who provides cost-effective business setup solutions can give you a personalised checklist, making sure there are no unwelcome surprises on your journey.

How an Expert Partner Optimises Your Setup Costs

Trying to navigate the financial and administrative side of a Dubai business setup on your own can feel like fumbling through a maze in the dark. It might seem like the DIY route saves money upfront, but it often leads to surprise costs and frustrating delays down the line. That's where partnering with a corporate service provider comes in—it's not just another expense, but a strategic investment that helps manage the total cost of starting a business in Dubai.

Think of it like this: you're climbing a mountain. Would you go it alone or hire an experienced local guide? A specialist knows the terrain, the shortcuts, and the hidden pitfalls, making sure you get to the top faster and with all your resources intact. They stop you from overspending on obscure fees or picking a jurisdiction that’s a poor financial match for your long-term goals.

Strategic Selection for Maximum Savings

One of the biggest ways a setup expert saves you cash is by helping you choose the most cost-effective business structure right from the get-go. With real, on-the-ground knowledge of both Mainland and Free Zone company formation, a specialist can look at your business model and point you to the perfect fit.

This kind of strategic advice helps you sidestep common blunders like:

- Picking a Free Zone with hefty annual renewal fees when a cheaper option provides the exact same benefits for your business.

- Getting a Mainland licence with the wrong activities—either too many or too few—leading to wasted money or future amendment fees.

- Misjudging your office needs and paying for a physical space when a simple flexi-desk would have been perfectly fine.

This tailored guidance makes sure your initial capital is put to good use, funnelling your funds where they'll make the biggest difference.

Preventing Expensive Application Errors

The business setup process is loaded with paperwork. One tiny mistake on a form can get your application thrown out, and you won't see those government fees again. A corporate service provider is your quality control, making sure every document is filled out correctly, properly attested, and submitted on time.

✅ Cost-Effective Business Setup Solutions tailored to your needs. Partnering with a specialist is like having an insurance policy against bureaucratic headaches and financial penalties. Their job is to get it right the first time, protecting your investment and getting you launched faster.

With 24/7 support, you have a team ready to tackle any tricky administrative hurdles and deal with government departments for you. This hands-on approach doesn't just save you money; it frees you up to focus on what you should be doing—building your business.

Ready to see how a tailored, cost-effective solution can work for you?

📞 Call Us Now: +971-52 923 1246 or WhatsApp Us Today for a free consultation.

Got Questions About Dubai Business Costs? We've Got Answers

Thinking about the costs involved in setting up your Dubai business can feel a bit overwhelming. It’s a common hurdle for every entrepreneur. Let's break down some of the most frequent questions we hear to give you a clearer picture of the real cost of starting a business in Dubai.

What's the Real Price of a Basic Trade Licence?

There’s no one-size-fits-all answer here, as the final price tag really hinges on the path you choose for your business. For a Mainland setup, you're often looking at a starting point around AED 15,000. If you go the Free Zone route, many packages can get you started for closer to AED 12,000.

So, what makes these numbers fluctuate? It comes down to a few key things:

- Your Business Activity: A general trading licence that lets you deal in a wide range of goods will naturally cost more than a specialised consultancy licence.

- Your Chosen Jurisdiction: Every Free Zone sets its own fees, and Mainland costs are determined by government departments like the DED.

- Any Special Approvals: Some business types, like healthcare or education, need extra sign-offs from specific ministries, and these come with their own fees.

Do I Absolutely Need a Physical Office to Get Started?

Yes, a registered physical address is a non-negotiable legal requirement for pretty much every business setup in Dubai. But don't let that fool you into thinking you need to sign a lease on a huge, expensive office right away.

Many Free Zones are fantastic at offering cost-effective business setup solutions. Think 'flexi-desks' or virtual office packages. These are perfect for new startups and solo entrepreneurs because they tick the legal box for an address without the heavy financial weight of a full-time office. Mainland companies, on the other hand, usually have more rigid rules about having a dedicated physical office space.

What's the Main Cost Difference Between Mainland and Free Zone?

When you boil it down, the core financial difference between a Mainland and a Free Zone company is a trade-off between your initial investment and the market you can access.

A Mainland company typically means a higher upfront cost. You're dealing with direct government fees, often a mandatory physical office lease, and various other administrative charges. But what you get in return is huge: the freedom to trade directly with anyone, anywhere in the UAE market. For many businesses, that access is absolutely essential.

In contrast, a Free Zone company usually has a lower barrier to entry. They're known for convenient, all-in-one packages that make starting up more affordable. The catch? Your business activities might be limited to within your specific zone or to international trade. The right choice really comes down to your business model and where you see your company growing in the long run.

Making these decisions is much easier when you have an expert in your corner. At 365 DAY PRO Corporate Service Provider LLC, we specialise in building customised, cost-effective setup solutions for entrepreneurs. We are the best corporate service provider in Dubai, Abu Dhabi & Sharjah, and we take the complexity out of Mainland and Free Zone formations so you can focus on your business. We ensure you get every UAE tax benefit for international entrepreneurs with 24/7 support.

📞 Call Us Now: +971-52 923 1246

💬 WhatsApp Us Today for a Free Consultation at https://365dayproservices.com