When you start looking into the cost of setting up a Dubai mainland company, you'll quickly realise there’s no one-size-fits-all price tag. The total investment is really a mix of different fees and choices you'll make along the way. Generally, you can expect the cost to fall somewhere between AED 15,000 and AED 35,000, sometimes more, depending on the complexity of your business.

A Transparent Financial Roadmap for Your Setup

Trying to budget for a Dubai mainland company can feel like you're aiming at a moving target. With all the different government fees, licence types, and necessary approvals, pinning down a final number seems almost impossible at first. But don't worry. With a bit of expert guidance, you can map out a clear financial plan that avoids any nasty surprises and gets your business started on the right foot.

Think of it like building a custom car. The base model has its price, but the final cost really depends on the engine you pick, the extras you add, and how much you want to personalise it. Your company setup works the same way; the final cost is shaped by its specific operational needs and legal structure.

Understanding the Cost Spectrum

That final figure isn't just a random number; it's directly tied to what your business actually needs. The Dubai mainland company formation cost can swing quite a bit based on a few critical factors. The general consensus is that setup costs land somewhere in the AED 15,000 to AED 35,000 range. This wide gap exists because of variables like the type of business licence you're after, how many employee visas you'll need, and the mandatory office space requirements. You can discover more insights about business setup expenses in Dubai to see how these elements all fit together.

Before we dive deep into each specific cost, let's get a bird's-eye view of the main expense categories you'll encounter.

Quick Breakdown of Dubai Mainland Setup Costs

To give you a clearer picture, here’s a high-level overview of the primary costs involved. This table summarises the main expenses you should budget for.

| Expense Category | Typical Cost Range (AED) | What It Covers |

|---|---|---|

| Initial Approval & Name | 1,000 – 2,000 | Fees for trade name reservation and securing initial government approvals. |

| Business Licence | 10,000 – 25,000+ | The core licence fee, varying by activity (Commercial, Professional, etc.). |

| Office Space / Ejari | 5,000 – 20,000+ (Annual) | Mandatory physical or virtual office lease registration (Ejari). |

| Establishment Card | 2,000 – 2,500 | A required card for your company to be able to apply for employee visas. |

| Local Service Agent | 5,000 – 15,000 (Annual) | Fee for a UAE national agent, required for professional licences. |

| Partner/Investor Visas | 4,000 – 7,000 (Per visa) | Costs for medical tests, Emirates ID, and visa stamping for each partner. |

This breakdown should help you understand where your investment is going. Now, we'll explore each of these components in more detail.

As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we provide Cost-Effective Business Setup Solutions tailored to your needs. Our goal is to ensure you can Enjoy UAE Tax Benefits for International Entrepreneurs with complete transparency on all fees.

Core Cost Categories at a Glance

Getting a handle on the financial side of your company setup is much easier when you know what to expect. Think of your initial investment as being built on four main pillars:

- Government and Registration Fees: These are the non-negotiable charges for things like getting initial approvals, reserving your trade name, and notarising legal documents.

- Business Licence Fees: This is a big one. The cost changes dramatically depending on whether you need a Professional, Commercial, or Industrial licence for your business activities.

- Office Space and Sponsorship: This bucket includes the cost of leasing a physical office and, if your licence requires it, securing a Local Service Agent.

- Visa Processing: Every partner and employee visa you process comes with its own set of fees, adding to the overall budget.

By understanding these core components, you can start putting together a realistic budget and making smart decisions from the get-go. And if you have questions, our 24/7 Support Service means we're always here when you need us.

Decoding Government and Registration Fees

When you start mapping out your Dubai mainland company setup, the first set of costs you'll run into are the government and registration fees. These are the fixed, unavoidable charges that form the baseline of your budget. Think of them as the foundation of your new business building—you can't construct anything without them, and the price is set.

Getting a handle on these line-item costs is key to creating a realistic financial plan. It takes you from rough guesses to a clear picture of where your initial capital is going. This kind of clarity is what prevents surprise expenses from tripping you up during the critical registration phase, making for a much smoother launch.

Initial Approvals and Trade Name Reservation

Before your business can even be a legal entity, it needs a name and a nod from the authorities. This all starts with reserving your company's trade name and getting an initial approval from the Dubai Department of Economic Development (DED), which now operates as the Department of Economy and Tourism (DET).

Your trade name is more than just a brand; it’s your legal identifier here in the UAE. The DET has pretty strict rules for naming to make sure every name is unique, respectful, and doesn't mislead anyone. Paying the fee to reserve and register your name is the first non-negotiable step on the ladder.

At the same time, you'll apply for initial approval. This is basically the DET giving you a thumbs-up on your business concept. It’s not your licence to operate just yet, but it's the green light you need to move on to drafting legal documents and other formalities.

A critical part of budgeting for your Dubai mainland company formation cost involves accounting for these initial, non-negotiable government fees. Getting these right from the start lays a solid foundation for the entire setup process.

Legal Documentation and Notarisation

Once you have your initial approval, the next stage is all about formalising your company's legal framework. For most setups, like an LLC, this means drafting a Memorandum of Association (MOA). The MOA is the core legal document that spells out what your business will do, who owns what, and how it will be run.

Getting this document drafted correctly is one thing, but it also needs to be officially notarised to hold any legal weight. This process involves a public notary authenticating the document, which comes with its own fee. It’s a vital step that confirms all partners are on the same page and makes the agreement legally solid in the UAE.

For example, you're looking at mandatory fees like the initial approval from the DET costing around AED 267 and trade name approval expenses near AED 767. Then there's the verification of the Memorandum of Association, which is about AED 1,200, plus administrative costs like contract drafting for AED 500. You can explore a detailed cost breakdown to see how these foundational expenses stack up.

Ministry Registrations and Final Payments

With your legal documents notarised, you're on the home stretch. But there are a couple more key government fees to clear before you get your licence. One of the bigger ones is the registration with the Ministry of Economy.

This registration is required for certain business activities and legal structures, and it adds a layer of federal legitimacy to your company. This fee can often be one of the largest single payments you’ll make during the setup. For instance, registering with the Ministry of Economy frequently adds another AED 3,000 to your total cost.

After all approvals are in and documents are filed, the DET will issue a payment voucher. This voucher bundles together all the remaining fees for issuing your official trade licence. You usually have 30 days to settle this final payment. If you miss the deadline, your application is cancelled, and you'll have to start the whole process from scratch.

Here’s a quick summary of the main government-related payments:

- Trade Name Reservation Fee: Secures your unique business name.

- Initial Approval Fee: Gives you the go-ahead to continue the setup.

- MOA Drafting & Notarisation: Covers the creation and legalisation of your company's charter.

- Ministry of Economy Fee: A necessary registration for federal-level compliance.

- Trade Licence Issuance Fee: The final payment to the DET to get your official licence to operate.

By understanding what each of these fees is for, you can budget with much more confidence, making sure you have the funds ready at every stage. As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we can help you find cost-effective solutions for your specific needs and guide you through these requirements without a hitch. Call Us Now: +971-52 923 1246 for a consultation.

How Your Business Licence Choice Affects Costs

Think of choosing your business licence like picking a foundation for a house. It dictates the size, shape, and capabilities of everything you build on top of it. In Dubai, your decision between a Professional, Commercial, or Industrial licence is one of the biggest drivers of your total Dubai mainland company formation cost.

Each licence type is tailored to a specific set of business activities. This specialisation has a direct knock-on effect on the fees you'll pay, the legal structure you can use, and the compliance hoops you'll need to jump through. Getting this right from the start is about more than just following the rules—it's about aligning your business plan with the most cost-effective legal framework.

It’s just common sense, really. A freelance marketing consultant has vastly different needs and risks than a large-scale importer of goods. Their licences, and the costs that come with them, reflect that reality. This is precisely why a single, "one-size-fits-all" cost estimate for a Dubai mainland company is almost always misleading.

Commercial Licence: The Path of Trade

If your business involves buying and selling goods, a Commercial Licence is what you’ll need. This is the category for traders, retailers, real estate agencies, and logistics companies. Essentially, if you're in the business of commerce, this is your licence.

Since these businesses often deal with physical products and significant transaction volumes, the go-to legal structure is a Limited Liability Company (LLC). An LLC is crucial here because it creates a protective wall between your personal finances and any business debts or liabilities. Because of this added protection and the nature of trading activities, the initial setup costs tend to be higher than for other licence types.

The legal form you choose, like an LLC or a Sole Establishment, has to match your business activities. As Specialists in Freezone Company Formation across the UAE, we help entrepreneurs make these critical decisions to build a business that's both compliant and cost-effective.

Professional Licence: The Route for Expertise

Do you offer a service based on your expertise, skills, or craft? Then the Professional Licence is designed for you. This covers a huge range of businesses, from consultancies and law firms to design studios, IT support, and training institutes.

Here, the typical legal structure is a Sole Establishment if you're going it alone, or a Civil Company if you have partners. The key financial difference is the need for a Local Service Agent (LSA). Unlike a local partner in an LLC, an LSA holds no shares or equity in your business. They simply act as your official liaison for government paperwork in exchange for a fixed annual fee. This structure often makes the initial setup more affordable.

This creates two very different cost models:

- Commercial (LLC): Higher initial cost, but offers essential liability protection for trading.

- Professional (Sole Establishment): Lower upfront investment, requires an annual LSA fee, and is perfect for service-based entrepreneurs.

Choosing the right path means you aren't overpaying for a corporate structure your business simply doesn't require.

Industrial Licence: For Manufacturing and Production

For businesses that physically create or assemble products, the Industrial Licence is mandatory. This is for factories, manufacturing plants, and any operation that turns raw materials into finished goods. It’s the most specialised licence and, not surprisingly, often the most capital-intensive to secure.

An industrial setup requires major investment in facilities and machinery. It also involves securing approvals from various government bodies, including the Ministry of Industry and Advanced Technology. The complexity and heavy compliance load mean the Dubai mainland company formation cost for an industrial business is significantly higher than for commercial or professional ventures.

By taking the time to match your business activity to the right licence and legal form, you can build a far more accurate and manageable budget. For a free chat to figure out the best approach for your new venture, WhatsApp Us Today for a Free Consultation.

Office and Sponsorship: Your Two Biggest Cost Factors

Of all the line items on your setup budget, two will have the biggest and most recurring impact on your Dubai mainland company formation cost: your physical office and your local sponsorship.

These aren't just boxes to tick during the setup process. They are ongoing financial commitments that will directly affect your monthly burn rate and, ultimately, your long-term success. Think of it this way: your office is the physical home for your business, while your sponsor (if you need one) is your key to staying compliant. Getting both right from the start is a massive strategic advantage.

Let's break down what you need to know to manage these two major expenses wisely.

The Mandatory Requirement for a Physical Office

Here’s a non-negotiable rule for setting up on the Dubai mainland: you must have a physical office address. This has to be backed by a tenancy contract officially registered through the Ejari system. This isn't just about having a mailing address; it's a legal pillar of your company's existence in the UAE. The government needs to see a legitimate, physical base of operations.

But "physical office" doesn't have to mean a huge, expensive corporate suite in a glass tower. Dubai’s business ecosystem is thankfully quite flexible. The only real condition is that the space is commercially approved and properly registered.

You’ve got a few main options, each with a very different price point:

- Dedicated Office Space: This is the classic choice—leasing a private office that's all yours. It gives you the most privacy and brand control, but it's also the most expensive route when you factor in rent, utilities, and fitting it out.

- Business Centre Desks: A fantastic and very popular alternative. You can rent a dedicated desk or a small, private office within a fully serviced business centre. This neatly satisfies the legal requirement without the massive overheads of a traditional lease.

- Co-working Spaces: Perfect for startups, freelancers, and small teams. Renting a desk in a co-working space is often the most affordable way to get a compliant address, and it comes with the bonus of built-in networking opportunities.

The path you choose here will dramatically shape both your initial setup costs and your annual renewals. After the government fees, your office space will likely be your next biggest expense. Tools like a real estate square footage cost estimator can be incredibly helpful for forecasting these costs accurately.

One of the most appealing aspects of establishing a business here is the favourable tax environment. As you plan your budget, remember to factor in the ability to Enjoy UAE Tax Benefits for International Entrepreneurs, which can significantly improve your financial outlook.

Understanding Local Sponsorship Costs

The second major variable is sponsorship. Now, this area has seen a lot of positive changes recently, but depending on your specific business licence, you might still need to engage a UAE national. This is a critical cost factor, especially for professional service licences that don't qualify for 100% foreign ownership.

There are really two ways this works, each with its own cost structure:

-

Local Service Agent (LSA): If you're setting up a Sole Establishment or a Civil Company with a Professional Licence, you'll need an LSA. The great thing about an LSA is that they hold zero shares in your company and have no say in its day-to-day running or profits. Their role is simply to act as your representative for government paperwork. For this service, you pay a fixed annual fee, which typically runs anywhere from AED 5,000 to AED 15,000, sometimes more, based on who you work with. It's a clear, predictable cost.

-

UAE National Partner (Sponsor): While 100% foreign ownership is the new standard for most commercial businesses, some specific, strategic activities may still require a UAE national to hold a majority share. In these rare cases, the arrangement is almost always a negotiated fixed annual fee, not a percentage of your profits. This agreement is iron-clad and documented in your company's Memorandum of Association (MOA).

Choosing the right partner here is vital. A reputable corporate service provider can connect you with reliable LSAs at fair market rates, ensuring you're protected and fully compliant. If you need clarity on the best sponsorship structure for your business, WhatsApp Us Today for a Free Consultation. Our team is here for you with our 24/7 Support Service to help you make the right call.

Comparing Setup Costs: Dubai vs. Abu Dhabi

While Dubai often gets all the attention, it's a smart move to look across the UAE to see where your money goes furthest. Pitting the Dubai mainland company formation cost against what you'd pay in Abu Dhabi can be an eye-opening exercise, often revealing some pretty significant savings depending on what your business actually does.

Both emirates have excellent, well-regulated mainland jurisdictions, but they don't march to the beat of the same drum when it comes to fees and local rules. Getting a handle on these differences is key to making a strategic choice that doesn't just get you started, but also sets you up for long-term financial health. For some, Abu Dhabi is the more sensible entry point; for others, the unique ecosystem in Dubai is worth every dirham. It’s not about which city is “better,” but which one makes the most financial sense for your business.

As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we've guided countless entrepreneurs through this exact decision-making process, finding the most efficient and budget-friendly path for their venture.

A Look at Abu Dhabi's Cost Structure

So, what does it actually cost in the nation's capital? Abu Dhabi, also a UAE mainland jurisdiction, serves as a great benchmark. The process feels familiar, with similar steps to Dubai, but the price tags on key items are different.

For instance, in Abu Dhabi, you can generally expect mainland trade licence fees to be in the ballpark of AED 5,000 to AED 15,000. This puts your total annual licence cost somewhere between AED 10,000 and AED 25,000, depending heavily on your business activity. And just like in Dubai, a physical office isn't optional for mainland companies. Annual rent can be as low as AED 10,000 for a spot further from the city centre or climb past AED 50,000 for a prime address. For a deeper dive, you can get a full breakdown of the expenses of starting a business in Abu Dhabi.

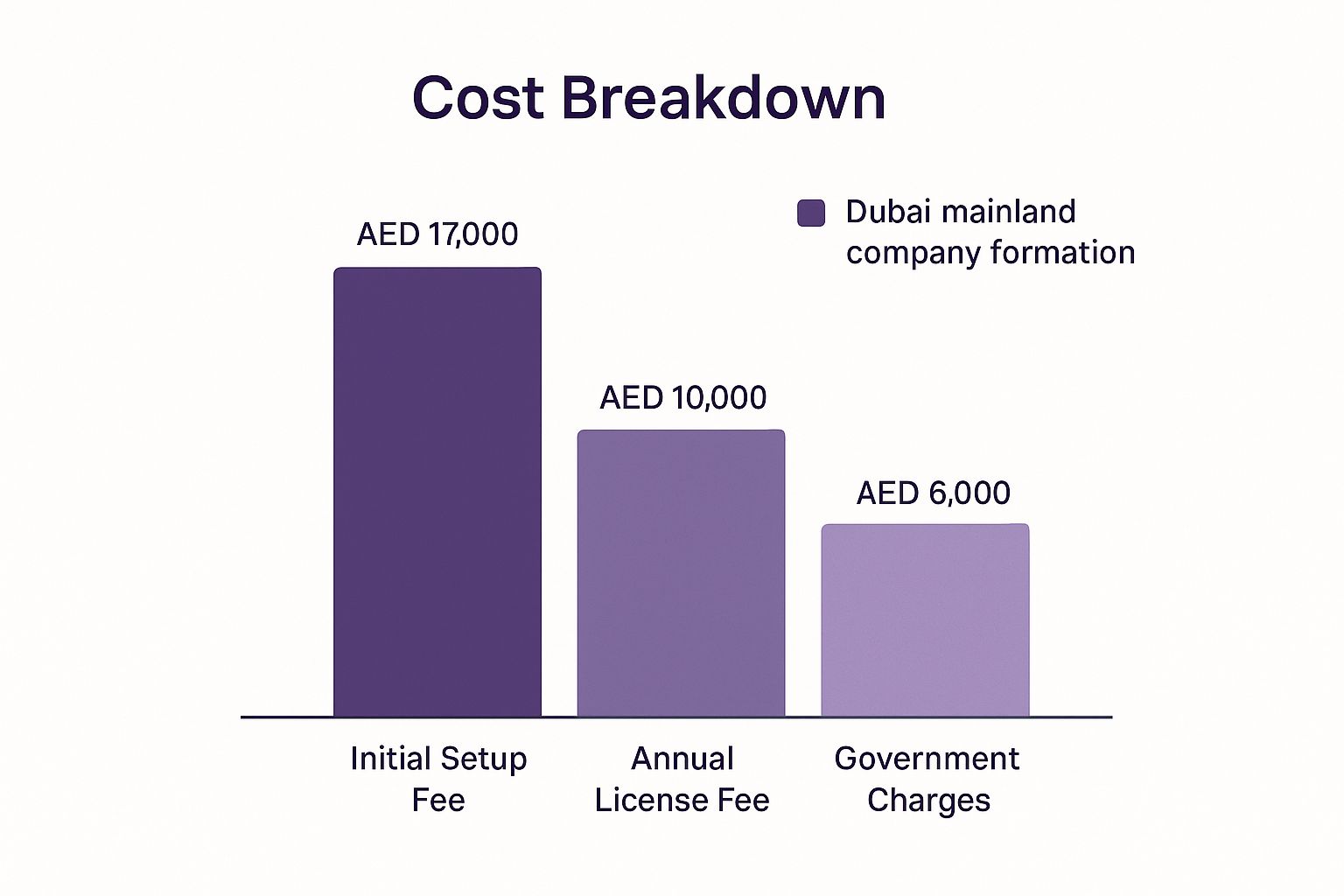

The infographic below gives you a clear picture of how these costs typically stack up for a Dubai mainland setup, showing you where the big chunks of your budget will go.

As you can see, the initial setup fees, the annual licence renewal, and various government charges form the foundation of your financial planning.

Cost Comparison at a Glance: Dubai vs Abu Dhabi

To make this easier to digest, here's a quick overview of the key business setup costs, helping you compare the financial requirements in each emirate side-by-side.

| Cost Component | Typical Cost in Dubai (AED) | Typical Cost in Abu Dhabi (AED) |

|---|---|---|

| Initial Trade Licence Fee | 10,000 – 20,000 | 5,000 – 15,000 |

| Total Annual Licence Cost | 15,000 – 30,000+ | 10,000 – 25,000+ |

| Office Rent (Annual) | 15,000 – 60,000+ | 10,000 – 50,000+ |

| Establishment Card | ~2,000 | ~2,000 |

| Local Service Agent Fee | 5,000 – 15,000 | 5,000 – 15,000 |

This table highlights the general cost brackets, but remember that specific activities and office choices can push these numbers in either direction. It's a starting point for your budget, not the final word.

Key Financial Differences to Consider

When you're weighing Dubai against Abu Dhabi, the real cost differences show up in a few key areas. You’ll want to pay close attention to government fees, how licences are structured, and what the office rental market looks like.

- Government Initiatives: Abu Dhabi has been quite proactive in launching initiatives to lower business setup costs and pull in more investment. This can sometimes mean the initial government fees are noticeably lower than what you might find in Dubai.

- Office Rental Market: Both cities offer everything from co-working spaces to entire floors, but the rental rates in prime business districts can be worlds apart. You absolutely have to do your homework here.

- Licence Fee Structure: The specific fees tied to your activity—whether professional or commercial—can vary between the two emirates' Departments of Economic Development. A consulting licence in one might be priced differently than in the other.

Choosing an emirate is a huge financial decision. By carefully comparing the detailed Dubai mainland company formation cost with Abu Dhabi's, you make sure your investment is placed strategically for the best possible return and long-term sustainability.

Ultimately, the best solution is the one that fits your specific business like a glove. Whether you land on Dubai or Abu Dhabi, our team is here to help you enjoy the full UAE tax benefits for international entrepreneurs. For a no-obligation chat to explore your options, WhatsApp Us Today for a Free Consultation.

Smart Ways to Reduce Your Business Setup Costs

Setting up a mainland company in Dubai doesn't have to break the bank. With some strategic planning, you can significantly reduce your initial investment without compromising on compliance or your long-term goals. It’s all about making smart choices, not just cheap ones.

Think of it like this: when packing for a trip, you select versatile items you know you'll use. The same logic applies here. Optimizing your setup costs means choosing the right components from the start to create a lean, efficient business launchpad. This is where expert advice can be invaluable.

Working with a seasoned business setup consultant gives you an insider’s perspective. They help you navigate regulations, avoid common costly mistakes, and prevent frustrating delays.

Aligning Legal Structure with Your Budget

One of the most impactful decisions you'll make is choosing your company's legal structure. Opting for a Professional Licence with a Sole Establishment, for example, is often more budget-friendly than forming a full LLC. This is because you typically only need a Local Service Agent (LSA) for a fixed annual fee—a simpler and less expensive arrangement.

The key is ensuring your chosen legal form genuinely matches your business activities. The wrong choice can lead to fines or a costly restructuring process later. Being clear about your business model from day one allows you to select the most direct and affordable legal path.

When you partner with a corporate service provider, you get more than just paperwork processing. You gain access to Cost-Effective Business Setup Solutions tailored to your needs. Our role is to identify these savings for you, ensuring your capital is invested where it matters most.

Using Flexible Office Solutions to Lower Overheads

The mandatory physical office space can be a major budget item. However, you don't need to commit to a long-term lease on a large, traditional office immediately. Flexible office solutions have revolutionized the landscape for new businesses in Dubai.

Renting a desk in a co-working space or securing a small serviced office in a business centre fulfils all legal requirements for a registered address. This approach offers significant advantages:

- Lower Upfront Costs: Avoid large deposits, furniture expenses, and restrictive long-term leases.

- Predictable Monthly Bills: Rent, utilities, and internet are often bundled into one clear payment, simplifying your budgeting.

- Scalability: As your team grows, you can easily add more space without being locked into a rigid contract.

By choosing a flexible office option, you convert a major capital expense into a manageable monthly operational cost. This frees up crucial cash for growth-driving activities like marketing, product development, or hiring key talent. If you need help deciding, our 24/7 Support Service is always here to guide you. Call Us Now: +971-52 923 1246 for a free chat.

Frequently Asked Questions About Dubai Mainland Setup Costs

When you're planning your business setup, financial questions can feel daunting. Let's address some of the most common queries we receive about the dubai mainland company formation cost. Our goal is to provide clear, straightforward answers so you can budget with confidence.

Is a Physical Office Mandatory for a Mainland Licence?

Yes, it is. The Dubai authorities require a legitimate physical address supported by a registered tenancy contract (Ejari). This is a non-negotiable requirement to confirm you have a genuine place of business.

However, this doesn't mean you need to rent a large, expensive office. Flexible solutions like a desk in a co-working space or a spot in a shared business centre are fully compliant and much more affordable, allowing you to start lean.

What is the Cheapest Mainland Licence in Dubai?

While costs vary based on your specific business activity, the most budget-friendly option is generally a Professional Licence with a Sole Establishment structure.

This setup is often cheaper because it typically only requires a Local Service Agent (LSA) for a fixed annual fee, avoiding more complex and costly partnership arrangements. It's crucial to ensure this licence type covers all your intended services. As Specialists in Mainland Company Formation in Dubai & Abu Dhabi, we can help you verify this before you proceed.

Are There Hidden Costs I Should Know About?

The costs aren't hidden, but they are recurring. Your initial setup fee is just the beginning; it's essential to plan for the annual expenses that keep your company compliant and operational.

Think of the setup fee as buying the car; the renewal fees are the fuel and maintenance that keep it running. Forgetting to budget for your annual trade licence renewal, office rent, visa renewals, and LSA fees is a common mistake. Plan for these from day one.

How Much Should I Budget for Visas?

Visa costs are a separate but essential part of your budget. For an investor or partner visa, you should budget between AED 3,500 and AED 7,500. This visa is typically valid for two years. Employee visas are usually slightly less expensive.

These figures cover everything from government application fees and mandatory medical tests to the final printing of your Emirates ID. The total cost will depend on the number of visas you need for yourself, your partners, and your employees.

Navigating these costs is much simpler with an experienced guide. As the Best Corporate Service Provider in Dubai, Abu Dhabi & Sharjah, we specialize in providing clear, cost-effective paths to establish your business without any surprises. For a free consultation to get started, contact us today.